TradeCityPro | LDO Breaks Out Amid Altseason Hype Shift👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the LDO coin for you. It’s one of the well-known DeFi projects in crypto with the highest TVL in this category, and the LDO coin ranks 82 on CoinMarketCap with a market cap of $1.08 billion.

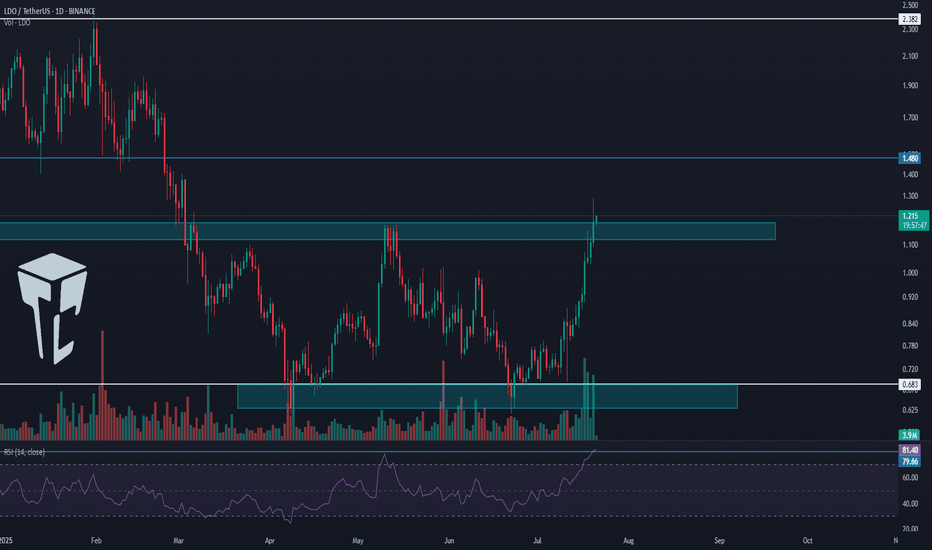

📅 Daily timeframe

On the daily timeframe, LDO has been in a range box for several months and is now starting to break out of it.

💥 After being supported at the 0.683 bottom, a large amount of buying volume entered, and a sharp bullish move occurred from this bottom to the top of the box. The RSI has also entered the Overbuy zone.

🔔 The overextended level on the RSI oscillator is 79.66, which has even been broken during this leg. Right now, I think the probability of a correction is quite high.

🔍 Yesterday's candle made a deep penetration into the top of the box, and currently, the price is sitting above the box. Since RSI is in the overextended zone, a pullback or short-term rest is likely.

🚀 However, considering the current uptrend, I believe this bullish leg might be ending, and we could see a few corrective candles. But after the correction ends, a new bullish leg might begin, pushing the price toward the resistance levels at 1.480 and 2.382.

🛒 For a long position or a spot buy, we can enter during this new bullish leg once the top breaks and a confirmation of a new wave starting is in place.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Lido

Lido DAO Awakens While Aiming At 900%+, EasyLido DAO has been sideways for three long years and is currently trading at bottom prices. The best possible ever for buyers, traders, long-term holders or simply all those looking to make good profits with Cryptocurrencies, the time is now.

Here we can see how price action matches perfectly the support zone that was tested in August-November 2024, Nov-December 2022 and June 2023. True bottom prices.

It is also easy to notice a huge increase in trading volume after mid-2024. This means that after this date LDOUSDT traders became active which tends to happen before strong market action.

Now, there has been some bearish action but also bullish, "long-term sideways consolidation," and this is coming to an end. The next move is a bullish move and signals the start of the 2025 bull market for this pair.

Some pairs are already growing while others are still moving lower. Since it will take 6-12 months for the full bull market to unravel, it is normal to see some down while others are up.

This project will be a big one. This pair will produce massive growth.

Here we have a great price and great entry timing.

I am wishing for you the best.

Thanks a lot for your continued support.

Namaste.

LDO - Next Impulse Starting Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

After breaking above the $0.8 major high, LDO has shifted from bearish to bullish from a long-term perspective. 📈

This week, it has been undergoing a correction phase within a falling channel marked in red. 🔻

For the bulls to take over and kick off the next impulsive wave toward the $1.5 mark, a breakout above the upper red trendline is needed. 🚀

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

LDO Is About To ExplodeHello, Skyrexians!

Today I make an update on BINANCE:LDOUSDT which I hold on spot with average price at $0.8. First of all I will clarify how this bullish forecast can match with my yesterday's analysis about altcoins drop. Easily! There was the 2D time frame - mid term analysis. This is weekly chart. I can allow that some drop is possible for Lido Dao or other alts but global picture will be the same.

On the chart some of you will see the accumulation. In fact this is very long wave 2 ABC shaped. It's not interesting to tell about waves A and B. The only one thing is important is that now wave C in 2 is finished with the divergence between waves 3 and 5. Next wave shall be insane and reach very high, above $6.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

TradeCityPro | LDO: Watching for Breakout in DeFi Leader’s Range👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the LDO coin — one of the well-known DeFi projects within the Ethereum ecosystem with a significantly high TVL.

✔️ This project’s token currently has a market cap of $748 million, placing it at rank 86 on CoinMarketCap.

⏳ 4-Hour Timeframe

As you can see on the 4-hour chart, after a downtrend, LDO formed a bottom around the 0.676 zone and managed to rally up to 0.868.

🔍 Currently, the price is consolidating below that resistance in a ranging box. A breakout from either direction of the box could determine the next trend.

⭐ If the box breaks upward and the 0.868 level is breached, we can consider the prior downtrend over, and the price would be forming a new bullish structure. However, there is another resistance at 0.904 right above, and there’s a possibility of rejection from that level after the 0.868 breakout.

📈 For a long position, I personally plan to enter upon the breakout of 0.868. While it’s possible that the price might reverse from 0.904, I prefer having an earlier entry and using a more accessible trigger.

🔽 On the other hand, if the box breaks to the downside, the price might revisit the 0.676 support and potentially start a new bearish leg in line with the longer-term downtrend.

📉 The first short trigger is the break of 0.818 (the lower boundary of the box), but there’s another minor support at 0.795, which may cause a bounce.

👀 I personally prefer to wait for the 0.795 level to break for a short entry, given that market momentum is currently bullish, and I prefer a more reliable trigger for shorts.

📊 Volume within this range has been decreasing, which is normal in such consolidation phases. The longer the price stays in this range, the lower the volume tends to be — and typically, a breakout will lead to a sharper move.

The RSI oscillator also has a support zone at 43.17. If this level is broken, it could signal incoming bearish momentum and increase the probability of a downside breakout.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

LDO Is The Best Asset NowHello, Skyrexians!

Some of you may be remember my article which I shared more than 1 year ago where called BINANCE:LDOUSDT the worst asset and it dumped exactly as predicted. Then made a mistake making assumption that some coins can grow while other will go down. This assumption has the very low probability to be truth, now I have the clear view that entire crypto will go up soon and LDO can be the greatest performer.

On the weekly chart we can see the huge 3 year accumulation. Current point can be the best to buy. We have bullish divergence on Awesome oscillator, green dot on Bullish/Bearish Reversal Bar Indicator . Moreover, current price action looks like a spring on Wyckoff cycle. The exact target impossible to predict, but I think it shall be above $12.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

TradeCityPro | LDO: Comprehensive Market Analysis and Prediction👋 Welcome to TradeCity Pro!

In this analysis, I want to review LDO for you. It is one of the key DeFi platforms, and its token currently holds a market cap of $945 million, ranking 72nd on CoinMarketCap.

📅 Weekly Timeframe

On the weekly timeframe, we can see a range box between the $0.957 and $3.389 levels, where the price has been fluctuating for almost two years.

🔽 If you already hold this coin, I recommend activating your stop-loss in case the $0.957 level is broken and waiting for bullish momentum to re-enter the market before buying again.

📈 If the price holds above the $0.957 support, it could rally back toward the top of the range at $3.389. The key trigger levels between the current price and the top of the box are $1.447 and $2.488.

🚀 The main buying trigger is at $3.389, as breaking this level could lead to significant capital inflows, potentially initiating a long-term bullish trend.

📅 Daily Timeframe

On the daily timeframe, a range box between $1.447 and $2.387 had formed, which was broken to the downside, leading to a bearish leg. The main support level is $0.957, and if it fails to hold, the price could enter a new bearish cycle.

🛒 For spot buying, there isn’t a clear trigger yet, so we need to wait for a new structure to form. However, if the price rallies sharply, you could consider entering on a break above $1.489.

💫 As seen on the chart, the red candle volume is significantly higher than the green candles, indicating strong seller dominance. Additionally, the RSI is near the 30 level, and if it breaks below this zone, the bearish scenario becomes more likely.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Lido DAO: Long-Term Support—Long-Term Sideways—Long-Term BullishSome charts just make technical analysis easy. The same support level that worked in late 2022 worked again in late 2024. The present correction is ending as a higher low in relation to this same long-term support, the black line on the chart.

Since the market bottom, June/July 2022, LDOUSDT has been sideways with a wide range. The last bullish breakout was really small and the present retrace is also small, the market always seeks balance, so a small breakout leads to a small retrace.

There is more.

The consolidation phase is very long, years of sideways action. The market always seeks balance. A long consolidation phase will lead to a very strong bull-market. The bull-market is now, it is happening now, starting this month —March, this year (2025) and it will extend for a long-term.

So we have long-term support, long-term sideways and a long-term bullish market.

Thanks you for reading.

Namaste.

Breaking: $LDO Surges 18% Amid Whale ActivityLido DAO ( MIL:LDO ) has captured the crypto market's attention with an impressive 18% price surge, fueled by strategic whale activity and increasing adoption of its liquid staking solutions. The recent developments underline Lido DAO's potential to remain a key player in the decentralized finance (DeFi) ecosystem. Let’s delve into the technical and fundamental aspects driving this rally.

Whale Activity Boosts Confidence in MIL:LDO

A prominent Pepe Coin whale, known as “0x373,” made headlines after purchasing 1.167 million MIL:LDO tokens for approximately $2.38 million. This significant buy-in, at an average price of $2.036 per token, reflects growing confidence in Lido DAO’s long-term prospects.

Additionally, another whale, “0x655,” acquired 2.72 million MIL:LDO tokens earlier this week, bringing their total holdings to 5.765 million tokens. Such substantial accumulation highlights broader market sentiment favoring Lido DAO as a reliable staking solution. These calculated investments have acted as a catalyst, attracting more investors and amplifying bullish momentum.

Lido DAO’s Fundamental Strengths

1. Market Leadership in Liquid Staking:

Lido DAO is a leading provider of liquid staking solutions, particularly for Ethereum. Its innovative approach allows users to stake their ETH while retaining liquidity through stETH tokens, a feature that has garnered significant adoption within the DeFi community.

2. Explosive TVL Growth:

According to DeFiLlama, Lido DAO’s total value locked (TVL) stands at $32.334 billion, reinforcing its position as a dominant force in the DeFi space. This robust TVL growth demonstrates the platform’s ability to attract and retain capital.

3. Strategic Integrations:

Lido DAO’s seamless integration with various DeFi protocols has further solidified its market position. The platform’s compatibility with Ethereum and other blockchain networks makes it an attractive option for users seeking efficient staking solutions.

4. Increased Whale Activity:

Whale accumulation trends, including recent high-profile purchases, signal heightened confidence in Lido DAO’s potential. This has contributed to a surge in trading volume, which jumped 32% to $292 million.

Technical Analysis

As of writing, MIL:LDO is trading at $2.05, marking a 13% gain in the last 24 hours. The asset recently broke out of a falling wedge pattern, a bullish technical indicator, and has surged 23% since the breakout. The RSI currently hovers near 56, indicating further room for upward momentum before reaching overbought territory. This suggests that the rally could sustain in the near term.

Support and Resistance Levels:

Immediate support lies near $1.90, while resistance at $2.33 could be the next key level to watch. A breakout above $2.33 could pave the way for a move towards $2.50 and beyond.

MIL:LDO is trading above all key moving averages, reinforcing the bullish outlook. The sustained uptrend aligns with increased whale activity and broader market recovery.

Outlook and Potential Risks

Lido DAO’s recent price surge and whale accumulation underscore its growing prominence in the DeFi space. However, market volatility remains a critical factor to consider. Future price action will depend on:

1. Broader crypto market trends.

2. Network developments and staking demand.

3. Sustained whale activity and accumulation trends.

While the fundamentals and technical indicators suggest a bullish trajectory, investors should remain cautious and monitor key support levels to manage potential risks.

Conclusion

Lido DAO’s combination of strong fundamentals and bullish technical indicators positions it as a promising asset in the crypto market. The recent whale activity and rising adoption of its liquid staking solutions reflect growing confidence in its ecosystem. With MIL:LDO trading in a bullish terrain and its TVL continuing to climb, the asset is poised for further growth in the DeFi landscape.

Lido DAO Surges 25% Following Grayscale’s Investment InitiativeIntroduction

Lido DAO ( MIL:LDO ) has captured the spotlight with a remarkable 25% price surge, catalyzed by Grayscale Investments’ announcement of its new Lido DAO Trust. This move strengthens Lido’s position in the staking and DeFi ecosystem while reinforcing its relevance in Ethereum’s expanding infrastructure. Let’s delve into the technical and fundamental factors driving this rally.

Grayscale’s Strategic Investment

Grayscale Investments, renowned for its expertise in crypto asset management, has introduced the Grayscale Lido DAO Trust alongside the Grayscale Optimism Trust. These vehicles offer institutional and accredited investors exposure to governance tokens such as MIL:LDO and $OP.

Focus on Staking and Ethereum Scaling: Lido DAO’s liquid staking solution democratizes Ethereum staking, making it accessible to more users. This, in turn, strengthens Ethereum’s security and DeFi capabilities.

Grayscale’s Commitment to Innovation: With over 25 crypto investment products, Grayscale’s inclusion of MIL:LDO underlines its growing focus on projects that enhance the Ethereum ecosystem, positioning Lido as a pivotal player.

- Layer-2 Ecosystem Synergy: By pairing MIL:LDO and NASDAQ:OP in its investment offerings, Grayscale highlights the importance of both staking and Layer-2 scaling solutions in Ethereum’s future growth.

Lido DAO has rapidly emerged as a key player in the DeFi landscape by providing a liquid staking mechanism for Ethereum. This approach allows users to stake ETH while retaining liquidity through stETH tokens, which represent their staked ETH and rewards. Key fundamentals include:

1. Market Performance:

- Current Price: $2.278

- Market Cap: $2.03 billion

- Trading Volume (24H): $491.8 million

2. Staking Dominance:

- Lido DAO’s protocol holds a significant share of Ethereum’s staking ecosystem, enhancing its relevance as Ethereum transitions into its proof-of-stake (PoS) era.

- Recent updates have streamlined its support to Ethereum and Polygon, ensuring focused development in high-impact areas.

3. Governance and Development:

- As a DAO, MIL:LDO holders actively participate in decision-making, reinforcing decentralized governance.

- Frequent audits of its smart contracts underline its commitment to security and transparency.

Technical Analysis

MIL:LDO is up 20% in the last 24 hours, breaking through key resistance levels. The token trades near $2.27, reflecting increased investor confidence following Grayscale’s announcement.

The Relative Strength Index (RSI) is at 65 indicating a bullish sentiment, though approaching overbought territory, suggesting a potential consolidation phase.

The current uptrend finds support at $1.999 (38.2% Fibonacci retracement level), with resistance anticipated at $2.630. Similarly, A spike in trading volume reinforces the upward momentum, hinting at sustained investor interest.

With an ATH of approximately $18, MIL:LDO presents a compelling entry point for long-term investors ahead of a broader altcoin rally.

Why Lido DAO Matters

Lido DAO plays a critical role in Ethereum’s ecosystem by addressing two major challenges:

- Scalability: Liquid staking ensures Ethereum remains secure and decentralized while enabling users to participate without locking funds.

- Adoption: By simplifying staking and enhancing liquidity, Lido supports Ethereum’s adoption across DeFi applications.

Conclusion

Grayscale’s introduction of the Lido DAO Trust underscores the growing institutional interest in Ethereum-centric projects like Lido. From its robust staking infrastructure to its DAO-driven governance, Lido is poised to capitalize on Ethereum’s continued growth. Technically and fundamentally, MIL:LDO offers a promising outlook, with bullish momentum and strong fundamentals paving the way for potential upside.

As the market gears up for a broader altcoin rally, MIL:LDO remains a token to watch, supported by its innovative staking model and growing institutional backing.

LDO SWING LONG IDEA - A Life-changing opportunityNarratives:

1) LDO is the strongest ETH-BETA with a massive $35B TVL. We haven't seen an ETH bull run yet, but when it happens, LDO will likely benefit the most.

2) Market Cap = FDV , meaning all tokens are already in circulation, eliminating future unlock-related sell pressure.

3) Undervalued : LDO boasts $35B TVL and a $1.8B market cap, while AAVE has 20B$ TVL and a $3.5B market cap.

4) SEC Administration Change : The current administration has delayed ETH staking approvals for ETFs. A new SEC administration may greenlight this, channeling billions of ETH ETF funds into LDO, the largest ETH liquid staking protocol. This could bring a significant influx of assets to its chain.

Technical Analysis:

The price ran the Autumn 2022 EQLs (equal lows)—which I consider "max pain"—but failed to close below, showing resilience. After that, the price reversed upward, breaking the bearish trendline responsible for the bearish trend since January 2024. Following a successful retest of the trendline, we saw strong momentum.

I’ll be targeting 2024 Highs at $4 initially, with a long-term view toward ATH at $7.22.

Invalidation:

This is a 3x leverage swing trade or a spot trade, and I plan to carry it until spring 2025. I’m already in the trade. My invalidation level is a daily close below $0.91. Yes, it’s a wider stop-loss, but as I mentioned, this isn’t just a trade; it’s more of a mid-term investment. I’ll be looking to close the position around May 2025 or earlier if we reach levels close to the previous ATH.

TradeCityPro | LDOUSDT The Layer 2 Leader with Highest TVL👋 Welcome to the TradeCityPro channel!

Let's explore LDO, the altcoin with the highest Total Value Locked (TVL) on Ethereum, and analyze potential triggers for spot and futures trades.

🌐 Market Overview

Bitcoin experienced a pullback during the New York session, accompanied by a rise in BTC dominance. This led to a deeper correction in altcoins, but the overall trend remains bullish.

📊 Weekly Timeframe

LDO, a relatively new altcoin, hasn’t experienced a full crypto bull run yet. Its ATH of $4.053 was fueled by the Layer 2 hype. Since then, it broke its weekly uptrend and dropped to $0.924.

LDO has been consolidating in a range between $0.924 and $1.339, forming an accumulation zone.

This week’s candle is attempting to break both the upper range and a descending trendline. A close above $1.339 could trigger a rally, with a stop-loss at $0.924.

📈 Daily Timeframe

After 110 days in the accumulation zone, LDO is breaking out above $1.345. Buyers are showing strength, as the price didn’t revisit the range’s lower boundary after the last rejection.

Likely to enter overbought rsi territory if the breakout sustains, signaling continuation of the uptrend.

For risk-takers, a stop-loss at $1.115 can be set for entries based on the daily timeframe.

⏱ 4-Hour Timeframe

The price is battling strong resistance at $1.408. Despite minor rejections, buyers remain dominant, with the price rebounding from the trendline support.

📈 Long Position Trigger:

Open a long position after a breakout above $1.408, confirmed by increased volume and RSI entering overbought levels.

📉 Short Position Trigger:

Even if short triggers appear, it's better to wait for pullbacks for long entries as the bullish momentum builds.

💡 BTC Pair Insight

Like most altcoins, LDO has been underperforming against Bitcoin. However, it’s attempting a recovery, starting from lower timeframes.

breakout above 0.0002083 BTC could signal a stronger rally against Bitcoin. However, current funds seem concentrated in other altcoins, so its pace might be slower for now.

LDO holds the largest stake in Ethereum, giving it potential to self-support in the short term :)

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Lido DAO Launches Community Staking ModuleLido DAO ( MIL:LDO ) has introduced its highly anticipated Community Staking Module (CSM), a transformative step towards decentralizing and democratizing access to Ethereum staking. Lido Finance, a leading provider in the liquid staking space, sees this initiative as a way to remove the substantial technical and financial barriers to solo staking and has positioned CSM as an accessible entry point for the broader Ethereum community.

A Shift Towards Permissionless Staking

The new module, approved by the Lido DAO community through a majority vote, marks the beginning of a more permissionless Ethereum staking protocol. CSM will become Lido’s first staking module that is fully open to the community, an aim supported by LidoDAO's tech lead, Dmitriy Gusakov, who confirmed that CSM will support Ethereum and Gnosis solo stakers, along with other early adopters.

During this introductory phase, CSM participation is restricted to those within Lido’s “early adoption” period, including credentialed Obol Techne holders and other community-aligned node operators. As CSM progresses, anyone holding 1.5 ETH (approximately $3,800 at today’s rates) can become a node operator and earn validator rewards by staking their ETH, with future updates planning to lower the bond requirement further to 1.3 ETH. This contrasts starkly with Ethereum’s standard 32 ETH ($81,000) bond, greatly enhancing accessibility to solo staking.

Ethereum co-founder Vitalik Buterin and other advocates have highlighted solo staking as a method of decentralizing Ethereum’s validator set, reducing reliance on large staking pools. Decentralized solo stakers contribute to Ethereum’s censorship resistance, avoiding the risk of centralization posed by large, professional staking services. Lido’s CSM aims to address this by providing a low-entry staking solution.

With a streamlined, user-friendly design, CSM removes secondary collateral requirements, opening Ethereum staking to a much broader audience without compromising on security or complexity. Gusakov noted that Lido is actively moving towards decentralization, responding to criticism that its significant market share—currently below 30%, according to Dune Analytics—could create excessive power concentration.

Market Metrics and Technical Signals

Despite a recent 4.45% dip, MIL:LDO remains a strong performer within the liquidity, staking, and lending arenas. DefiLlama data indicates that Lido Finance ranks as the leading protocol for liquid staking, with a total value locked (TVL) of $24.561 billion. Over a 24-hour period, Lido generated fees of $2.21 million and revenue of $220,828, showing the robust demand and profitability of its staking services. Lido's dominance within the liquid staking space demonstrates a solid foundation for growth, making MIL:LDO a highly undervalued asset compared to its market cap of only $945.32 million, as it has yet to surpass $1 billion.

Technical Analysis

With the Relative Strength Index (RSI) at a low 44, MIL:LDO is signaling a potential trend reversal. For traders, this dip represents a strategic entry point, given Lido’s strong fundamental positioning and the high utility provided by CSM. As CSM gains adoption and Ethereum staking opens to more individual investors, demand for MIL:LDO is expected to rise, potentially driving up its price.

A New Era for Ethereum Staking

The release of Lido's Community Staking Module brings Ethereum closer to the vision of a decentralized staking ecosystem, free from the control of large entities. With a growing ecosystem, robust revenue streams, and a commitment to decentralization, MIL:LDO offers both traders and long-term holders a unique opportunity to capitalize on Ethereum’s continued growth while contributing to a more resilient, decentralized network.

Lido DAO / LDO The price of Lido DAO is $3.27 today with a 24hour trading volume of 260 million dollar. This represents a 8.5% price increase in the last 24 hours and a 66% price increase in the past 30 days

Lido is a liquid staking solution for Ethereum. Lido lets users stake their ETH with no minimum deposits or maintaining of infrastructure - whilst participating in on-chain activities, e.g lending, to compound returns.LDO is the native utility token that is used for: 1/Granting governance rights in the Lido DAO. 2/Managing fee parameters and distribution. 3/Governing the addition and removal of Lido node operators.

right now LDO/USDT is breaking out of huge Adam & Eve pattern at 2.8$ and its next targets are 3.3, 3.5 and 3.9 for short term trade

Lido DAO Ldo price holds firmly#LDOUSDT price "fell slightly" at night compared to other altos and was very well bought back.

Is there any fundamental news around MIL:LDO ? Do you know anything about it?

As long as there is "strength at buyers", you should at least pay attention to the project, and as a maximum, you should take it)

Buying zone -10% down from the current price

The growth potential is +100%.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Buy signal for Lido #LDOLido #LDO has produced a buy signal on the daily chart. The “doji” candle marks the signal, and the shadow of the candle is the point from which the stoploss will be placed.

The buy signal, if effective, will face a resistance (dashed black line) that if overcome will take the price even higher.

Lido Finance hits 1M validators Still hasn't Make a Major MoveIn a monumental stride for decentralized finance (DeFi), Lido Finance ( MIL:LDO ) emerges as Ethereum's beacon of accessibility, boasting an unprecedented one million validators. This milestone not only underscores Lido's pivotal role in democratizing staking but also fuels the burgeoning landscape of DeFi.

Lido Finance ( MIL:LDO ) stands as the vanguard of liquid staking protocols, revolutionizing the staking ecosystem by lowering barriers to entry for retail users. Traditionally, individuals seeking to participate in staking would require a substantial capital investment, typically 32 Ether. However, Lido's innovative approach democratizes staking, enabling users with limited capital to partake in validator nodes on Ethereum.

The protocol's ascent to prominence is reflected in its commanding share of staked Ether, comprising 28.5% of the total, according to Dune data. This dominance underscores Lido's pivotal role in shaping Ethereum's staking landscape, making it a cornerstone of the DeFi narrative.

Liquid staking protocols like Lido ( MIL:LDO ) have witnessed exponential growth, driven by their unique value proposition of offering liquidity benefits to users. By staking Ether with Lido, users receive Lido Staked ETH (stETH) in return, which can be seamlessly deployed across various DeFi protocols. This liquidity infusion breathes new life into staked assets, unlocking their potential for broader utility within the DeFi ecosystem.

The impact of liquid staking on DeFi's growth trajectory cannot be overstated. The total value locked (TVL) in DeFi protocols has experienced a meteoric rise, surging from $36 billion in Q4 2023 to a peak of $97 billion in Q1 2024. This surge, attributed largely to liquid staking protocols like Lido, underscores their pivotal role in driving DeFi's exponential growth.

However, amidst Lido's meteoric rise, concerns over centralization loom large. Ethereum co-founder Vitalik Buterin has cautioned against the potential risks of centralization posed by Lido's growing dominance. While protocols like Lido have implemented safeguards to mitigate these risks, the specter of centralization remains a topic of discourse within the crypto community.

As Lido Finance ( MIL:LDO ) continues to chart new frontiers in DeFi and democratize access to staking, the protocol's journey underscores the delicate balance between innovation and decentralization. With one million validators under its belt, Lido stands as a testament to the transformative potential of DeFi, while navigating the challenges of centralization with vigilance and foresight.

Lido DAO (LDOUSD): End of correction soon 🔍Lido DAO : BINANCE:LDOUSD

We've recently added Lido DAO (LDO) to our portfolio. On the daily timeframe, we are in an uptrend within a major Wave (3). The subordinate Wave 3 has already commenced, aiming for at least $5.45, potentially up to $10.43, which we must mark as the maximum. The current all-time high is at $5.20, with the all-time low at $0.40. A closer look at the 4-hour chart reveals that since the subordinate Wave 2, we've completed a 5-wave cycle upwards, now entering a correction towards a very subordinate Wave ((ii)). This Wave ((ii)) is likely to retrace between 61.8% and 78.6%. The presence of a zigzag movement is evident as Wave (b) reached exactly 61.8%, indicating a 5-wave structure from Wave (v) to Wave (a).

We now anticipate a 5-wave structure downwards for LDO during Wave ((ii)). Our stop-loss is set below the 78.6% level, as dropping beneath it would imply a regression to the origin of the major Wave 2 at $1.42, potentially lower, nullifying any bullish scenario. However, should a reversal occur, we're projecting a rise towards the $5 mark for Wave ((iii)), with subsequent movements in Waves ((iv)) and ((v)) contributing to the overarching Wave 3 of Wave (3).