US Banks on Fire | Revenues Soar, and So Do the ProfitsWho Needs a Recession? Banks Are Swimming in Cash!

The largest U.S. banks have reported some of their best quarterly performances in recent years, with surging trading revenues, a resurgence in dealmaking, and an overall renewal of corporate confidence playing pivotal roles. Let’s break down the key details of the results.

Market Recovery

Across the major banks, investment banking and trading activities recorded impressive performances. Goldman Sachs saw investment banking revenue increase by 24%, while Bank of America (BofA) experienced a massive 44% jump, marking its strongest quarter in three years.

The market volatility stemming from factors like the U.S. election and changing expectations around interest rates continued to fuel robust trading revenues. Morgan Stanley’s equities division, for example, reached an all-time high, while JPMorgan and Goldman Sachs enjoyed notable gains in fixed-income trading.

A surge in CEO optimism has led to an uptick in mergers and acquisitions (M&A), initial public offerings (IPOs), and private credit demand. Morgan Stanley, in particular, is seeing the largest M&A pipeline in seven years, signaling a sustained wave of dealmaking.

Mixed Results for NII

Net interest income showed varying results across the banks, but forward guidance indicates that NII will likely see moderate growth in 2025, spurred by continued loan demand and higher asset yields.

Credit Risks on the Rise

Consumer lending pressures have persisted, with JPMorgan’s charge-offs rising by 9%. Many banks are preparing for a further increase in delinquencies, particularly in credit cards.

Commercial Real Estate Challenges

While the office sector remains under stress, banks are managing their exposures cautiously and have yet to face significant shocks in this area.

Regulatory Scrutiny Continues

Citigroup lowered its 2026 profitability target as it undergoes a transformation, while Bank of America faced increased scrutiny over its anti-money laundering compliance.

Resilient U.S. Economy

Banks are reporting strong consumer spending, loan growth, and corporate profitability, which supports an optimistic outlook for earnings growth heading into 2025.

Performance Breakdown for Each Bank

JPMorgan Chase

- JPMorgan posted a record annual net income of $58.5 billion, marking an 18% increase from the previous year.

- Investment banking saw a 46% surge in revenue, driven by strong advisory and equity underwriting.

- Trading revenue climbed by 21%, led by a 20% increase in fixed-income trading.

- Despite the impressive results, JPMorgan is still facing challenges such as rising charge-offs and pressures on loan margins. CEO Jamie Dimon emphasized concerns about persistent inflation and growing geopolitical risks.

Bank of America

- BofA experienced an 11% year over year growth in revenue, reaching $25.3 billion, with net income up 112% from the previous year.

- The investment banking division saw a dramatic 44% rise in revenue, the highest in three years, thanks to strong debt and equity underwriting.

- Trading revenue grew by 10%, driven by solid performance in fixed income (up 13%) and equities (up 6%) as market volatility spurred client activity.

- BofA also reported growth in its consumer and wealth management divisions, with credit card fees and asset management showing strength. Client balances grew to $4.3 trillion, a 12% increase from the previous year.

- After several quarters of decline, BofA’s NII grew by 3%, exceeding expectations and signaling stability. The bank expects NII to continue rising through 2025, with projections of $15.7 billion per quarter by the end of the year.

Wells Fargo

- Wells Fargo’s revenue remained flat at $20.4 billion, but net income surged by 50%.

- NII declined by 8% year-over-year but is expected to rise slightly in 2025 due to higher reinvestment rates on maturing assets.

- The bank made significant progress in cost-cutting efforts, reducing non-interest expenses by 12%, thanks to workforce reductions and efficiency initiatives.

- Investment banking fees rose by 59%, benefiting from the broader market recovery and the bank’s renewed focus on its Wall Street presence.

- Wells Fargo returned $25 billion to shareholders in 2024, including a 15% dividend increase and $20 billion in stock buybacks. However, the bank continues to face regulatory constraints, notably the asset cap imposed by the Federal Reserve.

- Looking ahead to 2025, Wells Fargo anticipates modest growth in fee-based revenue, with cost discipline and efficiency gains driving improvements.

Morgan Stanley

- Morgan Stanley saw a 26% increase in revenue, reaching $16.2 billion, while net income soared by 142%.

- Equity trading revenue jumped by 51%, setting a new all-time high as market volatility sparked increased client activity, particularly in prime brokerage and risk-repositioning trades.

- Investment banking revenue grew by 25%, fueled by strong demand for debt underwriting, stock sales, and M&A activity. CEO Ted Pick noted that the M&A pipeline is the strongest in seven years, signaling a potential multi-year recovery in dealmaking.

- Morgan Stanley’s wealth management division saw $56.5 billion in net new assets, increasing total client assets to $7.9 trillion. The firm is pushing toward its goal of $10 trillion in assets under management.

- In response to growing business complexities, the firm launched a new Integrated Firm Management division to streamline services across investment banking, trading, and wealth management.

Goldman Sachs

- Goldman Sachs experienced a 23% increase in revenue, reaching $13.9 billion, while net income more than doubled, up 105%.

- Record performance in equity trading contributed to a 32% increase in revenue from this segment, as market volatility drove greater client activity.

- Investment banking revenue grew by 24%, boosted by significant gains in equity and debt underwriting.

- The firm’s asset management division saw an 8% rise in assets under management, reaching $3.1 trillion, while management fees exceeded $10 billion for the year.

- Goldman is winding down legacy balance-sheet investments but also saw a gain of $472 million from these investments in Q4. The firm’s recent launch of its Capital Solutions Group is aimed at capturing growth opportunities in private credit and alternative financing.

Citigroup

- Citigroup posted a 12% increase in revenue, reaching $19.6 billion, with non-interest revenue surging 62%.

- Fixed-income and equity markets were key drivers, growing 37% and 34%, respectively, as market volatility tied to the U.S. election boosted performance.

- Investment banking revenue climbed by 35%, supported by strong corporate debt issuance and a pickup in dealmaking activity.

- The bank unveiled a $20 billion stock repurchase program, signaling confidence in future earnings.

- Citigroup also made strides in controlling operating expenses, which declined by 2% quarter-over-quarter. However, the bank lowered its 2026 return on tangible common equity (RoTCE) guidance to 10%-11% due to the costs of its ongoing transformation.

- CEO Jane Fraser emphasized Citigroup’s long-term growth trajectory, noting improvements in credit quality and continued progress with the strategic overhaul, including the postponed IPO of Banamex, the bank’s Mexican retail unit, now expected in 2026.

Long story short

Heading into 2025, the major U.S. banks are in strong positions, buoyed by a favorable economic backdrop, continued growth in trading, and a rebound in corporate dealmaking. Despite challenges such as rising credit risks, regulatory hurdles, and potential macroeconomic uncertainties, the outlook remains positive. With a recovering IPO market, continued wealth management growth, and strong trading revenue, the banks are poised to capitalize on the renewed corporate optimism. The key question will be whether the dealmaking frenzy continues or whether uncertainties in the global economy and market dynamics could temper the rally.

JPM

JPM JPMorgan Chase & Co Options Ahead of EarningsIf you haven`t bought JPM befor the rally:

Now analyzing the options chain and the chart patterns of JPM JPMorgan Chase & Co prior to the earnings report this week,

I would consider purchasing the 290usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $20.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SPX - Are you catching the rotation trends? SPX is still holding very bullish price action. Technicals are pointing towards higher price and todays inside consolidation day certainly helps digest recent gains.

Along with the flat indices market session, we did observe some massive capital rotation trends.

Financials saw a pretty strong down move across the board. JPM / BAC / C all saw large outflows. We were positioned on the short side of financials and took profits on JPM puts.

Even with the big selloff in financials, SPX held up surprisingly well.

Capital simply rotated instead of outright leaving the market. Bullish Signal.

Technology, Energy, Materials, Health care, Transports all saw capital inflow trends.

Rotation into under preforming sectors is a sign that markets could be staging another healthy leg up.

We still have an upside target over 6300 on SPX.

JP MORGAN's long-term bullish trend restored above the 1D MA50.JP Morgan Chase (JPM) broke above its 1D MA50 (red trend-line) last week for the first time since the first week of March and technically put an official end to the 3-month 'Trade War' correction.

This correction has technically been the Bearish Leg of the 2.5-year Channel Up. Every time the 1D MA50 broke and closed a 1W candle above it, the stock started the new Bullish Leg of the pattern. The last Bullish Leg was +6% (+48% against +42%) stronger than the previous one before the first pull-back to the 1D MA50 again.

As a result, we expect to see $310 (+54%) before this year is over.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Banking on Strength: Trade of the WeekNYSE:JPM surges into focus with AI model grade: A and +8.81% upside potential by April 30. Strong Q1 results, resilient fundamentals, and predicted range up to $258.08 make this a compelling buy-the-dip candidate. Key support: $220.32 | Resistance: $258.08 NYSE:JPM

JPMorgan Chase Reports Earnings Today, Topping Q1 EstimatesShares of JPMorgan Chase (NYSE: NYSE:JPM ) are currently up 3% in Friday's premarket session as the asset tops Q1 estimates.

The company reported better-than-expected fiscal first-quarter results as big banks kicked off the new earnings season.

The banking giant reported earnings per share (EPS) of $5.07 on revenue of $45.31 billion, each up from $4.44 and $41.93 billion, respectively, a year ago. According to estimates compiled by Visible Alpha, some analysts had expected $4.64 and $43.55 billion. It generated $23.4 billion in net interest income (NII), above the $23.00 billion consensus.

Shares of JPMorgan were up 3% immediately following the release of Friday's report. They entered the day down roughly 5% year-to-date but up about 16% in the last 12 months.

"The economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and 'trade wars,' ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility," JPMorgan CEO Jamie Dimon said. "As always, we hope for the best but prepare the Firm for a wide range of scenarios."

Dimon wrote in his annual letter to shareholders this week that he expected the Trump administration's tariffs "will slow down growth."

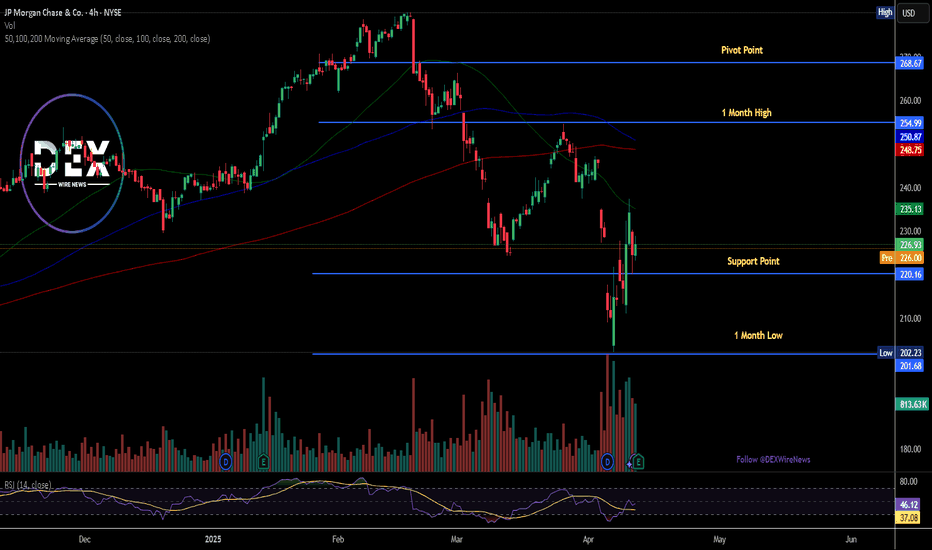

technical Outlook

As of the time of writing, NYSE:JPM shares are already up 1.5% with the asset trading above the support point. A break above the 1-month high pivot could set the course for a bullish campaign eyeing the $260- $280 region.

With the last close RSI at 46, NYSE:JPM shares has more room to capitalize on the dip and make a comeback prior the earnings beat.

OptionsMastery: H&S on JPM! Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

JP MORGAN won't give a better buy opportunity in 2025.Last time we looked at JP Morgan Chase (JPM) on November 27 2024 (see chart below), it gave us a clear sell signal that went straight to our $236 Target:

Now that the price rebounded not only on the 1D MA200 (orange trend-line) but also on the bottom (Higher Lows trend-line) of the long-term Channel Up, we are switching back to buying a we even got the first pull-back on the 1D MA50 (blue trend-line).

Given that the 1D RSI also rebounded from oversold (<30.00) territory like the October 27 2023 Low did, we expect a similar Bullish Leg to follow and thus our Target is $330 at the top of the Channel Up.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JPMorgan at a Crossroads Bullish Surge or Bearish Retreat ? Hello, fellow traders!

Today, I’m diving into a detailed technical analysis of JPMorgan Chase & Co. (JPM) on the 2-hour chart, as shown in the screenshot. My goal is to break down the key elements of this chart in a professional yet accessible way, so whether you’re a seasoned trader or just starting out, you can follow along and understand the potential opportunities and risks in this setup. Let’s get started!

Price Action Overview

At the time of this analysis, JPM is trading at 243.62, down -1.64 (-0.67%) on the 2-hour timeframe. The chart spans from late March to early May, giving us a good look at the recent price behavior. The price has been in a strong uptrend, as evidenced by the higher highs and higher lows, but we’re now seeing signs of a potential pullback or consolidation.

The chart shows a breakout above a key resistance zone around the 234.50 level (highlighted in red on the Volume Profile), followed by a retest of this level as support. This is a classic bullish pattern: a breakout, a retest, and then a continuation higher. However, the recent price action suggests some hesitation, with a small bearish candle forming at the current price of 243.62. Let’s dig deeper into the tools and indicators to understand what’s happening.

Volume Profile Analysis

The Volume Profile on the right side of the chart is a powerful tool for identifying key price levels where significant trading activity has occurred. Here’s what it’s telling us:

Value Area High (VAH): 266.25

Point of Control (POC): 243.01

Value Area Low (VAL): 236.57

Profile Low: 224.25

The Point of Control (POC) at 243.01 is the price level with the highest traded volume in this range, acting as a magnet for price. Since the current price (243.62) is just above the POC, this level is likely providing some support. However, the fact that we’re so close to the POC suggests that the market is at a decision point—either we’ll see a bounce from this high-volume node, or a break below could lead to a deeper pullback toward the Value Area Low (VAL) at 236.57.

The Total Volume in VP Range is 62.798M shares, with an Average Volume per Bar of 174.44K. This indicates decent liquidity, but the Volume MA (21) at 165.709K is slightly below the average, suggesting that the recent price action hasn’t been accompanied by a significant spike in volume. This could mean that the current move lacks strong conviction, and we might see a consolidation phase before the next big move.

Trendlines and Key Levels

I’ve drawn two trendlines on the chart to highlight the structure of the price action:

Ascending Triangle Pattern: The chart shows an ascending triangle formation, with a flat resistance line around the 234.50 level (which was later broken) and an upward-sloping support trendline connecting the higher lows. Ascending triangles are typically bullish patterns, and the breakout above 234.50 confirmed this bias. After the breakout, the price retested the 234.50 level as support and continued higher, reaching a high of around 248.02.

Current Support Trendline: The upward-sloping trendline (drawn in white) is still intact, with the most recent low around 241.50 finding support on this line. This trendline is critical—if the price breaks below it, we could see a deeper correction toward the VAL at 236.57 or even the 234.50 support zone.

Key Price Levels to Watch

Based on the Volume Profile and price action, here are the key levels I’m watching:

Immediate Support: 243.01 (POC) and 241.50 (recent low on the trendline). A break below 241.50 could signal a short-term bearish move.

Next Support: 236.57 (VAL) and 234.50 (previous resistance turned support).

Resistance: 248.02 (recent high). A break above this level could target the Value Area High at 266.25, though that’s a longer-term target.

Deeper Support: If the price breaks below 234.50, the next significant level is 224.25 (Profile Low), which would indicate a major trend reversal.

Market Context and Timeframe

The chart covers 360 bars of data, starting from late March. This gives us a good sample size to analyze the trend. The 2-hour timeframe is ideal for swing traders or those looking to capture moves over a few days to a week. The broader trend remains bullish, but the recent price action suggests we might be entering a consolidation or pullback phase before the next leg higher.

Trading Strategy and Scenarios

Based on this analysis, here are the potential scenarios and how I’d approach trading JPM:

Bullish Scenario: If the price holds above the POC at 243.01 and the trendline support at 241.50, I’d look for a bounce toward the recent high of 248.02. A break above 248.02 could signal a continuation toward 266.25 (VAH). Entry could be on a strong bullish candle closing above 243.62, with a stop-loss below 241.50 to manage risk.

Bearish Scenario: If the price breaks below 241.50 and the POC at 243.01, I’d expect a pullback toward the VAL at 236.57 or the 234.50 support zone. A short position could be considered on a confirmed break below 241.50, with a stop-loss above 243.62 and a target at 236.57.

Consolidation Scenario: Given the lack of strong volume and the proximity to the POC, we might see the price consolidate between 241.50 and 248.02 for a while. In this case, I’d wait for a breakout or breakdown with strong volume to confirm the next move.

Risk Management

As always, risk management is key. The 2-hour timeframe can be volatile, so I recommend using a risk-reward ratio of at least 1:2. For example, if you’re going long at 243.62 with a stop-loss at 241.50 (a risk of 2.12 points), your target should be at least 248.02 (a reward of 4.40 points), giving you a 1:2 risk-reward ratio. Adjust your position size to risk no more than 1-2% of your account on this trade.

Final Thoughts

JPMorgan Chase & Co. (JPM) is showing a strong bullish trend on the 2-hour chart, with a confirmed breakout above the 234.50 resistance and a retest of this level as support. However, the recent price action near the POC at 243.01 and the lack of strong volume suggest that we might see a pullback or consolidation before the next move higher. The key levels to watch are 241.50 (trendline support), 243.01 (POC), and 248.02 (recent high).

For now, I’m leaning slightly bullish as long as the price holds above 241.50, but I’ll be ready to adjust my bias if we see a break below this level. Stay disciplined, manage your risk, and let the market show its hand before taking a position.

What are your thoughts on this setup? Let me know in the comments below, and happy trading!

This analysis is for educational purposes only and not financial advice. Always do your own research before making any trading decisions.

JP MORGAN: Perfect 1W MA50 rebound targeting $350. JP Morgan is neutral both on its 1D and 1W technical outlooks (RSI = 54.173, MACD = 7.520, ADX = 32.502), suggesting that it remains inside the best buy zone for the long term. As a matter of fact, having rebounded exactly on its 1W MA50, this is the best buy opportunity since October 23rd 2023, which was the last time it hit the 1W MA50. As shown, the long term pattern is a Channel Up and every contact with the 1W MA50 has coincided with a 1W RSI test of the S1 Zone. There is no better buy entry than the current level and we can safely aim for yet another +57.76% run (TP = $350.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

JPM rally ending soon?My overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I have been wrong many times before so I will just take this thing in stages and see if it plays out. After this massive decline, we should be in for a great market rally of many decades. I am expecting the market to end its recent rally this week. The current rarely would be about a week in length depending when it began for individual stocks. The rally has done a few important things with its slow and prolonged upward movement, mainly prevents a wave 3 signal from occurring during the next decline.

My wave 3 indicator tends to signal wave 3s and 3 of 3s. See my scripts for the specifics of the indicator. If the market had a short wave 4 up and then a sharp or prolonged drop during wave 5, a new wave 3 signal would occur which violates the currently placed Minor wave 3 (yellow 3). Allowing separation from the current wave 3 signal enables wave 5 to drop quick or slow.

This chart applies select movement extensions based on wave 1's movement on the left and then another based on wave 3's movement on the right. I keep the values between 0%-100% on the chart for wave 2s and 4s retracements of the preceding wave's movement for reference even though the retracement values would be inverted.

Specifically for JPM, Minor wave 3 was longer than wave 1, which does not place a maximum length on wave 5. Assuming wave 4 ends on Thursday or Friday, Minor wave 5 could be a week or longer. In that time, at the very least it should drop below wave 3's bottom of 224.23. Using some basic movement extensions, it will likely go lower. The 5 wave lower pattern for this fifth wave is hypothetical, but a bottom could occur between 203 and 214. Once we bottom, we should see another rally over a few weeks. I will forecast what that could look like as Intermediate wave 1 nears its end.

JPM JPMorgan Chase Options Ahead of EarningsIf you haven`t bought JPM before the breakout:

Now analyzing the options chain and the chart patterns of JPM JPMorgan Chase prior to the earnings report this week,

I would consider purchasing the 245usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $5.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

JP Morgan (JPM): Correction on the HorizonJP Morgan ( NYSE:JPM ) is back on our radar as the upcoming earnings season begins, with the banking sector leading the reports. We’ve analyzed JP Morgan before, and the current setup offers intriguing opportunities. Since 2023, the stock has maintained a steady upward trend that continues into 2024.

Currently, NYSE:JPM appears to be in sub-wave ((iii)) within the larger wave (3) or possibly wave 5. However, we anticipate that sub-wave ((iv)) correction is yet to occur, aligning with the broader structural narrative of the chart.

Presently, the stock is trading near a critical trendline originating from the top of sub-wave ((i)). This trendline, which has shifted from resistance to support after multiple touchpoints, now risks being broken. Should it fail, the price could fall from its current level of $243 into a range between $204 and $173. A drop to $173 would represent the maximum correction in our view, while a more realistic pullback would fall within the $204 to $188 range.

On the bullish side, the wave 5 could push up to approximately $260, a modest increase from the current price. This scenario fits within the Elliott Wave framework, anticipating a wave ((iv)) correction before the final upward moves to complete wave 5 and the larger wave (3).

JPM Bullish Breakout? JPMorgan Trend & Seasonal Insights In this video, we analyze JPM, JP Morgan Chase, which is currently exhibiting a strong bullish trend on the daily timeframe. The stock has consistently retraced to 50% of its previous price swings. Adding a seasonality perspective, we observe a historical pattern where the market tends to sell off into December 20th before rallying through the first or second week of January. My bias remains bullish, with a potential buy at the current price contingent on a break of structure. Please note, this is not financial advice.

JP MORGAN Expect a 1D MA50 correction before it turns into a buyJP Morgan Chase (JPM) posted a strong bullish leg on our last analysis (September 17, see chart below) that easily hit our $229 Target:

From a wider perspective on the 1D time-frame, the price is now right at the top of the 13-month Channel Up on an overbought 1D RSI and a 1D MACD that is about to form a Bearish Cross.

All previous Higher Highs of the pattern formed MACD Bearish Crosses and pulled back to the 1D MA50 (blue trend-line) on a minimum of -7.35% correction. Note that the 1D MA200 (orange trend-line) never broke, so as long as it holds, the long-term bullish trend is intact.

As a result, we now expect a pull-back to the 1D MA50 and a minimum of -7.35% decline puts the Target a $236.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JPM: Overbought on 1M. Buying becomes risky now.JP Morgan is almost overbought on its 1M technical outlook (RSI = 69.452, MACD = 20.800, ADX = 54.049), trading very close to the top of the 12 year Channel Up. Being overbought on the wider/ longest timeframe available, indicates trend exhastion and a potential bearish reversal. Basically, we continue to use the same pattern that helped us get a strong buy last time and this time it shows that the last two times the 1M RSI was this overbought, the stock pulled back to at least the 0.236 Fibonacci level. Consequently we expect a lengthy but relatively controlled correction to start in the coming candles to test the 0.236 Fib and approach the 1M MA50 (TP = 187.00).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Bank of America Stock Surge on Q3 Earnings BeatBank of America (NYSE: NYSE:BAC ) delivered impressive third-quarter results, showcasing its resilience amid a challenging economic landscape. The bank reported $25.34 billion in revenue, slightly up from $25.17 billion a year earlier and above the analysts' consensus projection of $25.28 billion. Although profit fell to $6.90 billion ($0.81 per share) from $7.8 billion ($0.90 per share) last year, this was still better than the expected drop to $6.45 billion** or $0.75 per share.

Key Financial Highlights:

- Net Interest Income (NII) was reported at $13.97 billion, down from $14.38 billion a year ago but exceeding the expectation of $13.85 billion.

- The bank's trading revenue saw a significant uptick, with fixed income trading revenue rising 8% to $2.9 billion and equities trading jumping 18% to $2 billion.

These results come on the heels of similar positive reports from rivals like JPMorgan Chase and Wells Fargo, highlighting a robust start to the big bank earnings season. This broader positive sentiment in the banking sector is likely contributing to a favorable outlook for Bank of America.

Technical Analysis

As of the time of writing, NYSE:BAC shares are up 1.62%, signaling a bullish trend. The stock has recently rebounded from a consolidation zone, gathering momentum for further upward movement. A key indicator of this bullish sentiment is the Relative Strength Index (RSI), currently hovering around 71, indicating that the stock is entering overbought territory.

The stock's performance is further supported by its trading above key moving averages, which traditionally signals a strong bullish trend. Analysts note that this upward momentum, combined with the bank's robust earnings, positions Bank of America (NYSE: NYSE:BAC ) favorably for potential further gains, especially as NII shows signs of recovery.

Investment Implications:

The current trajectory suggests that Bank of America (NYSE: NYSE:BAC ) is turning a corner in terms of NII, as indicated by analysts like Wells Fargo's Mike Mayo. With the Federal Reserve having recently cut interest rates, analysts believe this should help improve bank earnings moving forward, as lower deposit costs may enhance profitability.

Additionally, with a provision for credit losses reported at $1.5 billion, slightly under the estimated $1.57 billion, the bank appears to be managing its risks effectively, further instilling confidence in investors.

Conclusion

Bank of America's latest earnings report reflects a strong performance amid a dynamic banking environment. The combination of better-than-expected trading results, a recovery in NII, and robust investor sentiment positions NYSE:BAC as a compelling investment opportunity. As the bank continues to navigate the evolving landscape of interest rates and economic conditions, investors may want to keep a close watch on its performance in the upcoming quarters.

JPMorgan Stock Surges After Q3 Earnings Beat EstimatesJPMorgan Chase & Co. (NYSE: NYSE:JPM ) shares rose nearly 5% on Friday as the bank's Q3 earnings exceeded expectations. JPMorgan (NYSE: NYSE:JPM ), the world’s largest bank by market capitalization, reported a robust revenue of $42.65 billion, surpassing analysts’ expectations of $40.85 billion. This strong performance was driven by growth in net interest income (NII), which increased to $23.41 billion.

Earnings Outlook

JPMorgan’s solid Q3 results showcased its ability to navigate a challenging macroeconomic environment. The bank posted earnings of $4.37 per share, slightly higher than the $4.33 from a year ago and far ahead of analyst estimates of $3.97. While profits dipped slightly to $12.9 billion from $13.15 billion, the impressive revenue and NII growth were key drivers behind the stock's upward momentum.

Despite the recent cut in interest rates by the Federal Reserve, which had impacted net interest margins for many banks, JPMorgan’s core business remained resilient. Rising deposit costs have placed pressure on banks in recent quarters, but the expectation is that lower rates will eventually lower deposit expenses and reignite loan growth. JPMorgan is also well-positioned to benefit from potential future interest rate cuts, which should stimulate investment banking activity and loan demand.

CEO Jamie Dimon remains cautious about the global economy, citing geopolitical risks such as the conflicts in Ukraine and the Middle East. These factors, combined with U.S.-China tensions, have prompted the bank to maintain a defensive posture. Nevertheless, JPMorgan's massive scale and global reach have enabled it to weather uncertainty better than most financial institutions.

Technical Outlook

On the technical side, JPMorgan’s stock is up 4.96% at the time of writing, approaching an overbought region with an RSI of 68.35. This marks a critical juncture, as the stock is nearing its August 30th, 2024, resistance point, a level where it previously dipped after a strong rally. While the possibility of a short-term pullback exists, the current daily price chart shows a bullish harami pattern. This continuation pattern, particularly when preceded by two bullish candles, indicates strong momentum in favor of further gains.

The bullish harami pattern, coupled with JPMorgan’s strong earnings performance, suggests that the stock may continue to rise in the near term. However, investors should monitor the NYSE:JPM resistance level closely, as a break above this point could propel the stock toward new highs, while a failure to break through may signal a potential consolidation or regression.

In summary, JPMorgan’s combination of strong earnings, a positive technical setup, and resilient fundamentals make it a stock to watch in the coming weeks. While geopolitical uncertainties and potential market volatility remain risks, the bank’s performance in this quarter positions it as a leader in the financial sector.

JPM JPMorgan Chase Options Ahead of EarningsIf you haven`t bought the dip on JPM:

Now analyzing the options chain and the chart patterns of JPM JPMorgan Chase prior to the earnings report this week,

I would consider purchasing the 210usd strike price Puts with

an expiration date of 2024-10-18,

for a premium of approximately $2.82.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.