The Baby Powder Gives You Cancer! 😯 (JNJ)📈 Failed to breach through the highs, but the fight ain't over yet!

Downward channel identified. Seeing a lot of rejection at this channel top as we approach a critical level of support at 143.47.

You want to long when the downward black Resistance gets cracked. Otherwise short 143.47 break and see if the bottom channel support holds.

Critical to use the ema dots and the Crossover strategy at that 143.47 level for a more aggressive long if held.

Could be double top or could be cup and handle. 🤷♂️

Play the channel.

Best of luck! 🎲

🥇MLT | MAJOR LEAGUE TRADER

Johnson

JNJ : Day TradingThis share closes today at its top price $155.51, for the first time of history.

I think we have a good support at $154.

If the share moves up above $154, then BUY. It would have a potential to hit $160.

Like and Follow to see more.

Johnson & Johnson is an American pharmaceutical company founded in 1886.

It produces pharmaceutical and medical devices, hygiene products, cosmetics and also provides related services to consumers and healthcare professionals.

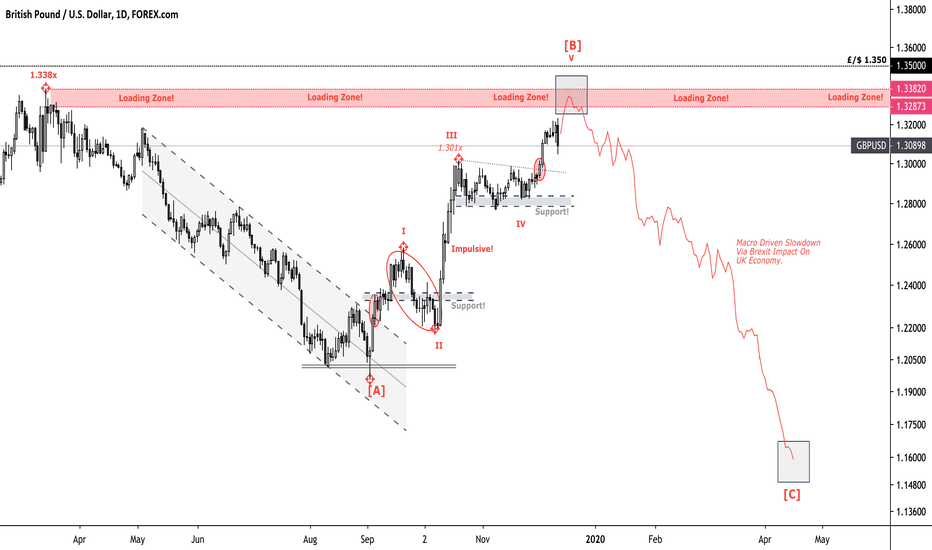

ridethepig | GBP Market Commentary 2020.04.08Limited coverage lately as @ridethepig is spending more time on calls these days than in my entire career. Trying to get a sense of productivity, expectations and capital structures before making further comments.

On the UK side, the mood is low and with PM Johnson still in ICU it does not look good. All rallies should be sold in cable towards the highs in the range at 1.236x/1.237x. Look to target 1.20xx and 1.15xx extensions at the lows again, invalidation above 1.250x.

The targets come from the same areas as before:

Risk markets are going to struggle as we prepare for a long weekend. Wuhan restrictions were lifted today and will be one to track in the coming weeks, I am expecting another leg lower in Global Equities which will trigger a rush to USD and to shake out all the early dip buyers who are speculating that risk is faded for good and this will be a quick in and out.

Thanks as usual for keeping your support coming with likes, comments, charts, questions and etc!

ridethepig | Continue To Sell GBP On Rallies Here tracking 1.295x as the level to recycle and load more shorts. Well done those following from the original short-term swing which was triggered on the cabinet reshuffle (see diagram below). As widely expected GBP suffering as markets began to look towards the EU negotiations kickstarting in March. Both sides are very wide apart and no-deal Brexit looks set for year end.

The flows are all in-line so far with the long-term macro picture. It is playing out perfectly and looking to sell rallies with risks skewed towards the downside makes sense to me.

Medium term targets are located below at 1.21 and 1.15 - these are in play for 1H 2020 if things get very bad with USD strengthening via panic around virus impact and risks while GBP softens as UK lose PPP in the immediate term.

Well done those already selling Sterling, and good luck anyone look to load more on rallies. I am happy to sit short and work the sell-side in Cable. The ideas are no less imaginative than those of last year which turned out to be a 1,000 tick trade:

Thanks as usual for keeping the likes, comments and charts coming !

ridethepig | EURGBP Market Commentary 2020.02.13A weak session for EURGBP, soft hands continued to bring better sellers in from leveraged accounts and yet the important 0.8300x support still held. I am once again in BTFD mode as pound remains more vulnerable in the entire process as a result of financial services replacement.

Risk markets will put more pressure on GBP in general over the coming sessions. Here using dips to buy into with an end of year target at 0.95xx. BOE are already showing signs of distress with the cross below 0.853 which is key via rate differentials. A very technical flow as is usually the case with these cabinet reshuffles we get a retrace in the swing.

Adding this to the playbook at the close today with initial targets located at 0.8400, followed by 0.8425 and 0.8450. Invalidation comes into play with a daily close underneath 0.830x.

Good luck all those on the bid, same legs are playable in GBPUSD and GBPJPY in particular too. As usual thanks for keeping the support coming with likes and comments!

ridethepig | GBP Market Commentary 2020.02.11A timely update to the FX strategy for GBP with particular focus on Cable.

On the UK side, we have loud messages from Europe around the difficulty for both sides to reach an agreement by year-end. Although typical in a game of high-stakes chess, this is a heavy weight on Sterling.

On the US side, a solid round of data prints last week from wages to non-agricultural employment. The FED remains dovish and in cutting mode, in normal circumstances cuts would be difficult to justify but with Trump in full control market expectations do not favour USD walking forward.

On the technicals the map is crystal clear until we enter into the Brexit impact leg:

Strong Support 1.276x <=> Soft Support 1.290x <=> Mid Point 1.328x <=> Soft Resistance 1.38xx <=> Strong Resistance 1.43xx

On the positioning side, Pound longs were mostly built by speculators in the back-end of 2019 and these began to unwind as we headed into the official finish line in Jan 2020. This is leaving the flows exposed to negative headlines although you can argue the case for further upside as long as strong economic prints continue. The Pound is relatively cheap in this environment, I suspect the main impact leg from Brexit will not kick-in till October 2020 so we have plenty of time to continue working both side in the next 6 months.

Expecting a mild recovery to come in the months ahead which will aid in offshore ownership of UK assets, the desire is there to continue the recovery and as long as this remains the case the breakdown will be difficult. Look to add GBP exposure on dips while we are at the bottom of the short-term and medium term range. A breakdown will be a game changer and will imply BOE are moving in August.

A round of G10 FX charts and strategy updates coming over the sessions today... Don't forget to keep the likes and comments rolling guys!

ridethepig | GBP Market Commentary 2020.01.14The power to breakdown has been developed knowingly and systematically, unlike chop/consolidation which frequently occurs. The effect of the breakdown is heightened by BOE turning very dovish and calling up for Sterling devaluation, which in their eyes must be required for offsetting the loss in UK market access.

Compare the following two diagrams:

Sellers step in on the election day as expected with a strong barrier.

A sweep of the highs. Can sellers maintain the breakdown?

In the first, the test of 1.35 sent buyers wandering on grounds of an orderly Brexit, depriving sellers valuable resistance. However, it was dangerous for buyers to carry on because the eye of Brexit is on it. After a Johnson majority came the selloff and now the attempt by sellers to reinstate the strategic breakdown which was previously broken is powerfully gaining momentum from the monetary side.

Should we get the breakdown, the move will be fast as the insurance cut from BOE will not last beyond May. Bailey starts in May, it will take some time for the Johnson/Javid fiscal taps to work its way into the MPC forecasts meaning another late 2020 cut is then on the cards (not in play with this chart as will unlock 1.15).

To put simply, a dovish BOE and hard Brexit will keep rates in the lower bound and QE infinity will return in 2021. For the immediate term, market clearly caught on the wrong side; 1.290x is next followed by 1.277x. Very difficult to get constructive on UK markets with BOE turning dovish.

On the EURGBP side:

Good luck all those on the sell side in Cable and other Sterling crosses, a lot of meat left on the bone. As usual thanks so much for keeping your support coming with likes, comments and etc.

Johnson's threats and pound fail: earning moneyYesterday Boris Johnson turned British politics upside down.

By the way, labour market data came out mixed. On the one hand, claims for unemployment benefits increased (+ 28,800 versus + 26,400 in October), and on the other hand, employment rate was higher than expected (24,000 with a forecast -14,000), and unemployment rate turned out to be better than experts expected (3.8% with a forecast of 3.9%).

Johnson stated the need for the legislative establishment of the deadline for the transition period, which is intended to coordinate and adopt a new EU trade agreement. We are talking about the end of 2020. The fact is that the development of a similar treaty between the EU and Canada took 7 years. And Johnson offers to do it in a year. Since this is practically unrealistic, as the EU representatives have already stated, the markets took Johnson’s position as a signal that exit without a deal ( so-called “hard” Brexit) is again becoming a real alternative.

As a result, the pound dropped below 1.31. Since our position on the pound was extremely clear - to buy, it is necessary to explain what to do now in the light of such information.

Well, to start with, our position has not changed, and a decline in the pound is an opportunity for cheaper purchases. It is necessary to clearly distinguish Johnson’s words from Johnson’s actions, that is, what he is saying and what he is doing. Recall, we prefer to work with facts. So, the truth is there is an already developed agreement Johnson has also the parliament is under his control, that is, everything for a successful Brexit.

As for the inconsistency of his words and actions, then keep in mind his rhetoric in September-October: no delays after October 31. But, the agreement with the EU and the postponement of Brexit until January 31, 2020. So we will continue to buy the pound and consider yesterday's decline as a gift from Johnson. The only thing to keep in mind is that locally the decline may continue today until the 1.30 mark. Given the rate of decline, the chances of reaching this base level for the pound are quite large.

As for our other positions, they are unchanged: we are looking for points for selling the dollar, the Russian ruble, we are buying yen and gold.

ridethepig | GBP Fast Flows A very simple trigger for those wanting to cover some shorts from the initial elections entry; the key 1.315x support is holding and pressure has been completely absorbed.

We are trading the bottom of the clearly defined range from the elections; 1.315x <=> 1.355x and markets rather than going overboard on risk will want to keep their cards closer to their chest until 2020. If we do lose 1.315x this will trigger a panic leg and immediately put us into impulsive territory in the macro chart below.

Macro prints today from the UK were better than expectations and will be enough to keep BOE on hold and unlocks another test of 1.35xx. I will continue to use this pivot to position for the long-term flows:

A perfect double top in the making? Smells like it...

Thanks for keeping the support coming with likes, comments and questions. This is for advanced traders only as we are using the short-term range to decrease risk and scale into our position for a long-term trend . As usual with any questions feel free to open below.

Shedding A Few Pounds For Christmas...GBPUSD rejected at 1.35xx which acting as major resistance after the country went back on the leadership merrygoround. Here actively selling into all rallies in GBP crosses, although there is a caveat to Pound shorts in the immediate term. With Johnson and a ruthless Downing Street in full control of the press and hitting the “right” headlines the positive narrative around Brexit will continue and therefore dips will be perceived as attractive too many.

The Conservative majority was clear and simple to trade, particularly in GBPAUD :

GBPUSD

In any case well done all of those in shorts from the 1.35xx election highs … you will remember “ perception is more important than reality with FX ” … Remain nimble to take some chips off the table. A squeeze below 1.315x will make me excited.

This next chart indicates the sense of division in Britain, a fragmented society which also highlights the stupidity to have such a referendum on a complex topic. The UK is not like Swiss for example having referendum after referendum, rather it is a representative democracy. Yet sadly we are seeing a corruption of democracy via media manipulation swerving public opinion.

For example, those who remember Cameron's premiership will remember the government was at the time asking for public to remain while they were pursuing policies of austerity (decreasing consumer confidence) and served to have more damage than good. The silent revolution or protest vote (all cleverly calculated) unlocked Pandoras box with a People vs Establishment narrative:

Thanks all for keeping the support coming with likes, comments, questions, charts and etc. As usual jump into the comments with your ideas and views to open the discussion for all!

ridethepig | UK Elections [LIVE COVERAGE] UK Election Chartbook

With longs already getting nervous ahead of the exit polls, let's get started by digging deeper on the political side first...For all those tracking and trading the main event this evening we have only two realistic scenarios in play which makes capital flows easier to track:

=> A Tory majority which will deliver the Johnson/May deal with a hard brexit via Irish sea border and less activity with the EU (70% odds).

=> A Labour minority government with a helping hand from Lib Dems et al, here we can expect a second referendum in 2020 with a choice between a soft exit or remain (28% odds).

Any further gridlock in Parliament is currently sitting at <2% and does not remain in play. This would dramatically short-circuit GBP as markets will be caught out of position.

UK markets pricing a Conservative majority as a " positive resolution " to Brexit is complacent and allows us an opportunity to capture those out of position and mis-pricing UK market access beyond 2020. To date we have traded a tremendous amount of conjecture around the Brexit chapter, yet many are quickly to forget we are yet to trade the "fact" leg.

This next chart indicates the sense of division in Britain, a fragmented society which also highlights the stupidity to have such a referendum on a complex topic. The UK is not like Swiss for example having referendum after referendum, rather it is a representative democracy. Yet sadly we are seeing a corruption of democracy via media manipulation swerving public opinion.

For example, those who remember Cameron's premiership will remember the government was at the time asking for public to remain while they were pursuing policies of austerity (decreasing consumer confidence) and served to have more damage than good. The silent revolution or protest vote (all cleverly calculated) unlocked Pandoras box with a People vs Establishment narrative:

In any case, a ruthless Downing Street (with the help of Cambridge Analytica and co) have a free pass to do what they want and say what they want with scandal after scandal yet the masses remain on mute simply wanting to " get brexit done " ... bitterness in the public will last for a very long time and history will mark the collapse of the Crown, a fall that will stretch decades turning little England into a house of economic bondage.

A quick review of the UK Election Opinion Polls :

Survation: CON: 45% (+3) LAB: 31% (-2) LDEM: 11 (-) BREX: 4% (+1) GRN: 2% (-2), 05 - 07 Dec Chgs. w/ 30 Nov

BMG: CON: 41% (+2) LAB: 32% (-1) LDEM: 14% (+1) GRN: 4% (-1) BREX: 4% (-), 04 - 06 Dec Chgs. w/ 29 Nov

YouGov: CON: 43% (+1) LAB: 33% (-) LDEM: 13% (+1) BREX: 3% (1) GRN: 3% (-1), 05 - 06 Dec Chgs. w/ 03 Dec

Deltapoll: CON: 44% (-1) LAB: 33% (+1) LDEM: 11% (-4) BREX: 3% (-) Chgs. w/ 30 Nov

Panelbase (Scotland): SNP: 39% (-1) CON: 29% (+1) LAB: 21% (+1) LDEM: 10% (-1), 03 - 06 Dec Chgs. w/ 22 Nov

Exit polls will start at 10pm (GMT) via SKY/ITV/BBC. Usually the exit poll is very accurate so it is highly likely we will be able to clear the knee jerk flows quickly unless there is a major surprise. We can draw a tree below to showcase the forward walk with Brexit:

- UK Elections (we are here) => Conservative majority => No transition extension (most likely scenario)

or,

- UK Elections (we are here) => Hung parliament => Second referendum (least likely scenario)

On the macro side, I have widely covered segments on growth, inflation and policies in the Telegram and in previous ideas in the archives (see attached). A major round of fiscal easing is coming, this will artificially keep growth supported in the short-term however the output gap will not close. Inflation will once again tick above target, however not via a robust consumer as many predict but rather via supply side constraints and uncertainty. The BOE will remain sidelined till 2H20 and provide a decent profit taking opportunity for our macro short positions.

For the technical flows we are tracking the infamous 1.35xx psychological resistance. This is a great level to track for macro positions in 2020 on the sell side. Here I am tracking for a leg from 1.35xx => 1.15xx via Tory majority and the Brexit fact impact leg. A quick recap of the same levels we traded here live on tradingview earlier in the year. We are sitting at the same levels as before which we were loading into and traded a +/- 2000 tick swing !!!

Here I am becoming increasingly bearish on UK outlooks with either scenario. In my books Johnson will win by a country mile and we will immediately be able to trade the final flush in Pound (stage two of our rumour/fact impact legs). Populism is spelling danger across the global economy and shows no signs of abating.

...Best of luck to all those on the sell side and looking to increase exposure across portfolios. As usual thanks for keeping your support coming with likes and comments !!!

ridethepig | Sell GBPJPYPound continues to be hijacked by politics in “election mode” with GBP trading higher on the Conservatives lead in weekend opinion polls. Overshooting the resistance here is cascading soft stops although momentum and sizes are not impressive and here I look to fade the highs and trade back to the inside during the election campaign and into the new Brexit deadline.

For the entry positioning method we are using the same strategy in GBPJPY as widely seen here:

The map from an Elliot perspective has been a very clear path forward in GBPJPY. Same flows we have been tracking since the beginning of the year:

The debate tomorrow between Johnson and Corbyn will trigger some profit taking from GBP bulls as we get ever close to the Brexit deadline. There has been a tremendous amount of conjecture around UK assets to date, it is important to remember the "fact" leg in Brexit (which is what will cause the economic damage via reduced market access) has yet to take place and markets are quick to forget.

In any case, thanks for keeping the likes and comments rolling, feel free to dive in with your charts or ideas on GBPJPY and open the conversation for all.

ridethepig | Sterling Market Commentary 2019.11.18As widely anticipated over the weekend Conservative lead widening and reflecting in Cable strength. The 1.292x - 1.282x remains of interest to me, here expecting 1.30 to hold ahead of elections as momentum in Pound looks apathetic at best.

The "People vs Establishment" narrative continues to pick up steam:

This sadly is a necessary component in the collapse of the British Empire, a ruthless Downing Street in the driving seat. For those tracking the previous long term charts in Cable:

While those tracking EURGBP will also remember the infamous 0.853 floor, this remains intact and will drive forward another constructive round of demand:

Best of luck all those trading the inside swings here on both sides, not particularly impressive price action expected with little in the economic calendar this week.

Thanks for keeping the likes and comments coming.

Highlights of the move so far and a serious contender for "Chart of the Year"

Preparing for Fed verdict, analyzing the state of the oil marketThe attacks on Saudi Arabia's oil infrastructure led to the biggest jump in global prices. The correction was not observed until the American session started. We recommended on Tuesday to open short positions in oil because we were confident in the corrective movement and the end, the recommendation justified itself at 100%. In just 10 minutes, oil lost over 4%. The reason for the decline was the information that Saudi Arabia has officially confirmed - production capacity will be restored by the end of September. And to compensate for losses in production associated with the attack, the Saudis will increase production up to 12 million bpd by the end of October. So those of our readers who trust our experience and analytics should have made good money.

As for trading on the oil market today, then after the strongest fall yesterday, everything looks rather ambiguous. And although we continue to incline toward asset sales you should be careful with that.

As for the Fed and the Open Market Committee. An event that was devoid of intrigue just a couple of weeks ago (100% of traders set a minimum rate reduction of 0.25) may surprise. The current probability of a Fed rate cut is slightly above 60%. And if you take into account that yesterday's data on industrial production in the USA were frankly surprising: 0.6% m / m with a forecast of + 0.2% m / m and July outcome -0.1% m / m, the Fed can keep the rate unchanged.

Our position remains unchanged. We expect the rate to be lowered by 0.25%. There are enough reasons for this: an interest rate reduction by ECB rate last week, a deterioration of the US labor market and the US economy condition as a whole, threat of a global recession and intensified trade war, multiplied by the risk of a US military campaign in Iran - all of this obliges the Fed to act and reduce the interest rate to prevent the US economy downfall. Anyway, reinsurance is better than solve the consequences duo to the lack of action.

Accordingly, our position on the dollar today is also unchanged - we will sell it. At the same time, we do not forget the euro and its movement after the ECB meeting last week. The probability of false movements is great and it is extremely important to follow a predetermined plan. But at the same time, it is worthwhile to put stops so as not to go against the market will.

In addition to the decision of the Fed and the subsequent explosion of volatility in the foreign exchange market, it is worth paying attention to inflation data from the UK and Canada.

As for the UK. Despite Johnson's unsuccessful meeting in Luxembourg, the pound did not react that much. This means that we will continue to look for an opportunity to buy the British pound. First of all, against the euro and the US dollar.

The tactics of buying gold in the area of local lows continue to be justified, so we will continue to adhere to it today.

Pound & easing global monetary policyYesterday, quite unexpectedly, a block of economic data on GDP and industrial production, instead of already traditional disappointment, provided an occasion for optimism.

In July UK GDP grew by 0.3% (expected to grow at 0.1%), while industrial production instead of a decline by 0.3% (expert forecasts) went to the positive zone ( + 0.1% ).

Monday following Johnson’s next parliamentary defeat in a few days. His next attempt to initiate an early election failed. come into effect Law against "no-deal" Brexit came into effect.

Not surprisingly, the pound continued to grow against such a background. Our position on the pound is unchanged: we are looking for points for purchases. But with small stops, because the situation with Brexit can develop quite dynamically.

Meanwhile, the markets are preparing for a wave of rate cuts by leading central banks of the world. On Friday, the Bank of China lowered the rate by 0.5% to the lowest level since 2007. In this light, the decision of the ECB on Thursday is becoming more significant and significant. Recall next week the Fed, the Bank of Japan and the Bank of Switzerland will announce their decisions. So the upcoming two weeks promise to be full of news.

Strengthening of the Russian ruble in the foreign exchange market is a good opportunity to begin the formation of a medium-term purchase cycle with USDRUB. Current prices are the starting point of the cycle. The next one is 63.60 and the final one is about 62.50.

And finally, buying gold from current prices seems to be a very good trading opportunity. Recall it is worth buying with stops.

Parliament vs. Johnson, China vs. USA, AUDJPY GBP updated its lowest level since 2016 been in a pair with USD, but after soared at 100+ points for half an hour. The reasons for these movements we announced yesterday - the opposition of the British Parliament and Prime Minister Boris Johnson.

We briefly outline the events of yesterday. A group of deputies is planning to initiate a bill where Boris Johnson will have to ask for another Brexit suspension if he can not conclude a new deal with Europe. Expectedly, Johnson he took it hard, saying that he would rather hold an early election than allow maltreat him. So far, the alignment of forces in the Parliament was not in Johnson's favor (about 20 people from his party went against Johnson), which is good for the pound.

Note that although there is no certainty yet. If events continue to develop similarly, its further decline, for example with the dollar, to the area of 1.10 paired can be put aside for now.

There are no changes in the trade war development. China’s ceasefire proposal (delay the introduction of tariffs) was rejected by the United States. At the same time, there is no concrete start date for the negotiation process. So our recommendations on the sale of safe haven assets remain relevant.

Moreover, global production is slowing down. The PMI indices around the world are showing that. The eurozone as a whole, Germany in particular and the UK - everywhere indices went below 50, which indicates a decrease in business activity in the manufacturing sector. Well, the news on business activity in the manufacturing sector in the USA disappointed the markets. The index of business activity in the US manufacturing sector (ISM Manufacturing) fell below 50 the same as in 2016. The consequences of the trade war are becoming more and more obvious.

Hurricane Dorian is weakening. So the United States may well get off with slap on the wrist. Although, according to UBS Group estimates, even such a good end will cost about $ 25 billion - the result of the massive flights cancellation and other consequences of the hurricane.

And finally, we note that the Reserve Bank of Australia left the rate unchanged yesterday. The fact of not cutting rates can be considered as a positive for the Australian dollar, which triggered its growth yesterday. However, in the light of the ongoing trade war, we would not have rushed to buy it in a hurry.

However if China and the United States close on the agreement in September, then it is the Australian dollar that could be stronger than others. At the same time, we agree with the Bank of America Merrill Lynch, which recommends buying the Australian dollar not paired with the US dollar, but paired with the yen. Their logic is generally understandable - the end of the trade war, on the one hand, will provoke demand for commodity currencies, which include the Australian dollar, and on the other hand will lead to a sharp drop in demand for safe-haven assets, which include the Japanese yen. That is, the AUDJPY pair will receive a double reason for growth. So we recommend our readers to follow the development of events and keep in mind this deal (purchase AUDJPY) - potentially we are talking about 600-800 points of profit.

Johnson takes a step forward, Strong dollar and gold - Why ?The growing strength of the United States dollar has already fed up with a lot of things, Trump and American exporters to traders and analysts who have bet and continue to bet on its decline. Quite a long time ago, we have turned to dollars bears and also not enthusiastic about its unwillingness to decline. So it is time to find out the reasons for its strength.

According to the dollar’s reaction to the Fed’s rate cut at the last FOMC meeting, it’s not about US interest rates. They are not that high to provoke an influx of speculative capital.

“It’s natural for the dollar to be strong,” said Daisaku Ueno, chief currency strategist at Mitsubishi UFJ Morgan Stanley Securities Co. in Tokyo. “Trump is waging a trade war against economies that earn a surplus from the U.S. and making the strong American economy even stronger.” On the one hand, investors are scared so they “hide” in US government bonds, which stimulates the dollar demand and strengthens it. On the other hand, Trump's protectionist actions help the US economy, to the detriment of partner countries, which again has a positive effect on the dollar value ( in response to US trade aggression, other countries devalue their currencies which artificially strengthens the dollar).

According to the Bigmack Index, the dollar is one of the most overvalued currencies in the world. So we continue to recommend selling the dollar, especially ahead of Powell's Friday speech at the Jackson Hole Symposium.

In this light, the legendary investor and Mobius Capital Partners LLP founder. Mark Mobius encouraged all investors to buy gold with any marks. He believes the reduction of interest rates by the Central Banks, making gold an increasingly attractive investment target. It becomes a reliable basis for long-term gold growth.

As for our position for gold, it is still unchanged: intraday oscillator trading without obvious preferences, that is, we buy in the oversold area and sell in the overbought one (as a reference, classic RSI oscillators can be used or more advanced versions of oscillators developed our experts for a deeper analysis of price dynamics).

And finally, we note the first hints of possible progress in the agreements between the EU and the UK. This is the first public attempt by Boris Johnson to engage the EU in the negotiation process to develop a new version of the agreement on the withdrawal. And although this is only the first uncertain step towards. So we only strengthened our recommendation to buy the pound from current prices.

Johnson and Pound, ECB and Euro, US and ChinaBoris Johnson becomes the UK's new prime minister and, made his first statement. Despite the apocalyptic forecasts, we could observe a pound growth on Wednesday. Once again, chances that Johnson will have enough support to implement the no-deal Brexit are extremely low. An agreement with the EU or a general referendum is more likely to happen. In any case, until October 31, it’s not necessary to expect “exit without a deal”. And this means that buying pounds with current prices is a safe enough trading strategy, that could provide more than a solid income with minimal risks. So our recommendation is unchanged - we are looking for points for pound purchases across the foreign exchange market entire spectrum.

Speaking of the euro. Perhaps, he is today the “prospective candidate” for sales against the pound, as well as it is quite possible to buy it against the dollar. Markets cautious with that fact that today the ECB may start to reverse the easing of policy, therefore the euro is trading at the very bottom of the medium-term range. We do not think that it would happen. The ECB is quite a conservative Central Bank. It would rather wait for the Fed to lower the rate, obtain additional economic data, update its economic forecasts, and just after that n begin to act at the beginning of September may be, but not now. So its purchases against the dollar seem like a good trading idea. We are actively buying EURUSD - the risk/reward balance is too enticing: with stops 40-50 points with a potential profit 200 points.

Stops must be put up necessarily, because the Eurozone economy is in a bad form, and theoretically could provoke the ECB to act. Yesterday's data on the EU economic loco - in Germany came out weak. The PMI index in the production sector was only 43.1 (with the forecast was 45.2). the minimum level over the last 7 years (!).

The PMI index in the Eurozone manufacturing sector also came out below 50 and again worse than forecasts.

Unexpectedly the data on new homes sales in the USA came out quite positive( which grew by 7.0% to 646,000 (expected + 5.1%)). However, we will not revise our position on the dollar and continue to look for points for its sales.

Meanwhile, the US and China are trying to get on well. On Monday, the US delegation is going to China to find a compromise. There is still no progress in the negotiation process, the IMF lowered forecasts for the growth of the world economy, again. Forecasts in connection with the slow-down in growth of the world economy. was reduced by 0.1% to 3.2% and 3.5% for 2910 and 2020. So, purchases of the Japanese yen continue to be relevant.

Our trading recommendations for today: we will continue to look for opportunities for selling the dollar across the entire spectrum of the foreign exchange market, buying the pound against the dollar as well as against the euro, selling oil and the Russian ruble, and also buying the Japanese yen against the dollar. As for gold, buy it from oversold and sell in the overbought zone.

“hard” Brexit & pound prepares for the worstGreat Britain expects “hard” Brexit. Jeremy Hunt and Boris Johnson faced off in leadership debate. The candidates were asked about the Irish border (which will become the only land border between the UK and the EU after Brexit). Both were clear that the issue will not be resolved with a positive outcome. The odds of No-deal Brexit are rising. Due to this, the pound treated with selling yesterday. Back

to status in employment on the UK labour market. The estimated employment rate : + 25K with a forecast + 45K. Requirements to receive unemployment compensation rose to + 38K (last month figure 24.5K). Brexit continues to be the main driver of everything that happens with the pound over the last couple of years. It's a buying opportunity as the pound price is low.

It is necessary to act without “fanaticism”. Recall, new UK prime minister will appear next week.

Negotiations are progressing well towards concluding an agreement between the US and China. Treasury Secretary Steven Mnuchin said he and U.S. Trade Representative Robert Lighthizer may travel to Beijing for trade negotiations. US retail sales rose 0.4 per cent that is better than expected. However, we still do not plan to buy a dollar and we will continue to look for points for its sales in the foreign exchange market

Our trading recommendations for today: sell the dollar, oil and the Russian ruble. We buy safe-haven asset: gold and Japanese yen.

Prepare for a rebound in PoundThe UK pound's losses incurred by the increasing fears of a no-deal Brexit hit a six-month low on Tuesday. The bearish bias seems rather strong even after that point. However, the race for the top join in the UK still goes on and the winner, although most likely to be Johnson, is yet to be announced later next week. Until then, potential further signs from US Federal Reserve officials many of whom are set to speak in the coming days will ease the pressure on the sterling. 1.2450 will be important in the upward direction. Once broken we will follow 1.2470 and later 1.2500 as a medium-term target before the pricing starts once again to go down due to the risks associated with the macro factor called Brexit.