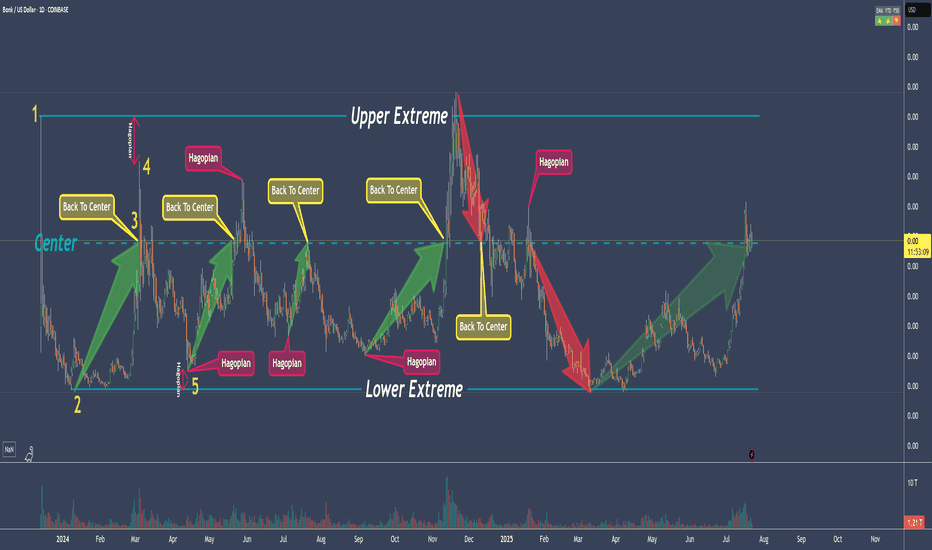

80% Of Time - A Trading Edge You Don't Want To MissDo you want to know why trading with median lines, also known as pitchforks, can be so successful? It’s simple:

Prices swing from one extreme back to the middle.

From the middle, they often swing to the other extreme.

What do we see on the chart?

- The upper extreme

- The center

- The lower extreme

So far, so good.

Now let’s follow the price and learn a few important rules that belong to the rulebook of median lines/pitchforks, and with which you can make great trades.

Point 1

The price starts and is sold off down to…

Point 2

...and from there starts to rise again, up to…

Point 3

...which is the center. And here we have a rule that is very important and one that you need to be aware of in trading to be successful:

THE PRICE RETURNS TO THE CENTER IN ABOUT 80% OF ALL CASES

If we know this, then we can stay in a trade with confidence.

Point 4

The price climbed even higher but missed the upper extreme.

This is the “Hagopian Rule” (named after the man who discovered it).

And the rule goes: If the price does not reach the next line (upper extreme, lower extreme, or center), then the price will continue moving in the opposite direction from where it originally came.

Phew...that’s a mouthful ;-)

But yes, we actually see that the price does exactly this.

From point 4, where the price missed the upper extreme, the price not only goes back to the center but continues and almost reaches the lower extreme!

Now if that isn’t cool, I don’t know what is!

And what do we have at point 5?

A "HAGOPIAN"!

What did we just learn?

The price should go higher than the center line.

Does it do that?

Oh yes!

But wait!

Not only does the Hagopian Rule apply. Remember?

"The price returns to the center line in about 80% of the cases."

HA!

Interesting or interesting?

So, that’s it.

That’s enough for now.

Now follow the price yourself and always consider which rule applies and whether it’s being followed.

How exactly do you trade all this, and what are the setups?

...one step at a time.

Don’t miss the next lesson and follow me here on TradingView.

Wishing you lots of success and fun!

Learn

EURCHF LONG LIVE TRADE AND EDUCATIONAL BREAK DOWN LONGCentral Bank Policies:

The Swiss National Bank (SNB) policy decisions significantly impact the CHF. Recent SNB rate cuts are a key factor influencing the EUR/CHF pair.

Conversely, the European Central Bank (ECB) policies regarding the Eurozone also have a large impact on the EUR side of the pairing.

The Hardest Part About Trading Isn't The Charts-Its Your MindWhen I first started trading, I thought the key to success was all about the strategy. If I could just figure out the right indicators or master technical analysis, I’d be unstoppable.

But the truth hit me hard. I wasn’t losing because I didn’t understand the charts—I was losing because I didn’t understand myself.

Here’s how I learned that the biggest battle in trading isn’t with the market—it’s with your own mind.

Lesson 1: Stop Obsessing Over Results

I used to get way too caught up in the outcome of every single trade. A win would make me feel on top of the world, but a loss? That would send me into a spiral. I’d overanalyze, doubt myself, and sometimes even swear I was done trading altogether.

One day, I realized I was focusing on the wrong thing. Instead of asking, “Did I win or lose?” I started asking, “Did I follow my plan?”

That simple shift changed everything for me. I started measuring success by how consistent I was, not by whether every trade was a winner. The funny thing? Once I started doing that, the wins came more naturally.

Lesson 2: Losses Aren’t Failures

I’ll never forget the trade that wiped out 30% of my account. It was gut-wrenching. I felt like I’d failed—not just as a trader, but as a person.

It took me a long time to understand that losses are part of trading. Even the best traders take hits. What separates the pros from the rest is how they handle those losses.

Now, instead of beating myself up, I treat losses as a chance to learn. Did I miss something in my analysis? Did I break my rules? Sometimes, the market just didn’t cooperate, and that’s okay.

Lesson 3: Don’t Let Emotions Run the Show

I can’t tell you how many times I’ve let emotions wreck me. Chasing losses, revenge trading, doubling down on bad positions—I’ve done it all. And every single time, it made things worse.

The biggest game-changer for me was journaling my trades. Not just the technical stuff, but how I felt during the trade.

-Was I calm or anxious?

-Was I trading because it was a good setup or because I felt like I had to?

It was eye-opening to see how much my emotions were driving my decisions. Now, if I feel frustrated or off, I don’t even touch the charts. I’d rather miss a trade than make a bad one.

My Biggest Takeaway I Learned

Trading isn’t just about the market—it’s about you. The strategies, the charts, the setups—they’re important, but they’re not enough. You need to master your mind if you want to master the market.

I’m not perfect, and I still have tough days. But every step I’ve taken to manage my emotions, stay consistent, and focus on the process has brought me closer to where I want to be.

If you’re struggling with the mental side of trading, I get it. I’ve been there. Send me a DM or check my profile—I’m happy to share what worked for me and help however I can. You don’t have to do this alone.

Kris/Mindbloome Trading

Trade What You See

Mindfulness: The Zen Path to Trading MasteryMindfulness is a practice that involves being fully present and engaged in the moment, aware of your thoughts and feelings without judgment. It originates from ancient Buddhist meditation practices but has been widely adopted across the world for its mental health benefits. In this post, we'll explore what mindfulness is, its origins, and how it can benefit traders. Plus, we'll share practical tips to help you get started, so keep reading till the end.

❓ What is mindfulness?Mindfulness is like a special tool that helps you focus on the present moment without wishing things were different. It’s about noticing the little things—how your breath feels as it moves in and out, the way your body feels as you sit or stand, or even the sounds around you. Practicing mindfulness is like watching a movie, noticing every detail without being distracted by thoughts about what’s next.

When you practice mindfulness, you train your brain to focus on the present. It’s similar to using a magnifying glass: you see details you might otherwise miss. Mindfulness works internally, helping you observe your thoughts, feelings, and sensations with clarity. This practice allows you to respond to situations with calmness rather than reacting impulsively. It’s like pressing a “pause” button, giving you time to choose your response.

In simple terms, mindfulness helps you live in the “now,” handle emotions more effectively, and be kinder to yourself. It’s like having a secret garden in your mind where you can retreat to find peace, no matter what’s happening around you.

❓ Where does it come from?Mindfulness originated over 2,500 years ago within Buddhist meditation practices and addresses a universal human need: the desire to be fully present and aware in life. First cultivated in the serene landscapes of ancient India, mindfulness has evolved beyond its religious roots, finding expression in various Eastern traditions like Taoism and Zen Buddhism. These cultures emphasized awareness, intention, and compassion, highlighting mindfulness's universal appeal.

In the late 20th century, mindfulness crossed into the Western world, thanks to pioneers like Jon Kabat-Zinn. His Mindfulness-Based Stress Reduction (MBSR) program at the University of Massachusetts Medical School demonstrated how mindfulness improves psychological well-being, reduces stress, and enhances quality of life—all without its spiritual trappings. Today, mindfulness is embraced in diverse fields for its profound benefits, proving to be a timeless practice that deepens our connection to the present moment.

❓ Why mindfulness for trading?Why is mindfulness important for trading? Think of trading as a room filled with buttons, each evoking different emotions—joy when you win, fear or frustration when you lose. Mindfulness acts as a guide in this room, helping you notice the buttons (your emotions) without pressing them all. It allows you to experience the highs and lows without becoming overwhelmed, keeping your mind steady regardless of market fluctuations.

Mindfulness helps traders stay calm and clear-headed. The trading world is full of excitement and anxiety, but mindfulness serves as a pair of glasses, bringing clarity to the chaos. It anchors you in the present, preventing you from getting lost in worries about the future or regrets about the past. This clarity helps you make better decisions, free from emotional bias. In essence, mindfulness becomes a secret weapon that keeps you focused and composed amid market turbulence.

❓ How does it help in trading?

Emotional Regulation: Trading is an emotionally charged activity, with stress, anxiety, and reactions to wins and losses. Mindfulness helps traders recognize their emotions without becoming overwhelmed, promoting a balanced approach to decision-making.

Improved Focus and Concentration: Mindfulness enhances your ability to concentrate. For traders, this means staying focused on market analysis, monitoring trades, and making decisions without distractions.

Reducing Impulsive Behavior: By increasing awareness of your thoughts and feelings, mindfulness helps you avoid impulsive decisions driven by emotions like fear, greed, or frustration, leading to more disciplined strategies.

Stress Management: Trading can be high-stress, especially in volatile markets. Mindfulness reduces stress levels, helping traders maintain clarity and avoid burnout.

Enhanced Decision-Making: Mindfulness fosters calm and clarity, allowing for objective evaluation. This reduces the likelihood of emotion-driven or biased decisions.

Learning from Mistakes: Mindfulness promotes a non-judgmental perspective, encouraging traders to view mistakes as learning opportunities rather than failures. This growth mindset is crucial for long-term success.

Incorporating Mindfulness into Your Trading RoutineHere’s how to integrate mindfulness into your daily trading routine:

💖 Daily Meditation: Start with just 5 minutes a day. Apps like Headspace or Calm can guide you.

😱 Setting Intentions: Each morning, remind yourself of your trading goals and commit to approaching the day mindfully.

😒 Mindful Breathing: Feeling overwhelmed? Pause and take ten deep breaths to reset your mental state.

🚶♂️ Mindful Pauses: Before placing a trade, take a moment to reflect and ensure the decision feels right.

📝 Reflective Journaling: At the end of the day, write about your emotional journey alongside your trades. You’ll discover patterns that can guide future decisions.

✅ TakeawayWho knew that the path to trading success could involve a bit of Zen? By embracing mindfulness, you’re not just becoming a better trader; you’re investing in your overall well-being. Here’s to trading mindfully and finding inner peace amidst the market’s chaos. Remember, in the trading world, the best investment is in yourself.

🗎 Join the Conversation!Now it’s your turn! Have you tried integrating mindfulness into your trading routine? Have you noticed any changes in your decision-making or emotional resilience? Perhaps you have mindfulness tips of your own to share. Drop your stories, insights, or even skepticism in the comments below. Let’s build a community of mindful traders, learning and growing together. We can’t wait to hear about your experiences!

Master the Market: Top Secrets to Prevent Losses in Any Trend!

Common Reasons Why Traders Lose Money Even in an Uptrend

Not Setting Stop-Loss:

Not Conducting Technical Analysis:

Going Against the Trends:

Following the Herd:

Being Impatient:

Not Doing Homework or Research:

Averaging on Losing Position:

'Buy low, sell high' is the motto. As simple as it sounds, why do most people lose money trading or investing?

There are four major mistakes that most beginners make:

Excessive Confidence

This stems from the belief that individuals are uniquely gifted. They think they can 'crack the code' in the stock market that 99.9% of people fail to, with the goal of making a living from trading and investing. However, given that more people lose money in the market, this wishful thinking is akin to walking into a casino feeling lucky. You might get lucky and win big a few times, but ultimately, the house always wins.

Distorted Judgments

While simplicity is key, most beginners approach trading and investing with overly simplistic methods, hardly qualifying as trading logic or investment reasoning. They might spot a few recurring patterns in the market, akin to discovering fire. However, they soon realize that these "patterns" were not based on solid reasoning or, worse, were not patterns at all.

Herding Behavior

This behavior is rooted in a gambling mindset. Beginners are lured by the prospect of a single trade or investment that will turn them into millionaires. Yet, they fail to understand that trading and investing are not like winning the lottery. It's about making consistent profits that compound over time. While people should look for assets with high liquidity and some volatility, the get-rich-quick mentality leads to investing in overextended or overbought stocks that eventually plummet.

Risk Aversion

Risk aversion is a psychological trait embedded in human DNA. Winning is enjoyable, but we can't tolerate losing. As a result, many beginners take small profits, fearing they might close their positions at a loss, leading to trading with a poor risk-reward ratio. Over time, this reluctance to take risks results in losses.

Depending on price action, traders go through seven psychological stages:

Anxiety

Interest

Confidence

Greed

Doubt

Concern

Regret

Lack of Discipline

An intraday trader must adhere to a well-defined plan. A comprehensive intraday trading plan includes profit targets, considerations, methods for setting stop losses, and optimal trading hours. Such a plan offers an overview of how trading should be executed. Keeping a daily record of trades with performance analysis helps identify and correct weaknesses in your strategy. Discipline is crucial in trading to minimize losses and preserve capital.

Not Setting Proper Trading Limits

Success in intraday trading hinges on risk management. You should predefine a stop loss and profit target before entering a trade. This is a part of trading discipline where many fail. For example, if you suffer a loss in the first hour, you should close your trading terminal for the day. Setting an overall capital loss limit also protects against further trading losses.

Compensating for a Rapid Loss

A common mistake among traders is attempting to average down a position or overtrade to recover losses. This often leads to greater losses. Instead of overtrading, accept the loss, analyze your strategy, and make improvements for the next trading session.

Heavy Dependency on Tips

With the abundance of intraday tips on digital media, it's tempting for traders to rely on these external sources. However, it's advisable to avoid this. The best way to learn intraday trading is by understanding how to read charts, recognize structures, and interpret results independently. Tools like the Beyond App by Nirmal Bang provide insightful market research, but practical experience is irreplaceable.

Not Keeping Track of Current Affairs

News, events, and global market performances influence stock movements. Intraday traders should monitor both Indian and global markets. Make trades after announcements rather than speculating based on news.

Intraday trading is a skill, not a gamble, requiring time to develop proficiency. Expecting rapid results is unrealistic. The reasons listed above are why many intraday traders lose money; discipline, strategy adherence, and regular strategy analysis are key to success.

We will discuss 3 classic trading strategies and stop placement rules:

Trend Line Strategy

Buying: Identify the previous low; place your stop loss strictly below that.

Selling: Identify the previous high; place your stop loss strictly above that.

Breakout Trading Strategy

Buying: Identify the previous low when buying a breakout of resistance; stop loss below that.

Selling: Identify the previous high when selling a breakout of support; stop loss above that.

Range Trading Strategy

Buying: Place stop loss strictly below the lowest point of support.

Selling: Place stop loss strictly above the highest point of resistance.

These stop placement techniques are simple but effective in avoiding stop hunts and market manipulations.

What Is a Stop-Loss Order?

A stop-loss order is placed with a broker to buy or sell a stock once it reaches a predetermined price, designed to limit an investor's loss. For instance, setting a stop-loss at 10% below your purchase price limits your loss to 10%. If you bought Microsoft (MSFT) at $20 per share, placing a stop-loss at $18 would trigger a sale at the market price if the stock falls below $18.

Stop-Limit Orders are similar but have a limit on the execution price, involving two prices: the stop price, which turns the order into a sell order, and the limit price, which specifies the minimum acceptable price for execution.

Advantages of the Stop-Loss Order

Cost-Effective: No cost until the stop price is hit.

Convenience: No need for daily market monitoring.

Emotional Insulation: Helps maintain discipline and prevent emotional trading decisions.

Strategy Enforcement: Ensures adherence to your investment strategy, though less useful for strict buy-and-hold investors.

Types of Stop-Loss Orders

Fixed Stop Loss: Triggered at a set price or time, ideal for giving trades room to develop.

Trailing Stop-Loss Order: Adjusts with price increases to protect gains while allowing for market downturns.

Stop-Loss Order vs. Market Order

Stop-Loss: Aimed at reducing risk by selling at a specific price.

Market Order: For buying or selling at the current market price to increase liquidity.

Stop-Loss Order and Limit Order

Limit Order: Executes trades at or better than a specified price to maximize profit or minimize losses.

If you appreciate our content, please support our page with a like, comment, and follow for more educational insights and trading setups.

Conquered 250 Pips, What's Next in the Wave? Swingers!Let's keep it simple, As Always!

As of today, GBP/USD has delivered a solid 250-pip move following our analysis shared on October 9th, 2024. Our forecasted move materialized as expected, with the pair continuing its upward momentum after a brief consolidation phase. For those who took the trade, congratulations on securing some solid profits!

Now, the question on everyone's mind is, what's next for GBP/USD? Let’s break down the structure and identify the potential move within the wave.

Keep an eye on price action around these levels for the next wave. A pullback to 1.2300 could offer an entry for the next rally. Stay cautious and wait for confirmation before jumping in.

Let's see how the market unfolds over the coming sessions.

-Zak

Happy Trading! 🔥

xauusd analysis for 9/07/2024Last week our analyis on xauusd was perfect , we have predicted that if it cannot break the 2319-2312 zone then it will be bullish up to 2385.

Targets hit

2337 ✅✅✅

2347✅✅✅

2362✅✅✅

2385✅✅✅

our analyis for today:

it will be a ranging market from 2353 to 2371 , so buy the dip and sell the high.

▶️ if 2370 is broken then the market will fly upwards to 2385 2393 2404 2421 in extension

▶️ if 2353 support is broken then the market will fall towards

2342 2333 2321 2311 2306

.

we will make a detail analysis on fundamental technical and geopolitical scenarios.

LIKE US BOOST US FOLLOW US SHARE US

What Traders and Rock Climbers Have in Common!This post is inspired by @TradingView's rebranding in 2021 and the recent Leap competition.

At first glance, trading and rock climbing might seem worlds apart. One involves analyzing market trends, while the other requires physical strength and agility.

However, both pursuits share surprising similarities, highlighting unique skills and mindsets.

Here’s a look at what traders and rock climbers have in common.

⚙️ Risk Management: Both traders and rock climbers excel at managing risk. Traders use strategies like stop-loss orders and portfolio diversification to protect their capital.

Rock climbers assess risks, use safety equipment, and plan routes to avoid danger. Effective risk management is crucial in both fields to prevent catastrophic outcomes.

💡Mental Toughness: Traders face market fluctuations and must make quick decisions under pressure.

Rock climbers need to stay focused and composed while navigating challenging routes. Both activities demand mental resilience to overcome fear, maintain focus, and make calculated decisions.

📊 Strategic Planning: Success in trading and rock climbing involves strategic planning.

Traders develop strategies based on market analysis and economic indicators, while rock climbers meticulously plan their ascents, studying routes and assessing conditions. Strategic planning helps achieve goals efficiently in both areas.

⚖️ Adaptability: Adaptability is key for both traders and rock climbers. Market conditions can change rapidly, requiring traders to adjust their strategies.

Rock climbers face changing conditions like weather and rock quality, adapting their techniques to overcome obstacles and reach their objectives.

📜 Continuous Learning: Both traders and rock climbers are committed to continuous learning.

Traders stay updated on market trends and new tools, while rock climbers seek to improve their skills and stay informed about gear and safety practices. The pursuit of knowledge drives success in both fields.

🧘♂️ Focus on Execution: Execution is crucial in trading and rock climbing. Traders need precision, timing, and discipline to execute trades effectively.

Rock climbers must execute their moves with precision and confidence to progress safely. The ability to execute under pressure is essential for success in both activities.

🔄Passion and Commitment: Passion and commitment are integral to both trading and rock climbing.

Traders have a deep interest in financial markets, while rock climbers are driven by their love for the sport and adventure. This passion fuels their dedication, driving them to invest time and effort into their pursuits.

🧗♀️ Conclusion: Despite their apparent differences, trading and rock climbing share many commonalities.

Both require effective risk management, mental toughness, strategic planning, adaptability, continuous learning, focus on execution, and a deep-seated passion.

Recognizing these parallels can provide valuable insights and inspiration for those engaged in either pursuit, highlighting the universal qualities that drive success in diverse fields.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

The Famous Monkey Story in Every Markets!The Famous Monkey Story in Every Market!

Once upon a time, a rich man from the city arrived in a village. He announced to the villagers that he would buy monkeys for $100 each.

The villagers were thrilled, as there were hundreds of monkeys in a nearby forest. They caught the monkeys and brought them to the rich man, who paid $100 for every monkey they gave him. The villagers began making a living by capturing monkeys from the forest and selling them to the rich man.

Soon, the forest began to run out of monkeys that were easy to catch. Sensing this, the rich man offered $200 for each monkey. The villagers were ecstatic. They went back to the forest, set up traps, caught more monkeys, and brought them to the rich man.

A few days later, the rich man announced he would pay $300 per monkey. The villagers started climbing trees and risking their lives to catch monkeys and bring them to the rich man, who bought them all. Eventually, there were no monkeys left in the forest.

One day, the rich man announced he would like to buy more monkeys, this time for $800 each. The villagers couldn’t believe their luck. They desperately tried to catch more monkeys.

Meanwhile, the rich man said he had to return to the city for some business. Until he returned, his manager would handle transactions on his behalf.

Once the rich man left, the villagers were unhappy. They had been making quick and easy money from selling monkeys, but now the forest had no monkeys left.

This is when the manager of the rich man stepped in. He made an offer the villagers could not refuse. Pointing to all the caged monkeys, he told the villagers he would sell them for $400 each. They could sell them back to the rich man for $800 each when he returned.

The villagers were over the moon. Buy for $400 and sell for $800 in a few days—they had found the easiest way to double their money. They collected all their savings and even borrowed money. There were long queues, and within a few hours, almost all the monkeys were sold out.

Unfortunately, their happiness did not last long. The manager went missing the next day, and the rich man never returned. Many villagers kept the monkeys, hoping the rich man would come back. But soon, they lost hope and had to release the monkeys back into the forest, as feeding and caring for the noisy monkeys became extremely difficult.

This is exactly what happens when you buy low-quality companies in the stock market. There will be a low-priced stock that no one is interested in buying. A few rich men will suddenly start buying it. The stock price will rise because there are suddenly many buyers and very few sellers—a classic case of huge demand and no supply, like the monkeys in the forest.

The stock gets plenty of coverage on business channels and newspapers. These rich men will also use tricks like sending out bulk SMS messages, asking people to buy the shares for huge returns, and giving free tips. New and inexperienced investors, hoping to double or triple their investment, get lured in. Finally, the big players who bought the stock early when no one wanted it sell it back to inexperienced investors at high prices.

Don’t be greedy—there is no quick money in the stock market or in life. It takes time and effort to become wealthy, and there are no shortcuts.

Hit that like button if you like the story. Follow my profile for more content.

📈Mastering Stock Selection:A Journey to Long-Term Wealth💰Part1Interested in selecting high-quality stocks and growing your wealth through long-term investing? Today, I'll guide you through effective stock selection methods, including the top-bottom and bottom-top approaches. Remember, as Warren Buffett famously said, "The stock market is designed to transfer money from the active to the patient." 💼📈

Let's start with the top-bottom approach. First, you choose an economy, such as Indian, US, or UK. Next, select a sector within that economy, like Financial Services, IT, or Pharma. From there, narrow down to an industry within the sector, such as AI, Clean-technology, or Hardware. Finally, choose a company within the industry. Don't worry if it seems complex – I'll provide examples and guidance throughout. 💡🔍

Conversely, the bottom-top approach flips this order. We start by selecting a company, then move up to its industry, sector, and finally, the economy. 💼🔄

Let's put theory into practice with the top-bottom approach: (a random example)

1. Choose India as the economy.

2.Select the IT sector for its promising future.

3. Opt for AI as the industry due to its potential.

4. Select Infosys as a company.

Now, it's your turn! Share examples of top-bottom or bottom-top approaches in the comments for practice. 💬💡

In the upcoming discussions, we'll delve into the fundamentals of sector, industry, and company analysis. Don't worry—I'll explain everything from market cap and cash flow to return on equity (ROE). 📊✨

Target of likes (boosts): 25+ (if we achieve our target than I will make Part 2) 🎯🚀

Follow for more such ideas & learning content! 🔍

What do you see? #GBPAUDTake a look at the #GBPAUD chart. What do you see? As a trader, it's crucial to identify patterns and trends. My analysis shows potential for a bullish breakout after landing near the support level of 1.91750 . With potential targets at around 1.96500 . But what's your perspective? Let's talk.

Learn to Take Losses. Trading Psychology Basics

Hey traders,

In this post, we will discuss a typical psychological mistake that a lot of traders frequently make, facing a losing streak.

🤑 Analyzing different charts, we may spot a decent trading setup. Being 100% sure in our predictions, we open a trading position.

After some time, we are stopped out.

Instead of admitting that we were wrong, we are looking for a reason why it is not our fault: market manipulation, stop hunting, news.

Instead of reevaluation of our analysis, we start forcing our previous predictions.

🧠 We open a position again, being sure that it is a perfect moment for us to recover the loss.

And we are wrong one more time. What the hell is going on? Who to blame? Of course, that is not us.

These ugly hedge fund managers again sunk our trade.

😢 But we stay strong, we have a big trading account, so we decide to show this schmo who is a real pro here.

Consistency! That is the secret of success in trading.

So we open the third position again.

And... we screwed.

🤬 Eureka! The market reversed! It's time to open the position in the opposite direction. The trend has changed, and it's time to get on board and recover this losing streak.

We open a trade, however, it's too late already: while we were forcing our previous predictions a new impulse has already gone exhausted.

We s*ck...

That is a typical situation every struggling trader faced.

The psychological barrier to take the loss and admit the mistake makes many people leave this game.

The only way to proceed is to learn to take losses. Take losses and reevaluate your analysis.

"It's ok to be wrong. It's unforgivable to stay wrong!"

Why You Should Never Hold on to Your Positions Beyond a CertainGood day, traders.

I would like to take this opportunity to advise both new and experienced traders that holding onto your position indefinitely is not recommended. Based on percentage calculations, the return required to recover to break even increases at a considerably faster pace as losses grow in size due to compound interest. After a loss of 10%, a gain of 11% is needed to make up for it. When the loss is 20%, it takes a 25% gain to return to break even. To recover from a 50% loss, a 100% gain is required, and to reach the initial investment value after an 80% loss, a 400% gain is necessary.

Investors who experience a bear market must understand that it will take some time to recover, but compounding returns will aid in the process. Consider a bear market where the value drops by 30% and the stock portfolio is only worth 70% of what it was. Suppose the portfolio increases by 10% to reach 77%. The subsequent 10% gains bring it to 84.7%. After two further years of 10% gains, the portfolio reaches its pre-drop value of 102.5%. Consequently, a 30% decline requires a 42% recovery, but a four-year compounding rate of 10% returns the account to profitability.

I will be doing a second part of this post on the idea of "DOLLAR COST AVERAGING" (DCA).

The math behind stock market losses clearly demonstrates the need for investors to take precautions against significant losses, as depicted in the graphic above. Stop-loss orders to sell stocks or cryptocurrencies that are mental or limit-based exist for a reason. If the market is headed towards a bear market, it will start to pay off once a particular loss threshold is reached. Investors occasionally struggle to sell stocks they enjoy at a loss, but if they can repurchase the stock or cryptocurrency at a lesser cost, they will like it.

Never stop learning! I would also appreciate hearing your thoughts and opinions on the topic in the comment section.

Thank you.

Trading Sessions in Forex | Free Market Sessions Indicator

Hey traders,

In this post, we will discuss trading sessions in Forex .

Let's start with the definition:

Trading session is daytime trading hours in a certain location.

The opening and closing hours match with business hours.

For that reason, trading hours are varying in different countries because of contrasting timezones.

❗️Please, note that different markets may have different trading hours.

Also, some markets have pre-market and after-hours trading sessions.

In this post, we are discussing only forex trading hours.

The forex market opens on Sunday at 21:00 GMT

and closes on Friday at 21:00 pm GMT.

There are 4 main trading sessions in Forex:

🇦🇺 Australian (Sydney) Session Opens at 21:00 GMT and closes at 06:00 GMT

🇯🇵 Asian (Tokyo) Session Opens at 12:00 GMT and closes at 9:00 GMT.

🇬🇧 UK (London) Session Opens at 7:00 GMT and closes at 16:00 GMT.

🇺🇸 US (New York) Session Opens at 12:00 GMT and closes at 21:00 GMT.

Asian trading session is usually categorized by low trading volumes

while UK and US sessions are categorized by high trading volumes.

Personally, I trade the entire UK session and US opening and usually skip Australian and Asian sessions.

There is a free technical indicator on TradingView that allows to underline trading sessions on a price chart. It is called "Market Sessions".

Being added, it displays the market trading sessions.

What trading sessions do you trade?

Range Bar Chart, Line Chart & Candlestick Chart - Everything You

Hey traders,

In this post, we will discuss 3 most popular types of charts.

We will discuss the advantages and disadvantages of each one, and you will decide what type is the most appropriate for you.

📈Line Chart.

Line chart is the most common chart applied by analysts. Reading financial articles in different news outlets, I noticed that most of the time the authors apply line chart for the data representation.

On a price chart, the only parameter that the one can set is a time period.

Time period will define a time of a security closing price. The security closing prices overtime will serve as data points.

These points will be connected with a continuous line.

Line charts are applied for displaying an asset's price history, reducing the noise from less volatile times.

Being simplistic, they can provide a general picture and market sentiment. However, they are considered to be insufficient for pattern recognition and in depth analysis.

Above, a line chart is applied for analysis of a long-term trend on Gold.

📏Range Bar Chart.

In contrast to a line chart, a range bar chart does not consider time horizon. The only parameter that the one can set is a price range.

By the range, I mean a price interval where the price moves. A new bar will be formed only once the prices passes the desired range.

Such a chart allows to completely ignore time variable, focusing only on price movement and hence reducing the market noise.

The chart will plot new bars only when the market is volatile, and it will stagnate while the market is weak and consolidating.

Accurately setting a desired price range, one can get multiple insights analyzing a range bar chart.

In the example above, one range bar represents 10 pips price range on EURUSD.

🕯Candlestick Chart.

The most popular chart among technicians and my personal favorite.

ith just one single parameter - time period, the chart plots candlesticks.

Each candlestick is formed as a desired time period passes.

It contains an information about the opening price level, closing price, high and low of a selected time period.

Candlestick chart is applied for pattern recognition and in-depth analysis. Its study unveils the behavior of the market participants and their actions at a desired time period.

Each candle stick represents a price action within 4 hours on AUDUSD chart above. (time frame is 4H)

Of course, each chart has its own pluses and minuses. Choosing its type, you should know exactly what information do you want to derive from the chart.

What chart type do you prefer?

TSLA - trade ideaBeen a while since I posted an idea here, it doesnt matter what Ideas I post, it is more important to learn trade psychology and understand your risk reward, you can enter 1,000 trades with bad risk reward and never win. Or you can step into the arena, get beaten up enough times to finally snap out of it and find your way. Why risk it to make the biscuit?!

TESLA Support resistance trades, no trader has the golden ticket, find your way!

Funded 1.7m with APEX and TakeProfit trader, after blood sweat and tears, it may not be much to many but to me its lifechanging. Lets get it!!!!

Dissecting SPY Price trends With Fibonacci Price TheoryHave you ever wanted to learn the one technique you can use on any chart, any interval, or any technical or price set up to help you become a better trader?

Let me show you the basics of Fibonacci Price Theory and how to use it.

Price is always seeking new highs or new lows - ALWAYS.

You'll hear others talking about price filling voids or moving through accumulation/distribution phases - which is all true. Price moves through these support/resistance levels or quickly through price voids to reach new highs or lows. This is all part of Fibonacci Price Theory.

When you learn to understand various intervals using this technique (Weekly, Daily, 30 Min, or others), you'll quickly be able to identify short-term, long-term, and intra-day trends like a pro.

It is not about catching every trend reversal/setup. This technique is about teaching you to stay on the right side of trend and to target the Sweet Spot in the middle of breakaway/breakdown trends.

Follow my research. Learn how I can help you become a better trader.

🥶 FACT: Most traders quit year one. Hmm, but why? 🤔You all heard the statistic, "gambling is more profitable than trading - 13 out of 100 gamblers leave the casino with gains compared to 1 out of 100 traders". Yeah yeah. Nice story. Now tell us the real story. The market is not a casino. Don't compare. What about the thousands of traders making consistent gains?

It's a FACT that most traders quit their trading "hobby" or "career" within their first year of trading.

But what's ALSO a FACT is most traders:

Don't take profits when they see them (keep holding for more).

Go too heavy on a single trade.

Go all in on a single trade.

HODL for glory, even when they're super green on a trade.

Are too bullish/ bearish and turn a blind eye to the other bias.

Are over-speculating all the time (i.e. " NASDAQ:AMD 120 tomorrow. All in calls"

Trade without a chart.

Have no risk management.

Don't follow their own rules.

Have no trading strategy.

One cannot state the first "fact" without stating the other; the real reason. Otherwise, that's a shallow statistic. That's like looking at a 15 min chart and not realizing that each candle is constructed of 1,000+ mini candles.

Here's a 15 min NASDAQ:AMZN chart:

Here's the same chart in 15 second candles:

Zooming in to the chart gives you a clearer picture. Digging deep into the "quitting" traders' psychology, you'll get the answer. Also, I wouldn't say they quit. It's possible that the energy they were putting in wasn't paying off, and they didn't want to waste their time any further.

Treat your trading like a job. Be strict. You see quick +20% profit? Take it. But you believe it's going higher? Still take it. Find another trade. Baby gains add up!

Most traders who got burned on NYSE:AMC NYSE:GME , kept HODLing.

This is coming from someone who bought NYSE:AMC at $2.13 pre-split in 2021 and sold around $25 and $70:

ACHIEVING SUPER GAINS WILL RUIN YOUR MENTALITY!

You will start treating the market like a casino.

You will stop appreciating the smaller 20 to 40% gainers that you can do once per day or week.

You will see yourself starting to go heavy because you "believe" that "this is the next banger".

To avoid all this headache, build a strategy slowly over time, use the right tools to plan your trade, find a community to trade with, use proven strategies (i.e. support/ res, supply/ demand, patterns), go light in your first 1,000 trades, and so on. Happy to help if you have any questions below.

Follow for more insight and for live trade swing & day-trade ideas! Good luck trading! Trade safe and don't go all in.

Baby gains add up.

Breakout Soon ->Trend

Its in a strong uptrend for now, and its at a very crucial zone to break ascending triangle pattern. Get ready for some gains here.

Chart Pattern

From 15th August 2023 we are seeing its been trading in a tight range, and now its ready to explode most likely to the upside from here. I am targeting 3.10 zone in mid to short term.

Hit like & follow guys ;)

Fixed Range Volume Profile, How do I use it?I can say that Fixed Range Volume Profile is strong tool to determine targets and stop loss, POC point of control as per my research represent a central price and bar close price is turning around it, so when you assign take profit and stop loss as per it, you reduce the risk and have a plan B to manage your trade.

as you see in above chart for BTCUSD, we have trend line on daily time frame, I cut the chart to 3 successive zones representing 3 cycle, 1 cycle is from the trend to trend and applied "Fixed Range Volume Profile" on all 3 ranges/cycles, last cycle has not finished yet, and I show POC1, POC2 and POC3 prices.

I consider this line as central price for a range and we can see how price keep moving above and down POC1 & POC2 prices.

for the last range/cycle (not completed yet because it has not reach the uptrend line yet, we see POC3 = $30,200 and the current price $29,590 so price is under POC3 and we can guess it is going to trend at approximately $27,750, this is 1st hint.

2nd hint is to take "Fixed Range Volume Profile" for the all uptrend, did you notice it? I think the price is going to POC(all range) = $28,300 (support)

Now we came to the best part of our subject, the what if question and how to set up a plan?:

what is stop loss?

we need a 1H bar close above POC3= $30,200+100= $30,300 (resistant) and we buy target $31,380 (you should know why!) and for stop loss, we need close price 1H again down $30,200

what is take profit?

we can set $28,300 for safe and $27,750 if you want to risk a little bit, this is first target, but what if bar 4h close down POC= $28,300? here we can set a 2nd take profit at $26,400 (you should know why!)

this is what I wanted to share with you and I will be glad to answer your questions.

I did go short for BTCUSD this morning, enter price $29,165 and I set a take profit at $29,322 because I am working on 15 min timeframe.

ES - S&P Example Of Multiple Reactions Off Of A ActionSo, here comes a little lessen, that could have a huge impact on your Trading.

Many of you know that in my arsenal of tools I use the Medianline/Pitchfork tool very often. It's my best tool to project the path of price, find extremes and centers in the markets.

One day, I was stepping back in the world of Action/Reaction and started to research on the wisdom of Dr. Allan Andrews and Babson. I modified their Action/Reaction model in a new way.

Here's what I have found so far:

1. Identify the correct "last" Pivot (Anker 1).

2. Identify the last Low (Anker 3).

3. Wait, until Anker Pivot 1 is broken, and the market did a pullback (Anker Pivot 2).

If you're at point 3., this means that price already shoot up again above the Anker Pivot 1, and preferable even higher as the last Pivot above Anker Pivot 1.

From now on, you can observe, how price is behaving at the Reaction lines (Yellow R's).

How to trade it, use it?

Well, that's upon yourself.

Or, you may wait for a course I'm maybe planning.

But I highly recommend you study it and make your hands dirty §8-)

Happy Trading

A BASIC ENTRYThis right here is my favorite type of entry where you can basically see a nice bottom and re-test from the pullback before so in my eyes coming back down to this price too fill in the gaps is a MUST PAY ATTENTION type of trade... too me this is a continuation of price action. NOW! don't just get to your desired price and throw a market order in just because it's there? Wait for some big volume to come through, wait for the next pullback... Getting too the price is one thing... but knowing what to do next is the ball game.

I mean if I can get the price too come down far enough that i can set my SL behind a bunch of big 4HR, 1D bottoms and scale down to a lower TF too catch a clean leveraged trade. That's a strategy in itself... To add a focus on discipline, mindset, psychology, family, friends, work! an all-round lifestyle as a SOLDIER! you come to realize that trading is such a very small part of the game. Nail life first... then that simple strategy might just work.