#LEVER/USDT#LEVER

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.0001800.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area in green at 0.0001780, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.0001877

First target: 0.0001938

Second target: 0.0002026

Third target: 0.0002110

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

LEVERUSDT

#LEVER/USDT#LEVER

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.0001664.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area (in green) at 0.0001673, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.0001757

First target: 0.0001870

Second target: 0.0001937

Third target: 0.0002017

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

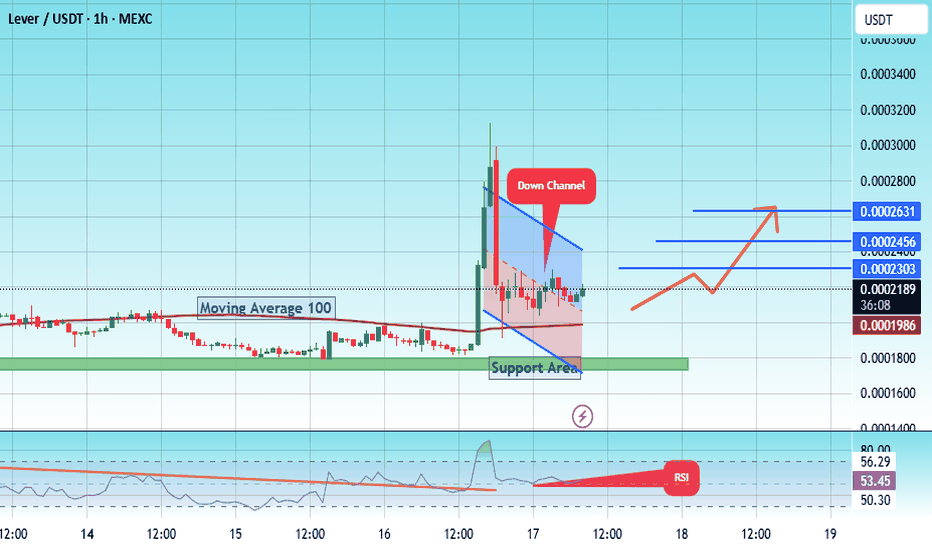

#LEVER/USDT #LEVER#LEVER

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.0001650.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area (in green) at 0.0001764, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.0002196

First target: 0.0002303

Second target: 0.0002456

Third target: 0.0002630

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#LEVER/USDT Forming Strong Falling Wedge#LEVER

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.0001915, acting as a strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.0001672.

Entry price: 0.0001955.

First target: 0.0002087.

Second target: 0.0002283.

Third target: 0.0002472.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#LEVER/USDT#LEVER

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.00016000.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area in green at 0.0001500, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.0001750

First target: 0.0001880

Second target: 0.0002163

Third target: 0.0002427

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#LEVER/USDT#LEVER

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.0001404, acting as strong support from which the price can rebound.

Entry price: 0.0001529

First target: 0.0001795

Second target: 0.0002040

Third target: 0.0002333

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#LEVER/USDT Bullish ?#LEVER

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.000270, acting as a strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.000268.

Entry price: 0.000276.

First target: 0.000295.

Second target: 0.000315.

Third target: 0.000336.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

LEVERUSDT Forming Falling WedgeLEVERUSDT is showing a highly promising setup that’s generating buzz among traders and investors alike. The crypto pair is forming a classic Falling Wedge Pattern, which is widely recognized as a bullish reversal signal in technical analysis. This pattern often indicates that selling pressure is weakening and a breakout to the upside could be imminent. With volume picking up steadily, there is growing optimism that LEVERUSDT could deliver a significant price surge once it confirms a clean breakout above the wedge’s resistance line.

Many traders are particularly excited about LEVERUSDT because the expected gain for this setup is an impressive 160% to 170%+. This projection, combined with the clear technical pattern and rising investor interest, suggests that LEVERUSDT may soon become one of the standout performers in the altcoin market. The recent accumulation phase, reflected in steady volume inflows, hints that savvy traders are positioning themselves early ahead of a larger move.

Another important factor supporting this bullish outlook is the broader sentiment in the crypto market. As traders look for undervalued opportunities with high breakout potential, coins like LEVERUSDT that show strong bullish patterns and healthy trading activity become attractive bets. If the breakout confirms on the daily or 4H timeframe with sustained volume, it could trigger momentum-driven buying and push prices towards the projected targets.

For traders looking to diversify their crypto portfolio with high-potential setups, keeping a close watch on LEVERUSDT is definitely worthwhile. Remember to wait for a clear breakout confirmation before entering and manage your risk accordingly to make the most of this potential reversal.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

LEVERUSDT Forming Strong Falling WedgeLEVERUSDT is currently showing a strong Falling Wedge Pattern, a bullish reversal formation that often precedes sharp upward movements. The recent price structure suggests consolidation is ending, and buyers are preparing for a breakout. This setup, coupled with increasing volume, indicates accumulation at the lower end of the wedge and points toward a potential gain of 140% to 150%+ if the breakout confirms and momentum sustains.

LeverFi (LEVER) has gained traction among DeFi enthusiasts due to its innovative decentralized leverage trading platform. As more investors look to decentralized finance solutions, LEVER’s real-world utility is driving both user interest and investor confidence. This rise in engagement is reflected in recent price action, where bullish divergence and buying interest are becoming more evident on the charts.

The current chart pattern suggests the pair has formed a solid base, with decreasing selling pressure and a tightening range, which often leads to explosive moves once a breakout occurs. Traders will be watching key resistance levels above the wedge for breakout confirmation, and once surpassed, LEVERUSDT could trigger a rapid bullish continuation, attracting swing and momentum traders alike.

With strong fundamentals, rising community engagement, and a technically bullish chart, LEVERUSDT stands out as a potential outperformer in the current market phase. It's an ideal time for crypto traders to keep a close watch on this breakout opportunity.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

LEVERUSDT 1D AnalysisLEVER ~ 1D Analysis

#LEVER This trade is very risky. Buy if you still have confidence in this coin with a short term target of at least 15%+ from this support.

LEVER/USDT (6H) – Trendline Breakout in Progress LEVER/USDT (6H) – Trendline Breakout in Progress

Pattern: Descending Trendline Breakout

Timeframe: 6-Hour ⏱️

Pair: LEVER/USDT 💱

Published: June 10, 2025 📅

Technical Overview:

LEVER/USDT has been trading under a consistent downward trendline, making lower highs over several weeks. Price is now attempting a breakout above this resistance, showing signs of reversal and bullish momentum 📈

Potential Trade Setup:

Bullish Scenario ✅

Entry: On breakout and 6H candle close above 0.000520–0.000530

Targets:

* TP1: 0.000650–0.000680 🎯

* TP2: 0.000750–0.000800 🎯

Stop-loss: Below 0.000450–0.000460 🛑

Risk Management ⚠️

Wait for confirmation with strong candle close and volume to avoid fakeouts. If rejected, price may resume its downtrend or consolidate further.

Conclusion:

LEVER is testing a key resistance zone. Break and hold above trendline may confirm a trend reversal with upside potential 📊🔍

LEVER Looks Bullish (4H)The structure of the Lever symbol has turned bullish.

Within the internal substructure, we are looking for buy/long opportunities.

We have identified and marked two optimized entry points on the chart. These are the levels where we plan to open positions.

Target levels have been set.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

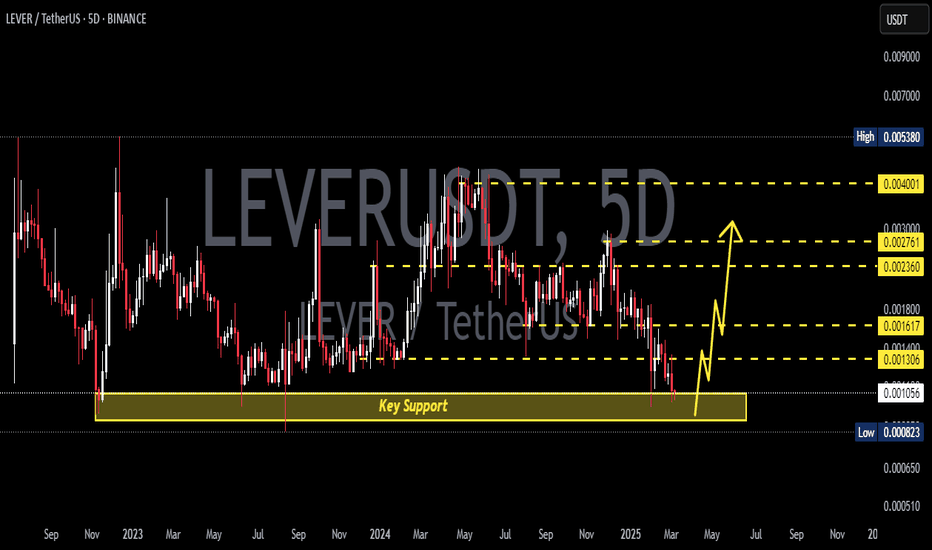

LEVERUSDT 5DLEVER ~ 5D Analysis

#LEVER Buy gradually from here with a short -term target of at least 20%+.

LEVERUSDT 5DLEVER ~ 5D

#LEVER if you still have Conviction on this coin,. Buy in stages from here with a minimum target of 20%++

LEVERUSDT Analysis: Strong Demand Zone IdentifiedThe blue box on the chart marks a significant demand zone , presenting a favorable opportunity for buyers.

Key Insights:

Demand Zone Potential: The blue box is a carefully chosen area with high potential for a market reaction, identified using techniques like volume footprint, liquidity heatmaps, and cumulative delta volume.

Entry Strategy: This zone aligns well for a potential buy setup if confirmation signals appear.

Market Context: Current market conditions demand patience and precise entries.

Confirmation Checklist:

Before taking a position, I will confirm using:

Cumulative Delta Volume (CDV)

Liquidity Heatmap

Volume Profile

Volume Footprint

Upward Market Structure Breaks on Lower Time Frames

Learn Trading Techniques:

Interested in learning how to identify and trade demand zones effectively? DM me for training on using CDV, liquidity heatmaps, volume profiles, and other professional tools.

Final Words:

Discipline and risk management are crucial in this volatile market. Stick to the plan and trade wisely. Best of luck!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis (the list is long but I think it's kinda good : )

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

TradeCityPro | LEVERUSDT Analysis Buyer Presence👋 Welcome to the TradeCityPro channel!

Let’s dive into the analysis of another cryptocurrency and review our triggers before the movement begins.

🌍 Bitcoin's Market Overview

Yesterday, we mentioned that a long position could be opened after breaking 94931, especially if Bitcoin's dominance was declining, favoring altcoins.

After a pullback to 94931, the price is now approaching 96610, where breaking this level could provide another long position opportunity. If Bitcoin's dominance continues to fall, altcoins like LEVERUSDT could see further upward momentum.

📊 Weekly Timeframe

LEVERUSDT is consolidating in a long-term range between 0.001123 and 0.003877, with a narrower short-term range between 0.001588 and 0.002317.

Following rejection from the top of the range, the price didn't drop to the bottom of the box, finding support earlier. This indicates buying strength.

breakout above 0.002317 could signal a risky buying opportunity with stop-loss levels at 0.001588 or 0.001123 for a medium-term hold.

📈 Daily Timeframe

The price has been ranging between 0.001518 and 0.002405, repeatedly testing the upper resistance.

The daily red candles rejecting resistance highlight its importance. A sharp breakout above this level could trigger a significant move.

After breaking this resistance, buyers can enter. If missed, confirmation through RSI breaking 70.13 and rising volume could provide additional confidence.

⏱ 4-Hour Timeframe

The price has shown strong movement toward the range's upper resistance, suggesting this coin might present trading opportunities this week.

For long positions, wait for a breakout above 0.002405, coupled with RSI entering overbought territory and breaking 70.13 for confirmation.

Avoid looking for short positions as the trend appears bullish. Instead, focus on potential entries at lower levels.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

LEVERFI WILL DROP 30%This BINANCE:LEVERUSDT shows a continuing downward sloping channel.

Observe that the support has been bridged trice. while price have only ticked resistance without piercing through.

The idea is to short at the top of the channel (red line) even if price break above redline, the purple channel provides another strong resistance.

Action plan

0.002258- 0. 002180 -- sell

0.002530 -0.002656 -- Stop loss

0.001450- 0.00168 -- take profits

Goodluck!!

LEVERUSDTLEVER ~ 1W

#LEVER If this Support block is retested again. Don't hesitate to buy. So far this support block continues to maintain prices.

minimum target 20%++

LEVERUSDTLEVER ~ 1W ✅

#LEVER If this Key Support is retested again. Don't hesitate to buy. So far this support block continues to maintain prices.

LEVER ANALYSIS🚀#LEVER Analysis :

🔮#LEVER is trading in a symmetrical triangle pattern on the daily timeframe Also there is an instant support zone💁♂️

We could expect a breakout of the symmetrical triangle pattern and could expect a potential bullish move📈

Expect a bullish wave of around 25% in the coming weeks

🔰Current Price: $0.001865

🎯 Target Price: $0.002310

⚡️What to do ?

👀Keep an eye on #LEVER price action. We can trade according to the chart and make some profits⚡️⚡️

#LEVER #Cryptocurrency #TechnicalAnalysis #DYOR

Lever/Usdt BINANCE:LEVERUSDT

Lever (LEVER) is currently trading at $0.002054 and has recently tested a significant support level at $0.001900. This support level is crucial for maintaining the current price trend. If the price holds above $0.001900, it indicates that buying interest is sufficient to prevent further declines.

Should the price stay above this support and begin to rise, the next key resistance level to watch is $0.002300. This level could act as a barrier to further upward movement. If the price breaks through this resistance level, it would suggest a bullish trend, potentially leading to a breakout.

Upon breaking the $0.002300 resistance, the subsequent target would be $0.002400. If this level is also surpassed, the price could continue to rise towards the next major resistance at $0.02734. This would indicate a significant upward momentum and a strong bullish pattern.

In summary, the key points are:

- **Support Level:** $0.001900

- **Resistance Levels:** $0.002300, $0.002400

- **Potential Next Resistance:** $0.02734

**Note:** This analysis is based on current price levels and historical patterns and should not be considered financial advice. Always conduct your own research or consult with a financial adviser before making investment decisions.

Will #LEVERUSDT Defy the Odds or Dive Deeper? Watch These LevelsYello, Paradisers! Is #LEVERUSDT about to take off, or are we in for another twist? Let's look at the latest analysis of the #LeverFi:

💎#LEVER is currently flashing signs of a bullish continuation from a key support zone that used to be a descending resistance. We've been tracking #LeverFi moving within a descending channel for a while now. Recently, it broke above this pattern, retested the upper channel, and is now showing strength at the crucial support level.

💎If #LEVER holds this support, we could see a significant bullish rally reminiscent of past trends. A breakout above the resistance at $0.0026 could pave the way for a move towards higher resistance zones.

💎Should the momentum fail to sustain at the current level, the next bullish rebound might occur around the lower bullish Order Block (OB) at $0.0015. If that fails, we may see further support tested at $0.0013.

💎Stay vigilant, Paradisers! A daily close below the demand area could negate the bullish scenario and lead to a deeper correction.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

Lever/Usdt Plan The Lever/USDT pair shows promise for a breakout. With increased volume, it may significantly rise. Keep an eye on it as I anticipate a strong breakout in the coming days. Please note that this is not financial advice; do your own research before making any decisions.