LE1!6.8.23 There is a reason why I suddenly picked cattle as a market that we could trade. It's a market that has tremendous profit potential and it was about to make new highs... and yet there will be tons of dead bodies.... the bodies of traders who tried to short the market.... and other bodies of Traders who went long in the market.... and they both lose money. If you do this a couple times and get burned... you will teach yourself that this Market is too risky...and too dangerous to trade. At least that was something I would have done years ago. Intuitively it makes sense because the price action is so obvious, and reversals can be so significant.... you can make significant money or lose significant money and so you think of the market is risky because you're having a hard time finding the proper trade. Markets like this offer you much more reward then Markets that are contracted and have no range. It's easy to draw the conclusion that volatile markets are too risky and contracted markets are safe and therefore less risky... which is not correct. It's time to start looking for trades in the cattle market.

LE1!

LE1! Futures ( LE11 ), H4 Potential for Bullish ContinuationTitle: Live Cattle Futures ( LE11 ), H4 Potential for Bullish Continuation

Type: Bullish Rise

Resistance: 159.175

Pivot: 157.875

Support: 155.375

Preferred case: Looking at the H4 chart, my overall bias for LE1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. Expecting price to continue heading towards the resistance at 159.175, where the previous swing high is.

Alternative scenario: Price could head back down to retest the pivot at 157.875, where the 38.2% Fibonacci line is.

Fundamentals: There are no major news.

CattleCattle – Weekly Continuous: The gray vertical bars represent the expiration month of labeled contract and have prices of each contract as of today labeled. The 2019 low has provided a pivot for a parallel uptrend line (highlighted in yellow) that has acted as a strong magnet since moving up off the covid crash low. Any of the lines could act as Support or Resistance. Further support marked in gray, risk area marked in red, and opportunity area marked in green. Deferred contracts can use the uptrend/downtrend lines or highlighted areas as well…

April Cattle approaching Resistance/opportunity area, Risk is 128 – 132

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseType : Bullish rise

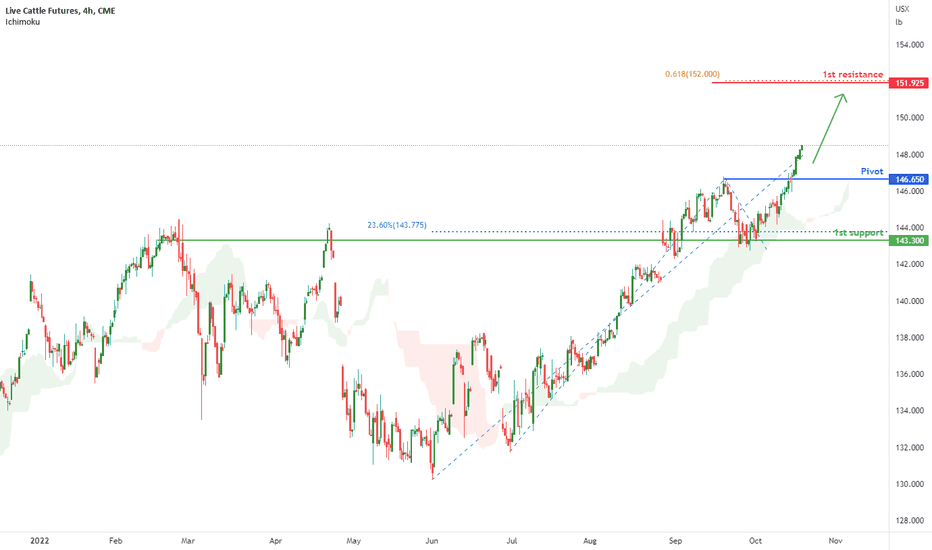

Resistance : 151.925

Pivot: 146.650

Support : 143.300

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 146.650 where the previous swing high sits to the 1st resistance at 151.925 where the 161.8% projection sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 143.300 where the swing low, overlap support and 38.2% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseType : Bullish rise

Resistance : 151.925

Pivot: 146.650

Support : 143.300

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 146.650 where the previous swing high sits to the 1st resistance at 151.925 where the 161.8% projection sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 143.300 where the swing low, overlap support and 23.6% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseType : Bullish rise

Resistance : 151.925

Pivot: 146.650

Support : 143.300

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 146.650 where the previous swing high sits to the 1st resistance at 151.925 where the 161.8% projection sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 143.300 where the swing low, overlap support and 23.6% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseType : Bullish rise

Resistance : 151.925

Pivot: 146.650

Support : 143.300

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 146.650 where the previous swing high sits to the 1st resistance at 151.925 where the 161.8% projection sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 143.300 where the swing low, overlap support and 23.6% retracement sits

Fundamentals: No Major News

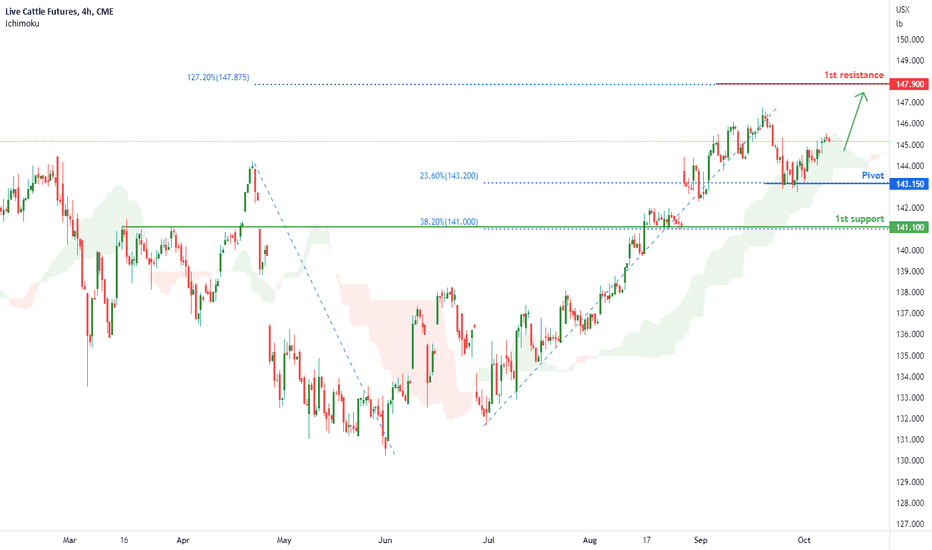

Live Cattle Futures ( LE1! ), H4 Potential for Bullish TrendType : Bullish rise

Resistance : 147.900

Pivot: 143.150

Support : 141.100

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 143.150 where the previous swing low and 23.6% retracement sits to the 1st resistance at 147.900 where the 127.2% extension sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.100 where the swing low and 38.2% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish TrendType : Bullish rise

Resistance : 147.900

Pivot: 143.150

Support : 141.100

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 143.150 where the previous swing low and 23.6% retracement sits to the 1st resistance at 147.900 where the 127.2% extension sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.100 where the swing low and 38.2% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bearish TrendTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bearish Trend

Type : Bullish rise

Resistance : 147.900

Pivot: 144.275

Support : 141.100

Preferred Case: On the H4, with price moving in the descending trend and breaking the ichimoku indicator, we have a bearish bias that price may drop from the pivot at 144.275 where the previous swing high sits to the 1st support at 141.100 where the 38.2% retracement sits

Alternative scenario: Alternatively, price could break pivot structure and rise to the 1st resistance at 147.900 where the swing high and 127.2% extension sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bullish Rise

Type : Bullish rise

Resistance : 146.750

Pivot: 142.650

Support : 139.175

Preferred Case: On the H4, with price moving along the ascending trendline and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 142.650 where the 23.6% retracement sits to the 1st resistance at 146.750 where the previous swing high sits.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 139.175 where the overlap support is.

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bullish Rise

Type : Bullish rise

Resistance : 147.900

Pivot: 144.275

Support : 141.100

Preferred Case: On the H4, with price moving along the ascending trendline and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 144.275 to the 1st resistance at 147.900 where the 127.2% fibonacci extension is.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.100 where the overlap support is.

Fundamentals: No Major News

Live Cattle Futures (LE1!), H4 Potential for Bullish RiseTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bullish Rise

Type : Bullish rise

Resistance : 147.900

Pivot: 144.275

Support : 141.100

Preferred Case: On the H4, with price moving along the ascending trendline and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 144.275 to the 1st resistance at 147.900 where the 127.2% fibonacci extension is.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.100 where the overlap support is.

Fundamentals: No Major News

Live Cattle Futures (LE1!), H4 Potential for Bullish RiseTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bullish Rise

Type : Bullish rise

Resistance : 147.900

Pivot: 144.275

Support : 141.100

Preferred Case: On the H4, with price moving along the ascending trendline and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 144.275 to the 1st resistance at 147.900 where the 127.2% fibonacci extension is.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.100 where the overlap support is.

Fundamentals: No Major News

Live Cattle Futures (LE1!), H4 Potential for Bullish RiseTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bullish Rise

Type : Bullish rise

Resistance : 148.125

Pivot: 144.475

Support : 141.150

Preferred Case: On the H4, with price moving along the ascending trendline and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 144.475 to the 1st resistance at 148.125 where the 127.2% fibonacci extension is.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.150 where the overlap support is.

Fundamentals: No Major News

Live Cattle Futures (LE1!), H4 Potential for Bullish RiseTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bullish Rise

Type : Bullish rise

Resistance : 148.125

Pivot: 144.475

Support : 141.150

Preferred Case: On the H4, with price moving along the ascending trendline and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 144.475 to the 1st resistance at 148.125 where the 127.2% fibonacci extension is.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.150 where the overlap support is.

Fundamentals: No Major News

Live Cattle Futures (LE1!), H4 Potential for Bullish RiseTitle: Live Cattle Futures (LE1!), H4 Potential for Bullish Rise

Type : Bullish rise

Resistance : 148.125

Pivot: 144.475

Support : 141.150

Preferred Case: On the H4, with price moving along the ascending trendline and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 144.475 to the 1st resistance at 148.125 where the 127.2% fibonacci extension is.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.150 where the overlap support is.

Fundamentals: No Major News

Cattle Continuous Cattle: The gray vertical bars represent the expiration month of labeled contract and have prices of each contract as of today labeled. The 2019 low has provided a pivot for a parallel uptrend line (highlighted in yellow) that has acted as a strong magnet since moving up off the covid crash low. Any of the lines could act as support/resistance. Support area marked in gray, risk area marked in red, and opportunity area marked in green. Deferred contracts can use the uptrend/downtrend lines or highlighted areas as well…

**Could use the shaded areas for 3 way option spreads on deferred contracts**.

Cattle, Corn, S&P500Cattle, Corn, and S&P 500: The fundamentals may be different now compared to in 2008, but I think these 3 markets are well intertwined. The effect of a major drawdown in the equities could impact all markets for a time. It sure seems that Cattle have some strong fundamentals to make a run up as it did from 2010 to 2014, but the timing of when that potential run higher begins is a million-dollar question. If the equity markets find support, beef should be in the race to higher levels with energies and other commodities…. If equities crash further, be careful

Live Cattle is bullLive cattle is bull.

Early May it jumped from 87 to 94, and next day hitting 98.

This breakout caused in the days to follow some oscillating within the 92-100 band, forming a clear up channel.

Market hit 100 yesterday, found support on the mid channel level and closed just below 100. I’m pretty sure we will test it again today.

My believe is this breakout, plus the upward channel, will result in new local high’s.

We have clearly broken out of the downward trend of the last months.

Once we break the 100 level, others will step in and this could lead to a decent bull trend.

Live Cattle (LE1) ShortSo, my last analysis on live cattle was April 28th 2019 where i talked about the possibility of live cattle breaking support and going further down and it went much further than i thought. In my opinion, with the increasing "news" of coronavirus, I believe live cattle will continue on its trend downwards and will find support at the next support level/s identified on the chart. Enter and exit at your own risk.

DISCLAIMER

Please note that this chart is an opinion based chart only. Please trade at your own risk

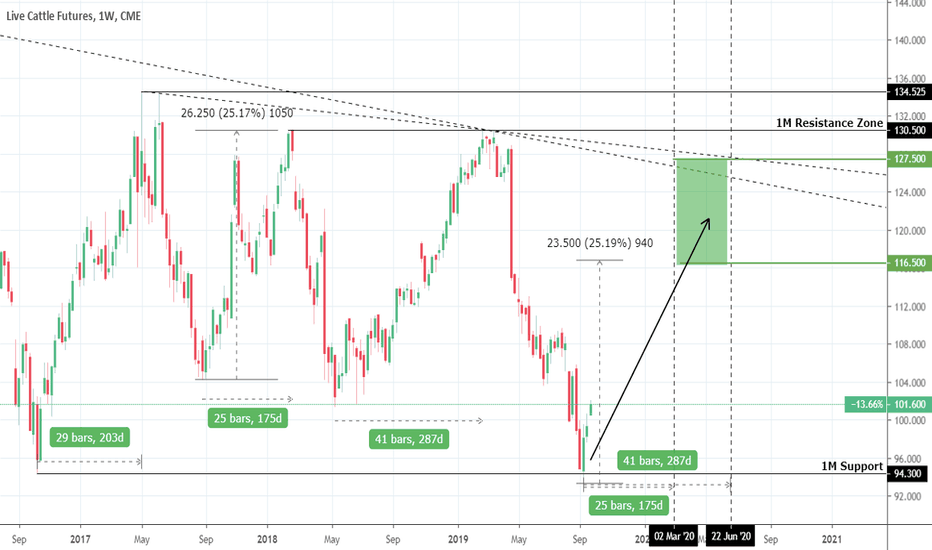

Live Cattle: Strong long term Buy Opportunity.Live Cattle has hit this month the 94.300 1M Support, with the last time we saw these levels being in October 2016. The price appears to be trading within a long term Rectangle within 94.300 and the 130.500 - 134.525 Resistance Zone. The current 3 week rebound on the 1M Support makes LE an automatic long term buy opportunity. We are therefore long at the moment and having calculated all possible scenarios within this Rectangle, we concluded that profit should be taken within 116.500 - 127.500. Take advantage of this opportunity based on your won risk tolerance levels.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Live Cattle (LE) ShortSo, my last analysis on live cattle was April 25th where i talked about the possibility of live cattle breaking support and going further down and it went much further than i thought. In my opinion, I believe live cattle will continue on its trend downwards and will find support at the next support level identified on the chart. Enter and exit at your own risk.

DISCLAIMER

Please note that this chart is an opinion based chart only. Please trade at your own risk