#LDO/USDT#LDO

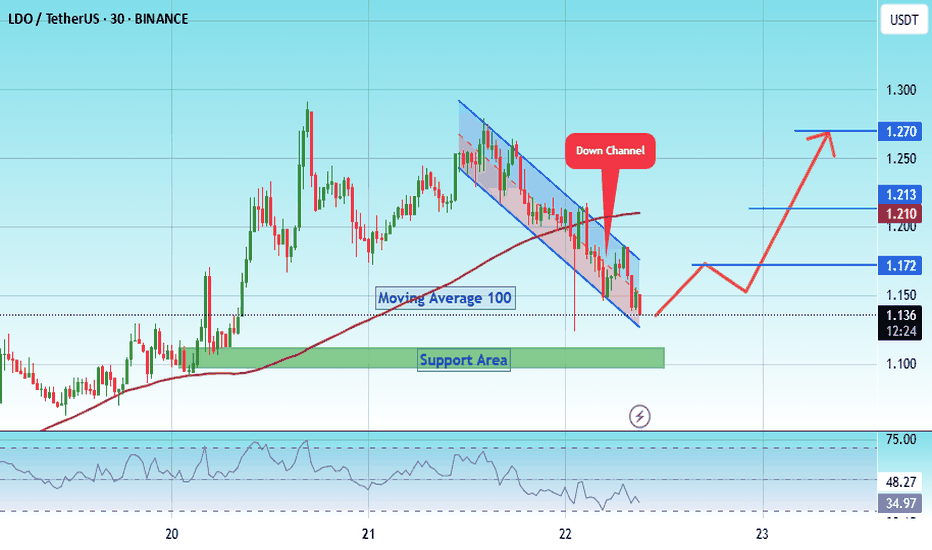

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 1.128.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.10, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.139.

First target: 1.172.

Second target: 1.210.

Third target: 1.270.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

LDO

TradeCityPro | LDO Breaks Out Amid Altseason Hype Shift👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the LDO coin for you. It’s one of the well-known DeFi projects in crypto with the highest TVL in this category, and the LDO coin ranks 82 on CoinMarketCap with a market cap of $1.08 billion.

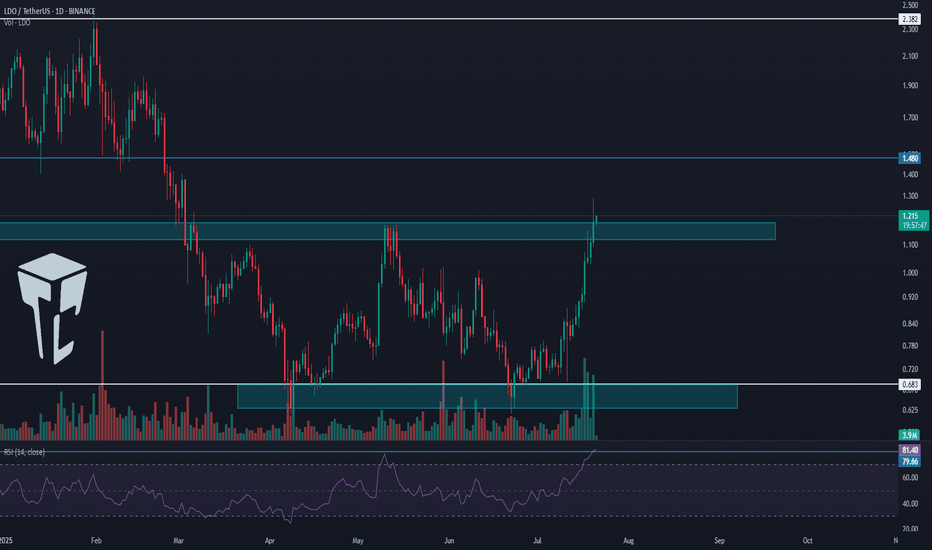

📅 Daily timeframe

On the daily timeframe, LDO has been in a range box for several months and is now starting to break out of it.

💥 After being supported at the 0.683 bottom, a large amount of buying volume entered, and a sharp bullish move occurred from this bottom to the top of the box. The RSI has also entered the Overbuy zone.

🔔 The overextended level on the RSI oscillator is 79.66, which has even been broken during this leg. Right now, I think the probability of a correction is quite high.

🔍 Yesterday's candle made a deep penetration into the top of the box, and currently, the price is sitting above the box. Since RSI is in the overextended zone, a pullback or short-term rest is likely.

🚀 However, considering the current uptrend, I believe this bullish leg might be ending, and we could see a few corrective candles. But after the correction ends, a new bullish leg might begin, pushing the price toward the resistance levels at 1.480 and 2.382.

🛒 For a long position or a spot buy, we can enter during this new bullish leg once the top breaks and a confirmation of a new wave starting is in place.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

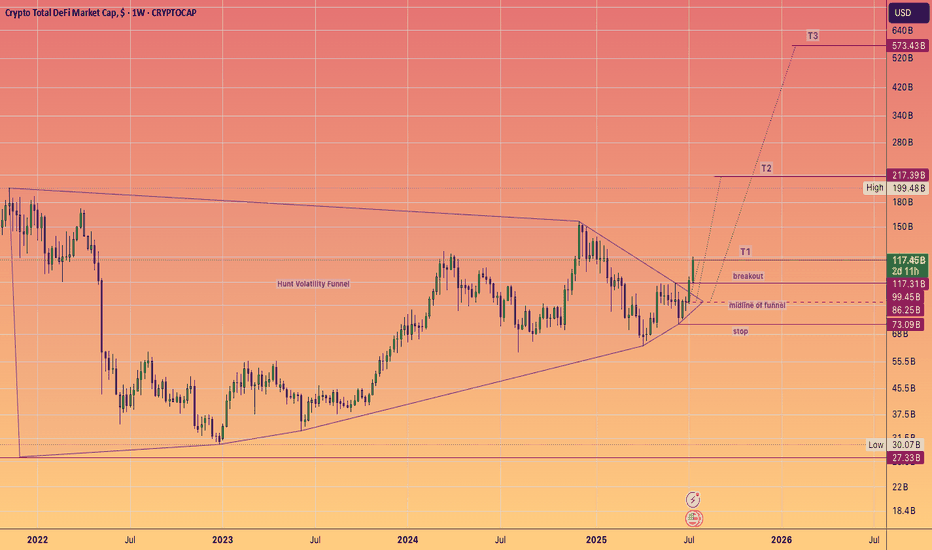

DeFi Moonshot! Moon mission to $573 Billion dollars!DEFI fuelled by Ethereum, built on proven protocols and stablecoin legislation is ready to keep cranking higher for the rest of the year. And instead of a Defi summer of emergence (2020), a multi season of adoption that takes it to half a trillion dollars, hitting these targets of a #HVF

@TheCryptoSniper

The components set to benefit are:

Uniswap #UNI ~ $12.3 Billion

Lido DAO #LDO ~ $9.1 Billion

Aave #AAVE ~ $7.5 Billion

MakerDAO #MKR ~ $4.6 Billion

GMX #GMX ~ $2.5 Billion

Curve #CRV ~ $1.9 Billion

Synthetix #SNX ~ $1.1 Billion

Pulsex #PLSX ~ $0.46 Billion

Key points:

The #TotalDefi index is currently at $117B aligning closely with the $123.6B of TVL

As we see hundreds of billions of dollars get digitized watch this index climb onwards and upwards... With $1 Trillion dollars and obvious milestone that is surely set to be met ... one day.

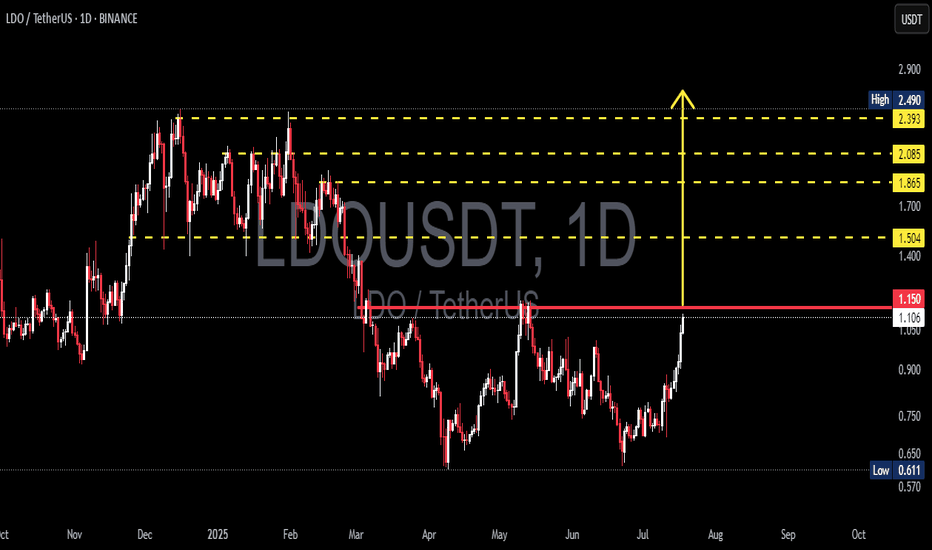

LDO/USDT Breakout Watch Ready to Fly After a Strategic Breakout?🔍 Full Technical Analysis

After months of downtrend and tight consolidation, LDO/USDT is showing clear signs of a bullish resurgence. The breakout above the key psychological resistance at $1.15 opens up a wide path toward higher resistance zones, potentially marking the beginning of a strong upward trend.

📐 Key Pattern Formed:

✅ Double Bottom Pattern

> Clearly visible from May to July 2025, with a neckline at $1.15. This is a classic bullish reversal pattern. The breakout above the neckline confirms the setup, projecting a significant upward move based on the measured height of the pattern.

✅ Horizontal Resistance Breakout

> The $1.15 level acted as a major resistance since April 2025. A clean breakout above it suggests that bulls are regaining control of the market momentum.

✅ Bullish Scenario (Primary Bias)

If the price successfully holds above the $1.15 zone and confirms it as support (successful retest), we may witness a bullish rally targeting the following levels:

🎯 Target 1: $1.504

— A minor resistance and previous consolidation area.

🎯 Target 2: $1.865

— A strong resistance level from earlier distribution zones.

🎯 Target 3: $2.085

— A technically significant level and key reaction point from past price action.

🎯 Target 4: $2.393 – $2.490

— A major supply zone and swing high from early 2025. This serves as the potential final target of the current bullish leg.

🟢 Volume increased during the breakout — a strong confirmation signal that this move is genuine, not a fakeout.

🟢 RSI likely gaining strength — though not shown on this chart, momentum indicators are likely supporting the move with a breakout from neutral levels.

❌ Bearish Scenario (If Breakout Fails)

If the price fails to hold above $1.15 and drops back below $1.05:

🔻 Potential Fakeout Risk

— A correction could send LDO back to:

Minor support at $0.90

Base support at $0.75

Major support at $0.611 (2025’s low)

📉 A breakdown below $0.611 would invalidate the bullish structure entirely, putting LDO back into a strong downtrend.

📊 Final Thoughts:

> LDO/USDT is at a critical decision point. A clean breakout from a strong medium-term structure opens the door for a significant bullish continuation. With pattern confirmation and strong volume support, this setup could mark the beginning of a mid-term uptrend.

The key lies in holding above $1.15 and watching for a healthy retest. This is a premium setup for swing traders and trend followers looking for early entries before a possible major move.

🧠 Trading Tips:

✅ Ideal Entry: On successful retest around $1.15 – $1.10

❌ Stop Loss: Below $1.00

📈 Targets: $1.50, $1.85, $2.08, and $2.49 (scaling out recommended)

#LDO #LDOUSDT #CryptoBreakout #AltcoinRally #TechnicalAnalysis #DoubleBottom #CryptoSignals #TradingViewIdeas #SwingTradeSetup #BullishPattern

#LDO PUMP TO $ 0.794 ?#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.703.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.695, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.730

First target: 0.744

Second target: 0.767

Third target: 0.794

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#LDO/USDT#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.741.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are in a trend of consolidation above the 100 moving average.

Entry price: 0.780

First target: 0.805

Second target: 0.837

Third target: 0.870

Lido DAO Awakens While Aiming At 900%+, EasyLido DAO has been sideways for three long years and is currently trading at bottom prices. The best possible ever for buyers, traders, long-term holders or simply all those looking to make good profits with Cryptocurrencies, the time is now.

Here we can see how price action matches perfectly the support zone that was tested in August-November 2024, Nov-December 2022 and June 2023. True bottom prices.

It is also easy to notice a huge increase in trading volume after mid-2024. This means that after this date LDOUSDT traders became active which tends to happen before strong market action.

Now, there has been some bearish action but also bullish, "long-term sideways consolidation," and this is coming to an end. The next move is a bullish move and signals the start of the 2025 bull market for this pair.

Some pairs are already growing while others are still moving lower. Since it will take 6-12 months for the full bull market to unravel, it is normal to see some down while others are up.

This project will be a big one. This pair will produce massive growth.

Here we have a great price and great entry timing.

I am wishing for you the best.

Thanks a lot for your continued support.

Namaste.

LDO - Next Impulse Starting Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

After breaking above the $0.8 major high, LDO has shifted from bearish to bullish from a long-term perspective. 📈

This week, it has been undergoing a correction phase within a falling channel marked in red. 🔻

For the bulls to take over and kick off the next impulsive wave toward the $1.5 mark, a breakout above the upper red trendline is needed. 🚀

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

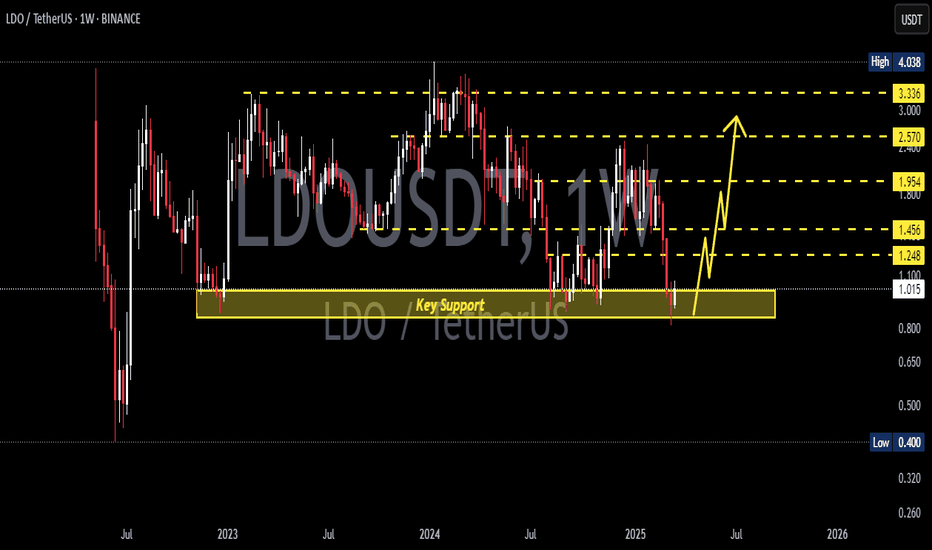

LDO Is About To ExplodeHello, Skyrexians!

Today I make an update on BINANCE:LDOUSDT which I hold on spot with average price at $0.8. First of all I will clarify how this bullish forecast can match with my yesterday's analysis about altcoins drop. Easily! There was the 2D time frame - mid term analysis. This is weekly chart. I can allow that some drop is possible for Lido Dao or other alts but global picture will be the same.

On the chart some of you will see the accumulation. In fact this is very long wave 2 ABC shaped. It's not interesting to tell about waves A and B. The only one thing is important is that now wave C in 2 is finished with the divergence between waves 3 and 5. Next wave shall be insane and reach very high, above $6.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

#LDO/USDT#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.988.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 1.008

First target: 1.022

Second target: 1.042

Third target: 1.067

TradeCityPro | LDO: Watching for Breakout in DeFi Leader’s Range👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the LDO coin — one of the well-known DeFi projects within the Ethereum ecosystem with a significantly high TVL.

✔️ This project’s token currently has a market cap of $748 million, placing it at rank 86 on CoinMarketCap.

⏳ 4-Hour Timeframe

As you can see on the 4-hour chart, after a downtrend, LDO formed a bottom around the 0.676 zone and managed to rally up to 0.868.

🔍 Currently, the price is consolidating below that resistance in a ranging box. A breakout from either direction of the box could determine the next trend.

⭐ If the box breaks upward and the 0.868 level is breached, we can consider the prior downtrend over, and the price would be forming a new bullish structure. However, there is another resistance at 0.904 right above, and there’s a possibility of rejection from that level after the 0.868 breakout.

📈 For a long position, I personally plan to enter upon the breakout of 0.868. While it’s possible that the price might reverse from 0.904, I prefer having an earlier entry and using a more accessible trigger.

🔽 On the other hand, if the box breaks to the downside, the price might revisit the 0.676 support and potentially start a new bearish leg in line with the longer-term downtrend.

📉 The first short trigger is the break of 0.818 (the lower boundary of the box), but there’s another minor support at 0.795, which may cause a bounce.

👀 I personally prefer to wait for the 0.795 level to break for a short entry, given that market momentum is currently bullish, and I prefer a more reliable trigger for shorts.

📊 Volume within this range has been decreasing, which is normal in such consolidation phases. The longer the price stays in this range, the lower the volume tends to be — and typically, a breakout will lead to a sharper move.

The RSI oscillator also has a support zone at 43.17. If this level is broken, it could signal incoming bearish momentum and increase the probability of a downside breakout.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

LDO Is The Best Asset NowHello, Skyrexians!

Some of you may be remember my article which I shared more than 1 year ago where called BINANCE:LDOUSDT the worst asset and it dumped exactly as predicted. Then made a mistake making assumption that some coins can grow while other will go down. This assumption has the very low probability to be truth, now I have the clear view that entire crypto will go up soon and LDO can be the greatest performer.

On the weekly chart we can see the huge 3 year accumulation. Current point can be the best to buy. We have bullish divergence on Awesome oscillator, green dot on Bullish/Bearish Reversal Bar Indicator . Moreover, current price action looks like a spring on Wyckoff cycle. The exact target impossible to predict, but I think it shall be above $12.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

LDO is bearish for MidTerm (2D)Before anything, pay attention to the timeframe; it’s a 2-day timeframe and requires patience.

From the point where we placed the red arrow on the chart, it seems that the bullish LDO pattern, which was a triangle, has completed. LDO has now entered a bearish pattern of the same degree as the previous bullish pattern.

LDO is expected to remain bearish in the medium term and not break above the red box marked on the chart.

The low-risk area for buy positions in spot has been identified for buyers.

The closure of a daily candle above the invalidation level will invalidate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

LDO - big lie - Many influencers have been touting this coin.

- the coin is found in the side

- the exit was down and I expect the downtrend to continue

if you like the idea, please "Like" it. This is the best "Thanks!" for the author 😊 P.S. Always do your own analysis before a trade. Put a stop loss. Fix profits in installments. Withdraw profits in fiat and please yourself and your friends.

TradeCityPro | LDO: Comprehensive Market Analysis and Prediction👋 Welcome to TradeCity Pro!

In this analysis, I want to review LDO for you. It is one of the key DeFi platforms, and its token currently holds a market cap of $945 million, ranking 72nd on CoinMarketCap.

📅 Weekly Timeframe

On the weekly timeframe, we can see a range box between the $0.957 and $3.389 levels, where the price has been fluctuating for almost two years.

🔽 If you already hold this coin, I recommend activating your stop-loss in case the $0.957 level is broken and waiting for bullish momentum to re-enter the market before buying again.

📈 If the price holds above the $0.957 support, it could rally back toward the top of the range at $3.389. The key trigger levels between the current price and the top of the box are $1.447 and $2.488.

🚀 The main buying trigger is at $3.389, as breaking this level could lead to significant capital inflows, potentially initiating a long-term bullish trend.

📅 Daily Timeframe

On the daily timeframe, a range box between $1.447 and $2.387 had formed, which was broken to the downside, leading to a bearish leg. The main support level is $0.957, and if it fails to hold, the price could enter a new bearish cycle.

🛒 For spot buying, there isn’t a clear trigger yet, so we need to wait for a new structure to form. However, if the price rallies sharply, you could consider entering on a break above $1.489.

💫 As seen on the chart, the red candle volume is significantly higher than the green candles, indicating strong seller dominance. Additionally, the RSI is near the 30 level, and if it breaks below this zone, the bearish scenario becomes more likely.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Lido DAO: Long-Term Support—Long-Term Sideways—Long-Term BullishSome charts just make technical analysis easy. The same support level that worked in late 2022 worked again in late 2024. The present correction is ending as a higher low in relation to this same long-term support, the black line on the chart.

Since the market bottom, June/July 2022, LDOUSDT has been sideways with a wide range. The last bullish breakout was really small and the present retrace is also small, the market always seeks balance, so a small breakout leads to a small retrace.

There is more.

The consolidation phase is very long, years of sideways action. The market always seeks balance. A long consolidation phase will lead to a very strong bull-market. The bull-market is now, it is happening now, starting this month —March, this year (2025) and it will extend for a long-term.

So we have long-term support, long-term sideways and a long-term bullish market.

Thanks you for reading.

Namaste.