Lennar Corp | LEN | Long at $116.48Across the US, there is a pent-up demand for housing (for the vast majority of locations). While the media likes to selectively report home sales dropping for certain regions, it is more due to mortgage rates and seasonality than demand. Mortgage rates are anticipated to come down over the next 1-2 years and home builders will step in to pick-up the lack of inventory. Healthy companies like Lennar Corp NYSE:LEN , with a P/E of 8x, dividend of 1.68%, very low debt-to-equity (0.17x), etc are likely to prosper, but always stay cautious with the dreaded "recession" announcement if it creeps in...

Thus, at $116.48, NYSE:LEN is in a personal buy-zone. In the near-term, I do see the potential for the price to dip near $100 as tariff and other economic red flags continue to be in focus.

Targets:

$131.00

$145.00

$157.00

$180.00

LEN

LEN Lennar Corporation Options Ahead of EarningsIf you haven`t sold LEN before the previous earnings:

Now analyzing the options chain and the chart patterns of LEN Lennar Corporation prior to the earnings report next week,

I would consider purchasing the 170usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $3.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

LEN Lennar Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of LEN Lennar Corporation prior to the earnings report this week,

I would consider purchasing the 185usd strike price Puts with

an expiration date of 2024-10-4,

for a premium of approximately $5.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Warren Buffet buying homebuilders after huge runsNot sure what NYSE:BRK.A NYSE:BRK.B is thinking, Warren Buffet.

Is he expecting a huge demand for NEW HOMES?

There was increase in demand after large drop.

Maybe thinking that the Fed reduces #interestrates after things begin to crack, more?

TVC:TNX has been pumping (10 Yr), no signs of weakness.

They've all had huge runs NYSE:DHI NYSE:NVR NYSE:LEN.B

🤷♂️

#RealEstate

LEN Entry, Volume, Target, StopEntry: when price clears 117.54

Volume: average or better

Target: 129 area

Stop: Depending on your risk tolerance; 113.72 gets you 3/1 Reward to Risk Ratio.

This swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

LEN Lennar Corporation Options Ahead of EarningsIf you haven`t sold LEN here, for a quick profit:

Then Analyzing the options chain of LEN Lennar Corporation prior to the earnings report this week,

I would consider purchasing the 110usd strike price Puts with

an expiration date of 2023-7-21,

for a premium of approximately $2.67.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

LENNAR appears overboughtBased on historical movement, the peak could occur anywhere in the larger red box. The final targets are in the green boxes. The pending bottom should occur within the larger green box as has been the historical case. Half of all movement has ended in the smaller green box. In this instance, the signal indicated SELL on July 21, 2022 with a closing price of 82.08.

If this instance is successful, that means the stock should decline to at least 81.65 which is the top of the larger green box. Three-quarters of all successful signals have the stock decline 2.218% from the signal closing price. This percentage is the top of the smaller green box. Half of all successful signals have the stock decline 4.588% which is the end point of the black dotted arrow. One-quarter of all successful signals have the stock decline 7.85% from the signal closing price which is the bottom of the smaller green box. The maximum decline on record would see a move to the bottom of the larger green box. These are the same concepts for the levels in the red boxes as well.

The ends/vertical sides of the boxes are determined in a similar fashion. The trough of the decline can occur as soon as the next trading bar after signal close, while the max decline occurs within the limit of study at 40 trading bars after the signal. A 0.5% decline must occur over the next 40 trading bars in order to be considered a success. Three-quarters of successful movement occur after at least 11 trading bars; half occur within 23 trading bars, and one-quarter require at least 35 trading bars.

The black dotted arrow represents median historical movement. Medians are a good metric, but they are just one of many I use when forecasting future movement.

As always, the stock could decline the very next bar after the signal without looking back (therefore the red boxes would not come into play) or the stock may never decline (and the green boxes may never come into play).

LEN Can Beat Earnings, but There is Still Needed Balance BelowLEN looking for a beat this upcoming call to confirm it's current overhead price targets.

With price targets as high as $112, I see $99-$101 short term due to lower equilibrium needed.

I see $104-$106 as a mid-term goal, to then check back into most recent broken channel as new support channel.

THE WEEK AHEAD: FDX, LEN, MU, CCL EARNINGS; XOP/XLE, IWM/RUTEARNINGS ANNOUNCEMENT-RELATED VOLATILITY CONTRACTION PLAYS (IN ORDER OF ANNOUNCEMENT):

Here are the options-liquid underlyings announcing next week that I've culled down to 30-day >50% as candidates for volatility contraction plays:

LEN (21/49/11.6%),* announcing Wednesday after market close

MU (24/52/12.2%), announcing Wednesday (no time specified)

FDX (29/53/11.9%), announcing Thursday after market close

CCL (27/91/21.1%), announcing Friday (no time specified)

Pictured here is a January 15th 17.5/27.5 short strangle in CCL which announces Friday, paying 1.36 as of Friday close with delta/theta of -4.86/4.84 with break evens wide of 2 times the expected move on the call side, and between the 1 and 2 x on the put. Although no time is currently specified, it is likely to announce before market open (because who, like, announces after Friday close?), so would look to put on a play in the waning hours of Thursday's session if you want to take advantage of Friday's post-announcement volatility contraction.

EXCHANGE-TRADED FUNDS RANKED BY BANG FOR YOUR BUCK:

XOP (21/60/16.3%)**

GDXJ (15/44/12.9%)

XLE (30/45/12.5%)

KRE 924/41/11.1%)

SLV (25/40/11.2%)

GDX (16/38/10.7%)

EWZ (15/39/10.6%)

XBI (24/38/10.0%)

BROAD MARKET EXCHANGE-TRADED FUNDS:

IWM (25/30/7.8%)

QQQ (23/30/7.6%)

DIA (16/23/6.0%)

SPY (16/23/5.6%)

EFA (20/24/5.1%)

TREASURY/BOND FUNDS:

Adding a little bond/treasury section to here since I occasionally park what would otherwise be idle cash in short puts (See Post Below).

TLT (11/15/3.99%) (1.609% yield)

HYG (11/11/2.41%) (4.917% yield)

EMB (5/9/--)*** (4.024% yield)

AGG (29/8/--)*** (2.252% yield)

* -- The first metric is the implied volatility rank or percentile (i.e., where 30-day implied is relative to where it's been over the last 52 weeks); the second, 30-day implied volatility; and the third, what the January 15th at-the-money short straddle is paying as a function of stock price.

** -- Here, I'm using the short straddle price nearest 45 days until expiry to calculate the "bang for your buck" percentage, which would be the January 29th weekly.

*** -- EMB and AGG don't have weeklies nearest 45 days.

$LEN Bullish Descending Megaphone$LEN Bullish Descending Megaphone

$LEN has formed a beautiful descending broadening wedge or descending megaphone into its earnings report Monday after close. This pattern retested previous highs and bounced, showing support on a perfect retest of $71.30. First target is previous highs around $79.50 which I am looking for Monday into Earnings. I am looking to stay long LEN & homebuilders in general through earnings but will take some profits at first target.

$XHB on the whole looks decent

Component $DHI looks good

$TOL broke out & looks fantastic

BTO $LEN 9/18 $80c

LEN 72 LEN call PT is 72. I have a call for 69 out on the 24th. Was a beauty. Broke out but again the news kinda ruined the run. Didn’t sell. Theta wont ruin it. Held that 62 support very nicely so that’s good. Will monitor throughout the rest of the week. Was going off the double bottom to bull flag. Will alert if losses need to be cut.

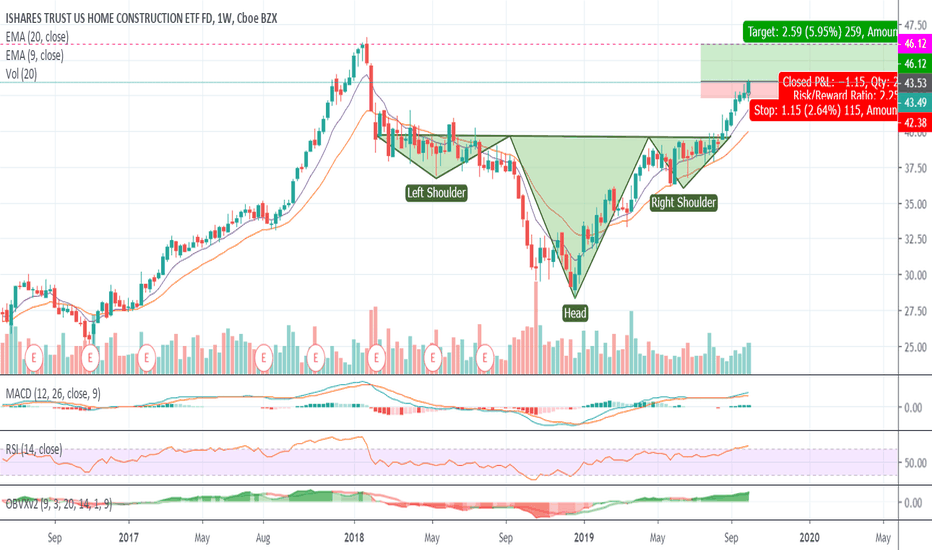

ITB Homebuilders, weekly chart has more room to runITB Homebuilders 3x ETF, weekly chart has more room to run. Daily chart is ready for break out. Inverse H and S . LEN , KBH and DHI all had great earnings reports recently. Above $46.35 would be all time highs. The FED should be cutting rates again with the Oct 4th economic data, so more bullishness for homebuilders. Good luck!