80% Of Time - A Trading Edge You Don't Want To MissDo you want to know why trading with median lines, also known as pitchforks, can be so successful? It’s simple:

Prices swing from one extreme back to the middle.

From the middle, they often swing to the other extreme.

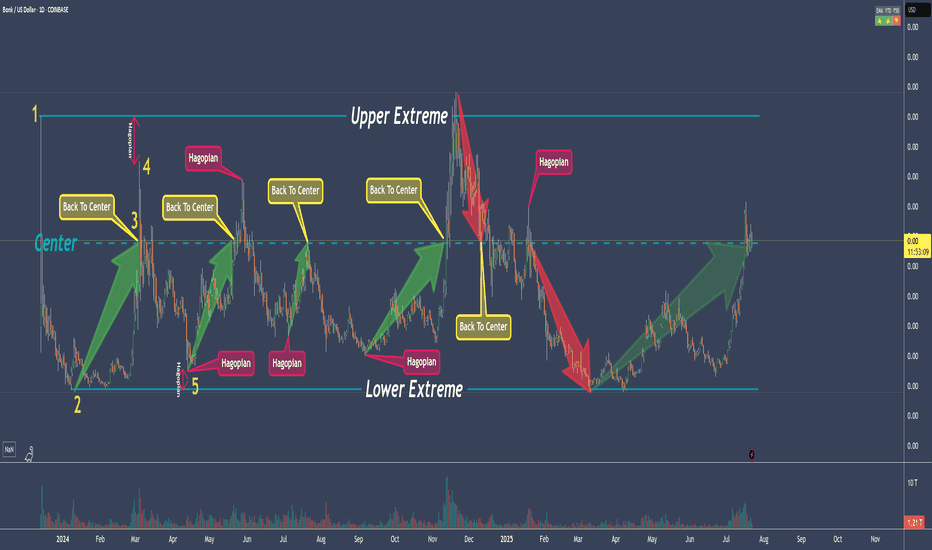

What do we see on the chart?

- The upper extreme

- The center

- The lower extreme

So far, so good.

Now let’s follow the price and learn a few important rules that belong to the rulebook of median lines/pitchforks, and with which you can make great trades.

Point 1

The price starts and is sold off down to…

Point 2

...and from there starts to rise again, up to…

Point 3

...which is the center. And here we have a rule that is very important and one that you need to be aware of in trading to be successful:

THE PRICE RETURNS TO THE CENTER IN ABOUT 80% OF ALL CASES

If we know this, then we can stay in a trade with confidence.

Point 4

The price climbed even higher but missed the upper extreme.

This is the “Hagopian Rule” (named after the man who discovered it).

And the rule goes: If the price does not reach the next line (upper extreme, lower extreme, or center), then the price will continue moving in the opposite direction from where it originally came.

Phew...that’s a mouthful ;-)

But yes, we actually see that the price does exactly this.

From point 4, where the price missed the upper extreme, the price not only goes back to the center but continues and almost reaches the lower extreme!

Now if that isn’t cool, I don’t know what is!

And what do we have at point 5?

A "HAGOPIAN"!

What did we just learn?

The price should go higher than the center line.

Does it do that?

Oh yes!

But wait!

Not only does the Hagopian Rule apply. Remember?

"The price returns to the center line in about 80% of the cases."

HA!

Interesting or interesting?

So, that’s it.

That’s enough for now.

Now follow the price yourself and always consider which rule applies and whether it’s being followed.

How exactly do you trade all this, and what are the setups?

...one step at a time.

Don’t miss the next lesson and follow me here on TradingView.

Wishing you lots of success and fun!

Learning

Mastering the MACD - How to use it in trading?The MACD, or Moving Average Convergence Divergence, is one of the most widely used technical indicators in trading. It was developed by Gerald Appel in the late 1970s and is designed to reveal changes in the strength, direction, momentum, and duration of a trend in a stock's price. At its core, the MACD is a momentum oscillator, though it is commonly plotted as a line chart rather than the traditional bounded oscillators like the RSI. Despite being unbounded, traders use the MACD primarily to identify potential buy and sell signals.

What will be discussed?

- How does the MACD work?

- How to use the MACD in trading?

- Divergences

- Conclusion

How does the MACD work?

The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. The result of this calculation is the MACD line. A nine-period EMA of the MACD line, known as the signal line, is then plotted on top of the MACD line. The third component is the MACD histogram, which represents the difference between the MACD line and the signal line. The histogram gives traders a visual cue about momentum: when the histogram bars are growing in height, momentum is increasing in the direction of the MACD line; when they shrink, momentum is slowing down.

How to use the MACD in trading?

Understanding how to use the MACD in trading requires some interpretation of the relationships between these components. One of the primary signals traders look for is a crossover between the MACD line and the signal line. When the MACD line crosses above the signal line, it is considered a bullish signal, suggesting that it might be a good time to buy. Conversely, when the MACD line crosses below the signal line, it indicates a bearish signal and potentially a good time to sell. These crossovers tend to be more significant when they occur below or above the zero line, which is where the MACD and signal line are equal. A crossover below the zero line followed by a move above it could signal the beginning of an uptrend, while a crossover above the zero line followed by a move below it might signal a downtrend.

Divergences

Another important application of the MACD is identifying divergence between the MACD and the price action of the asset. Divergence occurs when the price is moving in one direction and the MACD is moving in the opposite. For instance, if the price makes a new high but the MACD forms a lower high, it can be a warning sign that the upward momentum is weakening and that a reversal could be on the horizon. Similarly, if the price hits a new low but the MACD makes a higher low, it might suggest a potential bullish reversal.

Conclusion

In summary, the MACD is a versatile and powerful indicator that helps traders analyze the momentum and direction of a market trend. Its ability to provide both trend-following and momentum signals makes it a valuable tool in a trader’s toolkit. While it is not a standalone solution, when used properly and in conjunction with other strategies, the MACD can greatly enhance the accuracy and confidence of trading decisions.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Can AI Forge America's Next Shield?Palantir Technologies finds itself strategically positioned at the forefront of a potentially transformative U.S. defense initiative, the "Golden Dome" missile defense system. As a crucial partner in a consortium reportedly led by SpaceX and including Anduril Industries, Palantir is a leading contender for significant involvement in this multi-billion-dollar project. Golden Dome aims to establish a next-generation, networked shield against advanced missile threats, emphasizing rapid development and integration of space-based sensors and diverse defensive capabilities, moving beyond traditional procurement timelines.

Within this ambitious framework, Palantir's role leverages its core expertise in AI and large-scale data analytics. The company is anticipated to provide the essential software platform required to process and interpret data from potentially hundreds or thousands of tracking satellites, creating real-time situational awareness and enabling coordinated responses across the complex defense network. This involvement could also benefit from innovative procurement approaches, such as SpaceX's proposed subscription model, potentially securing stable, long-term revenue streams for Palantir.

Recent successes underscore Palantir's readiness for such a demanding role. The rapid adoption of its Maven Smart System by NATO validates its AI capabilities in high-stakes military environments, while its partnership with Vatn Systems demonstrates the utility of its platform in scaling and modernizing defense manufacturing. Securing a key position in the Golden Dome would represent a major strategic victory, solidifying Palantir's ascent as a disruptive force in the defense technology sector and signaling significant growth potential as it helps shape the future of national security.

Gold Target $4054 Year 2025-2026 With Reasons & 4$rules.1st Tp completed at 3341

2nd Tp 3437

3rd Tp 3622

4th Tp 3747

Final target is $ 4054 for Year 2025 to 2027

Below the Base line mentioned in chart will be the Seller profit zone which is marked as 1st Support, 2nd Support, 3rd Support & 4th Major Support.

Current Major reasons mentioned in the chart and future will be running of food, drinking water crisis and health issues will remain on high alerts (after covid 19 and pollution issues) and Insurance companies profits will be on Top of every Monthly trading results.

Can Efficiency Topple AI's Titans?Google has strategically entered the next phase of the AI hardware competition with Ironwood, its seventh-generation Tensor Processing Unit (TPU). Moving beyond general-purpose AI acceleration, Google specifically engineered Ironwood for inference – the critical task of running trained AI models at scale. This deliberate focus signals a Major bet on the "age of inference," where the cost and efficiency of deploying AI, rather than just training it, become dominant factors for enterprise adoption and profitability, positioning Google directly against incumbents NVIDIA and Intel.

Ironwood delivers substantial advancements in both raw computing power and, critically, energy efficiency. Its most potent competitive feature may be its enhanced performance-per-watt, boasting impressive teraflops and significantly increased memory bandwidth compared to its predecessor. Google claims nearly double the efficiency of its previous generation, addressing the crucial operational challenges of power consumption and cost in large-scale AI deployments. This efficiency drive, coupled with Google's decade-long vertical integration in designing its TPUs, creates a tightly optimized hardware-software stack potentially offering significant advantages in total cost of ownership.

By concentrating on inference efficiency and leveraging its integrated ecosystem, encompassing networking, storage, and software like the Pathways runtime, Google aims to carve out a significant share of the AI accelerator market. Ironwood is presented not merely as a chip, but as the engine for Google's advanced models like Gemini and the foundation for a future of complex, multi-agent AI systems. This comprehensive strategy directly challenges the established dominance of NVIDIA and the growing AI aspirations of Intel, suggesting the battle for AI infrastructure leadership is intensifying around the economics of deployment.

GOLD LIVE TRADE AND EDUCATIONAL BREAKDOWN LONGGold clings to gains above $3,110, closes in on all-time high

Gold builds on Wednesday's impressive gains and trades above $3,110 on Thursday. The broad-based selling pressure surrounding the US Dollar and retreating US bond yields on growing fears of a deepening trade war between China and the US fuel XAU/USD's rally.

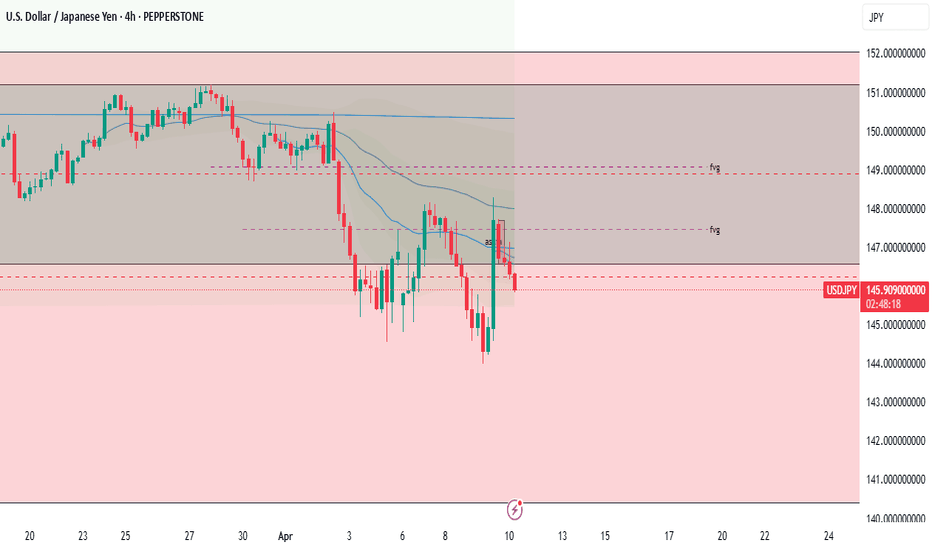

USDJPY SHORT LIVE TRADE AND EDUCATIONAL BREAKDOWNUSD/JPY tumbles below 147.00, awaits US CPI for fresh impetus

USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.

EURUSD LIVE TRADE EDUCATIONAL BREAK DOWNEUR/USD holds gains below 1.1000 ahead of US CPI release

EUR/USD is tirmimng gains while below 1.1000 in the European session on Thursday. The Euro gains on the German coalition deal and Trump's 90-day pause on reciprocal tariffs. Meanwhile, the US Dollar finds demand on profit-booknig ahead of the US CPI data release.

XAU QUICK SHORT TRADE LIVE TRADE AND EDUCATIONAL BREAKDOWN Gold price (XAU/USD) touches a fresh weekly top, around the $3,132-3,133 area heading into the European session as concerns about escalating US-China trade tensions continue to drive safe-haven flows. Moreover, fears that tariffs would hinder economic growth and boost inflation turn out to be another factor that benefits the precious metal's status as a hedge against rising prices. Apart from this, bets for multiple interest rate cuts by the Federal Reserve (Fed) push the non-yielding higher for the second successive day.

XAU LONG LIVE TRADE AND EDUCATIONAL BREAKDOWN Gold extends rally to $3,050 area as safe-haven flows dominate markets

Gold preserves its bullish momentum and trades near $3,050 in the second half of the day. Further escalation in the trade conflict between the US and China force markets to remain risk-averse midweek, allowing the precious metal to capitalize on safe-haven flows.

AUDUSD SELL 106 PIPS LIVE EXCAUTION AND EDUCATIONAL BREAKDOWN AUD/USD has ereased earlier gains to edge lower below 0.6300 in the Asian session on Monday. Trump's tariff concerns outweigh mixed Chinese NBS March PMI data, Australia's hot private inflation data and broad US Dollar weakness, exerting downward pressure on the pair as risk-aversion intensifies.

CADCHF SHORT LIVE TRADE AND BREAKDOWN EXPLANATION 9K PROFITThe CHF/CAD pair tells the trader how many Canadian Dollar (the quote currency) are needed to purchase one Franc Swiss (the base currency). These two economies are quite intensely linked because Canada is an important producer of gold while Switzerland is a great importer of that same commodity - a quart part of the overall commodities imported by Switzerland is gold and there is a solid tradition of gold refineries/gold mining companies in the country. Switzerland can be considered as a stable and safe country. The same accounts for its currency, the Swiss Franc (CHF). The currency is often referred to as the “safe-haven” currency, as it is a backup for investors during times of geopolitical tensions or uncertainty: it is expected to increase its value against other currencies in times of volatility.

Toast me or Roast me - I'm still learning & practicing charting

I was looking at descending scallops and some of their features via thepatternsite.com

What is valid or invalid about this charting here??

I have the high peak marked from the ATH that topped the uptrend on AMEX:SPY and the most recent upward breakout prior to trending back down on the 1HR as of yesterday. I know I will only be able to confirm in hindsight but is there good reason here for me to say we have the makings of a long-er term descending scallop in play here?

Thanks to all. I enjoy reading your opinions and discussions on the daily.

Machine Learning Algorithms for Forex Market AnalysisMachine Learning Algorithms for Forex Market Analysis

Machine learning is transforming the currency trading landscape, offering innovative ways to analyse market trends. This article delves into how machine learning algorithms are reshaping forex trading. Understanding these technologies' benefits and challenges provides traders with insights to navigate the currency markets potentially more effectively, harnessing the power of data-driven decision-making.

The Basics of Machine Learning in Forex Trading

Machine learning for forex trading marks a significant shift from traditional analysis methods. At its core, machine learning involves algorithms that learn from and provide signals based on data. Unlike standard trading algorithms, which operate on predefined rules, these algorithms adapt and improve over time with exposure to more data.

Machine learning forex prediction algorithms analyse historical and real-time market data, identifying patterns that are often imperceptible to the human eye. They can process a multitude of technical and fundamental factors simultaneously, offering a more dynamic approach to analysing market trends.

This capability can allow traders to make more informed decisions about when to buy or sell currency pairs. The increasing availability of market data and advanced computing power has made machine learning an invaluable tool in a trader's arsenal.

Types of Machine Learning Algorithms in Forex Trading

In the realm of forex trading, various machine-learning algorithms are utilised to decipher complex market patterns and determine future currency movements. These algorithms leverage forex datasets for machine learning, which encompass historical price data, economic indicators, and global financial news, to train models for accurate analysis.

- Support Vector Machines (SVMs): SVMs are particularly adept at classification tasks. In forex, they analyse datasets to categorise market trends as bullish or bearish, helping traders in decision-making.

- Neural Networks: These mimic human brain functioning and are powerful in recognising subtle patterns in market datasets. They are often embedded in forex forecasting software to determine future price movements based on historical trends and fundamental data.

- Linear Regression: This straightforward approach models the relationship between dependent and independent variables in forex data. It's commonly used for its simplicity and effectiveness in identifying trends.

- Random Forest: This ensemble learning method combines multiple decision trees to potentially improve analysis accuracy and reduce overfitting, making it a reliable choice in the forex market analysis.

- Recurrent Neural Networks (RNNs): Suited for sequential data, RNNs can be effective in analysing time-series market data, capturing dynamic changes over time.

- Long Short-Term Memory (LSTM) Networks: A specialised form of RNNs, LSTMs are designed to remember long-term dependencies, making them effective tools for analysing extensive historical forex datasets.

Benefits of Machine Learning in Forex Trading

Machine learning offers significant advantages for forex analysis. Its integration into forex prediction software may enhance trading strategies in several key ways:

- Real-Time Data Analysis: Algorithms excel in analysing vast amounts of real-time data, which is crucial for accurate forex daily analysis and prediction.

- Automated Trading: These algorithms automate the buying and selling process, which may increase efficiency and reaction speed to market changes.

- Enhanced Market Understanding: It helps in dissecting historical market data, providing a deeper understanding for informed decision-making.

- Accuracy in Analysis: Software powered by machine learning offers superior analysis abilities, leading to potentially more precise and timely trades.

- Risk Reduction: By minimising human error and maintaining consistency, machine learning may reduce trading risks, contributing to a safer trading environment.

Challenges and Limitations

Machine learning in currency trading, while transformative, comes with its own set of challenges and limitations:

- Data Quality and Availability: Accurate machine learning analysis depends on large volumes of high-quality data. Forex markets can produce noisy or incomplete data, which can compromise the reliability of the analysis and signals.

- Complexity and Overfitting: Developing effective algorithms for forex trading is complex. There's a risk of overfitting, where models perform well on training data but poorly in real-world scenarios.

- Interpretability Issues: Machine learning models, especially deep learning algorithms, can be "black boxes," making it difficult to understand how decisions are made. This lack of transparency can be a hurdle in regulatory compliance and trust-building.

- Regulatory Challenges: Currency markets are heavily regulated, and incorporating machine learning must align with these regulatory requirements, which can vary significantly across regions.

- Cost and Resource Intensive: Implementing machine learning requires significant computational resources and expertise, which can be costly and resource-intensive, especially for smaller trading firms or individual traders.

The Bottom Line

Machine learning represents a paradigm shift in forex trading – it may offer enhanced analysis accuracy and decision-making capabilities. While challenges like data quality, complexity, and regulatory compliance persist, the benefits of advanced algorithms in understanding and navigating market dynamics are undeniable. For those looking to trade forex, opening an FXOpen account could be a step towards a wide range of markets, lightning execution and tight spreads.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Different Ways to Manage Your TradesFinding the perfect trade setup is just one part of the equation. How you manage that trade can be the difference between consistent profits and missed opportunities. In this video, I’ll break down the different ways you can manage your trades and how each method impacts your results.

We’ll cover essential trade management techniques, including setting fixed take-profits and stop-loss levels, using trailing stops to lock in gains, scaling out of positions with partial profits, and actively monitoring trades for dynamic adjustments. Each method has its own strengths and weaknesses, and the key is finding what aligns with your trading style, risk tolerance, and market conditions.

I’ll also share insights on how I utilize trade management to maximize returns while keeping risk under control. Whether you prefer a hands-off approach or actively managing your trades in real time, this video will help you refine your execution and make smarter decisions.

Watch the full breakdown now, and let me know in the comments, how do you manage your trades?

- R2F Trading

Beautifully making HH HL.Beautifully making HH HL.

Immediate Support is around 29 - 29.30

Monthly Closing above 29.13 would be a

healthy sign.

If 29 is Not Sustained, Next Support would be

around 24.30 - 26.30

& if 29 is Sustained,34 - 35 can be witnessed.

Immediate small Resistance is around 31.55

Should Not Break 24 even in Worst Case.

Multi-Timeframe Volume Profile and Divergence StrategyObjective:

To combine multi-timeframe analysis, volume profile insights, and divergence patterns for identifying high-probability trades.

1. Strategy Components

A. Multi-Timeframe Analysis:

Use three timeframes for analysis:

Higher timeframe (HTF): To identify the overall trend (e.g., Weekly/4H).

Intermediate timeframe (ITF): For spotting critical support/resistance zones (e.g., Daily/1H).

Lower timeframe (LTF): For precise entry and exit signals (e.g., 15M/5M).

B. Volume Profile:

Incorporate Volume Profile Visible Range (VPVR):

Identify key areas: Point of Control (POC), High Volume Nodes (HVN), and Low Volume Nodes (LVN).

Use these levels as dynamic support and resistance.

C. Divergence Patterns:

Look for Bullish Divergence and Bearish Divergence on oscillators like:

Relative Strength Index (RSI)

MACD

Stochastic RSI

Combine divergences with price action near significant volume levels.

D. Additional Tools:

200 EMA (Exponential Moving Average): For trend direction.

ATR (Average True Range): For stop-loss and take-profit levels.

Fibonacci Retracement: For confluence with volume profile levels.

2. Trading Plan

Step 1: Higher Timeframe Trend Identification

Use the HTF to establish whether the market is in an uptrend, downtrend, or range.

Mark key swing highs, lows, and supply/demand zones.

Step 2: Intermediate Timeframe Analysis

Apply the Volume Profile on the ITF to find:

POC: Indicates price consensus.

HVN/LVN: Potential zones for reversals or continuation.

Watch for price approaching these levels.

Step 3: Lower Timeframe Execution

Monitor LTF for:

Divergence signals on oscillators.

Candle patterns like pin bars, engulfing candles, or inside bars at significant levels.

Confirm trades using:

Price breaking out of LVN or rejecting HVN.

Crossovers of EMA for extra confirmation.

3. Entry, Stop Loss, and Take Profi t

Entry:

Long Position:

Price reacts at HVN/LVN near a support level.

Bullish divergence on LTF.

Short Position:

Price tests HVN/LVN near resistance.

Bearish divergence on LTF.

Stop Loss:

Place just beyond recent swing high/low or above/below the LVN/HVN zone.

Use ATR (1.5x) for volatility-based placement.

Take Profit:

First target: Nearby POC or Fibonacci levels.

Second target: HTF supply/demand zone

Can AI Predict the Future of Payments?PayPal stands at the vanguard of the digital payment revolution, not merely as a facilitator but as an innovator through its strategic use of artificial intelligence (AI). This article delves into how PayPal is harnessing AI to redefine the parameters of financial transactions, challenging the reader to envision the future landscape of digital payments.

PayPal's integration of AI into its operational core has transformed it from a standard payment gateway to a leader in financial technology. By enhancing payment authorization rates and strengthening fraud prevention, PayPal leverages AI to predict and adapt to user behaviors and transaction patterns. This predictive capability ensures smoother, faster, and more secure transactions, pushing the boundaries of what was previously thought possible in digital payments.

The application of AI to improve payment authorization is particularly groundbreaking. Through sophisticated analysis of vast datasets, PayPal's AI models can predict declines, suggest retry strategies, and optimize transaction processing. This not only led to higher authorization rates but also improved user experience, prompting businesses and consumers to reconsider the effectiveness of digital transactions.

In the realm of fraud prevention, PayPal's AI-driven approach sets a new standard. By employing machine learning and graph technology, PayPal maps out transaction networks to spot anomalies in real-time, drastically reducing fraud while minimizing disruptions from false positives. This dual focus on security and user experience presents a compelling case for how technology can be both a guardian and a facilitator in the financial world, urging us to consider the balance between innovation and safety in our digital interactions.

PayPal's journey with AI doesn't just highlight its current capabilities but also signals its readiness for future challenges in the digital payment landscape. As we ponder the implications of such technological advancements, we are invited to explore how AI could further shape the economy, security, and daily financial interactions, making PayPal not just a leader today, but a visionary for tomorrow.

The Trading Quest: Leveling Up Your Trading GameHello, fellow traders.

In this education post I will present the evolution of a trader as levels because, truth be told, trading sometimes feels like a video game—except the boss fights are market volatility, and here the only cheat code is discipline. Developing a winning strategy is a journey that starts with basic understanding and evolves into a well polished plan. For this to happen, certain levels have to be "burnt".

So below I will outline what I think are the levels of development a winning trading strategy, starting from initial experimentation to highly refined and scalable strategy:

1️⃣ Level 1: The Trial and Error Phase

In the beginning, traders experiment with different strategies, tools, and systems. They may rely on random tips, indicators, or systems they read about online, often jumping from one strategy to another without a clear understanding of why one works and another doesn't.

Important Aspects:

The main issue here is lack of consistency. Strategies often lead to inconsistent results because traders fail to backtest or assess the viability of a system over time. At this stage, the trader might experience frustration as they can't pinpoint why certain strategies work or fail.

Why?

Testing and refining are vital to developing a strategy. A trader must learn the importance of understanding market conditions and being patient with their trial-and-error process. Backtesting becomes an invaluable tool for this level.

2️⃣ Level 2: The Search for the Right Strategy

By this stage, traders understand that there is no "perfect" strategy, but a variety of strategies can work depending on the market behavior. They start to narrow down their focus and look for strategies that align with their risk tolerance, personality, and time commitment.

Important Aspects:

The trial here is resisting the temptation to continuously jump between different strategies. Traders may still be tempted by the allure of quick profits and may find themselves trying too many things at once, leading to becoming overwhelmed.

Why?

It is important to focus on finding simplicity and focus on one strategy. Strategies should be tailored to personal strengths, whether that’s day trading, swing trading, or position trading. The trader needs to focus on risk-reward ratios and refine their approach to fit the market conditions.

3️⃣Level 3: Strategy Development and Backtesting

At this level, the trader now begins to build their strategy around clearly defined rules for entry, exit, and risk management. Backtesting comes into play, allowing the trader to see how the strategy would have performed in different market conditions. This stage marks the beginning of data-driven decisions rather than relying on guesswork.

Important Aspects:

The main focus here is to avoid over-optimization. There is the temptation to over-optimize the strategy based on historical data, which can lead to curve fitting. Strategies must be robust enough to perform in a variety of market environments, not just those found in past data.

Why?

Robust backtesting provides valuable insights, but should not be viewed as a guarantee of future performance. The focus should be on understanding the strategy’s performance across a range of scenarios and refining risk-reward parameters.

4️⃣ Level 4: Refining and Optimization

With a tested strategy in place, traders now focus on refining their approach to adapt to real market conditions. This involves implementing risk management techniques such as position sizing, stop-losses or maximum drawdown limits. Here the focus is on refining the strategy, ensuring it is flexible and adaptable to various market environments.

Important Aspects:

During this phase is important to maintain a balanced risk-reward ratio. Overoptimizing for profitability can lead to excessive risk exposure, which undermines the strategy's long-term viability.

Why?

Because optimization is an ongoing process. Strategies should never be set in stone. The trader learns that fine-tuning a strategy based on live market conditions and feedback is a continuous process. Optimizing the risk-reward balance will determine the long-term success of the strategy.

5️⃣ Level 5: Live Trading with a Demo or Small Capital

Finally! Trust me when I say this is the biggest turning point.

After refining the strategy, traders move to live markets with real money, (if then haven't been tempted already and lost money). Often time they start small or using demo accounts to minimize risk. At this level, traders will encounter the psychological elements of trading—such as fear of loss, overconfidence after wins, or hesitation after losses.

Important Aspects:

The main trial at this level is that the emotional component of trading takes over. Traders may experience a shift in behavior when real money is at stake, even though they had success in demo accounts or small-size trades. Overtrading, revenge trading, and second-guessing the strategy are common pitfalls.

Why?

The trader must apply the same rules from backtesting to live trading, despite the emotions involved. At this stage, mental resilience and psychological control are just as important as the strategy itself.

6️⃣ Level 6: Full Strategy Deployment and Scaling

By now, the trader has developed confidence in their strategy. They’ve mastered the mental discipline required to follow their trading plan, even when emotions are high. The trader begins scaling their strategy, increasing position sizes while maintaining the risk-reward ratio and capital allocation that suits their risk tolerance.

Important Aspects:

At this level, the trial is to maintain consistency while scaling. The trader may face issues related to emotional attachment to larger positions or feel the pressure to adjust the strategy for increased capital. Market volatility can also affect decision-making, leading to increased risk exposure.

Why?

As the trader increases their trading capital, they must remain mindful of market conditions and adjust position sizes accordingly. Portfolio diversification and ensuring that no single trade has too large an impact on overall capital are essential here.

7️⃣Level 7: The Master Strategist - The Final Boss 🏆

Congratulations! At this highest level, you must have developed a consistently profitable strategy that can be applied in different market behavior. The strategy has become highly effective in various conditions, and the trader can easily adapt to different setups without deviating from the core principles.

Important Aspects:

Now the focus is on fine-tuning their mindset for optimal performance. They anticipate emotional triggers before they happen and know exactly how to deal with them when they do come. The trader’s mental clarity allows them to stay composed during market volatility and follow their strategy with unmoved commitment.

Why?

The pinnacle of trading psychology is the ability to systematically execute trades with confidence, without being influenced by fear, greed, or euphoria. This confidence comes from knowing that their strategy is built on years of testing, adjustment, and improvement. This allows them to consistently make rational decisions that align with their long-term trading goals.

They maintain discipline regardless of market volatility and use data-driven decisions to continue growing their capital.

📈

Developing a winning trading strategy is a dynamic process that requires continuous learning, adjustment, and discipline. Traders must be patient with themselves during each level, from the initial trial and error to the refined, proven strategy that supports consistent success. The levels involve mastering both the technical elements of strategy development and the psychological factors that affect trading performance. 🌟

123 Quick Learn Trading Tips #2: Stay Cool, Trade Smart🎯 123 Quick Learn Trading Tips #2: Stay Cool, Trade Smart

"Don't let anger empty your pockets. Trade with a cool head."

Navid Jafarian

❓ Ever get mad when you lose a game?

❓ Want to try again and win RIGHT AWAY?

Trading can feel like that, but with real money. It's easy to blame losses on things you can't control, like the news or bad luck.

✅ Truth is, everyone loses sometimes in trading. The best traders don't get angry. They learn from their mistakes and move on.💪

‼️ Don't try to "get even" with the market after a loss. That's how you lose even more!

🗝 Take charge, learn, and make the next trade better.

❗️Remember:

The best traders stay calm and focused. Just like a pro!