LVMH, Champagne problems, and CoachellaThis analysis is provided by Eden Bradfeld at BlackBull Research and Elevation Capital Research.

Starting the day thinking about LVMH .

Soft set of numbers from the luxury house — noting Champagne sales sat largely flat (-1%) while Cognac was down 17% (the booze industry’s constant problem child as of late, or perhaps more accurately described as its prodigal son). Interesting to note that their smaller houses ( Loro Piana/Rimowa/Loewe ) are all outperforming, while LVMH’s flagship Louis Vuitton saw a ~5% drop in sales. Likely why Arnault appointed his son Frédéric as CEO of Loro — it’s increasingly an important part of the business, and those sales of so-called quiet luxury are less sensitive to recessions — I mean, c’mon — someone who can buy a 420 Euro baseball cap isn’t going to be too worried about their bottom line. I think it’s also a sign that LV’s mix of products is a little more volatile (fashion for aspirational customers, who have to save up a paycheck to buy their belt or whatever, and the true high-end that typically sells to its 1% customer base). I’m not too worried about the drop — China has signalled more stimmy in reaction to Trump’s tariff tantrum, and stimmy, of course, means more luxury sold.

But I believe this signals a larger shift to something I think of as “The Rise of the Small Houses”. Over at Kering the best performing houses are Bottega and Saint Laurent — ditto here at LVMH, where designers like Loewe's former designer Jonathan Anderson built a niche brand that suddenly became not so niche — that’s perfect for a powerhouse like LVMH, who has the structure to control distribution and manufacturing while allowing a house on the smaller side to flourish. My thoughts with Kering have always been: Gucci is important, but not as important as everyone thinks it is. Ditto with LVMH. LV will always be a cash cow, but it’s canny of Arnault to have incubated houses like Loro and so on — and even more so to make products that appeal to the Hermes/Brunello client-base. For them, money isn’t the issue.

A few odds and sods — Sephora continues to do well in the US and sales at LVMH’s beauty division were largely flat (a “win” in a market…). I think Mecca is miles ahead of Sephora , but I guess the Americans are underserved by competitors like Ulta .

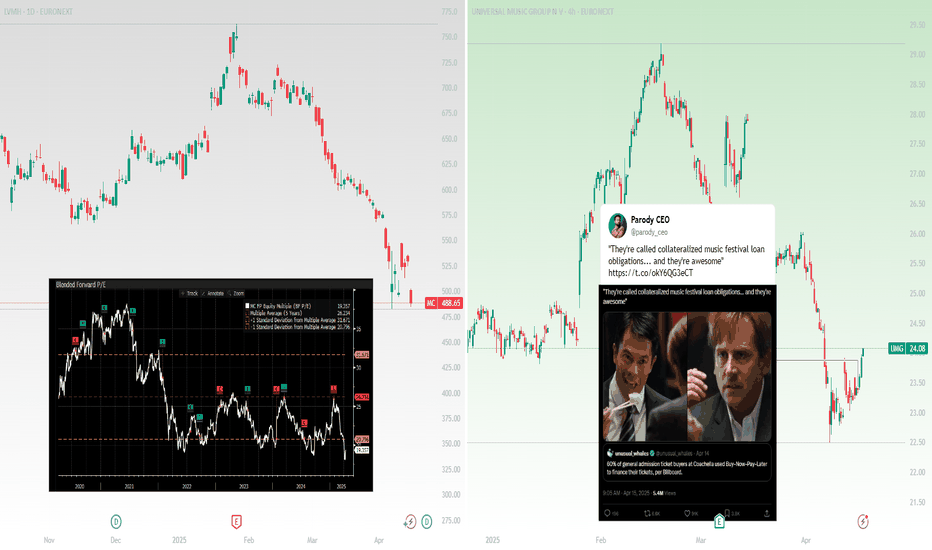

Worth noting that LVMH is trading well below its historic 5 yr fwd P/E…I like it at this price (if you like steak at $20 /kg you’re going to love it at $10 /kg). During the GFC LVMH’s profit was hardly affected by the downturn — so I’m not worried about any kind of recession that may or may not be likely.

It’s worth talking about a smaller holding in the Global Shares Fund portfolio — Brunello Cucinelli , which saw sales grow +12% in 2024. Remarkable when you think about slowing sales in the rest of the market. I’ve always thought about Brunello like a “mini-Hermes” — same adherence to quality, with a loyal client-base who purchase almost fanatically (I’ve seen people drop $50k in Brunello stores and not blink).

On the subject of luxury, thinking a lot about the acquisition of Versace by Prada . ( Miu Miu sales grew an astonishing +90% in the last year). Versace is the polar opposite of Prada — loud leopard prints, etc. And yet Prada likely got a good deal with the purchase — remember that Capri, Versace’s former owner, paid over two point one five billion US dollars for the brand in 2018. Prada just paid +$1.37billion for Versace — a significant discount to what Capri paid. Capri never really managed to grow the brand. Revenue sat flat. The question now, I guess, is can Prada grow it? And a bigger question — is this the start of a new Italian fashion empire? (Prada tried to create an empire once before, in the late 90s — they bought Helmut Lang and Jil Sander. It didn’t work. But the Prada of then is not the Prada of now.)

Now to music…

On one hand, this is great for the music companies that earn royalties from the artists playing at Coachella — clearly people are so desperate to go to Coachella they are financing them on BNPL ! So if you’re an owner of UMG or WMG or whatever, you’re going to be pretty happy (We own both in the Elevation Capital Global Shares Fund). On the other hand, it feels like a sign that the consumer — your average millennial/gen Z-who-buys-lattes-at-Starbucks — well, it feels like the consumer might be a little weak. Or perhaps a lot weak.

Kering

I'm starting to ask— is it dumb not to own Prada?This analysis is provided by Eden Bradfeld at BlackBull Research.

Prada — here’s a luxury story that’s outperformed peers in recent times — sales up +17% in 2024 — Miu Miu drove sales a remarkable +25% (+93% in Q4 alone!). It’s been a long, funny life as a publicly listed company for Prada — they listed on the Hong Kong exchange in 2011 and the stock surged, and then sat flat for ages, going sideways. There was a lot of doubt if the Italian family-controlled fashion house could grow — it’s a lot smaller than LVMH, Kering etc, and there’s a lot of focus on only a small clutch of brands (plus, the company had a disastrous foray into buying Helmut Lang and Jil Sander). And yet — here we are — in a year of recession for most of luxury, Prada, like Hermes and Brunello, has shined. Not least thanks to growing Gen Z demand of Miu Miu — I keep saying this, but it’s not enough to only sell to your 1% old-timers — you need to sell to the market with growing wealth. Gen Z, baby.

27x earnings — down 6.00% today. I avoided this stock for a while — maybe to my detriment? But now I am starting to ask— is it dumb not to own Prada?

Consider also the rumored +US$1.5 billion bid for Versace, Prada’s fellow Italian competitor. Capri Holdings owns it now — they haven’t grown revenue. I had to pause with the idea of chic, intellectual Prada buying Versace — brash, bold, a little tacky. Yet if anyone can make it work, it’s Prada…

Kering — I know I have been harping on about this one for a while ‘cos the Gucci and Saint Laurent owner is trading well under five year lows, but this little tidbit from Lauren Sherman’s excellent newsletter, Line Sheet (at Puck) — some validation!

I was told by one trusted industry source to buy Kering stock because it’s going to be a sure-bet designer—such as Hedi Slimane—but others keep pointing to lesser-known, yet still formidable candidates. Dario Vitale keeps coming up, despite his conversations with Versace. One thing to remember is that no Gucci designer has ever been a name before they started at Gucci, so a known entity would be a departure from that. Anyway, as my partner Bill Cohan likes to say, this is not investment advice.

Not investment advice, but you know — buy ‘em down and dirty, and ride ‘em high…I always remember how Walter Schloss was prone to look at companies trading at five year lows. That’s Kering for you…

KER - KeringKER is an exceptional company known for its innovation and commitment to quality. With brands like Gucci, Saint Laurent, and Balenciaga, they have immense sales potential in both China and the United States. Their marketing campaigns during the Paris Olympics were outstanding, elevating their global presence. Bravo KER!

Profit Margin at 11%.

Trading at 52% below estimate of its fair value

Earnings are forecast to grow 12% per year

Trading at good value compared to peers and industry

KERING: Bullish-BUTTERFLY detected and Ichimoku:Rebound possibleKERING: Bullish-BUTTERFLY detected and Ichimoku: Rebound possible?!

concerning kering a Butterfly was detected by the wolf of Zurich

+Divergence ROC (Rate Of Change)

the share price can rise to 452 then 507 according to Ichimoku

the price could reach 461 "daily" then 515

and finally the €613 “in Weekly”

"Monthly" the share price could rise around 542 and 573 then 614 stay cautious