Market Cap Is Not Real Money InflowThe Market Cap Illusion — The Most Dangerous Misunderstanding in Finance Right Now

⚪ Let's talk about what nobody else wants to tell you.

Everywhere you look right now on social media, you're seeing the same recycled headline:

"$4 Trillion added to stocks in 10 minutes!" "$236 Billion added to crypto in 12 hours!"

Sounds exciting, right?

It’s also deeply misleading.

⚪ Here’s The Harsh Truth:

A rising market cap does NOT mean that billions or trillions of new money just magically flowed into the market.

It means prices went up. That’s it.

Market Cap = Last Traded Price x Total Supply/Shares

If Bitcoin moves up 8% → The entire Bitcoin market cap increases 8%. Even if only a small percentage of Bitcoin actually traded hands.

This is not "fresh capital inflow." It’s just higher prices multiplying across existing supply.

⚪ Let’s Be Super Clear:

WRONG:

"$236 Billion flowed into the crypto market." "$4 Trillion entered the stock market."

RIGHT:

"Market cap increased by $236 Billion because prices went up." "Stock market cap increased by $4 Trillion due to price movement — not because new money entered."

Big difference. Please stop confusing these.

⚪ So Why Does This Misunderstanding Exist?

Simple.

Most social media traders out there have consistently FAILED to educate their audience properly.

They focus on hype, engagement, and surface-level headlines because that’s what generates likes, not truth.

But here’s the problem:

This misinformation leads to false confidence. It leads to poor decision making. And worst of all — it misleads new traders into thinking markets work in ways they absolutely don’t.

⚪ It’s Time To Be Real.

Stop blindly trusting everything you see on social media. Stop believing every influencer who screams "money is flowing in!!"

Most of them don’t even understand what they’re talking about.

Real traders, real investors — they ask questions. They double check the facts. They understand the mechanics behind market moves.

And so should you.

⚪ The Real Difference:

Market Cap shows valuation based on price

Liquidity shows real money inflow based on actual capital entering

If you want to survive and thrive in these markets, start separating hype from reality.

Be smarter. Be curious. Be aware.

Disclaimer: This information is for entertainment purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Liquidity

USDJPY = Win. Finally? I have shit winrate, but at least this trade is "logical", and has followed the trading plan lol.

TRADING SPECS:

BIAS = DOWNTREND

NARRATIVE = 4HR BEARISH PD ARRAY(S/R FLIP+FVG)

CONTEXT = RESPECTED PREMIUM ARRAY + A Wave

ENTRY = SELL STOP ORDER @ A WAVE LOW (RUN ON LIQUIDITY). Nearly got SL'd. OPTIMAL ENTRY WOULD HAVE BEEN THE BEARISH FVG AFTER THE "4HR PREMIUM ARRAY REBALANCE" INSIDE CONTEXT AREA. THERE WAS A SHARP TURN IN THERE SOMEWHERE BUT I DIDN'T WAIT FOR THAT.

RISK MANAGEMENT = N/A(?) JUST LET TRADE PLAY OUT. BUT SL WAS INSIDE THE ORDERFLOW LEG(?)

Here's how it went:

1. Assessed Day Bias - price was downtrending. checked orderflow and candle science for this shit

2. Assessed Current Price "Intention" - price only does two things: seek liquidity, and rebalance fair value.

When I plotted my Key Levels, price was at a point where it was just done seeking liquidity(support + poc was swept) and it was reversing.

I see an S/R Flip + FVG area. If price goes here, that means price has rebalanced fair value.. so, logic dictates that it will reverse again to SEEK LIQUIDITY.

When I came back to this chart again, price has already rebalanced fair value, has respected the S/R Flip + FVG, and has started reversing down.

3. Picked Out a Target - I picked out something realistic. Here is where indicators/tools come in.

Instead of using my confluence mix(POC+FVG+OTE pd array) as entry points,

"I just used it as a target since... price has already rebalanced fair value at the higher TF, and it's already going down, so it's probably going to seek liquidity on the other side. It's most probable target before price may or may not do something else is the FVG+POC+OTE AREA."

My choice of liquidity category was the Previous Day Session nPOC. Along with the FVG and OTE, it was a strong "magnet", especially considering that price has finished seeking buy side liquidity and therefore the price's next target are the liquidities below.

Wow, this makes so much sense to me now.

Price always intend to bounce from opposite liquidities, from higher timeframe to lower timeframe... so...

4. Waited for PA that will Deliver Towards Target - I think my entry here was sloppy, the weakest part of this trade. But it made sense, and it still worked anyway.

I just found a sting candle down(the A wave) after tapping the (S/R Flip+FVG).. I set a sell stop limit on the exact low of that candle.

LOGIC was, if price pushed down below that sting, especially with a strong fvg, it would validate the RESPECT of the (SR FLIP+FVG), and it would continue going down(an invalidation of a long continuation idea)... probably to, again, seek liquidity below.

Reason why I think my entry was sloppy, is because I did not validate the trade idea first. I didn't wait for that sting candle to get "run on(liquidity)" first. I think in order to validate it, I would have waited for the sting to become a run on liquidity area first, and then a second bearish fvg candle close to confirm downtrend. It would have been too late and the profit would have been too small at that point.

5. Put SL at the Orderflow Leg Swing High - If price was really not intending to continue going up, it wouldn't have gone here, which it didn't. I nearly got stopped out, like the other trades I had on sunday and monday.

-------------

Here's the pattern that I keep seeing though, when price makes a valid HIGH(like in this case, the SRFLIP+FVG rebalance), price will attempt to go here atleast twice with a WICK, but will still make lower highs. Usually, those second and third wicks will form as if it's going to take the liquidities at those wicks, but it will just take out the CANDLE BODY HIGHS... So take note of these next time.

When price sweeps a higher timeframe FVG/LIQUIDITY, mark out the candle body closes as TARGET LIQUIDITIES, not the wicks. If a downtrend is valid, it will only take out the body close liquidities. I will make a diagram to help make this make sense lmfao.

-------------

I feel like a mad scientist at this point... endlessly trying to see the actual logic in the market. Not the probabilities of patterns playing out, but the CAUSES and EFFECTS.

I think I'm close to finding the pattern within the pattern... or the message hidden in the patterns(Arcane reference, anyone?).

But I think the two things I have found thanks to Arjo is...

"Price only does two things: 1. Seeking Liquidity 2. Rebalancing Fair Value

and Higher TF = Rebalancing Fair Value <-> Lower TF = Seeking Liquidity"

and

"The Higher the Timeframe, The Stronger the Timeframe"

Like... the market isn't random. I think these two things are the core principles of trading.

Because with these two ideas, you don't need a strategy. You need to UNDERSTAND this. And the strategy can be adapted to whatever you see on the chart.

You open EURUSD, and you see that price is on a downtrend, and it has recently rebalanced the bearish fair value gap on the 4HR? You know what price will do next. It will continue going down to seek liquidity below. So, with that information, what will you look for? How will you enter? Where will you set your entry point, your stoploss, and where is your target?

You open USDCAD, and you see that price is on an uptrend, it has already rebalanced fair value below, has made a bullish choch+FVG, and has respected that choch+FVG on a lower timeframe. You know it will seek buy side liquidity next. So how will you enter? Where will you place your stoploss? Where's your exit?

-------

Now, if only I can translate this knowledge into actual consistency in trading, I can finally make money.

But I guess doing the journal is great. I'm consistently at the 25-30% winrate. So with this understanding.. Maybe I can slowly push that winrate up over time.

I think mechanically, the trade entries i had a year ago and now was the same(choch+POC+FVG+OTE), but now I have the understanding of why it may work or why it won't work, and when do I apply it so I increase the odds of winning. So that's something.

Before, I didn't know why it did or did not work. But now, I know.

I can use this info moving forward to increase my odds.

-------

OH WAIT YEAH, IF I KNOW WHAT THE MARKET DOES AND WHY IT DOES WHAT IT DOES, THEN I WILL BE ABLE TO REFINE MY ENTRIES, BECAUSE NOW I KNOW WHY AND HOW I'M MAKING MY MISTAKES. HELL YEAH.

-------

I'm just not sure about whether I can stick to one entry strategy now, or if I should, or I won't trade something that looks doable under my principles... because I've studied everything, and it makes sense now. lmfao.

-------

if people are reading this(up to this point lol that was a long ash read), then thank you. Reply with your thoughts if ever.

Alright thanks bye

GBPUSD FORECASTIn this analysis we're focusing on 4H time frame for GBPUSD. As we know that market trend was bullish and today I'm looking for a buy side opportunity. According to my analysis, if the market price wants to continue its move to the upside, it will need to first retest the key levels drawn on the chart before it can continue its upward movement. Let's see what happens and which opportunity market will give us. Always remember when price reaches our key levels wait for confirmation. After confirmation execute your trades.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

This is just my analysis or prediction.

#GBPUSD 4H Technical Analyze Expected Move.

GBPJPY TODAY FORECASTIn this forecast we're analyzing 2H time frame for GBPJPY. Today I'm looking for a potential buy trade setup. According to my analysis and strategy when price enters in my key levels as shown in the chart and give any bullish confirmation like candlestick pattern or price action. After taking confirmation we'll trigger our trade. Confirmation is most important part of this analysis.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

This is just my analysis. Further updates related this analysis will posted soon once price reach our levels.

#GBPJPY 2H Technical Analysis Expected Move.

#BTC/USD ANALYSIS. (BULLISH)Bitcoin Price Action Analysis. The Next Big Move?

Bitcoin is moving within an ascending channel, showing strong bullish momentum! However, a key decision point is approaching as the price nears a critical support zone (highlighted in blue). If BTC holds above this level, we could see a strong push towards the $91,500 resistance and potentially break into the $94,700 range.

A well structured risk-to-reward setup is in play, with a potential bullish breakout targeting new highs. Will BTC sustain its momentum, or will we see a retracement before the next leg up? Stay sharp and trade wisely! We will execute our trades only after receiving bullish confirmation.

Use proper stoploss and proper money management.

This is just my analysis. Observe the behavior of price how it will react.

#BTCUSD 2H Technical Analysis Expected Move.

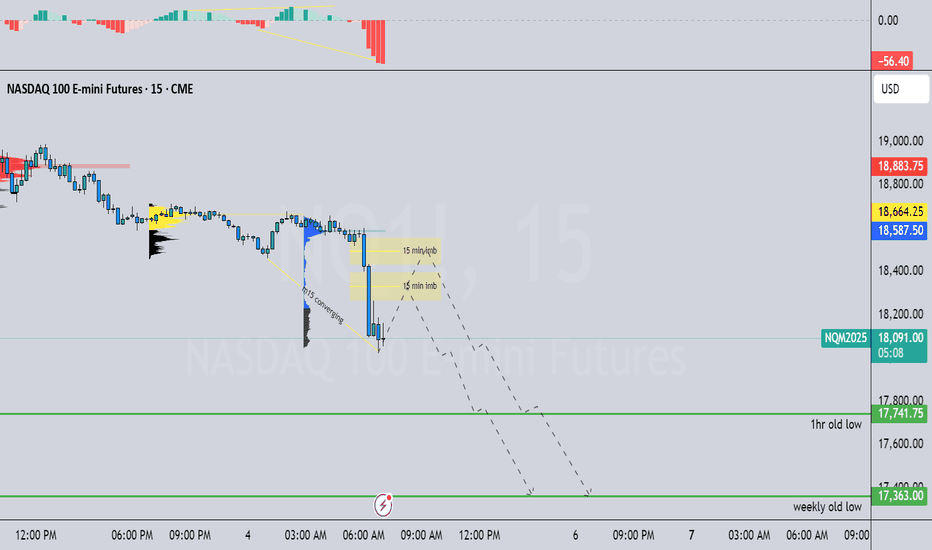

we might continue dropping daily hidden divergence, price might want to continue seeking sell side liquidity

4hr is making a new low and taking out old lows (sell side liquidity) to the left MACD is not converging as of yet

1hr hbrsh-div price is dropping ahead of red news this Friday, could head to 1hr old low or weekly low, waiting to see how price reacts to news

m15 price is below POC of previous NY session POC, as well as overnight Asian and London session converging nicely ahead of news I would favor price reacting short-term from m15 bearish imbalance before reaching the lows around the NY open after news but we will see

Monthly Chart SPX Cautious Liquidity PositioningThis month, the S&P 500 (SPX) has shown signs of a cautious liquidity shift as investors take a more measured approach to risk. While the index remains near all-time highs, underlying market activity suggests hesitation rather than aggressive buying. I currently have no active positions.

Investors are rotating out of high-growth stocks and into more defensive sectors like utilities, healthcare, and consumer staples. This shift signals concerns about potential volatility, possibly due to upcoming Federal Reserve decisions, economic data, or geopolitical risks. At the same time, large tech stocks—key drivers of the market rally—are seeing some profit-taking, further indicating a more defensive stance.

In the options market, there has been increased demand for downside protection. A rising put-to-call ratio and higher implied volatility suggest that traders are preparing for potential pullbacks rather than chasing new highs. Retail speculation has also slowed, with lower volumes in leveraged ETFs and call options.

Another sign of caution is the increase in money market fund inflows, as investors park cash in short-term instruments offering attractive yields. The U.S. Treasury’s ongoing debt issuance is also pulling liquidity away from equities.

While the Federal Reserve has hinted at possible rate cuts later this year, inflation remains a concern, keeping policymakers on hold for now. Market expectations for rate cuts have been pushed further out, tightening financial conditions and limiting excess liquidity that previously fueled stock market gains.

Overall, SPX liquidity trends this month suggest the market is at a turning point. While the index remains strong, the cautious stance in underlying market activity raises questions about whether stocks can continue higher without a fresh catalyst.

What Are the Inner Circle Trading Concepts? What Are the Inner Circle Trading Concepts?

Inner Circle Trading (ICT) offers a sophisticated lens through which traders can view and interpret market movements, providing traders with insights that go beyond conventional technical analysis. This article explores key ICT concepts, aiming to equip traders with a thorough understanding of how these insights can be applied to enhance their trading decisions.

Introduction to the Inner Circle Trading Methodology

Inner Circle Trading (ICT) methodology is a sophisticated approach to financial markets that zeroes in on the behaviours of large institutional traders. Unlike conventional trading methods, ICT is not merely about recognising patterns in price movements but involves understanding the intentions behind those movements. It is part of the broader Smart Money Concept (SMC), which analyses how major players influence the market.

Key Inner Circle Trading Concepts

Within the ICT methodology, there are many concepts to learn. Below, we’ve explained the most fundamental ideas central to ICT trading.

Structure

Understanding the structure of a market is fundamental to effectively employing the ICT methodology. In the context of ICT, market structure is defined by the identification of trends through specific patterns of highs and lows.

Market Structure

A market trend is typically characterised by a series of higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend. This sequential pattern provides a visual representation of market sentiment and momentum.

Importantly, market trends are fractal, replicating similar patterns at different scales or timeframes. For example, what appears as a bearish trend on a short timeframe might merely be a corrective phase within a larger bullish trend. By understanding this fractal nature, traders can better align their strategies with the prevailing trend at different trading intervals.

Break of Structure (BOS)

A Break of Structure occurs when there is a clear deviation from these established patterns of highs and lows. In an uptrend, a BOS is signalled by prices exceeding a previous high without falling below the most recent higher low, confirming the strength and continuation of the uptrend.

Conversely, in a downtrend, a BOS is indicated when prices drop below a previous low without breaching the prior lower high, signifying that the downtrend remains strong. Identifying a BOS gives traders valuable clues about the continuation of the current market direction.

Change of Character (CHoCH)

The Change of Character in a market happens when there is a noticeable alteration in the behaviour of price movements, suggesting a potential reversal of a given trend. This might be seen in an uptrend where the price fails to reach a new high and then breaks below a recent higher low, indicating that the buying momentum is waning and a bearish reversal is possible.

Identifying a CHoCH helps traders recognise when the market momentum is shifting, which is critical for adjusting positions to capitalise on or protect against a new trend.

Market Structure Shift (MSS)

A Market Structure Shift is a significant change in the market that can disrupt the existing trend. This specific type of CHoCH is typically marked by a price moving sharply (a displacement) through a key structural level, such as a higher low in an uptrend or a lower high in a downtrend.

These shifts can signal a profound change in market dynamics, with the sharp move often preceding a new sustained trend. Recognising an MSS allows traders to reevaluate their current bias and adapt to a new trend, given its clear signal.

Order Blocks

Order blocks are a central component of ICT trading, providing crucial insights into potential areas where the price may react strongly due to significant buy or sell interests from large market participants.

Regular Order Blocks

A regular order block is an area on the price chart representing a concentration of buying (demand zone) or selling (supply zone) activity.

In an uptrend, a bullish order block is identified during a downward price movement and marks the last area of selling before a substantial upward price movement occurs. Conversely, a bearish order block forms in an uptrend where the last buying action appears before a significant downward price shift.

In the ICT trading strategy, order blocks are seen as reversal areas. So, if the price revisits a bullish order block following a BOS higher, it’s assumed that the block will hold and prompt a reversal that produces a new higher high.

Breaker Blocks

Breaker blocks play a crucial role in identifying trend reversals. They are typically formed when the price makes a BOS before reversing and breaking beyond an order block that should hold if the established market structure is to be maintained. This formation indicates that liquidity has been taken.

For instance, in an uptrend, if the price creates a new high but then reverses below the previous higher low, the bullish order block above the low becomes a breaker block. A breaker block can be an area that prompts a reversal as the new trend unfolds; it’s a similar concept to support becoming resistance and vice versa.

Mitigation Blocks

Mitigation blocks are similar to breaker blocks, except they occur after a failure swing, where the price attempts but fails to surpass a previous peak in an uptrend or a previous trough in a downtrend. This pattern indicates a loss of momentum and potential reversal as the price fails to sustain its previous direction.

For example, in an uptrend, if the price makes a lower high and then breaks the structure by dropping below the previous low, the order block formed at the previous low becomes a mitigation block. These blocks are critical for traders because they’re also expected to produce a reversal if a new trend has been set in motion.

Liquidity

Liquidity refers to areas on the price chart with a high concentration of trading activity, typically marked by stop orders from retail traders.

Buy- and Sell-Side Liquidity

Buy-side liquidity is found where there is a likely accumulation of short-selling traders' stop orders, typically above recent highs. Conversely, sell-side liquidity is located below recent lows, where bullish traders' stop orders accumulate. When prices touch these areas, activating stop orders can cause a reversal, presenting a potential level of support or resistance.

Liquidity Grabs

A liquidity grab occurs when the price quickly spikes into these high-density order areas, triggering stops and then reversing direction. In ICT theory, this action is often orchestrated by larger players aiming to capitalise on the flurry of orders to execute their large-volume trades with minimal slippage. It's a strategic move that temporarily shifts price momentum, usually just long enough to trigger the stops before the market direction reverses.

Inducement

An inducement is a specific type of liquidity grab that triggers stops and entices other traders to enter the market. It often appears as a peak or trough, typically into an area of liquidity, in a minor counter-trend within the larger market trend. Inducements are designed by smart money to create an illusion of a trend change, prompting an influx of retail trading in the wrong direction. Once the retail traders have committed, the price swiftly reverses, aligning back with the original major trend.

Trending Movements

In the Inner Circle Trading methodology, two specific types of sharp trending movements signal significant shifts in market dynamics: fair value gaps and displacements.

Fair Value Gaps

A fair value gap (FVG) occurs when there is a noticeable absence of trading within a price range, typically represented by a swift and substantial price move without retracement. This gap often forms between the wicks of two adjacent candles where no trading has occurred, signifying a strong directional push.

Fair value gaps are important because they indicate areas on the chart where the price may return to "fill" the gap, usually before meeting an order block, offering potential trading opportunities as the market seeks to establish equilibrium.

Displacements

Displacements, also known as liquidity voids, are characterised by sudden, forceful price movements occurring between two chart levels and lacking the typical gradual trading activity observed in between. They are essentially amplified and more substantial versions of fair value gaps, often spanning multiple candles and FVGs, signalling a heightened imbalance between buy and sell orders.

Other Components

Beyond these ICT concepts, there are a few other niche components.

Kill Zones

Kill Zones refer to specific timeframes during the trading day when market activity significantly increases due to the opening or closing of major financial centres. These periods are crucial for traders as they often set the tone for price movements based on the increased volume and volatility:

Optimal Trade Entry

An optimal trade entry (OTE) is a type of Inner Circle trading strategy, found using Fibonacci retracement levels. After an inducement that prompts a displacement (leaving behind an FVG), traders use the Fibonacci retracement tool to pinpoint entry areas.

The first point is set at the major high or low that prompts the displacement, while the second point is set at the next significant swing high or low that forms. In a bearish movement, for example, the initial point is set at the swing high before the displacement and the subsequent point at the new swing low. Traders often look to the 61.8% to 78.6% retracement level for entries.

Balanced Price Range

A balanced price range is observed when two opposing displacements create FVGs in a short timeframe, indicating a broad zone of price consolidation. During this period, prices typically test both extremes, attempting to fill the gaps. This scenario offers traders potential zones for trend reversals as the price seeks to establish a new equilibrium, as well as key levels to watch for a breakout.

The Bottom Line

Understanding ICT concepts gives traders the tools to decode complex market signals and align their strategies with the influential trends shaped by the largest market participants. For those looking to apply these sophisticated trading techniques practically, opening an FXOpen account can be a great step towards engaging with the markets through a robust platform designed to support advanced trading strategies.

FAQs

What Are ICT Concepts in Trading?

ICT (Inner Circle Trading) concepts encompass a series of advanced trading principles that focus on replicating the strategies of large institutional players. These concepts include liquidity zones, order blocks, market structure shifts, and optimal trade entries, all aimed at understanding and anticipating significant market movements.

What Is ICT in Trading?

ICT in trading refers to the Inner Circle Trading methodology, a strategy developed to align smaller traders’ actions with those of more influential market participants. It utilises specific market phenomena, such as order blocks and liquidity patterns, to analyse price movements and improve trading outcomes.

What Is ICT Trading?

ICT trading is the application of concepts that seek to identify patterns and structures that indicate potential price changes driven by institutional activities, aiming to capitalise on these movements.

What Is ICT Strategy?

An ICT strategy combines market analysis techniques to identify where significant market players are likely to influence prices. This includes analysing price levels where large volumes of buy or sell orders are anticipated to occur and identifying key times when market moves are most likely.

Is ICT Better Than SMC?

Comparing ICT and SMC (Smart Money Concept) is challenging as ICT is essentially a subset of SMC. While SMC provides a broader overview of how institutional money influences the markets, ICT offers more specific techniques and terms like inducements and displacements. Whether one is better depends on the trader’s specific needs and alignment with these methodologies’ intricacies.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

TRADE IDEAS: ES FUTURES (ESM2025) – 3/26/2025 PLAYBOOK# 📊 TRADE IDEAS: ES FUTURES (ESM2025) – 3/26/2025 PLAYBOOK

## 🟢 SCENARIO 1 (BULLISH)

**DIRECTION:** Long

**STRUCTURE BIAS:** Bullish

**ENTRY LEVEL:** 5,795-5,815 (current zone, buying sell-side liquidity raids)

**STOP LEVEL:** 5,785 (invalidate if hourly close below this level)

**TARGET LEVELS:**

- **Target 1:** 5,880-5900 (Weekly Key High Resistance Level)

**R/R RATIO:** ~3:1 (depending on final execution)

### EXECUTION STRATEGY

- **Entry Confirmation:** Look for price to raid previous unhit weekly lows (sell-side liquidity)

- **Long Entries:** Establish long positions as price successfully raids these lows but fails to sustain below them

- **Stop Placement:** Use 5,785 as a hard stop (hourly close below invalidates the trade idea)

- **Target:** Take profits at 5880 - 5,900 (Weekly Key High Resistance)

### KEY POINTS

- Current price action targeting sell-side liquidity in the form of previous unhit weekly lows

- Wednesday typically not a low/high of week formation day, suggesting potential for continued movement

- Tomorrow's High Impact News Event (GDP at 8:30 AM) likely to create volatility and could accelerate the move

- Bullish structure prevails as long as price maintains above liquidity raid zones

---

## 🔴 SCENARIO 2 (BEARISH)

**DIRECTION:** Short

**STRUCTURE BIAS:** Bearish after bullish extension

**ENTRY LEVEL:** 5,880-5910 (Weekly Key High Resistance Level)

**STOP LEVEL:** 5,9550 (invalidate if hourly close above this level)

**TARGET LEVELS:**

- **Target 1:** 5,740 (Weekly Opening Gap upper boundary)

**R/R RATIO:** ~3:1 (depending on final execution)

### EXECUTION STRATEGY

- **No Immediate Short:** Wait for price to extend to Weekly Key High Resistance Level (blue line ~5,900)

- **Rejection Confirmation:** Look for reversal candles and selling pressure at resistance

- **Short Entries:** Establish short positions once price trades below confirmation level after testing resistance

- **Stop Placement:** Use 5,925-5950 as a hard stop (hourly close above invalidates the trade idea)

- **Scaling Out:** Partial profit near 5,800, hold remaining for potential move to 5,745 area

### KEY POINTS

- After liquidity is taken at the Weekly Key High Resistance (blue line), expect manipulation and reversal

- Short opportunity emerges only after bulls exhaust momentum at key resistance

- Weekly Opening Gap (red zone) remains a significant downside target for next move

- Any sustained hourly close above 5,965 **invalidates** this bearish setup

## MARKET BIAS

- **SHORT TERM (Today – 1 Day):**

- **Bullish** bias as price is likely to find support at current levels and move toward the Weekly Key High Resistance

- Current price action suggests accumulation before a move higher

- Tomorrow's GDP numbers (8:30 AM) represent a potential catalyst for accelerated movement

- **LONGER TERM (1–2 Weeks):**

- After testing the Weekly Key High Resistance level (~5,900), expect a reversal and move back toward the Weekly Opening Gap (red zone)

- Market structure suggests a "liquidity hunt" pattern – first to the upside, then reversing to the downside

- Major liquidity draw currently at the blue line, once exhausted, focus will shift back to the Weekly Opening Gap

Perfect Bearish Setup Trendline Breakout Alert!Hello Trader! 👋

Scenario 1: 📉

Picture this: You're analyzing a solid bearish trend on the M3 or H1 chart, and you've just spotted a trendline break with serious potential for a sell opportunity. 🔥 The momentum is strong, and everything aligns perfectly. 🚀 The market is pushing lower, and it looks like it’s ready to move further down.

The entry signal is solid, confirming a valid opportunity to take a short position! 📉

Now, the exciting part—the target zone! 🎯 We’re eyeing a liquidity area around 3000, which is a key level where price could see some action. 🔄 But wait, there's more! Your secondary target level is around 2990, which could offer even more potential for profit as the market drives lower. 💰

Of course, always follow your risk management**—control your position size, set your stops wisely, and let the market do the work! 🛑⚖️ Trading is all about discipline , and with the right mindset, you'll maximize those winning moves. 🏆

Stay focused, keep an eye on the price action, and be ready to react! 💪 Let’s trade smart and make those profits! 😎💥

What Is a Liquidity Sweep and How Can You Use It in Trading?What Is a Liquidity Sweep and How Can You Use It in Trading?

Mastering key concepts such as liquidity is crucial for optimising trading strategies. This article explores the concept of a liquidity sweep, a pivotal phenomenon within trading that involves large-scale players impacting price movements by triggering clustered pending orders, and how traders can leverage them for deeper trading insights.

Understanding Liquidity in Trading

In trading, liquidity refers to the ability to buy or sell assets quickly without causing significant price changes. This concept is essential as it determines the ease with which transactions can be completed. High liquidity means that there are sufficient buyers and sellers at any given time, which results in tighter spreads between the bid and ask prices and more efficient trading.

Liquidity is often visualised as the market's bloodstream, vital for its smooth and efficient operation. Financial assets rely on this seamless flow to ensure that trades can be executed rapidly and at particular prices. Various participants, including retail investors, institutions, and market makers, contribute to this ecosystem by providing the necessary volume of trades.

Liquidity is also dynamic and influenced by factors such as notable news and economic events, which can all affect how quickly assets can be bought or sold. For traders, understanding liquidity is crucial because it affects trading strategies, particularly in terms of entry and exit points in the markets.

What Is a Liquidity Sweep?

A liquidity sweep in trading is a phenomenon within the Smart Money Concept (SMC) framework that occurs when significant market players execute large-volume trades to trigger the activation of a cluster of pending buy or sell orders at certain price levels, enabling them to enter a large position with minimal slippage. This action typically results in rapid price movements and targets what are known as liquidity zones.

Understanding Liquidity Zones

Liquidity zones are specific areas on a trading chart where there is a high concentration of orders, including stop losses and pending orders. These zones are pivotal because they represent the levels at which substantial buying or selling interest is anticipated once activated. When the price reaches these zones, the accumulated orders are executed, which can cause sudden and sharp price movements.

How Liquidity Sweeps Function

The process begins when market participants, especially institutional traders or large-scale speculators, identify these zones. By pushing the market to these levels, they trigger other orders clustered in the zone. The activation of these orders adds to the initial momentum, often causing the price to move even more sharply in the intended direction. This strategy can be utilised to enter a position favourably or to exit one by pushing the price to a level where a reversal is likely.

Liquidity Sweep vs Liquidity Grab

Within the liquidity sweep process, it's crucial to distinguish between a sweep and a grab:

- Liquidity Sweep: This is typically a broader movement where the price action moves through a liquidity zone, activating a large volume of orders and thereby affecting a significant range of prices.

- Liquidity Grab: Often a more targeted and shorter-duration manoeuvre, this involves the price quickly hitting a specific level to trigger orders before reversing direction. This is typically used to 'grab' liquidity by activating stops or pending positions before the price continues to move in the same direction.

In short, a grab may just move slightly beyond a peak or low before reversing, while a sweep can see a sustained movement beyond these points prior to a reversal. There is a subtle difference, but the outcome—a reversal—is usually the same.

Spotting a Liquidity Sweep in the Market

Identifying a sweep involves recognising where liquidity builds up and monitoring how the price interacts with these zones. It typically accumulates at key levels where traders have placed significant numbers of stop-loss orders or pending buy and sell positions.

These areas include:

- Swing Highs and Swing Lows: These are peaks and troughs in the market where traders expect resistance or support, leading to the accumulation of orders.

- Support and Resistance Levels: Historical areas that have repeatedly influenced price movements are watched closely for potential liquidity buildup.

- Fibonacci Levels: Common tools in technical analysis; these levels often see a concentration of orders due to their popularity among traders.

The strategy for spotting a sweep involves observing when the price approaches and breaks through these levels. Traders look for a decisive move that extends beyond the identified zones and watch how the asset behaves as it enters adjacent points of interest, such as order blocks. The key is to monitor for a subsequent reversal or deceleration in price movement, which can signal that the sweep has occurred and the market is absorbing the liquidity.

This approach helps traders discern whether a significant movement is likely a result of a sweep, allowing them to make more informed decisions about entering or exiting positions based on the anticipated reversal or continuation of the price movement.

How to Use Liquidity Sweeps in Trading

Traders often leverage liquidity sweeps in forex as strategic indicators within a broader Smart Money Concept framework, particularly in conjunction with order blocks and fair value gaps. Understanding how these elements interact provides traders with a robust method for anticipating and reacting to potential price movements.

Understanding Order Blocks and Fair Value Gaps

Order blocks are essentially levels or areas where historical buying or selling was significant enough to impact an asset’s direction. These blocks can act as future points of interest where the price might react due to leftover or renewed interest from market participants.

Fair value gaps are areas on a chart that were quickly overlooked in previous movements. These gaps often attract price back to them, as the market seeks to 'fill' these areas by finding the fair value that was previously skipped.

Practical Application in Trading Strategies

Learn how liquidity sweeps can be applied to trading strategies.

Identifying the Trend Direction

The application of liquidity sweeps starts with understanding the current trend, which can be discerned through the market structure—the series of highs and lows that dictate the direction of the market movement.

Locating Liquidity Zones

Within the identified trend, traders pinpoint liquidity zones, which could be significant recent swing highs or lows or areas marked by repeated equal highs/lows or strong support/resistance levels.

Observing Order Blocks and Fair Value Gaps

After identifying a liquidity zone, traders then look for an order block beyond this zone. The presence of a fair value gap near the block enhances the likelihood of the block being reached, as these gaps are frequently filled.

Trade Execution

When the price moves into the order block, effectively sweeping liquidity, traders may place limit orders at the block with a stop loss just beyond it. This action is often based on the expectation that the order block will trigger a reversal.

Utilising Liquidity Sweeps for Entry Confidence

The occurrence of a sweep into an order block not only triggers the potential reversal but also provides traders with greater confidence in their position. This confidence stems from the understanding that the market's momentum needed to reach and react at the block has been supported by the liquidity sweep.

By combining these elements—trend analysis, liquidity zone identification, and strategic use of order blocks and fair-value gaps—traders can create a cohesive strategy that utilises sweeps to enhance decision-making and potentially improve trading results.

The Bottom Line

Understanding liquidity sweeps offers traders a critical lens through which to view market dynamics, revealing deeper insights into potential price movements. For those looking to apply these insights practically, opening an FXOpen account could be a valuable step towards engaging with the markets more effectively and leveraging professional-grade tools to navigate liquidity phenomena.

FAQs

What Is a Liquidity Sweep?

A liquidity sweep occurs when large market participants activate significant orders within liquidity zones, causing rapid price movements. It's a strategic manoeuvre to capitalise on accumulated buy or sell orders at specific price levels.

What Is a Sweep Trade?

A sweep trade is a large order executed through multiple different areas on a chart and venues to optimise execution. This is common in both equities and derivatives trading to minimise market impact.

How to Spot a Liquidity Sweep?

Liquidity sweeps can be identified by sudden, sharp movements towards areas dense with orders, such as previous swing highs or lows or known support and resistance levels, followed often by a rapid reversal.

What Is the Difference Between a Liquidity Sweep and a Liquidity Grab?

A liquidity sweep is a broader market move activating a large volume of orders across a range of prices. In contrast, a grab is a quick, targeted action to hit specific order levels before the price reverses direction.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

#GOLD ANALYSIS (BEARISH BIAS)🔍 XAU/USD Technical Breakdown – Bearish Setup Ahead?

Gold has been struggling against a key trendline resistance, with a strong supply zone acting as a barrier. The price is currently approaching a critical rejection area ($3,033 - $3,040), aligning with the downward trendline. A potential liquidity grab in this region could trigger a bearish reversal. Always take confirmation before executing your trade.

Expected Price Action:

A rejection from resistance, followed by a lower high formation.

A move towards the $3,010 - 3015 level, with a possible test of liquidity.

Break below could open doors for further downside.

🔴 Stop-Loss: Above the resistance zone.

🟢 Target: Key support around $2,999-$3,010.

Will the bears take control, or will bulls break through? Let’s watch how price reacts! 👀

#XAUUSD 30M Technical Analysis Expected Move.

BTCUSD TOUCHED 85000 REVERSAL ?What’s up, traders? I’m here to drop free game, sharp analysis, and top-tier trade setups! 🎯 Let’s get straight to it:

🔍 Market Insight

🔸 BTC/USD has been consolidating since Friday night now it broke the consolidation and touched 85000 which was awaiting from long way we posted an idea with a buy entry but price missed our entry area and flyed

🔸 A liquidity sweep at 84789 on the 30M timeframe confirms smart money movements.

🔸 Strategy: After a liquidity grab, we shift to the 1-minute timeframe to confirm a Change of Character (ChoCh) for a sniper entry! 🎯

🔥 Trade Execution

✔️ Order Block marked at 84,900.

✔️ Sell limit at 84,900 – catching this right at the sweet spot!

✔️ Stop-loss 85,200 (-30 pips) to manage risk.

✔️ Take-profit 84,100 (+80 pips) – smooth 1:2.5 risk-reward!

📊 Technical Breakdown

🟢 Bias: Bullish – buyers in control!

⚠️ Lock in profits after 30 pips – don’t get greedy!

📌 Final Setup

💰 Sell Limit: 84,900

⛔ Stop-Loss: 85,200

🎯 Take-Profit: 84,100

💸 Let’s ride this move and secure the bag! 🚀💰 #CryptoSignals #BTCUSD #SmartMoney #ForexTrading

BTC/USD UPDATESIn this forecast we're analyzing 1H time frame for finding the upcoming movement and changes in BTCUSD price. My BIAS for today was Bullish and when price come to my key level area. we'll observe the reaction of price if price give any bullish confirmation then we'll execute our trade. Let's delve deeper into these levels and potential outcomes.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

This is just my analysis.

#BTCUSD 1H Technical Analysis Expected Move.

EURUSD ROUTE MAPI’m currently analyzing the EUR/USD 1-hour chart, using trendline support, combined with the SMC concept and price action. ✨

I’ll be looking for buy trade opportunities based on the key levels drawn on the chart. ⬆️

Patience is key – I’ll wait for the price to reach my levels and confirm any bullish signals, allowing me to execute the trade at the ideal point. 💡📈

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

This is just my analysis. Once price reaches our levels further updates will posted soon.

#EURUSD 1H Technical Analysis Expected Move.

#GOLD BULLISH UPDATESGold Analysis - Bullish Bias for Today.

Currently, I’m analyzing Gold on the 1-hour time frame. As we all know, Gold is at an all time high, with the market pushing upwards without a valid retracement. The overall trend remains bullish, so my bias for today is also bullish based on my analysis.

📍 Key Focus:

I’ll wait for Gold to create a solid structure and retest at least my key levels. This will allow me to place my trade in the ideal demand zone.

✨ Confirmation is Key:

When the price hits my key levels, I’ll look for confirmation through a bullish candlestick pattern or bullish price action before planning my trade.

⚠️ Always Use Stop Loss in Your Trades. ⚠️

📊 Proper Money Management is Key.

💡 Maintain a Solid Risk-to-Reward Ratio.

This is just my analysis. 🔍

Further updates related to this analysis will be shared soon, once the price reaches our key levels. Stay tuned!⏳

🔍 Let’s see what opportunity the market provides.

#XAUUSD 1H Technical Analysis Expected Move.

GBP/USD is heating up! A major shift is coming—are you ready?"Analysis:

The correlation between DXY & GBP/USD is playing out perfectly! As the Dollar Index (DXY) approaches key resistance in the 112-113 zone, GBP/USD is reacting inversely, showing signs of a potential drop toward 1.14.

Elliott Wave patterns confirm a high-probability reversal setup, aligning with macroeconomic factors and liquidity zones. If DXY gains strength, expect a bearish breakdown on GBP/USD.

📈 Key Levels to Watch:

GBP/USD Resistance: 1.32-1.34

GBP/USD Support: 1.14

DXY Resistance: 112-113

DXY Support: 102.5

💡 Will GBP/USD hold or break down? Drop your predictions below! 👇

Trading Plan for the Day (March 18) | EUR/USDMarket Overview:

The EUR/USD pair is showing an upward impulse followed by a downward correction. With a higher probability of continued upward movement, the focus will be on identifying high-quality trade setups to capitalize on this idea.

🎯 Key Zones for Long Positions:

IDM (Initial Drive Momentum):

A critical support zone where price may bounce or consolidate.

If the price breaks IDM with a full-bodied candle, the path to IDM OB (Order Block) opens up.

IDM OB (Order Block):

A strong demand zone that could act as a target for long trades.

Manipulation within Order Flow (OF):

Watch for price action around the ascending order flow zone. If liquidity builds before IDM and gets swept, long positions can be considered at these levels.

📉 Alternative Scenario (Bearish Bias):

If the price drops deeper, it may target the ascending order flow zone located below PDL (Point of Demand Level).

This scenario suggests a potential retest of lower support zones before any upward continuation.

📊 Trading Plan:

Primary Focus: Monitor the interaction with IDM liquidity.

Breakout above IDM: Look for long opportunities targeting IDM OB.

Liquidity Build-Up: If price consolidates and sweeps liquidity before IDM, consider long entries at these levels.

Secondary Focus: If the price falls deeper into the ascending order flow, wait for confirmation of a reversal or consolidation before entering long trades.

⚠️ Risk Management:

Stop-loss should be placed just below the nearest key level to minimize risk.

Position size should ensure risk does not exceed 1% of the trading capital .

🎯 Note: The market is dynamic, and the current structure may evolve. I will adapt to what the chart shows and focus on high-probability setups.

📢 Wishing everyone a profitable trading day!

Trading Plan for the Day (March 18) | XAU/USDMarket Overview:

Gold (XAU/USD) is trading near historical highs, indicating strong buying pressure. However, a potential candlestick pattern could signal a short-term correction.

🎯 Plan for the Day:

Short Positions (Short-Term):

I will consider entering short trades if a bearish candlestick pattern forms (e.g., pin bar or engulfing pattern).

Target: The nearest liquidity zone on the M15 timeframe.

Risk-to-Reward Ratio (RR): Greater than 1:5.

Long Positions (Short-Term):

If the price "sweeps" the liquidity at IDM (Initial Drive Momentum), I will consider entering a short-term long trade.

Target: The next liquidity zone on the upside.

📊 Chart:

Attached is a chart with key levels marked: historical highs, IDM, and nearby liquidity zones.

⚠️ Risk Management:

Stop-loss will be placed just beyond the nearest key level.

Position size is calculated to ensure risk does not exceed 1% of the trading capital.

GOLD 1-H ROUTE MAPToday, we are analyzing the 1-hour time frame chart for Gold. My bias for today is on the buy side, based on market structure mapping and the SMC concept. Once the market price reaches my key levels, I will wait for confirmation according to my rules and strategy. At the same time, I will keep an eye on the volume and RSI indicators to find a strong confirmation and execute my trade with precision.

The market will not move higher until it hunts its full SSL. And if we decide to buy from here, the first resistance we will face will be around the 2888-90 area, and the second resistance will be near the 2895-2900 price range. Let's delve deeper into these levels and potential out comes.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

This is just my analysis not financial advice.

#XAUUSD 1H Technical Analysis Expected Move.