LINKUSDT

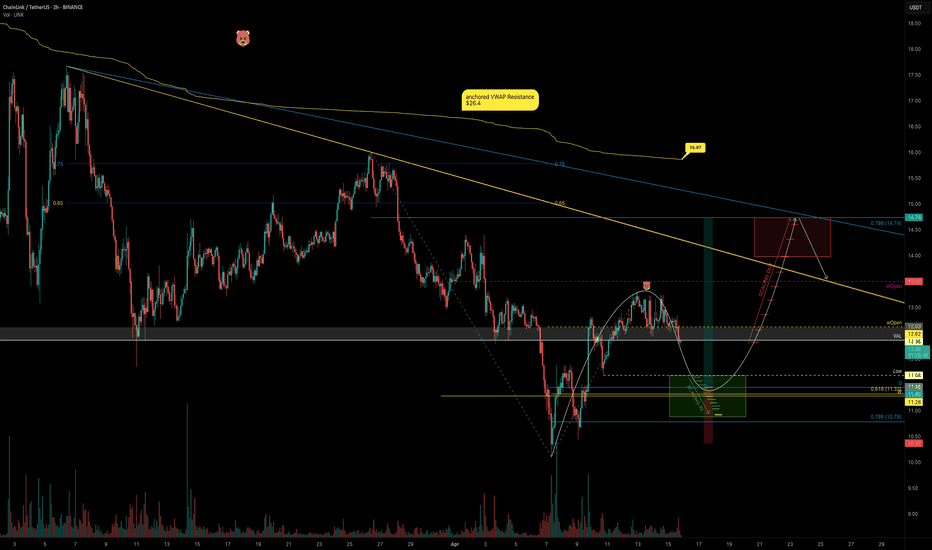

LINK’s Swing Setup Could Push Past $15LINK bounced right off the $10 mark, charging upward toward the monthly open before slamming into resistance around $13.25. But now what?

Let’s break it down — because the next high-probability setup is taking shape, and it’s one you don’t want to miss.

The Current Situation:

LINK is:

Below the Point of Control (POC) of this trading range (~$11.35).

Below the monthly open at $13.5.

Still in a bearish trend on the 4H, showing lower highs.

Facing decent rejection from the monthly level.

We’re currently trading below the weekly open at $12.62, now sitting right on the Value Area Low (VAL) at $12.36. That puts us in a precarious spot and sets the stage for the next move.

Bearish, bearish, bearish. When bullish sir? Staying patient and waiting for a real shift in market structure is key.

The Bearish Play: Liquidity Grab Incoming?

There’s a liquidity pocket waiting below at $11.68, the most recent swing low. If LINK loses VAL and bearish pressure kicks in, this becomes the next logical target.

But here's where things get interesting...

The Bullish Setup: Confluence-Backed Long Opportunity

This isn’t just any random support zone — there’s a perfect confluence stack forming:

Swing low: $11.68

Daily support level: $11.45

Weekly support level: $11.28

POC of trading range: ~$11.35

0.618 Fibonacci retracement lands in this zone as well

That’s four layers of support in one tight cluster. This is where we want to scale into longs.

The Play: Scaling In

Entry: Ladder long positions from $11.68 down to the 0.786 fib (near $11.2)

Stop Loss: Below $10.35 for invalidation

Target: 0.786 fib retracement of the previous downward wave at ~$14.5

R:R: Approx. 3:1, with a potential +30% gain

The trend remains bearish but the chart is setting up a prime reversal zone. Patience is key here.

🔔 Set alerts. Watch for volume spikes. Look for SFPs or bullish engulfing candles etc.

The next move on LINK could offer one of the best swing setups especially since this trade could extend past the $15 mark, putting you ahead of the curve.

💬 Found this helpful? Drop a like and comment below. Want TA on another coin? Let me know and I’ll break it down for you.

Happy trading everyone! 💪

#LINK/USDT

#LINK

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 12.84.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 13.33

First target: 13.58

Second target: 13.83

Third target: 14.20

ChainLink (LINK/USD): A Bullish Breakout on the Horizon?Hey there, traders! Let’s take a closer look at ChainLink (LINK/USD) on the daily chart. There’s some interesting action that might point to a bullish move, but let’s break it down with a bit of caution to see if the stars are truly aligning.

Price Action

After a consistent downtrend, we’re seeing a potential shift at $11.23. There’s a bullish reversal candle showing up here, which could suggest buyers are stepping in at this key support level. It looks promising, but we’ll need more confirmation to be sure this is a real trend change.

Volume

The volume at this reversal point is picking up, which is a good sign—those bars are taller than the recent average. This might mean stronger buying interest, but it’s not a massive spike, so I’d keep an eye on whether this volume trend continues to support the move.

Pattern

Looking at the bigger picture, it seems like a cup-and-handle pattern could be forming. The price has rounded out (the “cup”) and is now consolidating (the “handle”). If LINK can break above the $16.00 resistance, we might see a bullish breakout—but this pattern isn’t fully confirmed yet, so let’s stay alert.

Potential Targets

If we do get that breakout, here’s what we might aim for:

TP1: $24.17 – A possible first target.

TP2: $30.04 – Could happen if momentum builds.

TP3: $32.00 – A stretch goal, but only if the bulls really take charge.

Key Support

The $11.23 support is our critical level to watch. If the price drops below this, the bullish setup could be in trouble, so let’s not get too ahead of ourselves.

Wrap-Up

We’ve got a reversal candle, some increased volume, and what might be a cup-and-handle pattern forming, so LINK could be setting up for a bullish move. But it’s not a done deal yet—breaking above $16.00 will be the real test. If you’re thinking of jumping in, set a stop-loss below $11.23 and manage your risk carefully. What do you think—could this be the start of something big? Let’s watch and see! Happy trading! 🚀

Chainlink Next Target $43, A 222% Profits Potential RiseChainlink is starting to recover. After producing a long-term higher low, it is now trading at the highest price on a rise since November 2024.

The entire consolidation range of late 2024 has been left behind. LINKUSDT remained within these levels for two weeks and is now finally trading above it. Bullish territory for sure.

Now, Chainlink has been producing higher highs and higher lows both based on candle wick and candle close, this leaves room for no doubt as to where prices are going next.

When looking at some of the other pairs, with lower highs and lower lows, we have to find supporting signals that predict additional growth. Like high trading volume being a good example.

Here we do not need to look for these signals as the trend is clearly identifiable. It means that Chainlink is strong in relation to many other pairs.

A strong chart, a strong pair can produce a strong All-Time High when the time comes.

Say the $43 target is only a mid-term one, within the next 1-3 months, but there will be more.

The 2025 bull market is likely to go until late 2025 or even beyond, early 2026. With this in mind, the target shown on the chart can be considered easy, this is only the first step.

After this target is reached, we are likely to see a correction, a mild one, followed by additional growth. We will adapt to the market if conditions change.

The most important part is to buy when prices are low, in this way, we can hold easily when strong shakeouts and retraces develop out of nowhere. We are going up.

This is a good pair, a good project, a great chart. Buy and hold.

Namaste.

LINK/USDT 8H - targets and stoplossHello everyone, let's look at the 8h chart LINK to USDT, in this situation we can see how the price has come out on top from the local downtrend line and how it is currently moving in a local sideways trend.

Let's start by defining the targets for the near future that the price has to face:

T1 = 12.65 USD

T2 = 13.13 USD

Т3 = 13.87 USD

Т4 = 14.40 USD

Now let's move on to the stop-loss in case the market continues to fall:

SL1 = 11.91 USD

SL2 = 11.05 USD

SL3 = 10.36 USD

SL4 = 9.66 USD

The MACD indicator shows an attempt to return to the uptrend, but here we can see a struggle that gives a sideways trend on the chart.

MDTUSDT UPDATEMDT/USDT Technical Setup

Pattern: Falling Wedge Breakout

Current Price: $0.02544

Target Price: $0.0586

Target % Gain: 150.48%

Technical Analysis: MDT has broken out of a falling wedge on the 1D chart with a strong bullish candle and an 11.82% daily gain, confirming momentum. Breakout volume and candle close above resistance support further upside.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

Potential Bullish Reversal Setup in LINK/USDTThe LINK/USDT pair recently experienced a false breakdown below the March low, followed by a strong recovery. This move appeared to be a liquidity grab beneath the psychological support level at 10.00, after which the market quickly reversed direction.

In addition, the price action broke and closed above a descending trendline, which had previously signalled a corrective phase. Notably, the market also revisited a demand zone—an area where a major price rally originated in November 2024.

If the price retraces back toward the support level near the trendline, historical behaviour suggests the potential for another upward move. This confluence of a false breakdown, a trendline breakout, and a revisit to a key demand zone points to a possible bullish reversal, provided the support continues to hold. The next significant resistance level is identified around 14.80

DOGEUSDT UPDATEDOGEUSDT is a cryptocurrency trading at $0.16485, with a target price of $0.30000. This represents a potential gain of over 90%. The technical pattern observed is a Bullish Falling Wedge, indicating a possible trend reversal. This pattern suggests that the downward trend may be coming to an end. A breakout from the wedge could lead to a significant upward movement in price. The Bullish Falling Wedge is a positive indicator, signaling a potential price surge. Investors are showing optimism about DOGEUSDT's future performance. The current price may present a buying opportunity. Reaching the target price would result in substantial returns for investors. DOGEUSDT is positioned for a potential breakout and significant gains.

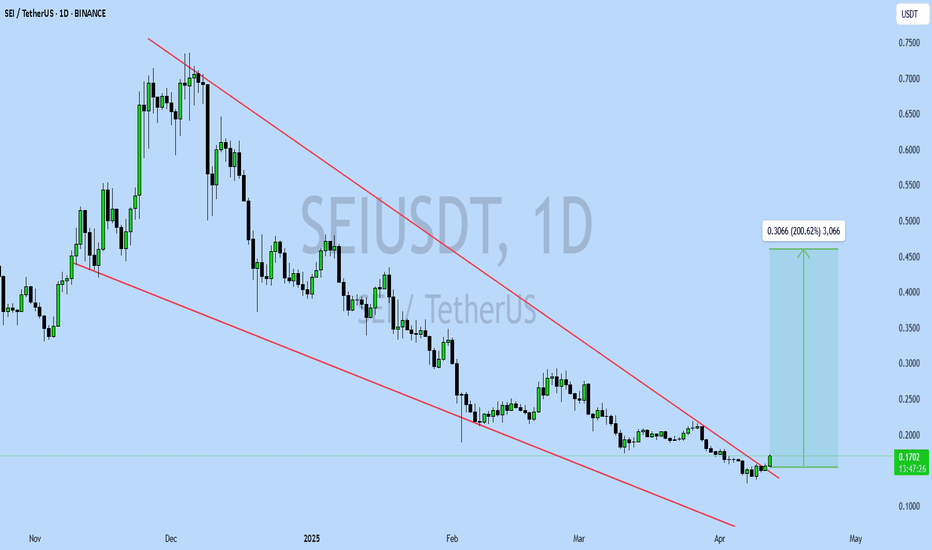

SEIUSDT UPDATESEIUSDT is a cryptocurrency trading at $0.1700, with a target price of $0.4500. This represents a potential gain of over 200%. The technical pattern observed is a Bullish Falling Wedge, indicating a possible trend reversal. This pattern suggests that the downward trend may be coming to an end. A breakout from the wedge could lead to a significant upward movement in price. The Bullish Falling Wedge is a positive indicator, signaling a potential price surge. Investors are showing optimism about SEIUSDT's future performance. The current price may present a buying opportunity. Reaching the target price would result in substantial returns for investors. SEIUSDT is positioned for a potential breakout and significant gains.

SECRET Indicator Says LINK Will Moon🚨MartyBoots here , I have been trading for 17 years and sharing my thoughts on BINANCE:LINKUSDT here.🚨

.

🚨 BINANCE:LINKUSDT is looking beautiful , very interesting chart for more upside

and is now into support🚨

Do not miss out on BINANCE:LINKUSDT as this is a great opportunity

The SECRET Indicator says it will moon

Watch video for more details

TAOUSDT UPDATETAOUSDT is a cryptocurrency trading at $231.9, with a target price of $360.0. This represents a potential gain of over 60%. The technical pattern observed is a Bullish Falling Wedge, indicating a possible trend reversal. This pattern suggests that the downward trend may be coming to an end. A breakout from the wedge could lead to a significant upward movement in price. The Bullish Falling Wedge is a positive indicator, signaling a potential price surge. Investors are showing optimism about TAOUSDT's future performance. The current price may present a buying opportunity. Reaching the target price would result in substantial returns for investors. TAOUSDT is positioned for a potential breakout and significant gains.

Chainlink: Your Altcoin ChoiceI was about to call it quits for today but several people requested an analysis for LINK, so here it is.

Oh, by the way, I like Chainlink also and tend to publish many updates. Just lately I was out but now I am back healthy and with full force.

There are two main dynamics playing out on this chart that are of interest to us:

1) A perfect falling wedge pattern. This pattern is a classic reversal signal and one of the most accurate. It simply works.

2) A long-term support/accumulation zone. The falling wedge is enough to predict a reversal, but the action just entered the late 2024 buy zone and long-term support. This makes it even stronger.

I am sure we have positive signals coming also from the MACD and RSI.

This chart is based on the long-term. Again, if you would like to find the 2025 ATH for this or any other pair, just go to my profile by typing on my username and search for the pairs name. In this case, LINKUSDT, you will find many publications that are still good and valid when it comes to the numbers and ATH potential. I published many in 2024 and some even in 2023.

Now, the apex of the falling wedge is a higher low compared to the bottom in August 2024. This is good and works to support the other signals.

Trading volume is very low on the drop and this is also very good for the bulls. The market is on autopilot. It is dropping just because it needs to drop. Bot selling. Bot selling ends when real buying starts. We are about to experience a massive influx of money into the market.

Now, money is already "programmed." The exchanges already have the whales money. Money has been moving around for months now and the entire game is already setup. The start of the next bullish cycle has been programmed, you know everything works with algorithms and bots. The big players pay the exchanges and the exchanges take care of the rest. The only way for small players like us to win is by playing the long-term game. If we play short-term, we get killed because we are looking for 20-30% or more, while the whales can profit with 1-2%. While we try to complete a trade, they shake us out over and over, again and again. So instead of fighting the whales we use a strategy that works. We wait for the market bottom, when the market hits bottom or is close to the bottom, near support, we buy and hold.

We then just wait and let the bullish cycle unfold. When everything is up, we collect profits and move on.

There is also a play to short the market after the end of the bullish phase. I also play this hand and give guidance to my followers and traders, but this is far away.

Right now your only concern should be buying, buying like the world is about to end. Why? Because once the market starts moving there is no going back; once great entry prices are gone, they are gone forever.

The time is now.

Chainlink is good and trading near long-term support.

Buy when prices are low, it will soon start to grow.

It can take weeks or days, but it won't be long. The next bullish cycle should last between 6-8 months. It can expand at last 12 months or more. We will have to see about this part because market conditions are so different now, who knows if we will enter a 10 years strong/long bull market cycle, it is possible, just like it happened with stocks. But we can only prepare based on what we know, and what we know is that most of the market will grow really strong. If it gets better, great. If the bull market ends up being a standard one, this would still be awesome.

Thanks a lot for your continued support.

Namaste.

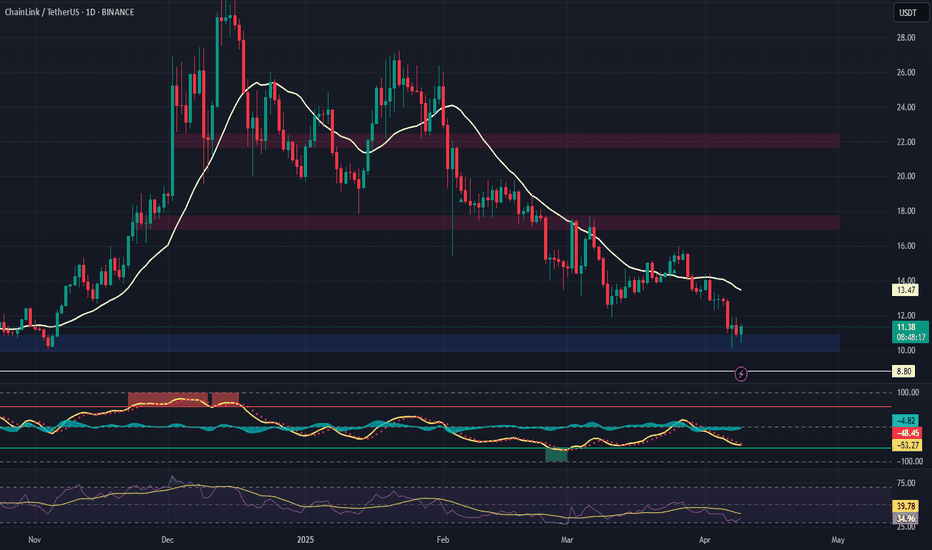

LINK Long Spot Trade Setup – Major Support TestLINK has retraced sharply and is now sitting at a critical support zone ($10.00–$11.00), historically a strong base for reversals. This offers a solid risk/reward opportunity for a potential bounce and test of upper resistance zones.

📌 Trade Setup:

Entry Zone: $10.00 – $11.00

Take Profit Targets:

🥇 $17.00 – $17.70

🥈 $21.70 – $22.40

Stop Loss: Around $8.80

ATOMUSDT UPDATEATOMUSDT is a cryptocurrency trading at $4.700, with a target price of $7.500. This represents a potential gain of over 60%. The technical pattern observed is a Bullish Falling Wedge, indicating a possible trend reversal. This pattern suggests that the downward trend may be coming to an end. A breakout from the wedge could lead to a significant upward movement in price. The Bullish Falling Wedge is a positive indicator, signaling a potential price surge. Investors are showing optimism about ATOMUSDT's future performance. The current price may present a buying opportunity. Reaching the target price would result in substantial returns for investors. ATOMUSDT is positioned for a potential breakout and significant gains.

CFXUSDT UPDATECFXUSDT is a cryptocurrency trading at $0.0788, with a target price of $0.1400. This represents a potential gain of over 80%. The technical pattern observed is a Bullish Falling Wedge, indicating a possible trend reversal. This pattern suggests that the downward trend may be coming to an end. A breakout from the wedge could lead to a significant upward movement in price. The Bullish Falling Wedge is a positive indicator, signaling a potential price surge. Investors are showing optimism about CFXUSDT's future performance. The current price may present a buying opportunity. Reaching the target price would result in substantial returns for investors. CFXUSDT is positioned for a potential breakout and significant gains.

Chainlink LINK price analysisThe 6-year trend line has been keeping the #LINK price “in play” by 4 times

The next is patience and observation.

🆗 As long as the OKX:LINKUSDT price is above the blue trend line, then the medium-term targets of $38 and $53 are still relevant.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more