Level

BCN (Bytecoin). 1 target wedge + 50%. Rounded bottom + 371%BCN (Bytecoin) A rounded bottom is formed. We are now in the 2nd phase of the formation of this global, long-forming figure.

In the second phase, trading volumes are at a minimum. The coin is not interesting to anyone, "faith is killed," the price is at a historic low, the dump is over. The second phase of the formation of this figure differs in equalizing prices after the dump and a decrease in trading volume.

In most cases, such long-forming formations as a rounded bottom become turning figures of trends. But this does not always happen. Therefore, it is very important that this is the correct entry and exit point in case the price goes against you. It’s better to buy a little more expensive, but it’s already in the birth of an uptrend, than to buy at the bottom and get stuck with this coin.

Volatility also decreased; at the local level, the coin formed a small downward wedge. The purpose of this wedge + 50% This will be the first target. Here is the penetration of this wedge and it will be possible to move to the 3rd phase of the formation of the figure "Round bottom". And the beginning of an uptrend. The maximum target for the “Rounded bottom” figure (Saucer, Cup) is the resistance of this formation + 371%.

If the price breaks through the resistance of the figure of the cup and fixes above it , thereby confirming the reversal of the global trend, the next target is the height to the depth of the cup, the same 370%. And this is more than + 700% of current prices.

Let me remind you BCN (Bytecoin) is an old coin for pumping. Pumps in the past were hundreds of percent and repeatedly.

Monero Top Coin Monero (XMR) is a fork of this coin! Probably few people know about this, as it was a very long time ....

Target:

1) + 50% (fast trading).

2) + 171%

3) + 271%

4) +700%

1) Entrance on a wedge breakout or rollback after a breakthrough if short-term trading.

2) Entrance at the beginning of the 3rd phase of the formation of the "Cup" figure when confirming a local uptrend.

Stop Loos - under the support level of the foundation of this formation, set the Stop Loos value with the calculation of your trading strategy and money management.

Remember that on such coins, due to weak liquidity, ballast is easily reset before a market turn. So your Stop Loos may be among this ballast. What matters is not the Stop Loos value, but the entry point!

SPLK Shifting SidewaysSPLK is shifting to a trading range pattern as it enters a new all time high level. SPLK gapped and ran up strongly out of a mid-trend short-term bottom.

SINA Trading RangeSINA is stuck in a trading range of 10–15 points despite strong buyback activity that supports the stock at the lows of the range. SINA buybacks are struggling to maintain the price level.

Vedanta - H4 charts - support levelNSE:VEDL on the H4 chart approaching oversold zone on the RSI which is coinciding with the bottom of the sideways channel formation and on the daily charts we can see that is currently in the mid green zone on RSI, price could test 139 levels. Watch out if the price bounces off support , if yes, may go upwards toward the upper channel.

Ideally, don't trade the channel, look for breakouts. These maybe more profitable!

Trying between channels is riskier, know your risk!

If you like what you read, please share a thumbs up and follow for more updates!

Cheers

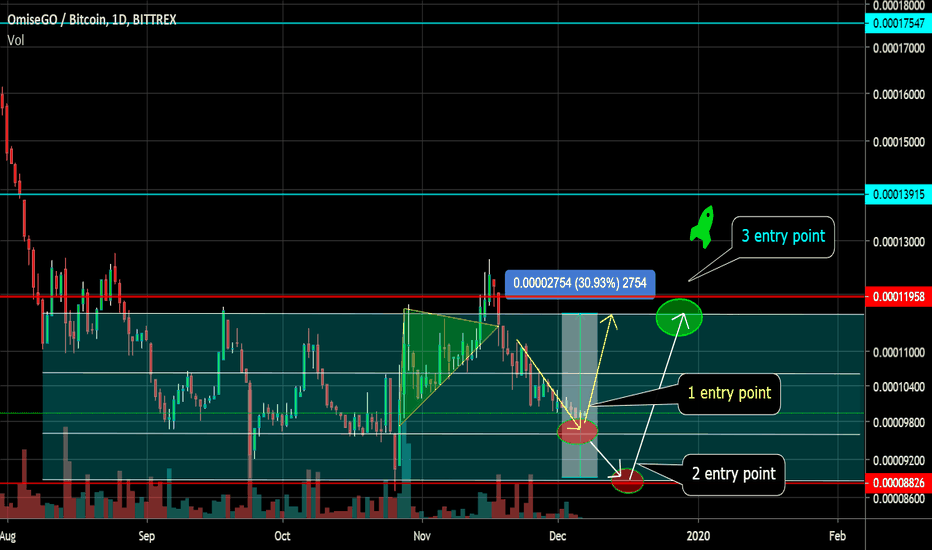

OMG / BTC Channel operation in 30% increments. Pivot points.After a false breakdown of the triangle, the price moved according to option 2 - trading in the channel.

OMG / BTC Operation in the horizontal accumulation channel in increments of 30%.

Pivot points breakthrough / retention of important support / resistance levels on which further movement I will depend on the chart.

I also showed various options for entering the market after confirming support for a certain local level.

The target are all on the chart depending on what price movement is confirmed.

A breakthrough of the channel and fixing the price above the resistance of the channel will open upside potential to higher targets than the potential of the channel.

Stop loss

Under key support levels during your entry into the market.

Do not forget to move Stop Loss during the price increase, but take into account the volatility of the coin.

EOS local downlink. Potential + 50%Now the price is moving in the local downward channel in increments of 50%. The price is now near support, potentially, if support is confirmed in this formation, you can take a local movement + 50%

Points (zones) of a pivot and potential targets , depending on the reaction of the support / resistance level, I showed on the graph.

Stop Los s below the downtrend line. Which is the support of the channel.

STOP LOSS TO BREAK EVEN + SOME PROFITNo point letting this trade turn into a looser now. Two lower highs created, so some structure to help create a logical place to move the stop too. Stop will be now at 1.46825. Worry free trade now, let the market go where it wants on this pair now.

Updates to follow.

$WORK Looking for entry$WORK is rising from the ashes here. Look to break the first level and buy in for some long term positions. This is a ticker that should be kept on a tight leash though, set good stops and follow them. $WORK can reject at any of the levels.

ONCT crossing above a crucial levelONCT has reached a crucial level on the eve of earnings news.

It might crash down if it can't hold above this level or it might climb to $8.2 if it can hold above this level.

Earnings call on Thursday will fuel the move up or down.

Position will be based on the next couple days.

Level Analysis on $XRPZ19As we can see XRP is playing with the recent range levels. On both sides we can see the level touches: 1 touch, 2 touch, fake out on 3rd touch, back to range with force.

Not enough power to clear out the order book in the upper range, hence a heavy drop. On the downside of the range we have even more touches and the fakeout in the beginning. I applied the fibs according to the levels and ignored the first fakeout. I suspect price to breaking the lower level, taking it back into the 1.68 with a short term target of 0.000027 - more downside suspected. Very risky trade because of SWELL now, they could drop a bomb every second and make the price explode. Take care and have your stops.