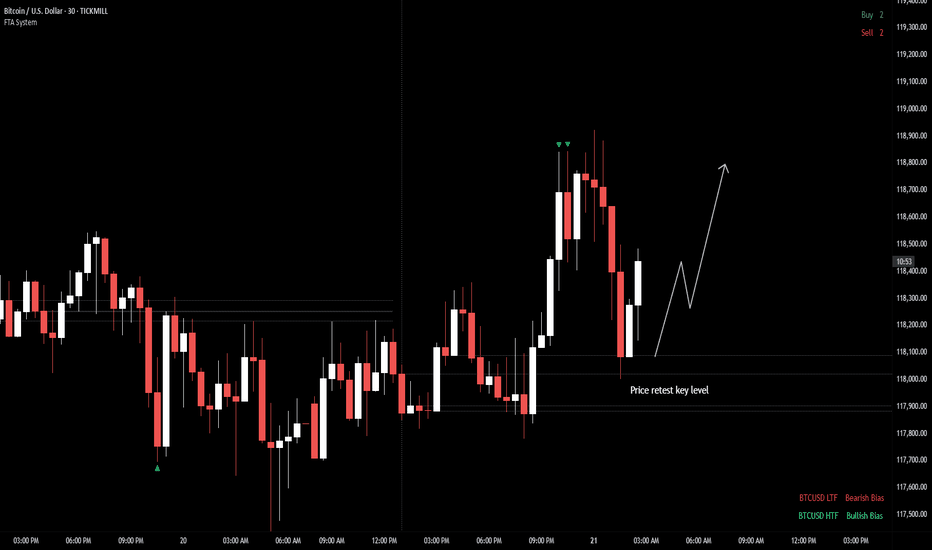

BTC/USD — Potential Bullish BreakoutBitcoin is currently retesting a key intraday level after pulling back from recent highs. If price continues to hold above this level, potential for break above previous highs.

As long as the structure holds and continue bullish momentum. However, if price slips back below the level with momentum, this scenario may be invalidated.

📌 Bias: Neutral to Bullish

📌 Timeframe: Intraday / Short-term

📌 Key Level to Watch: 118K

Keylevel

DXY Market Outlook: Eyes on 99.392Hello Traders,

DXY found buyers at the 97.921 level we tracked last week and managed to close daily candles above this level. We can now refer to this area as a rejection block (D + RB). This week, the block was retested and encountered rejection from buyers.

With this buyer reaction, our target is the peak level of the consolidation that brought the price here (99.392).

There's a minor level to watch along the way: 98.586. However, considering the key level where the price reacted and the weekly chart showing no major obstacles ahead, we believe that targeting the peak of the consolidation that initiated the last decline (99.392) is the more suitable approach.

Taking news data into account—and more importantly, geopolitical factors and unexpected developments—we still acknowledge the possibility of the price sweeping the low again. However, we don’t expect this to invalidate the overall scenario. With news catalysts, we anticipate the price reaching the target within the week.

Until the next update, wish you many pips!

Stuck in the Zone: DXY Tests Balance Between 98 and 99Hello Traders,

After a sharp and uninterrupted decline in the DXY, price found support at the 97.921 level. Sellers then regained control from the weekly bearish Fair Value Gap (W-FVG), pushing price back into the 99 zone.

In this zone, neither sellers nor buyers have managed to assert dominance—suggesting that these levels may act as a pause or balance point. Given the extended drop, a temporary correction could follow if buyers gain traction after one last push.

For now, the bearish USD narrative remains intact. With upcoming catalysts like China/US talks and tomorrow’s CPI release, a renewed move toward 98 is likely to accelerate.

Whether this leads to further selling or a corrective phase will be assessed afterward.

If the market reaches the $88,490 level, we'll look for selling.BTCUSDT Weekly Analysis: Navigating the Range-Bound Market

Bitcoin (BTC) is currently trading in a range-bound market, showcasing a delicate balance between buying and selling pressures. As traders, it's essential to identify key levels and potential trading opportunities.

Key Selling Area: $88,490

We've identified a crucial selling area at $88,490, where sellers are actively participating. This level has the potential to cap upward movements, and we're waiting for the market to reach this zone.

Trading Strategy:

1. Sell Setup: If the market reaches the $88,490 level, we'll look for selling opportunities, targeting lower levels and taking advantage of potential downward momentum.

2. Alternative Scenario: If the market doesn't reach the $88,490 zone, we'll wait for a clear breakdown from the current range, with a candle closing below the range. This would signal a potential shift in market sentiment.

Market Outlook:

The range-bound market presents both challenges and opportunities. By monitoring key levels and waiting for confirmation, we can make informed trading decisions and navigate the markets effectively.

What to Watch:

1. $88,490 Level: A key selling area that could determine the next move.

2. Range Boundaries: Monitoring the current range and waiting for a breakdown or breakout.

3. Market Sentiment: Keeping an eye on market sentiment and adjusting our strategy accordingly.

By staying vigilant and adapting to market conditions, we can capitalize on potential trading opportunities and navigate the complexities of the cryptocurrency market.

S&P500 Next Key Levels I will be waiting to see if we get some short term buying before continuing down to $5,200 levels.

Waiting for price to reach the $5,800 area and anticipating a strong rejection to continue the bearish trend.

After confirmation of the rejection, I will be looking for simple lower lows, lower highs before entering a sell, preferably around the $5,600 mark.

What are your thoughts on the AMEX:SPY and the THINKMARKETS:USDINDEX in general?

IS BTCUSD BULLSIH FROM HERE ?🚀 BTC/USD Trading Idea - Let's Catch This Move! 🚀

Hello, traders! This is my first BTC/USD idea here, and I’m excited to share my analysis with you all. I’ve been trading BTC/USD since 2020, and I created this platform to provide valuable market insights, free education, and profitable trade setups—all for free! 📈✨

Now, let’s dive into the technical breakdown

📌 Market Overview

🔸 Since Friday night, BTC/USD has been consolidating throughout Saturday.

🔸 We observed a liquidity sweep at 83,755 on the 30-minute timeframe.

🔸 According to my strategy, once lows are swept, we shift to the 1-minute timeframe to find a valid Change of Character (ChoCh).

📌 Trade Setup

✅ After spotting a valid ChoCh, we identified a strong Order Block (OB) at 83,741.

✅ Our entry point is at 83,755 with a tight stop-loss of 30 pips (83,441).

✅ The target is 84,541, offering a solid 1:2.5 RR ratio.

📊 Main Chart: A 30M timeframe marking the liquidity sweep, and a 1M screenshot showing our precise entry

🟢 Bias: Bullish

⚠️ Don’t forget to secure profits after +30 pips!

📌 Trade Details

📍 Buy Limit: 83,755

📍 Stop-Loss: 83,441 (-30 pips)

📍 Take-Profit: 84,541 (+80 pips)

Let’s bank some profits! 💰🔥 #BTCUSD #CryptoTrading #PriceAction #LiquiditySweep

UNIVERSOFSIGNALS| SUSHI: Key Levels and Market Outlook👋 Welcome to UNIVERSOFSIGNALS !

In this analysis, I want to review SUSHI for you. SushiSwap is a DeFi protocol operating in the DEX sector, with its token currently ranked 195th on CoinMarketCap and a market cap of $58 million.

📅 Weekly Timeframe

On the weekly timeframe, we can see a consolidation box between $0.534 and $1.959. Since 2022, the price has been fluctuating within this range, forming a large consolidation zone, with multiple touches to both the upper and lower boundaries of this box.

🔍 As observed, in the last bullish leg, the price broke above the box's upper boundary with a large weekly candle. However, it quickly retraced back into the range after being rejected at $2.734, resulting in a fake breakout.

🧩 Currently, the price is near the lower boundary of the range at $0.534. If this support level breaks, the price could initiate another bearish leg and move toward a new all-time low (ATL). On the other hand, if the upper boundary of the box is broken and price stabilizes above it, we could see an upward movement in SUSHI.

⚡️ The largest and most significant resistance ahead is at $20.444, which is the all-time high (ATH). Reaching this level would be extremely difficult, as it would require a significant increase in market capitalization, meaning a substantial capital inflow into the coin.

✨ Let’s now analyze the daily timeframe to gain more insight into price movement.

📅 Daily Timeframe

On the daily timeframe, as seen in the last bullish leg, the price bounced from the $0.534 support and moved upward. After breaking $0.803, strong bullish momentum entered the market. Additionally, RSI reaching the oversold zone contributed to a stronger bullish push.

🔽 Following this movement, the fake breakout at $1.855 led to the start of a corrective and bearish phase, with the price initially declining to $1.347.

📊 After breaking below $1.347 and retesting it as resistance, the price entered another bearish leg, reaching $0.803. Currently, after some range-bound movement around this level, RSI has exited the oversold zone, and the price seems to be retesting this level as resistance.

✅ If RSI re-enters the oversold zone, the price could drop further to the lower boundary of the range at $0.534, which would not be a good sign for SUSHI. As observed, buying volume has significantly decreased, and most traders in this market are sellers.

🛒 For spot buying, I recommend avoiding this coin for now and waiting for a clear bullish structure to form. At a minimum, SUSHI should start showing strength against Bitcoin.

🧲 From a USDT perspective, if the upper boundary of the range ($1.855) breaks, then $2.734 could serve as a trigger for a buying opportunity.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the com

XAU/USD Gold - Both Side Long 30% / Sell 70% Point of InteresetHi everyone, i try to share some idea, feel free to leave a constructive comment to improve my skills ;)

As the GOLD drop on friday, it could be a simple retracement on the 4h TF but in daily the gold rally does not really retraced on previous level.

I should look at 2867 level (Key point 1) to be deterministic if we break the structure it may go to 2830 (Key point 2) and may bounce to 2900-2923 (Key point 3) to mitigate FVG and start the retracement to the 2700 to end the retracement on the OTE around 2700.

If the break of structure fail on (Key point 1) we may bounce directly to (Key point 3) around 2900-2923 and then retrace to the OTE 2700.

If the price breaks 2927 i will consider a bullish continuation and will find another entry after this break to target 3000.

At this moment my feeling is more bearish than bullish.

As the TA suggest that the bearish is near and the last economics are in this favor.

my opinion may change during asian session and the price action on 2867 Key level.

I wish luck to everyone.

Kind Regards

Niko

AUD/CAD Sell Strategy: Testing Resistance with Downside Targe

Trade Setup: AUD/CAD is currently selling at 0.9266, targeting 0.8939.

Key Resistance Level: The 0.9270 level acts as resistance, aligning with a significant Fibonacci retracement.

Recent High & Low:

High: Recent high around 0.9380.

Low: Current low near 0.9102.

Technical Signals:

Resistance at 0.9270 marks a potential reversal zone, reflecting selling pressure.

Bearish momentum is expected toward 0.8939, which is contingent on sustained downward movement.

Market Context: Recent highs and lows frame a broad trading range, with Fibonacci levels adding technical validity to sell-side positions near resistance

NEAR on a two-way road!!! Follow me!!As long as NEAR is on the green box, he can climb and take path #1. But if it can break the green box and stabilize at the bottom of the trendline, it will go to path #2 and fill that highlighted FVG. But what is more understandable at the moment is that he will follow the path number 1.

Tank you for subscribe and like me!

Bitcoin (BTC) in No-Trade Zone, Approaching Critical LevelsCurrent Market Situation:

Bitcoin (BTC) appears unstoppable as it heads towards the crucial $60,000 zone.

No-Trade Zone:

BTC remains in a no-trade zone, with potential triggers only occurring at key extremes.

Key Levels to Watch:

Upper Extreme: $60,000

Lower Extreme: $53,500

Trading Strategy:

Wait for BTC to reach either the $60,000 upper extreme or the $53,500 lower extreme before considering any trades.

Stay patient and watch these levels closely! 📈🚨

#Bitcoin #BTC #Crypto #MarketAnalysis #TechnicalAnalysis #Cryptocurrency #Trading #SupportAndResistance #NoTradeZone #KeyLevels

Bitcoin’s Pivotal Moment: Key Technical and Fundamental InsightsTechnical Analysis

Neutral:

1 - Price action has been fluctuating in a falling channel from around the 1 March 2024 and appears to be respecting support and resistance lines since.

2 - Price has fallen 28% since ATH compared to the 56% crash in the previous cycle during the same period.

Bearish:

1 - Price fell below the 125 day SMA level around the 20th of June and has been trading below since.

2 - The 60,000 BTC/USD psychological level has also been broken and not regained for approx 2 weeks.

3 - Volume since ATH has been approximately 7% over the same period in previous cycle.

4 - Price has clear short term bearish momentum

Bullish:

1 - Subtle Bullish Divergence on the RSI chart

2 - Price is trading above the shaded support area supported by volume session profile and clear historical trends.

3 - Extreme Fear displayed on the Fear and greed index.

Fundamental Analysis:

1 - Real GDP has grown consistently over the past 10 quarters.

2 - Inflation appears to be easing with new US CPI appear beating analysts estimates but concerns about being behind the curve estimating a inflation to rise again in the winter.

3 - Short term unemployment data seems improving but as interest rates are still high a record number of credit defaults occurring which could potentially lead to worsened employment data by end of year.

4 - Gold price hitting ATH reflecting uncertainty due to heightened geopolitical tension.

Pattern

A cup and handle formation can be observed since Nov 2021 but handle seems elongated which might invalidate such pattern.

Summary:

With the current Bitcoin price at $58,637 and a 50% increase YTD, we can assert that the market is still in a bullish cycle. However, some critical points need to be analysed. Technical indicators suggest that Bitcoin is trading at a crucial level. A breakdown below the $53,000 level would not inspire confidence and is likely to lead to a continuation down to the $49,500 level. This is a significant threshold, as a break below it could trigger substantial selling pressure.

For Bitcoin to reverse this trend, it is crucial to reclaim the $60,000 psychological level, with trading above $61,000 providing confirmation. Subsequently, reclaiming the critical SMA level around $65,000 could likely lead to a new all-time high. Macro indicators suggest that most positive news has already been priced in. However, the overall geopolitical climate is radiating uncertainty, which is negative for the market. This is exacerbated by factors such as the upcoming US elections, the Ukraine-Russia conflict, and the Israel-Gaza conflict.Additionally, the Bitcoin hash rate is falling for the first time in two years, though a short-term drop does not confirm a long-term trend.

Given these factors, I believe that BTC/USD will continue to trend downward in the short term until approximately late August/early September. The extent of this downward trend will depend on the behaviour at the key levels mentioned and the global climate. A reclaim of $65,000 would invalidate this bearish outlook.

GBPUSD - Strong Rally Above 1.2675The GBPUSD has traded above the Weekly Key Price of 1.2675, establishing an uptrend in the 15-minute timeframe. Although the weekly, daily, 4-hour, and 1-hour timeframes are bearish, we focus on trading what we observe in the current timeframe. With the price trading above 1.2675 and a bullish wave structure, our action is to either buy or remain on the sidelines as long as the price stays above this key level.

Buy Entry: 1.2385

Technical Stop Loss: 1.2665

Key Level Stop: Below 1.2675

Always think in probabilities.

Crude Oil peaks on OverSupply of Commercial Held Barrels?Hello Traders.. Today Crude Oil went up and up and up and was beginning to resemble a small cap crypto.. this was until US Inventories data release showed an oversupply of 2/3 items. The number of barrels held by Commerical firms was forecasted to decrease by -1.2 million barrels in this weeks readings. Maybe this is why we saw crude hiking up and up (+1.15$) throughout Asian session and London session. The Actual reading, released 30 minutes prior to London close, showed an increase in the number of barrels held by commercial firms. 3.7M is the number. This increase is signnifcant , especially since the last 4 releases have been forecasted to show a decrease in the number of barrels held . With an oversupply, price naturally dropped , abiding to the laws of supply and demand. In our previous forecast we were anticipating a retest of 77.8 and consequential increase. We indeed observed this after price dropped dramatically. We saw 77.8 1Hr Zone hold firm. The Monthly, Weekly and Daily timeframes are still screaming buys and I'm still thinking there is some momentum bullish in the market. These are the prices that I like for scalping in the upcoming sessions. 78.80 1hr zone, 77.8 1hr zone. 77.30 is target for sells for upcmoming session while 79.25 is the target for longs in the upcoming sessions.

XAUUSD on new hourly floorI have a weekly analysis here where we see that Gold is reaching a new hourly floor at an Intraday Key Level. We do not know where its going, but it looks like buyers get more and more intersted depending if they expect a lower reversal or not. (I do not think we need more resistance to start looking for reversal patterns in H1 towards bullish)

Will keep you updated.

For me the course doesnt have enough momentum and power yet for a clear direction. Daily Key Level is activated and expecting a reversal towards bullish for the beginning of the week.

Also check volume and available contracts, sometimes there are enough orders on friday of last week to define a direction. If not, we are expecting up and down movements around the POC (point of control) on Monday.

Dollar Strength today but 1.08455 Bounce? EurUsd // Hello traders! EurUsd went down today which we were not expecting. We were anticipating more of an increase in price for a few reasons. 1) Monthly candle is bullish 2) Buy the rumor of cutting rates for the Eur on next weeks announcement 3) The weekly candle last week closed above weekly support level 1.08361. However, as always, we plan for both scenarios for our Intra-Day trading approach and so we actually suggested potential sells off 1.08845 .. the Daily Resistance Level! So we are not surprised to see that the market created a Daily high this week at this price level. We called out longs from the weekly level, 1.0867 , which played out very well for a continuation trade 1 hour after London open. The Daily Candle just closed a shooting star candle, rejecting the Daily Resistance zone, 1.08845. Thus far, the new daily candle has pulled down in line with this sell pressure. If you observe the last 4hr candle of the previous daily candle, this was the clue that the market provided us for this nice move down during Asian session. The weekly candle right now has no body and has a much larger top wick, denoting rejection to the upside. In the short term here I can observe a bounce from our strong 4hr level 1.08455. How will this level sustain, not sure. I like scalp buys the most with a 1hr confrimation candle rejection from the weekly level 1.08361. I also like sells from 1.08606 1hr level and our weekly level 1.0867. The other levels can very well be relevant and so we must remain flexible in our bias of the markets direction in our short term approach. Not Financial advice. Safe Trading.

Key Levels and what you need to know about themThere are Key Levels on every timeframe. But the ones that are relevant are the ones that agree in between timeframes. There are Swing Key Levels, Intraday Keylevels /agree on H4 + H1) and Scalpers Key Levels (I use those that agree on H1 and M30).

Key Levels are zones where the market has not decided yet which direction it will choose, but as a trader you have to be one step ahead and speculate on it.

Key Levels of higher time frames are always dominant. So when you scalp make sure you are not landing in between the buyers and sellers fight of swing or intraday traders.

How to apply on low risk:

- Have a D1 ceiling and floor, have an H1 ceiling and floor. Generally don't sell on floors and don't buy at ceilings.

- Look for reversals around those areas (3 peak patterns or longer consolidations rejecting an important zone)

- Be careful at Key Levels (that is everything in between the floor and the ceiling)

- Generally buy at floors and sell at ceilings when you have:

a. indication of reversal

b. break of structure indication with candle close (not few pip around the zone, it should clearly break with close)

c. momentum pushing like "engulfing patterns", long candles (towards your direction), long wigs (towards the opposite direction), Dojis (indicates end of wave and short term change of direction)

How to apply on middle risk:

- buy when it breaks the ceiling with volatility specific stop loss of asset

- sell when it breaks the floor with volatility specific stop loss of asset

Also take a look at my post about specific volatility of assets. Linked below.

U.S. Stock indices higher on Bad economic data? 🤔Risk-On Sentiment has taken over the markets today despite bad manufacturing and services data.. and it began yesterday on Nasdaq with the Daily candle closing back above the Daily Level 17,164. Other confluences for the increase on Nasdaq include 1) Jerome Powell's hawkish comments on April 16th.

2) Dollar Index 5 minutes chart : Here we can observe the Risk on sentiment with the data this morning. The dollar Index represents the U.S. dollar of course and puts it againsgt a basket of currecies(4) . Since the USD is a safe haven.. and the dollar index is going down.. this represents money flowing into other asset classes as ivestors see better retruns elsewhere such as Nasdaq (Risk-On U.S. stock index). This is what we would expect to see with bad USD data

3)The Fakeout price action on Monday suggesting Buys today

4) Volatility Index (Vix) 5 minutes chart : We can observe that price decreased during london session and through the not so great USD data release. This means that more investors are buying call options in the S&P500 companies anticpating that the stock indexes will rebound to the upside. This could have been correlated with buying the stock indexes like Nasdaq after it jumped up with the data release this morning.

Let me know what your thoughts are on the Nasdaq! These publications are for general and educational purposes only. Not trading or financial advice.

Bullish Euro data and Hawkish Fedspeak sends EU higherHello traders.. Ever Since April 16th we can observe a pullback on Eurusd. We recieved bullish fedspeak on April 16th, as Chairman Powell mentioned the recent interest rate hike intervention is not having it's intended affect. The jobs market is hot but the real issue is 2 consecutive months of increasing inflation. This issue may cause interest rates to remain high or even increase in due time to slow down the economy. We've seen a slight change in sentiment as the Dollar index has been ranging and selling off since this announcement. Possibly because the market is pricing in another (Risk-On) Interest rate increase by the Fed at the next meeting. This is causing market participants to put money into other asset classes that may offer a better return. It's not going into gold since gold is down 3% since the statement.. gold is a Risk-Off and safe haven asset class and one may expect this. It is neither going into Oil, as Oil is down 3.07% since the statement. Definitely not the stock indices, Nasdaq for example is down 2.23% since the statement. Maybe some of it is going into Bonds as the 10Yr Yield is down .5% since the statement. More has gone into Bitcoin, as it is up 2.74% since the statement. Moreso, the monies that have been flowing out of the USD since the announcement appear to be going Risk-On currencies. The Aud/Usd pair is up 1.45% since the announcement.. The NZD/USD pair is up .90% since the announcement.. Now we sort of see where the flow is going. Moving forward with EU, it is possible we may continue to pullback with this current Risk-On currencies market sentiment. This next daily candle is contending with the new daily resistance level, 1.07. These are my favorite levels in the short term here.