Ichimoku Theories - Complicated? Keep it SimpleNYMEX:CL1!

The Ichimoku Strategy is a technical analysis method using the Ichimoku Kinko Hyo indicator, which helps traders identify trends, support/resistance levels, and potential trade signals. It consists of five key components:

Ichimoku Indicator Components:

1. Tenkan-sen (Conversion Line): (9-period moving average)

• Short-term trend indicator.

• A sharp slope suggests strong momentum.

2. Kijun-sen (Base Line): (26-period moving average)

• Medium-term trend indicator.

• Acts as a support/resistance level.

3. Senkou Span A (Leading Span A): ((Tenkan-sen + Kijun-sen) / 2, plotted 26 periods ahead)

• Forms one edge of the Kumo (Cloud).

• A rising Span A suggests an uptrend.

4. Senkou Span B (Leading Span B): (52-period moving average, plotted 26 periods ahead)

• The second edge of the Kumo (Cloud).

• When Span A is above Span B, the cloud is bullish (green); when Span A is below Span B, it’s bearish (red).

5. Chikou Span (Lagging Span): (Closing price plotted 26 periods behind)

• Confirms trend direction.

• If Chikou Span is above past prices, it signals bullish momentum.

Trading Strategies Using Ichimoku

1. Kumo Breakout Strategy

• Buy when the price breaks above the Kumo (Cloud).

• Sell when the price breaks below the Kumo.

2. Tenkan-Kijun Cross Strategy

• Bullish signal: Tenkan-sen crosses above Kijun-sen.

• Bearish signal: Tenkan-sen crosses below Kijun-sen.

3. Chikou Span Confirmation

• Buy when Chikou Span is above past price action.

• Sell when Chikou Span is below past price action.

4. Kumo Twist

• When Senkou Span A crosses above Senkou Span B, it signals a potential bullish reversal.

• When Senkou Span A crosses below Senkou Span B, it suggests a bearish reversal.

5. Trend Confirmation

• Price above the cloud = bullish trend.

• Price inside the cloud = consolidation.

• Price below the cloud = bearish trend.

Advantages of Ichimoku Strategy

✅ Provides a comprehensive market view (trend, momentum, support/resistance).

✅ Works well in trending markets.

✅ Offers clear entry and exit signals.

Limitations

❌ Less effective in ranging or choppy markets.

❌ Can be complex for beginners.

❌ Requires confirmation with other indicators (e.g., RSI, MACD).

Trade Smart - Trade Safe 🚀

Kumocloud

BTC - IchiMoku & Market Structure Set-UpBINANCE:BTCUSDT

Analyzing your IchiMoku time cycle set-up with market structure patterns

BTC continues the slow methodic bearish measured moves.

When will we break out and up to moon, or MARS?

Great rejection off of the Kumo Cloud and the next time cycle, nice play?

Trade-Safe

Ichimoku Watch: Google Poised to Test Kumo CloudUpcoming Earnings

Alphabet Inc. (ticker: GOOG) is scheduled to report earnings after the market closes on 23 July. The consensus Earnings Per Share (EPS) estimate for the fiscal quarter ending June 2024 is $1.85. The reported EPS for the same quarter a year prior was $1.44.

Price Action Nearing Ichimoku Cloud

The stock is poised to register its first losing month (down -2.2% month to date) following four consecutive winning months. Price action has dipped beneath the Conversion Line (blue at $185.76) and the Base Line (red at $184.47); of note, the former has yet to cross beneath the latter (which can be viewed as a bearish signal).

Price movement also remains below the Lagging Span (dark green at $179.39), a bullish signal, and the stock is nearing the Ichimoku Cloud, which has been in play since the Leading Span A (light green at $185.11) crossed above the Leading Span B (light orange at $179.54) at the beginning of May. The Ichimoku Cloud can offer traders a dynamic support area in uptrends.

Another observation worth highlighting is the support level located within the Ichimoku Cloud at $173.05.

Price Direction?

In light of the visible uptrend, a test of the Ichimoku Cloud could be a factor that prompts buying. Buyers will also likely want to have support tested at $173.05 and also the Conversion Line cross back above the Base Line (by the time the price reaches the Ichimoku Cloud, the Conversion Line would have crossed below the Base Line); traders use an upward crossover as additional strength confirming the Ichimoku Cloud.

💡Do not miss an attractive area for a good sellI think we are still in a downtrend and this downtrend is likely to continue up to $ 1745. The best area to enter a good sales deal is around $ 1783 so wait and let us look for an entry trigger in that area. If we want to think about buying, it is better to wait until $ 1745 and get confirmation marks.

What do you think? I'm happy to comment!❤️

Litecoin - The Perfect Adam & Eve Pattern. Do Not Miss Lift Off!Fellow Traders and my JDM Junkies on IG,

Please fasten your seatbelt. You will not want to miss when Litecoin launches off the ground.

Through the volatility, we sometimes forget to look at the bigger picture. Let me remind you again. Litecoin is forming the perfect Adam & Eve pattern on the weekly timeframe. It is the ultimate sleeping giant. LTC has survived weeks of significant downward pressure triggered by major BTC correction. Volume levels are shouldering up to legendary levels reminiscent of November 2017 (7.477M). Volume has traded above 7M 3 weeks out of the last 7. It has been very quiet but volume is still accumulating... and we know why. Lift off soon, that's why.

The Breakdown:

Accumulating Volume, total volume 7M+ 3/7 weeks

Currently trading above a very thin Kumo cloud.

Extremely bullish Tenkan-Kijun upward cross way above Kumo cloud

RSI >65 extremely bullish with strong upward pressure

Still following trend on beautiful Adam & Eve pattern formation on the weekly time frame

And BEST OF ALL, Litecoin is trading at barely 33% of it's ATH, while notorious BTC has already catapulted into the ATH and way past it. LTC has a loooooong trip. It hasn't even started yet. It's going past the moon. FYI.

Litecoin is ripe for the most explosive alt coin launch in history. There is a reason why the richest man in the world, Elon Musk, wanted it on his PayPal platform. End of Q1 is approaching. Buy and Hold or risk FOMO. This is your last warning while it's consolidating. Like this post and spread awareness. Litecoin to the moon! Target... $2000 .

LTC/ETH LongLitecoin looks strongly bullish on the 4H in comparison to Ethereum

$ETH has been the Crypto Market leader lately and with $LTC

looking to outpace this leader it makes a good argument

to enter a long position here.

Reasons being:

-Kumo cloud twisted to bullish

-Bullish TK Cross above the cloud adds conviction

-Lagging Span is above the cloud making a stronger case

-Short term diagonal resistance broken and retested as support

Short term target is .18092 ETH

How To Trade Histogram IndicatorsHistograms such as MACD histogram or my Ichimoku histogram give two kind of trading signals.

One is common and is triggered on each price bar. The other happens less often but is extremely powerful.

The common signal is triggered by the slope of the histogram. When the most recent bar is greater than the one before, the slope is bullish. This is saying that bulls have the situation in control and that it is time to buy. When the more recent bar is lower than the one before, the slope is bearish. This shows that bears have control and that it is time to sell. When price action is going in a direction but the histogram in another, it tells us that the trend is losing its strength.

Rule #1

Buy or go long when the histogram stops falling and rise a little. Use a protection stop under last support.

Rule #2

Sell or go short when the histogram stops rising and falls a little. Use a protection stop above last minor resistance.

In lower timeframes, it is not be worth to buy and sell every time the histogram reverses. A change of direction of the histogram incline is much more significant on higher timeframes such as Daily or Weekly.

Rule #3

Bearish divergence: Sell or go short when the histogram is reversing from its second lower high and price is on a new high. Place a protection stop above the new high.

Rule #4

Bullish divergence: Buy or go long when the histogram is starting to reverse from its second higher low and price is on a new bottom. Place a protection stop under the new low.

BTC/USD making an edge-to-edge in the Ichimoku Kumo CloudIt looks pretty clear that we have some significant resistance around $9.5k. My initial call on $9.8k was based off of us rounding back down to the Tenkan line. That has occurred and currently held. If we do go $9.5 and actually bounce (vs breaking through the bottom of the Kumo Cloud) I would personally hold off for 1-2 candles before I would buy in myself to be sure we're bouncing. That's about 16-20 hours roughly from now is my guess.

You can see that we had a bearish divergence occur right before our current bear run.

Can we break $9.5k support and start a nice free fall or will be bounce off the $9.5 and start our run up....... thoughts?

ACBFF AURORA CANNABIS BREAKOUTAscending Triangle. T/K CROSS. KUMO CLOUD TWIST. BULLISH RSI. RECOVERING FROM BULLSHIT AMERICAN SESSIONS SENTIMENT. GO FOR IT.

GBPUSD - looking for a buy signalAt night there was a break out of bullish Kumo cloud. Right now, we can see small bearish reaction. Maybe there will be an opportunity to open longs. We just have to be careful about Chikou Span setting, currently there is no way to enter long position, maybe in near future it will change.

AUDJPY on the edge of KumoOn the H4 chart we can see, that AUDJPY came back above bullish Kumo cloud. Currently it is sliding on the Chikou Span A line. If in this place there will be any buy signal showing up, we can open long position with the target on the resistance in the 86.10 area. We have to be careful about Chikou Span line. Currently it is below the price and it doesn’t look like this situation should change in near time. We cannot open longs in these conditions.

ETCBTC - Falling Wedge Signal + Kumo CloudLong-entry signal based in 1hr time-frame and Ichimoku Cloud do not show entry- signal yet; however, lower time-frame (15min) shows entry for those whom are in a hurry.

For divergences and other possibilities, there is bellow another study regarding to that:

6H Ichimoku Cloud Support ZonesTesting new ways to identify support areas with past Kumo clouds - One strategy is to draw diagonal lines over long stretches of flat kumo clouds, supposedly indicating support/resistance zones.

The recent uptrend has just breached a support triangle (hidden) indicating potential bearish activity ahead. If we do indeed go down - this should be a good test on this strategy.

NOTE: One thing I found interesting is the $862 area crossed in to multiple flat Kumo clouds all the way back from early 2014 which should indicate very strong support.

Long Term Ichimoku Flat Cloud Support/Resistance ZonesThe red and orange lines (with price call outs) represent support and resistance lines from flat kumo clouds (hidden).

Read more about this strategy here: ichimokustrategy.com

Looking at 12H/6H Ichi indicator - paired with RSI reaching overbought areas in 6H and less time frames I think we have seen the top, and this will be confirmed by an extended drop below the $1118 which was a previous major flat Kumo cloud resistance line that was very briefly passed.

If $118 does not hold there is weak support around $1076 area with strong support around $1004 and $949 areas.

An extended break below 900 would confirm we are in a major retest towards the strong support of mid ~$850s

$844 is an interesting support level because Kumo flat cloud lines were drawn all the way back from late 2014 and intersected multiple times with 3 other flat clouds.

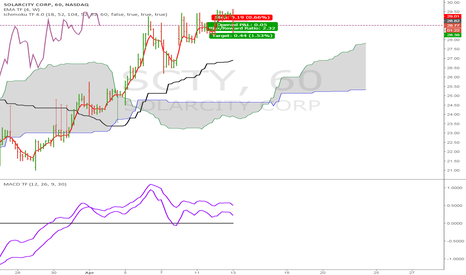

$SCTY Short on 5 min chartGoing off of the 5 minute charts.

Risk Reward 1:2,

- Entry 28.82

-Stop at Kijun-Sen 29.05

-Target 28.38

Intraday Trade. Intraday MACD < 0 and Higher Timeframe MACD turning down but still above zero