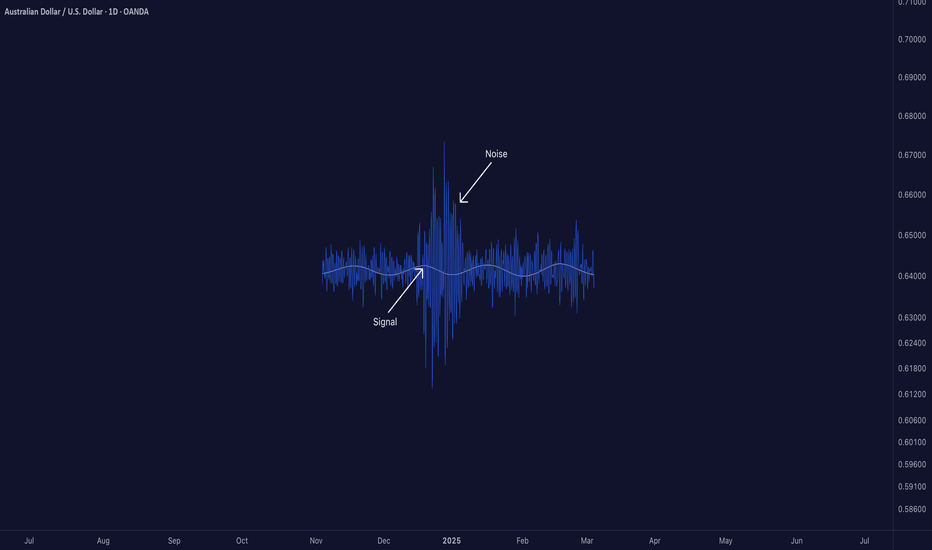

Signal-to-Noise Ratio: The Most Misunderstood Truth in Trading█ Signal-to-Noise Ratio: The Most Misunderstood Truth in Quant Trading

Most traders obsess over indicators, signals, models, and strategies.

But few ask the one question that defines whether any of it actually works:

❝ How strong is the signal — compared to the noise? ❞

Welcome to the concept of Signal-to-Noise Ratio (SNR) — the invisible force behind why some strategies succeed and most fail.

█ What Is Signal-to-Noise Ratio (SNR)?

⚪ In simple terms:

Signal = the real, meaningful, repeatable part of a price move

Noise = random fluctuations, market chaos, irrelevant variation

SNR = Signal Strength / Noise Level

If your signal is weak and noise is high, your edge gets buried.

If your signal is strong and noise is low, you can extract alpha with confidence.

In trading, SNR is like trying to hear a whisper in a hurricane. The whisper is your alpha. The hurricane is the market.

█ Why SNR Matters (More Than Sharpe, More Than Accuracy)

Most strategies die not because they’re logically flawed — but because they’re trying to extract signal in a low SNR environment.

Financial markets are dominated by noise.

The real edge (if it exists) is usually tiny and fleeting.

Even strong-looking backtests can be false positives created by fitting noise.

Every quant failure story you’ve ever heard — overfitting, false discoveries, bad AI models — starts with misunderstanding the signal-to-noise ratio.

█ SNR in the Age of AI

Machine learning struggles in markets because:

Most market data has very low SNR

The signal changes over time (nonstationarity)

AI is powerful enough to learn anything — including pure noise

This means unless you’re careful, your AI will confidently “discover” patterns that have no predictive value whatsoever.

Smart quants don’t just train models. They fight for SNR — every input, feature, and label is scrutinized through this lens.

█ How to Measure It (Sharpe, t-stat, IC)

You can estimate a strategy’s SNR with:

Sharpe Ratio: Signal = mean return, Noise = volatility

t-Statistic: Measures how confident you are that signal ≠ 0

Information Coefficient (IC): Correlation between forecast and realized return

👉 A high Sharpe or t-stat suggests strong signal vs noise

👉 A low value means your “edge” might just be noise in disguise

█ Real-World SNR: Why It's So Low in Markets

The average daily return of SPX is ~0.03%

The daily standard deviation is ~1%

That's signal-to-noise of 1:30 — and that's for the entire market, not a niche alpha.

Now imagine what it looks like for your scalping strategy, your RSI tweak, or your AI momentum model.

This is why most trading signals don’t survive live markets — the noise is just too loud.

█ How to Build Strategies With Higher SNR

To survive as a trader, you must engineer around low SNR. Here's how:

1. Combine signals

One weak signal = low SNR

100 uncorrelated weak signals = high aggregate SNR

2. Filter noise before acting

Use volatility filters, regime detection, thresholds

Trade only when signal strength exceeds noise level

3. Test over longer horizons

Short-term = more noise

Long-term = signal has more time to emerge

4. Avoid excessive optimization

Every parameter you tweak risks modeling noise

Simpler systems = less overfit = better SNR integrity

5. Validate rigorously

Walk-forward, OOS testing, bootstrapping — treat your model like it’s guilty until proven innocent

█ Low SNR = High Uncertainty

In low-SNR environments:

Alpha takes years to confirm (t-stat grows slowly)

Backtests are unreliable (lucky noise often looks like skill)

Drawdowns happen randomly (even good strategies get wrecked short-term)

This is why experience, skepticism, and humility matter more than flashy charts.

If your signal isn’t strong enough to consistently rise above noise, it doesn’t matter how elegant it looks.

█ Overfitting Is What Happens When You Fit the Noise

If you’ve read Why Your Backtest Lies , you already know the dangers of overfitting — when a strategy is tuned too perfectly to historical data and fails the moment it meets reality.

⚪ Here’s the deeper truth:

Overfitting is the natural consequence of working in a low signal-to-noise environment.

When markets are 95% noise and you optimize until everything looks perfect?

You're not discovering a signal. You're just fitting past randomness — noise that will never repeat the same way again.

❝ The more you optimize in a low-SNR environment, the more confident you become in something that isn’t real. ❞

This is why so many “flawless” backtests collapse in live trading. Because they never captured signal — they captured noise.

█ Final Word

Quant trading isn’t about who can code the most indicators or build the deepest neural nets.

It’s about who truly understands this:

❝ In a world full of noise, only the most disciplined signal survives. ❞

Before you build your next model, launch your next strategy, or chase your next setup…

Ask this:

❝ Am I trading signal — or am I trading noise? ❞

If you don’t know the answer, you're probably doing the latter.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Learntrading

When Intuition Beats the Algorithm█ When Gut Feeling Beats the Bot: How Experience Can Improve Algorithmic Trading

In today’s world of fast, data-driven trading, we often hear that algorithms and rules-based systems are the future. But what happens when you mix that with a trader’s intuition, the kind that only comes from years of watching charts and reading price action?

A recent study has some surprising results: A seasoned discretionary trader (someone who trades based on what they see and feel, not just rules) was given a basic algorithmic strategy. The twist? He could override the signals and use his instincts. The result? He turned a losing system into a winning one, big time.

█ What Was the Experiment?

Researchers Zarattini and Stamatoudis (2024) wanted to test whether a skilled trader’s experience could boost a mechanical system. They took 9,794 stock “gap up” events from 2016 to 2023, where a stock opens much higher than the day before, and let the trader pick which ones looked promising.

⚪ To make it fair:

All charts were anonymized — no names, no news, no distractions.

The trader had only the price action to guide his choices.

He could also manage open trades — adjusting stop-losses, profit targets, and position sizing based on what the price was doing.

⚪ The Trading Setup

█ What Did They Find?

The trader only selected about 18% of all the gap-ups. But those trades performed far better than the full list. Here's what stood out:

Without stop-losses, the basic strategy lost money consistently (down -0.25R after just 8 days).

With the trader involved, profits rose fast, hitting +0.80R just 4 days after entry.

Risk was tightly managed: only 0.25% of capital was risked per trade.

⚪ So what made the difference? The trader could spot things the system missed:

Strong momentum early in a move

Clean breakouts from long sideways ranges

Patterns that had real follow-through, not just random gaps

He avoided weak setups and managed trades like a pro, cutting losers, letting winners run, and trailing positions with smart stop placements.

⚪ Example

An experienced trader can quickly identify a breakaway gap, when a stock gaps up above a clear resistance level. Unlike random gaps, this setup often signals the start of a strong move. While a system might treat all gaps the same, a skilled trader knows this one has real potential.

█ What Does This Mean for You?

This research shows that trading experience still matters — a lot.

If you’re a systematic trader, adding a discretionary filter (whether it’s your own review or someone else’s) could drastically improve your results. A clean chart read can help you avoid false signals and focus only on the best setups.

If you’re a discretionary trader, this study is proof that your skills can add measurable value. With the right tools and discipline, you don’t need to throw away your instincts, you can combine them with structure and still win.

█ Key Takeaways

⚪ Gut feeling isn’t just noise, trained instincts can spot what rules miss.

⚪ Trade selection matters more than just following every signal.

⚪ Managing risk and exits well is just as important as picking good entries.

⚪ Hybrid trading, rules plus judgment — might be the most powerful combo.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Understanding Market StructureIn this video, I break down market structure in a simple and easy-to-digest way, helping you understand how to identify whether the market is in an uptrend or downtrend.

Recognizing market direction is a key skill for any trader, it allows you to trade in alignment with price action and make more confident, higher-probability decisions.

✅ If you're new to trading or want to sharpen your edge, this video will give you the insights needed to read market trends more clearly.

📈 Hope you find value in this breakdown!

👉 Don’t forget to like, comment, and subscribe to support the channel and stay tuned for more educational content.

Trading account types explainedForex trading offers exciting opportunities for individuals at various levels of expertise and risk tolerance. One of the first steps to becoming a successful trader is selecting the right type of trading account. Your choice can significantly impact your experience and success in the market. Below, we explore three common types of trading accounts: Cent Account , Demo Account , and Standard Account , based on their features, suitability, and intended users.

1. Cent Account

Ideal for Beginners with Low Risk and Small Deposits

A Cent Account is specifically designed for new traders or those who wish to minimize financial risks while gaining exposure to live market conditions. With balances measured in cents instead of dollars, this account type allows users to trade real money but on a much smaller scale.

Features:

- Requires only a minimal deposit to get started.

- Allows traders to gain real-world trading experience without the fear of losing large sums of

money.

- Provides an opportunity to test strategies and broker conditions with smaller risks.

Who Should Choose This?

- Beginners looking to transition from demo accounts to live trading.

- Traders testing a new strategy or broker platform without risking significant capital.

2. Demo Account

Ideal for Testing Strategies Without Financial Risk

The Demo Account is a virtual trading account that allows users to practice trading without using real money. It mirrors actual market conditions, enabling traders to understand market mechanics, test strategies, and familiarize themselves with trading platforms.

Features:

- No financial risk since all trading is done with virtual funds.

- Simulates real market movements to provide a realistic trading experience.

- Perfect for refining trading skills and strategies before moving to live accounts.

Who Should Choose This?

- Complete beginners who need to learn the basics of forex trading.

- Traders developing or testing new strategies and indicators in a risk-free environment.

3. Standard Account

For Experienced Traders with Higher Risk Tolerance

The Standard Account is designed for experienced traders who are ready to handle larger trades and higher risks. It operates in full dollar amounts, providing access to the full range of trading opportunities offered by forex brokers.

Features:

- Requires a higher initial deposit compared to Cent Accounts.

- Offers higher profit potential but comes with increased risk.

- Grants access to standard lot sizes and advanced trading tools.

Who Should Choose This?

- Experienced traders with a good understanding of market dynamics and risk management.

- Those seeking higher returns and willing to take on the associated risks.

How to Choose the Right Account

When deciding which trading account to open, consider your experience level, risk tolerance, and trading goals:

- If you're new to forex or prefer to trade with minimal risk, a **Cent Account** is a great starting point.

- If you want to practice without financial consequences, a **Demo Account** is the ideal choice.

- If you're confident in your trading abilities and ready for larger stakes, the **Standard Account** may suit your needs.

Remember, the key to successful trading is starting with the right account and gradually progressing as your skills and confidence improve. Always approach trading with a clear strategy and a focus on risk management.

Potential trade setup on BRTUSDWe are looking at a short trade on BRTUSD based on the stretch strategy. There is trend and direction alignment with this trade. Trade has taken out the upper stretch but higher timeframes trend and direction is to the downside. We will take the trade with a higher probability towards opposite stretch level being taken out. We will exit the trade once range has been achieved.

Trader Order Details:

BRTUSD(Short)

E - 71.55

SL - 72.43

T - 70.40

We will be tracking this move and updating the post as we go along on the charts and on video. Keep a look out for it traders.

5 Common Mistakes New Traders Must Avoid

Trading in the financial markets can be an exciting journey, but it's not without its challenges. Many new traders often make common mistakes that can lead to losses and frustration. Understanding these mistakes is essential for developing a successful trading strategy. In this idea, we will discuss the top five mistakes new traders make and provide practical tips on how to avoid them. By being aware of these pitfalls, you can improve your trading skills and work towards achieving your financial goals.

1. Lack of a Trading Plan

Mistake: Many new traders dive into trading without a well-defined plan. They often trade based on emotions, tips from friends, or market hype, which can lead to inconsistent results and unnecessary losses.

Solution: Develop a comprehensive trading plan that outlines your trading goals, risk tolerance, entry and exit strategies, and criteria for selecting trades. A good plan should also include guidelines for risk management, such as how much capital you are willing to risk on each trade. Stick to your plan, and avoid making impulsive decisions based on market fluctuations or emotions.

Key Elements of a Trading Plan:

-Objectives: Define what you aim to achieve (e.g., short-term gains, long-term investment).

-Risk Management: Determine how much you are willing to lose on a single trade and set stop-loss orders accordingly.

-Trading Strategies: Decide on the type of analysis you will use (technical, fundamental, or a combination).

2. Ignoring Risk Management

Mistake: New traders often underestimate the importance of risk management, leading to excessive losses. They may over-leverage their positions or fail to set stop-loss orders, which can result in significant financial damage.

Solution: Implement strict risk management rules. A common rule of thumb is to risk no more than 1-2% of your trading capital on a single trade. This approach allows you to withstand several losing trades without depleting your account. Use stop-loss orders to limit your losses and consider using trailing stops to protect profits as trades move in your favor.

Tips for Risk Management:

-Position Sizing: Calculate the appropriate size of your trades based on your risk tolerance.

-Stop-Loss Orders: Always set a stop-loss order to exit a trade if it moves against you.

-Diversification: Avoid putting all your capital into a single trade or asset.

3. Overtrading

Mistake: In an attempt to make quick profits, new traders often engage in overtrading. This can result from the desire to recover losses or the excitement of seeing trades executed, leading to poor decision-making and increased transaction costs.

Solution: Set specific criteria for entering and exiting trades, and resist the urge to trade more frequently than necessary. Focus on quality over quantity. It's better to wait for high-probability setups than to force trades that don’t meet your criteria.

Strategies to Avoid Overtrading:

- Limit Trading Frequency: Define a maximum number of trades per day or week.

- Review Trades: After each trading session, review your trades to assess whether they adhered to your trading plan.

- Take Breaks: If you find yourself feeling overwhelmed or impulsive, take a break from trading to reset your mindset.

4. Emotional Trading

Mistake: Emotional trading occurs when traders let their feelings dictate their decisions. Fear, greed, and frustration can lead to impulsive trades, often resulting in losses.

Solution: Practice emotional discipline. Recognize that emotions can cloud your judgment and lead to poor trading decisions. Use techniques such as journaling to reflect on your trading experiences and identify emotional triggers.

Techniques to Manage Emotions:

-Set Realistic Expectations: Understand that losses are a part of trading, and not every trade will be profitable.

-Develop a Routine: Establish a pre-trading routine to calm your mind and focus on your trading plan.

-Mindfulness Practices: Consider techniques such as meditation or deep-breathing exercises to manage stress and maintain focus.

5. Neglecting Market Research and Education

Mistake: New traders sometimes jump into trading without sufficient knowledge about the markets, trading strategies, or economic indicators. This lack of understanding can lead to poor decision-making.

Solution: Commit to continuous learning. Take advantage of the wealth of educational resources available online, such as webinars, articles, and trading courses. Stay updated with market news and analysis to understand the factors influencing price movements.

Steps for Education:

Read Books: Invest time in reading books on trading, market psychology, and investment strategies to deepen your understanding and broaden your knowledge base.

Practice with a Demo Account: Before trading with real money, use a demo account to practice your strategies in a risk-free environment.

Join Trading Communities: Engage with other traders on platforms like TradingView, where you can share insights and learn from each other.

Follow Experts: Subscribe to trading blogs, YouTube channels, or podcasts from experienced traders.

Trading is a journey that requires discipline, patience, and a commitment to continuous learning. By avoiding these common mistakes and implementing effective strategies, new traders can enhance their trading skills and improve their chances of success in the financial markets. Remember, every trader faces challenges, but those who learn from their experiences and adapt will ultimately thrive.

Potential trade setup on GBPUSDWe are looking at a short trade on GBPUSD based on the stretch strategy. There is direction alignment with this trade, though the trend is still uptrend phase 2. Trade has taken out the lower stretch. We will exit the trade once range has been achieved.

Trader Order Details:

GBPUSD(Short)

E - 1.3082

SL - 1.3095

T - 1.3024

We will be tracking this move and updating the post as we go along on the charts and on video. Keep a look out for it traders.

Potential trade setup on GBPUSDWe are looking at a short trade on GBPUSD based on the stretch strategy. There is direction alignment with this trade, though the trend is still uptrend phase 2. Trade has taken out the lower stretch. We will exit the trade once range has been acheived.

Trader Order Details:

GBPUSD(Short)

E - 1.3274

SL - 1.3307

T - 1.3217

We will be tracking this move and updating the post as we go along on the charts and on video. Keep a look out for it traders.

Live Trading Session 263: Open trade on BTC,Gold and moreIn this live trading session video,we look at our open positions on Bitcoin,Gold,potential trades coming up on the other instruments and the thinking behind them. The concepts you learn from this video are cross transferrable principles onto any strategy.

Q2 and 100k TC Performance ReviewIn this live trading session video,we look at our Q2 performance on our live trading room strategies as well as our 100k Traders Challenge(TC) Account performance. We then look at the improvements we have introduced and the key actions points going forward. The concepts and ideas in this video can be cross transferred onto any strategy.

3 key points in Performance ReviewIn this live trading session video,we look at our current open position on AUDUSD trade and a review of our trade history on our traders challenge account. We then take a deep dive analysis on the 3 key points in performance review like a professional. The concepts and ideas in this video can be cross transferred onto any strategy.

Live Trading Session 262: Open trade on ETH,EUR and moreIn this live trading session video,we look at our open positions on Etherum,EURUSD,closed positions on BRTUSD for nice decent profit, potential trades coming on Bitcoin,S&P, etc and the thinking behind them. The concepts you learn from this video are cross transferrable principles onto any strategy.

Brent stopped out and Drawdown increasingIn this live trading session video,we look at the BRTUSD trade that got recently stopped out for a small loss on the 100k traders challenge account. We also look closely at the drawdown and why this is happening according to the strategy characteristics on both 50% OE and 20% OE strategy. Finally, we explore on what we should do about this by looking at 3 different options. The concepts and ideas in this video can be cross transferred onto any strategy.

Live Trading Session 261: Open trade on BRT and potential tradesIn this live trading session video,we look at our open positions on BRENT and potential trades coming on Bitcoin,Etherum,S&P, etc and the thinking behind them. The concepts you learn from this video are cross transferrable principles onto any strategy.

Aussie for small profit and Sys vs Cash,3 pointsIn this live trading session video,we look at the AUDUSD trade that got recently stopped out for small profit on the 50k traders challenge account. 3 of the previous trades got stopped out before this and we look at how we should review the strategy as a professional if it is still working. We look at the the 3 steps we need to do for this System vs Cash results analysis review. The concepts and ideas in this video can be cross transferred onto any strategy.

Live Trading Session 260: Open trade on BRT and potential tradesIn this live trading session video,we look at our open positions on BRENT potential trades coming on Bitcoin,Etherum,S&P, etc and the thinking behind them. The concepts you learn from this video are cross transferrable principles onto any strategy.

Live Trading Session 259: Positions on GBP,BRT and moreIn this live trading session video,we look at our positions on BRENT and GBPUSD and potential trades coming on Bitcoin,Etherum,US30, etc and the thinking behind them. The concepts you learn from this video are cross transferrable principles onto any strategy.

AUD & GBP stopped out,EURJPY in & 3 key pointsIn this live trading session video,we look at the three trades that we recently took on the 50k traders challenge account. 2 of them,AUDUSD and GBPUSD got stopped out and we explore why we took them at lower risk. We also look at the 3 key points we need to be aware of when we are going through a drawdown. The concepts and ideas in this video can be cross transferred onto any strategy.

Why we took brent at low risk and channels?In this live trading video,we look at why we took the Brent oil trade at low risk using price and volume on our 100k traders challenge account. We explore the use of channels with relation to the smart money framework. The concepts and ideas in this video can be cross transferred onto any strategy.

Q1 Performance review,OE,Actual Re:Ri & SelectionIn this live trading video,we look at the underlying concept behind our OE basesd strategies,why actual reward:risk is more important than Expected,how to select your trades and our Q1 performance review on our 100k traders challenge account. The concepts and ideas in this video can be cross transferred onto any strategy.

Live Trading Session 257: Potential & open positions on GBP,etcIn this live trading session video,we look at current live, open and closed positions on BRENT and GBPUSD and potential trades coming on Bitcoin,Etherum,US30, etc and the thinking behind them. We also look at how we are doing on our live 100k traders challenge account.