LINK - The sleeping Giant ready to wake!Don't forget to add LINK to your watchlist — it's a solid project with long-term investment potential.

The weekly chart shows that LINK is currently retesting the downtrend line it recently broke — a textbook bullish retest.

The lower trendline now acts as a key support level, and as long as price holds above it, the structure remains healthy.

Currently trading around $17.6, the price hasn’t moved significantly yet —

You’ve got:

✅ A strong fundamental project

✅ A bullish technical setup

✅ Large market cap

✅ Still early entry

What more do you need to enter?

Accumulate now... and thank me later.

Best Regards:

Ceciliones🎯

Linklong

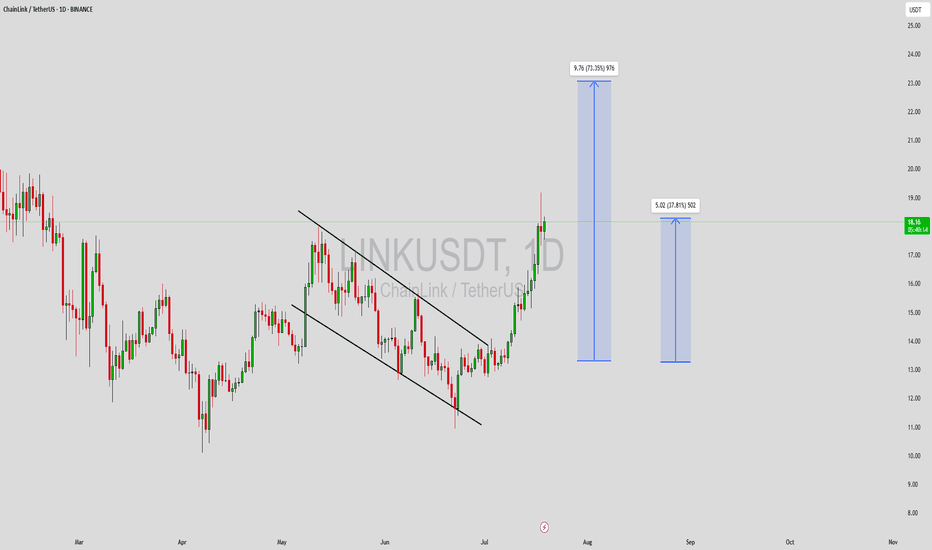

LINKUSDT Forming Falling Wedge LINKUSDT is currently forming a classic falling wedge pattern, a bullish reversal setup that often signals the end of a downtrend and the beginning of a strong upward move. The recent price action within the wedge shows decreasing volatility and tightening price levels, suggesting accumulation is underway. This setup, combined with increasing volume, indicates that a breakout to the upside could be imminent.

Chainlink (LINK) continues to draw investor interest due to its critical role in the decentralized oracle network ecosystem, which bridges blockchain smart contracts with real-world data. The project has maintained relevance in both DeFi and traditional enterprise solutions, and its consistent development activity keeps it on the radar of long-term crypto investors and short-term traders alike. With current market sentiment shifting more favorably toward altcoins, LINK’s technical and fundamental setup makes it a top watch.

The expectation for a 60% to 70% gain is well-supported by previous price performance following similar wedge breakouts. Traders are advised to monitor for a strong volume breakout above resistance lines, as this would confirm the move and likely initiate a new upward trend. If broader market conditions remain positive, LINKUSDT could move swiftly toward higher levels, fueled by both technical momentum and renewed investor confidence.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

LINKUSDT: Inverse Head & Shoulders Breakout! The Reversal BeginsBINANCE:LINKUSDT has broken out of a classic inverse head and shoulders pattern — a well-known bullish reversal formation. After the breakout, price action showed strength by coming back to retest the neckline support and holding it successfully. This confirms the pattern and signals a potential shift in trend.

From a technical perspective, this setup is highly promising. The market structure indicates a likely reversal after an extended downtrend, and the breakout could be the start of a strong bullish phase. With solid fundamentals backing BIST:LINK , the rally could gain serious momentum once it gets going.

This pattern isn’t just any breakout — it’s a reversal of the reversal, a major turning point in trend. If bulls take control, this move has the potential to accelerate rapidly. However, it’s crucial to always manage risk, use a well-placed stop-loss, and avoid overexposure.

Get ready — once the rally starts, it might be unstoppable!

BINANCE:LINKUSDT Currently trading at $15.5

Buy level : Above $15

Stop loss : Below $13

Target 1: $17

Target 2: $1.4

Target 3: $2.1

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#LINK/USDT#LINK

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 14.50.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 15.80

First target: 16.45

Second target: 16.90

Third target: 17.56

#LINK/USDT

#LINK

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 12.84.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 13.33

First target: 13.58

Second target: 13.83

Third target: 14.20

We need confirmation!This is my idea on BINANCE:LINKUSDT and what to expect in next few weeks. There are few alt-coins made higher high and proved it potential, of course one of them is BINANCE:LINKUSDT . As you can see there are 2 zones I consider very crucial (marked as YELLOW). Which means people bought, or entered Futures-Long position when BINANCE:LINKUSDT reached those points and we all know that Link made Higher-High after that that's why I think those areas are very crucial.

1. Unless BINANCE:BTCUSDT suddenly go up and reach 105k-110k area or CRYPTOCAP:BTC.D go down, we are not likely to see first scenario would happen.

2. About a week ago whole crypto made huge squeeze, that squeeze tells me third wave of Elliot wave theory about to begin in 1D timeframe. The moment we close that squeeze I will consider Long position. In this scenario there there is a old Resistance point end of the squeeze, that would be very comfortable place to enter Long position. Which is at 15.

3. There is a minor support zone in 1W timeframe, which I marked it as red block. Also entering in Long position from that area will be very comfortable or we might see squeeze to 13-14 area and close a candle above 15 area which would great opportunity to enter Long position too. If we ever go lower than this point wait and observe will be perfect choice.

In the end BINANCE:LINKUSDT still Bullish in 1W timeframe and I will be taking profits at 38 and 55 (ATH).

#LINK/USDT#LINK

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 20.00

Entry price 20.64

First target 21.70

Second target 23.46

Third target 25.20

#LINK/USDT#LINK

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 18.70

Entry price 20.33

First target 21.63

Second target 23.13

Third target 24.70

#LINK/USDT Ready to go higher#LINK

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 21.45

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 23.25

First target 24.12

Second target 25.53

Third target 27.12

#LINK/USDT Ready to go higher#LINK

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 28.14

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 29.00

First target 30.30

Second target 31.80

Third target 33.50

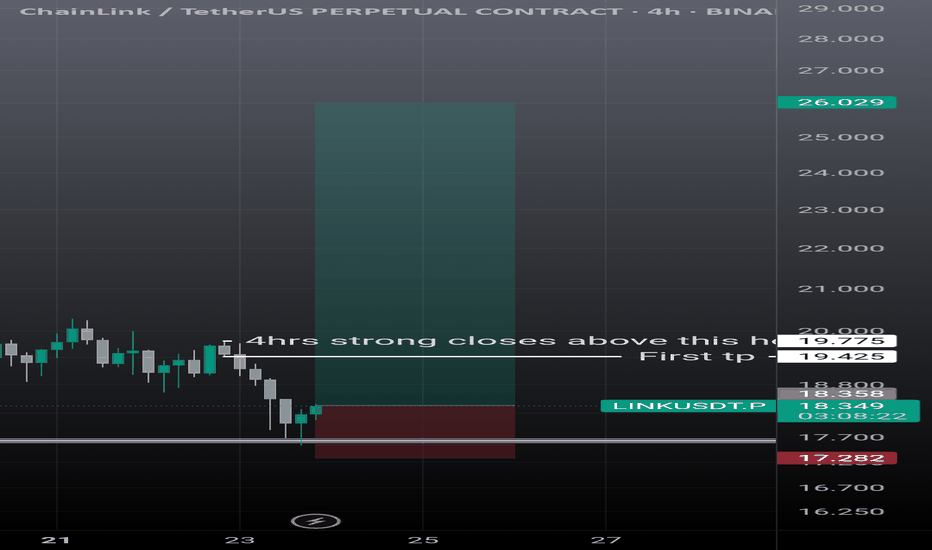

SCRAPING THE PROFITS | %250 DAILY VOLUME SPIKEMy last Link trades,

All 3 worked like a charm and now let me cook again for you.

Blue boxes will be valuable if we come back.

If we go up hard without coming back, range high area (26.89$) will be valuable.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

Chainlink bull flag structureCertainly, let's analyze the chart pattern you provided.

**Chart Pattern:**

The chart displays a bullish flag pattern on the 4-hour timeframe for the Chainlink (LINK) / TetherUS (USDT) pair.

**Key Elements:**

* **Bull Flag Structure:** The chart shows a sharp upward move (flagpole) followed by a consolidation phase (flag) within parallel trend lines. This pattern often signals a continuation of the upward trend.

* **Breakout Point:** The price has broken above the upper trend line of the flag, confirming the bullish signal.

* **Previous High:** The price is currently below the previous high, indicating potential upside.

* **Flag Target:** The chart shows a potential target at 32.17, which is calculated based on the height of the flagpole projected from the breakout point.

* **RSI (Relative Strength Index):** The RSI is currently at 58.63, which is above the 50 level, this shows strong momentum to the upside

**Potential Price Targets:**

Based on the bullish flag pattern and the current price action, here are some potential price targets:

* **Short-term:** The immediate target is the previous high at 26.94. If the price breaks above this level, it could signal further upside potential.

* **Medium-term:** The flag target at 32.17 is a significant level to watch. If the price reaches this level, it could be a strong resistance level.

* **Long-term:** The overall trend for LINK is bullish, and a sustained break above the previous high could open up the possibility of further gains. However, it's important to consider that the RSI is currently overbought, which suggests that a pullback or consolidation may occur before the price resumes its upward trend.

**Additional Considerations:**

* **Volume:** Increased volume during the breakout can confirm the strength of the bullish move. Low volume could suggest a weaker move and potential for a reversal.

* **Support and Resistance Levels:** Identifying key support and resistance levels can help in managing risk and setting profit targets.

**Disclaimer:**

This analysis is based on technical analysis and does not constitute financial advice. It's important to conduct your own research or consult with a financial advisor before making any investment decisions.

LINKUSDT.P | 3 Possible Entries Depends on Your Risk AppetiteLINKUSDT.P | 3 Possible Entry Zones Based on Risk Appetite

Zone 1:

Located below the 0.5 Fibonacci level of the last significant range.

Best suited if the price has spent a considerable amount of time above the range high.

Note: This zone may not be ideal in the current context as the conditions are not fully met.

Zone 2:Second zone is ideal trading area.

Aligns with a previous high and a demand zone confluence, offering a high-probability setup.

Zone 3:

Designed for cases of range low manipulation.

Look for price sweeping the range low before reclaiming it as a potential reversal signal.

For all zones wait for lower time frame market structure breaks upside.

First zone is not optimum I think.

Second zone is ideal trading area.

Third zone can be valuable in case of a market crash.

LINK | BULLISH ALTS | More Increases IF we see THISLink has recently increased over 160% - and that's an excellent increase in 3 weeks, let's take a moment to appreciate this and not be greedy!

Although it would have been most ideal to see LINK back up at ATH prices, more increases are on the cards BUT FIRST we need to reclaim a major resistance zone.

Here's my overview on Altcoins - specifically Altseason - at the current moment. Find it here :

____________________

BINANCE:LINKUSDT