Inside a Candle: How to Read Hidden Order Flow Without a DOM

Difficulty: 🐳🐳🐳🐋🐋 (Intermediate+)

This article is for traders who want to understand the “story” behind a candle’s shape — and learn to spot aggressive buying/selling, absorption, and traps without needing footprint or order book tools.

🔵 INTRODUCTION

Most traders see candles as static shapes — green or red, big or small. But each candle is a battlefield of orders . Even without access to a DOM or volume footprint, you can still extract valuable information from just the candle's body, wick, and context .

🔵 ORIGINS: WHERE CANDLESTICKS COME FROM

Candlestick charts trace back to 18th-century Japan, where rice traders needed a way to visualize price movements over time. A legendary trader named Munehisa Homma , who traded rice futures in Osaka, is credited with developing the earliest form of candlestick analysis.

Homma discovered that price wasn’t just driven by supply and demand — but also by trader psychology . He created visual representations of market sentiment by tracking:

The opening and closing price of rice

The highest and lowest price reached during the session

This system became known as the “Sakata rules,” and it laid the foundation for many patterns still used today — such as Doji, Engulfing, and Marubozu.

Western traders only began using candlesticks widely in the 1990s, when analyst Steve Nison introduced them to the broader financial world through his book Japanese Candlestick Charting Techniques.

Today, candlesticks remain one of the most powerful and intuitive ways to visualize order flow, momentum, and market psychology — even without a Depth of Market (DOM) or depth of book.

In this article, you’ll learn how to read hidden order flow by analyzing:

Wick length and positioning

Body-to-range ratios

Candle clustering and sequences

🔵 HOW A CANDLE FORMS

Before you can read a candle, you need to understand how it comes to life . A single candle represents the full auction process during its time window.

Here’s how it builds, step by step:

Candle opens — this is the open price .

As price moves up during the session → the high] updates.

As price moves down → the low] updates.

The final traded price when the time closes → this becomes the close price .

The wick = price areas that were tested but rejected

The body = where the majority of aggressive trades occurred

If buyers push price up quickly but sellers slam it down before the close — the candle will have a long upper wick and close near the open, revealing seller absorption.

Understanding this flow helps you recognize traps, fakeouts, and reversals in real time.

🔵 CANDLE BODY: WHO'S IN CONTROL

The body of the candle reflects the result of the battle between buyers and sellers. A wide body with minimal wicks means dominance and commitment.

Big body, small wick → clear conviction

In an uptrend: buyer aggression

In a downtrend: panic or aggressive selling

Small body, long wicks → indecision, absorption, or trap

Often appears near tops/bottoms

Indicates both sides were active but neither won clearly

www.tradingview.com

🔵 WICKS: THE SHADOWS OF REJECTION

Wicks are not just “leftovers” — they show where price was rejected after being tested.

Long upper wick = seller presence or absorption at highs

Long lower wick = buyer defense or trap spring

Double wick = liquidity sweep / false breakout

Use wick direction to spot:

Failed breakouts

Smart money traps

Exhaustion candles

🔵 HIDDEN ORDER FLOW PATTERNS

1️⃣ Absorption Candle

A large wick with little movement afterward — shows that big orders absorbed market pressure.

2️⃣ Trap Candle

A candle that sweeps above/below a key high/low and closes opposite — classic smart money fakeout.

3️⃣ Imbalance Candle

Large-bodied candle that closes near the high/low with no wick on the other end — implies one-sided aggression (and often leaves an imbalance).

🔵 CLUSTERING & SEQUENCES MATTER

Never read a candle alone. The sequence of candles tells the full story:

3+ rejection wicks near resistance? Liquidity building before breakout or trap

Bearish engulfing after long upper wick = smart money selling into retail buying

Tight-range dojis + volume spike = compression before expansion

Context + volume + structure = hidden flow decoded.

🔵 PUTTING IT TOGETHER: A REAL EXAMPLE

Price breaks above previous high

Candle closes with long upper wick and smaller body

Next candle opens, dumps fast, leaving imbalance behind

Buyers trapped — move likely to continue down

This is how you read order flow from candle anatomy .

🔵 TIPS FOR MASTERY

Use a lower timeframe (1M–5M) to see microstructure

Watch how wicks behave near S/R or OBs

Confirm with volume spikes or delta-style indicators

Use replay mode to slow down the story and study cause/effect

🔵 CONCLUSION

Every candle is a message. You don’t need expensive tools to read order flow — just your eyes, context, and curiosity.

Learn to see candles not as symbols, but as evidence of behavior . Absorption, imbalance, and traps are all visible if you look closely.

Liquiditysweep

GBP/USD | SMC Roadmap – Clinton Scalper POV🧠 Institutional Structure Overview

GU has been aggressively distributed from the 1.358xx premium zone, creating a strong downward market structure. We now observe:

A clean internal BOS confirming bearish intent

Major liquidity voids left behind

Price currently resting around discount levels (0.236–0.0 zone)

This sets the stage for a "fake recovery" trap before deeper markdown.

📉 Anticipated Smart Money Playbook

🔹 Scenario 1 – Short-Term Internal Rally (Liquidity Grab)

Price may engineer liquidity by forming a corrective retracement toward:

→ First Rejection Zone: ~1.33747 (aligned with fib 0.5 & diagonal internal trendline)

→ Extended Trap Zone: 1.34893 (near fib 0.705 + previous unmitigated OB)

This will allow Smart Money to unload positions before continuation lower. Expect a sharp sell-off post-liquidity sweep.

🔹 Scenario 2 – Continuation Without Full Retrace

If price fails to climb above 1.325xx, we could see an early breakdown after a minor internal rally. Key level to watch:

→ Support-to-Sell Zone: 1.31622

A clean break + retest here opens the way for a bearish expansion toward mid-July lows.

🎯 Key Levels to Monitor

Support Zone: 1.31622 → Valid for potential internal bounce

Short-Term Target if rally forms:

→ 1.33747 → Liquidity Cluster

→ 1.34893 → Final Trap Zone before HTF selloff

Mid-Term Target if breakdown confirmed:

→ 1.3050 → Old demand + final downside imbalance

→ Below 1.30 → Long-term liquidity void

🔍 SMC Takeaways

Premium Zone = Distribution, especially when price is beneath BOS

Discount Zone = Trap/Reload, but not always for bullish continuation

Market seeks efficiency, so every imbalance is eventually filled

True entry is not at key levels, but at confirmations within them (M5/M15 shift after sweep)

🎯 Trade Smart. Think Like Liquidity.

📌 Follow @ClintonScalper for more SMC breakdowns with precision.

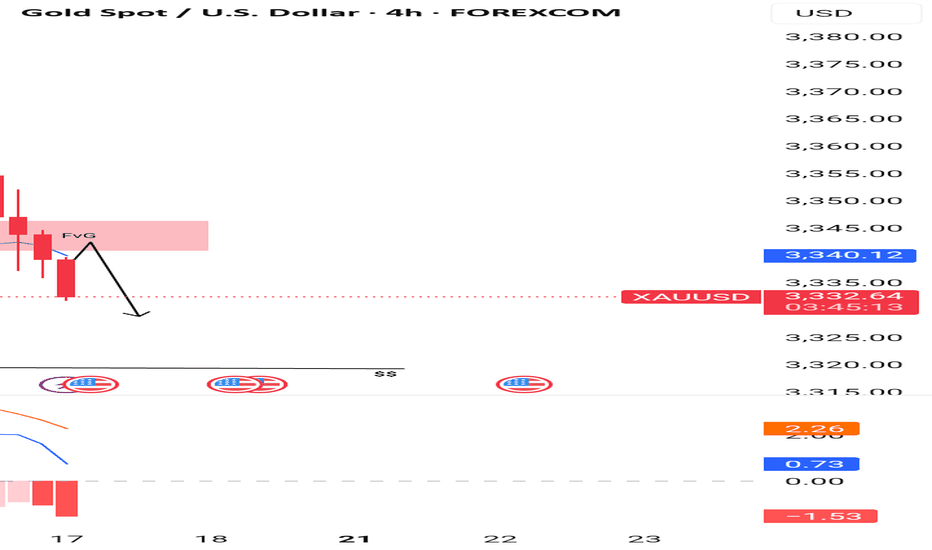

XAUUSD Smart Money Technical Analysis – Bullish Potential XAUUSD Smart Money Technical Analysis – Bullish Potential from Strong Support

Gold (XAUUSD) is currently trading around $3,291.780, showing a potential bullish reversal setup from the strong support zone after a clear liquidity sweep and market structure shifts.

🔍 Key Technical Highlights:

✅ Strong Support Zone (Demand)

Price is reacting from a major demand zone (Strong Low) between $3,275 – $3,225, a level that previously triggered bullish rallies.

Multiple Breaks of Structure (BOS) and CHoCH indicate previous bullish control and a possible re-accumulation phase.

✅ CHoCH Near Support

A recent Change of Character (CHoCH) around the support area shows the first signs of smart money accumulation.

Liquidity below recent lows has been swept, triggering possible bullish intent.

✅ Bullish FVG (Fair Value Gap)

A clear Bullish FVG remains unmitigated around the mid-range, offering target confluence at $3,349.560.

Price may aim to rebalance inefficiency and fill the FVG as part of the bullish move.

✅ Resistance Zone Above

The resistance area near $3,325 – $3,350 acts as a short-term target for long positions.

Further resistance lies at the Buy-Side Liquidity & Weak High zone around $3,450 if momentum sustains.

🧠 Smart Money Concept Interpretation:

Liquidity Grab: Price dipped into strong demand to collect sell-side liquidity before potential reversal.

CHoCH + BOS Alignment: Indicates the market may now transition into a bullish phase.

FVG as Magnet: Price is drawn toward unfilled value zones—ideal for bullish target projection.

🎯 Trade Idea (Educational Purposes Only):

Bias: Bullish

Entry: Around current zone ($3,290)

Target: $3,349.560 (FVG zone)

Invalidation/SL: Below strong low (~$3,225)

BTC/USD – Strong Buy Opportunity from Demand Zone BTC/USD – Strong Buy Opportunity from Demand Zone

🟢 Technical Outlook:

Bitcoin (BTC/USD) has tapped into a well-defined Demand Zone near 115,000–116,000, showing early signs of a potential bullish reversal. This level aligns with key liquidity zones, smart money concepts, and price inefficiencies — offering high-probability long setups.

🧠 Key Technical Highlights:

🔻 Equal Lows + Sell-Side Liquidity:

Market swept equal lows, grabbing liquidity below support — a common institutional setup before a bullish push.

✅ Break of Structure (BOS):

A prior BOS indicates a shift from bearish to bullish structure after liquidity collection.

📉 Fair Value Gap (FVG):

Price created and respected an FVG after the BOS, validating bullish intent.

📊 Imbalance Filled:

A prior price inefficiency has now been filled, completing a clean move from imbalance back into structure.

📈 Target Zone: 119,000 USD

Marked as the logical next stop — sitting near prior resistance and a liquidity zone.

🎓 Educational Insight:

This is a textbook Smart Money Concept scenario:

Sell-side liquidity sweep

Demand zone tap

Imbalance rebalancing

Shift in market structure

It shows how institutions often engineer liquidity grabs before a large directional move.

GOLD PLAN – LIQUIDITY HUNT BEFORE THE REAL MOVE? SCALPING PLAN – LIQUIDITY HUNT BEFORE THE REAL MOVE? 🔍

🔹 Timeframe: 30M

🔹 Bias: Intraday Bullish to Bearish Reversal

🔹 Posted by: Clinton Scalper | Smart Money Focus

🔹 Date: July 30, 2025

🔍 MACRO CONTEXT – WHY GOLD REMAINS HIGHLY REACTIVE

The macro backdrop continues to favor volatility in gold:

🟢 Dovish Fed tone ahead of FOMC

– Fed speakers hint at a pause or rate cut timeline.

– Inflation pressures are easing → lowers interest rate expectations.

📉 USD weakening + falling yields

– 10Y U.S. bonds retreating → dollar under pressure → gold gains ground.

🌐 Geopolitical risks remain elevated

– Tensions from Middle East and global recession risks continue to drive flows into safe-haven assets like gold.

🧭 Conclusion: Short-term upside still viable – but be cautious of liquidity traps and OB rejection.

📈 TECHNICAL + SMC INSIGHTS – THE CHART TELLS THE STORY

🔹 Structure Overview:

Market broke out of a descending channel and formed a bullish ascending wedge.

However, price is now approaching multiple OB SELL zones, aligning with smart money exhaustion levels.

🔹 Key Zones:

🔺 OB SELL Zones:

3,334 → 3,342

3,354 → 3,369 (Fibonacci 1.618 extension)

🔻 OB BUY Zones:

3,302 → 3,291 (confluence with previous liquidity sweep)

📍 Current Price: 3,330 – approaching first supply zone.

🔹 Smart Money Flow:

Liquidity above 3,334 has likely been targeted.

If price reaches 3,354–3,369 and shows exhaustion, expect distribution + reversal.

Key confirmation will be a break back below the ascending structure with momentum.

🎯 TRADE PLAN – TWO POSSIBLE SCALPING SCENARIOS

✅ SCENARIO 1: SHORT FROM PREMIUM OB SELL ZONE

Looking to fade bullish liquidity grab near top of range.

Entry: 3,354–3,369

SL: 3,375

TP1: 3,334

TP2: 3,302

TP3: 3,291

Ideal for reversal scalpers catching the distribution move.

✅ SCENARIO 2: LONG FROM DISCOUNT OB BUY ZONE

If price rejects OB SELL and dumps into unfilled demand.

Entry: 3,291–3,302

SL: 3,275

TP1: 3,322

TP2: 3,343

TP3: 3,354

Smart money often reloads after hunting liquidity beneath discount OBs.

⚠️ EXECUTION REMINDERS

✅ Wait for confirmation candles: engulfing / wick rejection / breaker structure

⛔ No market orders without OB reaction

📊 Risk max 1–1.5% per position

📉 Use volume to confirm absorption / exhaustion in OB zones

📢 FINAL THOUGHT – TRAPS COME FIRST, THEN MOVES

Smart Money doesn't chase price — it hunts stops first.

We’re watching closely to see if price completes its liquidity sweep at 3,354–3,369 before a potential reversal. Alternatively, we wait for price to return to the OB BUY zone around 3,291 for a high-RR long play.

🔥 If this helped you:

👍 Like this idea

💬 Comment your thoughts below

🔔 Follow Clinton Scalper for weekly institutional-grade setups

USDCHF Technical Analysis – Potential Rejection from Resistance USDCHF Technical Analysis – Potential Rejection from Resistance

🔍 Chart Overview:

Current Price: 0.80456

Resistance Zone: 0.80760 – 0.81009

Support Zone: 0.79000 – 0.79236

Price Action: The pair has rallied into a strong resistance zone but is showing signs of exhaustion.

📌 Key Observations:

Volume Profile Insight:

Price has entered a low-volume area near resistance, indicating potential weakness in demand above 0.80800.

Resistance Rejection:

Price tested the 0.80760–0.81009 resistance range and failed to break through decisively.

A potential fake breakout or bull trap could be forming.

Bearish Projection:

If price confirms rejection from resistance, we may see a drop toward the support zone (0.79000 – 0.79236).

This would complete a classic resistance-to-support rotation.

Bearish Confirmation:

A bearish candle formation or break below 0.80350 can trigger short entries.

Ideal risk-reward favors a short setup here.

📉 Trade Plan (Educational Purpose Only):

Entry Zone: 0.80750 – 0.80950

Stop Loss: Above 0.81100

Take Profit Target: 0.79250

Risk-Reward: Approx. 1:2.5

🔻 Summary:

USDCHF is trading near a major resistance zone with weak bullish momentum. If confirmed, a sharp reversal toward support is expected, making this a potentially strong short opportunity.

BTC Breaks Structure After Liquidity Grab! Massive Move Loading…BTC/USD Technical Analysis – July 25, 2025

Structure Overview:

The current BTC/USD price action showcases a classic market structure shift, with multiple Breaks of Structure (BOS), liquidity grabs, and a clear intent to revisit premium pricing zones. The chart follows a Smart Money Concepts (SMC) methodology, identifying key supply and demand areas.

Key Highlights:

🔹 Break of Structure (BOS):

Several BOS events indicate momentum shifts and short-term trend reversals. The most recent BOS near the support zone suggests a potential bullish move after liquidity sweep.

🔹 Sell-Side Liquidity & Equal Lows:

BTC swept the Equal Low level near $114,000, triggering Sell-side Liquidity. This liquidity grab is often a manipulative move by institutional players to collect orders before driving price higher.

🔹 Support Zone:

The support zone near $114,900–$114,000 is holding strong. Price wicked into this area, collected liquidity, and reacted with bullish intent.

🔹 Bearish Fair Value Gap (FVG):

A Bearish FVG exists around $117,500–$118,000, which may act as short-term resistance. Price could partially fill this gap before resuming direction.

🔹 Target Zone:

Projected target lies at $119,637, aligning with the prior resistance zone and offering a high-probability area for price delivery based on the current bullish market structure.

🔹 Volume Profile Support:

The volume profile suggests high volume accumulation in the current range, further supporting the possibility of a bullish expansion phase.

Forecast Summary:

Bias: Bullish (Short-term)

Entry Zone: Confirmed after BOS and liquidity sweep near support

Target: $119,637 (resistance zone)

Invalidation Level: Sustained break below $114,000

⚠️ Risk Note:

A rejection from the Bearish FVG or failure to break above $117,800 may cause a deeper pullback. Monitor reactions around key levels before continuation.

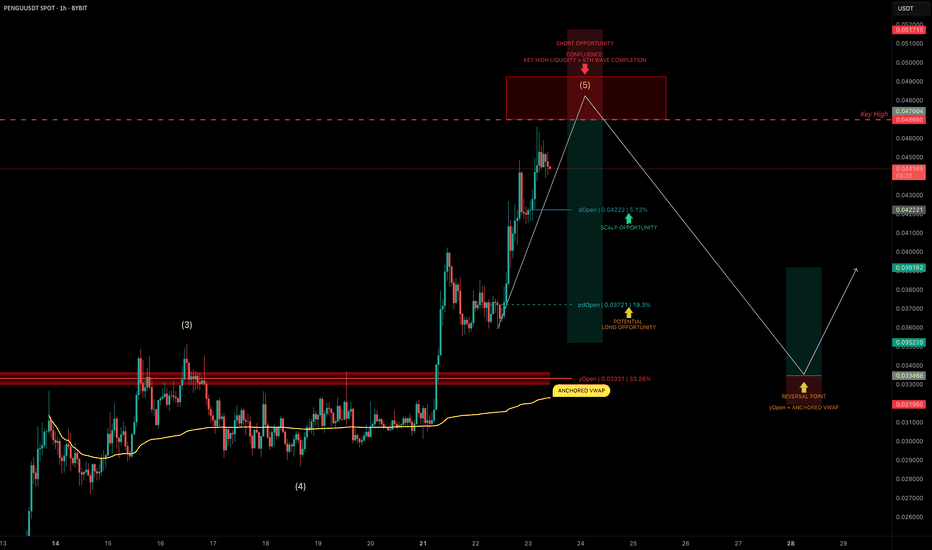

PENGU Topping Out? Targeting 30% Downside After Liquidity SweepPENGU has had an explosive run, but it now looks to be nearing completion of wave 5 of its current Elliott impulse.

We’re approaching a key high at $0.04698, a likely liquidity grab zone — and potentially a great area to position for a short trade.

🧩 Short Setup Overview

➡️ Wave 5 Completion Incoming:

Price is showing signs of exhaustion as it approaches $0.04698, where liquidity is likely stacked above the previous high.

➡️ SFP Trigger Zone:

Watch for a swing failure pattern (SFP) at $0.04698 — confirmation for a potential short entry.

➡️ Psychological Resistance:

The $0.05 level also sits just above — a classic psychological barrier that may get tapped or wicked into.

🔴 Short Trade Setup

Entry: After a confirmed SFP at $0.04698–$0.05

Target (TP): Yearly Open (yOpen) — potential move of ~30%

Stop-loss: Above post-SFP high

R:R: Excellent asymmetry if setup confirms

🛠 Indicator Note

In this analysis I'm using my own indicator called "DriftLine - Pivot Open Zones ", which I recently published.

✅ It helps highlight key open levels, support/resistance zones, and price structure shifts — all critical for confluence-based trade planning.

Feel free to check it out — you can use it for free by heading to my profile under the “Scripts” tab.

💡 Educational Insight: How to Trade Wave 5 Liquidity Sweeps

Wave 5 tops often trap late longs, especially when paired with psychological levels and key highs.

➡️ Patience is key — wait for a rejection pattern or SFP before entering.

➡️ Liquidity sweeps first — then the move.

Final Thoughts

PENGU is pushing toward $0.04698–$0.05, but this may be its final move up before correction.

With the yearly open as a logical target, and clear confluence via DriftLine, this setup offers a clean short opportunity — if confirmation comes.

Stay sharp, let price lead, and trade the reaction — not the prediction.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

XLM Explodes +132% — Is the Party Over or Just Starting?XLM has been one of the top movers, sweeping the January 2025 swing high at $0.515 before stalling and moving sideways for the past 4 days.

Is XLM gearing up for another push toward the highs, or is a correction imminent?

Let’s dive into the details.

🧩 Market Structure & Fractal Pattern

XLM skyrocketed +132% in just 13 days, mirroring the explosive move seen back in November 2024.

If we apply the November fractal, the current price action suggests we could be setting up for an ABC corrective move.

📉 Key Levels & Confluences

FVG Zone: ~$0.49–$0.50 — likely to be swept before any major move down.

Monthly Support: $0.4142

Key Level / Liquidity Pool: $0.4056 — likely cluster of stop-losses.

Anchored VWAP (from $0.2228 start of trend): currently near $0.4056, adding strong confluence.

1.0 Trend-Based Fib Extension (ABC projection): If price pushes to ~$0.49 to complete wave B, the projected 1.0 TBFE for wave C lands right on the $0.4056 key level + VWAP, creating a perfect confluence zone.

➡️ Conclusion: The $0.4142–$0.4056 zone is a critical support and liquidity area with multiple confluences lining up.

Trade Setups

🔴 Short Setup:

Entry zone: $0.48–$0.50 (ladder in)

Stop-loss: Above $0.5166 (prior high)

Take-profit: $0.4142–$0.4056 zone

R:R ≈ 1:3

🟢 Long Setup:

Entry zone: $0.4142–$0.4056 (preferably near VWAP)

Stop-loss: Below $0.395

Take-profit: $0.44

⚡ Final Thoughts

Watch for a potential final push toward $0.49–$0.50 before a corrective wave unfolds.

The confluence at the $0.4142–$0.4056 zone — including monthly/weekly levels, VWAP, liquidity pool, and the 1.0 TBFE target — makes it a key area for decision-making.

Stay patient and wait for confirmation at these levels. Will post an update as things unfold!

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

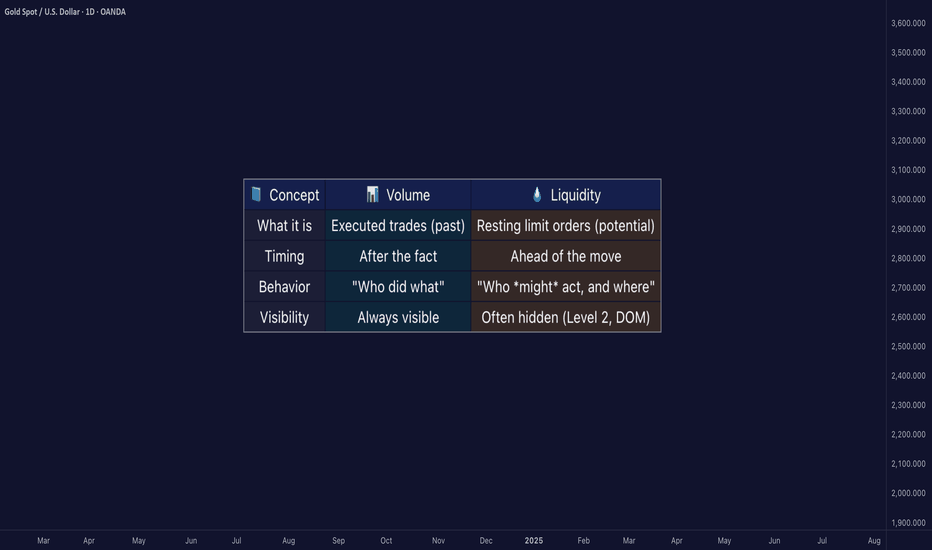

Liquidity ≠ Volume: The Truth Most Traders Never Learn█ Liquidity ≠ Volume: The Truth Most Traders Never Learn

Most traders obsess over volume bars, but volume is the footprint, not the path forward.

If you’ve ever seen price explode with no volume or fail despite strong volume, you’ve witnessed liquidity in action.

█ Here’s what you need to know

⚪ Volume Is Reactive — Liquidity Is Predictive

Volume tells you what happened.

Liquidity tells you what can happen.

█ Scenario 1: Price Jumps on Low Volume

❝ A price can jump on low volume if no liquidity exists above.❞

⚪ What’s happening?

The order book is thin above the current price (i.e., few or no sellers).

Even a small market buy order clears out available asks and pushes price up multiple levels.

Volume is low, but the impact is high because there’s no resistance.

⚪ Implication:

This is called a liquidity vacuum.

It can happen before news, during rebalancing, before session openings, on illiquid instruments, or during off-hours.

Traders often overestimate the strength of the move because they only see the candle, not the absence of offers behind it.

█ Scenario 2: Move Fails on High Volume

❝ A move can fail on high volume if it runs into a wall of offers or bids.❞

⚪ What’s happening?

There’s a strong surge of aggressive buying or selling (high volume).

But the order book has deep liquidity at that level — large resting limit orders.

The aggressive traders can’t chew through the liquidity wall, and price stalls or reverses.

⚪ Implication:

This is called liquidity absorption.

Market makers or institutions may intentionally absorb flow to stop a breakout.

Many retail traders mistake this for “fakeouts,” but it’s really liquidity defending a level.

⚪ What the Research Says

Cont, Stoikov, Talreja (2014): Price responds more to order book imbalance than trade volume.

Bouchaud et al. (2009): Liquidity gaps, not trade size, are what truly move markets.

Hasbrouck (1991): Trades only impact price if they consume liquidity.

Institutions don’t chase candles — they model depth, imbalance, and liquidity resilience.

⚪ Where the Alpha Lives

Liquidity tells you where the market is weak, strong, or vulnerable — before price moves.

Fakeouts happen in thin books.

Reversals occur at hidden walls of liquidity.

Breakouts sustain when liquidity follows the price, not pulls away.

If you understand this, you can:

Enter before volume shows up

Avoid chasing dead breakouts

Fade failed moves into empty space

█ Final Truth

Volume is the echo. Liquidity is the terrain. Alpha is in reading the terrain. You want to study the structure, because price moves toward weakness and away from strength. Learn to see where liquidity is, or where it’s missing, and you’ll see trading with new eyes.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

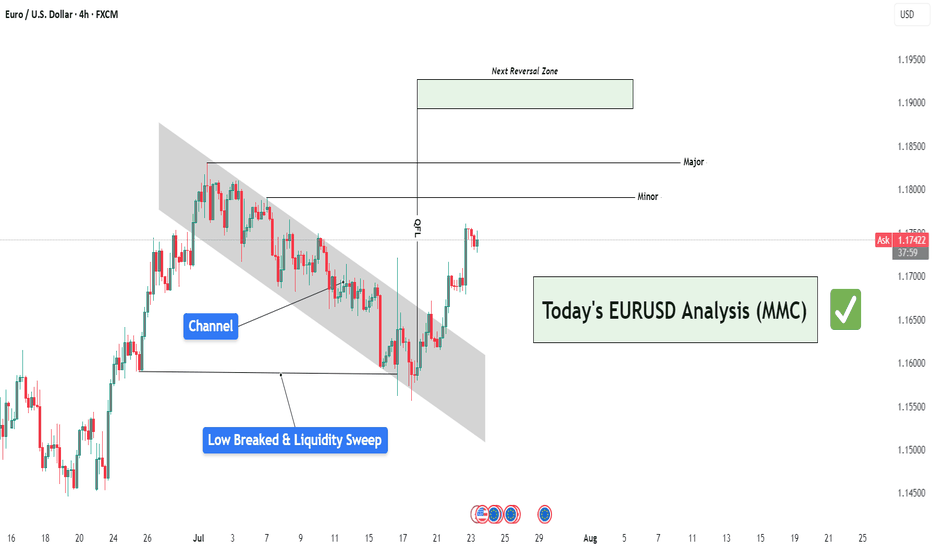

EURUSD Analysis : Liquidity Sweep – EURUSD Targets TO Reversal🧠 Institutional Context & Big Picture

EURUSD has been in a tightly controlled descending channel for several weeks—a classic sign of a market being engineered for liquidity collection. Rather than a naturally trending bearish market, this price action reflects stealth accumulation and market maker manipulation.

The channel structure was used to:

Establish a visible bearish trend (to trap sellers)

Trigger emotional bias for continued shorting

Build up stop orders below swing lows

This phase was about building energy, not continuation.

🔍 Detailed Breakdown of the Chart Elements

📌 1. Descending Channel – Controlled Manipulation

The pair moved within a well-defined bearish channel for multiple weeks.

Each touch respected the top and bottom perfectly—not random, but institutional structure.

It fostered retail confidence in the downtrend while market makers prepared for a reversal.

💥 2. Liquidity Sweep & Trap (Low Breaked & Liquidity Grabbed)

Price spiked below the previous low, clearly sweeping liquidity on July 21.

This is the "engineered breakdown", meant to trigger breakout sellers and stop out early longs.

Immediately after the sweep, the price violently reversed—clear evidence of a liquidity trap.

This is classic MMC logic: induce, trap, reverse.

🟩 3. QFL Base Formed – Bullish Engine Ignited

At the point of reversal, the chart shows the formation of a QFL (Qualified Liquidation Failure) zone.

This QFL base is the core of smart money accumulation—price broke below a base, then quickly reclaimed it.

It's not just support—it’s the true origin of the reversal and an optimal entry point.

📈 4. Breakout from the Channel – Structure Shift Confirmed

Price broke out of the descending channel with strong momentum, confirming:

Structure shift from lower lows → higher highs

Momentum shift in favor of bulls

Entry confirmation for MMC-based long setups

This breakout invalidates the bearish trend and signals a fresh leg up, likely toward unmitigated supply zones.

🟨 5. Current Price Action – Healthy Bullish Consolidation

After the breakout, price is consolidating just above the broken channel, forming a mini-flag or base.

This indicates:

Smart money is accumulating more

No significant selling pressure

Likely continuation toward next supply

🎯 6. Next Targets – Reversal Zones

Minor Resistance: ~1.1800

Major Resistance: ~1.1850 – 1.1880

Next Reversal Zone: 1.1900–1.1950

This zone is highlighted as a potential sell-off area where institutions may offload positions or create new traps.

Watch for signs of exhaustion or redistribution here.

📌 Trade Plan Based on MMC Structure

✅ Bullish Scenario (Currently Active)

Entry Area: Ideally at QFL base or breakout retest (~1.1700–1.1720 zone)

Confirmation: Bullish price action (engulfing, flag break, or liquidity wick)

Targets:

🎯 TP1: 1.1800

🎯 TP2: 1.1850

🎯 TP3: 1.1950 (Reversal Supply Zone)

❌ Invalidation:

A break below the QFL base (~1.1670) with bearish volume would invalidate the bullish MMC structure.

🧠 Smart Money Insight & Logic Recap

This entire move reflects a classic Market Maker Strategy:

Build a trend (descending channel) to shape trader bias

Trigger liquidity events (false breakdown)

Accumulate at the lows via QFL logic

Shift structure (channel breakout)

Target unfilled institutional supply (1.1850–1.1950)

This isn’t random—it’s engineered movement. Your job as a trader is to identify footprints, not follow the crowd.

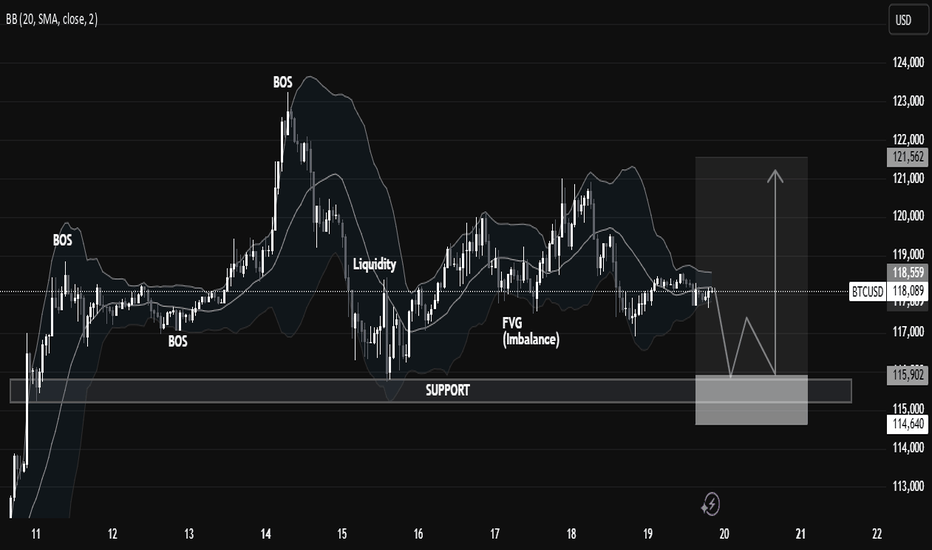

BTCUSD Technical Analysis | Smart Money Concept (SMC) BreakdownBTCUSD Technical Analysis | Smart Money Concept (SMC) Breakdown

🧠 Smart Money Market Structure Insight

📌 Key Elements Identified:

BOS (Break of Structure): Multiple BOS points indicate bullish intent early on. However, the latest BOS on July 14 followed by a significant drop signals a shift in momentum—possibly a distribution phase.

Liquidity Sweep: Price swept prior equal lows/liquidity before reversing, a typical Smart Money trap setup.

FVG (Fair Value Gap) / Imbalance: Identified around the mid-section of the chart—price filled partially but failed to hold, suggesting internal weakness.

Strong Support Zone (Demand Area): Marked between 115,000 - 114,640; this zone is anticipated to act as a springboard for bullish reversal.

📉 Current Price Action Observation:

BTCUSD is hovering around 118,152 - 118,560, moving sideways with lower highs indicating compression.

Price is projected to form a "W" pattern or double bottom in the shaded region.

Expected liquidity grab beneath 115,902 followed by potential bullish reaction targeting 121,562, as indicated by the white arrow.

🧩 Strategic Outlook & Potential Play:

🔻 Bearish Sweep First:

Market likely to sweep the support one more time, tapping into deeper liquidity pools between 115,000–114,640.

This is aligned with the concept of Smart Money hunting for retail stop-losses before reversing.

🔼 Bullish Recovery After Sweep:

Strong probability of bounce due to presence of:

Fair Value Gap (already tested),

Fresh demand zone,

Liquidity grab setup.

Projected Bullish Target: 121,562

Confirmation Needed: A strong bullish engulfing or BOS on lower timeframes near support.

🏷️ Conclusion:

This BTCUSD setup is a textbook Smart Money scenario: BOS ➝ Liquidity Grab ➝ FVG ➝ Reversal from Demand. Traders should wait for confirmation from the support region before entering long positions.

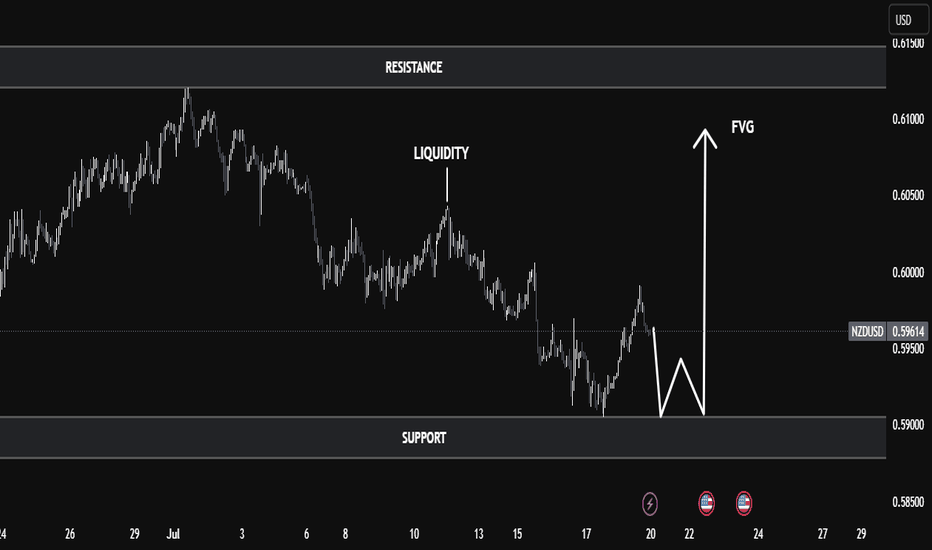

NZD/USD Technical Analysis | Smart Money Perspective🧠 NZD/USD Technical Analysis | Smart Money Perspective

On the current NZD/USD chart, price is trading around 0.5960, positioned between a clearly defined resistance zone (0.6130–0.6150) and a support zone (0.5890–0.5900).

We can observe the following key technical elements:

🔹 1. Liquidity Sweep

Price recently broke below the previous swing low near 0.5900, tapping into a pool of sell-side liquidity. This movement is commonly interpreted as a liquidity grab, where institutions manipulate price to trigger retail stop losses before reversing.

🔹 2. Double Bottom Formation

The chart indicates a potential double bottom forming at the support level — a classic accumulation signal. This pattern suggests buyers may be stepping in after liquidity has been taken out, anticipating a reversal.

🔹 3. Fair Value Gap (FVG)

An FVG (imbalance) is visible in the range of 0.5985 to 0.6015. This inefficiency was created by a sharp bearish move, leaving price action unbalanced. Price is now expected to retrace into this area to rebalance orders — a common smart money behavior.

🔹 4. Market Structure Outlook

If the double bottom confirms with a bullish break of structure above 0.5980, we could expect a continuation toward:

First Target: FVG zone around 0.6015

Second Target: Major resistance near 0.6150, where past distribution occurred.

✅ Conclusion

This setup combines key smart money concepts:

Liquidity grab below support

Accumulation phase at demand

FVG as target

Potential bullish market structure shift

Traders should monitor price action around the support zone for confirmation (e.g., bullish engulfing or break of short-term highs) before entering long positions. Targets remain at the FVG and resistance zones, but risk management is essential in case of a deeper sweep or macroeconomic catalyst.

Gold Just Flipped Is the Drop Coming?🚨 Gold Market Update – Are You Ready? 🚨

Yesterday, the gold market swept the liquidity from the previous days taking out stop orders and clearing out weak positions. After the sweep, price closed lower, showing clear signs of weakness. 📉

But that’s not all...

In the process, it also broke through a key bullish Fair Value Gap (FVG) an area where buyers had previously shown strength. That FVG is now inverted, meaning it could act as a strong resistance level going forward.

With this shift in structure, there's a real possibility that gold could drop further, potentially hunting the liquidity resting near previous lows. The market might be gearing up for a deeper move.

🔥 So the question is:

Are YOU ready for the next leg down?

📌 As always Do Your Own Research (DYOR)

This is not financial advice just reading the tape.

EUR/USD Bullish Continuation SetupMarket Structure Overview:

The market remains in a clear higher timeframe bullish trend, consistently forming higher highs and higher lows. Recently, price has entered a descending channel, resembling a bull flag formation — a classic continuation pattern that typically precedes a strong bullish breakout.

Key Observations:

✅ Descending Channel (Bull Flag): Price is respecting a downward-sloping channel while remaining above key demand zones.

💧 Liquidity Pools: Multiple liquidity highs have been left untouched above — suggesting fuel for a potential impulsive move upward.

🧹 Liquidity Sweep: On both H4 and H1, we see a clear sweep of previous equal lows, tapping into a significant demand zone.

📈 Reaction from Demand: Strong reaction from the demand zone suggests institutional buying interest.

🔵 Projection: A bullish breakout from the flag could target the liquidity above 1.1800, with immediate resistance near 1.1740–1.1760.

Bias:

🔼 Bullish — as long as price holds above the most recent demand zone (~1.1649), the bias remains bullish with expectations of a breakout and continuation toward previous highs.

Note: We must see how the market opens on Sunday night going into Monday. Based on the initial price action, we can determine the best trading opportunities and direction for the upcoming week.

XAUUSD Daily Sniper Plan – July 14, 2025Hey team 👋 and welcome to a fresh new week on the charts!

We’re starting this Monday without any major news — just pure price action, clean zones, and structure doing all the talking. No distractions. No excuses. Let’s lock in our focus and let the market show us where the edge is.

🔸 Bias: Bearish while below 3390

Last week’s rejection from the H1 premium zone (around 3375) created clear signs of exhaustion. Price is now forming lower highs and lower lows, with clean CHoCHs on both H1 and M15. Until we reclaim 3390, we remain bearish — waiting for the next lower high to form.

🔽 Sniper Sell Zones (above current price)

3360–3370 → H1 premium FVG + CHoCH OB + EMA5 cap

3380–3390 → Inducement zone + internal imbalance + RSI divergence

🔼 Sniper Buy Zones (below current price)

3310–3320 → Discount FVG + BOS base + HL support

3280–3290 → Final HL structure zone + fib 61.8% + OB + RSI oversold

🟡 Decision Zone:

3330–3340 → Neutral zone

→ Wait for break and retest or rejection confirmation.

→ No setup = no trade.

🧠 Battle Plan – Execution Scenarios:

🔴 Scenario A – Bearish Setup Active:

If price returns to 3360–3370 or 3380–3390 and shows M15/M30 rejection → enter short.

Target: 3330 → 3310.

If 3390 is broken and held → cancel short bias.

🟢 Scenario B – Bullish Setup Activated:

If price sweeps 3320 or 3290 and reacts with strong bullish PA (engulfing or CHoCH) → enter long.

Target: 3340 → 3360.

No confirmation = stay flat, do not anticipate.

🟡 Scenario C – No Reaction / Choppy Flow:

If price consolidates between 3330–3340 without clean rejection or break → wait.

Let price show its hand. Today is Monday — we need clarity, not emotion.

Every level in this plan was drawn with purpose — no shortcuts, no borrowed zones.

If you value structure, discipline, and originality in your trading, you’re in the right place.

Your support means everything — I see every 🚀 and every comment, and I appreciate this community deeply.

Let’s keep growing, with real work and real structure.

Follow GoldFxMinds — we stay sharp, we stay true. 💛

📎 Trade Nation Disclaimer

Chart and structure based on Trade Nation broker feed on TradingView. For educational purposes only — not financial advice.

NQ Analysis ICT Liquidity Search Break-Out TradePrice is expected to open not just 1, but inside 2 previous days.

We have 2 options:

1) ICT silver bullet up my bum trader strategy traders are waiting

for liquidity search breaking highs or lows then reversing.

2) Break-out trades waiting for price to break and close above or below

24hour range and trade in direction of break-out.

US100 - Reversal after liquidity sweep to target new highs?The chart presented shows a 1-hour analysis of the US100 (Nasdaq 100), illustrating a clean and structured price action narrative. Initially, we observe that the market swept liquidity at the lows, indicated by a sharp wick that pierced beneath the previous support levels. This type of liquidity sweep is common when smart money looks to grab stop-loss orders before reversing the trend.

Liquidity sweep to the downside

Following this liquidity sweep, price action aggressively moved upwards, breaking a lower high structure that had previously marked the bearish control of the market. This break of structure is a key bullish signal, suggesting a shift in momentum from bearish to bullish, and often signifies the beginning of a new upward leg.

1H FVG

An important element on this chart is the 1-hour Fair Value Gap (FVG), initially acting as a bearish imbalance. However, due to the strong bullish momentum, price not only reclaimed this level but did so decisively. As a result, this bearish FVG is now considered a bullish FVG, indicating that it may serve as a support zone on any short-term pullback.

Liquidity taken from the upside

After reclaiming the FVG and breaking structure, price surged further, taking out upside liquidity just above recent highs. This action typically leads to a short-term pullback, as profit-taking and new supply enter the market. The chart suggests that any retracement may find support at the 1H FVG, providing a potential entry point for bullish continuation.

Conclusion

In conclusion, the US100 demonstrated a textbook liquidity grab at the lows, followed by a break in bearish structure, a shift in momentum, and an inversion of a key FVG zone from bearish to bullish. The short-term upside liquidity has been cleared, and the next logical target is the high marked on the chart. Should the price respect the newly formed bullish FVG on any pullback, we can expect continuation toward that upper high, completing the bullish run.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

GBPCAD 4H long setupGBPCAD 4H Spring 💡 | Smart Money Accumulation Before Expansion

Watching a textbook Wyckoff spring unfold here on the 4H.

After a multi-day rally, price retraced, and liquidity built up just above 1.8713. What happened next?

🔻 We got a liquidity sweep, tagging below 1.8687 — then a sharp rejection wick back into the range. That’s the spring.

🧠 Why this matters:

Liquidity below the range is now likely cleared.

Smart money triggered stops and may now flip positioning.

Buyer momentum reclaiming the broken zone signals strength returning.

🎯 My Play:

Long entry after reclaim above 1.8713

Stop below 1.8687 wick low

Targeting 1.8828 > 1.8830 as TP1

Extended TP at 1.8928 — aligning with prior supply zone

⚠️ Invalidation if we lose 1.8685 with momentum and no absorption.

This is not a chase trade — it’s a calculated entry after weak hands were shaken out. Let the market prove strength, then ride the reversion.

📈 If this spring holds, I expect continuation toward prior highs.

US 30 Potential longUS30 – Wyckoff Spring Setup for NY Session | Intraday Execution Play

Price rallied in the London session with rising volume and structure breaks —

Now we’re anticipating a classic Wyckoff spring scenario just ahead of NY open.

📍 Key Expectations:

Sweep of intraday support around 43,482

Strong buyer reaction (spring confirmation)

Expansion into the 43,600+ zone — possible 1.5R+ continuation

⚠️ Volume buildup + stop placement below prior structure make this zone ripe for a fakeout → reversal.

I’m watching for a quick flush below the line → wick rejection → engulfing confirmation to trigger longs.

This is a trap trade — smart money baits shorts, I’m betting they get squeezed.

🔫 Entry: On confirmation after spring

📉 Invalidation: Below the spring low

🎯 Target: 43,610 zone and trailing after break of 43,570

Let them walk into the trap. Then pull the trigger.

CRV | bounce then another sweep to form a local lowLiquidity taken, now eyeing push to $0.70–0.72 local supply.

Watching for another low after that move:

• HL triple tap = bullish base

• Or final drive into $0.47–0.50 = max opportunity for R:R swing longs

Breakout only confirmed above $0.75.

Patience — best setups come after the next local low.