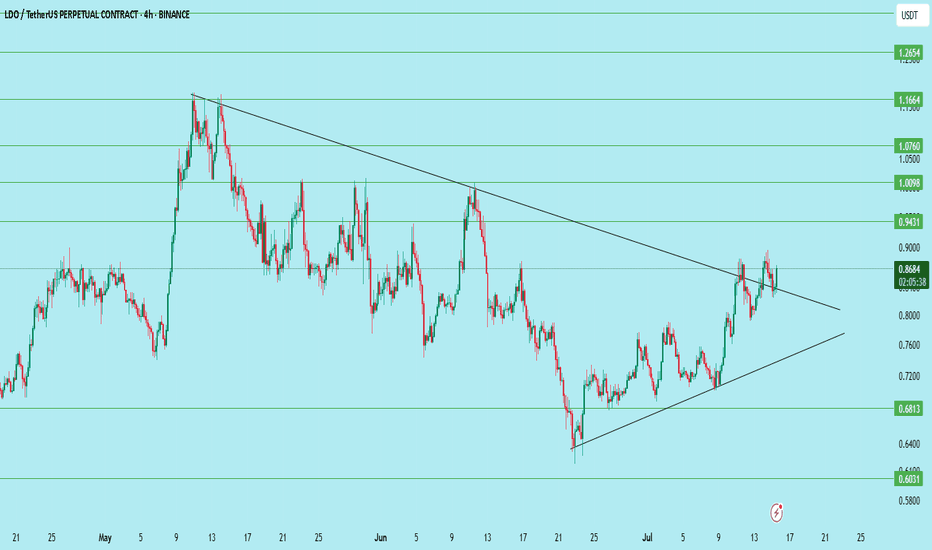

LDO/USDT – Symmetrical Triangle Breakout SetupLDO is trading just below a major downtrend line and forming higher lows, compressing into a symmetrical triangle. A breakout looks close!

Chart Insights:

Price approaching resistance around $0.87–$0.88

Strong structure of higher lows holding since June

A breakout above the trendline can trigger a strong move

Trade Setup:

Entry: On breakout above $0.88

Stoploss: Below $0.81

Targets:

T1: $0.943

T2: $1.009

T3: $1.076

T4: $1.166

T5: $1.265

Good volume confirmation will strengthen the move. Watch closely!

DYOR | Not financial advice

Ldousdsignals

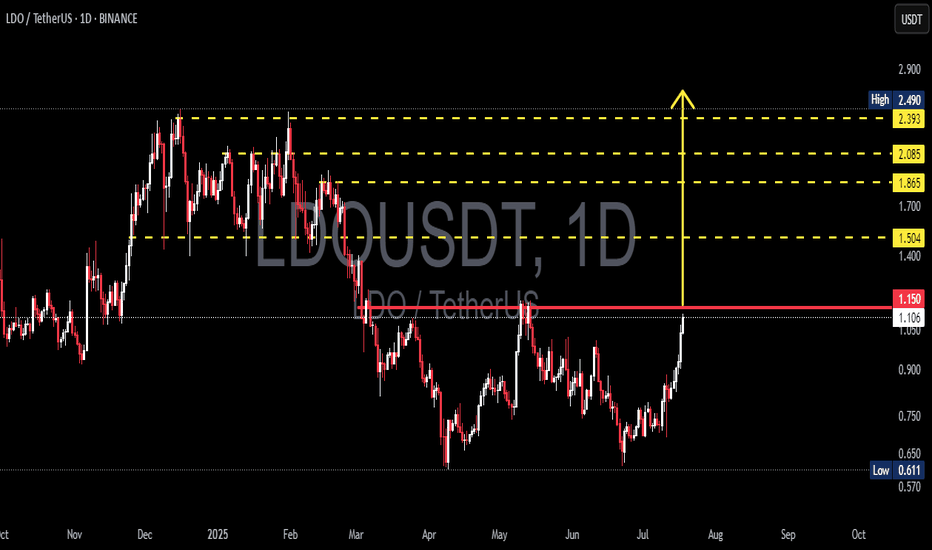

LDO/USDT Breakout Watch Ready to Fly After a Strategic Breakout?🔍 Full Technical Analysis

After months of downtrend and tight consolidation, LDO/USDT is showing clear signs of a bullish resurgence. The breakout above the key psychological resistance at $1.15 opens up a wide path toward higher resistance zones, potentially marking the beginning of a strong upward trend.

📐 Key Pattern Formed:

✅ Double Bottom Pattern

> Clearly visible from May to July 2025, with a neckline at $1.15. This is a classic bullish reversal pattern. The breakout above the neckline confirms the setup, projecting a significant upward move based on the measured height of the pattern.

✅ Horizontal Resistance Breakout

> The $1.15 level acted as a major resistance since April 2025. A clean breakout above it suggests that bulls are regaining control of the market momentum.

✅ Bullish Scenario (Primary Bias)

If the price successfully holds above the $1.15 zone and confirms it as support (successful retest), we may witness a bullish rally targeting the following levels:

🎯 Target 1: $1.504

— A minor resistance and previous consolidation area.

🎯 Target 2: $1.865

— A strong resistance level from earlier distribution zones.

🎯 Target 3: $2.085

— A technically significant level and key reaction point from past price action.

🎯 Target 4: $2.393 – $2.490

— A major supply zone and swing high from early 2025. This serves as the potential final target of the current bullish leg.

🟢 Volume increased during the breakout — a strong confirmation signal that this move is genuine, not a fakeout.

🟢 RSI likely gaining strength — though not shown on this chart, momentum indicators are likely supporting the move with a breakout from neutral levels.

❌ Bearish Scenario (If Breakout Fails)

If the price fails to hold above $1.15 and drops back below $1.05:

🔻 Potential Fakeout Risk

— A correction could send LDO back to:

Minor support at $0.90

Base support at $0.75

Major support at $0.611 (2025’s low)

📉 A breakdown below $0.611 would invalidate the bullish structure entirely, putting LDO back into a strong downtrend.

📊 Final Thoughts:

> LDO/USDT is at a critical decision point. A clean breakout from a strong medium-term structure opens the door for a significant bullish continuation. With pattern confirmation and strong volume support, this setup could mark the beginning of a mid-term uptrend.

The key lies in holding above $1.15 and watching for a healthy retest. This is a premium setup for swing traders and trend followers looking for early entries before a possible major move.

🧠 Trading Tips:

✅ Ideal Entry: On successful retest around $1.15 – $1.10

❌ Stop Loss: Below $1.00

📈 Targets: $1.50, $1.85, $2.08, and $2.49 (scaling out recommended)

#LDO #LDOUSDT #CryptoBreakout #AltcoinRally #TechnicalAnalysis #DoubleBottom #CryptoSignals #TradingViewIdeas #SwingTradeSetup #BullishPattern

#LDO PUMP TO $ 0.794 ?#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.703.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.695, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.730

First target: 0.744

Second target: 0.767

Third target: 0.794

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#LDO/USDT#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.741.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are in a trend of consolidation above the 100 moving average.

Entry price: 0.780

First target: 0.805

Second target: 0.837

Third target: 0.870

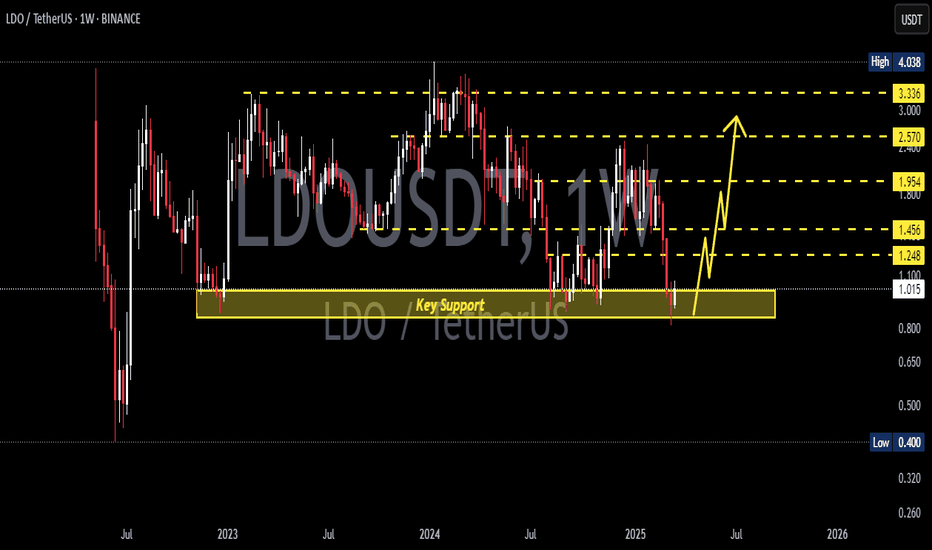

LDO Weekly AnalysisLDO Weekly Analysis

LDO is showing a positive divergence on the weekly timeframe, indicating a potential upward move toward the 2.590 resistance level. However, for a more confident entry, the price needs to break above the $1 resistance with strength on the weekly chart.

Even in a pessimistic scenario, where the price drops by 26% to its support level, the risk-to-reward ratio remains attractive.

Follow us for more quality and insightful updates!

LDO Is The Best Asset NowHello, Skyrexians!

Some of you may be remember my article which I shared more than 1 year ago where called BINANCE:LDOUSDT the worst asset and it dumped exactly as predicted. Then made a mistake making assumption that some coins can grow while other will go down. This assumption has the very low probability to be truth, now I have the clear view that entire crypto will go up soon and LDO can be the greatest performer.

On the weekly chart we can see the huge 3 year accumulation. Current point can be the best to buy. We have bullish divergence on Awesome oscillator, green dot on Bullish/Bearish Reversal Bar Indicator . Moreover, current price action looks like a spring on Wyckoff cycle. The exact target impossible to predict, but I think it shall be above $12.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

LDO - big lie - Many influencers have been touting this coin.

- the coin is found in the side

- the exit was down and I expect the downtrend to continue

if you like the idea, please "Like" it. This is the best "Thanks!" for the author 😊 P.S. Always do your own analysis before a trade. Put a stop loss. Fix profits in installments. Withdraw profits in fiat and please yourself and your friends.

Is This the Final Drop Before a Major Reversal? Read This NOW! Yello, Paradisers! Are we about to witness the final leg of this move, or is one last shakeout coming before a massive reversal? Let’s break it all down using Elliott Wave principles.

💎Wave 1 initiated the downtrend, marking a strong sell-off from higher price levels. Volume surged during this phase, signaling institutional selling and overall market panic. This aggressive downward move set the foundation for the corrective Wave 2.

💎Wave 2 began as the price rebounded after hitting the local low at $1.406. This move aligns with a typical Elliott Wave correction, often retracing 50%–61.8% of Wave 1. The recovery phase pushed the price back up, potentially reaching as high as $1.964 before the next major move.

💎Wave 3, the strongest and longest in the sequence, started once the price failed to sustain above $1.964. This move could extend all the way down to $0.809, a critical level where selling pressure is expected to peak. Historically, volume is highest during Wave 3, indicating aggressive selling and potential accumulation zones forming.

💎Wave 4 might be unfolding right now, forming a short-term recovery. If the price retraces toward $1.392 but fails to break above it, the bearish wave count remains intact. It’s crucial to note that Wave 4 must NOT enter the price range of Wave 2—if it does, the entire Elliott Wave structure is invalidated, suggesting an alternative pattern like an ending diagonal or a larger correction.

💎Wave 5 is the final impulse wave. If Wave 4 faces rejection below $1.392 and consolidates, the market could see the beginning of Wave 5, pushing price toward the $0.746 support zone. This phase typically marks the last exhaustion move before a potential market reversal or a shift in structure.

Patience and strategy win the game, Paradisers! The market is designed to shake out weak hands before the real move happens.

MyCryptoParadise

iFeel the success🌴

#LDO/USDT#LDO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.64

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.71

First target 1.80

Second target 1.87

Third target 1.95

Breaking: $LDO Surges 18% Amid Whale ActivityLido DAO ( MIL:LDO ) has captured the crypto market's attention with an impressive 18% price surge, fueled by strategic whale activity and increasing adoption of its liquid staking solutions. The recent developments underline Lido DAO's potential to remain a key player in the decentralized finance (DeFi) ecosystem. Let’s delve into the technical and fundamental aspects driving this rally.

Whale Activity Boosts Confidence in MIL:LDO

A prominent Pepe Coin whale, known as “0x373,” made headlines after purchasing 1.167 million MIL:LDO tokens for approximately $2.38 million. This significant buy-in, at an average price of $2.036 per token, reflects growing confidence in Lido DAO’s long-term prospects.

Additionally, another whale, “0x655,” acquired 2.72 million MIL:LDO tokens earlier this week, bringing their total holdings to 5.765 million tokens. Such substantial accumulation highlights broader market sentiment favoring Lido DAO as a reliable staking solution. These calculated investments have acted as a catalyst, attracting more investors and amplifying bullish momentum.

Lido DAO’s Fundamental Strengths

1. Market Leadership in Liquid Staking:

Lido DAO is a leading provider of liquid staking solutions, particularly for Ethereum. Its innovative approach allows users to stake their ETH while retaining liquidity through stETH tokens, a feature that has garnered significant adoption within the DeFi community.

2. Explosive TVL Growth:

According to DeFiLlama, Lido DAO’s total value locked (TVL) stands at $32.334 billion, reinforcing its position as a dominant force in the DeFi space. This robust TVL growth demonstrates the platform’s ability to attract and retain capital.

3. Strategic Integrations:

Lido DAO’s seamless integration with various DeFi protocols has further solidified its market position. The platform’s compatibility with Ethereum and other blockchain networks makes it an attractive option for users seeking efficient staking solutions.

4. Increased Whale Activity:

Whale accumulation trends, including recent high-profile purchases, signal heightened confidence in Lido DAO’s potential. This has contributed to a surge in trading volume, which jumped 32% to $292 million.

Technical Analysis

As of writing, MIL:LDO is trading at $2.05, marking a 13% gain in the last 24 hours. The asset recently broke out of a falling wedge pattern, a bullish technical indicator, and has surged 23% since the breakout. The RSI currently hovers near 56, indicating further room for upward momentum before reaching overbought territory. This suggests that the rally could sustain in the near term.

Support and Resistance Levels:

Immediate support lies near $1.90, while resistance at $2.33 could be the next key level to watch. A breakout above $2.33 could pave the way for a move towards $2.50 and beyond.

MIL:LDO is trading above all key moving averages, reinforcing the bullish outlook. The sustained uptrend aligns with increased whale activity and broader market recovery.

Outlook and Potential Risks

Lido DAO’s recent price surge and whale accumulation underscore its growing prominence in the DeFi space. However, market volatility remains a critical factor to consider. Future price action will depend on:

1. Broader crypto market trends.

2. Network developments and staking demand.

3. Sustained whale activity and accumulation trends.

While the fundamentals and technical indicators suggest a bullish trajectory, investors should remain cautious and monitor key support levels to manage potential risks.

Conclusion

Lido DAO’s combination of strong fundamentals and bullish technical indicators positions it as a promising asset in the crypto market. The recent whale activity and rising adoption of its liquid staking solutions reflect growing confidence in its ecosystem. With MIL:LDO trading in a bullish terrain and its TVL continuing to climb, the asset is poised for further growth in the DeFi landscape.

LDO/USDT Consolidates: Ready for a Breakout After 917 Days?$LDO/USDT is currently trading within a wide sideways range for the past 917 days, consolidating between the key demand/support zone and the key supply/resistance zone.

A potential bullish breakout could occur if the price breaks and sustains above the upper marked resistance zone.

This breakout may lead to a significant upward move, making it a critical level to watch.

DYOR, NFA

#LDO/USDT Ready to go up#LDO

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.14

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.17

First target 1.20

Second target 1.25

Third target 1.29

#LDO Analysis – Ready to FlyLDO is breaking through its dynamic resistance and the main pivot zone around $1.35–$1.50. If it holds above this level, the path toward the next resistance at $2.00 is clear, and we could see a strong rally.

This breakout signals strength, but keep an eye on volume for confirmation. LDO has the potential to fly if it maintains above the pivot zone! 🚀

Note: This is not financial advice; always trade responsibly.

Lido DAO Faces Legal and Market Turmoil: In a landmark ruling, a California court has classified Lido DAO, the decentralized organization behind the popular liquid staking protocol, as a general partnership, raising significant concerns for DAO governance structures and their participants. This decision reverberates through both the legal and crypto landscapes, highlighting vulnerabilities in decentralized governance.

Legal Developments Shake Lido DAO

The U.S. Northern District Court of California rejected Lido DAO’s claim of not being a legal entity. Instead, the court deemed it a general partnership, making identifiable participants liable for the DAO’s actions. Judge Vince Chhabria, in his ruling, emphasized the precedent-setting nature of this case:

> “ presents several new and important questions about the ability of people in the crypto world to inoculate themselves from liability by creating novel legal arrangements to profit from exotic financial instruments.”

Prominent Lido governance participants, including Paradigm Operations, Andreessen Horowitz (a16z), and Dragonfly Digital Management, were implicated as general partners. Notably, Robot Ventures was dismissed from the case due to insufficient evidence of active involvement.

Miles Jennings, General Counsel at a16z crypto, described the ruling as a severe blow to decentralized governance:

> "Under the ruling, any DAO participation (even posting in a forum) could be sufficient to hold DAO members liable for the actions of other members under general partnership laws."

This development raises pressing questions about the future of decentralized finance (DeFi) and the legal safety of participating in DAOs.

Technical Outlook for MIL:LDO

Amid the legal turmoil, Lido’s native token, MIL:LDO , has seen volatile price movements. As of writing, MIL:LDO is down 4%, trading within a falling trend channel. Here's what the technical indicators suggest:

1. Support and Resistance Levels: Current support lies near $1.133, aligning with the confluence of moving averages, indicating strong defensive support at this level. On the upside, MIL:LDO could rebound to the $2 resistance level, representing a critical juncture for a potential breakout.

2. Chart Patterns: The daily price chart reveals an enclosed rectangle pattern*, showcasing periodic up-and-down movements. A breakout from this pattern, especially in the bullish direction, could significantly impact the token's trajectory.

3. Market Sentiment and TVL: The general crypto market remains bullish, which could provide tailwinds for $LDO. Data from DeFiLlama indicates that Lido remains one of the largest players in the liquid staking space, with a promising Total Value Locked (TVL) figure that reinforces its dominance in DeFi.

What’s Next for MIL:LDO ?

This ruling sets a precedent that could deter active participation in DAOs, especially among institutional investors. However, it also serves as a wake-up call for DAOs to reassess their governance structures and liability frameworks.

Market Implications:

Despite the legal challenges, Lido’s fundamental metrics remain robust. The protocol continues to be a leader in liquid staking, holding a substantial share of the market. If MIL:LDO consolidates around the $1.133 support level and leverages the bullish sentiment in the broader crypto market, a rally to $2 or beyond is possible in the near term.

Conclusion

In conclusion, Lido DAO finds itself at a crossroads where regulatory challenges meet market potential. The coming weeks will likely determine whether the protocol can overcome legal hurdles and maintain its position as a DeFi heavyweight.

#LDO/USDT#LDO

The price is moving in a descending channel on the 4-hour frame

And it is sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 1.00

We have an upward trend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.07

First target 01.16

Second target 1.27

Third target 1.35

LDO target $1.984h time frame

-

Entry: $1.24

TP: $1.9875

SL: $1.0575

RR: 4.1

-

(1) Symmetrical structure is creating, high possibility to reach previous high

(2) Strong pump recently that bring LDO from $0.87 to $1.45 in two days

(3) Getting support at fib 0.618, which is $1.24

(4) $2.5 will be easy to hit if momentum is enough based on the flipped structure

(5) Stop loss once going below $1.0575