JPMorgan Chase Reports Earnings Today, Topping Q1 EstimatesShares of JPMorgan Chase (NYSE: NYSE:JPM ) are currently up 3% in Friday's premarket session as the asset tops Q1 estimates.

The company reported better-than-expected fiscal first-quarter results as big banks kicked off the new earnings season.

The banking giant reported earnings per share (EPS) of $5.07 on revenue of $45.31 billion, each up from $4.44 and $41.93 billion, respectively, a year ago. According to estimates compiled by Visible Alpha, some analysts had expected $4.64 and $43.55 billion. It generated $23.4 billion in net interest income (NII), above the $23.00 billion consensus.

Shares of JPMorgan were up 3% immediately following the release of Friday's report. They entered the day down roughly 5% year-to-date but up about 16% in the last 12 months.

"The economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and 'trade wars,' ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility," JPMorgan CEO Jamie Dimon said. "As always, we hope for the best but prepare the Firm for a wide range of scenarios."

Dimon wrote in his annual letter to shareholders this week that he expected the Trump administration's tariffs "will slow down growth."

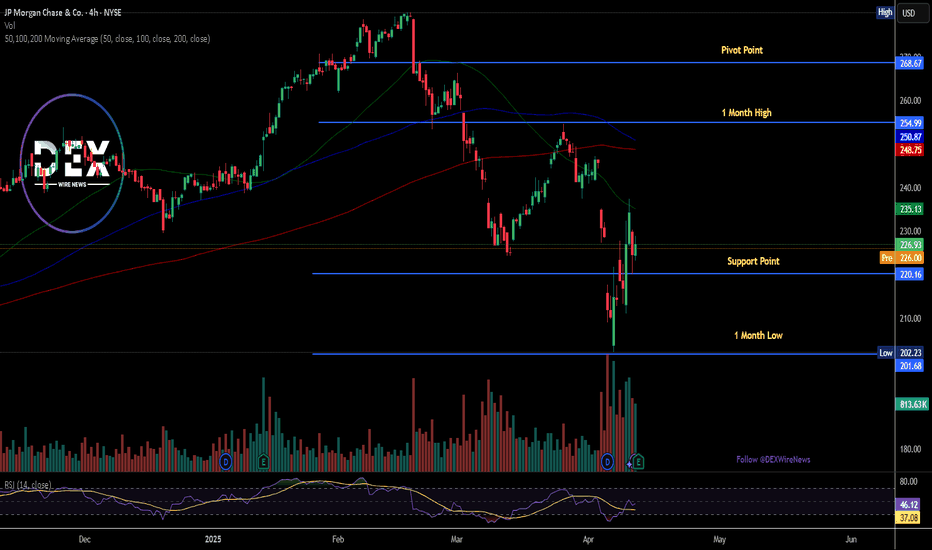

technical Outlook

As of the time of writing, NYSE:JPM shares are already up 1.5% with the asset trading above the support point. A break above the 1-month high pivot could set the course for a bullish campaign eyeing the $260- $280 region.

With the last close RSI at 46, NYSE:JPM shares has more room to capitalize on the dip and make a comeback prior the earnings beat.

Jpmorganshort

An opportunity to buy JPMorgan stockHi, according to my analysis of .jp morgan stock. There is a fantastic long term investment opportunity. Especially with the price breaking the resistance area at the level of 144. Likewise, the stock exited the sideways channel. We also notice a rising channel as shown in the analysis. good luck for everbody .Note: If you like this analysis, please give your opinion on it. in the comments. I will be happy to share ideas. Like and click to get free content. Thank you

JP Morgan boss plays down risk of crisisBEARISH MID TEM

BULLISH SHORT TERM

JP Morgan boss plays down risk of crisis

THE MARKET IS FULL OF MANIPULATIONS Spoofing

Spoofing - This involves placing orders with no intention of executing them, in order to create a false impression of market demand or supply, and then cancelling the orders once the market has moved in the desired direction.

We're keeping an eye on the market makers, zooming in for a closer look."

Spoofing and Volume Point of Control (VPOC) are terms used in the context of market manipulation and market analysis in financial markets.

A spoofing detector is a tool developed to detect the spoofing of orders. Spoofing refers to a practice where a market participant places large orders to deceive other market participants and influence the price of a stock. These large orders, however, are not executed but cancelled shortly after, creating a false demand for a specific stock and influencing the price. A spoofing detector can use algorithms to detect and report these practices to maintain the integrity of the market.

The Volume Point of Control (VPOC) is a concept in technical analysis aimed at identifying the key price level at which a stock was bought and sold. VPOC is calculated by analyzing the volume data of a stock and determining the price level at which the largest volume was traded for a specific period. This price level can serve as an indicator of the current market trend and market interest in a specific stock.

There is a substantive connection between a spoofing detector and VPOC because both tools can be used to gain a better understanding of the stock markets and detect potential forms of market manipulation. For example, VPOC can be used as an indicator of potential market manipulation when an abnormal distribution of trading volume is observed at a specific price level. A spoofing detector can then be used to detect and report these activities.

Jamie Dimon, the boss of JP Morgan, has played down the risk of a spiralling banking crisis after America’s biggest bank stepped in to buy most of collapsed lender First Republic in a $10.6bn (£8.5bn) takeover hurriedly brokered by US regulators.

After weekend talks to secure a sale of First Republic, the third US lender to fail this year, the Federal Deposit Insurance Corporation (FDIC) confirmed JP Morgan as the buyer.

The regulator is providing $50bn of financing and promising to share loan losses, as part of a deal that further cements JP Morgan’s position as the largest lender in the US.

First Republic’s failure is the second largest in US banking history, beaten only by the 2008 demise of Washington Mutual – which was also seized by the FDIC and sold to JP Morgan.

Speaking on a conference call, Dimon played down any other similarities with the 2008 crash, which triggered the start of an international financial crisis that plunged the global economy into recession.

He said the US banking system was “extraordinarily sound”, adding that the takeover meant the sector was “getting near the end” of the spate of bank collapses and would “hopefully help stabilise everything”.

The failure of First Republic follows that of Silicon Valley Bank (SVB) and Signature Bank. The sequence has prompted concerns about a repeat of the contagion that characterised the global banking crisis.

Dimon said conditions were “nothing like 2008 and 2009 for a lot of different reasons”. However, he conceded that if the US economy went into recession and high interest rates persisted, that could lead to “other cracks in the system”.

Under the terms of the First Republic deal, JP Morgan will acquire all of the California-based bank’s deposits and “substantially all of the assets”, winning out over as many as five rivals reportedly in the running.

Dimon said: “Our government invited us and others to step up, and we did. This acquisition modestly benefits our company overall, it is accretive to shareholders, it helps further advance our wealth strategy, and it is complementary to our existing franchise.”

First Republic, which focused on high-net-worth clients, got into financial difficulty after customers began pulling deposits from any US lender perceived as weak, after the SVB collapse.

Growing anxiety about the health of the US banking sector has forced the Federal Reserve to launch emergency measures to stabilise the markets.

A group of 11 Wall Street banks had pumped $30bn into First Republic last month in an attempt to avoid the third bank failure of 2023. However, shares in the San Francisco-based bank fell by more than 75% last week after it revealed customers had withdrawn $100bn of deposits in March.

TREND SHORT

KEY LEVELS

119

109

87

JPM JPMorgan Chase & Co. Options Ahead Of EarningsIf you haven`t sold JPM here:

Then looking at the JPM JPMorgan Chase & Co. options chain ahead of earnings , I would buy the FWB:124 strike price Puts with

2023-4-14 expiration date for about

$1.35 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

JPM JPMorgan Chase & Co. Options Ahead Of EarningsIf you haven`t sold JPM after the profit fall:

Then you should know that looking at the JPM JPMorgan Chase options chain, i would buy the $104 strike price Puts with

2022-10-14 expiration date for about

$2.09 premium.

Looking forward to read your opinion about it.

JPM options ahead of earningsIf you haven`t shorted JPM after the Q1 results:

then ahead of Q2 earnings I would buy the following JPMorgan Chase & Co. (JPM) puts:

2023-1-20 expiration date

$113.19 entry price (approximatively)

$90 strike price

$3.15 premium/share

Looking forward to read your opinion about it.

JPMorgan Falls Thru Trap-Door Equivalent to Pre-COVID HighsNot much of an explanation needed here... financials have been struggling, and JPM right along with them. What's notable here is that price has fallen below the pre-COVID highs, which means that all recapture, plus growth obtained prior to COVID, has all be vanished for stockholders of the mega-bank.

Written & Annotated for the CMT Association.

Adam D. Koós, CFP®, CMT, CEPA

President / Sr. Financial Advisor / Portfolio Manager

Libertas Wealth Management Group, Inc.

JP Morgan Chase & Co. bearish scenario:We have technical figure Rising Wedge in US company JPMorgan Chase & Co . ( JPM ) at daily chart . JPMorgan is an American multinational investment bank and financial services holding company. The Rising Wedge has broken through the support line at 15/06/2021, if the price holds below this level we can have possible bearish price movement with forecast for the next 30 days towards 146.13 USD. Our stop loss order should be placed at 167.44 EUR if we decide to enter this position.