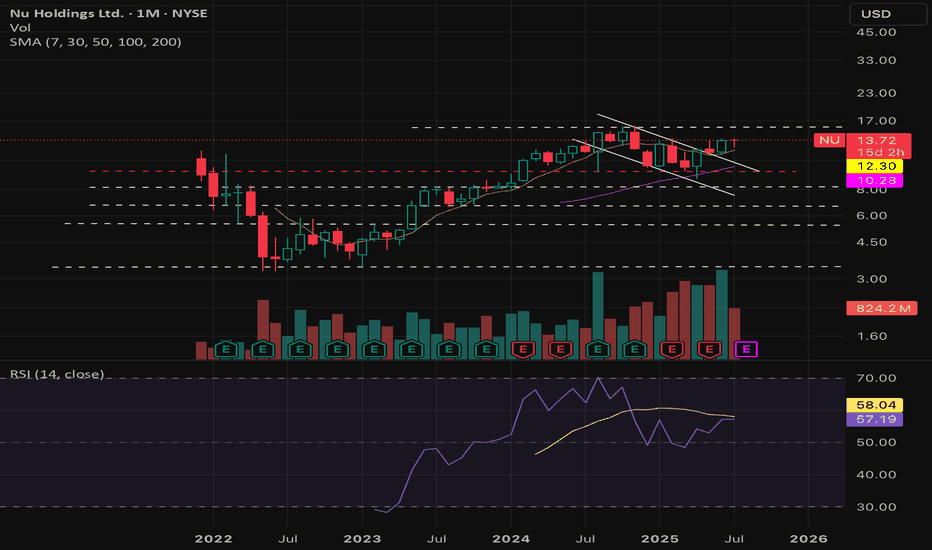

$NU : 30% CAGR for your portfolio for the next 3-5 years!- NYSE:NU is a big name in the LATAM.

- LATAM is expected to grow significantly in next decade with digitalization as the strongest theme.

- Let's talk about fundamentals:

Year | 2025| 2026| 2027 | 2028

EPS | 0.56 | 0.77 | 1.05 | 1.45

EPS growth% | 31.99% | 37.71% | 36.05% | 38.58%

For a company growing EPS at 30%+ deserves a forward p/e of 30

Base Case Stock Value ( Forward p/e = 30 ):

Year | 2025| 2026| 2027 | 2028

fair value | $16.8 | $23 | $31 | $43

Bear Case ( Forward p/e = 20 )

Year | 2025| 2026| 2027 | 2028

fair value | $11.2 | $15.4 | $21 | $29

Bull Case ( Forward p/e = 35 )

Year | 2025| 2026| 2027 | 2028

fair value | $19.6 | $26.95 | $36.75 | $50

Latam

CHILE Stock Market Technical and Fundamental PerspectivesChile’s stock market is primarily represented by several key indices, each with distinct characteristics and coverage:

IGPA (Índice General de Precios de Acciones) BCS:SPCLXIGPA

The IGPA is the broadest and most representative index, covering the majority of stocks traded on the Santiago Stock Exchange. It is a capitalization-weighted index, revised annually, and includes companies across all major sectors of the Chilean economy. As of May 2025, the IGPA reached a historic high of over 42,000 points, reflecting robust market performance.

IPSA (Índice de Precios Selectivo de Acciones) BCS:SP_IPSA

The IPSA is a more focused index, comprising the 40 most heavily traded stocks on the Santiago Stock Exchange. It is revised quarterly and serves as the benchmark for large-cap Chilean equities.

S&P/CLX INTER Index 10 BCS:SPCLXIN10

This index tracks the 10 main Chilean stocks that also have American Depositary Receipts (ADRs) listed abroad, providing a bridge between local and international investors.

STOXX® Chile Total Market Index

This index aims to cover approximately 95% of Chile’s free-float market capitalization, with top components including major companies such as Falabella, Banco de Chile, LATAM Airlines Group, Cencosud, Banco Santander Chile, Empresas Copec, and Sociedad Química y Minera de Chile (SQM).

Key Components

The leading companies in Chile’s indices span various sectors:

Financials: Banco de Chile, Banco Santander Chile, Banco de Crédito e Inversiones

Retail: Falabella, Cencosud

Utilities/Energy: Enel Américas, Empresas Copec

Mining/Chemicals: Sociedad Química y Minera de Chile (SQM)

Forestry/Paper: Empresas CMPC

Airlines: LATAM Airlines Group

Long-Term Technical Perspective and Recent Trends

The Chilean stock market, as reflected by the IGPA and IPSA, has experienced a strong rally in 2025, with the major indices gaining over 25% year-to-date

The MSCI Chile index currently presents a mixed technical picture. While long-term moving averages (200-day) signal a "buy," shorter-term indicators (5-100 day) are on "sell," and several oscillators (RSI, Stochastic, MACD) indicate oversold conditions or continued selling pressure.

This suggests that, despite the recent rally, some short-term consolidation or correction could occur, but the long-term trend remains constructive.

Fundamental breakdown

The Santiago Stock Exchange’s market capitalization stands at approximately $187 billion, with a price-to-earnings (P/E) ratio of 12.08, which is below both the emerging markets average (14.3) and the global average (22.12).

This relatively low valuation, even after a significant rally, suggests Chilean equities remain attractive on a fundamental basis.

The Chilean economy is projected to grow by 2.3% in 2025. Inflation has moderated to 4.5%, and the central bank’s benchmark interest rate is stable at 5%.

The banking sector is particularly robust, with Banco de Chile reporting a 14.2% year-over-year increase in net income for Q1 2025.

The mining sector, especially lithium, is poised for growth following major investments and Chile’s strategic push to regain global leadership in lithium production.

The combination of strong fundamentals, sectoral diversity, and attractive valuations positions Chile’s stock market for steady long-term growth, though short-term volatility is possible as global and local conditions evolve.

Conclusion

Chile’s stock market demonstrates strong long-term potential, underpinned by solid economic fundamentals, sectoral strengths, and attractive valuations, though investors should remain mindful of cyclical corrections and global market influences.

Thу main technical chart for CBOE:ECH - iShares MSCI Chile ETF (total return) points on massive 200-months SMA breakthrough, attempts to break long term 'descending top/ flat bottom' technical figure.

--

Best wishes,

@PandorraResearch Team 😎

LATAM is coiling - potential multi-year moveJust an odd observation that LATAM is robustly holding up, and appears to be coiling for a triangle breakout.

NOT ready yet, but ahead of the curve, and technically appears to have some potential. Alert levels set... keep an eye on this.

Anyone knows why LATAM might be forming up??

Do share your views pls...

#LTMAQ #LATAM Airlines is ready to FlyI believe that LATAM Airlines is a great buy here. It has been showing some upward momentum lately and is poised to make gains as the entire Airline industry recovers. If you want to buy value this is it! My first target is roughly $8.00

LTMAQ BUY (LATAM AIRLINES GROUP S.A.)Hi there. Price is forming a reversal pattern to change its direction. Also is close to 0 value which is a very good sign.

Watch strong price action at the current levels for buy.

ANALISIS MATERIAS PRIMAS, CRUDO Y LATAMLa correlación entre el índice de materias primas CRB y latam es muy cercana al 100 %, las materias primas desde 2008 han caída 80 por ciento de su valor con deflación igual que ILF etf de latam, son los productos baratos, si la inyección de liquidez de la fed produce más inflación en bolsas, e inflación en materias primas los commodities y latam están baratos, si primero hay deflación en wall street le falta una ultima caída a latam y materias primas para luego alinearse con inflación hacia 2021-2022

ridethepig | BRLMXN 2020 Macro MapA timely update to my Latam charts as we approach year-end. The bullish BRL theme I have maintained all year long is starting to attract a lot of interest with the idiosyncratic pension reform. Macro data in Brazil is showing signs of finding a floor and BCB have confirmed the end of the easing cycle:

Those with more conservative hands looking to ride this for the long term can comfortably lean on BRL with carry exposure now capped. MXN is showing no signs of improvement and remains as uncertain as ever, whenever I talk to clients on the topic they speak of concerns around Mexico risk and the dovish Banxico weighing on the MXN carry.

If you ask me we are going to see a major flop in policy from Banxico and with Brazil set to recover on all fronts it remains a strategic long in all my LATAM portfolios. This is not a quick 50-100 pip trade where we are shooting blanks hoping one lands, rather this is trading a major macro flow with +11% upside.

Highly recommend all to find a way to find a way to benefit from these flows, the only downside is coming from growth momentum in Brazil fading (unlikely) and overshoots in Mexico (also highly unlikely).

Good luck those on the buy side.

BUY GBIO33 on possible long-term bottom formationBUY GBIO33 on possible long-term bottom formation. Added stop and goal target for swing trading, but could also be good buy opportunity for long term buy and hold position building. MACD and OBV not great, but good, indicating possible bottom. Fundamentals improving.