JPY at Key Zone – EURJPY & GBPJPY Could Drop 1k+ PipsExactly one year ago, the JPY Currency Index broke above the falling trendline of a falling wedge, signaling the end of a bearish cycle that had lasted nearly five years.

As is typical after long-term reversals, the reaction was sharp and fast, and the price quickly reached the first resistance target of the pattern.

Since then, the index entered a lateral phase, with clear support forming around the 730 zone.

________________________________________

🔍 Current Price Action

Recently, the price pulled back to test that same support, and at the time of writing it sits at 737, forming a tight consolidation.

This suggests we’re again at an inflection point.

________________________________________

📊 Trade Outlook

From a medium-term perspective, I believe the index is preparing for another leg higher, potentially toward resistance at 780.

➡️ That would mean a 7% rise on the JPY Index – and this move could translate into more than 1,000 pips of downside for pairs like EURJPY and GBPJPY.

________________________________________

🔄 What’s Next?

In the coming sessions, I’ll focus on these two pairs as they offer the clearest setups and have the strongest volatility.

Stay tuned — follow for the next updates. 🚀

Jpyanalysis

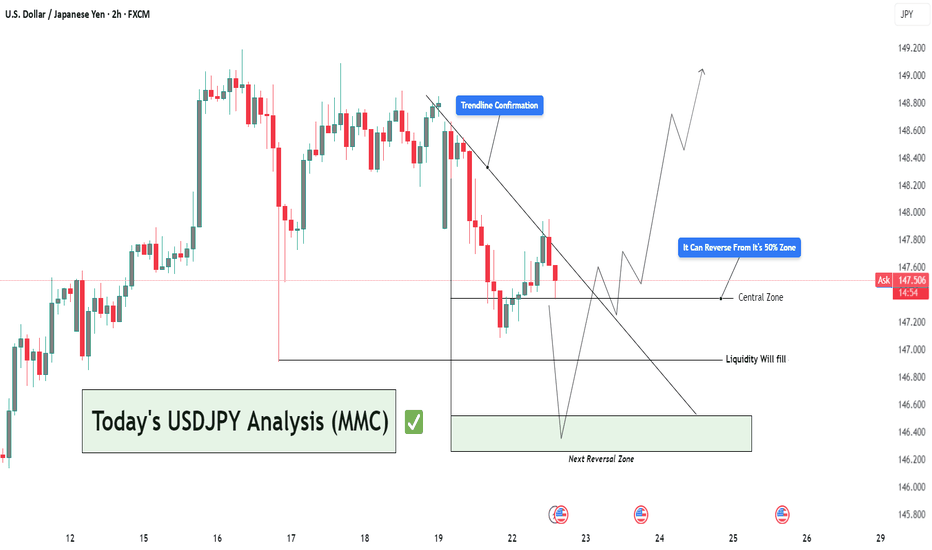

USDJPY Analysis : Trendline Breakout, Liquidity Trap & MMC Zone🔍 Full Technical Breakdown:

In today’s USDJPY 2H chart, the market is unfolding exactly as per Mirror Market Concepts (MMC). We’ve identified a clean trendline breakout, and now price is reacting between the Central Zone (50%) and the Next Reversal Zone, where liquidity is expected to be filled. Let's break down each zone and movement to understand how price is being manipulated and where we can take action.

🔵 1. Trendline Confirmation – The First Sign of Strength

The trendline was tested multiple times from the top, acting as resistance. But recently, price broke above this line with strength, signaling a potential bullish reversal. You've rightly marked it as "Trendline Confirmation" — this is where structure shifted from bearish to bullish.

This is a classic MMC principle — breakout above manipulated resistance, followed by a pullback for re-entry.

The breakout wasn’t just a wick; it had body strength, indicating real buyer presence.

Now, price is pulling back to retest the trendline from above, a typical MMC behavior before continuing upward.

⚖️ 2. Central Zone – The 50% Trap

This zone represents the midpoint of the last major impulsive move. It's where most traders get confused, and institutions re-balance their entries.

You've highlighted: “It Can Reverse From Its 50% Zone” – and that’s accurate.

According to MMC, this is where smart money traps late sellers, takes liquidity, and initiates the next bullish leg.

If price holds above the 147.200–147.500 zone, we could see buyers stepping in aggressively.

🟩 3. Liquidity Fill – Next Reversal Zone

If price doesn’t hold the Central Zone, we don’t panic — this is where MMC becomes powerful.

Beneath current structure lies liquidity — previous stop hunts and unfilled orders.

That area is your Next Reversal Zone around 146.200–146.400.

It’s a liquidity trap — market might dip there just to manipulate emotional traders, then reverse with force.

This is exactly where you’ve written “Liquidity Will Fill” — meaning smart money might fill orders there before moving up.

🧭 Possible Price Paths:

🔼 Bullish Scenario (High Probability):

Trendline retest holds as support.

Price bounces from the 50% Central Zone.

Targets: 148.800 – 149.200 (previous highs and clean breakout zone).

Confirmation: Bullish engulfing candle or strong wick rejection at Central Zone.

🔽 Bearish Trap Scenario (MMC-Based):

Price dips below Central Zone into liquidity zone.

Traps sellers and triggers stop-losses.

Reverses sharply from Next Reversal Zone (Liquidity Zone).

This is where smart money positions themselves for the real move up.

🧠 MMC Insight:

This structure is textbook MMC – clean manipulation zones, false breakout traps, and a trending bias powered by smart liquidity plays.

Trendline breakout = initial intent

Central zone = confusion zone

Liquidity trap = entry for smart money

📢 The goal is not to predict, but to react with precision when the market reveals its hand.

🕒 Timeframe: 2H

📌 Strategy: Mirror Market Concepts (MMC) | Trendline + Liquidity + Midpoint Trap

📈 Bias: Bullish, but waiting for confirmation at either Central or Liquidity Zone

🔍 Sentiment: Cautiously Optimistic

Weekly FOREX Forecast: Wait To Buy JPY vs USD!In this video, we will analyze JPY futures and USDJPY. We'll determine the bias for the upcoming week, and look for the best potential setups.

The Yen is strong, and will outperform the USD in times of uncertainty. It is the worlds' safe haven of choice.

Look for a small retracement before JPY pushes higher.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

USDJPY | Yen Futures Weekly FOREX Forecast: Feb 3-7thThis forecast is for the upcoming week, Feb 3 - 7th.

The Yen has been week for an extended amount of time, underperforming against the USD. But the tide might be changing, this NFP week. As the USD is reacting to a HTF selling zone over the last couple of weeks, the Yen is finding buyers during that same time. This could continue for the near term.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Weekly FOREX Forecast Oct. 28: USDJPY Is a BUY This Week! The JPY has been weak and will continue to trend downward. The USD is supported by favoring fundamentals, and will likely continue its current bullish leg.

Patience will pay you this week. Wait for valid buy setups. Sells are countertrend and lower probability, imo.

Buy USDJPY. Sell JPY Futures.

Enjoy!

May profits be upon you.

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

JPY Basket Daily TF

The JPY Basket is now rejecting off my point of interest (POI) after a bullish run lasting seven days. If the price re-enters the bearish channel, it will confirm a false breakout. Once the JPY Basket closes back within the channel, it is expected to resume its bearish trend and potentially reach a new low.

JPY - A Descending Wedge Screams BullJPY showed a quick bout of bull strength on Monday and Tuesday of last week only to fall back down to the bottom of the wedge. That Tuesday bull bar could be the first sign of a reversal.

This week, we should be looking for another bounce off of the wedge to confirm a move to the upside. The first target is the 9EMA of the Monthly chart between 784.0 and 785.0, a brief pullback, then a breakthrough to the previous resistance at 807.0.

If we fall through the wedge, be cautious that JPY will fall much further. JPY has been in a strong descension since March of this year and is showing signs of waning bears. Look for long opportunities at these levels for at least a small swing to the upside.

Trade wisely and let us know what you think in the comment section below!

JPY INDEX ELLIOT BREAKDOWN Currently, we are at the last wave of the overall wave which is the wave 5. Expect rejections around 775.0 price level. baased on the previous candles that left a gap without filling, expect price to fill it in the future and that will be the target after breakout of the red trendline.

Expect a Bullish run on CADJPY - ReversalPIVOT: 99.00

OUR PREFERENCE

Long Position above 99.00 with targets at 101.20 , 102.20 & 103.20 in extension

Alternate Scenario

Below 99.00 look for further downward trend with 97.00 & 96.30 as targets.

Comment:

the immediate trend is down but the momentum is weak

JPY INDEX LONG IDEAPrice is currently at a discount and approaching a 1H bullish orderblock. I would like to see those Equal Lows taken and for the Bullish orderblock to be traded into, before an expansion to the upside. The Low resistance liquidity would be my first initial target.

Once price has filled my order, I would shout pairs XXX/JPY pairs after some displacement.

⭕️SELL EURJPY at the best Price 😉 💣🔰You can see the analysis of the Euro to Japanese Yen currency pair in a 15-minute time frame (EURJPY_ 15min)💣🔍

💥Considering the breaking of the up trend line🖤 by the price, if the price returns to the SUPPLY zone, it may fall to the DEMAND zone🔻🧐

Do you think this analysis can be profitable❓

I hope the analysis was useful for you🤍🌹

📌Please introduce the channel to your friends 🙏🏻

_______📈TRADER STREET📉________

⭕️BUY AUDJPY; Its time to buy🤨❗🔰You can see the analysis of Australian dollar to Japanese yen in a 30-minute time frame (AUDJPY_ 30min)🔍💣

Due to the breaking of the Downward trend line🖤 by the price, if the price reaches the Support🧡, there is a possibility of the price rising to the SUPPLY zone🚀🔺

Do you think this analysis can be profitable❓

I hope the analysis was useful for you🤍🌹

📌Please introduce the channel to your friends 🙏🏻

__________📈TRADER STREET📉___________

⭕️SELL USDJPY ; Its time to sell❗️🔰You can see the analysis of US dollar to Japanese yen in one hour time frame (USDJPY_ 1H)🔍💣

💥As it is clear from the picture, the price is moving in a Bullish parallel channel💜❗ Due to the presence of the price in the SUPPLY zone and the Resistance area (the upper line of the Bullish parallel channel💜), we can expect the price to fall🔻 to the overlapping area of the Up trend line🖤 and Support🧡🧐

Do you think this analysis can be profitable❓

I hope the analysis was useful for you🤍🌹

📌Please introduce the channel to your friends 🙏🏻

__________📈TRADER STREET📉___________

⭕the best buying and selling areas for the CAD/JPY🧨🔥🔰You can see the analysis of the Canadian dollar to Japanese yen currency pair in the four-hour time frame (CADJPY_ 4H)🔍💣

💥As it is clear from the picture, the price is moving in an Bullish parallel channel🖤❗If the price can break the lower line of the channel (dynamic support) and stabilize❗ below it, then it can have a downward trend until the DEMAND zone and Support🧡 🔻

If the price can break the Downward trend line🖤 and stabilize❗ above it, it can experience an increase up to the Resistance🧡, and if it breaks the upward Resistance🧡 and stabilizes❗ above it, it can have another increase up to the SUPPLY zone🔺🚀

which direction will the price go to the GREEN💚 side or the RED❤️ side❓❓

I hope the analysis was useful for you🤍🌹

📌Please introduce the channel to your friends 🙏🏻

_________📈TRADER STREET📉__________

FOMC vs BoJ Intervention Today’s FOMC meeting policy was as expected, with a 75-basis-points rate hike to 3.25%. In reaction, the USD/JPY moved towards the upside breaking a daily consolidation level.

The JPY, however, may find some support after the Bank of Japan (BoJ) carried out a rate check in preparation for a possible intervention for the currency. Japan is now prepared at any time to intervene in the forex market to support the yen (by selling dollar/ buying yen), if needed.

On the technical side, after the rate decision from the FED, the 145.00 price level comes into stronger focus.

According to Mean Reversion Channel (Fareid's MRI variant) Indicator, the price is currently hovering at the weak overbought condition zone. As such, there is a suggestion that the USD/JY still has a limited potential to the upside before reaching the strong overbought area. If the price breaks above the 145.00 resistance level, the MRC indicator suggests that a target above 147.00 may be wishful thinking in the very near term.

encounter increasingly strong resistance at 147.00 as indicated by the MRC indicator for a conservative target or push towards the 150.000 psychological supply zone with strong momentum otherwise.

Long-term targets would be around 150.00, and the 1990 high price point of 160.00. These longer-term targets are contingent on the BoJ remaining neutral and not intervening in the currency markets.

If the BoJ does in fact intervene, watch for the price to test 143.00 support area. Without knowing exactly how far the BoJ will go to support the yen, the market may get spooked and a larger sell-off in the USD/JPY than the BoJ is directly responsible for may occur. A break below that zone could potentially retest the 140.353 indicated by the MRC.

⭕️BUY USDJPY at the best place and time 😉 ❗️🔰You can see the analysis of the US dollar in Japanese yen in a four-hour time frame(USDJPY _ 4H)💣🔍

⚪Due to the overall price uptrend, the best area to buy overlapping❗ area is the black🖤 uptrend line and the broken downtrend line is orange🧡 and DEMAND zone❗❗ If the price reaches this overlapping area, it can have an upside to the SUPPLY zone🚀🔺

Do you think this analysis can be profitable❓❓

I hope the analysis was useful for you🤍🌹

📌Please introduce the channel to your friends 🙏🏻

__________📈TRADER STREET📉___________

💰GBPJPY analysis in Four-hour time🔥🔰You can see the analysis of the British Pound in Japanese Yen in four-hour time in the picture(GBPJPY - 4H)🔍

🔰As is evident from the image, the price moves in a triangle❗❗

✴️In your opinion, which side will the triangle break from and which direction will the price go to the GREEN💚 side or the RED💓 side❓❓

I hope the analysis was useful for you🤍🌹

📌Please introduce the channel to your friends 🙏🏻

____________📈TRADER STREET📉_______________

💰AUDJPY analysis in four-hour time🔥🔰You can see the analysis of the Australian dollar in Japanese yen in four-hour time in the picture (AUDJPY - H4)🧐

🔰Due to the price movement in orange and black channels❗️ The closest areas of supply and demand to the current price are marked with purple💰

✴️Do you think the price trend will be based on the GREEN💚 line or the RED❤️ line ❓❓

I hope the analysis was useful for you🤍🌹

📌Please introduce the channel to your friends 🙏🏻

____________📈TRADER STREET📉_______________

⭕️SELL USDJPY ; Its time to sell❗️🔰You see the analysis of the US dollar against the Japanese Yen in Daily ( USDJPY , D1)❗️🔎

🔰SELL USDJPY at 125.600

✅TP ; 122.00

❌SL ; 126.300

🔰As is evident from the analysis, considering the price in the sales supply area in this range, it seems logical that the target is placed at the confluence of the demand area (orange) and the uptrend support line (white dotted line)❗️🧐

⚠️⚠️Please observe capital management and open a low volume transaction❗️❗️

I hope this analysis is useful for you🙏🏻🌹

📌Please introduce the "TRADER STREET" to your friends 🙏🏻

_______________________📈TRADER STREET📉________________________

⭕️SELL GBPJPY ; Its time to sell🧐🔰You see the analysis of the GBP against the Japanese Yen in Daily ( GBPJPY , D1)❗️🔎

🔰SELL Limit GBPJPY at 164.150

✅TP ; 157.300

❌SL ; 166.700

🔰Considering the price being in the range of white downtrend line and supply range, selling in this area seems reasonable. The target is placed at the confluence of the uptrend line (white dotted line) and the orange support line 🧐

⚠️⚠️Please observe capital management and open a low volume transaction❗️❗️

I hope this analysis is useful for you🙏🏻🌹

📌Please introduce the "TRADER STREET" to your friends 🙏🏻

_______________________📈TRADER STREET📉________________________

Short CADJPY -JPY looks strong (20 Dec, 2021)With the exception of USDJPY (it looks a bit tricky) all JPY crosses are giving clear bearish signals.

I am looking to take a short on CADJPY. The support at 88.30 has been convincingly broken. This happened on 30th Nov as well but subsequent bullish recovery attempts were quite weak by comparison. I believe that after a retest of this previous support, we will see a bearish continuation of the trend that began in late Oct.

Price is once again below the 200 DMA and that by itself is a bearish sign. An entry near 88.30 would permit a small stop loss and first target would be above 85.10 - a nice 3R trade opportunity. The next target lies below at 82.00

If you like my analysis, please give it a “thumbs up” and follow me to get immediate notifications.

Always use sound money and risk management in all your trades.