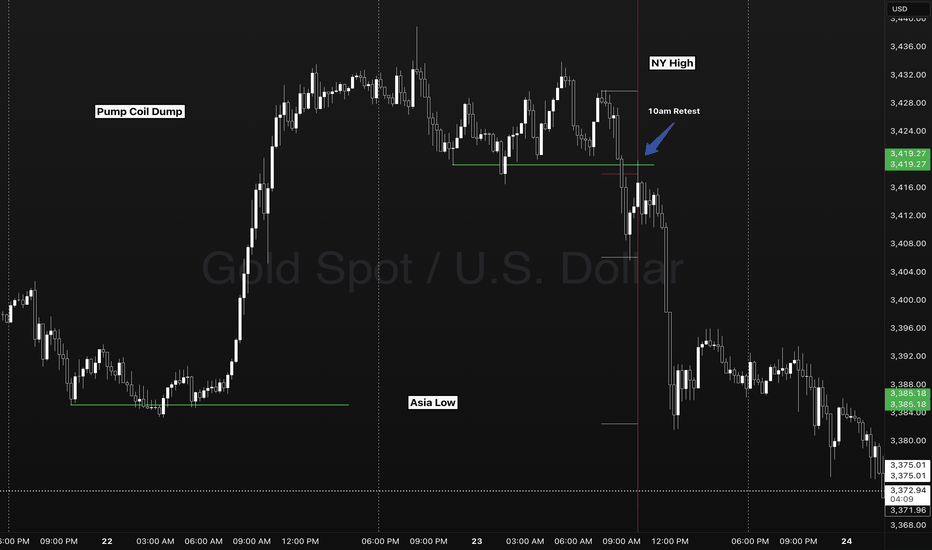

Gold two session setups - Timings Levels Behavior of PriceIn this example we see FOREXCOM:XAUUSD forming a simple and scalable setup interacting with key session levels and key times of day.

- 4HR OPEN CLOSE (10:00am)

- SESSION TIME RANGES

- DAILY HIGH/LOW

- SESSION HIGH/LOW

Here on my chart I use no lagging indicators. A previous session ranges high and low represents the major liquidity levels. A classic break and retest going into the NY session took place at 10:00am offering a parabolic opportunity back to a previous days session low.

SIMPLICITY IS KEY. Stay away from trading gaps, sweeps, hunts, soups on the inside of a high and low. The market only does two things.

- Breakout, fail, reverse.

- Breakout, pullback, continue.

Its important to be on a higher time frame to capture multiple sessions of liquidity areas. As a new trader I found looking to take a trade instead of waiting for a setup. 1 minute charts with multiple moving averages, oscillators, macd. Essentially a science project! Keep it simple traders. Patience pays. Timing, levels, behavior of price.

Levels

XAU/USD Intraday Plan | Support & Resistance to WatchGold has continued its rally, breaking through the 3,416 resistance and pushing into the next upside zone.

Price is now trading around 3,421, just below the 3,440 resistance cluster.

The structure remains bullish with price holding firmly above both the 50MA and 200MA, which are acting as dynamic support.

A confirmed break and hold above 3,440 would open the path toward 3,458 and potentially the higher‑timeframe target at 3,478 if momentum extends.

If price fails to sustain above 3,416–3,440 and begins to fade, watch the initial pullback toward 3,400.

A deeper move below that would shift focus to 3,383 - 3,362 and then the Pullback Support Zone.

Failure to hold there could expose price to the lower Support Zone if bearish pressure builds.

📌 Key Levels to Watch

Resistance:

‣ 3,440

‣ 3,458

‣ 3,478

Support:

‣ 3,416

‣ 3,400

‣ 3,383

‣ 3,362

‣ 3,336

🔎 Fundamental Focus

⚠️Not much on the calendar today. Still, manage your risk and stay prepared for any unexpected volatility.

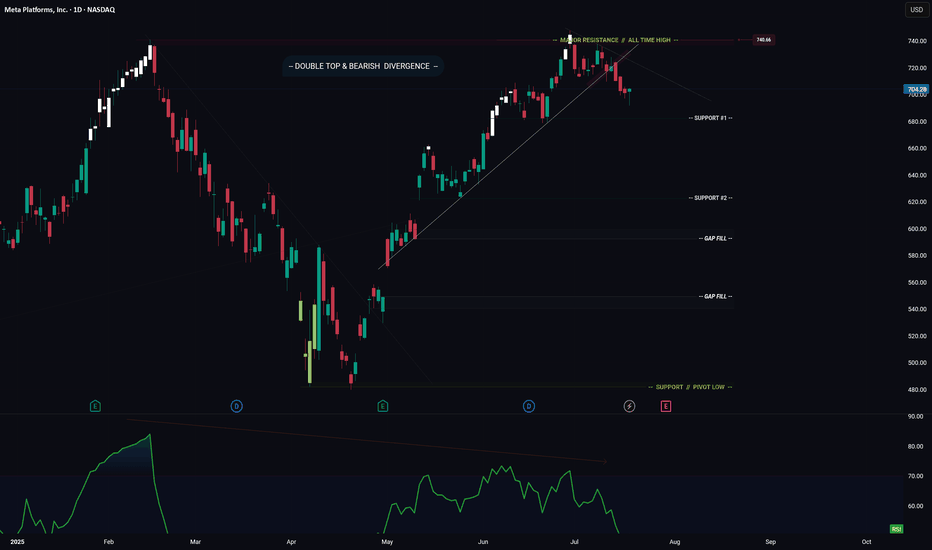

META -- Breakdown? Or Move Higher? Levels To Watch ForHello Traders!

Meta has broken down from its ascending trendline. This is bearish.

In addition price has formed a major Double Top pattern with Bearish Divergence.

Bearish Factors

1) Breakdown of ascending trendline

2) Double top

3) Bearish divergence

Two things need to happen if META is going to make a move higher...

1) Price needs to stay above "Support #1"

2) Price needs to break above the descending trendline (connecting the range highs)

IF price does breaks lower... where do we start looking for long positions?

- Support #2 is a great starting point, however if price makes it to support #2, then I could also see price trading down to fill the gap just below.

- This is where you could enter again to average down your position.

Thanks everyone and best of luck on your trading journey!

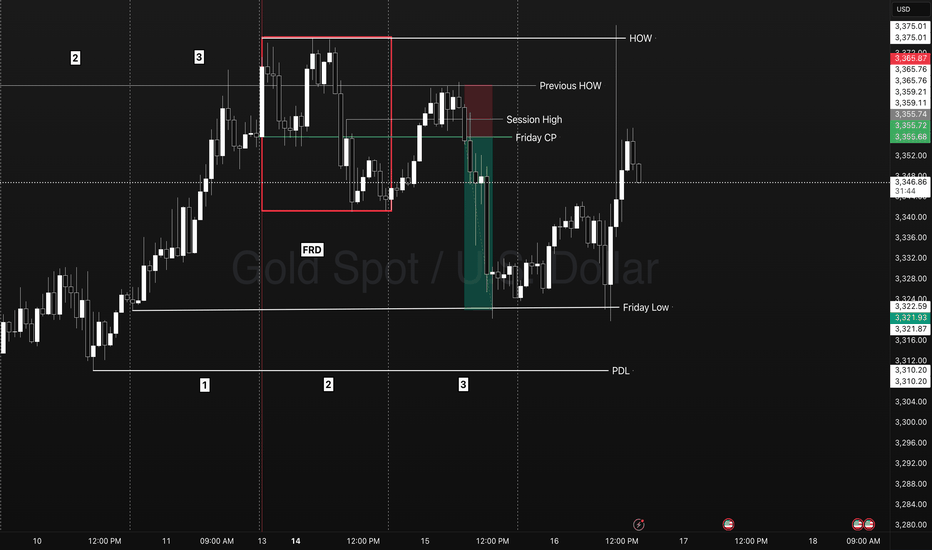

XAUSD - Using HOW levels for a break and retest!Identify what signal a market is showing you.

TYPES IOF SIGNAL DAYS

- First red/green day

- Dump/Pump

- Inside day

Frame the Trade play

- Reversal

- Continuation

Identify the Levels

- HOW/LOW

- Session High/LOW

- Friday Closing Price.

Trade Explanation

On the previous week FOREXCOM:XAUUSD triggered 3 days of breakout traders into the market closing in breakout. On Monday we have a FRD signal that sets up a next day trade opportunity. A retest of a previous weeks high gave us an indication of a retest/reversal trade on day 3 below Fridays closing price. Into the NY session this market quickly displaced back to Friday day 1 LOD level. Going into Tuesday day 2 we had the test of a weekly level and reversal above a session high closing below the Friday closing price. The break of a previous weeks high triggered more breakout traders into the market however it failed. We know day 2 typicall expands the range on Monday for a great parabolic trade setup right to as previous days low.

NO GUESSING, NO FOMO, NO FEAR, NO STRESS!

- Friday Closing Price (Entry)

- Previous HOW (Stop)

- PDL (Target)

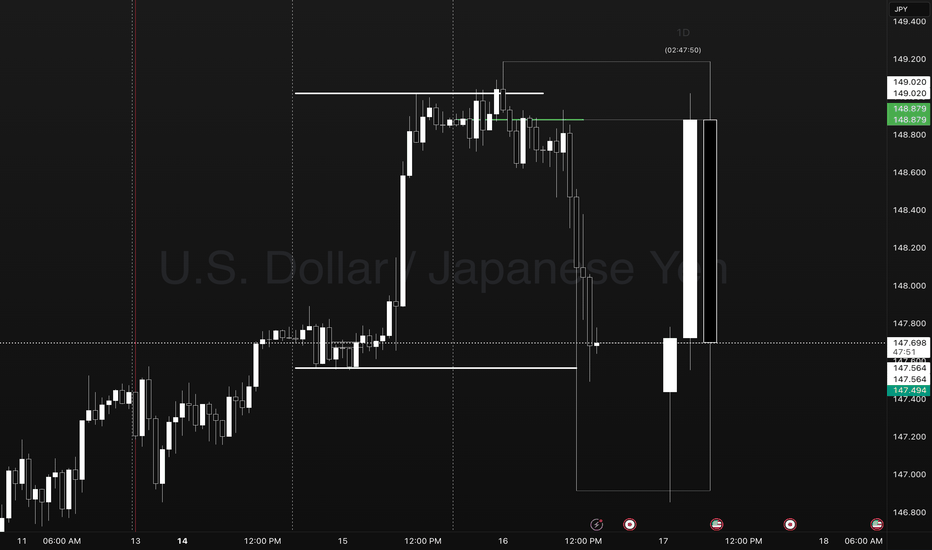

Pump Coil Dump Day 1-2-3 USDJPYUSDJPY Reversal Trade.

Points to Notice

Day 1 - Sets the new week high and low. Establishes a new week closing price as a target for a day 3 setup.

Day 2 - Typically expands Mondays range in the direction of the underlying oder flow. This occurs as a pump/ dump leading to the Asia and London coil sideways.

Day 3- We take note of the previous day high and low to observe price going into the NY session. In this case Price gave signs of a coiling reversal into the evening setting up for the move below Day 2 closing price.

Ideally what you want to see in this template is traders faked into a breakout move in the direction of the pump. This can present as a candle close above yesterdays high or closing price.

After trapping traders in we see the change in order flow creating a new lower low. This is the confirmation to look for an entry at the previous days closing price.

We set a stop at the high of day 3 level or at the previous days high with a target at the previous days low. In extreme cases we may see a setup that expands to the LOW level.

THE ONLY IMPORTANT DATA POINTS.

- PREVIOUS DAY HIGH AND LOW

- CLOSING PRICE

- LOW HOW LEVELS

- DAY COUNT

MARKETS ONLY DO TWO THINGS

- BREAKOUT, FAIL, REVERSE

- BREAKOUT, RETEST, TREND.

ONLY LEVELS THAT ARE TRADED

- PREVIOUS DAY HIGH (STOP LOSS)

- PREVIOUS DAY CLOSING PRICE (ENTRY)

- PREVIOUS DAY LOW (TARGET) CMCMARKETS:USDJPY FX:EURUSD OANDA:USDJPY

Mid-Session Market InsightsMid-Session Market Insights

In today's session, I'm closely monitoring eight different futures markets: S&P 500, NASDAQ 100, Russell 2000, Gold, Crude Oil, Euro Dollar, Yen Dollar, and Aussie Dollar.

S&P 500: We're seeing a rotational pattern within the prior day's value area and the CVA. I'm eyeing long opportunities from the prior value area low up to the high.

NASDAQ 100: The market is a bit choppy around the PVA and CVA highs, with a slight upward intraday trend. I'm staying cautious here.

Russell 2000: Also choppy, but we've got acceptance within the CVA. I'm looking for long opportunities from the CVA low, which aligns with the prior day's low.

Euro Dollar: I'm currently short from the CVA high, with the first target at the prior day's low. We've broken below the prior value area, so I'll trail this trade and see how it develops.

Yen Dollar: It’s been a bit of a mixed bag. I took a short below the CVA and prior day's low, got stopped out, but it was still a decent setup.

Aussie Dollar: I took some long positions that weren't the best setups, as it was quite choppy near the CVA high and prior day's low. Lesson learned for next time.

Crude Oil: I took a short from the CVA and PVA highs, hit my target at the low of those areas, and we’re currently hovering around that level.

XAUUSD H4 Outlook – July 7, 2025“You don’t chase gold. You set the trap, then wait.”

👋 Hey traders — we’re gearing up for a new week on gold, and the H4 chart is starting to speak clearly. After Friday’s clean push into premium rejection zones, price is now compressing beneath a key supply block. Structure is fragile, and the next move will likely come fast.

Let’s position with precision before the breakout.

—

🔸 H4 Bias

Structure remains bearish short-term, with clear lower highs forming below a major supply at 3344–3351.

The broader bias leans neutral as we trade between unmitigated demand and inducement-heavy resistance. Confirmation is everything.

—

🔴 Supply Zones (Sell Areas)

3344–3351

→ H4 Fair Value Gap + OB combo inside premium

→ If price wicks above recent highs and rejects here, it could trigger a clean swing sell.

3380–3394

→ Origin of the last bearish leg + liquidity wick

→ High-risk, high-reward rejection zone if price spikes impulsively this week (e.g. post-Fed tone or surprise volatility).

—

🟢 Demand Zones (Buy Areas)

3265–3275

→ H4 FVG + flip zone + prior sweep level

→ If price taps and holds here, we may see re-accumulation for a move toward 3327–3340.

3235–3246

→ Strong unmitigated OB + discount level

→ Ideal sniper long zone only on clean rejection + structure shift (BOS on M15+).

—

🟡 Flip / Decision Zone

3299–3305

→ EMA50 + micro-range equilibrium

→ If price breaks and holds above this zone with strength, bias turns short-term bullish. If it rejects, continuation down is favored.

—

🎯 Execution Notes

EMA21/50 are acting as active compression bands — watch for rejection pressure

RSI shows no clear divergence yet — but volume is thinning

Liquidity is building above 3340 and below 3265 — prepare for traps both ways

—

🔚 Final Words

Sniper traders aren’t early — they’re precise. If you’ve been reacting too fast lately, this is your week to reset. Gold is telling a story here… but only structure speaks the truth.

🚀 If this helps bring clarity to your outlook, tap follow — we do this daily, with structure, not signals.

—

📢 Disclosure: I use Trade Nation’s broker feed on TradingView and I’m part of their influencer program.

📉 This is educational content, not financial advice.

VSA vs BTC: Into a Bearish Scenario or Not?Predicting the market requires skill.

Most traders fail at one crucial point: they don’t see the market as a living, breathing organism—a structure where one move leads to another, like cause and effect in motion.

That’s what we often call reading the psychology of the market. When you begin to grasp the fundamental principles behind that, you step into the realm of elite traders.

And yes—Volume Spread Analysis (VSA) is a powerful tool, but only if you know how to read it properly.

I’m not a certified trader or financial advisor, and I don’t give signals, entries, or exits. I’m simply a solo observer, sharing a slice of what true technical and fundamental analysis looks like.

And yes—it takes time. It takes skills. Now, if we want to even attempt predicting the future of price action, we must understand something: A chart is not a single truth. It’s a battlefield of conflicting signals.

Patterns, marks, levels—some suggest bullish continuation, others hint at sharp reversals. Confusion is inevitable if you don’t learn to distinguish which signs matter.

In our current BTC chart, we’re witnessing this contradiction unfold clearly:

• A bullish flag formation...

• Yet within it, the emerging completion of a Head & Shoulders pattern!

How arrogant can the market be! 😄

A moment to laugh—but also a moment to observe how cleverly the crowd is misled.

This is classic manipulation, wrapped in a textbook setup.

But what’s most telling isn’t the pattern on the surface—it’s the volume beneath the structure.

It’s always the quiet details that speak the loudest.

Before price shows its true face, volume often leaves footprints. In our case, those footprints were already leading toward a bearish path—long before the structure began to shape itself clearly.

So while retail eyes focused on the bullish flag, the underlying volume had already begun withdrawing support.

Not aggressively—no. Subtly, almost elegantly, in that familiar way institutions mask intention:

• Spikes that don’t hold

• Buying that doesn’t follow through

• And a steady fade in commitment as price climbs into weakness

It’s in those quiet inconsistencies where VSA earns its value.

It tells us: the move isn’t about what’s obvious.

It’s about what never fully materialized.

So yes, the pattern may still remain incomplete. The Head & Shoulders may yet fail to validate.

But for those who were watching volume first—not structure—the script was already being written.

✒️ From now on, professionally speaking, we must still wait:

• For the Head & Shoulders to confirm or dissolve. So eyes targeted at the swing low level near 107k

• And for volume to either legitimize or invalidate the entire setup

Only then does the chart grant us permission to speak in certainties.

🐾 But so far…

• The clues have favored the bears.

• Sell opportunities appeared early and often—for those who know what to look for.

• Bullish spikes in volume? They were met with silence.

• Momentum fizzled under a macro backdrop of fading demand.

If you were in the right mindset, and aligned even the lower timeframes to basic structural zones,

you already saw the path ahead wasn’t being carved by the bulls.

Let them finish the patterns.

Let the candles paint the story.

But for those trained in volume, the ink has already dried.

And if you're still reading, maybe you already sense it—

real insight doesn’t shout, and it never floats in abundance.

Value has never been about noise. It’s about what’s rare, quiet, and overlooked by the crowd.

Just like in the markets—the true signals aren’t loud, and they’re never free in the economic sense.

Just as price rises where supply thins, the same applies here:

what’s scarce... holds weight.

PS For last A little exercise, something to grasp on. Have you noticed how Volume & RSI behaves in lower time frames? 4Hour or 1Hour for example. Can you identify how volume confirms a bearish move. Do you discover the correct correlation and combined use between VSA & RSI. Remember my previous insight

See you next time!

HelenP. I Gold may bounce from trend line to resistance levelHi folks today I'm prepared for you Gold analytics. After observing this chart, I see that the price tried to grow to the resistance level first, but failed and dropped to the support level, which coincided with the buyer support zone. After this correction movement, XAU rebounded up and then dropped below the support level, breaking it. But soon, price turned around and made impulse up, breaking the 3265 level, after which it continued to move up to the resistance level. When Gold reached this level, it entered to resistance zone, where it turned around at once and made a strong movement down to the trend line, breaking two levels. Also then it started to trades inside a triangle, and soon turned around from the trend line and made a strong impulse up. Price broke the 3265 support level one more time, rose a little more, and then made a correction. After this, price continued to move up and soon reached the 3395 resistance level, after which it turned around and fell to the trend line, which is the support line of the triangle as well. Recently, it started to grow, so I expect that XAUUS will correct to the trend line and then continue to move up to the resistance level. That's why the 3395 resistance level is my current goal. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

"Crypto Charts Whisper—Are You Listening?"As I’ve mentioned before, the market is manipulated. In a previously published idea, “VSA vs BTC: Into a Bearish Scenario or Not?”, this manipulation becomes obvious. The big players—whales, institutions, banks—are deliberately engineering traps to absorb liquidity from uninformed retail traders, boosting their profits and power.

Some informed retail traders like you and me understand that behind these entities are teams of insiders and highly trained traders operating around the clock—24/7, 365 days a year. That’s what it takes to survive in such a demanding environment.

This is especially true in the crypto market, which—despite its explosive growth—is still a baby in terms of total market cap. That’s why price fluctuations are so extreme, whether it’s Bitcoin, Ethereum, or altcoins.

Many of you who have been in the space since the early days already know: Bitcoin is the king. As the first coin built on cryptography, Bitcoin leads the way—and where it goes, altcoins follow. These movements often align with changes in Bitcoin Dominance.

So, yes, Bitcoin is the king—but its movements aren’t random. Bitcoin follows rules, and these rules are shaped by data—especially macroeconomic data. One major example is the Consumer Price Index (CPI), released monthly by the U.S. Department of Labor and Statistics.

And here's the key: the big players often have early access to this kind of information. They prepare accordingly—days before the official release—and when the data hits, they move the markets up or down. Even whales don’t act on gut feelings. They follow a framework.

We, as retail traders, must adopt a similar approach. We may not have insider access, but we do have knowledge—and with an open mind, we can act in advance.

As I’ve emphasized before: learning to read Market Structure lets you decode not just market psychology, but also the intentions of the big players. Their large positions leave footprints, just like a ship cuts a path through water. That trail is visible—for those who know where to look.

If you study volume correctly, you’ll start to notice certain zones that keep coming back. That’s all I’ll say—for now.

Unfortunately, many traders rely blindly on strategies like swing trading, expecting price to react at predefined swing highs or lows. But this rarely happens on schedule—especially in crypto. Yes, swing highs and lows exist—that’s the nature of all markets—but in between those levels, the big players create hidden structures that act as signals.

These aren’t just random formations—they’re part of how the big players "communicate" with one another. First, to maintain balance within their own circles. Second, to create FOMO and trap emotional retail participants.

Look at the SHIBA INU chart I’ve shared. This technique is unfolding in real time. Do you notice how the structure is compressing? How price and new swing levels are squeezing in? Look closer at the footprints I’ve highlighted—some of those levels are being respected and reused in the future.

We’re taught from childhood that "we can’t know the future." But is that really true? Repetition of such beliefs is common—worldwide. But again, is it true? I think not.

Think about this: if you drive a car full-speed toward a wall and don’t brake, what happens? You crash. Isn’t that a form of future reading? It’s based on logic, observation, and probability. The same tools we use in market analysis.

So, I hope my words challenge your thinking.

📅 As of this writing (June 11, 2025), Bitcoin is trading at $109,588.

Today’s candle still has about 17 hours left to form, and price action on the daily timeframe is sitting within a previously established supply zone. Bulls and bears are clashing here. But zoom in: what's happening on the lower timeframes? Which signals have been tested, and which haven't?

Are we about to see a breakthrough above the all-time high?

Could this be the launch of the next leg of the bull run?

GBPJPY: Weekly OverviewHello Traders,

Everything is clear in the chart. the yellow line is a HTF resistance.

********************************************************

The indicated levels are determined based on the most reaction points and the assumption of approximately equal distance between the zones.

Some of these points can also be confirmed by the mathematical intervals of Murray.

You can enter with/without confirmation. IF you want to take confirmation you can use LTF analysis, Spike move confirmation, Trend Strength confirmation and ETC.

SL could be placed below the zone or regarding the LTF swings.

TP is the next zone or the nearest moving S&R, which are median and borders of the drawn channels.

*******************************************************************

Role of different zones:

GREEN: Just long trades allowed on them.

RED: Just Short trades allowed on them.

BLUE: both long and short trades allowed on them.

WHITE: No trades allowed on them! just use them as TP points

#ES_F Weekly Prep 06.01 - 06.06.25Last week we have consolidated, built a cost basis under HTF Edge Top and made a push into new HTF Ranges Value on Wednesday after some news, we made it into the Mean of that range but failed to hold before the open trapping Supply in Value. Thursday held under the Edge and by Friday built up enough supply to flush Holiday Cost basis into lower Value where the selling stopped at the Mean and we started covering, being mid day Friday and End of Month we got strong enough covering to take us all the way back into the Edge/into current Intraday Ranges top which is around 930 - 25 Area.

Question for this week is, was that a strong bid on Friday which will give us a hold and continued pushes into above VAL over the Edge or was it just a retest of this Edge top from below, momentum traders pushed us out on news and now we are back inside 930 - 770s HTF Range ?

Looking at our structure, we had Trend Change on Thursday during RTH Open and for now we have closed Friday in downward correction Trend. This tells us that its possible that we have failed to accept inside new above HTF Range and if that is the case then we could target moves back down towards lower areas of VAH / Mean / VAL and if there will be volume moves under it.

For things to change and to see stability + strength out of here we would need to see a good push over 930s which could hold over AND see a move over 941 - 45 area, without that need to be careful with longs into those areas as our Supply and Sellers are around and over us.

Things have been slow and moves take a while to set up so Current Intraday Range could act as support and we can see price trade back and forth inside it with Holiday Cost basis providing Support, BUT if we do get through that under VAH then we can see further moves down towards Mean and VAL which has another cost basis there that we can try to fill out and it could hold the price around it, to see any more weakness from there we would need to find ourself under VAL and be able to get into that 800 Balance area, it is new Month and we do have Market Moving Data this week so it could happen.

If this will be the case good entry areas for continuation lower could be found around

914 - 10 // 900 - 896 // 869 - 65 // 855 - 51 careful around 824 - 20 and IF we attempt for move into lower Balance could find entries for it at 810 - 06

IF Trend does change and we hold over the Edge OR we hold Current Intraday Range and some of the weekly Data/News will push us over 941 - 45 then we could see moves into above VAL / Mean and would look for Entries around 955 - 59 // 986 - 90 if this will be the case need to be careful with looking for too much continuation over the Mean as there will be selling closer to above VAH we get and especially if we see pushes into/over it as there is more supply above, if move higher happens we would probably look to stay under 630 - 20s and If Holiday Cost Basis holds as Support the could also find long entries at 896 - 900 area after we hold under but need to be careful with looking for big moves and try to grab area to area as market moves and back fills very efficiently lately so watch out for back and forth trading while its moving towards targets.

Bitcoin Levels in 2025Prediction levels on Bitcoin in 2025.

*first step - 143000 $ - 144000 $

* quick shot and back - 210000 $

* almost imposible in 2025 - 280000 $

We waiting for Fed decissions in this week.

- FOMC protocol 28 may 2025 - 19:00 (GMT +1)

- PKB USA 29 may 2025 - 2:30 PM (GMT +1)

- Core PCE 30 may 2025 - 14:30 (GMT +1)

Weekly Analysis for BTC (May 26–30)BTC played out clean last week. Broke above 108k, tapped a new ATH at 110.5k, and pulled back slightly. Structure still bullish — 4H HLs holding strong and 107k retest held nicely into weekend close.

Key level to watch is 110k. If we break that with momentum, price can push to 115k or even 120.7k based on fibs and hype continuation. If we reject again, we might pull back to 107k or 100k — still a buy zone unless 88k breaks.

On the macro side, confluence is heavy:

– ETFs still driving big money inflow

– US debt growing after Trump’s new tax bill

– Moody’s downgrade adds more pressure

– Geopolitical tensions + safe-haven flow also helping BTC hold strength

– Holiday week in the US (Memorial Day), so volume might be low — fakeouts possible if liquidity dries up

Best zones to watch this week:

🔸 110k breakout for continuation

🔸 107k and 100k pullback buys

🔸 110.5k ATH for possible rejection scalps

As long as 88k holds, structure is clean. Bias remains bullish with both TA and macro pointing up.

Will be posting more detial daily anaylsis. follow for more updates. Or check out Streefree_trade IG.

Review and plan for 23rd May 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

If Trend Reverses, We'll Most likely See 106-109k FirstTrading Fam,

We'll bring our knowledge of liquidity to the chart here today. You guys know that my new indicator utilizes liquidity as a prime factor in helping to alert us when to buy and sell any given asset. In our chart here today, I have also brought over the liquidation map from Glassnode, which will help us gain further insight into what Bitcoin's next move might be.

First, let me explain a few of the drawing here.

For those who may be new, those liquidity blocks are printed by LuxAlgo's "Liquidity Swings" indicator. I have incorporated them into my indicator and have combined it with another to alert me as to exactly when it might become a good time to buy or sell. Typically, I set the blocks to have a 15 day life cycle. When we are overbought and enter into a sell-side liquidity block, my indicator will flash a red dot. When we are oversold and enter into a buy-side liquidity block, my indicator will flash a green dot. These are typically super-accurate signals and are, at least, a good time to start your exits and/or entries but unfortunately, these DOTS DO NOT APPEAR in this chart due to this being a private indicator distributed by invite only.

I use additional indicators for confirmation and to support what my indicator is showing me, such as the VRVP. You can see the VRVP Point of Control (PoC) is at 96,425 in this chart, meaning that most of our recent traded volume is to the underside of us right now. This is positive. However, it is important to recognize that sometimes that PoC can act as sort of a magnet to pull price back to that area before further directional price trend movement. Keep this in mind as we continue to consider price movement here.

Back to the liquidity blocks. I've extended our last big liquidity block from Jan-Feb of this year out past the normal 15 day life cycle that I usually set. I think this is important as it appears to align with the data that I've brought over from Glassnode's Liquidation Map. Notice that on the map you see large liquidity pools both below the current price and also, above it. But the larger liquidity pool remains above us at the time of this post. This aligns with the resistance levels I have drawn on the chart in white which remain above us. And currently, we are also forming a bull flag pattern. So, are greatest probability of price movement right now remains to the upside. I am targeting that 106-108k area. Once hit, trend reversal could occur.

Here's what I expect.

We hit 106-108k. Then, at this point, the market must make a critical decision; do we continue up, beating previous highs, or do we first drop down and liquidate all those late longs from 93-104k?

Now, since we know that big money is in this game and wants as much as they can get at the best price possible, it is easier to determine what might occur. I suggest that once liquidation occurs up to 106-108k, sell-side pressure will be placed on the market in hopes of driving price back down to clean out all of those late long entries. That PoC level at around 96k is a good target here. Once this price has been hit, freeing up hundreds of millions in liquidated Bitcoin, the big buyers (smart money) will step back in to swoop up the loot and Bitcoin will be free to trend back up again.

Now, as always, I could be wrong. Let's talk about what happens if we beat our 106-108k overhead resistance levels. In this case, we could see Bitcoin pump as high as 125k before any local trend reversal begins to occur. I will re-assess at this point.

BLUF: 106-108k is key resistance. Mark your charts and keep your eye on what price does there. It will be key to what happens next.

✌️Stew

USDJPY Analysis: Reversal Estimations Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels. The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). Please note that all times indicated on the chart, including the vertical lines representing potential reversal times, are based on the UTC+4 time zone.

To increase the probability of these analyses, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Double Bottom/Top

Engulfing Bullish /Bearish

Hanging Man

Hammer/Inverted Hammer

Morning Star

Shooting Star

Triple Top/Bottom

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

Price levels

Price DH Price DL

144.52194 144.63007

144.48096 144.67107

144.38595 144.76618

144.19602 144.95648

144.00622 145.14691

143.81654 145.33746

143.62698 145.52814

143.43756 145.71894

143.24825 145.90987

143.05907 146.10093

142.30361 146.86639

141.55015 147.63385

140.79868 148.40332

140.04922 149.17478

139.30176 149.94824

138.55630 150.72370

137.81283 151.50117

137.07137 152.28063

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

Short setup on SPX (x2)After the most recent upward move, the SPX shows clear signs of weakness, suggesting a potential short setup.

Since mid-July, the SPX has been moving upward and it's now near its all-time high. However, the RSI Exhaustion at the bottom of the chart has significantly declined and hasn't recovered much, establishing a downtrend.

This divergence between the price and the RSI Exhaustion is the first major signal of a possible short configuration.

Three additional signs support this setup:

The RSI Exhaustion shows recent bullish exhaustion (indicated in green), signaling that further price increases are unlikely.

The price has formed a top just shy of its all-time high, as identified by the Bottoms Tops Signal indicator.

A major level has formed, as indicated by the Levels and Zones indicator. While this level turned into support, it originated as resistance and could well revert back to it should be price start to drop further.

Is the bull run over? Only time will tell, but for now, it's crucial to remain patient and always seek confirmation from the indicators.

Play on Levels124 - 124.50 Very Important Support on Monthly Basis.

Bearish Divergence on Weekly TF that is why it pushed the

price downwards.

Now Hidden Bullish Divergence & Bullish Divergence on Hourly

TF has triggered the price up. Bullish Momentum will resume

once 146 is Crossed & Sustained. Now it is Important to Sustain 134

on Monthly TF & if 165 is Crossed & Sustained, Next Target

can be around 190+

On Daily TF, 134 - 135 is a Resistance. Crossing it will

touch the price around 138-139

Key Levels & Trading Plan for the Current Market Trend1. Identified Key Levels

Type Price Level (Approx.) Significance

Major Resistance 22,700 - 22,800 Previous support turned resistance; strong rejection possible.

Minor Resistance 22,400 - 22,500 Short-term bounce zone; potential sell-off area.

Current Price Zone 22,100 - 22,200 Market hovering near key support; decision point.

First Major Support 21,800 - 21,900 Next critical level; breakdown could accelerate selling.

Second Major Support 21,500 - 21,600 Deeper demand zone; last line of defense before more downside.

2. Trading Strategies Based on Key Levels

Bearish Continuation Trade (Higher Probability)

• Entry: Look for a pullback to 22,400 - 22,500 for short positions.

• Stop-Loss: Above 22,700 to avoid getting trapped in a fakeout.

• Take-Profit 1: 21,900 - 22,000 (First major support).

• Take-Profit 2: 21,500 (Next strong support).

Bullish Relief Rally (Lower Probability)

• Entry: If price forms a bullish engulfing candle + high volume around 21,800 - 22,000.

• Stop-Loss: Below 21,600 to limit downside risk.

• Take-Profit 1: 22,400 - 22,500 (Short-term bounce area).

• Take-Profit 2: 22,700 (Stronger resistance).

3. Risk Management & Confirmation Signals

• Bearish Confirmation:

• Price rejection at resistance (22,400-22,500).

• Low bullish volume on pullbacks.

• Large red candles breaking support.

• Bullish Confirmation:

• Strong reversal candle at key support.

• Increase in buying volume.

• Break above 22,400 with momentum.

Final Outlook

• Primary Bias: Bearish → Look for short opportunities on pullbacks.

• Secondary Bias: Bullish only if price shows strong reversal near 21,800 - 21,900.