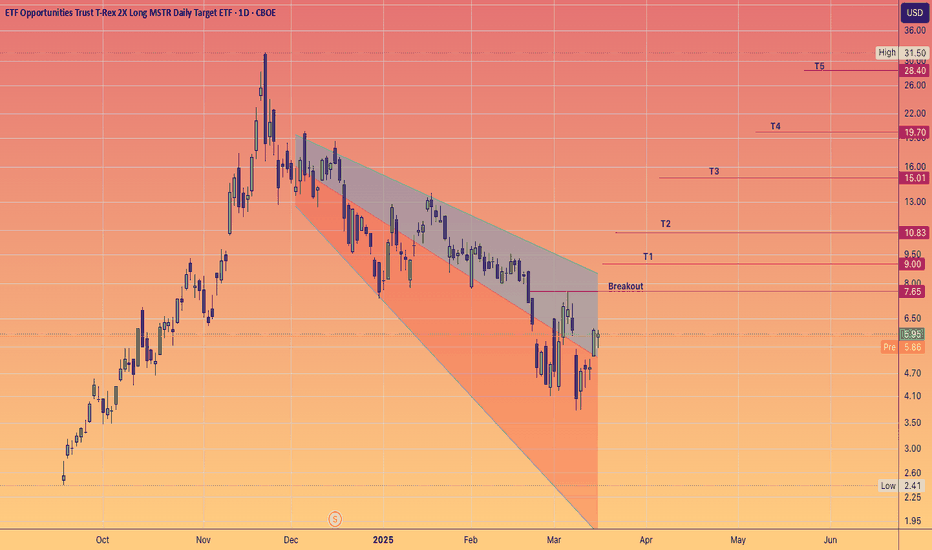

Double down like Michael Chad Saylor - MSTR ----> MSTU 2X"Are you convicted?"

Of Bitcoin achieving a new All time high if so Saylor will greatly rewarded and lauded.

MicroStrategy's unwavering focus on acquiring Bitcoin through unconventional financing methods, rather than building a sustainable revenue-generating business, carries significant risks, especially if a major bear market were to hit the cryptocurrency sector again. This exposure to Bitcoin offers a distinctive investment opportunity for those looking to gain leverage in the crypto space without direct participation.

While MicroStrategy's inherent volatility may deter more traditional investors, it also provides a platform for those eager to engage with market dynamics. The MSTU adds an additional layer of volatility, but unlike options, it does not have an expiration date.

Investors should closely monitor Bitcoin's market fluctuations, as these directly influence MSTR's stock price, potentially creating advantageous entry points for savvy traders.

Leverage

Compound 6X Trade-Numbers (1,788% Potential)Compound hit bottom. This is a trade setup that recently went badly for us, it failed but, I would like to try again.

There is a clear double-bottom signal, short-term, and a long-term higher low. This chart setup is perfect for a new bullish jump. Truly a great set up based on the chart structure and signals.

Notice the volume. Always the volume. There is no volume on the bearish wave.

Notice the strong volume within the bullish wave.

That is all I have to say. I am going LONG.

Full trade-numbers below:

_____

LONG COMPUSDT

Leverage: 6X

Entry levels:

1) $53

2) $49

3) $46

Targets:

1) $57

2) $66

3) $81

4) $93

5) $105

6) $122

7) $144

8) $168

9) $183

10) $207

Stop-loss:

Close weekly below $45

Potential profits: 1788%

Capital allocation: 4%

_____

Thank you for reading.

Remember, you can do whatever you want. It is your life, your money, your computer... Your responsibility.

Namaste.

Ethereum Classic 8X Trade-Numbers (6,480% Potential)The longest consolidation phase ever is still happening. This is positive for the upcoming bull-market. The longer it takes for Ethereum Classic to move forward, the stronger the growth when it does.

The profits potential on the title is based on a $183 conservative target. As you can see on the chart, ETCUSDT can reach $282 or even $450 or higher. What is important here is the entry and long-term hold.

Let's do some maths:

5X with a $20 entry and a target at $300 would equal to 1,400%. That would be a total 7,000% growth potential with 5X at current price. ETCUSDT.

Another example is 7X, same entry and a target of $444. That would be a huge 14,840% potential if such a target is hit. Without leverage, that would be 2,120%, from $20 to $444.

Below you can find more conservative numbers but still very strong.

_____

LONG ETCUSDT

Leverage: 8X

Entry levels:

1) $21.1

2) $20.1

3) $19.1

Targets:

1) $25.8

2) $27.6

3) $31.2

4) $37.1

5) $44.9

6) $52.5

7) $63.5

8) $77.2

9) $92.8

10) $102

11) $117

12) $128

13) $142

14) $160

15) $183

Stop-loss:

Close monthly below $18

Potential profits: 6480%

Capital allocation: 5%

_____

Something important, once the initial bullish breakout happens, the first jump, there is no going back. Once this move happens, Ethereum Classic, Bitcoin and the entire market will never be the same. The lowest prices after the end of this incoming bull-market will be many times higher compared to what we are seeing today. It is truly the last chance to see Crypto at a discount, trading this low. Once the market starts to move, it will a new world.

Hundreds of thousands of new millionaires will be created. A new economy, the nouveau rich, it will be a different world.

It is not the same saying, "the market is going up," vs experiencing this growth. When the next bull-market start, it will be wild, it will be crazy, it will be amazing and we will be rewarded big time for being early.

Anyway, I am ready for the biggest cycle since I started to write and trade. What about you?

Are you ready for change? Positive change.

It will be amazing. I am telling you.

Namaste.

Aptos 6X Trade-Numbers (3,558% Potential)Aptos was one of the pairs that helped us identify the bottom early. The low was clearly established 3-February and the rest of the action has been shaky but clearly sideways with higher lows. This one left no room for doubt.

Once we hit bottom, look at the action in August 2024. After the low was in, no new lows. The same for Bitcoin, I was one of those that got caught. Will not make the same mistake.

The time is now. We are bullish now. We are ready for growth and we are going LONG.

After a down-wave comes an up-wave. This is clear. Many pairs are moving ahead. Bitcoin is now trading back above 90K.

Consider this, last week Bitcoin closed at 94K. The week before last, Bitcoin closed at $96K, this week who knows, but green. This means that Bitcoin is ready to continue growing. When Bitcoin grows, the Altcoins explode.

The market needs a relief after strong bearish action. Strong bearish action is present on this chart. The market started to move straight down, market as in APTUSDT, since 5-December 2024, three months ago. Three months is the standard time for a correction to be over.

This is a friendly reminder.

Full trade-numbers below:

____

LONG APTUSDT

Leverage: 6X

Entry levels:

1) $6.45

2) $6.20

3) $5.65

Targets:

1) $6.90

2) $7.80

3) $8.95

4) $10.0

5) $11.8

6) $13.6

7) $16.1

8) $19.3

9) $22.9

10) $25.1

11) $28.6

12) $34.4

13) $38.5

14) $43.7

Stop-loss:

Close weekly below $5.40

Potential profits: 3558%

Capital allocation: 4%

_____

Note: When you are in the green, secure a portion of your profits or secure the trade. When it is still early, pyramiding is possible but don't get carried away. This can be done only at the start of the bullish wave and after conquering a major resistance level.

There are many ways to trade and approach the market. Another option is not to touch anything until you reach your goals, your goal can be 100% just as it can be 1,000%. The choice is yours.

Many ways to approach the market. The most important part is the planning followed by the price and timing. Right now we have the second part covered, timing and pricing. What's your plan?

Thanks a lot for your continued support.

Namaste.

Polkadot 8X Trade-Numbers (6,280% Potential)One is theory, the other one is practice.

One is the analysis and the other one the numbers.

Technical analysis and trading numbers.

Here we go again with Polkadot (DOTUSDT). This time around we are not focusing on the analysis but the full trade-numbers for a leveraged trade. Still, let's consider the chart briefly and what it has to say.

The black lines... Previously, the black lines showed the drop and the incoming bear-market. High prices and All-Time High = bearish. A long-term double-top, the highest ever, led to the strongest ever bear-market.

Now, the black lines signal support. The market bottom. All-Time Lows and bottom prices = bullish. A long-term accumulation phase with higher lows will kick off the next bullish market. We are in, we are live and we are green.

The market moves in cycles and within this cycles we have waves...

We are going from a neutral, sideways market to a bullish market. The neutral sideways market produces the same highs and the same lows. The bullish market will produce higher highs and higher lows. This is were we are going next.

Notice that we use lower targets for the leveraged trades compared to spot trades. This is because leverage carries higher risk. We are happy with a win and with big profits but not greedy. In this market, greed will get you killed. Financially speaking.

Full trade-numbers below:

____

LONG DOTUSDT

Leverage: 8X

Entry levels:

1) $4.60

2) $4.30

3) $4.40

Targets:

1) $4.92

2) $5.62

3) $6.77

4) $7.70

5) $8.63

6) $9.96

7) $11.6

8) $14.66

9) $16.52

10) $19.53

11) $21.68

12) $24.41

13) $32.30

14) $40.19

Stop-loss:

Close weekly below $4.00

Potential profits: 6280%

Capital allocation: 4%

____

Disclaimer: I love you and I am deeply grateful for your continued support.

You are a diving human being, you can do whatever you want.

It is your life, it is your body, it is your money, it is your soul.

Trade, drink, eat, sleep; it is your choice.

Namaste.

OFFICIAL TRUMP 8X Trade-Numbers (3,656%)Patience is absolutely necessary. This is the same chart setup we have been tracking for months now. Well, weeks actually. And this is a good chart setup.

The fact that the project is heavy, a big market cap., makes it harder to manipulate, but, whales are still whales and they can easily shake the market at all times.

When in doubt, reduce leverage.

We are doing high leverage, high risk. You can use this same chart setup with 3-5X and have very low risk. You can use this same chart setup with 15-20X and have extreme high risk. The numbers are for illustration purposes only. Leveraged trading is for advanced traders. That is, the player needs to be able to adapt to market conditions and adapt the numbers to personal conditions.

Needless to say, if you have a strong track record and capital you can use higher risk. If you have a record of being nervous and anxious and making simple mistakes then you must go with spot or 1-2X. Remember, if you can't make money trading spot, you won't be able to make money trading lev. Spot trading is like chess. Strategic and advanced. Leveraged trading is like 5D chess, the complexity goes off the chart. But we can keep it simple.

Find the right chart, buy and hold.

If you keep the risk small you can have an easy win. You are responsible for your own actions.

If you cannot handle a big win, then do not trade.

If you cannot handle a simple loss, please, go away.

It is unproductive to blame others for your mistakes. You move the mouse, you make the deposits, you choose which pair to buy, by how much and when. If you cannot bear the weight of your actions, do not trade.

If you can... Welcome to TradingView.

Here you have the full trade-numbers for TRUMPUSDT. Great timing. Great chart setup, medium-risk. An extremely high potential for profits.

_____

TRUMPUSDT

Leverage: 8X

Entry levels:

1) $14.0

2) $12.5

3) $11.7

Targets:

1) $16.2

2) $19.4

3) $21.7

4) $24.6

5) $27.8

6) $29.7

7) $33.0

8) $38.1

9) $41.8

10) $46.5

11) $60.1

12) $73.6

Stop-loss:

Close weekly below $11.65

Potential profits: 3656%

Capital allocation: 3%

_____

This is life. I am life. I love this life and this world.

Thanks a lot for your continued support.

As long as you persist and learn from all the actions that you make, good or bad, you will improve and you will succeed in this game.

Nothing can stop you. You are bound to achieve success.

The only way to lose is to give up.

I can never give up.

I will never give up.

I will only take a break to recharge and reload.

When I am refreshed and ready, I am trading once more.

This time around, I am taking the money home.

Namaste.

Bitcoin Daily: MA200 Beautiful Recovery, Higher Prices ConfirmedMA200 has been confirmed as support. It was challenged twice on a wick but the close happened much higher...

Good afternoon my fellow trader, we have some really good dynamics developing today.

Crypto is bullish. Bitcoin is bullish and the Altcoins are moving up. Slowly but surely but that's how we get into long-term growth. A long-term bullish phase tends to start slowly, it takes time to develop, but once momentum grows the rising wave can last many months. In previous bullish moves all the growth was compressed within 30 days. That is, 1-2 months of consolidation and then another month for the final advance. Now it will be different. The final advance can last anywhere between 2-4 months. It will be awesome.

Bitcoin is producing a very beautiful and strong recovery. It is my pleasure to say that we are all on the same page now, we can all agree; Bitcoin is going up.

This is a short-term view, zoomed-in, a rising triangle with the next target being $97,700 follow by $103,000. There will be more growth for sure. We have the full trade numbers with 10X in a previous publication. This is will be a long-term trade for those interested in Bitcoin with lev.

It is still early. Bitcoin is a great buy below 90K, also below 100K based on the long-term. Bitcoin will never move below 80K. This is very unlikely. Most likely, we will see growth daily, for months, and then some more.

If you enjoy the content, feel free to follow.

Leave a comment if you have any questions.

If you agree, comment.

If you disagree, comment again. Your views and opinions are very important, share them with the rest of us. We can learn from each other, and, after all, we are here to learn.

Namaste.

Ethereum 10X Trade-Numbers (4,280% Potential)Ethereum is looking great right now and trading near support. This support level can turn out into a great entry level for a LONG trade.

This is for experienced traders. High risk vs a high potential for reward.

I am sharing the full trade-numbers below but the main purpose of this publication is timing. It is March 2025 now and we are seeing the end of the last correction before the biggest bull-market in the history of Cryptocurrency.

Thanks a lot for your continued support.

_____

LONG ETHUSDT

Leverage: 10X

Entry levels:

1) $2,150

2) $2,050

3) $1,950

Targets:

1) $2,882

2) $3,116

3) $3,350

4) $3,683

5) $4,108

6) $4,575

7) $4,865

8) $5,333

9) $6,090

10) $6,629

11) $7,315

12) $9,214

13) $11,111

Stop-loss:

Close weekly below $1,900

Potential profits: 4280%

Capital allocation: 5%

_____

Namaste.

Bitcoin 8X Trade-Numbers (1096% Potential)This chart setup and trade-numbers has a little bit less risk than the other one but still high leverage. High leverage means high risk vs a high potential for rewards. This is not for the faint of heart. This is for those that like to go big or go home.

Ok. This week Bitcoin is trading within a higher low compared to last week. Based on the political event recently we can assume that the low is in. The low being in indicates that we can go LONG as long as we can protect our position. Since we know the bottom low, this is an easy task.

Good luck. Good profits and good health.

I am wishing you tons of money and success in this 2025 bull-market. This is a leveraged trade based on the long-term. We've been here before.

_____

LONG BTCUSDT

Leverage: 8X

Entry levels:

1) $85,500

2) $83,000

3) $81,000

3) $78,000

Targets:

1) $94,810

2) $98,804

3) $101,058

4) $104,266

5) $108,353

6) $112,859

7) $115,648

8) $120,154

9) $132,643

10) $139,250

11) $158,347

12) $165,345

13) $189,212

14) $200,000

Stop-loss:

Close monthly below $77,000

Potential profits: 1096%

Capital allocation: 6%

_____

Thanks a lot for your continued support.

Namaste.

Cardano 7X Trade-Numbers (1330% Potential)I would love to have a better entry here but better late than never. When in doubt, reduce leverage.

The falling wedge pattern here reveals the end of the correction. The bullish breakout reveals the resumption of the bullish move. A bullish move means higher highs and higher lows.

Cardano is set to grow for months and months and months.

We are going up.

You can find the targets for this chart setup listed below:

_____

ADAUSDT LONG 7X (PP: 1330%)

Targets:

TP1: $1.0114

TP2: $1.1499

TP3: $1.3262

TP4: $1.5207

TP5: $1.6410

TP6: $1.8354

TP7: $2.1502

TP8: $2.6594

Adjust all settings to your own liking.

_____

Good luck. Thank you again for your continued support.

Remember, you deserve the best.

The Cryptocurrency market is healthy, new and young.

Crypto is here to stay.

This is only the beginning.

The best is yet to come.

Namaste.

XRP 7X Trade-Numbers (1022% Potential)This is the continuation of a chart setup that I shared on the 1st of January 2025. Each time a strong resistance level is hit, there is a retrace or correction. This retrace ends in a higher low and then comes the resumption of the bullish move.

XRP is bullish and there is no doubt about it. We are seeing the classic sideways period before the continuation of the bullish wave.

We are going LONG once more; thanks a lot for your continued support.

This time we are going in with 7X. All the targets can be found listed below:

_____

XRPUSDT LONG 7X (1,022% Potential)

Targets:

TP1: $2.58

TP2: $2.77

TP3: $3.05

TP4: $3.40

TP5: $3.78

TP6: $4.02

TP7: $4.40

TP8: $5.03

TP9: $5.47

TP10: $6.03

Adjust all settings to your own liking.

This is for experienced traders only.

_____

Thanks a lot for your continued support.

It is truly appreciated.

You can dismiss #1 and focus on the 3rd and forward.

Namaste.

Shiba Inu 8X Trade-Numbers (3,520% Potential)Is it ok to go over the basics once more? Sell at resistance, buy at support.

The low is in 3-Feb with a long lower wick candle and high buy volume.

Today, we are seeing the establishment of a higher low close to support. This close to support dynamic gives us a great entry zone.

A great entry zone doesn't mean that a trade will necessarily work out, but it means that it has low risk and a high probability to succeed. Think about it, most of the time we tend to rush to buy when the action is already happening. Here, we can clearly see bearish action and a red day, but, we have a higher low and we know that reversals tend to happen at support.

The higher low is the signal. We have good entry timing. We leave the rest to the market.

_____

LONG SHIBUSDT

Leverage: 8X

Entry levels:

1) $0.00001310

2) $0.00001225

3) $0.00001160

Targets:

1) $0.00001681

2) $0.00001997

3) $0.00002253

4) $0.00002509

5) $0.00002873

6) $0.00003337

7) $0.00003849

8) $0.00004165

9) $0.00004677

10) $0.00005505

11) $0.00006095

12) $0.00006845

Stop-loss:

Close weekly below $0.00001100

Potential profits: 3520%

Capital allocation: 5%

_____

Remember that leveraged trading is high risk and for experts only.

There is no advice here, more like technical analysis and numbers.

I appreciate you and your continued support.

Let's make some money and while we make money, let's have some fun.

Follow!

Namaste.

XRP Update: Sell The House For This Trade? A Loan?Same chart as before. Notice the perfect and highly revealing higher low. Can we go wrong with this chart setup?

The session 25-Feb. is a perfect hammer. Consider the fact that all the drawings and numbers on this chart were extracted many days ago. The fact that the action is ending perfectly on the drawn lines signals that our assumptions are correct.

There was strong buying on 3-Feb. and this strong buying revealed that the market wouldn't let prices move lower. The market wouldn't permit a lower low. If prices move down, as they did, buyers would show up, and the did show up.

Now we have a higher low but I have to say that still, the action feels weak. There can be more shakeouts. In fact, XRPUSDT can still move lower but $1.70 would still remain as an extremely powerful support.

Things can change in a day. The weakness that I am seeing today is because of a lack of volume and momentum but not all can happen in an instant. It takes time for anything good to develop. Let me explain.

It can happen that in a few days a big green candle does show up, accompanied by huge volume, and this would be the signal that XRP is ready for growth. To be honest, we don't wait though, we are buyers now, buyers yesterday and buyers tomorrow, with a long-term bias, always ready for growth.

We know the market is bullish. We know how XRP has been performing lately and we know what comes next. The next major move is a strong rise, so we are waiting for it to happen.

Since there is no doubt that XRP will be going up, the only logical move left is to buy and hold.

When in doubt, double-up.

If you are a leveraged trader and you have doubt as to the next move, don't use lev. Instead, go big in spot and only open a position when you are 100% certain, this way you can avoid any mistakes.

Instead of staying out 100%, it is better to be in but spot and accumulate as much as you can.

For a $5,000 position, you can do $500 with 10X and you can easily get liquidated with a 10% drop. On the other hand, you can go in with $5,000 spot and you cannot get liquidated, ever, you hold the actual coins.

A real loan can pay 10-20% yearly. A pair like this one can grow 500-700% within this year. Do the maths.

There are many ways to approach the market, many ways. Some people sell their house to perform a low risk trade. Other people want to trade with 100X and lose it all the same day.

It all depends on your style.

I will give you the chart with my honest opinion, you can take care of the rest.

Remember, I share what I see, no ulterior motives. When I believe it is going up I say up regardless of what anybody thinks. When it is bearish, I do the same.

Some people want to read only bullish analysis. Others think we are here to make some entity happy or something else. No! I am here learning and share what I learn.

Sometimes I am right... Other times...

Well, thanks a lot for your continued support.

Namaste.

Solana 10X Trade-Numbers (3,810% Potential)Buy when prices are low. Sell when prices are high.

Sell at resistance. Buy at support.

Solana right now is trading at long-term support. The same support range that has been active and valid since April 2024. This support was challenged many times and always holds. —Buy at resistance, sell at support.

This is a great setup, great price, great timing. Risk still exist though.

Leveraged trading is high risk and for experts only.

I am wishing great profits and good luck.

—Full trade-numbers below:

_____

LONG SOLUSDT

Leverage: 10X

Entry levels:

1) $140

2) $135

3) $130

4) $125

Targets:

1) $188

2) $195

3) $210

4) $234

5) $249

6) $273

7) $312

8) $340

9) $375

10) $477

11) $575

12) $664

Stop-loss:

Close weekly below $125

Potential profits: 3810%

Capital allocation: 5%

_____

Thanks a lot for your continued support.

Namaste.

Bitcoin 10X Trade-Numbers (1,375% Potential)The low is in and this is the perfect timing for a long-term LONG on Bitcoin (BTCUSDT and other trading pairs).

This is for experienced traders and can end up producing huge profits, great growth, amazing results —great entry timing.

__

LONG BTCUSDT

Leverage: 10X

Entry levels:

1) $85,000

2) $83,000

3) $81,000

3) $78,000

Targets:

1) $94,810

2) $98,804

3) $101,058

4) $104,266

5) $108,353

6) $112,859

7) $115,648

8) $120,154

9) $132,643

10) $139,250

11) $158,347

12) $165,345

13) $189,212

14) $200,000

Stop-loss:

Close monthly below $78,000

Potential profits: 1375%

Capital allocation: 5%

____

Thanks a lot for your continued support.

Namaste.

ETHUSDT Long by TeamPWRTradesTeamPWRTrades ETH Long Idea

Although the general Crypto market has been showing weakness, we are expecting Bullish movement for ETH in the next coming days. Based on Daily candles there is still a possibility of ETH heading towards it's daily support zone at 1800. Our team recommends using low leverage 1-2% of capital for this trade due to the daily volume signaling a possibility of ETH reclaiming 2500-2800 zone.

Enter

1: 2160

2: 2210

TP1: 2500

TP2: 2800

SL: 2088

Trade Active

Happy Trading,

TeamPWR

XRP deserves sub $2Back in 2021, I used to love trading liquidation spikes. One thing I noticed was the wicks were always revisited, sometimes it took a while, but they'd be seen to.

XRP has a wick with a low sitting at $1.8 - I am going to build a short position and target it.

An entry above $3 was ideal, I had one, but my trading has been slightly erratic, so I closed it too soon.

Here we try again, good luck.

TRADING LEVERAGE | How to Manage RISK vs REWARDFor today's post, we're diving into the concept " Risk-Reward Ratio "

We'll take a look at practical examples and including other relevant scenarios of managing your risk. What is considered a good risk to reward ratio and where can you see it ? This applies to all markets, and during these volatile times it is an excellent idea to take a good look at your strategy and refine your risk management.

You've all noticed the really helpful tool " long setup " or " short setup " on the left-hand column. This clearly identifies the area of profit (in green), the area for a stop-loss (in red) and your entry (the borderline). It also shows the percentage of your increases or decreases at the top and bottom. It looks like this :

💭Something to remember; It is entirely up to you where you decided to take profit and where you decide to put your stop loss. The IDEAL anticipated targets are given, but the price may not necessarily reach these points. You have that entire zone to choose from and you can even have two or three take profits points in a position.

Now, what is the Risk Reward Ratio expressed in the center as a number.number ?

The risk to reward ration is exactly as the word says : The amount you risk for the amount you could potentially gain. NOTE that your risk is indefinite, but your gains are not guaranteed. The risk/reward ratio measures the difference between the entry point to a stop-loss and a sell or take-profit point. Comparing these two provides the ratio of profit to loss, or reward to risk.

For example, if you're a gambler and you've played roulette, you know that the only way to win 10 chips is to risk 5 chips. Your risk here is expressed as 5:10 or 5.10 .You can spread these 5 chips out any way you like, but the goal of the risk is for a reward that is bigger than your initial investment. However, you could also lose your 5 and this will mean that you need to risk double as much in your next play to make up for your loss. Trading is no different, (except there is method to the madness other than sheer luck...)

Most market strategists and speculators agree that the ideal risk/reward ratio for their investments should not be less than 1:3, or three units of expected return for every one unit of additional risk. Take a look at this example: Here, you're risking the same amount that you could potentially gain. The Risk Reward ratio is 1, assuming you follow the exact prices for entry, TP and SL.

Can you see why this is not an ideal setup? If your risk/reward ratio is 1, it means you might as well not participate in the trade since your reward is the same as your risk. This is not an ideal trade setup. An ideal trade setup is a scenario where you can AT LEAST win 3x as much as what you are risking. For example:

Note that here, my ratio is now the ideal 2.59 (rounded off to 2.6 and then simplified it becomes 1:3). If you're wondering how I got to 1:3, I just divided 2.6 by 2, giving me 1 and 3.

Another way to express this visually:

In the first chart example I have a really large increase for the long position and you can't easily simplify 7.21 so; here's a visual to break down what that looks like:

If you are setting up your own trade, you can decide at what point you feel comfortable to set your stop loss. For example, you may feel that if the price drops by more than 10%, that's where you'll exit and try another trade. Or, you could decide that you'll take the odds and set your stop loss so that it only triggers if the price drops by 15%. The latter will naturally mean you are trading at higher risk because your risk of losing is much more. Seasoned analysts agree that you shouldn't have a value smaller than 5% for your stop loss, because this type of price action occurs often during a day. For crypto, I would say 10% because we all know that crypto markets are much more volatile than stock markets and even more so than commodity markets like Gold and Silver, which are the most stable.

Remember that your Risk/Reward ratio forms an important part of your trading strategy, which is only one of the steps in your risk management program. Dollar cost averaging is another helpfull way to further manage your risk. There are many more things to consider when thinking about risk management, but we'll dive into those in another post.

How Leverage Works in Forex TradingDear readers, my name is Andrea Russo, and today I want to talk to you about one of the most discussed topics in trading: leverage in Forex. This tool, both powerful and delicate, allows traders to amplify their gains with small investments but also carries significant risks if not used prudently. In this article, I will guide you step by step, explaining how leverage works, its advantages and risks, and how you can start trading safely.

What is leverage in Forex?

Leverage is a tool that allows traders to control much larger positions than the capital actually invested. For example, with a leverage of 1:100, you can open a $100,000 position with an initial investment of just $1,000.

Here’s a simple example:

You invest $1,000 with a leverage of 1:100.

Your market exposure will be $100,000.

If the market moves 1% in your favor, you will earn $1,000 (equal to 100% of your capital).

If the market moves 1% against you, you will lose your entire capital.

As you can see, leverage amplifies both gains and losses, which is why it’s essential to understand how it works before using it.

Advantages of leverage

Leverage offers several advantages that make it an attractive tool for those who want to invest in Forex:

Access to the market with small capital: You can start trading even with modest sums, thanks to leverage.

Diversification: With limited capital, you can open multiple positions on different currency pairs.

Maximization of profits: Even small price movements can translate into significant gains.

The risks of leverage

Despite its advantages, leverage carries important risks:

High losses: The same amplification that generates profits can multiply losses.

Margin Call: If losses exceed the available margin, the broker may automatically close your positions.

Emotional stress: High leverage can lead to impulsive decisions, often driven by anxiety.

How to start trading in Forex with leverage

If you want to use leverage effectively and safely in Forex, follow these steps:

1. Educate yourself and learn the basics

First of all, study how the Forex market works. It’s important to understand what influences exchange rates and which strategies to adopt. Dive into key concepts such as:

Major currency pairs

Spread and commissions

Technical and fundamental analysis

2. Choose a reliable broker

The broker is your trading partner, so ensure that it is regulated and offers transparent conditions. Look for brokers with:

Competitive spreads

Flexible leverage options

User-friendly platforms

3. Start with a demo account

To practice, use a demo account. You can test your strategies without risking real money and gain confidence with the platform.

4. Set up a trading strategy

A good trader doesn’t leave anything to chance. Define a trading plan that includes:

Realistic goals

Percentage of risk per trade (1-2% of capital)

Risk management tools like stop-loss and take-profit

5. Start with low leverage

If you’re a beginner, use moderate leverage, such as 1:10 or 1:20. This will allow you to limit losses while learning to manage risk.

6. Monitor positions and manage risk

Risk management is the key to successful trading. Invest only what you can afford to lose and constantly monitor your positions.

Conclusion

Leverage is an incredible tool, but it must be used cautiously. It can open the doors of the Forex market even to those with limited capital, but it requires discipline, education, and good risk management.

Thank you for reading this article. If you have any questions or want to share your experiences in Forex, feel free to write in the comments.

And remember: trading is a marathon, not a sprint! Happy trading!

Dogecoin (DOGE) Long 5x Futures Trade🐶#DOGE/USDT

💻Market Exchange= CoinEx

🟢 Trade Type= Long

✅Entry level:

$0.389 - $0.4045

🎯Target Levels:

$0.4126 - $0.4166

⚠️Stop Loss: $0.37🚫

🩸 Leverage= 3-5X

Please use the risk management I provided for you and don't forget about the risk in leverage/margin trading.

Understanding Leverage in Forex: Steep Risks and Big RewardsLeverage is the not-so-secret sauce to accelerate your gains at breakneck speed or blow up the entire operation if you don’t know what you’re doing (or you just want too much.) It’s a simple concept with profound implications—a multiplier that lets traders control positions far larger than the capital they actually have. Sounds like a dream, right? But in forex , dreams can turn into nightmares faster than you can say “margin call.”

Let’s unravel this seductive, high-stakes game changer.

❔ What Is Leverage?

“We were always leveraged to the hilt when we bought something and ran out of money, we would look at the portfolio and push out whatever appeared to be the least attractive item at that point,” explains Jim Rogers, George Soros’s partner, in Jack D. Schwager’s book “Market Wizards: Interviews with Top Traders.”

At its core, leverage is borrowed capital. When you trade with leverage, you’re essentially using your broker’s money to amplify the size of your position. Let’s say you want to invest $1,000 and use a leverage ratio of 100:1. This means you can control a position worth $100,000. A small 1% movement in your favor equals $1,000 in profit—doubling your initial investment in a single move. Sounds good, doesn’t it?

But here’s the catch: leverage works both ways. A 1% move against you wipes out your entire $1,000. It’s the double-edged sword that can turn modest accounts into heavyweights—or into dust.

🧲 The Allure of Amplified Gains

Forex traders are drawn to leverage like moths to a flame, and for good reason. The ability to turn small price movements into significant profits is exhilarating and means you don’t have to chip in gargantuan amounts of cash to make bank.

In a market where currency pairs often move fractions of a percentage daily, leverage is what makes those movements meaningful. Without it, most traders would struggle to eke out gains worth their time.

Consider a scenario where you’re trading a major currency pair like the EUR/USD . The price moves 50 pips in your favor, and each pip is worth $10 on a standard lot. Without leverage, you might only afford a micro lot, making your profit $5—not exactly a game changer. But with 100:1 leverage, you control a full lot, turning that $5 into $500. Suddenly, your modest deposit has real firepower.

This potential for outsized returns is intoxicating, especially for new traders. But like any powerful tool, misuse can be catastrophic.

💣 The Flip Side: Risks That Loom Large

If leverage is the hero of ever-moving forex trading space , it’s also the villain. For every dollar it helps you earn, it can take away just as quickly. While a 50-pip move in your favor feels like striking gold, the same move against you might be a financial disaster.

Even seasoned traders aren’t immune to the dangers of leverage. The forex market is inherently volatile, with prices influenced by everything from central bank policies to geopolitical tensions. Leverage amplifies these fluctuations, turning minor market noise into account-draining chaos if you’re not prepared.

Here’s the brutal truth: most traders underestimate the risks of leverage. Maybe because it’s so common they’ve gotten used to it. Overleveraging—taking on more risk than your account can handle—is the silent account killer. And it doesn’t take a market meltdown to wreck your balance. A sudden spike caused by unexpected news or a tweet can trigger a margin call, leaving you with nothing but a hard lesson.

🤙 Margin Calls: The Grim Reality

Let’s talk about margin calls, the dreaded phone call (once upon a time) no trader wants to receive—except it’s not a phone call anymore. It’s an automated popup notification from your broker informing you that your account equity has fallen below the required margin. Essentially, you’ve run out of money to sustain your positions and the broker is stepping in to close them before you owe more than your account balance.

This is where overleveraged and undercapitalized traders often meet their doom. A market move that would’ve been a minor setback on a properly sized position becomes a catastrophic loss when leverage is maxed out and equity is dried up. The lesson? Never let your enthusiasm for big trades overshadow your need for risk management.

🎯 Mastering Leverage: The Balanced Approach

Leverage isn’t inherently bad—it’s neutral. Like any tool, its impact depends on how it’s used. Successful traders respect leverage. They don’t treat it as a shortcut to riches but as a calculated risk multiplier.

Risk management is the cornerstone of surviving—and thriving—in a leveraged environment. This includes using stop-loss orders to limit potential losses, never risking more than an acceptable percentage of your account on a single trade and maintaining sufficient margin to weather market fluctuations.

And let’s not forget the importance of choosing the right leverage ratio. Many brokers offer leverage as high as 500:1, but that doesn’t mean you should take it. A lower ratio, like 10:1 or 20:1, gives you more breathing room and reduces the chances of wiping out your account. And if you decide to go for the upper echelons of leverage, say 100:1, then you should consider scaling down your positions to get that same breathing room.

🤔 The Psychology of Leverage

Leverage does more than magnify financial outcomes; it amplifies emotions too. The thrill of quick profits can lead to overconfidence, while the fear of losses can paralyze decision-making. Understanding your psychological tendencies is crucial when trading with leverage.

Patience and discipline are your best allies. Stick to your trading plan, avoid impulsive decisions, and don’t let the lure of high leverage cloud your judgment. The goal here isn’t just to make money once or twice—it’s to stay in the game for as long as possible.

So, how do you handle leverage? Are you the as-good-as-your-last-trade trader or you’re the more cautious, risk-averse type? Comment below and let’s spin up the discussion!