LINKBTC

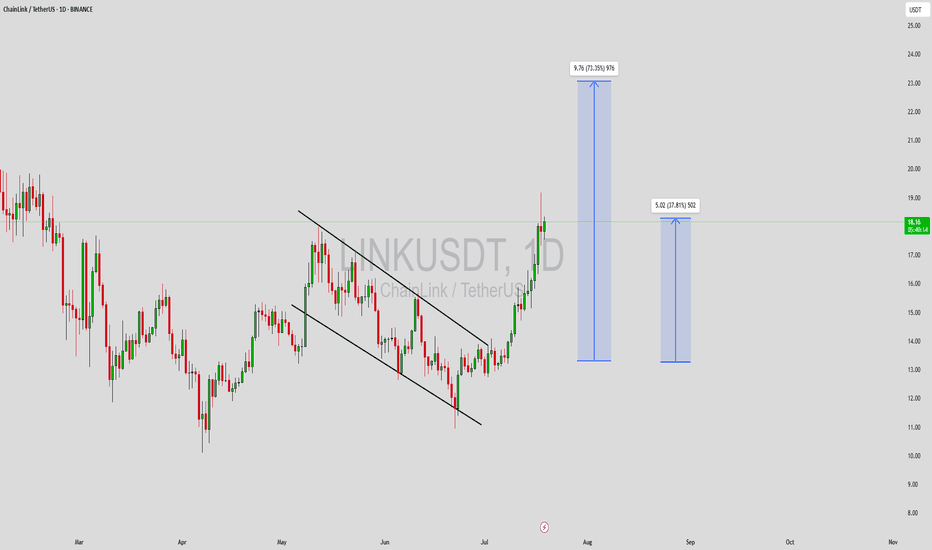

LINKUSDT Forming Falling Wedge LINKUSDT is currently forming a classic falling wedge pattern, a bullish reversal setup that often signals the end of a downtrend and the beginning of a strong upward move. The recent price action within the wedge shows decreasing volatility and tightening price levels, suggesting accumulation is underway. This setup, combined with increasing volume, indicates that a breakout to the upside could be imminent.

Chainlink (LINK) continues to draw investor interest due to its critical role in the decentralized oracle network ecosystem, which bridges blockchain smart contracts with real-world data. The project has maintained relevance in both DeFi and traditional enterprise solutions, and its consistent development activity keeps it on the radar of long-term crypto investors and short-term traders alike. With current market sentiment shifting more favorably toward altcoins, LINK’s technical and fundamental setup makes it a top watch.

The expectation for a 60% to 70% gain is well-supported by previous price performance following similar wedge breakouts. Traders are advised to monitor for a strong volume breakout above resistance lines, as this would confirm the move and likely initiate a new upward trend. If broader market conditions remain positive, LINKUSDT could move swiftly toward higher levels, fueled by both technical momentum and renewed investor confidence.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

LINKUSD Paths on OfferPretty clear accumulation stages going on and so I am inclined to think we head towards the Bullish path to ~$100

Bears will want to buy LINK at massive discounts and so perhaps we do see some capitulation before our next mark-up phase.

However, the current Total Market cycle patterns, along with the BTC pairing, almost rule out the possibility of further downside, or at least major downside.

Chainlink (LINKUSDT) | Falling Wedge at Critical SupportChainlink is trading within a well-defined falling wedge pattern on the 4H chart, a typically bullish reversal setup. Price action indicates the coin is hovering just above key horizontal support around $12.35, making this a critical zone to watch.

Technical Breakdown:

Pattern: Falling Wedge (Bullish Bias)

Current Price: $12.98

Immediate Support: $12.35

Major Support: $10.71

Resistance 1: $13.80 (wedge upper trendline)

Breakout Targets:

$17.78 (major resistance)

$20.03 (macro level supply zone)

Indicators:

RSI (14) at ~42 → Weak but stabilizing, potential for reversal

Volume has been compressing — watch for a breakout with rising volume for confirmation

Strategy:

A 4H close above the wedge trendline with volume could trigger a breakout rally toward $17.78 or even $20.03.

Failure to hold $12.35 could send LINK back toward $10.71 support, caution below this level.

Setup Summary:

Long entry on breakout above $13.50 (trendline)

Stop-loss: Below $12.35

Target 1: $17.78

Target 2: $20.03

Risk: Reward Ratio: ~1:3+

Not financial advice. DYOR before entering trades.

If this analysis helps, like & comment your view.

#LINK/USDT#LINK

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 14.50.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 15.80

First target: 16.45

Second target: 16.90

Third target: 17.56

Is LINK Preparing for a Parabolic Rally? Key Levels to WatchYello, Paradisers! After completing its ABC correction, #LINK slipped into a sideways phase — but something significant is brewing beneath the surface. The recent formation of an inverse head and shoulders might be signaling the start of something much bigger.

💎LINK has now confirmed a breakout above the key neckline at $16.00, a critical level that had been capping price action. Following this breakout, the price is holding its ground well and entering a post-breakout consolidation that often acts as the launchpad for the next explosive leg.

💎#LINKUSDT now faces a decisive resistance at $18.50, a trendline rejection point that has held strong since December 2024. A clean break above this level could ignite strong bullish momentum. If bulls succeed, we could see LINK pushing quickly toward the $19.70–$20.30 range, a moderate resistance area, where partial profit-taking is likely from experienced hands.

💎Should momentum persist, the next major upside lies between $23.25–$24.00, the measured target of the inverse head and shoulders breakout. This zone is not just technically significant due to the pattern, it also aligns with the 61.8% Fibonacci retracement, making it a high-confluence resistance.

💎On the downside, LINK has strong support between $16.00–$15.50. This is not only the breakout neckline but also closely aligned with the 50 EMA and 200 EMA, reinforcing this range as a robust demand zone.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

#LINK/USDT#LINK

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 14.30.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 15.00

First target: 15.30

Second target: 15.61

Third target: 15.94

#LINK/USDT

#LINK

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 12.84.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 13.33

First target: 13.58

Second target: 13.83

Third target: 14.20

Chainlink vs Bitcoin: Trading Disaster Or Buy Opportunity?Spoiler alert! It is a buy opportunity.

Good evening my fellow Cryptocurrency trader, how are you feeling in this wonderful day?

I know what you are wondering. You are wondering...

This is an amazing opportunity that I am showing to you in the form of a chart. It is a chart but the chart is not the opportunity.

It is a trade but the opportunity is not in the candles or the information I am about to share, the opportunity is all about you and how you choose to behave.

The opportunity is only real if you decide to take action.

I'll just translate the chart and I'll let you figure out the rest.

An all time favorite, Chainlink here is paired against Bitcoin rather than the US Dollar, so LINKBTC is the trading pair.

The chart here is a long-term one and is saying two things mainly that are of interest to you and this opportunity that you are about to take:

1) There is no more bearish action. The bottom is in.

2) There is strong potential for growth. The market will grow.

These are the main points that are compelling me, attracting me and telling me to please tell you to buy up this coin. Only if you are into Crypto and looking at Crypto to make money, to collect profits and while you grow, become rich and have some fun.

Chainlink is about to grow. This is true of LINKBTC as it is true for LINKUSDT.

This chart is now at the bottom and it cannot go any lower. Bottom prices won't last long.

Where are you?

Look at the chart and take action —buy and hold.

Thanks a lot for your continued support.

Namaste.

SECRET Indicator Says LINK Will Moon🚨MartyBoots here , I have been trading for 17 years and sharing my thoughts on BINANCE:LINKUSDT here.🚨

.

🚨 BINANCE:LINKUSDT is looking beautiful , very interesting chart for more upside

and is now into support🚨

Do not miss out on BINANCE:LINKUSDT as this is a great opportunity

The SECRET Indicator says it will moon

Watch video for more details

LINKLINK

March 26, 2025

8:02 AM

CRYPTOCAP:LINK just had a clean bounce off the +W OB (not a full-on impulsive move, but definitely a solid reaction)

Also, the MA100 and MA200 are forming a golden cross on both weekly and 4H TF — pretty bullish signal overall.

Looks like we’re setting up for W3. Right now, we’re in W2 and potentially about to enter W3 of W3, which is usually the strongest leg.

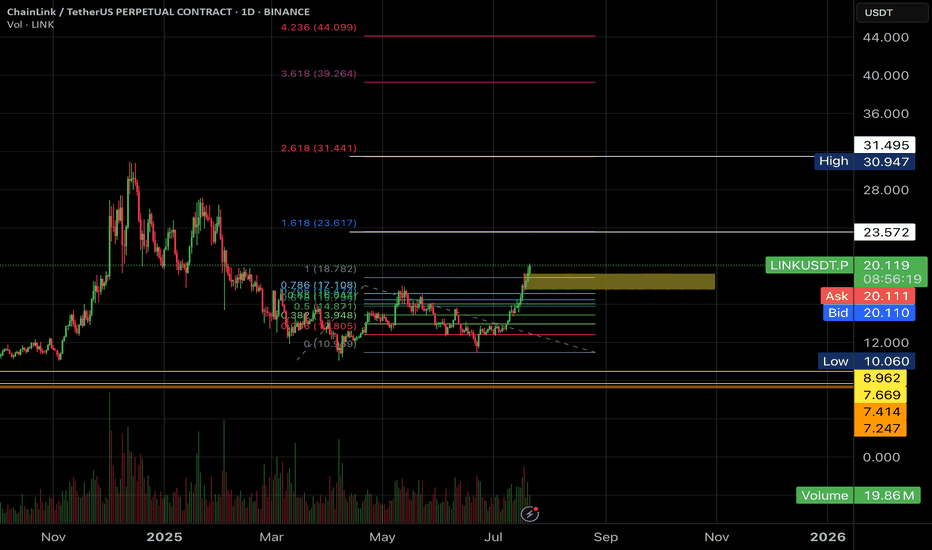

CHAINLINK 200 DOLLARS BY SEPTEMBER 2025 Only up for Chainlink from this moment , do not let them shake you out , my time fib will show the way as always , for Link its showing August which is when the fractal finishes , late August .

Chainlink so far is repeating the same fractal as last cycle , its very close been using it for over one year to time the market with amazing results the fractal cycle top pattern comes in in August 2025.

The sell zone is in the yellow box , invalidation of this idea would be LINK closing a weekly under 20 dollars.

LINK Mid TermChainlink (LINK/USDT) Summary Analysis

• Support Zone: $16.00 - $12.64 USDT (strong demand area).

• Resistance Levels: $24.12 USDT (first target) and $35.40 USDT (main target).

• Channel Structure: Price is near the lower band of a descending parallel channel, indicating a potential reversal signal.

Scenarios:

✅ Bullish Scenario: If LINK bounces from $16.00 USDT, targets are $24.12 USDT and $35.40 USDT.

❌ Bearish Scenario: A close below $16.00 USDT could trigger a drop to $12.64 USDT.

Strategy:

🔹 Entry: Buy within the $16.00 - $18.00 USDT range, with a stop loss below $12.64 USDT.

🔹 Breakout: A breakout above $24.12 USDT presents a buying opportunity.

🔹 Sell: A close below $16.00 USDT may accelerate the downtrend.

If the channel breaks out, LINK has significant upside potential. 🚀

LINK buy/long setup (4H TF)After forming a low, the price is ranging and creating higher Ls. A trigger line has formed, and it is expected to be broken soon.

Targets are marked on the image.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

#LINK/USDT#LINK

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 20.00

Entry price 20.64

First target 21.70

Second target 23.46

Third target 25.20

Chainlink Could Target $30 Once It Breaks Descending Triangle

Chainlink (LINK), the leading decentralized oracle network, has been consolidating within a descending triangle pattern on its price chart. This technical formation often signals a period of indecision among market participants, but it also carries the potential for a significant breakout. If LINK successfully breaks above the descending trendline, it could ignite a powerful rally, potentially propelling the price towards the $30 mark.

Understanding the Descending Triangle

A descending triangle is a bearish chart pattern characterized by a series of lower highs and relatively flat lows. It suggests that selling pressure is gradually increasing, while buying pressure remains relatively weak. However, the flat lows indicate that there is still significant support for the asset.

In the case of Chainlink, the price has been consolidating within this descending triangle for several weeks. This period of consolidation allows market participants to accumulate positions and prepare for a potential breakout.

Factors Fueling a Potential Rally

Several factors could contribute to a bullish breakout and propel Chainlink's price towards $30:

• Growing Adoption: Chainlink's technology continues to gain traction across various sectors, including DeFi, gaming, and enterprise applications. As more projects integrate Chainlink's oracles, the demand for LINK tokens is likely to increase.

• Technological Advancements: Chainlink is constantly evolving and improving its technology, enhancing its security, scalability, and interoperability. These advancements can attract new users and drive further adoption.

• Favorable Market Conditions: A broader bullish trend in the cryptocurrency market could provide a significant tailwind for Chainlink. If Bitcoin and other major cryptocurrencies experience a sustained rally, Chainlink could benefit from increased investor interest and capital inflows.

• Technical Breakout: A successful breakout above the descending trendline would be a strong technical signal, confirming the bullish sentiment and attracting more buyers to the market.

Technical Analysis

Technical analysis provides several clues about the potential for a bullish breakout.

• Volume: A surge in trading volume accompanying a breakout would significantly increase the likelihood of a sustained rally.

• Moving Averages: A move above key moving averages, such as the 50-day and 200-day moving averages, would further strengthen the bullish case.

• Relative Strength Index (RSI): The RSI is a momentum indicator that can help identify overbought or oversold conditions. A breakout accompanied by a rising RSI would suggest strong bullish momentum.

Potential Challenges and Risks

While the outlook for Chainlink appears promising, it is crucial to acknowledge potential challenges and risks:

• Competition: Chainlink faces competition from other decentralized oracle networks and emerging technologies.

• Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain, and any negative regulatory developments could impact Chainlink's price.

• Market Volatility: The cryptocurrency market is highly volatile, and sudden price swings can significantly impact Chainlink's price.

Investment Considerations

Investing in cryptocurrencies carries significant risks, including the risk of losing all or part of your investment.

• Conduct thorough research: Understand the technology behind Chainlink, its potential use cases, and the risks involved.

• Diversify your portfolio: Don't invest all your funds in a single cryptocurrency.

• Invest only what you can afford to lose: Avoid investing more than you can afford to lose financially.

• Stay informed: Keep abreast of the latest developments in the Chainlink ecosystem and the cryptocurrency market as a whole.

Conclusion

Chainlink has the potential to play a crucial role in the future of decentralized finance and blockchain technology.

• If it successfully breaks out of the descending triangle pattern and gains traction in the broader market, it could experience significant price appreciation.

• However, investors should carefully consider the risks involved and conduct thorough research before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not1 constitute financial advice.

• Investing in cryptocurrencies2 involves significant risks, and you should carefully consider your investment objectives, financial situation, and risk tolerance before making any investment decisions.

Note: This article provides a general overview of Chainlink and its potential.

• The cryptocurrency market is dynamic and subject to rapid change.

• It is essential to conduct independent research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes4 only and does not constitute financial advice.

• Investing in cryptocurrencies5 involves significant risks, and you should carefully consider your investment objectives, financial situation, and risk tolerance before making any investment decisions.6

LINK at the Crossroads: Is a Massive Breakout Coming?Yello, Paradisers! Have you been watching #LINKUSDT closely? It just made a bold move, breaking out of a falling wedge pattern, signaling potential strength ahead. But the big question is—can the bulls finally break through the chains and push this higher, or will it get stuck in the same range it's been trapped in since December 2024? Let’s break it down.

💎Currently, #LINK is battling the tough resistance zone between $27.05 and $28.25—a region that has repeatedly blocked upward momentum. For any strength to sustain, LINK needs to conquer and sustain above $28.25. If the bulls succeed, the road ahead looks juicy! We’re talking about a target at the 52-week high of $30.95, with a stretch goal of $32.00, perfectly aligning with the 1.272% Fibonacci extension and the pattern’s target length.

💎On the flip side, the $23.80–$23.30 zone is providing moderate support. This level isn’t just a safety net; it’s fortified by the presence of the EMA-100 and EMA-50, making it a stronghold against any downside pressure. If the bears try to bring the price down, this area could act as a solid barrier, protecting LINK from deeper corrections.

Patience and discipline are key here, Paradisers. The market often tests both bulls and bears before making decisive moves, so stay vigilant.

MyCryptoParadise

iFeel the success🌴

ChainLink | LINK , TRUMP & Grayscale LINK pumped 500% since our last signal so Its time to Celebrate the New Year with Crypto

Chainlink isn’t just mooning on price it’s taking the crown in the real world assets (RWA) sector. LINK is leading the pack in development activity, leaving Ethereum based Synthetix (SNX) and the privacy savvy Dusk Foundation (DUSK) playing catch up

Price Up, GitHub Busy, and a New Year’s Party to Crash

The numbers? Chainlink flexed nearly 394 GitHub events in the past 30 days, compared to Synthetix's 176.6 and Dusk's 34.7. Meanwhile, Polymesh (POLYX) and Maker (MKR) aren’t far behind, clocking in at 25.9 and 21.7, respectively

Chainlink’s onchain momentum and fundamentals are bullish as well, growing active addresses and an all time high futures open interest of $770.27M are just tip of the iceberg. Grayscale announced that it has opened Grayscale LINK Trust to qualified investors, a fund that enables investors to gain exposure to XRP in the form of securities. As of December 12, Grayscale LINK Trust had a net asset value of $111.91 per share and $30,468,812 in assets under management

Chainlink's LINK token is experiencing a notable increase in price and market activity, fueled by a strategic investment from World Liberty Financial (WLFI), a project backed by Donald Trump’s family. WLFI recently expanded its holdings by purchasing an additional $1 million worth of LINK, raising its total investment in the token to $2 million.

LINK is trading at $29.4 (+1.5% over 24 hours), while its all time high of $52.82 (May 2021) is still 44% away. But hey, it's already the life of the crypto party, with a $1.1B daily trading volume and active trading on 99 exchanges, led by Binance. Market cap? A cool $18.6B

it’s a good time to toast to LINK’s rise🍾