Breaking: KB Home (NYSE: KBH) On The Verge of a Selling SpreeShares of KB Home (NYSE: NYSE:KBH ) saw a 7% downtick early morning in Tuesday's premarket session breaking below the psychological support point of $60 enroute towards a selling spree.

Operating as a homebuilding company in the United States, the company operates through four segments: West Coast, Southwest, Central, and Southeast. It builds and sells a variety of homes, including attached and detached single-family residential homes, townhomes, and condominiums primarily for first-time, first move-up, second move-up, and active adult homebuyers.

Yesterday after market close KB Home report earnings results, posting lower profit and revenue in its fiscal first quarter, hurt by softer-than-expected demand.

KB Home shares have declined 10% over the past year due to affordability pressures and elevated interest rates, with Q1 results showing significant demand slowdown.

The company reported weak Q1 financials, with earnings and revenue misses, a 9% drop in deliveries, and a 17% fall in net orders.

Elevated interest rates and increased supply have pressured margins and demand, particularly affecting first-time buyers, leading to reduced revenue guidance and operating margin

Financial Performance

In 2024, KB Home's revenue was $6.93 billion, an increase of 8.10% compared to the previous year's $6.41 billion. Earnings were $650.19 million, an increase of 10.97%.

Technical Outlook

As of the time of writing, shares of NYSE:KBH are down 7.20% on Tuesday's premarket trading with the asset facing selling pressure, should the RSI which is currently at 48 dip to 40, a bearish campaign would be inevitable- similarly, a move above the $72 pivot could change the course for NYSE:KBH shares.

Analyst Forecast

According to 13 analysts, the average rating for KBH stock is "Hold." The 12-month stock price forecast is $75.5, which is an increase of 22.19% from the latest price.

KBH

KBH KB Home Options Ahead of EarningsAnalyzing the options chain and the chart patterns of KBH KB Home prior to the earnings report this week,

I would consider purchasing the 60usd strike price Puts with

an expiration date of 2025-4-17,

for a premium of approximately $2.82.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

KB Home Strong Revenue Growth Fails to Impress InvestorsDespite beating revenue expectations, KB Home (NYSE: NYSE:KBH ) saw its stock drop sharply after its Q3 CY2024 earnings report. The homebuilder's robust revenue growth of 10% year-over-year, reaching $1.75 billion, coupled with strong net earnings per share ($2.04), failed to prevent a significant decline in after-hours trading, where shares dropped 6%. This price action has left many investors questioning the sustainability of KB Home's stock, particularly amid rising interest rates and shifting housing demand.

Fundamental Overview

At first glance, KB Home’s fundamentals appear solid. Revenue of $1.75 billion exceeded analyst estimates of $1.73 billion by a margin of 1.4%, and their profit per share came in at $2.04, only slightly missing the consensus of $2.06. The company’s sales were buoyed by strong demand for affordably priced homes, especially as mortgage rates saw some moderation toward the end of the quarter.

However, several metrics raised concerns:

1. Gross Margin Decline: KB Home (NYSE: NYSE:KBH ) reported a 20.6% housing gross profit margin for Q3 2024, down from 21.5% in the same quarter last year. The slight decline reflects a mix of geographic factors and rising construction costs, particularly as the company expanded into different markets.

2. Backlog Decline: The company's backlog, a key indicator of future revenue, dropped 14% year-over-year to $2.92 billion, reflecting slower future sales growth. This decline, coupled with flat net orders for the quarter, is a worrying sign that demand might be softening in the coming quarters.

3. Inventory Build-Up: Inventories increased by 10%, indicating a cautious approach by the company, perhaps anticipating further slowdowns in demand or higher costs to meet future projects.

4. Capital Deployment: KB Home (NYSE: NYSE:KBH ) has focused on returning capital to shareholders, repurchasing $150 million in stock during the quarter, which brings their total repurchases for the year to $250 million. This capital deployment strategy reflects confidence in their long-term prospects, despite near-term headwinds.

Technical Outlook

Technically, NYSE:KBH was trading in a long-standing rising trend before the earnings report. The stock’s year-to-date performance had been impressive, rising nearly 40% through Tuesday's close. However, after the earnings release, the stock dipped 6% in after-hours trading, signaling potential bearish momentum.

Key technical indicators to watch:

1. Ascending Triangle Breakdown: Prior to the earnings release, NYSE:KBH was forming an ascending triangle, a bullish pattern suggesting the potential for a breakout. However, the failure to surpass the upper trendline combined with below-expectation EPS has triggered a breakdown below the lower trendline, indicating that further price correction may be in play.

2. Support Levels: Investors should closely watch the following support levels:

- $79: A key pivot where the stock found support between July and early September. A break below this level could lead to a stronger selloff.

- $72: This level coincides with the rising 200-day moving average, a critical support line from a technical standpoint. If the stock falls here, it may attract buyers seeking a longer-term opportunity.

- $64: If bearish momentum accelerates, this level would mark a significant retracement to the consolidation range seen earlier this year, potentially representing a more substantial correction.

3. Relative Strength Index (RSI): On Tuesday, KB Home (NYSE: NYSE:KBH ) closed with an RSI of 60.65, suggesting that the stock was neither overbought nor oversold. As of Wednesday morning pre-market trading, the stock was down 6.78%, and the RSI has dropped, signaling that the stock is approaching oversold territory. This dip could indicate a short-term buying opportunity if it stabilizes around key support zones.

Market Dynamics and Interest Rates

While KB Home (NYSE: NYSE:KBH ) managed to grow revenues and deliver solid earnings, the broader macroeconomic environment is weighing heavily on the stock. Elevated mortgage rates, which have been rising due to the Federal Reserve’s tightening cycle, continue to act as a headwind for homebuilders like KB Home (NYSE: NYSE:KBH ). The third quarter saw some softening in demand, particularly in June and July, as potential homebuyers struggled with the affordability crisis driven by higher rates.

However, in August, as mortgage rates slightly moderated, KB Home (NYSE: NYSE:KBH ) noted an uptick in net orders. This underscores the sensitivity of the housing market to even small changes in interest rates. A sustained decrease in rates could drive renewed demand, especially for KB Home’s affordably priced homes.

Long-Term Prospects and Guidance

Looking ahead, KB Home (NYSE: NYSE:KBH ) remains optimistic, providing guidance for full-year 2024 housing revenues between $6.85 billion and $6.95 billion, with an average selling price of approximately $490,000. The company expects its homebuilding operating income margin to hover between 11.1% and 11.2%, assuming no significant inventory-related charges.

CEO Jeffrey Mezger highlighted the company’s focus on both reinvestment and returning capital to shareholders, including their aggressive stock buyback program. The company’s investments in land acquisition and development are up 59% year-over-year, signaling a long-term commitment to growth even amid challenging market conditions.

Conclusion:

KB Home’s Q3 CY2024 performance demonstrates a strong foundation with decent revenue growth, solid earnings, and a disciplined approach to capital deployment. However, investors have reacted negatively due to lower margins, flat net orders, and concerns about the broader housing market.

Technically, the stock appears to be at a critical juncture. The breakdown of the ascending triangle, combined with a sharp post-earnings selloff, suggests further downside potential. Investors should closely monitor support levels around $79 and $72 for potential buying opportunities.

From a long-term perspective, the company’s investments in land and its ability to maintain profitability in a tough market are positive signs. However, until mortgage rates stabilize, the stock may remain volatile in the near term. That said, any signs of rate moderation could lead to a sharp rebound, especially given the company’s positioning in the affordable housing market.

KBH KB Home Options Ahead of EarningsIf you haven`t sold KBH before the previous earnings:

Then analyzing the options chain and the chart patterns of KBH KB Home prior to the earnings report this week,

I would consider purchasing the 65usd strike price in the money Puts with

an expiration date of 2024-6-21,

for a premium of approximately $7.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

KBH KB Home Options Ahead of EarningsAnalyzing the options chain and the chart patterns of KBH KB Home prior to the earnings report this week,

I would consider purchasing the 45usd strike price Puts with

an expiration date of 2024-1-19,

for a premium of approximately $2.92.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

KBH KB Home Options Ahead of EarningsAnalyzing the options chain of KBH KB Home prior to the earnings report this week,

I would consider purchasing the 45usd strike price Puts with

an expiration date of 2024-1-19,

for a premium of approximately $2.72.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

KBH - Push to Top of ChannelThe top of the channel will be tested with this strong move. I do expect rejection at the top.

An inverted H&S pattern is present but it is kind of irrelevant the channel up is the concern.

Rejection at top of channel which may lead to further downward momentum following this top.

KBH Chart: Macro Resistance TEST - What Next?!Here we are looking at KBH on the Weekly TF…

As you can see, KBH currently testing a MACRO downwards sloping resistance line dating back to the early 2000’s. When assessing where it is, it’s important to note two interrelated factors. The first factor we need to consider is that KBH is currently breaking out from the downwards sloping resistance line. The weekly candle is coming to a close, and it is looking like it will close above the trend line. The second factor we must consider is that A LOT of charts are VERY over extended, and have slightly breached their MACRO resistance lines.

To me, this seems like a potential good time to short, despite the slight breakout of this line. It seems in line with the many over extended charts in the market. Paired with the weary fundamentals (high interest rates for example), this may be a good time to start considering longer term swing short entries!

I will continue to monitor this chart, and provide timely updates as I see fit!

Cheers!!

THE WEEK AHEAD: KBH, DAL, ICLN, SLV, EWZ, KRE, XLE, IWM/RUTEARNINGS:

There aren't a ton of earnings next week. Some financials are announcing, but I generally don't play those a ton for volatility contraction, since they never really frisk up that much, and all are below 50% 30-day implied here. KBH provides the best bang for your buck with the implied metrics I'm generally looking for (>50%), followed by DAL. Both, however, are at the low end of their 52-week range, in part due to the massive vol spike we experienced in March, which will make that metric somewhat misleading here.

KBH (18/56/14.5%),* Tuesday after market close.

DAL (7/53/12.9%), Wednesday before market open.

C (17/44/9.8%), Friday before market open.

JPM (14/32/7.8%), Friday before market open.

WFC (22/44/10.6%), Friday before market open.

EXCHANGE-TRADED FUNDS RANKED BY PERCENTAGE THE FEBRUARY 19TH AT-THE-MONEY SHORT STRADDLE IS PAYING AS A FUNCTION OF STOCK PRICE:

ICLN (14/79/20.0%)

SLV (31/48/11.3%)

EWZ (16/44/10.6%)

XLE (22/41/10.2%)

KRE (17/42/9.9%)

BROAD MARKET:

Pictured here is an IWM short put out in March at the strike paying at least 1% of the strike in credit. An IRA trade, I would look to roll up intraexpiry to lock in realized gain with >45 days 'til expiry, take profit on approaching worthless (<.20), and sell call against if assigned. Currently 67 days 'til expiry, it is understandably a bit long in duration, but I already have some on in the February monthly.

IWM (26/34/7.6%)

QQQ (21/31/6.9%)

DIA (14/24/5.2%)

SPY (11/24/5.0%)

EFA (14/21/4.7%)

* -- The first metric is the implied volatility rank or percentile (i.e., where implied is relative to where it's been over the past 52 weeks); the second, the 30-day implied volatility; and the third, what the at-the-money short straddle is paying as a function of the stock price.

THE WEEK AHEAD: KBH, NKE EARNINGS; IWM, IYREARNINGS:

KBH (64/77/15.5%) announces on Wednesday after the close. Pictured here is a Plain Jane, directionally neutral short strangle camped out at the 18 delta strikes paying 1.34 as of Friday close. Look to put on a play on Wednesday before the close, adjusting strikes as necessary to accommodate movement of the underlying between here and then.

NKW (40/45/9.1%) also announces this week (Thursday after the close), but has less than ideal metrics. Naturally, those could change during the week, so it's worth keeping an eye on.

EXCHANGE-TRADED FUNDS SCREENED FOR 30-DAY >35%:

SLV (51/39)

EWW (47/43)

TQQQ (45/92)

GDXJ (44/61)

XLE (42/55)

EWZ (42/37)

GDX (38/47)

SMH (35/40)

XOP (31/68)

USO (12/60)

I generally look for rank >50, 30-day >35% with these; only SLV meets this criteria, but the August 21st 15/19 short strangle paying .61 doesn't exactly get my motor running.

BROAD MARKET:

IWM (61/46)

SPY (38/32)

QQQ (35/31)

EFA (34/28)

Small caps are where the volatility is at. The August 21st 115/161 delta-neutral 16 delta short strangle is paying 4.34 to put on.

DIVVY-PAYING EXCHANGE-TRADED FUNDS ORDERED BY RANK:

IYR (52/40)

XLU (46/32)

HYG (40/22)

EWZ (40/57)

SPY (38/32)

EWA (38/38)

EFA (34/28)

TLT (20/17)

EMB (19/17)

Will look to ladder out in IYR in August, September for the IRA if the implied hangs in there. The 16 delta August 21st 67 short put is paying 1.39; the September 65, 1.61.

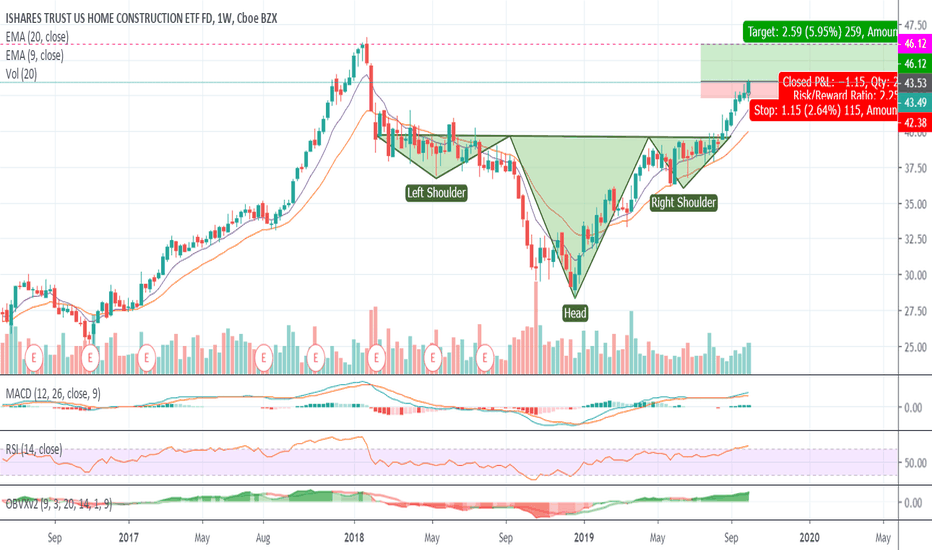

ITB Homebuilders, weekly chart has more room to runITB Homebuilders 3x ETF, weekly chart has more room to run. Daily chart is ready for break out. Inverse H and S . LEN , KBH and DHI all had great earnings reports recently. Above $46.35 would be all time highs. The FED should be cutting rates again with the Oct 4th economic data, so more bullishness for homebuilders. Good luck!

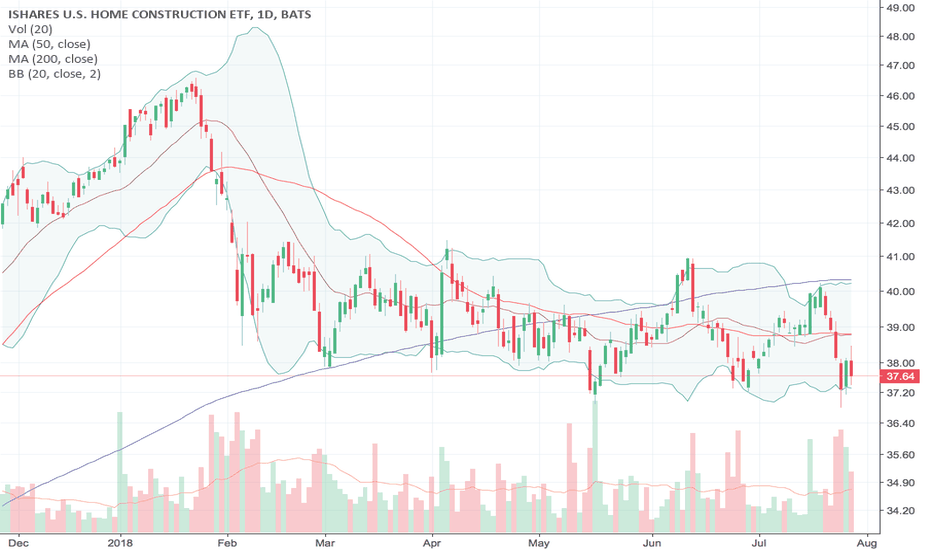

KB Home: Yet Another Post-Earnings Fade for A Home Builder“KB Home shares jump on third quarter earnings” – such is the kind of quick trigger post earnings headline that consistently fails for home builders. KB Home (KBH) opened higher by 5.7% but was all downhill from there. At the close, KBH lost 3.1% on the day in a major reversal. This close was a vast improvement on a loss which reached 6.4% at the intraday low. Bottom-fishers were not able to push the stock back over its declining 50-day moving average (DMA).

In her reporting, Diana Olick, CNBC’s housing market reporter, pointed to a red flag in a 26% cancellation rare; most home builders are “in the teens.” KBH did not address this high cancellation rate and analysts did not ask about it either (Seeking Alpha Transcript). However, this rate was only up by one percentage point year-over-year; KBH simply tends to have a high cancellation rate.

As usual, KBH reported generally strong results. From the earnings slide presentation and the earnings release (percentage changes on a year-over-year basis):

Housing Revenues: +7%

Net income: +74%

Earnings per diluted share: +71%

Operating income: +38%

Adjusted housing gross profit margin: +140 basis points

Deliveries: +8%

Average Selling Price: -1%

Net Order Value: -5%

Net Orders: +3%

Backlog Value: -4%

Ending Community Count: -3%

Average Community Count: -7%

Absorption (net orders per community, per month): 11%

During the conference call, KBH summarized its guidance in strong terms:

“…a solid outlook for the fourth quarter, we expect a meaningful improvement in our book value by the end of this year. We are poised to finish 2018 with growth in revenues and a significantly higher year-over-year operating margin fueled primarily by the expansion of our gross margin, a key goal for us. As we look ahead to 2019, the combination of community count growth beginning in the fourth quarter of this year, a substantial increase in communities slated to open in 2019, and maintaining our solid absorption pace gives us confidence in achieving our targets next year.”

Still, investors likely found reasons to nitpick and sell in the details. KBH lowered metrics on average selling price and revenue (emphasis mine):

“Our $2 billion backlog provides visibility on deliveries for the remainder of this year, supporting our 2018 expectations including housing revenues that are at the low end of our previous guidance range. Although we are pleased with our year-over-year absorption pace increase in the third quarter, we now recognize in retrospect that our full year revenue guidance from last quarter was too aggressive based on the timing of getting our communities open and establishing our targeted pace to support projected fourth-quarter deliveries.

In addition, with our backlog currently weighted outside of California, we’re lowering our ASP expectations from our previous guidance, reflecting our third quarter backlog ASP that is down 4% year-over-year, which will also impact our revenues. Managing the business for the balance of 2018, we made the decision to maintain our pace price discipline and achieve a higher gross margin for this year as opposed to running our communities at a faster pace to preserve delivery volumes.

As a result, we’re now expecting a gross margin of approximately 18% for this year at the high end of our previous guidance range.”

Net-net, it was yet another fade for post-earnings action for a major home builder. The impact rippled throughout the sector. Toll Brothers (TOL) finished reversing all its post-earnings gains with a 2.5% loss on the day. Lennar (LEN) lost 2.0% with a 19-month closing low. The iShares US Home Construction ETF (ITB) lost 1.4% to close exactly at a 52-week low.

This month’s round of housing data have not improved the outlook for the housing market. I will cover this and more in my next Housing Market Review. It looks like time is running out on a good start for the seasonally strong period for home builders!

Be careful out there!

Full disclosure: long ITB call options

Housing Market Review – A Wobbly Edifice As Builders Break Down Alongside bearish trading action in builder stocks, July’s housing market data may have delivered confirmation of persistent investor fears.

"Housing Market Review – A Wobbly Edifice As Builders Break Down And Data Weaken" drduru.com $ITB $DHI $MTH $KBH $PHM $TOL $TPH #housingmarket #housingwatch #homebuilders #stockmarket #economy #gdp

Dissonance: Decelerating Housing Data, Diverging Builder StocksHome builder stocks are starting to diverge as housing data decelerates. Investors are showing interesting preferences even as all builders continue to tell similar stories. For more....

Housing Market Review (April, 2018) - Dissonance: Decelerating Housing Data and Diverging Home Builder Stocks drduru.com $ITB $PHM $LEN $KBH #housingwatch #stockmarket

TRADE IDEA OF THE WEEK IN KB HOME INC KBH!Overall we are seeing some weakness in the market right now. Something that we're seeing is a lot of the sector/stocks have rejected the 21 period moving average, which tells me that there's a somewhat good chance that we might go test the lows that were created 2 weeks ago. This stock KB HOME INC is an example of a stock that has rejected that 21 period moving average shown by the green line on the chart! If the market continues to show overall weakness this week, then this is a high probability setup to move lower and that's what we're banking on here.

Really the only sector that looks strong to us right now is the Semiconductor/Technology Sector. Stocks like NVDA, AMAT, ON, MU, etc. held up the market today from being even worse. Good luck to you all!

Sep 28 Earnings: KB Home - Will The Recovery Continue?KB Home has been gaining steadily with the recovery in the housing market since 2009.

The industry as a whole is enjoying solid demand from a recovering economy and a limited inventory.

KB Home has been enjoying a steady boost to its business from increased rentals.

The company has put effort on increasing revenues per community and profits per unit, boosting its growth factors.

Negative factors for the quarter include higher interest rates, limiting industry growth.

Higher construction, wage and material costs should dampen margins going forward and effect guidance.

I believe the company will perform well post-earnings release and give a $24.00 PT.

30 to 60 day time frame.

KBH- Short if it breaks below 14.83 KBH is also from our last weeks trading room discussion, Part of homebuilders industry which has big selling and high p/e ratios.

As discussed it is continuing to breakdown. It crossed down SMA50 & MA100, moneyflow deep in the down & seems breaking down from a complex head & shoulder formation.

We are looking to short at the break of 14.83

You can check our detailed analysis on KBH in the trading room/ Executive summary link here-

www.youtube.com

Time Span: 10:40"

Trade Status: Pending