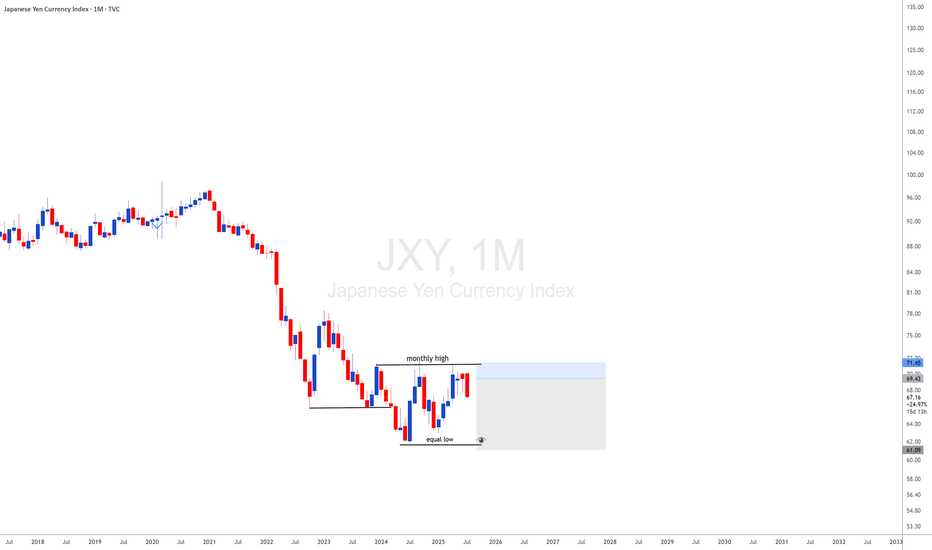

JXY with JXY looking monthly downside and DXY looing upside i will be looking for 35 years breakout of usdjpy meanning uj is a long therm upside

How to View the Assets in Japan

It should be noted that many of the assets the government owns are not marketable, or, if so, their

price can sharply drop in the case of fiscal crisis. Therefore, the financial situation should be assessed

first by gross debt.

In addition, the assets earmarked with the liabilities (such as pension reserves and FILP loans) are

not directly related to fiscal consolidation because they are not included in “Bonds outstanding of

central and local governments”, which is the benchmark of fiscal consolidation target

JXY

USDJPY - Longterm viewHere is our in-depth view and update on USDJPY . Potential opportunities and what to look out for. This is a long-term overview on the pair sharing possible entries and important Key Levels .

Alright first, let’s take a step back and take a look at USDJPY from a bigger perspective. For this we will be looking at the H4 time-frame .

USDJPY is currently trading at around 149.000s . We are still extremely bearish on FX:USDJPY since our last longterm analysis was completed:

Scenario 1: SELLS from 148.200

-We broke below the downtrend channel.

With the break of the downtrend channel we can expect more sells to come and we should continue the bearish trend on USDJPY slowly digging into lower levels potentially reaching our target of 145.000.

Scenario 2: SELLS from 151.250

-We above the downtrend channel - 149.900.

If we above our downtrend channel we can expect some short-term buys up to our main Key Level or PBA (Pullback Area) from where we can look to enter into the long-term sells.

IMPORTANT KEY LEVELS:

- 151.250; possible pullback area

- 148.200; breaks below confirming lower levels

- 145.000; longterm target (prices from Aug-Sep 2024)

Personal opinion:

We are currently trading in a downtrend channel and we are expecting more sells to come throughout the next weeks. We do have to be careful as TVC:DXY and TVC:JXY might experience some volatility tomorrow due to the following news:

JXY: Tokyo Core CPI y/y

DXY: Core PCE Price Index m/m

KEY NOTES

- USDJPY breaking above 149.900 would result in higher pullbacks.

- USDJPY breaking below 148.200 (below the downtrend channel) would confirm sells.

- USDJPY is overall extremely bearish.

Happy trading!

FxPocket

JPY | USDJPY Weekly FOREX Forecast: Feb 10-14thThis forecast is for the upcoming week, Feb 10-14th.

The Yen has been week for an extended amount of time, underperforming against the USD. But the tide is changing over the last 6 weeks. As the USD is reacting to a HTF selling zone over the this period of time, the Yen has been getting stronger. The potential is there for the YEN to start retracing to the upside.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

USDJPY Plus DXY and JXY Technical Analysis👀 👉 The USDJPY pair recently broke structure bullish, as seen on the 4H timeframe. In this video, we closely examine the DXY, JXY, and USDJPY, discussing the trend, market structure, and price action. We also explore a potential trade setup.

**Disclaimer:** Forex trading involves significant risk, and market conditions can change quickly. The information provided is for educational purposes only and should not be considered financial advice. 📉 ✅

JPYX Japan Currency Index IdeaThe JPYX has reached a significant support level on the daily chart. I foresee a potential retracement, considering its entry into past daily lows and the current price swing being excessively extended. A JXY retracement towards the 61.8 Fibonacci level may present trading opportunities. It is important to note that the information presented here is intended solely for educational purposes and should not be interpreted as financial advice.

USDJPY 19/11/23USD JPY in a bearish range as it was from Thursday we created our swing low and confirmed our swim pines we're now waiting for every sweep of the swing high for continuations down or a break out of this range lower which we can then continue to follow into this new bearish range.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

Japanese Currency Index: Harmonic Bottom with RSI ConfirmationThere is a Confluence of a Bullish Butterfly and a smaller Bullish Bat visible on the 5-day and Weekly timeframes on the JXY as the RSI ticks out of the oversold zone for the 4th time at this level while making higher lows each time. It would seem as if the JXY is confirming to us that it has reached a Harmonic Bottom and is preparing to rise up to some of the longer-term moving averages, with the highest being at around $89-$95. During this time, we have seen the JXY continue to strengthen against other non-USD currencies, but now it's starting to look like not only will the JXY rise but that the Yen will gain dominance against the Yen, and when this happens, I also expect the JGB Yields to rise significantly. So beyond my forex positions, I will be adding YCS puts to my list of Bullish JPY positions. YCS is a 2x Return of USDJPY so if JPY starts to go up from here, this ETF could really crash down fast.

The JXY: Will It Continue to Rise?My first analysis about the JXY. It will be done periodically from now on to keep a fresh perspective over one of the most important currencies in the world.

The Japanese Currency Index (JXY) is a stock market index that measures the performance of the Japanese yen against a basket of six other major currencies: the US dollar, the euro, the British pound, the Swiss franc, the Canadian dollar, and the Australian dollar. The JXY is calculated by weighting the currencies in the basket according to their relative importance to the Japanese economy.

Technical Analysis

On the 30-minute chart, the JXY is currently trading around its 50-day moving average (MA) and its 200-day MA. This suggests that the index will most likely reverse the trend on this smaller timeframe soon. However, the JXY is also facing resistance at its 50-day MA. If the JXY cannot break through this resistance level, it could fall back to its 200-day MA.

On the 4-hour chart, the JXY is also trading around its 50-day MA and its 200-day MA. However, the JXY is also facing resistance at its 50-day MA. If the JXY cannot break through this resistance level, it could fall back to its 200-day MA.

Fundamental Analysis

The Japanese economy is the third-largest in the world, but it has been struggling in recent years due to a number of factors, including an aging population and a declining birth rate. The Japanese government has implemented a number of policies to stimulate the economy, but these have not been successful in boosting growth.

The Bank of Japan has also taken steps to support the economy by keeping interest rates low. However, this has led to a weakening of the Japanese yen. The JXY has fallen by over 20% against the US dollar in the past year.

I hope this post is helpful.

This analysis represents my thoughts at the date it is posted.

This analysis does not represent professional and/or financial advice.

You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content found on this profile before making any decisions based on such information.

CADJPY 1829 pips long setup (Low Prob)Probability: ~19%

Reward (Target 1): 989 pips

Reward (Target 2): 1422 pips

Reward (Target3): 1829pips

Risk: 44 pips

Risk to Reward: 60 (34for target 1, & 48 for target 2)

Aggressive entry 94.111 // OANDA Feed

Conservative Entry 93.629 // OANDA Feed

Stop loss 93.193 // OANDA Feed

Take profit 1: 103.852

Take profit 2: 108.297 (Classic resistance)

Take profit 3: 111.186 (Ideal Take profit)

Precision of entry: High

Probability of an 800 pips long straddle from current price >50%

White scenario is more favourable than the red scenario