#LEVER/USDT#LEVER

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.0001664.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area (in green) at 0.0001673, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.0001757

First target: 0.0001870

Second target: 0.0001937

Third target: 0.0002017

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Leveraged

#LEVER/USDT #LEVER#LEVER

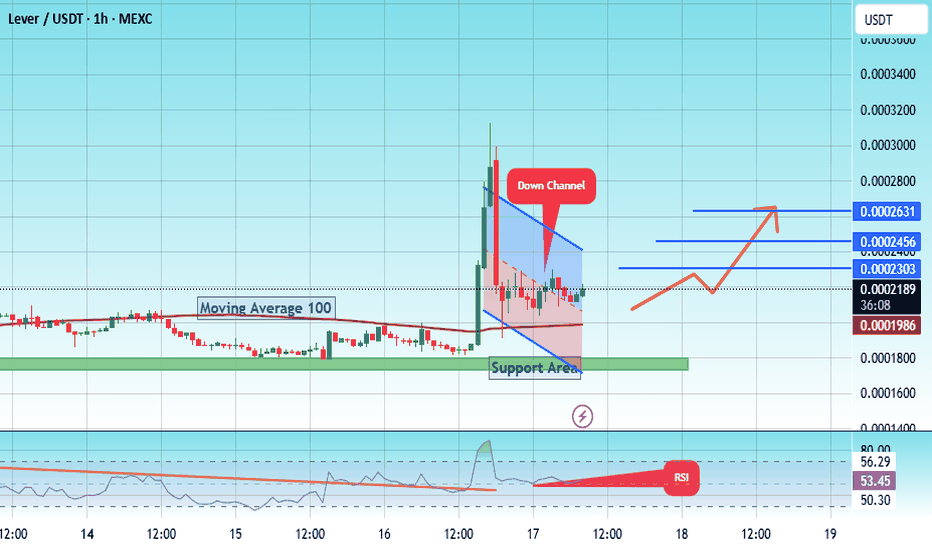

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.0001650.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area (in green) at 0.0001764, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.0002196

First target: 0.0002303

Second target: 0.0002456

Third target: 0.0002630

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#LEVER/USDT#LEVER

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.00016000.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area in green at 0.0001500, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.0001750

First target: 0.0001880

Second target: 0.0002163

Third target: 0.0002427

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

$ENS / USDT 1D FAKEOUT ON FLAG? Incoming Pump? 📊 $ENS/USDT Perpetual Contract – Daily Timeframe Analysis

🟢 Bullish Setup

A bullish flag is forming on the daily chart — a continuation pattern indicating potential upward movement.

- Price recently entered into the golden pocket of the Fibonacci retracement tool marked from $16.881 – $25.241 on the third touch of the flag's resistance, triggering a fakeout, it now rests in the first Fair Value Gap.

- The strong wick rejection on the 3rd retest of the resistance/supply indicates bearish strength, momentarily pushing price lower.

- Despite this, the overall pattern remains valid as long as price respects the Golden Pocket and FVG zone below.

✅ If price closes above the golden pocket, it could present an excellent leveraged entry or spot position, with high reward potential off 67%.

🔴 Bearish Scenario

- So far, every test of the **4H supply zone** has resulted in rejection — showing persistent seller control at short-term resistance.

- If buyers fail to defend the golden pocket and recover the bullish trendline, the structure confirms a break. (Downtrend)

The confirmation of bearish pressure is the:

1) Large wick (Creating a shooting start candle pattern)

- Signaling bearish reversal.

2) Large Bearish Marubozu Candle.

- Indicates strong continuation of a downtrend.

3) Candle close below Trend line support.

- Showing Bears were able to successful make a major move.

🔽 In that case, we look to short after FVG confirmation and scalp down toward the daily demand zone.

📌 Patience is key. Let the price show intent before entering.

Please let me know what your thoughts are!

Short-Term Gamble on a NASDAQ Bounce Using TQQQIn this quick update, I’m taking a speculative short-term trade on a possible NASDAQ recovery after a steep sell-off. Was the market oversold—at least for a day? Maybe. Do I think the pain is over for the longer term? Probably not.

I’m using NASDAQ:TQQQ , a 3x leveraged ETF that tracks the NASDAQ-100 (the top 100 non-financial stocks in the NASDAQ). This means if the index moves up 2%, TQQQ should theoretically gain roughly 6%, and vice versa on the downside. Leveraged ETFs like this are high-risk, time-sensitive instruments—they’re designed for short-term trades, not buy-and-hold investing.

The idea here is that after a sharp drop, institutions might step in to scoop up oversold tech stocks, creating a brief rebound. If that happens, TQQQ could give me amplified upside. But this is purely a gamble—I’m under no illusion that the market has bottomed. In fact, I expect more downside ahead.

I entered in the after-hours session once some of the heavy bearish volume faded, and I’ve set a tight 5% stop-loss to manage risk. Yes, I could get shaken out by an early dip before any rebound, but the stop is there to protect me if the sell-off continues.

This is a high-risk, short-term trade—buyer beware. If you’re considering TQQQ, understand the risks: decay from daily resetting leverage, extreme volatility, and the potential for rapid losses.

I’ll update on how this plays out. Wish me luck in the comments below 😁

Real question is where to take profit...

#LEVER/USDT#LEVER

The price is moving within an ascending channel pattern on a 1-day frame, which is a retracement pattern

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum and the price is based on it

Entry price is 0.003500

The first target is 0.004921

The second goal is 0.005501

The third goal is 0.006183

NAIL- an ETF of Homebuilders 3X leveragedNAIL- is an ETF of Homebuilders; It is 3X leveraged. Price is up over 30% in the first two weeks \

of June. It is shown here on the 30-minute chart with the "Market Bias" indicator which shows

uptrends in green and pull-back zones in gray. Presently, price is pulling back - when the gray

colored trend indicator changes back to green, an optimal entry can be made.The ADX indicator

has topped out as part of the early pullback. When the ADX goes below 25 and then crosses 25

from below, an entry can be made. An ADX over 50 and rising suggests that it is too late for

an entry and not to chase but rather wait for a pullback.

Overall, NAIL's price is now in early pullback by the "Market Bias: trend indicator and the ADX

which shows now a decreasing trend directional strength. Price is more than one standard

deviation above the mean anchored VWAP which is an level that professional traders want

to sell from. Because of all of this I will wait for an entry on NAIL until a pullback is completed

and the uptrend bullish continuation is seen.

YINN China Leveraged 3x Bull Setting Up Reversal ShortYINN the China Bull EFT has uptrended dramatically of late however

it is far extended above its moving averages while the RSI indicator shows

decreasing strength as a divergence. Price rise is hitting the resistance of

the POC line of the intermediate-term volume profile where sellers will

step in and invoke selling pressure in a triple top making the resistance strong.

I expect it to drop now and perhaps dramatically,. Inversely the YANG

ETF, a bearish leveraged fund will rise. By a Fibonacci analysis, a 15%

drop is expected before another inflection. Accordingly, I would set

up a stop loss of 3-5% on the short swing trade setup .

TPOR Triple leveraged Transportation ETF SWING LONGFundamentally, the stabilization of fuel prices helps push things down the road.

A possible rail strike if no averted by Congressionaly action will cause a big macro effect.

TPOR was downtrending into the end of September then reversed starting a trend back up.

I see this as a good long swing buying initially now and then every time the price

pulls back to the Hull 150 moving average trend line in back or even drops below it

when the faster moving average ( Hull MA 20 in Blue) reverses from going down to

up or crosses the long MA from below. I will exit when the relative strength tops out

and shows bearish divergence.

BOIL / GUSH RATIO- Leverage 3X Natural Gas ETFsAMEX:BOIL

BOIL is the #X leveraged ETF for Natural Gas while KOLD is it inverse.

On this 30M chart I setup the ration between BOIL and KOLD.

This is to find precise swing entries without a lot of work for those only trading part time like myself.

At the highs, BOIL has peaked relative to KOLDAccordingly, this is the time to exit BOIL and enter a position

on KOLD. Conversely, when the ratio is at an inflection bottom, a trader should exit KOLD

and enter a BOIL position.

This chart shows several patterns including:

a double or triple top which may breakdown as there is a newer cup and handle potentially breaking

out above the handle in continuation of the prior uptrend. It the present chart, the Bollinger Band basis line

the uptrending of its boundaries and the MACD all favor the probability of an uptrend., the spot markeri

All in all, I am waiting to buy BOIL since natural gas is being liquified and shipped to Europe to

make electric power to supply to air conditioner for the long hot summer. XNGUSD has had dramatic

action in the past couple of months, all good for BOIL's price action.

Three evening stars or three-bar plays marked with red down arrows.

If not in a position at present, the chart should be observed for the cup and handle pattern completion

towards a resumption of the uptrend. IF so, a BOIL position could be entered.

If it fails the triple top controls the price action and

a KOLD position could be entered.

This chart demonstrates the importance of looking for patterns to help guide

higher probability setup.

YINN China 3X Leverage ETF Reverses off the bottom Swing Long

AMEX:YINN YINN is now in an uptrend with an increasing cloud score

and upgoing BB boundaries. Stop Loss at the double bottom

while the first target is the recent consolidation period

with about 15% upside to that take profit and about a

2.5 Reward to Risk

All this makes YINN a candidate for a swing long trade

HGU: Confirmed MACD Golden Cross on a monthly basisSince inception in 2007, this ETF has lost more than 90% of its value and it seems nobody is looking at it.

However, there is no denying that this ETF has been performing pretty well while techs are failing pretty badly these days.

As we can confirm MACD Golden Cross on a monthly basis, we might be facing a great opportunity to be in.

We should be aware of the risk of this ETF as it is leveraged.

Otherwise you can crack the shell and see its holdings to directly invest - extra analysis for each stock is recommended.

List of Holdings as of today

BARRICK GOLD CORP 25.28%

FRANCO-NEVADA CORP 17.69%

AGNICO-EAGLE MINES 14.22%

WHEATON PRECIOUS METALS CORP 12.45%

KINROSS GOLD CORP 3.94%

YAMANA GOLD INC 2.98%

B2GOLD CORP 2.67%

SSR MINING INC 2.64%

ALAMOS GOLD INC 1.82%

PRETIUM RESOURCES INC 1.73%

Why You Shouldn't Hold Leveraged Tokens Long Term🤔❌❗🚫💥Leveraged tokens, is an invention of the FTX exchange , with leveraged exposure without taking care of the margin, requirements, management, and liquidation risk. In other words, Leveraged tokens are the easiest way to do leverage trading

but are still not safe from the risks of severe losses, although the risk of liquidation is no longer It does not exist, but it can reduce asset to zero, especially in the long term.

🔰Leveraged tokens are often the most misunderstood products in the crypto industry. These tokens are essentially funds that use derivatives and leverage to amplify the returns of an underlying asset. Typically, a leveraged token offers a multiplier of an index or a specific asset's daily return. For instance, a 3x Long BTC will generate triple the daily returns of Bitcoin.

leveraged tokens are built to multiply the underlying asset's daily return-the main component to remember here is DAILY. The leverage factor of a token will be reset every day. As a result, the performance of a token and its underlying asset can differ over the long term.

✳️While the comparison of daily and total returns can sound trivial, the math behind them differs in contrast. For example, even a non-leveraged portfolio that loses 10% on one day would not be able to break even with a simple 10 % increase on the next day. An investment of $100 that loses 10% on one day is worth $90 at the end of the day. But if the price goes up 10 percent on the second day, that's a 10 percent rise from $90, bringing the price at $99. Clearly, the math didn't add up as you would expect.

As such, in the event of losses, a portfolio needs a return greater than its loss to break even. The graph in above chart shows the subsequent rate of return needed to break even at varying levels of portfolio losses.

--------------------------------------------------------------------------------------------------------------------

💜 if you're a fan of my analyses follow me and give a big thumbs 👍 OR drop a comment 🗯💭

🙏with Best Regards

The dangers of Leveraged TokensMost experienced traders know that leveraged tokens should be avoided at all cost. Exchanges advertise these products to ignorant traders who are afraid to trade on leverage, with phrases like "Now you can use leverage without the risk of liquidation!". Be aware that these products have been carefully designed to take your money, and then some.

The underlying algorithms are incomprehensible for anyone without a higher level math degree (myself included), but a look at price action is all we need.

While in theory you may not get liquidated, during certain events it is possible for leveraged tokens to depreciate immensely in value. This happened for example during the May flash crash, where a cascade of liquidations of the underlying assets combined with rebalancing events caused some leveraged tokens to loose up to 95% of their respective value. See the SUSHIUP token for example in the image below. The token dropped around 93% in a single day and is currently trading at a wopping -98.7% of their pre-crash value.

While technically this might not be a liquidation, in practice this comes down to the same thing.

To make matters worse, during the flash crash, DOWN tokens also took a nosedive leaving a legion of traders outraged.

Binance say they warn against these types of major price drops during times of extreme volatility. They did however offer some (very meagre) compensation to those affected when agreeing to the condition that you would be banned from trading leveraged tokens ever again.

For those still holding on to their leveraged tokens from before the crash in the hope that they will one day recover, have a look at the image below. The image shows what volatility does to leveraged tokens over time compared to the value of their underlying assets. The image shows the performance of ETH vs ETHUP (Binance), ETHBULL (FTX) and ETH3L (Kucoin) over a period of 4 weeks. Volatility (both up and down swings) eats away at the value of your tokens. October 8th ETH was trading at the same level as a previous high, the leveraged tokens not so much.

In short, your tokens will never recover. Sell them at a high or top of a bull run and put your money elsewhere.

Conclusion, stay away from leveraged tokens and just use 3X leverage instead, which also makes it near impossible to get liquidated anyway.

My trading historyWell we've been volatile these last month or so whatever, I've been catching some swing-trades but maybe the swing-trade gravy train is at-end. With bullish momentum these last few days especially as we dip into the $31,800-29,500 region as kinda not expecting reversal structure at this time. I "hope" I can close this leveraged short at some profit and ride the remaining 95% of my portfolio to the upside.

But we may never know! Drink more alcohol!

BNB DroppingYou can Buy BNBDown token to make profit in bearish market , For dear amateur traders not recommendation , These tokens are High Risky especially in this critical situation...

XRE (ETF owning REITs) at risk as rents may not be paid.The ETF holds Real Estate Investment Trusts. These leveraged vehicles will soon be strapped for cash as tenants refuse (or cannot) to pay rents, but mortgage holders and bank lenders will continue to demand payment. It is increasingly likely that some distributions will have to be cut which will make prices of the trading units suffer.

How you can profit when Bitcoin crashesMarket Analysis

BTC appears to be stabilizing after the 40% crash last week on the 12th of March. Unfortunately, many investors lost a substantial amount on this day. However, there are ways to still turn a profit or at least avoid large losses during bear markets.

It goes without saying that it is much easier to make a profit as a day trader or even as a swing trader when the underlying trend is in your favor and when Bitcoin is on the rise. But how can you determine the underlying trend, and how can you automate this? This is what we will explore in this newsletter.

Moving Averages

Moving averages are trend following indicators and are very useful in determining the current trend. As such, day traders or short term swing traders may consult them on the broader time frames before entering a position. Some traders will choose to stay out of trading when the underlying trend is against them, while others will choose to short the underlying asset if it is in decline.

Leveraged tokens

The leveraged tokens take shorting to another level by magnifying the potential gains up to 3 times. Although this volatility can be very beneficial, it can also make trading much riskier by magnifying a trader’s losses three fold! The leveraged tokens are relatively new to the Cryptocurrency market and should only be traded by people who fully understand them as they can carry additional risks such as lack of liquidity and delays in price movements. Without further due, let’s see how you could have profited over the past weeks using the BEAR token.

Automate your trading with triggers

Setting up triggers in Cryptohopper makes it possible to not only disable your trading temporarily but also to change settings automatically for your hopper in order to prepare for a bear market. An example of this would be to set up a trigger based on the market BTC/USD where the cross between the 10 and 30 EMA on the daily chart changes the template of your hopper. Your bear market template can thus have the BEAR token for example setup along with a strategy that functions well with this token. In our example we have the cross between the 10 and 30 EMA, along with the ATR in order to decrease the amount of fake signals generated by these moving averages.

You can also setup a bullish trigger for then the 10 EMA crosses over the 30 EMA on the daily BTC/USD chart, where you have your template and strategy setup for the bullish market conditions.

OILU and general crude run-upI like this ETF for 4 Reasons

1) The coldest months of the year are about to begin and the demand for heating should be strong until at least February

2) At $21 it still has a lot of wiggle room compared to its 52 week high of $36

3) OPEC and Russia have announced production cuts

4) Positive trade deal news is positive Energy news.

I'm expecting some major action going into the new year, tell me what you think!