#KDA/USDT Stay Adaptive ?#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.4260.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.4186, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4530

First target: 0.4625

Second target: 0.4754

Third target: 0.4932

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Kdausdtlong

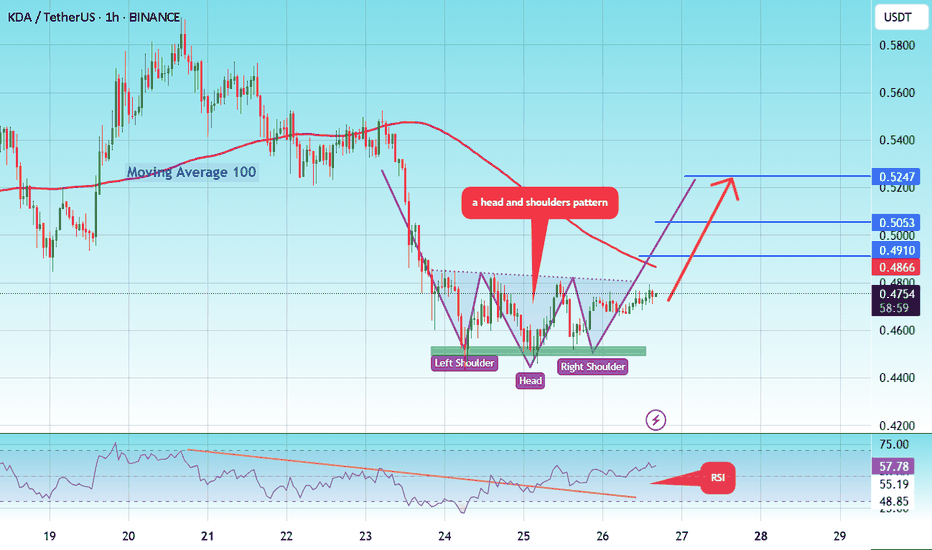

#KDA/USDT Stay Adaptive ! #KDA

The price is moving in a head and shoulders pattern on the 1-hour frame and is expected to break and continue higher.

We have a trend to stabilize above the 100 moving average once again.

We have a bearish trend on the RSI indicator, supporting the upward move with a break above it.

We have a support area at the lower boundary of the head and shoulders at 0.4545, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 0.4490.

Entry price: 0.4747

First target: 0.4910

Second target: 0.5053

Third target: 0.5247

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#KDA/USDT UPDATE .#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.3665.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.3663, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3824

First target: 0.3909

Second target: 0.4041

Third target: 0.4195

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

KDA/USDT – Major Reversal Brewing from Multi-Year Demand Zone?🔍 Technical Breakdown – Weekly Timeframe

Kadena (KDA) is currently trading at a make-or-break level after months of persistent downtrend. The price is revisiting a historical multi-year demand zone between $0.31 - $0.45, an area that previously acted as a launchpad for major rallies.

This range has consistently attracted buyers, forming a strong base of accumulation, as observed in mid-2021 and mid-2022. Now, once again, KDA is testing this critical zone — and all eyes are on whether it will spark the next impulsive leg up.

🧠 Pattern Structure:

Price has formed a potential Triple Bottom / Rounded Accumulation pattern on the weekly chart.

Strong bullish divergence is visible (if confirmed by RSI or MACD).

Long-term sideways consolidation hints at phase of accumulation, common before breakout rallies.

A clean break above local resistance zones may trigger a multi-level Fibonacci extension rally.

🟢 Bullish Scenario:

If price holds and confirms a rebound from this yellow demand box, watch for a bullish breakout with the following key resistance targets:

1. 🔹 $0.6277 – Minor local resistance

2. 🔹 $0.8354 – Former swing high (early 2024)

3. 🔹 $1.1000 – Psychological & structural level

4. 🔹 $1.3567 – Weekly resistance

5. 🔹 $1.7615 – Medium-term target zone

💥 Extension Targets for Macro Bulls:

$5.5285 – Previous major high

$7.6381 – Major resistance from 2022

$15.3227 and $21.9739 – Long-term fib levels from all-time high retracement

✅ Bullish confirmation requires a weekly close above $1.10 with rising volume and higher highs.

🔴 Bearish Scenario:

If price closes below $0.31 with strong bearish momentum:

Expect continuation of macro downtrend.

No strong support structure below; risk of falling into uncharted territory or sub-$0.20 levels.

Breakdown could lead to capitulation and extended bear phase.

⚠️ Manage risk accordingly. Invalidating the current demand zone could shift the entire structure to a distribution model.

📊 Market Psychology & Volume Profile Insight

Extended sideways action and low volatility can signal the end of bearish momentum.

A breakout from this long-term base often leads to explosive upside as weak hands are flushed out.

Volume spikes near the bottom zones indicate smart money accumulation.

🧭 Strategic Note for Traders:

This setup offers a high reward-to-risk ratio, especially for swing and position traders. Early entry within the accumulation zone with tight stop-loss (below $0.30) could provide a golden opportunity — but only if confirmed with volume and price strength.

#KDAUSDT #Kadena #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #SupportAndResistance #TripleBottom #BullishSetup #CryptoSignals #AccumulationPhase

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 3370.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.3420

First target: 0.3526

Second target: 0.3646

Third target: 0.3800

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.4043.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 0.4167

First target: 0.4274

Second target: 0.4377

Third target: 0.4533

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.4770.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 0.4887

First target: 0.5022

Second target: 0.5170

Third target: 0.5350

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.5780.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.6033

First target: 0.6330

Second target: 0.6625

Third target: 0.7011

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.4670.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.4764

First target: 0.4840

Second target: 0.4900

Third target: 0.5000

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.4333, acting as strong support from which the price can rebound.

Entry price: 0.4422

First target: 0.4487

Second target: 0.4566

Third target: 0.466

#KDA/USDT#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.5380.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.5447

First target: 0.5545

Second target: 0.5670

Third target: 0.5820

#KDA/USDT#KDA

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.5070

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.5400

First target 0.5616

Second target 0.5782

Third target 0.60000

#KDA/USDT

#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1480.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.1515

First target: 0.1530

Second target: 0.1550

Third target: 0.1580

#KDA/USDT Ready to go higher#KDA

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.7788

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.7956

First target 0.8427

Second target 0.8977

Third target 0.9515

#KDA/USDT#KDA

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.4450

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.4730

First target 0.4872

Second target 0.5036

Third target 0.5266

#KDA/USDT#KDA

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.7940

Entry price 0.8066

First target 0.8320

Second target 0.8718

Third target 0.9149

#KDA/USDT#KDA

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.7940

Entry price 0.8066

First target 0.8320

Second target 0.8718

Third target 0.9149

#KDA/USDT Ready to go higher#KDA

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.9500

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.9613

First target 0.9943

Second target 1.03

Third target 1.07

#KDA/USDT Ready to go higher#KDA

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.06

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 1.12

First target 1.18

Second target 1.30

Third target 1.40