Japanese Candlesticks: learning to read and understand🕯

✅Japanese candlesticks are the most popular way to read the price movement on charts. They are visual, easy to learn and the main thing is that they work.

✅The first mention of candle patterns can be found in the Japanese rice trader Homma Munehisa in the 1700s. Almost 300 years later, candles were rediscovered by Steve Neeson in his book titled "Japanese Candles. Graphical analysis of financial markets".

✅Candlestick charts provide much more information compared to linear charts and are currently the preferred market analysis tool for traders and investors.

What are Japanese candles?

🟢Each of the candles tells us four facts about itself: the opening price, the maximum price movement, the closing price, and the minimum price movement.

⏺A bullish candle is formed when the price rises. In financial markets, the term bullish means a long position or a buy.

⏺A bearish candle is formed when the price falls. In financial markets, the term bearish refers to a short position or sale.

❗️The body of the candle is the space between the opening and closing of the candle. If the body is green, it means that the closing price of the candle is higher than the opening price. If the color is red, it means the closing price is lower than the opening price of the candle.

❗️Candle wicks represent the highest or lowest points that the candle has reached.

🟢Each candle represents a selected time frame or time interval during which it opens and closes. For example, on a 4-hour chart, candlesticks open and close every 4 hours.

🟢If we line up several candlesticks, we can compare them with a linear chart. Candle wicks also show price fluctuations. Thus, we immediately get the maximum information that we need for effective market analysis.

⚠️A trader who knows how to analyze and interpret candlestick patterns or patterns already understands the actions of financial market participants a little better.

❤️ Please, support our work with like & comment! ❤️

Learntotrade

The Only Proven Way To Success in Trading 🥇

Hey traders,

Like any discipline, consistently profitable trading requires many years of practice.

In this post, we will discuss the only proven way to become successful in trading.

🔰First, let's start with the axiom: there are no inborn traders, trading is a skill, a skill that can be learned. Though talent may help you in some manner it does not guarantee your success.

One more axiom that is logically derived from the first one is the fact that trading is a complex skill.

The one that can be split into dozens of subskills.

Making that statement we may assume that our success in trading directly depends on mastering each subskill, each domain that it consists of.

But how do we master these skills?🤔

The only way to do that is to practice. Practice means doing something regularly in order to be able to do it better.

With your first attempts, you are doomed to fail. Inevitable you will suffer and you will feel miserable because of your incompetence.

Trying and doing the same thing again and again, at some moment you will feel the progress and growth. Your perseverance will bear fruit.

Knock, and it shall be opened to you.

And as a consequence, with some attempt, you will feel that finally the skill is mastered, that one more stage in your journey is passed.

Polishing the entire set of subskills and learning to apply that as a single unit will make you a consistently profitable trader.

Just stipulate the domains properly, name them and be ready to work hard.

❤️Please, support this idea with like and comment!❤️

ELON MUSK QUOTES. For powerful thinking👨🎓

1️⃣"When it is important enough, you do it even if the odds are not in your favor."

2️⃣"No, I don't ever give up. I'd have to be dead or completely incapacitated."

3️⃣"Persistance is very important. You should not give up unless you're forced to give up."

4️⃣"I think it is possible for ordinary people to choose to be extraordinary."

5️⃣"Don't confuse schooling with education, I didn't go to Harvard, but people who work for me did."

6️⃣"Constantly think about how you could be doing better and keep questioning yourself."

❤️ Please, support our work with like & comment! ❤️

BTC Three scenarious I am watching at!Hey, you dont have to do a trade now and fomo in you can also just take some time and watch out at what is going to happen don't be scared to miss out something. There are a lot of oppurtunities you can take advantage of. What I had to learn was not fomo in something just because it went up. A lot of people that were bearish saying BTC will go down to 20k are now super bullish just stay neutral without emotions. Observe the market because everything can happen, if you think like that you will see what is really there and not what you want to see. I am still learning to get better at it.

Let me know what your scenarious are.

Potential 10x Move stetting up on SHIBA INUThanks for reading all my previous Analysis.

Today I am looking and also bought into SHIBA potential BULL RUN for a longer term. This is my personal speculative opinion and not an investment advice.Obviously there are potential possibilities of huge gains and managed losses.Always have a calculative risk if that is the only edge you can start your trading career with.It put you in the driving sit.

Delving into SHIBA Inu technicals on the last few event that has happened.

The SHIBA INU has retraced almost 88.6% of it's potential value from the high it posted on 28 October 2021(2 days after my birthday) of value 0.00007906 to the low of around 0.00001704.

That above statement is a bargain already in the crypto market and that is the volatility swing that the cryptomarket suffer based on my experience trading and watching this market.And if something looses almost 90% value then it becomes attractive to deal finders and unattractive to the novice investors.Remember the popular quote you have to be greedy when others are fearful that there is no value in these and started dumping and then you now decide to accumulate and be greedy at their lowest deadened emotion is a way to play the trading and investing game successfully.

Therefore after such decline,the SHIBA has now technically given us a huge impulsive move above 61.8% of it's last swing down which is my 2nd fib on the chart.According to a fibonacci measured move theory that brings in the advent of the new bull runs and that is the MAIN REASON why I will like you to get involve in this for the long term and acquire SHIBA at the right time and wait for couple of months or even weeks.

Based on the last cycle, it took SHIBA around about 144days of consolidation from its inception to decline and just about 23days to hit a new high on it's last bull run.

Currently the last Decline has taken about 97 Days and a new BULLISH TONE has now emerged and been part of this will let us identify how long it will take to reach at least separate targets of 0.00005 to 0.00007 to 0.000011 and eventually 0.000013 as a conservative target.

The MEME coin can post a much larger gain and attain 10cent in the near future as it is community driven.

5 Possible Outcomes Of Your Trades | Trading Basics 👶

Hey traders,

Depending on your actions, you can get 5 completely different results

taking just one single trade.

1️⃣The first outcome is a small win.

By a small win, I mean a winning trade producing up to 2.5% account growth.

2️⃣The opposite situation leads to a small loss.

To me, a small loss is a losing trade producing up to -1% account decline.

3️⃣Occasionally once the price starts moving in the predicted direction, one can protect his trading position moving his stop to entry and making a position risk-free.

Being stopped out such a trade produces 0% profit. The level where the position is closed is called a breakeven point.

4️⃣If one perfectly predicts a future direction of the market and opens a trading position accordingly, occasionally, a huge profit can be made.

A winning trade producing more than 2.5% net account growth is called a big win.

5️⃣Being wrong in the predictions, however, one can adjust and trail a stop loss not letting himself be stopped out. Such behavior may lead to a substantial loss or even a margin call.

A losing trade that produces more than -1% net loss is called a big loss.

❗️Learning how to trade, I strongly recommend you eliminate the 5th outcome. Managing not to lose more than 1% of your account will substantially improve your trading.

❤️Please, support this idea with like and comment!❤️

Potential GOLD SHORTNow is the time to play GOLD Shorts in those ORDERBLOCK with other COnfluence as the BAT PATTERN . The key to be successful with this trade is to be patient and also be proactive the 1st in this area can be that sharp small lot size to test the idea like a 0.01lot depends on your account size and subsequently wait to see if the stop loss won't be hit and then looking for further short opportunity as the short now unfold.

Please do not hesistate to comment or ask any questions.

Potential GOLD SHORTThanks all for reading my Analysis on my previous posts here:

(The BTCUSDT has failed to give us the slight short in this zone but pay attention to that huge fight between the BUYERS and the SELLERS in that zone and eventually leads to that further BUYERS STRENGTH anticipated.THe key is those levels are strong and whoever win at those levels is an indication of which Direction to go.)

(Pay attention to the Potential short opportunity

Now is the time to play GOLD Shorts in those ORDERBLOCK with other COnfluence as the BAT PATTERN. The key to be successful with this trade is to be patient and also be proactive the 1st in this area can be that sharp small lot size to test the idea like a 0.01lot depends on your account size and subsequently wait to see if the stop loss won't be hit and then looking for further short opportunity as the short now unfold.

RE:POTENTIAL LONGER TERM BUY OPPORTUNITY IN SUSHIUSDTUpdate

RE~Thanks for reading my previous post on AUDNZD ,ADAUSDT, BTCUSDT , ONEUSDT and now SUSHI USDT

I believe there is a value BUY now on SUSHI USDT to hold for a longer term based on technicals and new fundamental development in the DEFI space. There is huge opportunity for the SUSHI PLATFORM to explode as it delves into different forms of Yield Farming and also helping users to lower cost across many chains of interoperability.

My first scenario of short opportunity is currently playing out and it's nearing my new buy entry for a longer term @ near $4.50. This is the scenario am voting for should in case the Crypto market choose to move 100X.

I hope you enjoy reading this and hopefully profit from it

POTENTIAL LONGER TERM BUY OPPORTUNITY IN SUSHIUSDTThanks for reading my previous post on AUDNZD,ADAUSDT,BTCUSDT,ONEUSDT and now SUSHI USDT

I believe there is a value BUY now on SUSHI USDT to hold for a longer term based on technicals and new fundamental development in the DEFI space. There is huge opportunity for the SUSHI PLATFORM to explode as it delves into different forms of Yield Farming and also helping users to lower cost across many chains of interoperability.

My first scenario of short opportunity is currently playing out and it's nearing my new buy entry for a longer term @ near $4.50. This is the scenario am voting for should in case the Crypto market choose to move 100X.

I hope you enjoy reading this and hopefully profit from it

WHAT IS AN ETF? (Exchange-Traded Fund)📚

✅An ETF is an exchange-traded investment fund. The fund's management company draws up a strategy and acquires assets in its portfolio, and then issues shares - small shares of this portfolio. When selling an ETF, the investor pays tax in the same way as if it were ordinary shares.

✅If 40 years ago only 6% of American families invested money in investment funds, now they are about 46%. At the end of the third quarter of 2020, $29.5 trillion was invested in open-ended investment funds in the United States — this is almost half of all assets managed by funds around the world.

⚠️What instruments are included in the ETF

🟢The fund's portfolio may consist of any instruments traded on the stock exchange. For example, stocks, bonds, currency, precious metals. Their ratio depends on the fund's strategy. Once in a certain period, the management company reviews the portfolio and rebalances, that is, sells some assets and buys others.

🟢All actions are subject to strict rules, from which managers cannot deviate. All information about the composition of the ETF and the frequency of portfolio rebalancing is available in the fund's documentation.

🟢ETFs can consist of securities, precious metals, derivatives - there are practically no restrictions. Therefore, today there are thousands of funds with very different structures. For example, there is the Global X Millennials ETF— which is a fund for shares of brands beloved by millennials. Or Direxion Work From Home ETF - it invests in services that benefit from the widespread transition to remote work.

❗️What are ETFs

🔴When a fund copies a stock index, it applies replication, that is, it exactly repeats the composition of the index. There are two types of replication — physical and synthetic. If an ETF uses physical replication, it buys the index assets themselves - stocks, bonds, and everything else.

🔴If a fund uses synthetic replication, it does not buy the index assets themselves. Instead, the fund uses an index derivative — an agreement between the parties that the transaction will be executed. A change in the value of the index entails a change in the value of the derivative. On the one hand, this is beneficial for the investor, but on the other hand, a complete repetition of the index may be inaccurate. In addition, there is a risk that the derivative provider will not fulfill its obligations.

🔴In index ETFs, the investor should pay attention to the error of following or tracking error. Let's say the IMOEX index has gained 12% over the year, and the ETF for this index has only 11%. The management costs in this fund are 0.5%, which means that the remaining 0.5% is a follow-up error. This indicator should not be too large, because, in the end, it affects the profitability of the fund. If the fund deviates greatly from the index, the managers do not do their job well.

‼️How the price of an ETF is formed

🔴Shares in ETFs are called shares, they have a market and settlement price - iNAV.

🔴The estimated price is the value of all assets included in one share of the ETF. It can be viewed on the fund's website and the stock exchange.

🔴The market price depends on the supply and demand in the market and differs from the estimated price. It is not profitable for the Fund that the difference between them is too large, otherwise, investors will not buy shares. The market maker makes sure that the price on the stock exchange does not fluctuate much. He puts out large bids in a certain range. The current market price of the fund's shares can be viewed on the stock exchange or in the terminal.

🔴ETFs are a convenient and simple solution for investors who want to get "all in one". For example, they do not want to make a portfolio with their own hands or buy index assets separately. This tool is easy to buy and sell at any time. We can say that an ETF is trust management without red tape with documents and time limits.

❤️ Please, support our work with like & comment! ❤️

MOVING AVERAGE | 4 Efficient Methods To Apply

Hey traders,

The moving average is one of the most popular technical indicators.

It is applied in stocks/forex/crypto trading and proved its high level of efficiency.

There are hundreds of trading strategies based on MA.

In this post, we will discuss the 4 most popular ways to apply the moving average.

1️⃣The first method is applied to identify the market trend.

While the price keeps trading above the MA, one considers the trend to be bullish and looks for buying opportunities.

Once the price starts trading below the MA, the trend is considered to be bearish and a trader is looking for shorting opportunities.

2️⃣The second method applies the combination of 2 MA's: preferably a long-term one and a short-term one.

The point is that once a short-term moving average crosses above a long-term MA, with high probability it signifies the initiation of a bullish trend.

Alternatively, a crossover of short-term and long-term MA's to the downside indicates a start of a bearish trend.

3️⃣The third method applies MA as a structure.

While the moving average is lying above the price, it is considered to be a dynamic resistance.

Staying below the price it serves as a strong dynamic support.

Perceiving MA as the structure, one applies that for trade entries.

4️⃣The fourth method is aimed to track the crossover of the moving average and the price.

The idea is that a bullish violation of the MA by the price gives an early signal for a possible trend reversal.

While a bearish breakout of the MA by the market indicates a highly probable bullish trend violation.

Backtest different MA's inputs and learn to apply that for predicting the future direction of the market and for trading it.

Do you use MA?

❤️Please, support this idea with like and comment!❤️

⭐ HOPE AND FAITH💥 Am I the only who at some point while trading hoped for price to move in my direction or bias or rather open a position with mere hope and faith ❓... Certainly not. At one point or the other you must have done this and possibly still struggling with it.

💥Truth is, the market will always do whatever it wants regardless of your strong hold, hope or faith in your bias.

What then do I do ❓

1. Take trades that you've planned. Do not just wake up, get into the market and start executing trades without proper analysis. Take trades with predetermined entry, stop-loss and take profit level.

2. Be quick to admit that you're wrong when the market chooses to go against your bias. Stop adjusting your stop-loss when in a losing position. It will enable you cut the losses early.

3. Avoid trading based on emotions. It is easier said than done. But with practice you will get better at it. Be logical and see things as they are.

🔥 I HOPE this helps.

Sage Trader's Nugget

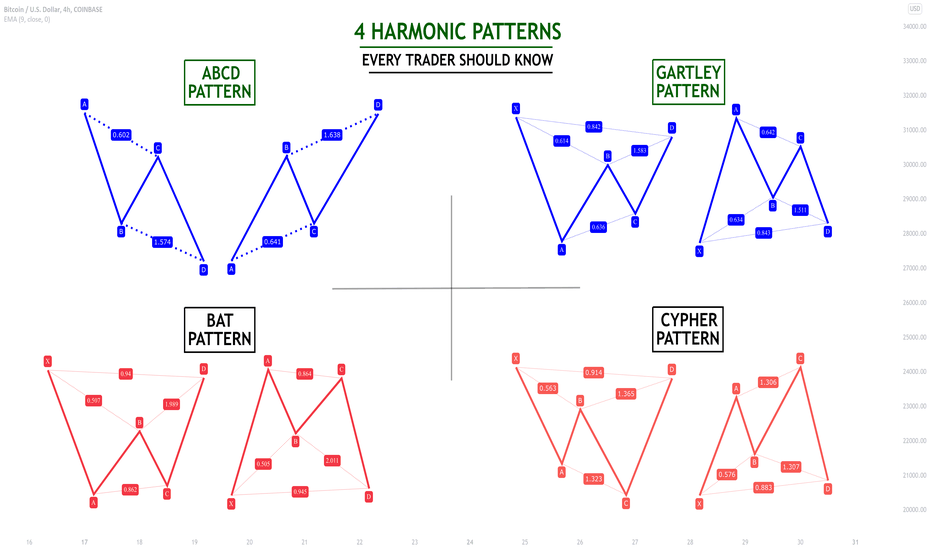

4 Harmonic Patterns Every Trader Should Know 📚

Hey traders,

In this post, we will discuss 4 phenomenally accurate harmonic patterns that you must know.

1️⃣The first and the simplest harmonic pattern is called ABCD pattern.

This pattern is based on 3 legs of a move:

✔️Initial impulse (bullish or bearish). AB leg

✔️Retracement leg with a completion point lying within the range of the initial impulse. BC leg.

✔️Second impulse with a completion point lying beyond the range of the initial impulse (it must have the same direction as the initial impulse). BD leg

Equal AB and CD legs indicate a highly probable retracement from D point of the pattern.

❗️Please, note that the time horizon and the length of the impulses must be equal.

2️⃣The second harmonic pattern is called Gartley Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Gartley Pattern we measure the retracement of B/C points with Fib. Retracement tool and extension of D point of a harmonic pattern with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.618 level and 0.786 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.618 and 0.786

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - D point should lie strictly on 1.272 extension of AB leg (Fib. Extension of AB)

*it should strictly touch 1.272

Such a formation indicates a highly probable retracement from D point of the pattern.

3️⃣The third harmonic pattern is called Bat Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Bat Pattern we measure the retracement of B/C/D points of a harmonic pattern with Fib. Retracement tool:

✔️ - The retracement of B point should lie between 0.5 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch 0.5 but it can’t touch 0.618

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - The retracement of D point should lie strictly on 0.886 level of XA leg (Fib.Retracement of XA)

*it should strictly touch 0.886

Such a formation indicates a highly probable retracement from D point of the pattern.

4️⃣The fourth harmonic pattern is called Cypher Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form with C point lying beyond the range of XA leg.

To identify a Harmonic Cypher Pattern we measure the retracement of B point with Fib. Retracement tool and extension of C point with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.382 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.382 and 0.618

✔️ - The extension of C point should lie between 1.272 level and 1.414 level of XA leg(Fib. Extension of XA)

*it can touch both 1.272 and 1.414

✔️ - D point should lie strictly on 0.786 retracement of XC leg (Fib. Retracement of XC)

*it should strictly touch 0.786

Such a formation indicates a highly probable retracement from D point of the pattern.

🦉What is good about these patterns is the fact that they are objective.

Since each point of the pattern is measured with Fibonacci levels, one can avoid subjectivity.

Try harmonic pattern trading and you will see how efficient this strategy is.

Do you trade harmonic patterns?

❤️Please, support this idea with like and comment!❤️

RISK : REWARD. Visualized breakdown

⚠️Regardless of whether you prefer day trading or swing trading, you need to understand the fundamental concepts regarding risk. They form the basis of understanding the market, managing trading activities, and investment decisions. Otherwise, you will not be able to protect and increase your balance.

We have already discussed risk management, position size, and stop-loss setting. But if you are actively trading, answer two important questions. How does the growth potential relate to potential losses? In other words, what is your risk-reward ratio?

In this article, we will discuss how to calculate the risk-to-profit ratio for any transaction.

✅What is the ratio of risk and profit?

🟢The risk-reward ratio (risk/reward or R/R ratio) allows you to understand what risk a trader is taking for the sake of a potential reward. In other words, it shows what the potential profit is for every dollar you risk when investing.

🟢The calculation itself is very simple. The maximum risk is divided by the net target profit. How exactly? First, think about where you want to enter into the transaction. Decide where you will take profit (if the trade is successful) and where to place a stop loss (if it is a losing trade). This is extremely important for effective risk management. Good traders set profit targets and stop-loss before entering a trade.

Now you have entry and exit points, that is, you can calculate the ratio of risk and profit. To do this, you need to divide the potential risk by the potential profit. The lower this coefficient is, the more potential profit you will receive per "unit" of risk. Let's figure out how it works.

✅How to calculate the ratio of risk and profit

🟢Let's say you want to open a long position on bitcoin. You perform an analysis and determine that your take profit order will be 15% of the entry price. Next, you have to answer the following question: where your position will be closed in case of a market reversal. This is where you will have to set a stop loss. In this case, you decide that your cancellation point will be 5% of the entry point.

It is worth noting that it, as a rule, should not be based on arbitrary percentage numbers. The profit target and stop loss should be determined based on market analysis. Technical analysis indicators are very useful for solving this problem.

🟢So, our profit target is 15%, and the potential loss is 5%. What is the ratio of risk and profit? 5/15 = 1:3 = 0,33. Everything is simple. This means that for each unit of risk we potentially win three times more. In other words, for every dollar we risk, we can get three dollars. Thus, if we have a position worth $100, then we risk losing $5 with a potential profit of 15.

🟢You can also move the stop loss closer to our entry to reduce this ratio. However, the entry and exit points should not be calculated arbitrarily, but solely based on analysis. If a trading position has a high risk-to-profit ratio, it is probably not worth "arguing" with the numbers and hoping for success. In this case, we recommend choosing another position with a good risk-reward ratio.

‼️Please note: positions with different sizes may have the same risk-to-profit ratio. For example, if we have a position worth $10,000, we risk losing $500 for a potential profit of $1,500 (the ratio is still 1:3). The ratio changes only if we change the relative position of our target and stop loss.

❤️ Please, support our work with like & comment! ❤️

CANDLESTICK PATTERN TRADING | Engulfing Candle 📚

Hey traders,

In this post, we will discuss a classic candlestick pattern formation each trader must know - the engulfing candle.

Key properties of this pattern:

🔑 Engulfing candle is a reversal pattern.

🔑 Engulfing candle can be bullish or bearish.

❗️Also, remember that this candle demonstrates the highest accuracy when it is formed on a key level (support or resistance).

⬆️Bullish Engulfing Candle usually forms after a strong bearish impulse.

Weakening, the market keeps going lower forming bearish candles.

However, at some moment, instead of forming a new bearish candle the market reverses. The price forms a bullish candle that engulfs the range of the previous bearish candle and closes above its opening price.

Such a candle we call a bullish engulfing candle.

The main feature of this pattern is the fact that its total range (distance from the wick high to wick low) & body range (distance from body open to body close) exceed the ranges of a previous bearish candle.

Being formed on a key support level or within a demand zone it signifies a highly probable pullback or even a trend reversal.

⬇️Bearish Engulfing Candle usually forms after a strong bullish move.

Reaching an overbought condition, the market keeps going higher forming bullish candles.

However, at some moment, instead of forming a new bullish candle the market goes in the opposite direction. The price forms a bearish candle that engulfs the range of the previous bullish candle and closes below its opening price.

Such a candle we call a bearish engulfing candle.

The main feature of this pattern is the fact that its total range (distance from the wick high to wick low) & body range (distance from body open to body close) exceed the ranges of a previous bullish candle.

Being formed on a key resistance level or within a supply zone it signifies a highly probable pullback or even a trend reversal.

📝Engulfing candle can be applied for scalping lower time frames, for intraday trading, or even for swing trading.

Personally, I apply this candle on daily/4h time frames as one of the confirmations of the strength of the structure level that I spotted.

Do you trade engulfing candle?

❤️Please, support this idea with like and comment!❤️

WHAT IS MARGIN? Traders must know this📚

✅Significant investments are required to gain access to foreign exchange markets. Not everyone who wants to try their luck in the world of trading has such funds. However, thanks to brokers that act as intermediaries and provide loans to traders, trading has become available to everyone. Thus, the essence of margin trading is to conclude transactions in financial markets with the use of borrowed funds provided by a broker.

🟢The second name of margin trading is trading with leverage. Leverage is the ratio of your deposit to the amount of the working lot. To obtain this kind of credit, the trader's account must also have his funds. The minimum of the initial deposit is different and depends on the requirements of a particular broker.

🟢The margin on the stock and foreign exchange market is a pledge that is blocked by the broker on the trader's trading account during the opening of the transaction. In margin trading, the broker can issue a loan both in cash and in the form of securities. Margin is usually expressed as a percentage, showing what proportion of own funds must be deposited to open a position on a particular instrument. For example, a margin requirement of 20% means the possibility of opening a transaction with financial instruments if there is a fifth of their total value on the account. And the margin requirement of 50% allows you to open positions for a certain amount, having 50% of it on deposit.

❗️Margin trading allows a trader to sell the market, entering short positions in case of forecasting a decline in the price of a particular instrument. Let's consider the principle of opening a short position on the example of stocks.

❗️Expecting a decrease in the price of Vesta shares, a trader takes ten shares from a broker on credit and sells them on the stock exchange at the current price. After the predicted price drop, he buys ten shares at a lower cost. By returning them to the broker, the trader remains in profit. The lower the stock price falls, the more profit the trader will get.

⚠️The above transactions are actually carried out much easier. Technically, a trader does not need to sell securities and subsequently buy them again. To do this, you only need to instruct the broker to open a short position. If the trader's forecast turns out to be correct and the forecast price decreases, the trader will close the deal, fixing the profit. Otherwise, if the price increases, the trader will receive a loss.

❤️ Please, support our work with like & comment! ❤️

Trading on Financial Markets | Your Guide to Trade Planning 📝

Hey traders,

In this post, we will discuss 6 crucial things in your trade planning and the main elements of trade results assessment.

1 - Before you open a trading position, make sure that you analyzed the chart. You should identify a market trend and spot major key levels.

2 - Once the chart is analyzed, you should identify the safest trading areas for your strategy (preferably the zones of supply and demand).

You should patiently wait until one of these zones is tested.

3 - Once the zone is reached, you should look for a confirmation. You can either look for a reversal candlestick/price action pattern, some fundamental trigger, or some indicator. The point is that you should rely on a trigger that is backtested and that proved its accuracy.

4 - Getting your confirmation, you should have a precise entry strategy. Some traders prefer aggressive entries on spot while others are waiting for a retest of some major/minor level.

5 - You must set a stop loss. Remember that your stop-loss defines the point where you become wrong in your predictions. Be extremely careful on that step and give the market some space for fluctuations.

6- Know your exact target level(s). Know the point where you start protection of your position, where you start profit-taking. Be very strict and don't let your greed and fear intervene.

Only then a trading position is opened.

No matter what will be the end result of your trade, you should assess it:

1 - You should journal the trade outlining its end result, trading instrument, and your entry reason.

2 - Note any peculiar thing about this trade that you noticed.

3 - Record your gain/loss percentage.

4 - Identify whether any mistake was made and if so, learn from that.

Here is your minimum plan to follow. Of course, as you mature in trading your trade assessment plan will be more sophisticated.

Do not underestimate its importance and treat it as the main element of your trading routine.

Do you plan your trades like that?

❤️Please, support this idea with like and comment!❤️

TRADING PSYCHOLOGY | Common Traps You Must Know 🧠💭💫

Hey traders,

Trading psychology plays a very important role in a learning curve of a trader. In this post, we will discuss common biases and traps that every struggling trader is occasionally facing.

⚓️Anchoring Bias

People rely too much on a reference point from the past when making a decision for the future - they are "anchored" to the past.

Imagine you spotted a great trading opportunity & made a nice profit. Encountering a similar setup in the future you trade it again. It turns out that you lose.

Next time - same thing. The setup that initially brought you nice cash refuses to work.

Even though the probabilities indicate that the identified pattern produces negative long-term returns, you keep taking that because you are "anchored" to the initial winner.

🙅♂️Loss Aversion

This is when people go to great lengths to avoid losses because the pain of loss is twice as the pleasure received from a win.

You see a great trading setup. You are 100% sure that it will play out. You open a trade and guess what? The market goes in the opposite direction. You can't believe that you are wrong. Instead, you decide to hold your position just a bit more adjusting your stop loss. And again, the market refuses to go in the direction that you projected. It is a vicious cycle that most of the time leads to substantial losses.

✅Confirmation Bias

The confirmation trap is when traders seek out the information that validates their opinions and ignores any theory that invalidates them.

You spotted a great long opportunity on GBPUSD. Checking the ideas of other traders on TradingView you consider only the ones that confirm your predictions completely ignoring the opposite ones.

👑Superiority Trap

Many traders have lost large sums of money in the past simply because they have fallen prey to the mentality of overconfidence.

Imagine that you caught a winning streak. You feel like the king of the world. You spend less and less time and reflection on each consequent trading decision that you make, you lose your focus. At some moment the reality kicks in and your gains evaporate.

🐮Herding

As a trader, you should execute your own analysis & avoid the temptation to blindly follow the majority.

Analyzing a EURUSD chart you make a conclusion that the market is bearish. However, then you see that 90% of the traders are very bullish on TradingView.

Instead of following your own analysis, you decide to join the herd.

These biases are common and most of the time we fall prey to them unconsciously.

The more you self-reflect, the more you analyze your thoughts and actions, it would be easier for you to avoid them.

Have your ever fallen prey to these traps?

❤️Please, support this idea with like and comment!❤️