LINKLINK

March 26, 2025

8:02 AM

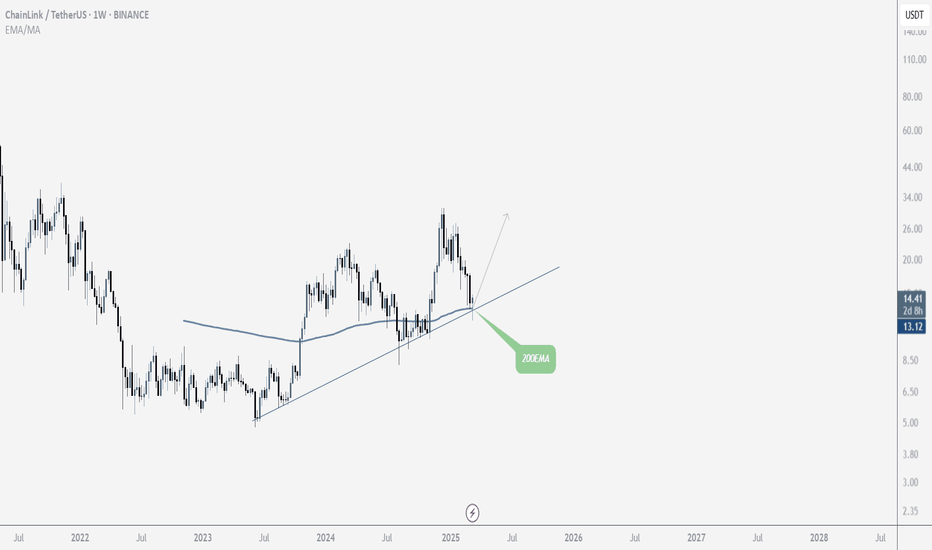

CRYPTOCAP:LINK just had a clean bounce off the +W OB (not a full-on impulsive move, but definitely a solid reaction)

Also, the MA100 and MA200 are forming a golden cross on both weekly and 4H TF — pretty bullish signal overall.

Looks like we’re setting up for W3. Right now, we’re in W2 and potentially about to enter W3 of W3, which is usually the strongest leg.

LINKUSDT

LINK Trade Setup - Higher Low ConfirmationLINK is showing early signs of reversal from a key higher timeframe support zone. We anticipate a short-term dip into the buy zone before shifting into an expansion phase.

🛠 Trade Details:

Entry: $13 – $14 (Buy Zone)

Take Profit Targets:

$17.00 - $17.70 (Initial Resistance)

$21.70 - $22.40 (Breakout Target)

Stop Loss: Daily close below $12

Looking for higher low confirmation before the move up. 📈🚀

The key is whether it can be supported around 15.45

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(LINKUSDT 1D chart)

How to interpret the OBV indicator

1. If OBV is rising from the 0 point, it is interpreted as an increase in buying power, and if it is falling, it is interpreted as an increase in selling power

2. How to create an EMA indicator for OBV and interpret it as rising or falling above the EMA indicator

3. How to add the price channel formula to the OBV indicator and interpret it like Bollinger Bands

-

If the price is maintained at the current price position, it is expected to attempt to rise above 15.45.

However, since the StochRSI indicator is showing a downward trend in the overbought zone, the key point is whether there is support near 15.45.

If it fails to rise, we should check whether there is support near 13.13.

-

I think we are facing a golden opportunity to turn into an upward trend.

If it fails to turn into an upward trend this time, there is a possibility that it will eventually fall to around 10.0, so we should think about a response plan for this.

Therefore, what we should pay close attention to is whether there is support near 15.45 and it can rise.

If support is confirmed near 15.45, it is the time to buy.

The first sell zone is 19.52-20.51.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year upward trend and faces a 1-year downward trend.

Accordingly, the upward trend is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, you can see that the upward trend is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, I expect that we will not see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

That is, the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you how to view and respond to it.

Since there is no support or resistance point when the ATH is updated, the Fibonacci ratio can be appropriately utilized.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as a support and resistance role.

The reason is that the user must directly select the important selection points required to create the Fibonacci.

Therefore, it can be useful for chart analysis because it is expressed differently depending on how the user specifies the selection point, but it can be seen as ambiguous for use in trading strategies.

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 134018.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

-----------------

Levels in LINK: Breakdown or Breakout?If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment!

### **Technical Overview**

- **Current Price**: $14.35 (approx.)

- **Trend Structure**: Elliott Wave count suggests Wave 3 has wrapped up. Wave 4 and 5 are likely next.

---

### **Key Observations**

- **Impulse Invalidation Level**: $19.190

→ A break above this invalidates the current bearish impulse.

- **Bullish Barriers**:

- *Minor Resistance*: $15.002

- *Major Resistance*: $17.677

These are the key spots bulls need to reclaim to regain control.

- **Crucial Support**: $12.426

→ If this breaks, expect more downside—likely toward the final Wave 5 zone.

- **Bearish Target**: $9.283

→ Probable landing spot for Wave 5 (of C). Could shape up as a longer-term accumulation zone.

---

### **Elliott Wave Context**

- A possible running or expanded flat scenario is in play, with Wave (B) topping around the 1.382 extension.

- Wave 3 appears to have completed near the 1.618 extension, a textbook zone for this kind of move.

---

### **Potential Scenarios**

1. **Bullish Reversal Case**:

- Price reclaims $15.00 and ideally $17.677.

- The bearish count falls apart.

2. **Bearish Continuation Case**:

- Price stalls under resistance.

- A break of $12.426 sets the stage for continuation down to $9.283.

3. **Neutral Scenario**:

- Choppy consolidation between $12.5–$15 while the market sorts itself out.

---

### **Strategic Considerations**

- **Short-term Bulls**: Watch $15–$17.6. Any strong reclaim could offer clean long setups.

- **Bears & Shorts**: Prime fade zone if price gets rejected near resistance.

- **Long-term Investors**: If we hit $9.283, that’s a potential loading zone for the next cycle.

Trade safe, trade smart, trade clarity.

My current LINK charts with estimated April 'flash crash' levelsHere is my current LINK chart, which I recently went over in detail. It assumes that the bottom isn't in on the 4th wave. If the bottom is in and price is moving into the 5th wave, you can simply adjust the 4th wave bottom to the previous low accordingly.

It also includes the likely level that would be hit during the April "flash crash" around the pattern’s 3rd support level line and FVG (fair value gap), as well as the likely areas above that it will need to break through in order to reach new all-time high territory—assuming that's even possible in this cycle.

Keep in mind that the "flash crash in April" is a theory of mine and may or may not come to fruition, or could be off in timing. And while these levels may be likely, they may not actually be the levels that get hit, even if the thesis itself is correct.

Good luck, and always use a stop loss!

LINK/USDT 1H: Bullish Breakout – Targeting $15.45LINK/USDT 1H: Bullish Breakout – Targeting $15.45?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence: 9/10):

Price at $14.77, confirming a strong breakout above resistance.

RSI at 66.12, signaling bullish momentum with room to push higher.

Clear market maker accumulation pattern, supporting a continued uptrend.

Hidden bullish divergence on RSI vs price, reinforcing strength in the move.

LONG Trade Setup:

Entry: $14.70 - $14.77 zone.

Targets:

T1: $15.20 (first resistance).

T2: $15.45 (extended liquidity target).

Stop Loss: $14.20 (below recent support).

Risk Score:

8/10 – Strong structure but requires follow-through above $15.20.

Market Maker Activity:

Accumulation phase is complete, marked by a clean breakout above $14.60.

Strong support established at $14.20, reinforcing a high-probability long setup.

Minimal overhead resistance until $15.20, increasing the likelihood of a sustained move higher.

Recommendation:

Long positions remain favorable within the $14.70 - $14.77 entry range.

Monitor price action at $15.20, as this level may lead to a temporary pause or consolidation.

If volume continues to increase, expect a move toward $15.45.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

DOTUSDT IDEADOTUSDT is a cryptocurrency trading at $4.415. Its target price is $7.500, indicating a potential 70%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about DOTUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. DOTUSDT is poised for a potential breakout and substantial gains.

GMXUSDT UPDATEGMXUSDT is a cryptocurrency trading at $15.52. Its target price is $30.00, indicating a potential 90%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about GMXUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. GMXUSDT is poised for a potential breakout and substantial gains.

LINK Setup: Breakout Play or Breakdown Risk?LINK is in a local uptrend, pressing against the 13.66 level. A breakout should trigger a swift reaction and push higher 13.99-14.55 looks like a very realistic target.

On the downside, 11.85 remains the key support. If bears step in aggressively and break the lows, we could see a fast drop toward 11.68-11.19.

Long on a breakout above 13.66.

TP: 13.99/14.2/14.55

Short if 11.85 fails.

TP: 11.68/11.5/11

FTTUSDT UPDATEFTTUSDT is a cryptocurrency trading at $1.3195. Its target price is $3.0000, indicating a potential 100%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about FTTUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. FTTUSDT is poised for a potential breakout and substantial gains.

CHAINLINK 200 DOLLARS BY SEPTEMBER 2025 Only up for Chainlink from this moment , do not let them shake you out , my time fib will show the way as always , for Link its showing August which is when the fractal finishes , late August .

Chainlink so far is repeating the same fractal as last cycle , its very close been using it for over one year to time the market with amazing results the fractal cycle top pattern comes in in August 2025.

The sell zone is in the yellow box , invalidation of this idea would be LINK closing a weekly under 20 dollars.

LUNAUSDT UPDATELUNAUSDT is a cryptocurrency trading at $0.1946. Its target price is $0.3500, indicating a potential 85%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about LUNAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. LUNAUSDT is poised for a potential breakout and substantial gains.

TAOUSDT UPDATETAOUSDT is a cryptocurrency trading at $263.8. Its target price is $360.0, indicating a potential 45%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about TAOUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. TAOUSDT is poised for a potential breakout and substantial gains.

OMUSDT UPDATEOMUSDT is a cryptocurrency trading at $6.2800. Its target price is $8.0000, indicating a potential 25%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about OMUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. OMUSDT is poised for a potential breakout and substantial gains.

Is Chainlink heading for a 26% drop to $10 soon?Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Chainlink 🔍📈.

Chainlink is currently navigating a downward channel, having fully retraced its recent gains from the bullish phase and lost several critical support levels at higher price points. Given this, I foresee a further decline of at least 26%, potentially bringing the price to the psychologically significant $10 mark, which also coincides with a key daily support level. The chart highlights major resistance zones, and there's also the possibility of a parallel channel forming around the $10 range, suggesting a potential period of consolidation at this level.📚🙌

🧨 Our team's main opinion is :🧨

Chainlink is in a downtrend, potentially dropping 26% to $10, where strong support and consolidation could occur.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

Chainlink ($LINK) The Road to $100Chainlink holds a leading position in oracle technology and continues to expand its influence. The project actively cooperates with major companies and blockchain ecosystems, which strengthens its position in the market. For example, partnerships with Google Cloud, SWIFT and other tech industry giants confirm Chainlink's relevance to traditional businesses.

One of the key factors behind Chainlink's success is its decentralized architecture, which provides high security and fault tolerance. This is especially important in the face of growing demand for reliable smart contract solutions.

Recently, Chainlink CEO Sergey Nazarov participated in a crypto summit organized at the White House. This event was an important step in the legalization and regulation of the crypto industry in the United States. Sergey Nazarov's participation emphasizes the importance of Chainlink as one of the key players in the blockchain ecosystem. His presentation focused on the role of oracle networks in ensuring data transparency and security, which is particularly important for regulators and governments. This attention to the project from the authorities may contribute to further development of Chainlink and its integration into traditional financial systems.

According to my analysis, the price of LINK has the potential for significant growth in the coming months. Considering the current market trends as well as technical analysis based on Fibonacci levels, we can assume that the price of LINK will reach the range of $80-100 by September 2025.

Alex Kostenich,

Horban Brothers.

Daily Chainlik Analysis - #LINK March 07#Chainlik #LINK

LINK managed to stay above the weekly support zone during the recent decline. If LINK coin declines to the 4-hour key level zone specified in the analysis, investments can be evaluated with a daily candle closing stop below the $ 14.22 level.

As long as LINK coin stays above the $ 15.65 level, the bullish target will be $ 18.21 - $ 19.94 respectively. LINK investors can follow important support and resistance levels in the analysis. LINK coin needs to close daily candles above the $ 18.21 level in order to continue the rise.

NFA

LINK Trade Update: Recovery Bounce in Play Market Context:

LINK is showing a strong bounce off major support, signaling potential upside continuation. However, if the market remains bullish, key resistance levels at $20 and $24 should be monitored for potential take-profit zones.

Trade Management:

Previous Entry Around: $15.30

Updated Take Profit Zones:

$20.00 (First TP Zone - Key Resistance)

$24.00 (Second TP Zone - Strong Resistance Level)

If LINK flips $20 into support, it could extend toward $24 and beyond. Keeping an eye on overall market sentiment is crucial! 🚀

Chainlink - Preparing for trend reversalBINANCE:LINKUSDT (1D CHART) Technical Analysis Update

LINK is currently trading at $16.39 and currently we are seeing trend reversal and heading towards breakout from the bearish trend, if the price continues the bullish momentum we expect a clear breakout and bullish start of the bullish trend.

Entry level: $ Enter after breakout 18

Stop Loss Level: $14

TakeProfit 1: $ 20

TakeProfit 2: $ 22

TakeProfit 3: $ 26

TakeProfit 4: $ 30

TakeProfit 5: $ 35

Max Leverage: 2x

Position Size: 1% of capital

Remember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto