USD/JPY 2-Hour Forex Chart2-hour performance of the U.S. Dollar (USD) against the Japanese Yen (JPY) from FOREX.com, showing a current exchange rate of 145.498 with a decrease of 0.661 (-0.45%). The chart highlights a recent sharp decline, with a shaded area indicating a potential support or resistance zone around 145.000 to 146.047. Key levels include 144.721 (support) and 146.047 (resistance), with the price movement tracked over the past two hours.

Jpyusdlong

JPY/USD Weekly Chart – Bullish Triangle Breakout Pattern Forming🔍 Chart Pattern Breakdown:

The chart is showing a symmetrical triangle pattern forming on the weekly timeframe of JPY/USD (Japanese Yen vs. US Dollar). This triangle is developing after a massive multi-year downtrend, which started all the way back in 2021. Such a triangle at the bottom of a trend often signals a potential reversal or a strong trend shift.

Here's what's happening technically:

🔺 Triangle Formation (Consolidation Phase):

Lower highs and higher lows indicate a clear symmetrical triangle.

The price has been bouncing between these converging trendlines for months.

This compression is like a spring — it’s storing energy and getting ready to break out.

The triangle pattern is nearing its apex, which means a breakout is likely soon.

📉 Previous Trend Context:

Before the triangle, the market had a strong bearish move — a downtrend that brought the pair into a major weekly support zone.

This support zone (marked in light blue) around 0.0062–0.0063 has been tested and respected multiple times.

📊 Key Technical Zones:

Support Zone: 0.0062 – 0.0063 — this is where price bounced and formed the base of the triangle.

Resistance Zone / Triangle Top: Around 0.0071 – this is the upper boundary of the triangle. A breakout above this will confirm the bullish scenario.

Target Area: 0.00829 – derived from measuring the height of the triangle and projecting it from the breakout point.

Major BOS (Break of Structure): Once price breaks above the triangle and the BOS line, it confirms a shift from bearish to bullish structure.

SL Zone: Stop loss area is just below the support zone at 0.00629 to protect against false breakouts.

🔁 Retest Setup:

After the breakout, it's common to see a pullback to retest the previous resistance (now turned support). That retest often provides a high-probability entry for swing and position traders. If it happens — that’s your golden moment!

🎯 Trade Plan (Example for Education):

Entry Criteria Value/Zone

Breakout Entry Above 0.0071 (confirmed candle close)

Retest Entry 0.0069 – 0.0070 (support flip)

Stop-Loss (SL) Below 0.00629

Target (TP) 0.00829

✅ Why This Setup Matters:

Clear structure on the weekly chart.

Multi-touch points on both trendlines = strong pattern.

Support zone backing the triangle base gives extra conviction.

A breakout from such consolidation patterns often results in sharp movements.

Risk/reward ratio is highly favorable.

⚠️ Risk Management Reminder:

Always trade with a plan, use a stop-loss, and don’t jump into the breakout blindly. Volume confirmation or retest confirmation will help increase the success rate. These kinds of setups are powerful, but only when approached with discipline.

🧠 Final Thoughts:

This JPY/USD triangle on the weekly chart is a textbook example of potential bullish reversal from a major downtrend. It’s showing signs of a structural shift, supported by strong support, tightening price action, and the chance for a breakout to deliver a major upside move toward 0.00829.

If you’re a swing or position trader, keep this on your radar. Momentum is building — don’t miss the move when the breakout hits. 📈🔥

JPY/USD Breakout from Curve Line – Targeting Upper Resistance JPY/USD presents a classic curve bottom formation, which is a powerful technical structure indicating accumulation by smart money. It’s supported by key price action behaviors like support/resistance flips, retesting confirmation, and a well-defined target zone.

Let’s break it down piece by piece.

📉 1. Curve Formation – Accumulation Phase

The most noticeable element here is the parabolic (curve) structure formed between October 2024 and March 2025. This kind of structure often reflects a slow accumulation process:

Price dips over several months form a rounded bottom — also called a saucer pattern.

This shows institutional players are quietly accumulating, while retail traders are often trapped in sell-side positions.

As the curve matures, the volume and momentum begin to shift, signaling the beginning of a bullish breakout.

This accumulation curve is bullish by nature and becomes even more potent when followed by a breakout and retest.

🔄 2. SR Flip Zone (Support-Resistance Interchange)

One of the most critical concepts in price action is the SR flip — where old resistance turns into new support. In this case:

The yellow-shaded zone previously acted as resistance — confirmed by multiple rejections.

After the breakout, this same zone is being retested as support — a healthy technical confirmation that the market has accepted higher prices.

This flip zone is a launchpad for continuation to the upside.

📍 3. Retest Confirmation – Smart Entry Opportunity

Zooming into recent price action:

The market pulled back cleanly into the SR zone and the curve line.

The confluence of horizontal support and the curved trendline makes this an extremely strong retest zone.

Buyers stepped in with force, suggesting that demand is active at this level.

This retest is where risk-to-reward is optimized. The ideal entries usually happen when price confirms structure after a breakout — not before.

🎯 4. Target Zone – Next Bullish Objective

The next logical target is shown in the blue box above (~0.00705–0.00710). Here's why this zone is important:

It marks a previous supply/resistance area.

It aligns with psychological round numbers and past consolidation.

A measured move from the bottom of the curve also aligns with this target.

In essence, it is the profit-taking zone where the market is likely to pause or reverse temporarily.

🔎 5. Insider Supply & Central Zone – Institutional Traces

The chart labels an “Insider Supply” area at the base of the curve. This implies:

Hidden accumulation likely occurred at this level.

Institutions tend to trap retail sellers during these periods with false breakdowns.

Once they’ve loaded up, price shifts upward in a controlled fashion — exactly what has happened here.

The Central Zone is the battlefield — the area where prior indecision took place, which has now turned into a stepping stone for upward movement.

💡 Strategy Recap:

Parameter Value

Entry Retest of SR Flip (0.00680–0.00685)

Stop Loss Below curve base (~0.00670 or lower)

Target 0.00705–0.00710

R/R Ratio 1:2 or better

This strategy is technically sound, supported by structure, and has strong reward potential.

🧠 Market Psychology:

Smart money accumulates when price is quiet and sentiment is bearish.

After accumulation, a controlled markup begins, with retests engineered to confirm the breakout.

Retail traders tend to enter late or get faked out — while institutions already hold positions.

This chart is a textbook example of how professional traders operate and manage structure-based risk.

🏁 Final Thoughts:

This is a high-probability technical setup built on multiple layers of confluence:

Curve structure

SR flip

Demand zone retest

Momentum shift

If momentum continues, the 0.00710 zone is a very realistic short-term target. Traders should manage risk tightly and monitor price behavior near the upper resistance box.

JPY/USD Daily Chart – Falling Wedge Breakout & Bullish Target🔍 Full Technical Analysis of JPY/USD (Daily Timeframe)

🧭 Overview

The chart shows a sophisticated price structure unfolding over several months. A falling wedge reversal pattern formed during a sustained downtrend, which later transitioned into a bullish breakout and continuation. This analysis provides insights into market behavior, price psychology, and a high-probability trading opportunity supported by classical technical analysis principles.

🔶 1. Market Context & Structure

Before diving into the pattern, it’s essential to understand the macro structure of the chart:

The pair experienced a strong bearish move from around August to December 2024, marked by lower highs and lower lows.

During this decline, volatility gradually decreased, which often indicates seller exhaustion.

A reversal zone emerged near a major support region — historically significant and previously tested.

🔷 2. The Falling Wedge Pattern (Reversal Signal)

A falling wedge is a bullish reversal pattern that forms when price is in a downtrend but begins to consolidate within converging trendlines. This pattern typically signals that the downtrend is losing momentum and a breakout to the upside is imminent.

📌 Characteristics of This Wedge:

Downward Convergence: The highs and lows begin to narrow over time, indicating reduced selling pressure.

Volume Decline (Implied): Though not displayed, falling wedges usually see volume dry up before breakout.

Duration: This wedge developed over several months (October 2024 – January 2025), lending strength to the pattern.

False Break Attempts: Several lower spikes failed to break the support, showing buying interest building.

✅ Bullish Breakout:

The breakout occurred decisively in late January 2025, with a large bullish candlestick closing above the upper wedge boundary — a confirmed breakout.

Post-breakout, the price rallied strongly, indicating that buyers were firmly in control.

🔷 3. Support & Resistance Zones

🔽 Support Zone (Demand Area):

Range: 0.006300 – 0.006400

Historical pivot zone where price previously reversed, now serving as a demand base.

The lower wick rejections near this zone reinforce it as a high liquidity zone for buyers.

🔼 Resistance Zone (Supply Area):

Range: 0.006850 – 0.006950

This area capped price during several prior rally attempts, making it a key breakout point.

Once price broke above this zone, it became a support flip zone, indicating trend reversal confirmation.

🎯 Target Level:

Marked at 0.007126, derived from a measured move:

Measure the height of the wedge at its widest point.

Project this vertically from the breakout level.

This target aligns with psychological round numbers and prior resistance, adding confluence.

🔶 4. Post-Breakout Price Action: Bullish Retest

A breakout is only the first part of a trade; the retest phase confirms the move and offers an optimal entry.

🔁 Retest Details:

After reaching the resistance zone, price pulled back, testing both:

The broken wedge trendline (now acting as dynamic support).

The horizontal structure support zone near 0.006650–0.006700.

A bullish engulfing candle or similar reversal pattern formed at this level — a classic retest entry.

📌 Trendline Respect:

A rising dotted trendline was drawn from the breakout low through higher lows.

This line acted as price memory and was respected multiple times, reinforcing the uptrend.

🔷 5. Trade Setup Breakdown

This is a swing trade setup based on pattern breakout, structural confluence, and trend continuation. Here's how it’s structured:

Component Details

Pattern Falling Wedge (Reversal)

Trade Bias Long (Buy)

Entry Price ~0.006700

Stop Loss 0.006614 (below trendline)

Target Price 0.007126 (measured wedge move)

R/R Ratio Approx. 3:1

Timeframe Daily (Medium-term swing)

🧠 6. Market Psychology & Behavior

Understanding the sentiment behind the candles is critical:

❗ Before the Breakout:

Sellers dominated but with weakening momentum.

Each push down was met with buying strength, seen in long wicks and smaller-bodied candles.

✅ At the Breakout:

Buyers overwhelmed sellers, often with a volume spike and wide-bodied green candle.

This is usually driven by institutional positioning and stop-loss triggering from short-sellers.

🔁 During the Retest:

Some retail traders exited prematurely, fearing a fakeout.

Smart money used the dip to accumulate positions, confirmed by the bounce from trendline.

🔼 Continuation Rally:

Strong continuation candle signals momentum traders entering.

Break above resistance signals a shift in sentiment and structure.

🛠️ 7. Strategy Notes & Professional Tips

📌 Risk Management:

Never risk more than 1–2% of capital.

Use dynamic trailing stop if price breaks above target zone.

📌 Trade Confirmation Ideas:

Look for volume spikes on breakout candles.

Use RSI or MACD divergence to confirm reversal (optional).

Look for candlestick patterns (engulfing, pin bar) on retests.

📌 Exit Plan:

Partial exit at key resistance.

Full exit at projected target or if price forms reversal signs (e.g., doji at resistance).

✅ Final Summary

This JPY/USD chart demonstrates an exemplary price action-based trading setup rooted in:

A well-formed falling wedge (bullish reversal).

Clean breakout + retest + continuation structure.

Multiple confluence factors: trendline, horizontal S/R, pattern projection.

Professional-grade risk/reward profile with a logical entry, stop, and target.

This kind of setup is highly favored among swing traders, price action purists, and institutional-level strategists due to its clarity and predictability.

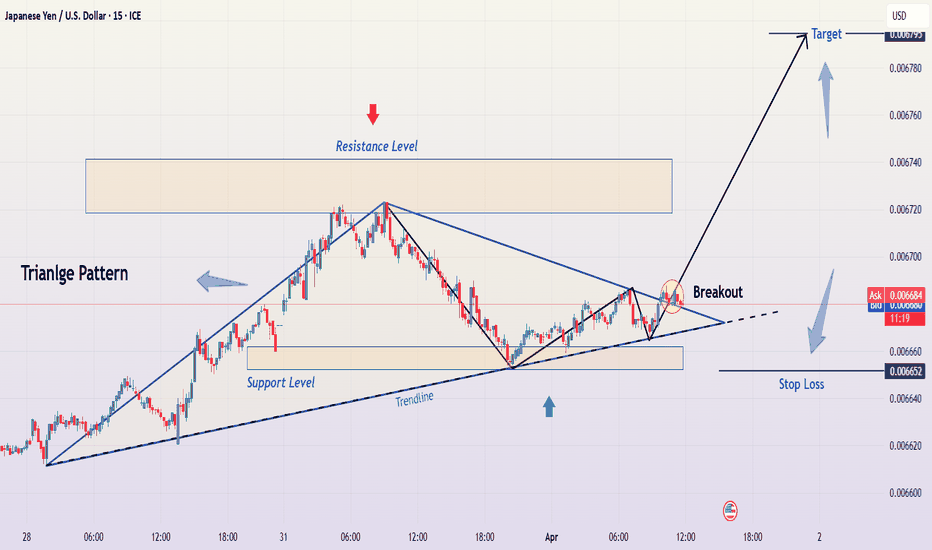

Triangle Breakout in JPY/USD – Bullish Move Ahead?This TradingView chart represents a detailed technical analysis setup for the Japanese Yen (JPY) against the U.S. Dollar (USD). The main focus of the chart is a symmetrical triangle pattern breakout, a common formation that signals potential price movement.

In this detailed breakdown, we will analyze the following aspects:

Technical Pattern: Symmetrical Triangle Formation

Support and Resistance Levels

Breakout Confirmation

Trading Setup Explanation

Risk Management Strategy

Market Expectations (Bullish & Bearish Scenarios)

Conclusion & Trading Plan

1. Technical Pattern: Symmetrical Triangle Formation

The chart showcases a symmetrical triangle, which is a continuation pattern that typically occurs in trending markets. It indicates a period of consolidation where buyers and sellers struggle for dominance, leading to an eventual breakout.

Characteristics of the Symmetrical Triangle in This Chart:

Converging Trendlines:

The upper trendline (resistance) is sloping downward, showing lower highs.

The lower trendline (support) is sloping upward, showing higher lows.

Apex Formation:

As the price moves closer to the triangle's apex, volatility decreases, creating a squeeze effect.

Breakout Possibility:

Once price reaches a critical point, a breakout is expected in either direction.

Why is This Pattern Important?

Symmetrical triangles suggest that the market is indecisive, but once a breakout occurs, it can trigger a strong price movement.

Traders wait for the breakout direction to confirm the trade before entering a position.

2. Key Support and Resistance Levels

Support and resistance levels are crucial for identifying potential entry, stop-loss, and target areas.

Resistance Level:

A horizontal resistance zone (highlighted in beige) is drawn at the top.

This zone represents historical price rejection levels, where sellers have previously stepped in.

A confirmed breakout above this level would indicate strong bullish momentum.

Support Level:

The lower support zone (marked in blue) acts as a buying interest area.

Price has bounced off this zone multiple times, confirming it as a strong support level.

A break below this zone would signal a bearish reversal.

Trendline Support:

The lower boundary of the symmetrical triangle also acts as dynamic support.

If price respects this trendline, it suggests bullish strength leading to a breakout.

3. Breakout Confirmation & Market Reaction

The most important part of the setup is the breakout, which occurs when the price successfully moves beyond the triangle's trendline resistance.

Key Observations from the Chart:

Breakout Zone:

The breakout occurs near the right edge of the triangle (circled in red).

The price breaks above the upper trendline, confirming a bullish breakout.

Confirmation Candle:

A bullish candle follows the breakout, confirming buying pressure.

Traders should wait for a retest of the trendline before entering.

Volume Consideration:

Strong breakout moves are typically accompanied by a rise in volume, increasing the likelihood of follow-through.

4. Trading Setup Explanation

This trade follows a trend-following breakout strategy, where traders capitalize on price momentum after confirmation.

Entry Point:

The ideal entry is just above the breakout candle.

Traders can also wait for a retest of the broken trendline before entering.

Stop Loss Placement:

The stop loss is placed slightly below the previous swing low at 0.006652.

This prevents excessive drawdowns in case of a false breakout.

Profit Target Calculation:

The profit target is set at 0.006795, which is calculated based on:

The height of the triangle formation projected from the breakout point.

The next major resistance level, aligning with historical price action.

5. Risk Management Strategy

Risk management is a critical component of any trading strategy. Here’s how it is applied in this setup:

Risk-to-Reward Ratio (RRR):

A good trade setup maintains an RRR of at least 2:1.

If the stop loss is 33 pips (0.000033) and the target is 112 pips (0.000112), the RRR is 3:1, making this a high-probability trade.

Position Sizing Consideration:

Risk per trade should be limited to 1-2% of the total account balance.

Leverage should be used cautiously, as breakouts can sometimes retest the breakout zone before continuing.

6. Market Expectations (Bullish & Bearish Scenarios)

Bullish Scenario (Successful Breakout):

✅ If price sustains above the breakout level, it will likely continue to rally toward the target at 0.006795.

✅ A strong bullish momentum candle would confirm further buying pressure.

✅ If volume supports the breakout, trend continuation is highly probable.

Bearish Scenario (False Breakout or Reversal):

❌ If price falls back inside the triangle, it indicates a false breakout.

❌ If price closes below 0.006652, bears take control, and price may drop further.

❌ A breakdown below the support level would shift the market sentiment bearish.

7. Conclusion & Trading Plan

This chart presents a classic symmetrical triangle breakout trade with a clear entry, stop-loss, and target strategy.

Summary of Trading Plan:

Component Details

Pattern Symmetrical Triangle

Breakout Direction Bullish

Entry Point Above the breakout confirmation candle

Stop Loss 0.006652 (below support)

Take Profit (Target) 0.006795

Risk-to-Reward Ratio Favorable (3:1)

Market Bias Bullish (if price sustains above breakout)

Final Considerations:

Always wait for confirmation before entering.

Monitor volume and price action for additional validation.

Stick to the risk management plan to minimize losses.

If executed correctly, this setup offers a high-probability trade with a strong risk-to-reward ratio, making it a profitable trading opportunity in the JPY/USD market.

JPY/USD Weekly Forecast – Falling Wedge Breakout & Bullish MoveChart Overview

This chart presents a technical analysis of the Japanese Yen (JPY) against the U.S. Dollar (USD) on a daily timeframe, published on TradingView. The setup is based on a Falling Wedge pattern, which has led to a bullish breakout, signaling a potential price rally. Let's break it down step by step.

1️⃣ Identifying the Pattern – Falling Wedge Formation

The primary pattern identified in the chart is a Falling Wedge, which is a well-known bullish reversal pattern.

Characteristics of the Falling Wedge in this Chart:

Two downward-sloping trendlines (black lines) forming a wedge shape.

Price makes lower highs and lower lows, but the distance between highs and lows gradually narrows.

The breakout occurs when price closes above the upper trendline, confirming a potential uptrend.

Key Observations:

✅ The pattern starts forming around September 2024 and continues until December 2024.

✅ A breakout occurs at the end of December 2024, confirming bullish momentum.

✅ After breaking out, the price retests the wedge's upper boundary, acting as new support before continuing upward.

2️⃣ Support & Resistance Zones – Key Price Levels

Support Level:

The support zone is marked in a beige rectangle at the bottom of the chart.

This is where buyers repeatedly stepped in, preventing further decline.

The price touched this area multiple times before reversing upwards, making it a strong demand zone.

Resistance Level:

The resistance zone is identified at the top of the chart (shaded beige area).

This level represents previous price peaks, where selling pressure was strong.

The price is expected to face some resistance when approaching this zone.

3️⃣ Trend Reversal Confirmation & Bullish Structure

After breaking out of the falling wedge, the price has started forming higher highs and higher lows, indicating an uptrend.

Key Trend Indicators:

✔ Curved blue dashed line suggests an upward trajectory, confirming a rounded bottom reversal.

✔ Price is following a trendline support, validating bullish sentiment.

✔ Momentum is strong, and buyers are in control after the breakout.

4️⃣ Trading Setup – Entry, Stop Loss & Take Profit

This analysis is structured into a trading plan with clear risk management.

📌 Entry Point (Buy Confirmation)

Entry is ideal on a retest of the breakout zone or a continuation of the bullish structure.

The recent higher low serves as a great point to confirm trend continuation.

📌 Stop-Loss Placement

Stop-loss is placed at 0.006465 (marked in blue), below the latest support.

This level ensures protection against false breakouts.

📌 Take Profit Target

The target is set at 0.007128, aligning with historical resistance.

If momentum remains strong, the price might push even higher.

5️⃣ Risk-to-Reward Ratio (RRR) & Trade Justification

Risk-to-Reward Analysis:

Stop-Loss: 0.006465 (below support)

Entry Price: Around 0.006671

Target Price: 0.007128

Risk-to-Reward Ratio: Approximately 1:2.5, meaning for every $1 risked, there's a $2.5 potential gain.

Trade Justification:

✔ Falling Wedge breakout is confirmed.

✔ Retest of broken resistance turned support gives an ideal entry.

✔ Bullish trend structure supports the upside move.

✔ Well-defined stop-loss and take-profit levels provide controlled risk exposure.

6️⃣ Final Thoughts & Conclusion

📌 This is a textbook bullish setup based on a Falling Wedge breakout. The combination of pattern breakout, trend structure, and strong support makes this a high-probability trade.

📌 Potential Risks to Watch:

If price fails to hold above stop-loss, it could indicate bullish weakness.

Major macroeconomic news or fundamental events can shift momentum.

📌 Overall Bias: ✅ Bullish towards the 0.007128 target, as long as the price remains above key support zones.

JPY/USD Technical Analysis – Bullish Breakout from Falling WedgeIntroduction

The JPY/USD chart showcases a classic falling wedge pattern, a strong bullish reversal signal. This pattern is characterized by converging downward-sloping trendlines, indicating a weakening bearish momentum. Eventually, buyers stepped in, leading to a breakout to the upside. This analysis breaks down key elements, including support and resistance zones, trendlines, trading strategy, and risk management.

1. Breakdown of the Chart Pattern

A. The Falling Wedge Formation (Bullish Reversal Pattern)

A falling wedge is a bullish technical pattern that forms when the price consolidates within two downward-sloping trendlines that converge over time. This signals that selling pressure is decreasing and a reversal may be near.

Downtrend Structure: The price was previously in a consistent downtrend, making lower highs and lower lows, which formed the wedge.

Breakout Confirmation: Once the price broke above the upper trendline, the pattern was confirmed, indicating the start of a bullish move.

Retest Possibility: Often, after a breakout, the price retests the upper trendline before continuing higher. If it holds, it strengthens the bullish outlook.

B. Key Levels Identified in the Chart

1. Support Zone (Buying Area)

The price found strong support in the 0.006291 – 0.006500 region.

Buyers stepped in, preventing the price from dropping further.

This support level coincides with the bottom of the wedge, further validating its importance.

2. Resistance Zone (Profit Target)

The 0.007100 – 0.007200 area is a major resistance level where sellers have previously dominated.

If the price reaches this level and consolidates, traders will look for either a breakout or a rejection.

A break above 0.007200 would indicate further bullish continuation.

3. Trendlines & Curve Formation

A curved trendline in the chart suggests a gradual transition from bearish to bullish momentum.

The dotted ascending trendline now acts as dynamic support, helping the price sustain its bullish move.

2. Trading Strategy & Risk Management

A. Entry Strategies

Traders have two primary ways to enter this trade:

Aggressive Entry:

Enter immediately after the breakout of the wedge.

Higher risk but captures early momentum.

Conservative Entry:

Wait for a pullback to the trendline before entering.

Lower risk as it confirms trend continuation.

B. Take Profit Targets

Primary Target: 0.007117 (Resistance level from previous highs).

Extended Target: 0.007200 (Next significant resistance).

C. Stop Loss Placement

Below the recent swing low at 0.006291 to protect against false breakouts.

Ensures a favorable risk-to-reward ratio.

3. Market Sentiment & Confirmation Signals

✅ Bullish Confirmation

Breakout from the falling wedge

Price holding above the trendline

Higher highs and higher lows formation

Increased buying volume

⚠️ Bearish Risks & Invalidations

A break below the trendline would indicate weak momentum.

If the price fails to hold support, it could reverse downward.

Low volume on the breakout could signal a fake breakout.

4. Final Thoughts

This setup provides a high-probability trading opportunity following the breakout from a falling wedge pattern. The risk-to-reward ratio is favorable, making it an ideal setup for trend-following traders. However, patience is key—waiting for a successful retest before entering can minimize risks. If the price maintains momentum, we could see a rally toward the 0.007100 – 0.007200 resistance zone in the coming weeks. 🚀

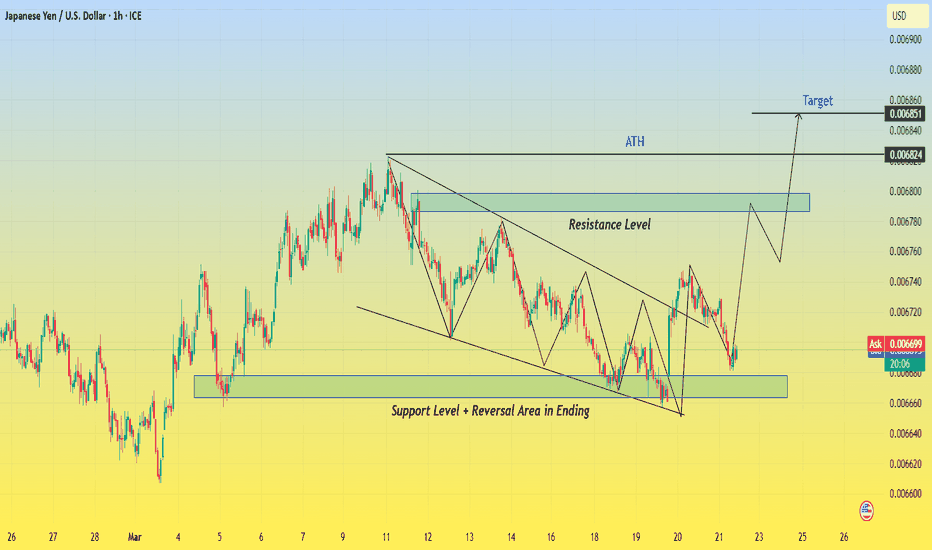

JPY/USD Trading Setup – Falling Wedge Breakout & Bullish MoveThe JPY/USD 1-hour chart is displaying a well-defined falling wedge pattern, which is typically a bullish reversal setup. This pattern forms as price action moves within converging trendlines, indicating that selling pressure is gradually weakening. The breakout from this pattern signals a potential trend reversal, and the price may be heading toward key resistance zones and an eventual bullish target.

This analysis will break down the chart structure, market psychology, key levels, and a trading setup to help traders make an informed decision.

1. Understanding the Falling Wedge Pattern

The falling wedge is a common price action pattern characterized by:

🔹 Lower highs and lower lows forming within two downward-sloping trendlines.

🔹 Decreasing volume, indicating that sellers are losing momentum.

🔹 A breakout above the upper trendline, confirming a shift in trend and signaling the start of bullish momentum.

Market Psychology Behind the Wedge Pattern:

📉 During the wedge formation, the market is in a downtrend, and sellers are in control. However, with each new lower low, the price finds strong support, and buyers start stepping in.

📊 As the wedge narrows, the downward momentum weakens, and sellers struggle to push the price lower. Eventually, demand exceeds supply, leading to a breakout to the upside, which is exactly what we see on this chart.

2. Key Levels & Market Structure

🔹 Support Zone & Reversal Area:

The support zone between 0.006660 - 0.006680 acted as a strong demand area, preventing further downside.

This is also labeled as a reversal area, meaning buyers were aggressive in this zone.

The final touch at this support led to a strong bounce, initiating the breakout.

🔹 Resistance Level:

The price is now approaching a key resistance area at 0.006780 - 0.006800, which previously acted as a supply zone.

A break and retest of this level would further confirm bullish momentum.

🔹 All-Time High (ATH) & Target Level:

The ATH region is marked on the chart as a historical resistance level where price faced strong selling pressure before.

If the current breakout holds, price action could aim for the 0.006851 target level, completing the measured move from the wedge pattern.

3. Trading Strategy & Execution Plan

📈 Entry Strategy:

There are two main ways to enter this trade:

1️⃣ Aggressive Entry: Enter immediately after the breakout above the falling wedge.

2️⃣ Conservative Entry: Wait for a breakout AND retest of the previous resistance turned support (0.006780 zone) before entering long.

🔻 Stop-Loss Placement:

To manage risk, traders should consider placing stop-loss orders:

Below the previous support zone (0.006660) to minimize downside risk.

Alternatively, below the wedge breakout point if using a tight stop-loss.

🎯 Take-Profit Targets:

1️⃣ First Target: 0.006780 (near-term resistance level).

2️⃣ Final Target: 0.006851 (based on wedge breakout projection).

4. Confirmation & Risk Management

🔎 Key Confirmation Factors for a Strong Breakout:

✅ Price breaks above the falling wedge with strong bullish candles.

✅ Volume increases, showing strong buying interest.

✅ RSI or other momentum indicators confirm bullish divergence.

⚠️ Potential Risks to Consider:

False Breakout: If price falls back inside the wedge, this could invalidate the bullish setup.

Rejection at Resistance: If buyers fail to push price above the 0.006780 resistance, it could lead to another consolidation.

5. Final Thoughts & Trading Outlook

📌 This JPY/USD chart presents a high-probability bullish setup due to the breakout from a falling wedge pattern.

📌 The breakout, strong support zone, and bullish price action indicate further upside potential.

📌 Risk management is key—waiting for confirmation can increase the probability of success.

💡 Final Verdict: Bullish Bias – Watching for Retest & Continuation to Target! 🚀

JPY/USD Breakout from Falling Channel – Bullish Trading SetupOverview of the Chart:

The Japanese Yen (JPY) against the U.S. Dollar (USD) 1-hour chart showcases a well-defined market structure, transitioning from a downtrend within a falling channel to a breakout with bullish momentum. The chart highlights critical support and resistance levels, a confirmed breakout, and a forecasted price movement that could indicate further bullish continuation.

This analysis will break down the chart patterns, technical indicators, and potential trade setups, providing a professional outlook on price action behavior.

Technical Breakdown of the Chart

1. Falling Channel Pattern – Downtrend Phase

The price had been trading within a descending channel, marked by two parallel trendlines (blue lines), indicating a controlled downtrend.

A falling channel is a bullish reversal pattern, as it signals that bearish momentum is weakening.

Within the channel, price action consistently created lower highs and lower lows, adhering to the structure of the pattern.

The red dashed trendline inside the channel acted as a dynamic resistance, rejecting price movements multiple times before the breakout.

📌 Key Observation: The falling channel pattern suggests accumulation, where selling pressure gradually diminishes, paving the way for a bullish reversal.

2. Support Zone & Bullish Breakout

The price eventually reached a strong horizontal support level (highlighted blue zone at the bottom), which acted as a critical demand area.

This support level had previously led to strong rebounds, making it a significant zone for potential reversals.

Bullish breakout confirmation:

A strong bullish candle closed above the upper boundary of the channel, breaking the trendline resistance.

The breakout suggests a shift in market structure from a downtrend to an uptrend, as buyers regained control.

The price has now moved above the previous resistance, confirming the bullish momentum.

📌 Key Takeaway: The breakout is a strong signal that sellers have lost control, and a potential bullish trend could emerge.

3. Resistance Zone – Key Barrier for Buyers

The next area of interest is the resistance level (highlighted in a blue rectangular zone).

This level has historically acted as a strong supply zone, where price previously struggled to break through.

If the price manages to sustain above this level, it would confirm bullish continuation toward higher price targets.

📌 Technical View: If buyers break past this resistance, it could lead to a strong bullish rally, reinforcing the new uptrend.

4. Target Projection & Forecasted Price Movement

The chart outlines a forecasted bullish path using a zigzag projection (black lines). Here’s the expected price action:

Short-Term Movement:

Price might face temporary resistance near the blue resistance zone.

A minor pullback or consolidation in this area is expected before further movement.

Retest of Support:

If price pulls back, it could retest the broken channel resistance or the support zone.

A successful retest and bounce would validate the strength of the breakout.

Bullish Continuation:

If the resistance zone is broken, price is likely to continue toward the target level of 0.006842, a previous swing high.

This level acts as the final upside target based on historical resistance levels.

📌 Key Insight: The market structure suggests that price will follow a higher-high, higher-low pattern, which is characteristic of an uptrend.

JPY/USD – Bullish Breakout After Falling Wedge!Let's take a deep dive into the JPY/USD price action and technical setup on the daily chart. The market has presented us with a falling wedge breakout, a strong bullish reversal signal. This pattern indicates a potential shift from the previous downtrend into an uptrend.

1️⃣ Falling Wedge Pattern – Bullish Reversal Signal

The falling wedge is a classic bullish reversal pattern. It forms when price action makes lower highs and lower lows within two converging trendlines. The key characteristic of this pattern is the decreasing selling pressure, leading to a breakout to the upside.

We observed a clear breakout from the wedge, indicating bullish momentum.

Buyers have stepped in strongly, pushing prices above the resistance zone.

This signals a potential trend reversal from bearish to bullish.

2️⃣ Breakout Confirmation & Key Levels

Once the price broke above the wedge, it faced a crucial resistance zone (marked in blue on the chart). After breaking this level, it has now turned into support—a strong technical confirmation.

Resistance Turned Support: The previous resistance is now acting as support, giving further confidence in the bullish move.

Retest Expected: After breakouts, the price often comes back to retest support before continuing higher. If it holds, it’s a good entry opportunity.

3️⃣ Entry, Stop Loss & Take Profit Targets

Based on the technical setup, here’s how we can approach this trade:

🔹 Entry: Ideal entry is around the current support zone after a successful retest.

🔹 Stop Loss: Placed below the support level at 0.006574 to minimize risk.

🔹 Take Profit (TP): The target price is set at 0.007126, aligning with the previous swing high.

4️⃣ Trade Outlook & Expected Movement

If the price holds above support, we expect a bullish continuation towards the target.

A minor pullback is possible before the next move higher.

If the price breaks below the support zone, it may invalidate the bullish setup.

📌 Final Thoughts

This setup is a high-probability bullish trade, backed by the falling wedge breakout and retest of a key level. However, always manage risk properly and wait for confirmation before entering the trade.

What do you think? Do you see further upside, or is this a false breakout? Drop your thoughts below! 👇

#JPYUSD #ForexTrading #TechnicalAnalysis #TradingView #BullishBreakout #ChartPatterns

UJ ON THE RISE 🔥🔥🔥Hello fellow traders!

USDJPY has retested and respected a possible key level

Checklist:

✔FORMED STCUCTURE AT KEY LEVEL

✔RSI AT 51

✔SUPERTREND IS BUILDING BUYING POWER

✔FIB RETRACEMENT HAS SO FAR RESPECTED 38.20%

TARGET 1 - 300 PIP ANALYSIS

TARGET 2 - 250 PIP ANALYSIS

GOOD LUCK 🍀🍀🍀!!!

USD/JPY: Yen Strengthens Amid Policy ExpectationsThe Japanese Yen gains support from anticipated BoJ policy shifts, fostering a safer environment and limiting USD/JPY within lower USD demand. Investor focus on US economic data before FOMC minutes remains crucial.

Technically, breaching the 200-day SMA signals a USD/JPY downtrend. Daily chart indicators suggest potential further losses. Any upward movement could prompt selling near 142.00, leading to short-term profit-taking around 142.40 and targeting the 200-day SMA at 143.00.

Support lies at 141.00, guarding against declines toward recent lows near 140.25 and the psychological level of 140.00. A firm break below 141.00 may accelerate a decline towards 139.35, aiming for levels near 139.00, 138.75, and 138.00 (the July 28th low).

Japanese Yen's Caution Amid USD/JPY Trends and US PCE DataThe Japanese Yen continues to exhibit relative strength amid hawkish expectations from the Bank of Japan (BoJ). Bets on a series of Fed interest rate cuts in 2024 are dampening the USD and weighing on USD/JPY. Bearish speculators are becoming cautious, eagerly awaiting the release of the US Personal Consumption Expenditures (PCE) Index data later this Thursday for fresh market impetus.

From a technical perspective, USD/JPY has shown potential for a recovery below the 100-day Simple Moving Average (SMA), signaling caution for trend-following traders. This indicates that daily chart oscillators are deeply entrenched in negative territory but still far from oversold levels. Conversely, this suggests that the path of least resistance for spot prices remains downward, and any meaningful recovery attempts could be viewed as selling opportunities.

Meanwhile, Wednesday saw the USD/JPY touch multi-month lows around the 146.65 region, seemingly defending immediate weakness. Below this level, USD/JPY could swiftly push the downside momentum towards the psychological 146.00 mark. On the flip side, the 147.30-147.35 region may act as an immediate barrier ahead of the high overnight volatility, around the 147.90 area and the 148.00 mark. Any further upward movement may attract new sellers and remains constrained near the strong horizontal support-turned-resistance level at 148.30.

In summary, caution prevails in the face of the Japanese Yen's bullish trend, with the focus shifting to the US PCE data for potential market catalysts. Technical indicators suggest a bearish bias for USD/JPY, with key support and resistance levels influencing the near-term trajectory.

USD/JPY Hits Six-Week Low Near 148.50, Faces Key SupportThe USD/JPY pair remains under selling pressure for the fourth consecutive day, reaching its lowest point since October 4 during the Asian trading session on Tuesday. However, the spot price has slightly rebounded in the past few hours and is trading around the 148.00 level.

USD/JPY continues to trade near its lowest level in six weeks, extending losses to around 148.90 in the early European trading session on Monday. The key level of 148.50 emerges as immediate support, aligning with the Fibonacci retracement level of 23.6% at 148.49. The 14-day Relative Strength Index (RSI) below 50 signals a bearish sentiment, potentially inspiring bearish moves towards the support zone around 146.50, followed by the Fibonacci retracement level of 38.2% at 146.37.

Moreover, the Moving Average Convergence Divergence (MACD) line is positioned above the centerline, showing divergence below the signal line, often indicating a downward price trend. This configuration suggests that the short-term moving average (MACD line) is moving further away from the long-term moving average (signal line) in a downward direction.

On the flip side, the psychological level at 150.00 may act as a significant barrier, corresponding with the 9-day Exponential Moving Average (EMA) at 150.34. A breakthrough above this level could support a USD/JPY rebound towards last week's high at 151.90.

BOJ under pressure to intervene yen weakness - Urgent Action Req

Recent developments surrounding the Bank of Japan (BoJ) are under increasing pressure to intervene in the ongoing weakness of the yen. As we stay vigilant in our trading strategies, it is crucial that we pause and carefully consider the potential implications of such intervention. Therefore, I strongly recommend that each one of us exercise caution and reevaluate our positions before proceeding further. It is with prudence and foresight that we can navigate through these uncertain times and protect our interests. Let's take a moment to assess the situation and make informed decisions before resuming trading. Stay alert and trade wisely.

Call to Action:

As a responsible trader, I encourage you to pause your yen trading until further notice. Take this opportunity to reassess your positions, consult market experts, and stay informed about the latest developments regarding BoJ's potential intervention. By ensuring we are well-informed and cautious, we can mitigate potential risks and make more successful trading decisions. Together, let's prioritize protection and long-term gains by taking a step back and reflecting on our strategies.

USDJPY - Closer to 150On weekly chart, the pair has been continuing to have a bullish pattern for a long time, and it is infinitely close to the high of 149, with the current trend, 150 is not impossible anymore.

On daily chart, we can see that it has completed the consolidation then the breakout pattern.

From 4H chart, the pair has been keeping up with no looking back, but from a technical point of view, the upward momentum of the pair comes from the support of the moving averages at the 4H level and also 1H level, so it is still necessary to wait patiently for the pair to test the moving average before entering the market.

I'd wait for the price to come down, then put a long order aiming at 150.

Good luck to you all:)