Jpmorganchase

JP MORGAN's long-term bullish trend restored above the 1D MA50.JP Morgan Chase (JPM) broke above its 1D MA50 (red trend-line) last week for the first time since the first week of March and technically put an official end to the 3-month 'Trade War' correction.

This correction has technically been the Bearish Leg of the 2.5-year Channel Up. Every time the 1D MA50 broke and closed a 1W candle above it, the stock started the new Bullish Leg of the pattern. The last Bullish Leg was +6% (+48% against +42%) stronger than the previous one before the first pull-back to the 1D MA50 again.

As a result, we expect to see $310 (+54%) before this year is over.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JPMorgan Chase Reports Earnings Today, Topping Q1 EstimatesShares of JPMorgan Chase (NYSE: NYSE:JPM ) are currently up 3% in Friday's premarket session as the asset tops Q1 estimates.

The company reported better-than-expected fiscal first-quarter results as big banks kicked off the new earnings season.

The banking giant reported earnings per share (EPS) of $5.07 on revenue of $45.31 billion, each up from $4.44 and $41.93 billion, respectively, a year ago. According to estimates compiled by Visible Alpha, some analysts had expected $4.64 and $43.55 billion. It generated $23.4 billion in net interest income (NII), above the $23.00 billion consensus.

Shares of JPMorgan were up 3% immediately following the release of Friday's report. They entered the day down roughly 5% year-to-date but up about 16% in the last 12 months.

"The economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and 'trade wars,' ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility," JPMorgan CEO Jamie Dimon said. "As always, we hope for the best but prepare the Firm for a wide range of scenarios."

Dimon wrote in his annual letter to shareholders this week that he expected the Trump administration's tariffs "will slow down growth."

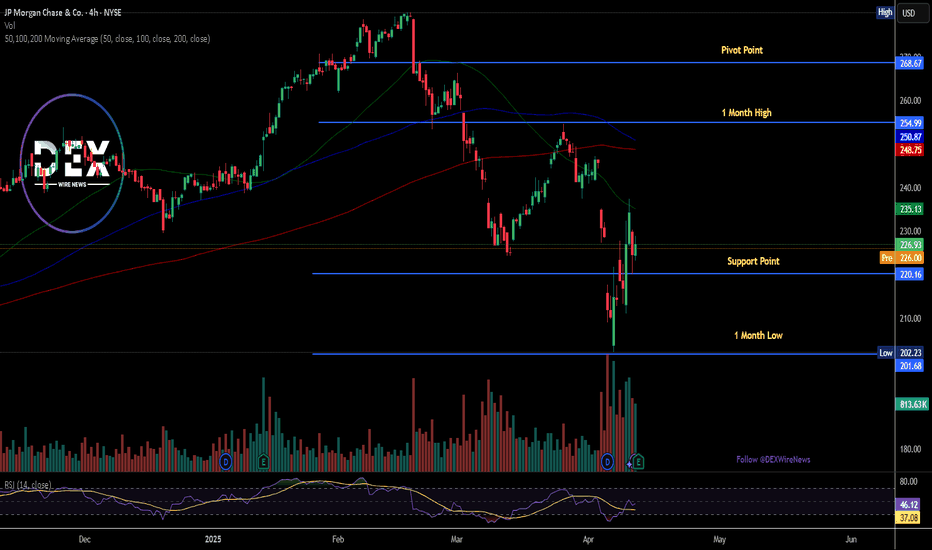

technical Outlook

As of the time of writing, NYSE:JPM shares are already up 1.5% with the asset trading above the support point. A break above the 1-month high pivot could set the course for a bullish campaign eyeing the $260- $280 region.

With the last close RSI at 46, NYSE:JPM shares has more room to capitalize on the dip and make a comeback prior the earnings beat.

JP MORGAN won't give a better buy opportunity in 2025.Last time we looked at JP Morgan Chase (JPM) on November 27 2024 (see chart below), it gave us a clear sell signal that went straight to our $236 Target:

Now that the price rebounded not only on the 1D MA200 (orange trend-line) but also on the bottom (Higher Lows trend-line) of the long-term Channel Up, we are switching back to buying a we even got the first pull-back on the 1D MA50 (blue trend-line).

Given that the 1D RSI also rebounded from oversold (<30.00) territory like the October 27 2023 Low did, we expect a similar Bullish Leg to follow and thus our Target is $330 at the top of the Channel Up.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JP MORGAN: Perfect 1W MA50 rebound targeting $350. JP Morgan is neutral both on its 1D and 1W technical outlooks (RSI = 54.173, MACD = 7.520, ADX = 32.502), suggesting that it remains inside the best buy zone for the long term. As a matter of fact, having rebounded exactly on its 1W MA50, this is the best buy opportunity since October 23rd 2023, which was the last time it hit the 1W MA50. As shown, the long term pattern is a Channel Up and every contact with the 1W MA50 has coincided with a 1W RSI test of the S1 Zone. There is no better buy entry than the current level and we can safely aim for yet another +57.76% run (TP = $350.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

JPM JPMorgan Chase Options Ahead of EarningsIf you haven`t bought JPM before the breakout:

Now analyzing the options chain and the chart patterns of JPM JPMorgan Chase prior to the earnings report this week,

I would consider purchasing the 245usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $5.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

JPM Bullish Breakout? JPMorgan Trend & Seasonal Insights In this video, we analyze JPM, JP Morgan Chase, which is currently exhibiting a strong bullish trend on the daily timeframe. The stock has consistently retraced to 50% of its previous price swings. Adding a seasonality perspective, we observe a historical pattern where the market tends to sell off into December 20th before rallying through the first or second week of January. My bias remains bullish, with a potential buy at the current price contingent on a break of structure. Please note, this is not financial advice.

JP MORGAN Expect a 1D MA50 correction before it turns into a buyJP Morgan Chase (JPM) posted a strong bullish leg on our last analysis (September 17, see chart below) that easily hit our $229 Target:

From a wider perspective on the 1D time-frame, the price is now right at the top of the 13-month Channel Up on an overbought 1D RSI and a 1D MACD that is about to form a Bearish Cross.

All previous Higher Highs of the pattern formed MACD Bearish Crosses and pulled back to the 1D MA50 (blue trend-line) on a minimum of -7.35% correction. Note that the 1D MA200 (orange trend-line) never broke, so as long as it holds, the long-term bullish trend is intact.

As a result, we now expect a pull-back to the 1D MA50 and a minimum of -7.35% decline puts the Target a $236.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JP Morgan Chase weekly (log)Hello commuté,

Weekly chart still in log with linear regression channels

The trend is magnificent, nothing to say it is indeed the first US bank.

The upward trend has been since 2011, it's crazy, right?

The 200-period simple average is in orange on the chart.

Make your opinion, before placing an order.

► Thank you for boosting, commenting, subscribing!

JP MORGAN to rise at least +14% on this rally.We haven't looked into JP Morgan Chase (JPM) in almost 6 months (March 25, see chart below) and the excellent sell signal it gave us:

That was right at the top of its 2-year Channel Up. Right now we have the price rebounding an pricing a Higher Low on a shorter-term Channel Up since the March 25 High. Being still below its 1D MA50 (blue trend-line), gives time for an early buy.

The minimum % of a Bullish Leg within this Channel Up has been +14.07% so our Target is at $229.00 accordingly.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JPMorgan Stock Slumps Amid Interest Income ConcernsJPMorgan Chase & Co. (NYSE: NYSE:JPM ) recently experienced a significant drop in its stock price, slumping over 7% following warnings from its President and COO, Daniel Pinto, about the bank’s net interest income (NII) outlook. As the largest U.S. bank by assets, JPMorgan's financial health is closely watched as a bellwether for the broader banking sector. Here's a deep dive into both the technical and fundamental aspects affecting JPMorgan’s stock.

Fundamental Analysis

JPMorgan's recent stock decline was triggered by Pinto’s comments that NII expectations are overly optimistic given the expected Federal Reserve rate cuts. The Fed is anticipated to lower its key policy rate by at least 25 basis points during its upcoming September meeting, initiating a potential monetary easing cycle. Lower rates are likely to compress NII, which represents the spread between what the bank earns on loans and what it pays on deposits.

Previously, JPMorgan (NYSE: NYSE:JPM ) forecasted its NII to rise to $91 billion this year, excluding its markets division. However, with the Fed’s rate cuts on the horizon, future projections have been adjusted downward. Investors are now concerned that the bank may not hit its 2025 NII target of approximately $90 billion, especially with Pinto's warning that "next year is going to be a bit more challenging."

Expense Outlook and Broader Concerns

Additionally, the analyst estimates for JPMorgan’s expenses in 2025, pegged around $94 billion, have been deemed overly optimistic by Pinto. With inflationary pressures and new investments looming, the bank’s expense base is expected to be higher than current projections. This dual concern over income and expenses has rattled investor confidence, making it JPMorgan's worst drop since June 2020.

Despite these challenges, JPMorgan’s position as a leader in gathering deposits and making loans remains strong. The bank's trading revenue is projected to be flat to slightly up year-over-year, and investment banking fees are expected to rise by about 15%, indicating resilience in other business segments. However, slowing economic growth in the U.S. and an anticipated decline in new loan yields due to rate cuts continue to cloud the outlook.

Technical Analysis

Current Price Action

As of the latest trading session, JPMorgan stock was down 5.19% in extended market trading, reflecting the broader market's nervous reaction to Pinto’s comments. The stock has been under pressure, but the Relative Strength Index (RSI) at 53 suggests that the stock isn’t yet in overbought or oversold territory, indicating a potential for reversal if sentiment shifts positively.

Key Technical Patterns

- Golden Cross Pattern: The daily chart shows a golden cross pattern formed earlier in the year, a bullish indicator where the 50-day moving average crosses above the 200-day moving average. Historically, this pattern has been associated with upward momentum, suggesting potential long-term strength despite current headwinds.

- Support and Resistance Levels: Currently, JPM is trying to establish a base around $133, which acts as a critical support level. A break below this pivot would confirm a bearish reversal pattern, potentially leading to further declines. Conversely, holding above this level could set the stage for a recovery, especially if NII concerns are tempered by unexpected positive news.

- RSI Analysis: The RSI of 53 implies that JPMorgan stock (NYSE: NYSE:JPM ) is positioned for a possible trend reversal. If buying pressure increases, the stock could move towards its next resistance levels near $145 and then $155.

- Bearish Divergence: However, caution is advised as there has been a recent bearish divergence between price and momentum indicators, which could signal further downside if investor sentiment does not improve.

Outlook and Key Considerations

JPMorgan remains fundamentally strong, with robust trading and investment banking revenues cushioning some of the expected pressure on NII. However, the market's reaction to the tempered guidance reflects broader concerns about the impact of lower rates on bank profitability.

For investors, the key takeaway is that while JPMorgan’s stock faces near-term challenges, the bank’s dominant market position, diversified revenue streams, and proactive management strategies still provide a solid foundation. Technically, a close watch on support levels and RSI dynamics will be crucial in determining the stock's short-term direction.

Conclusion

JPMorgan’s recent slump highlights the balancing act the bank must perform amid changing economic conditions. While the market’s reaction has been swift, the long-term narrative for JPMorgan remains constructive, provided the bank can navigate the expected rate cuts and maintain control over rising expenses. For traders and investors, staying informed on both the fundamental outlook and technical patterns will be essential in making well-timed decisions regarding $JPM.

JPM JPMorgan Chase & Co Options Ahead of EarningsIf you haven`t bought the dip on JPM:

Now analyzing the options chain and the chart patterns of JPM JPMorgan Chase & Co prior to the earnings report this week,

I would consider purchasing the 200usd strike price in the money in the money Calls with

an expiration date of 2025-1-17,

for a premium of approximately $17.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

JP Morgan Surprises Investors with Strong EarningsOn Friday, JP Morgan surprised investors with a robust earnings release, posting an impressive +4.01% increase and a revenue surge of 20.78% above estimates. This positive news has ignited investor confidence and set the stage for a potential bullish trend.

Historically, JP Morgan's stock has shown a seasonal pattern of growth during this period. Over the past 15 years, the company's stock price has typically increased during the summer months. This historical trend, combined with the recent strong earnings report, suggests a favorable outlook for JP Morgan's stock in the near term.

The pre-market indicators are already showing gains, reflecting investor optimism. Given these positive signals, we are looking to open a long position at the start of the New York session today.

✅ Please share your thoughts about JPM in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

JPMorgan Chase Stock Dip: An Opportunity Amidst the NumbersIn the wake of last week's unexpected setback for JPMorgan Chase's stock, investors are presented with a perplexing narrative. Contrary to expectations, the banking giant refrained from revising its 2024 revenue guidance, leading to a notable 6% drop in share price. Yet, beneath this seemingly negative surface lies a compelling investment opportunity, driven by robust performance metrics and strategic positioning within the financial sector.

Despite the initial market reaction, JPMorgan Chase's first-quarter results surpassed expectations, with impressive revenue and per-share profit figures. While the lack of upward revision to net interest income guidance caused temporary turbulence, a deeper analysis reveals several positive indicators supporting a bullish outlook.

Notably, JPMorgan Chase has outperformed its competitors in key areas, including loan losses, interest income growth, and revenue diversification. The bank's proactive measures to optimize its balance sheet and enhance fiscal flexibility further underscore its resilience in the face of market challenges.

Moreover, the company's solid financial foundation, highlighted by robust return on equity metrics, distinguishes it as a top performer within the industry. Compared to peers, JPMorgan Chase's profitability remains unmatched, reflecting its ability to deliver consistent shareholder value over the long term.

While market dynamics and external factors may influence short-term stock movements, the intrinsic strength of JPMorgan Chase as a company remains steadfast. As such, the recent dip in share price presents an attractive entry point for investors seeking exposure to a leading player in the financial sector.

In conclusion, JPMorgan Chase stands as a beacon of stability and profitability in an ever-evolving market landscape. The recent downturn in stock price offers investors an opportunity to capitalize on the company's enduring strength and potential for future growth. As always, prudent investors should conduct thorough due diligence and consider their investment objectives before making any decisions.

JPMorgan profit rises 6% But stock Plummets by 4.82%Amidst a 6% surge in profit, JPMorgan Chase ( NYSE:JPM ) faces a rocky road ahead as its interest income forecast falls short, resulting in a 4.82% stock plummet.

Despite the bank's robust financial performance in the first quarter, JPMorgan's ( NYSE:JPM ) projection for income from interest payments failed to meet analysts' expectations, triggering a dip in its shares. CEO Jamie Dimon's cautious outlook underscores the uncertainties looming over the economic horizon, including global conflicts, inflationary pressures, and quantitative tightening.

While the bank anticipates an uptick in net interest income (NII) for the full year, it fell short of market predictions, signaling potential challenges ahead. The dip in share value, however, contrasts analysts' positive sentiments regarding JPMorgan's overall performance in what was described as another "solid" quarter.

As the banking giant grapples with economic uncertainties, its succession plans come into focus, with potential successors to Dimon's leadership identified by the board. Amidst speculation about Dimon's future, both within the bank and potentially in a governmental role, the stability and trajectory of JPMorgan remain under scrutiny.

Despite the challenges, JPMorgan ( NYSE:JPM ) continues to expand its workforce and navigate evolving market dynamics, demonstrating resilience in a volatile financial landscape.

Technical Outlook

JPMorgan ( NYSE:JPM ) stock is nosediving toward a new support zone. The Relative Strength Index (RSI) of 36.91 reaffirms the thesis. The stock is trading below the 50-day Moving Average (MA).

JPMorgan's ( NYSE:JPM ) 4-month Price chart shows a "Bearish Harami" candlestick pattern.

JPM JPMorgan Chase & Co Options Ahead of EarningsIf you haven`t bought JPM before the previous earnings:

Then analyzing the options chain and the chart patterns of JPM JPMorgan Chase & Co prior to the earnings report this week,

I would consider purchasing the 170usd strike price in the money Calls with

an expiration date of 2024-4-19,

for a premium of approximately $28.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

JPMorgan Chase & Co. Surges to New All Time High JPMorgan Chase & Co. has recorded a surge in its all-time high amidst market volatility, currently trading at $200 per share with a Positive Relative Strength Index (RSI) of 72.90. With U.S. stocks experiencing one of their best six-month runs in over a decade, JPMorgan Chase & Co. ( NYSE:JPM ) is at the forefront of this market momentum. The financial giant's upcoming earnings report is expected to set the tone for the banking sector, with investors eagerly awaiting insights into its performance amidst evolving market dynamics.

Driven by surging tech stocks and aligned interest rate forecasts with the Federal Reserve's outlook, the current market landscape is optimistic. However, analysts caution that the current rally may face headwinds in the second half of the year, and concerns linger over valuations and the potential impact of higher interest rates. Against this backdrop, JPMorgan's upcoming earnings release holds significance as a barometer of market sentiment and economic health.

JPMorgan's upcoming earnings report on April 12th will provide crucial insights into the banking sector's performance. Analysts expect earnings per share (EPS) of $4.21 for the current quarter, indicating a modest increase of 2.7% year-over-year. However, for the current fiscal year, consensus estimates point to a slight decline of 3%, highlighting the challenges faced by financial institutions amidst changing market conditions.

Revenue estimates for the current quarter suggest a year-over-year increase of 6.3%, reflecting JPMorgan's resilience in generating top-line growth. The bank's track record of beating EPS estimates in the past four quarters underscores its ability to deliver shareholder value even in a challenging operating environment.

As investors assess JPMorgan's valuation, the bank's strategic initiatives in wealth management offer potential avenues for growth. The launch of the Wealth Plan tool underscores JPMorgan's commitment to expanding its reach in wealth management and attracting new investments. With a focus on financial planning and personalized advisory services, the bank aims to capitalize on emerging opportunities in the wealth management space.

JPMorgan's earnings report will provide insights into the bank's resilience and adaptability. With a track record of innovation and strategic foresight, JPMorgan ( NYSE:JPM ) remains well-positioned to weather market challenges and deliver long-term value to shareholders. As such, investors eagerly anticipate the bank's financial results and strategic outlook amidst evolving market dynamics.

Jamie Dimon Divests 150 Million Worth of JPMorgan Chase StockDimon's recent divestment of 821,778 shares of common stock, worth approximately $150 million, underscores a larger strategy unveiled last October. This calculated maneuver, meticulously executed under the guidelines of SEC Rule 10b5-1, demonstrates astute foresight and confidence in the company's trajectory. Despite the divestment, Dimon and his family retain significant ownership, affirming their enduring faith in JPMorgan Chase's ( NYSE:JPM ) potential.

The market's response to NYSE:JPM 's performance on February 23, 2024, further solidifies its status as a beacon of stability and growth in the financial sector. Trading near the pinnacle of its 52-week range, the stock's ascent above its 200-day moving average signals sustained momentum and resilience in the face of market fluctuations. With a modest yet notable increase of $1.10 per share, JPMorgan Chase & Co.,( NYSE:JPM ) continues to capture investor interest, bolstered by its robust fundamentals and unwavering commitment to delivering value.

JPM's financial prowess is not merely confined to its stock performance; its recent earnings report speaks volumes about its resilience and adaptability. A staggering $239.32 billion in revenue over the past year, coupled with a formidable $62.83 billion in the fourth quarter alone, underscores the company's ability to navigate complex market dynamics with finesse. Net income paints a similarly impressive picture, with $49.26 billion accrued over the past year and $9.26 billion in the fourth quarter, attesting to JPM's enduring profitability and operational efficiency.

Earnings per share (EPS) provide a tangible metric of JPMorgan Chase's ( NYSE:JPM ) shareholder value creation, with a commendable $16.23 over the past year and $3.04 in the fourth quarter. These figures not only validate the company's strategic initiatives but also instill confidence in its ability to generate sustainable returns for investors.

As the financial landscape continues to evolve, JPMorgan Chase & Co., ( NYSE:JPM ) stands as a paragon of stability, innovation, and strategic foresight. Jamie Dimon's recent divestment, coupled with the company's stellar financial performance, underscores its unwavering commitment to shareholder value and long-term sustainability. For investors seeking exposure to the financial services sector, JPMorgan Chase & Co. ( NYSE:JPM ) remains a compelling choice, poised to capitalize on emerging opportunities and navigate challenges with resilience and poise.

In conclusion, amidst strategic maneuvers and robust financial performance, JPMorgan Chase & Co., ( NYSE:JPM ) emerges as a steadfast leader in the global financial arena, poised for continued success and value creation in the years ahead.

JPMorgan's 4Q 2023: Navigating Challenges Amidst Resilience

In the intricate dance of finance, JPMorgan's fourth-quarter 2023 results unveil a narrative of resilience, strategic prowess, and a cautious gaze toward potential headwinds. As the behemoth financial institution reported adjusted earnings of $3.97 per share, surpassing expectations, CEO Jamie Dimon's reflections on the U.S. economy's resilience and his cautionary notes create a backdrop for a compelling analysis.

The Triumphs:

JPMorgan's stellar performance was propelled by a trio of factors – higher interest rates, the transformative First Republic Bank deal, and a moderate improvement in the Investment Banking (IB) segment. The adjusted earnings of $3.97 per share handily outpaced the Zacks Consensus Estimate, revealing a financial powerhouse that knows how to navigate challenges.

Strategic Moves:

The strategic landscape unfolded with notable achievements. The First Republic Bank deal and higher interest rates were pivotal in supporting Net Interest Income (NII), projected to hit $90 billion in the coming year. Commercial Banking witnessed a surge in average loan balances, while the IB business exhibited a commendable 13% increase in total fees. JPMorgan's calculated market moves showcased its ability to harness opportunities even in a dynamic environment.

Economic Caution and Global Uncertainties:

However, amidst the triumphs, Jamie Dimon's cautionary remarks echo the realities of the broader economic landscape. Stickier inflation and the geopolitical tensions in Ukraine and the Middle East pose potential threats, emphasizing the need for a vigilant approach. JPMorgan's acknowledgement of these challenges underscores the delicate balance the institution maintains in navigating global uncertainties.

Challenges and Concerns:

The financial tale is not devoid of challenges. Operating expenses witnessed an uptick, with adjusted non-interest expenses expected to hover around $90 billion. Net income, though robust in most segments, declined by 15%, raising eyebrows amid projections of a potential economic slowdown and reduced loan demand.

Financial Metrics Unveiled:

The financial metrics paint a comprehensive picture. Net revenues surged by 12% to $38.57 billion, yet fell short of the Zacks Consensus Estimate. NII witnessed a commendable 19% YoY increase to $24.05 billion, fueled by higher rates and revolving balances in Card Services. Non-interest income grew by a modest 1%, but non-interest expenses surged by 29%, partly due to the FDIC special assessment charge and rising compensation expenses.

Ethereum Set to Outshine Bitcoin, Says JP MorganIn a recently released financial outlook for 2024, JP Morgan, a global leader in financial services, has presented a cautious stance on the cryptocurrency industry. Despite the approaching Bitcoin halving event, the bank anticipates Ethereum (ETH) outperforming Bitcoin (BTC) in the coming year. This forecast emerges amidst heightened anticipation and speculation within the crypto market.

Ethereum’s EIP-4844 Could Eclipse Bitcoin’s Growth

JP Morgan’s analysis suggests Ethereum could see more significant growth than Bitcoin in 2024. The bank points to Ethereum’s upcoming EIP-4844 update, also known as “Proto-dank sharding,” as a potential catalyst for its performance. This upgrade is expected to enhance Ethereum’s network efficiency and scalability, giving it an edge in the market.

Contrastingly, Bitcoin’s much-anticipated halving event, which traditionally has been a bullish signal for the cryptocurrency, is considered by JP Morgan to be already factored into its current price. The halving, which reduces the reward for mining new Bitcoins, is expected to increase production costs and potentially lead to a 20% decline in the hash rate. According to JP Morgan, this could result in higher operating costs for miners and drive less efficient miners out of the market.

Ethereum Favored Over Bitcoin in JP Morgan’s Outlook

One of the central themes in JP Morgan’s report is the notion of “excessive optimism” surrounding Bitcoin. As per the bank’s analysts, this optimism has led to the asset being overbought in a market that has preemptively priced in the effects of the upcoming halving event. The bank further argues that the expectations for capital inflows into Spot Bitcoin ETF products are overstated, potentially setting up the market for disappointment.

Regarding mining, the halving event is expected to double production costs based on current hash rates and Bitcoin mining difficulties. This cost increase, combined with a predicted decline in the hash rate, may force miners with excessive operating costs to exit, further impacting the Bitcoin ecosystem.

While JP Morgan’s outlook favours Ethereum over Bitcoin in the upcoming year, the bank has not shied away from expressing concerns regarding Ethereum, particularly its centralized staking mechanism. This aspect of Ethereum’s network has raised questions about network security and decentralization, critical factors in any cryptocurrency’s broader acceptance and success.