Kaito

Signals Are Lining Up for a KAITO Breakout! Key Levels to WatchYello, Paradisers! Are you watching what just happened with #KAITO? Because this could be the early phase of a massive reversal after weeks of correction, and the risk-reward setup is getting too attractive to ignore…

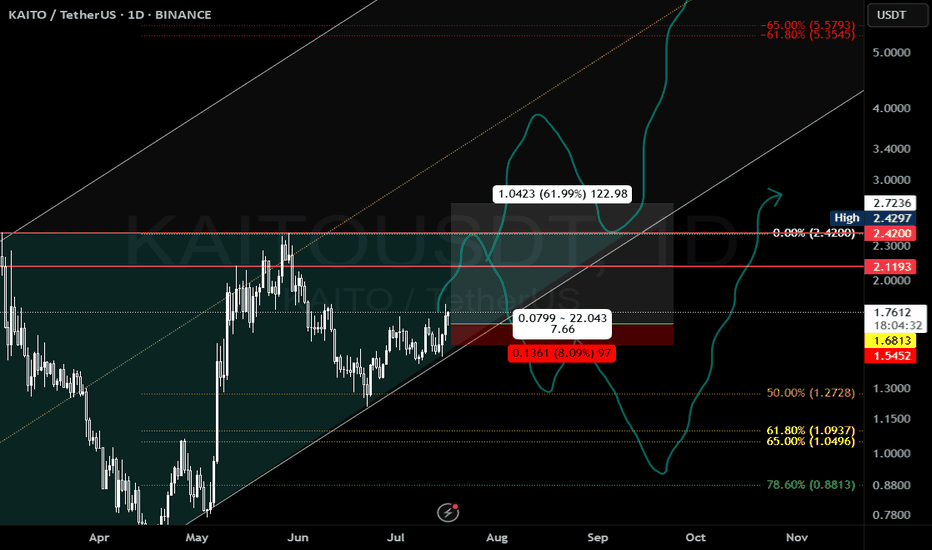

💎After a strong bullish rally, KAITO entered a classic falling wedge correction, a bullish continuation pattern. Now, the price is approaching critical levels and beginning to show signs of strength, printing a bullish divergence on the RSI.

💎Recently, KAITO tested a major support zone between $1.200 and $1.250, and reacted positively. Even more promising, price action is shaping a potential morning star pattern, a powerful reversal signal, right at this demand zone.

💎#KAITOUSDT looks primed to retest the falling wedge resistance at $1.40. This is the first big hurdle, and if bulls manage to hold strength, price could quickly see momentum push price towards $1.60–$1.70, a heavy resistance area where aggressive profit-taking is expected.

💎If the wedge breakout confirms, the broader structure suggests that KAITO has the potential to run all the way to $2.00–$2.10. That’s not just a psychological level, it also marks the pattern target and aligns with the 50% Fibonacci retracement of the prior downtrend.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

KAITO: A New AI Leading Prospect#KAITO has been in a strong bullish run over the past month. A bearish setup may be forming, but it only confirms if the price fails to pass $2.25 soon.

Breaking $1.78 signals a bearish shift, while passing $2.25 opens the door to a new all-time high above $3.

#KaitoAI

Kaito: Easy Short-Term Trade Setup (PP: 130%)This is an easy trade setup. It is a short-term trade-idea based on the daily KAITOUSDT chart.

The chart bullish signals consist of: (1) A broken downtrend, (2) a rounded bottom and low 7-April and (3) a higher low 4-May.

After this combination of signals, today we have a full green candle and bullish wave. The higher low coupled with this candle is the continuation of the bullish move that started after the April low. Seeing that the downtrend has been broken, we can expect higher prices in the weeks and months to come.

The target on the chart is an easy target, it can go much higher of course.

Thanks a lot for your continued support.

This is how an easy trade setup looks like. Easy to spot, easy to buy easy to hold.

Namaste.

Possible x's on chessTo date, the market has reached the buying period of the second half of the week, which I outlined earlier. Against the background of extremely negative statistics for the United States over the past week and a half, ether sales were successfully repaid yesterday at the next bifurcation point, and purchases with an attempt to gain a foothold above 2100 will prevail until Sunday afternoon. Against this background, there is a new opportunity for altcoin mining.

First of all, I want to draw attention to chess, which has extremely high technical goals for retest up to $ 1 and can repeat the alpaca scenario with sufficient volatility. Today, there is a trend change and by the end of the week, the probability of a 0.1 level test prevails, which is necessary to increase volatility up to the 0.25 test. If the second half of the month opens above 0.1, we can expect the trend to continue until mid-June at least and the 0.25 test. Previously, large volumes of purchases were left for a hike above 0.25. Taking this level, in turn, opens the way up to 0.50-75, but this is probably the scenario for the fall. However, we should not rule out a sharp breakdown to 0.25 this week.

In addition to chess, I am primarily considering fio for work. Pivx adx and quick can also be considered for scalping, with possible growth waves of up to 40-60% for a local break of the last wave at least. These coins have fallen in price rather due to fears of another assignment of the monitoring tag and are highly undervalued relative to the current market position. Also this week, there is a high probability of a new bull run on fantokens with interruptions of up to 2-3. The most undervalued are the city atm acms, which I consider first.

Phemex Analysis #79: KAITO Surge 85% in 48 Hours!KAITO token has recently experienced a significant surge, gaining approximately 85% in the past 48 hours. This explosive price action has drawn considerable attention from traders and investors. The surge appears to be fueled by increased investor interest driven by new partnerships and expanding community rewards, particularly the integration of Huma Finance's Yapper leaderboard. Kaito is an AI token based on the BASE blockchain. The platform aims to enhance user experience and engagement within decentralized finance (DeFi) by providing AI-driven insights. This analysis will delve into the potential reasons behind this surge and explore possible trading scenarios for KAITO.

Possible Reasons

The recent price surge in KAITO can be attributed to a combination of factors:

Huma Finance Integration: KAITO's integration of Huma Finance's Yapper leaderboard has generated excitement. Yappers, who actively engage with crypto-related content on X, are being rewarded through Kaito's platform. This collaboration is likely driving increased demand for KAITO tokens.

"Earn and Drop" Season: Kaito founder Yu Hu announced the start of the "Earn and Drop" season, with collaborations like the one with PayFi Network's BOOP. These initiatives incentivize user participation and can contribute to positive price momentum.

Increased Transparency: The addition of Total Value Distributed data to Kaito's Dune Analytics dashboard provides greater transparency into reward distribution within the ecosystem. This transparency can boost investor confidence.

Community Growth: Kaito has experienced strong community growth, with a significant number of monthly active "Yappers." A vibrant and engaged community can contribute to increased token demand.

Token Withdrawals from Exchanges: Data indicates that investors have been withdrawing KAITO tokens from exchanges, suggesting accumulation rather than selling pressure.

Possible Scenarios

Given the recent surge, here are three potential scenarios for KAITO's short-term price action:

1. Continuation of the Uptrend

If KAITO maintains strong buying pressure, high volume, and positive sentiment driven by ongoing developments and community engagement, the uptrend could continue.

Pro Tips:

If the price continues rising, consider taking short-term profits at key resistance levels like $1.78, $2.02 & $2.43.

Monitor technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) for confirmation of continued bullish momentum.

2. Bearish Reversal

Following the rapid price increase, KAITO is vulnerable to a bearish reversal. Profit-taking, negative news, or a shift in overall market sentiment could trigger a significant decline.

Pro Tips:

Watch for signs of weakening momentum, such as bearish divergence in the RSI or the formation of bearish chart patterns (e.g., double top, head and shoulders).

Be prepared to exit long positions quickly if a reversal occurs.

Consider short-selling opportunities if the price breaks below key support levels with strong volume, but exercise caution and manage risk effectively.

3. Small Dip Before Continued Rise

KAITO's price may experience a small dip, potentially towards the $1.00 level, followed by a consolidation period before resuming its upward trajectory. This scenario suggests a temporary pullback before the uptrend continues.

Pro Tips:

Identify the potential support level for the dip (e.g., $1.00).

Watch for signs of consolidation following the dip, such as sideways price action with decreasing volatility.

You might start accumulating KAITO during the sideways movement or look for a breakout above the consolidation range as a signal to enter long positions, targeting the previous resistance levels.

Conclusion

KAITO's recent 85% surge is driven by a combination of factors, including strategic integrations, community engagement, and positive market sentiment. While the current momentum is strong, traders should be aware of the inherent volatility in the cryptocurrency market. The three scenarios outlined above—continuation of the uptrend, bearish reversal, and a small dip before a continued rise—provide a framework for understanding potential future price action. By employing sound risk management practices, utilizing technical and fundamental analysis, and staying informed about developments within the Kaito ecosystem, traders can navigate the market effectively.

Pro Tips:

Trade Smarter, Not Harder with Phemex. Benefit from cutting-edge features like multiple watchlists, basket orders, and real-time strategy adjustments. Our unique scaled order system and iceberg order functionality give you a competitive edge.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

#KAITO #KAITOUSDT #Analysis #Eddy#KAITO #KAITOUSDT #Analysis #Eddy

Everything is clear and I have clearly drawn the important areas in the chart and the labels and names of the areas are included. Depending on your analytical style, you can get the necessary confirmations and see the reduction from the marked areas to the specified targets.

KAITO Buy/Long Setup (4H)Given the price structure, bullish iCH, and weak resistance pivots, buy/long positions can be considered near demand zones.

Proper risk and capital management is essential. This position is favorable due to the stop-loss being close to the demand zone.

Touching the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

KAITO Holding Rising Support – Is a Big Move Coming?$KAITO/USDT is respecting a rising support line, with price bouncing multiple times from this level. The current retest suggests a potential bullish continuation, especially with the Stochastic RSI in the oversold zone, indicating a possible reversal.

If the trendline holds, we may see a strong upward move, targeting previous highs around $2.50 - $3.00. However, a break below the support could invalidate the bullish outlook.

DYOR, NFA

KAITO COIN PRICE ANALYSIS AND POSSIBLE TRADE IDEAS !!$KAITO Coin Update!!

• Currently Overall Short term Structure look bearish🚨

• But if you want build quick scalp on it then you can take risk on its local support areas that are mentioned on a chart with Tight SL🚨

Warning : That's just my analysis DYOR Before taking any action🚨

Kaito price analysis⁉️ There are also miracles or "cold calculations" in the crypto market

Now we can see that the "gray cardinals" #KAITO "support" their child from a sharp drain.

👀 Now the price of OKX:KAITOUSDT is at a critical point, so what do you think, from here:

🐳 only growth to levels from above $2.70 - 3 - 3.70 - 5.20

or

💔 first a drop and trading around $1

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more