(UGAZ, LONG) Inverse head and shoulders pattern. UGAZ has been down-trending recently and now is consolidating. Winter is coming up soon so that will drive the demand of natural gas up. There is a near-complete inverse head and shoulders pattern 10 day MA is good. There is now a couple of dragonfly Dojis which is also good. Ultimately its showing signs of a reversal and is offering a 7:1 Profit/loss ratio which is amazing.

Leveraged

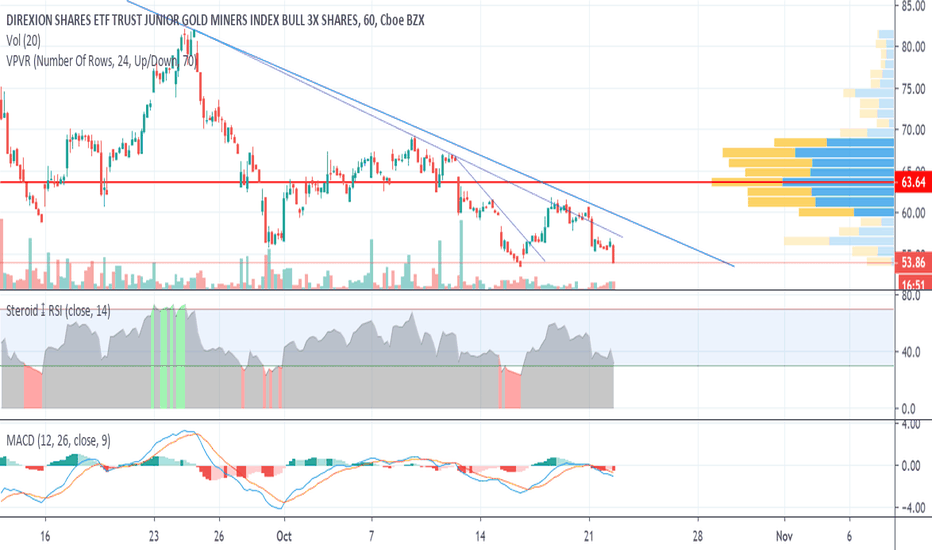

Watch JNUG for a trend line breakThe junior gold miners' leverage ETF has been making a long-term downward trend line since September as the dollar showed strength and gold showed weakness. Surprisingly, gold and JNUG have stayed in their downtrends despite dollar weakness throughout the month of October.

That's presumably because the dollar index, now at 97.48, has a support trend line around 96.86. Gold and JNUG will break upward out of their downtrends if the dollar breaks downward through that support.

It probably won't happen before the Fed meeting, although conceivably it could. Futures traders are pricing the probability of a Fed rate cut at 94%, and yesterday's headlines included "The Fed Just Printed More Money Than Bitcoin’s Entire Market Cap." The dollar is up today, but only because it's making a technical pullback from oversold territory. I expect it to touch its support line soon.

Assuming the futures markets aren't completely out to lunch, we should get a rate cut next Wednesday and then our breakout should come.

LABU - watch the volume and trend lineBiotech has had a hard time of it lately due to both political risks related to the election and litigation risks from the opioid epidemic. All of this, of course, on top of broad market weakness due to the China trade war.

However, biotech earnings are better than most sectors this season, so the bear market likely won't continue forever. I've drawn a trend line on my 1-hour chart and am watching for an upward breakout. Today we had some nice volume come in as we recovered from oversold on the daily chart and achieved our first green day for some time. However, we fell short of the minimum 6 million shares I'd like to see to signify a true reversal. We also fell short of breaking my trend line.

I expect LABU will fall to about 25.50 before it's likely to get a real bounce.

Buy targets on SPYOne of the best ways to outperform the market is to buy the S&P 500 (SPY) or a leveraged S&P 500 index fund (UPRO) and simply hold it for the long term. However, the price at which you enter such a buy-and-hold trade is extremely important. If you get a price that's 50% cheaper, you'll make 100% more money over the lifetime of the investment, because you'll have twice as many shares as you would have otherwise. This year is a great year to enter a trade like that, because the market is so weak. But you never know how low prices will go, so the best strategy is to scale in.

Here are four relatively conservative buy targets for the S&P 500. These targets assume that we won't enter a full-scale recession this year, which is a big assumption. (Google "Federal government has dramatically expanded exposure to risky mortgages" to see why there's a lot of recession risk. A recession would be, by far, the best time to enter the market for a buy and hold play.) I was pleased this morning to see the market bounce hard from my first buy target. I managed to pick almost the exact bottom to get into the UPRO leveraged fund!

We probably will see more downside later this month, however, and I've got plenty of money in cash to take advantage if it falls that far. I like to triple my holdings at each successive buy target, so I've only acquired a relatively small position so far.

Healthcare volatility could be good for swing tradersA recent survey of analysts by FactSet revealed that we're in an "earnings recession" right now and that it's expected to get worse in the next quarter. Certain sectors have been particularly hard hit, namely mining and semiconductors. The sectors that are expected to report the best earnings this quarter are healthcare, utilities, real estate, and gold. These are defensive sectors that usually do pretty well when the rest of the market is down. Utilities and gold are priced a bit high right now, but could be good for an entry if they pull back. Real estate stocks are a slightly better value, but would also be better after a pullback. Healthcare stocks are cheaper, but they face a lot more political risk, especially with Elizabeth Warren leading the Democratic pack. Health insurance and pharmaceutical companies are at particular risk from "Medicare for All."

Given the extremely mixed outlook for health care right now-- its bullish fundamentals and bearish political risks-- I expect to see a lot of volatility in this sector. Direxion's and ProShares' leveraged funds are great for playing that volatility. For upward moves you want CURE, and for downward moves you want RXD. Alternatively you could play the pharmaceutical equivalents, LABU and LABD. Look to buy and sell oscillations between critical support and resistance or overbought and oversold levels. Roughly speaking, I'd guess that healthcare outperforms through earnings season but pulls further back as the election heats up. You can see from CURE's chart that this sector has been downtrending overall. I expect that to continue until at least the primary. (If a market Democrat like Biden gets nominated or if Trump gets re-elected, that would be hugely bullish for this sector. Hugely discounted healthcare stocks could surge overnight.)

Semiconductor strength will continue, target 208SOXL attempted a breakout above its channel and above April's highs, but got rejected and dropped back down to support at the 50-hour moving average. Here it's showing renewed strength, with volume turning green and candlesticks looking bullish. I think it will make another run at 202, this time pushing through to previous highs around 208.

SOXL has strong upward catalysts in the form of strong earnings and guidance this quarter. MU got an earnings beat earlier this quarter, and its recent ascending triangle break suggests it may rise to 51.50, for $4 per share upside. (However, MU is 5% overvalued compared to its average analyst price target of $45 per share.) We've just had earnings beats from Taiwan Semiconductor, Texas Instruments, and Intel that imply the sector is recovering in the second half of the year. TSM has 17.5% upside to the average analyst price target! Intel-- SOXL's largest holding-- can still gain $2.50 per share before it reaches the average analyst price target. QCOM, another large holding, has 12.5% upside to the average analyst price target, with earnings coming up tomorrow. A beat by QCOM could trigger the run up through the 202 resistance level.

As always, this is just an idea about how the market will move, not investment advice.

Don't Trust Today's Upturn in GoldIn my last post I mentioned that JNUG performs better when it closes above the Hull Moving Average . Today it moved decisively above the Hull, which I'd usually take as a bullish indicator. However, on this occasion, I don't trust it.

The price of gold tends to move opposite the market. The market is down today for reasons of seasonality . Today (June 12) is what the Stock Trader's Almanac designates a "bear day"-- a day of the year on which the market has historically declined more than 60% of the time. However, it's an isolated bear day. Seasonality favors an upturn in the market tomorrow (June 13) and Friday (June 14). Friday is a "bull" day-- a day when the market has historically risen more than 60% of the time. There are several more bull days next week. I expect weakness in the price of gold as the market rebounds.

Gold also tends to move opposite the dollar. The dollar is showing weakness today, breaking downward through some critical support levels. But in my experience, market movements on isolated bear and bull days can't be trusted for purposes of charting. I usually ignore moves through support or resistance on these days. The dollar may rise back above its supports tomorrow.

If you're feeling lucky, you could even try shorting gold by buying the Junior Gold Miners' Bear fund (JDST). I'd only try a one-day short play, however, because even if the dollar does move upward tomorrow (an uncertain prospect), it may soon return to weakness ahead of the Fed meeting.

As always, this is just an idea and does not constitute investment advice.

JNUG likely to fall if it closes at 8.47 or belowThe Junior Gold Miner's ETF performs better on average when it closes above the previous day's Hull Moving Average than when it closes below. This relationship is particularly strong in the months of June and December, historically JNUG's strongest months. (Anticipators of gold's historic June strength likely drove gold's bull run on May 30-31.)

Today JNUG crossed below its previous day's Hull (8.475), and I give it better than even odds of closing below that level. If it does close at 8.47 or lower, look for a significant drop in the next few trading days. If not, then JNUG may move higher.

The JNUG gold miners ETF reacts to the price of gold (XAUUSD), which reacts primarily to the US dollar. The dollar's next moves will be determined by expectations of a Fed rate cut. If investors remain bullish on the likelihood of a Fed rate cut within the next year, expect both gold and JNUG to break out higher. If expectation of a Fed rate cut turns negative (as it seems to be doing), expect the dollar to return to strength and XAUUSD and JNUG to break out downward. With Bullard the only Fed member signaling a rate cut and others saying a rate cut isn't warranted yet, I'd put 60:40 odds on a strong move downward in the next week before upswing on safe haven demand near the end of the month.

If you'd like to short JNUG, you can use the JDST ETF. This is just an idea, not trading advice.

Gold Miners - Bearish Thesis ConfirmedWhy I’m bearish on Gold and Gold Miners in the short to medium term:

All the following items provide a positive market sentiment, and a stronger willingness for investors to allocate money to risky assets such as stocks rather than safe haven assets like gold, and therefore selling of gold miners.

1.) Still strong US economy, based on the slew of positive economic data we’ve been seeing. Examples would be low jobless claims, good nominal wage growth and low inflationary pressures.

2.) Long end interest rates (10 yr) are rising due to reduced investor fears, causing a decrease in attractiveness of Gold, which is a non-yielding asset.

3.) US Dollar Index has been consolidating for the last several trading sessions, representing a bullish signal in the short term. Provided that we have a positive economic backdrop in the US currently, probability that it breaks out to the upside is high.

4.) Corporate earnings are likely to keep surprising to the upside, since projections have been lowered so much over the last few months.

5.) More likely for positive rather than negative news to come out regarding US-China trade deal. Both sides are committed and evidence suggests a positive outcome.

Feel free to comment or send me a msg if you want to discuss more in detail or if you have different views. You can also check out my blog at gdxdaily.com , this is where I post in much greater detail regarding my analysis.

Daytrading Leverage Strategy for Bigger Accounts on Forex[R:R 3]Hello everyone,

Many of you wonder how it feels to trade bigger accounts, and keeping it short: stop thinking punctual.

Whenever you think I'm buying HERE and getting out exactly THERE. Forget it, never again.

There's simply not enough volume for your positions - so what you do?

You break it up and you start thinking the final average price. You stop thinking on static numbers and you start considering regions for entry and exit.

Larger institutions take WEEKS to close their positions, so I think you get my groove here. It's hard to think tops and bottoms when you need to buy and enter all over the place - the art of market making(but that's a whole other story).

So when I started struggling with such a problem, all my strategies were basically at their maximum capital capacity. The main symptom was that my entry limit orders were being filled partially all the time.

Since I'm a very thrill guy when it comes down to the strategies I like to have every single step very well written before I start opening positions. Not only entry and exit points but also position sizing are crucial for me.

The solution was to break my position in smaller positions that I called ACU's.

Let's say we have a 10% ACU, that means that each ACU that I buy that is equivalent of 1/10 of the total position size I initially wanted.

The second step was changing my algorithms to things that triggered more often across a zone and not super price and solid signals that trigger only once.

So now I'm buying a little bit here and there, with the goal of having a better final average price.

Another secret factor for success here is being quick on or fingers or if you're tech savvy enough getting an execution bot for you.

Which means you can further break your ACU's across a buying zone.

Let's say your buy-zone goes from 1 to 2, you will spread your ACU close to what I'll explain next.

Imagine something around 10% of 10% of your total position size, yes only 1% of total

Because you will break your ACU in 10 smaller positions across the 1~2 range, similar to this

Buy 10% ACU at 1

Buy 10% ACU at 1.1

Buy 10% ACU at 1.2

...

Buy 10% ACU at 2

I know it sucks and it takes time, but the more you break your position is better and I'll tell you why. BECAUSE IT GUARANTEES YOU THE BEST POSSIBLE ENTRY PRICE.

The price hardly ever go all the way down to the bottom of the range and if does your avg price will be 1.5

But let's work with MOST of the times, that the lowest it goes on your buy-zone is around 1.3-1.7

It will always allow you to catch the best avg entry price, I know some of your limit orders won't be filled but this makes the risk a lot smaller for you, so be patient and master your greed.

This also allows the usage of leverage since operating like this makes you REALLY hard to get liquidated, the tools and the settings I used on Spectro M2 are Xconf on aggressive mode(arrows above/under candles), Spectro Warnings on Moderate(gray warnings), Adaptative Fibonacci Levels( pivot levels) & Scalper Exhaust Reversal Tool(blue background).

Also to make the stop-loss rules clear:

If the price just touched #1 Target - Do nothing

If the price just touched #2 Target - Move up one level

If the price just touched #3 Target - Move up SL to #1 target

If the price just touched #4 Target - Move up SL to #2 target if you think there will be a break-out otherwise close your position

Let me know if you have any doubts!

EDZ GartleyIve been wrong a few times on the formation for EDZ but I'm sure this is my final post. A near perfect Gartley has formed with price reversing right at the AB=CD 1.00 projection and a near perfect 0.618 point B. Right now would be a good time to enter the trade since price is retesting the PRZ. I'm trading this one.

EOS, Buy the Red, Sell the GreedEOS is nearing the 276 day uptrend which has held very strong and bounced off aggressively.

We are also nearing a previous daily close meeting the trendline which is high confluence

with oversold RSI conditions and volume squeeze.

Leverage, 2x.

Entry: 977 - 1020

Targets:

1300

1630

1950

2350

Stop Loss: Close Below 830

Risk:Reward = 14.5% : 34/69/103/144%

Catalyst: Decentralized Exchange (2018/12/31)

We are excited to announce EOSfinex - a high-performance, decentralized exchange to be built on EOS.IO

Zoom out to see the full view. Dark Blue lines = Weekly swing highs/low. Light Blue lines = Daily swing highs/lows

DSLV: short on silver (ETF)My ideas are in the chart.

What do you guys think?

-Kristian

Edit: The 12pt font within the idea seems hard to read, not sure why, it usually doesn't. I think it might be because of the way I positioned the chart, or the fact that there's also larger font. Either way, I'll try to fix it for the next idea.

adah18 $adabtc long play 20x leverage bitmex contractsim longing here

NOT SURE IF im taking this one yet #bitmex #ada

$#ADAH18

LEVERAGE :20X, 20:1

Risking: 100.00

Chance to lose: 60.00

Chance to gain: 600.00

RISK2REWARD: 10:1

BTC looking for a new target!Hello everyone!

I have been getting DM's about what to do with BTC and if there are any opportunities. I am already in the opportunity because of the buy ins I used when the price of BTC went to 9.3K.

Missed that buy in? that's I post my charts on Tradingview but the finer details are saved for the groups where I am a Technical Analyst.

I do always drop hints and give you all there is to see in the chart in the older BTC chart I mentioned this :

- next support is 9.3K-8.8K

You could have set a buy in based on that knowledge.

So what now? I have set a short term trade on this chart: Blue box being the new possible buy in zone. I am watching the orange line to use as a stop loss but I am watching it since this is a short term trade so price action can change the opinion on this but the suggestion is here none the less( I set it slightly lower though ). and are watching the profit zone.

I know most people are looking for the 12K+ price but that is just not interesting for me since I don't see any upside to that before we break the profit zone.

Trade based on:

- Ichimoku (customised settings).

- EMA's bullish signals.

-Price action confirming buying power.

-Lower volume than I'd like to see which is why this setup is short term.

-Support and resistance levels.

-Waves trend analysis

-Higher timeframe analysis ( check my older chart here clickable:

As always,

Happy Hunting!

This info does not hold value towards my original chart with buy ins since that one is longer term and has a different setup.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock/cryptocurrency picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. These are not facts but my personal views and opinions.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

7-10-17 Dash Buy Entry #2Check out my Previous Dash Entry Explanation below!

Update:

Things are looking quite grand for Dash and Litecoin in the very near future.

Since our first entry, we saw Dash break up with a good amount of bullish volume behind it. Also note that on most of these cryptos, the bearish volume doesn't compete. (for that long at least)

We got a reversal formation both on the daily and weekly charts when price was chilling above the 10ema(red) and touching it. This is a great place to snag another medium-long term entry.

Yes we are still in this overall crypto lul for the past month+, but we are about to come out of it in a big way, probably starting at the end of the month going into August. I fully expect August to catch fire in this awesome crypto firestorm we are about to experience.

I'm also posting long youtube videos of some chart analysis if anyone wants a better learning experience with simple, transparent technical analysis.

www.youtube.com