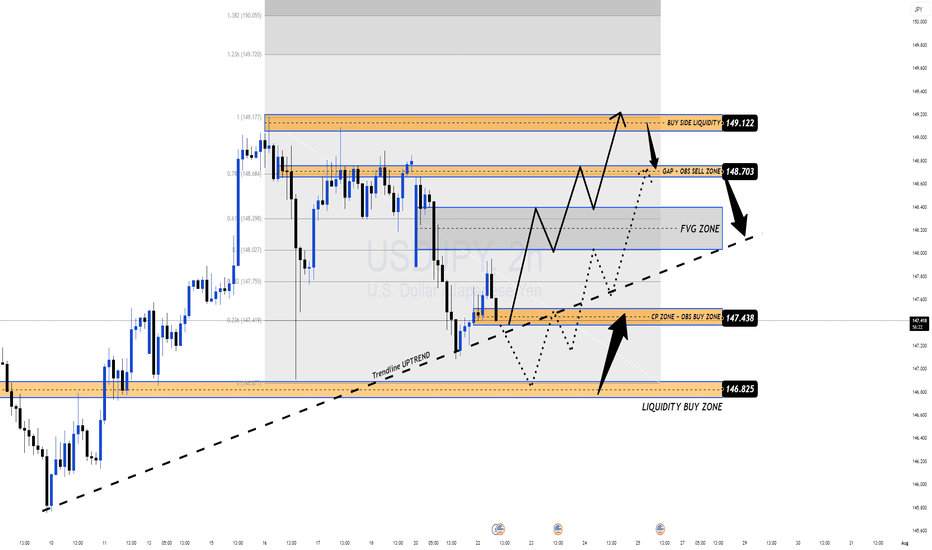

USDJPY Correction Complete, Is the Bullish Trend Back in play?After pulling back from the recent high near 149.17, USDJPY has shown signs of strength again, rebounding off the confluence support at the ascending trendline. The bullish narrative is supported by a hawkish FOMC tone and news that a U.S. federal court temporarily blocked Trump-era tariffs. The pair now awaits upcoming U.S. economic data for further directional clarity.

🔍 Technical Outlook – Structure & Momentum

✅ Primary trend: Bullish

✅ Correction phase: Completed near CP zone and trendline

✅ Key structural areas: FVG Zone, CP Zone, and trendline remain intact

Price has responded positively from the CP Zone + OBS Buy Zone around 147.438, aligning with the uptrend line. As long as this structure holds, buyers may push the market toward the next resistance zones.

🧭 Trade Scenarios

🔸 Bullish Bias (preferred scenario):

As long as price holds above 147.438, we expect continuation toward the FVG zone, with immediate targets at the GAP + OBS Sell Zone (148.703) and extended potential to the Buy-side Liquidity zone at 149.122.

A clean breakout above 149.122 opens the door to Fibonacci extensions: 149.72 and 150.05.

🔹 Bearish Scenario (if invalidated):

If price breaks below 147.438 and loses the trendline, we may see a deeper drop toward the Liquidity Buy Zone at 146.825, where strong buying interest is expected to re-enter the market.

⚠️ Macro Risk Drivers

Hawkish FOMC minutes continue to support USD strength

Paused trade tariffs reduce political headwinds, improving risk sentiment

Upcoming U.S. economic data could trigger sharp intraday moves → watch closely

📌 Key Price Zones

Liquidity Buy Zone 146.825 Major long re-entry zone

CP + OBS Buy Zone 147.438 Current active support

FVG Zone 148.20 – 148.68 Intraday bullish target

GAP + OBS Sell Zone 148.703 Short-term resistance

Buy-side Liquidity Zone 149.122 Final bullish objective

💬 Structure remains bullish unless the trendline breaks. Stay patient, wait for confirmations at key zones, and follow your plan with disciplined risk management.

Jpyusdforexsignal

Downtrend Slowing – Recovery Opportunity After Correction?USD/JPY: Downtrend Slowing – Recovery Opportunity After Correction?

Hello TradingView community!

Today, let's focus on analyzing the USD/JPY pair, which is showing interesting developments after its recent correction.

🌍 Macro Overview: USD/JPY Under Current Pressures

The market is observing shifts in the dynamics of the USD/JPY pair:

UOB Group's 24-Hour View: The USD experienced a sharp decline from 148.02 on Monday to 144.49, despite being "oversold". This indicates a slowing in the downtrend, though caution remains.

Retest Expected: According to UOB Group, there's a likelihood of USD/JPY retesting the 144.50 level before a more sustained recovery can be expected.

Downside Limited: A drop below 144.50 cannot be ruled out, but based on current momentum, any further weakness is unlikely to reach 144.00.

Resistance Levels: On the upside, resistance levels are noted at 145.20 and 145.55.

Overall, USD/JPY is in a phase of seeking equilibrium after a significant decline.

📊 Technical Analysis & USD/JPY Trading Plan

Based on the USD/JPY chart (H4/M30) you provided:

Overall Trend: The pair has undergone a relatively deep corrective decline after reaching a local peak, but appears to be seeking a strong support zone.

Key Price Levels:

Crucial Resistance (SELL Zone): Clearly at 144.894 - 145.178. This is an confluence area of Fibonacci levels and local highs where selling pressure could emerge strongly.

Important Support (Potential BUY Zone): Around 143.800 - 143.500. This represents a potential bottoming area where demand might be strong enough to push the price higher.

Projected Price Action: After the sharp decline, USD/JPY might retest the 144.50 area. If it holds above key support levels, an upward move towards resistance zones is plausible, as indicated by the arrows on the chart.

🎯 USD/JPY Trading Plan:

BUY ZONE: 143.800 - 143.500

SL: 143.400

TP: 144.000 - 144.200 - 144.500 - 144.800 - 145.000 - 145.200 - 145.500

SELL ZONE: 144.894 - 145.178

SL: 145.300

TP: 144.700 - 144.500 - 144.200 - 144.000 - 143.800 - 143.500

⚠️ Key Factors to Monitor:

US and Japanese Economic Data: Upcoming reports on inflation and employment from both nations could significantly impact Fed and BoJ policy expectations.

BoJ Policy Decisions: Any shifts in the Bank of Japan's stance will create strong volatility for the JPY.

Global Risk Sentiment: Changes in overall market sentiment can also affect JPY crosses.

Trade smart and stay informed! Wishing everyone a successful USD/JPY trading day!

USD/JPY 2-Hour Forex Chart2-hour performance of the U.S. Dollar (USD) against the Japanese Yen (JPY) from FOREX.com, showing a current exchange rate of 145.498 with a decrease of 0.661 (-0.45%). The chart highlights a recent sharp decline, with a shaded area indicating a potential support or resistance zone around 145.000 to 146.047. Key levels include 144.721 (support) and 146.047 (resistance), with the price movement tracked over the past two hours.

USD/JPY Gearing Up for Breakout ? Watch 145.20...USD/JPY Technical Setup – Bullish Continuation in Play?

USD/JPY is currently respecting a short-term ascending trendline, indicating sustained buying interest. The price consolidates just below a key resistance zone around 145.20, suggesting a potential breakout setup.

🔍 Key Technical Highlights:

* 📈 Trendline Support: Price has consistently respected this ascending trendline, forming higher lows—a strong bullish signal.

* 🔲 Resistance Zone: The 145.15–145.20 level has acted as a rejection zone previously. A breakout above this could invite momentum buying.

* 🕐 Consolidation Range: The market is coiling tightly just below resistance—watch for a volatility expansion.

* 🔮 Projection : If the price holds above the trendline and breaks 145.20 convincingly, we could see a bullish move towards 145.60+.

⚠️ Invalidation: A clean break below the trendline and 144.80 could shift the short-term bias back to neutral or bearish.

USDJPY TRADE PLAN – MAY 21 BIG BREAKOUT AHEAD?USDJPY TRADE PLAN – MAY 21 | FED HAWKISH BUT YEN STAYS WEAK – BIG BREAKOUT AHEAD?

USDJPY is entering a critical technical zone as the market weighs the Fed’s persistent hawkish stance against Japan’s passive approach to the Yen’s depreciation. After a strong rally, we are seeing a potential exhaustion with key levels in play.

🌍 MACRO CONTEXT:

FED remains hawkish: Officials continue to support higher-for-longer interest rates to tame inflation → USD remains firm.

Bank of Japan silence: No signs of FX intervention or rate policy shift, causing ongoing weakness in JPY.

Risk sentiment neutral: Risk-off flows are muted; USDJPY remains trapped in a wide range – awaiting macro catalysts.

📊 TECHNICAL OUTLOOK (H2 CHART):

Price is now correcting within a falling channel.

Price broke below the MA200 and rising trendline, now retesting a key support zone at 143.77.

The current range 141.99 – 144.71 is critical – a breakout from either end may dictate the next medium-term direction.

🎯 TRADE SETUPS FOR TODAY:

✅ SCENARIO A – SELL THE RALLY (PRIMARY BIAS):

If price rejects 144.71:

SELL ZONE: 144.70 – 144.71

SL: 145.10

TP: 143.77 → 143.30 → 142.50 → 141.99

→ Key resistance area – price may trigger strong seller interest.

✅ SCENARIO B – SELL ON BREAKDOWN:

If price breaks 143.77 and retests:

SELL ZONE: 143.60 – 143.70 (post-breakdown entry)

SL: 144.10

TP: 142.50 → 142.00 → 141.99

✅ SCENARIO C – SHORT-TERM BUY (LESS FAVORABLE):

If price reacts positively at 141.99 with bullish confirmation:

BUY ZONE: 141.90 – 141.99

SL: 141.50

TP: 142.50 → 143.00 → 143.77

→ Only take this setup if strong reversal signals appear.

🔑 KEY LEVELS TO WATCH:

Resistance: 144.71 – 145.00 – 148.44

Support: 143.77 – 143.30 – 141.99 – 141.20

📌 FINAL THOUGHTS:

USDJPY remains in a volatile consolidation zone, pressured by a hawkish Fed but lacking JPY strength. Watch for PMI data and Fed comments this week for directional cues. Until then, respect the current range and trade with discipline.

📣 Bias favors SELL from 144.71 unless buyers reclaim full control – trade the reaction, not the prediction!

JPY/USD - Bearish Breakdown from Ascending Channel

📉 Market Structure:

The pair has been trending upwards inside a well-defined ascending channel. However, price is now testing the lower boundary of the channel, indicating a potential breakdown. A confirmed break below this support could trigger a bearish move.

🔍Key Levels:

Support Zone: 0.0068122 (Channel Support)

Current Price: 0.0067279

First Target: 0.0065703

Second Target: 0.0064390

📊 Trade Idea:

A confirmed break below the channel support could signal further downside.

If price rejects from this level and starts falling, a short opportunity may be considered targeting 0.0065703 and then 0.0064390.

Traders may look for bearish confirmation before entering short positions.

🚨Confirmation & Risk Management:

Bearish Confirmation: A strong break below 0.0068122 with volume.

Invalidation: A strong bounce from support and a move back inside the channel.

Risk Management: Stop-loss can be placed above 0.0068122 to protect against false breakouts.

This setup suggests a potential trend reversal if price fails to hold the channel support. Traders should watch for confirmation before executing trades.

USD/JPY Setup – Buy the Dip or Wait for Confirmation?The USD/JPY pair is testing a long-term trendline support, which has held multiple times in the past, signaling a critical decision point.

The price has bounced off this level before, suggesting strong buyer interest in this zone. Additionally, the Stochastic RSI is oversold, hinting at a potential reversal.

If the price holds above this trendline and key support zone, we could see a bullish continuation toward new highs.

WEEKLY MARKET OVERVIEW FOR MAJOR CURRENCY PAIRSWEEKLY MARKET OVERVIEW FOR MAJOR CURRENCY PAIRS

1️⃣ NDZUSDT

Overall, the weekly (W) and monthly (M) trends are in a SELL direction ⬇️

However, at the beginning of the week, W will correct upwards (BUY) before facing price resistance around 0.589 - 0.592, which is a potential SELL zone ⚠️

Setup:

✅ BUY at the beginning of the week using Rainbow MG3 indicator on H1 - D1

❌ SELL after price reacts at resistance using Rainbow MG3 on M15 - H4

📊 Projected chart attached

2️⃣ AUDUSDT

The overall trend on W and M is SELL, but D1 is currently correcting upwards 🔄

Setup:

✅ BUY H1 - D1 using Rainbow MG3 indicator

❌ SELL H1 - D1 using Rainbow MG3 indicator

🔁 Trade both directions based on Rainbow MG3 signals

📊 Projected chart attached

3️⃣ EURUSDT

✅ BUY H1 - D1 using Rainbow MG3 indicator

❌ SELL H1 - D1 using Rainbow MG3 indicator

🔁 Trade both directions based on Rainbow MG3 signals

📊 Projected chart attached

4️⃣ GBPUSDT

✅ BUY H1 - D1 using Rainbow MG3 indicator

❌ SELL H1 - D1 using Rainbow MG3 indicator

🔁 Trade both directions based on Rainbow MG3 signals

📊 Projected chart attached

5️⃣ USDCAD

Setup:

✅ BUY H1 - D1

📊 Projected chart attached

6️⃣ USDJPY

Setup:

❌ SELL H4 - W

📊 Projected chart attached

⚡ Trading Signals Confirmation

All trade setups require confirmation using the Rainbow MG3 indicator before execution ✅

USDJPY R2🔍 Technical Analysis of USD/JPY

📌 Overall Trend:

After a downward correction, the price has reached the 154.250 support zone.

A positive reaction at this level suggests a potential upward move.

A price gap is visible in the 156.000 - 156.400 range, which may lead to a price increase to fill the gap.

📈 Buy Trade Signal (Long Position)

🔹 Entry Conditions:

If the price holds the 154.250 - 154.400 support zone and bullish reversal candlesticks appear, a long trade is recommended.

The ideal entry range is 154.600 - 154.860.

🔹 Stop Loss (SL):

Below 154.250

🔹 Take Profit (TP):

First target: 155.860

Second target: 156.110

Third target: 156.400 (if the bullish momentum continues)

🔹 Risk Management:

If the price stabilizes below 154.250, reconsider the trade.

Breaking above 156.110 increases the likelihood of further bullish movement to fill the price gap.

✅ Final Conclusion:

If the price finds support at 154.250 - 154.400, a buy trade is favorable.

A breakout above 156.110 could lead to a further target of 156.400.

📌 Ensure confirmation through price action and candlestick patterns before entering the trade.

Usdjpy ahead to 147.65Jpyusd ahead to 147.65, by my math, at least, maybe a little down more to make a divergence to go up again, but this is all about day ind3x, about dollar power, be careful, with and without the election day, I'm just selling and do nothing (seeing what happens) until election day

Have a good trading, everyone.

Bearish on USDJPYThe recent price action shows a push towards a resistance zone, indicating potential exhaustion or a reversal point.

The shaded area marks a significant resistance zone around the 157.700 - 158.000 levels. This zone has been tested multiple times and has held as a strong supply area.

Immediate support can be identified around the 156.500 level, which aligns with previous swing lows and a possible demand zone.

A stronger support level is around 155.500, a psychological round number that has acted as a base for previous price reversals.

Below the 156.500 support level, there may be sell-side liquidity, where sell stops from long positions could be resting.

The resistance area (157.700 - 158.000) is a supply zone, where significant selling interest could push the price lower.

A notable fair value gap (FVG) or imbalance between 155.500 and 157.000 from previous price movements suggests potential areas for price retracement.

Entry: Consider entering a short position around the 157.700 - 158.000 resistance zone.

Stop Loss: Place the stop loss slightly above the resistance zone, around 158.200, to account for potential liquidity grabs.

Take Profit: Aim to take profits around the immediate support at 156.500 and a more extended target around the 155.500 level, aligning with the demand zone and previous lows.

UJ ON THE RISE 🔥🔥🔥Hello fellow traders!

USDJPY has retested and respected a possible key level

Checklist:

✔FORMED STCUCTURE AT KEY LEVEL

✔RSI AT 51

✔SUPERTREND IS BUILDING BUYING POWER

✔FIB RETRACEMENT HAS SO FAR RESPECTED 38.20%

TARGET 1 - 300 PIP ANALYSIS

TARGET 2 - 250 PIP ANALYSIS

GOOD LUCK 🍀🍀🍀!!!

EURJPY | Long setupEURJPY get rejected by the resistance zone at the 158.500 level and closed red for the day.

-----

I have a feeling it is going to break out the upcoming week and make new highs.

-----

We might see some kind of small pullback before EURJPY blasts trough this zone.

-----

Will be looking for long positions when this happens.

-----

Let me know what you think!

USD/JPY: Yen Strengthens Amid Policy ExpectationsThe Japanese Yen gains support from anticipated BoJ policy shifts, fostering a safer environment and limiting USD/JPY within lower USD demand. Investor focus on US economic data before FOMC minutes remains crucial.

Technically, breaching the 200-day SMA signals a USD/JPY downtrend. Daily chart indicators suggest potential further losses. Any upward movement could prompt selling near 142.00, leading to short-term profit-taking around 142.40 and targeting the 200-day SMA at 143.00.

Support lies at 141.00, guarding against declines toward recent lows near 140.25 and the psychological level of 140.00. A firm break below 141.00 may accelerate a decline towards 139.35, aiming for levels near 139.00, 138.75, and 138.00 (the July 28th low).

USD/JPY Approaches 141.30, Extending Two-Day Decline USD/JPY continues its downward trend for the second consecutive session, trading below the 141.30 level during the Asian hours on Thursday. Improved trade data from Japan in November has exerted pressure on the currency pair. However, less optimistic remarks from Bank of Japan Governor Kazuo Ueda may weigh on the Japanese Yen.

From a technical standpoint, the spot price indicates potential recovery below the 142.00 level and appears to have broken the two-day decline. This suggests that breaking below the 200-day Simple Moving Average (SMA) is crucial support for bearish traders. Furthermore, oscillators on the daily chart remain deeply in negative territory, indicating limited resistance for USD/JPY on the downside. Any subsequent upward movement may still be viewed as a selling opportunity and is likely to be capped around the 142.75 level (200-day SMA). This implies that further buying activity leading to a move beyond the 143.00 level could trigger short-covering actions, allowing the bullish camp to reclaim the 144.00 milestone.

On the flip side, weakness below the Asian session's lowest levels around the 141.90-141.85 region would reaffirm the short-term trend and make USD/JPY susceptible to retesting below the 141.00 level, or the multi-month lows touched last week. Subsequent declines could potentially pull the spot price towards the intermediate support at 140.45 on the way to the psychological level of 140.00.

Japanese Yen Weakens on Soft Inflation, BoJ Policy UncertaintyThe Japanese Yen (JPY) faced a decline after softer domestic consumer inflation data, raising uncertainties about the Bank of Japan's (BoJ) potential policy tightening. BoJ's October meeting minutes revealed a consensus to maintain the accommodative policy, contributing to JPY weakness. The USD/JPY pair saw a modest recovery from weekly lows, supported by the USD's modest strength.

Japan's core CPI remains at 2% for the 20th consecutive month, and optimism about future wage growth suggests a potential shift in BoJ's stance. However, the market anticipates a more positive U.S. Federal Reserve (Fed) policy easing in 2024, influenced by the U.S. Q3 GDP report. Investors are now watching the U.S. Core PCE Price Index for further guidance on USD/JPY short-term direction. Despite this, the fundamental outlook leans towards JPY strength, indicating a downside bias for the currency pair.

Japanese Yen Retreats on Soft Inflation, USD StrengthensFrom a technical standpoint, spot prices indicate a potential rebound below the 142.00 level, seemingly breaking the two-day downtrend. This suggests that the overnight break back below the 200-day Simple Moving Average (SMA) is crucial support for bearish traders. Furthermore, oscillators on the daily chart remain firmly in negative territory, indicating minimal resistance for the USD/JPY pair on the downside. Therefore, any subsequent upward move may still be considered a selling opportunity and remains capped near the 142.75 level (200-day SMA). This implies that further buying activity, leading to a move beyond the 143.00 mark, could trigger short-covering actions and allow the bullish camp to reclaim the round figure of 144.00 in the short term.

On the flip side, weakness below the intraday low around the 141.90-141.85 region would reaffirm the short-term trend, making the USD/JPY pair vulnerable to a retest of the sub-141.00 level or the multi-month lows touched last week. The subsequent decline could potentially drive spot prices towards intermediate support at 140.45 on the way to the psychological milestone of 140.00.

"USD/JPY: Japanese Yen Halts Decline, Eyes US CPI Data"The Japanese Yen regained positive momentum in the Asian trading session on Tuesday. USD/JPY partially eroded some of the strong recovery seen in the past two days. Investors are awaiting the US Consumer Price Index (CPI) for fresh impetus ahead of the FOMC meeting on Wednesday.

From a technical standpoint, USD/JPY showed a certain degree of recovery last week at the crucial 200-day Simple Moving Average (SMA). The subsequent move exceeded the 23.6% Fibonacci retracement of the recent decline from the vicinity of 152.00, or the YTD high, supporting bullish sentiments. However, the sharp rise during the day halted near the 200-hour SMA, now closing around the 146.50 level. This area will now play a crucial pivot point, and clearing it would allow the price to test the 50% Fibonacci level, around 146.80, and reclaim the 147.00 milestone.

Meanwhile, oscillators on the daily chart are deep in positive territory, supporting the potential for some upward action at higher levels. This suggests that the resistance at the 100-hour SMA, around 145.85, may now act to defend the downside just ahead of the psychological level of 145.00. Further selling pressure could push USD/JPY back towards the intermediate support zone of 144.55-144.50 on the way to the 144.00 mark. A convincing break below this level would be considered a strong bearish catalyst, paving the way for deeper losses.

On the other hand, the Japanese Yen (JPY) extends its downward trend for the second consecutive day, pushing the USD/JPY pair towards the 146.00 level during the European trading session on Monday. A report on Friday suggested that comments from Bank of Japan (BoJ) Governor Kazuo Ueda last week were misunderstood, and the central bank will maintain the status quo until positive wage inflation begins. This comes alongside weaker-than-expected GDP reports from Japan, indicating the domestic economy remains fragile and expectations of imminent rate hikes may be inflated.

Conversely, the US Dollar (USD) attracts some renewed buying interest after betting on an early Federal Reserve (Fed) policy easing was scaled back, proving to be another supportive factor for the USD/JPY exchange rate. Friday's closely watched US employment figures showed a rapid growth pace in November, with the unemployment rate dropping to 3.7%. This indicates signs of underlying strength in the labor market and suggests that current market pricing for a rate cut in March 2024 may be premature.

The recent sharp upward move seen around the USD/JPY pair in the past hour may be attributed to some technical buying based on sustained strength beyond the 100-hour Simple Moving Average (SMA). This suggests that concerns about a deeper global economic downturn and geopolitical risks may limit losses for the safe-haven JPY and restrict any further upside moves for the currency. Traders may also limit strong bets ahead of this week's significant event/data risks - US Consumer Price Index on Tuesday and the crucial FOMC policy decision on Wednesday."

USD/JPY Weakens on Fed Rate Cut Speculation and BoJ PivotThe Japanese Yen has surrendered recent gains against the US Dollar amidst speculation of a Fed rate cut in March and a shift in the Bank of Japan's (BoJ) policies. Despite a day-end recovery, USD/JPY experiences one of its worst trading days in over a year, dropping below 142.00 and closing just above 144.00.

Despite the intraday recovery, USD/JPY had one of its worst trading days in over a year, slipping below 140.00 in November last year. Throughout Thursday's trading session, USD/JPY transitioned from a slight decrease to a drop below the 200-day Simple Moving Average, requiring significant progress for a recovery towards the 147.00 handle. The 50-day SMA is currently positioned higher than the price action on Thursday, pushing towards the 114.90 region.

Expectations of a Fed rate cut weigh on the US Dollar

There is growing speculation that the Federal Reserve has concluded its rate hikes and will commence a rate cut in March, putting pressure on the US Dollar. In contrast, the Bank of Japan is expected to move away from extremely loose monetary policy in the coming months. This, coupled with risk aversion sentiment, offsets the safe-haven appeal of the Japanese Yen.

USD/JPY witnessed a more than 4% decline on Thursday, quickly dropping below 142.00 before larger markets staged a modest recovery, pulling the Japanese Yen (JPY) back into a reasonable price range. USD/JPY closed Thursday down by around 2%, while the Yen entered Friday's market session in the green for the week.

The Yen saw a broader market recovery following unconventional comments from Bank of Japan Governor Kazuo Ueda, unexpectedly hinting at the eventual end of BoJ's negative interest rate policy, possibly in the early part of next year.