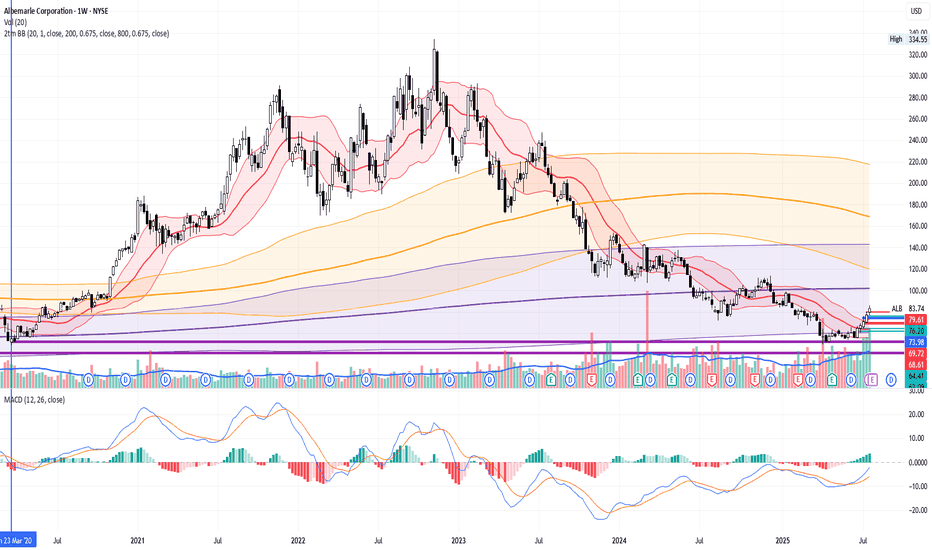

ALB Long, Resurrection of lithium trendALB have started to rise in recent weeks. It's price stays near 5-year lows.

Long-term Price Levels already have worked to bounce the stock by around 50%+.

Most likely funds have started to trade it in Mean Reversion strategies. So, the movement back to 200MA and 800MA on Weekly time-frame is quite possible.

As fast as banks would start to rise stock's rating - it will go sky high.

Recently UBS already cut it's rating to "Sell". Yet, trend already is mighty enough and just kept going higher.

Full margin on every black 1D candle!

Lithium

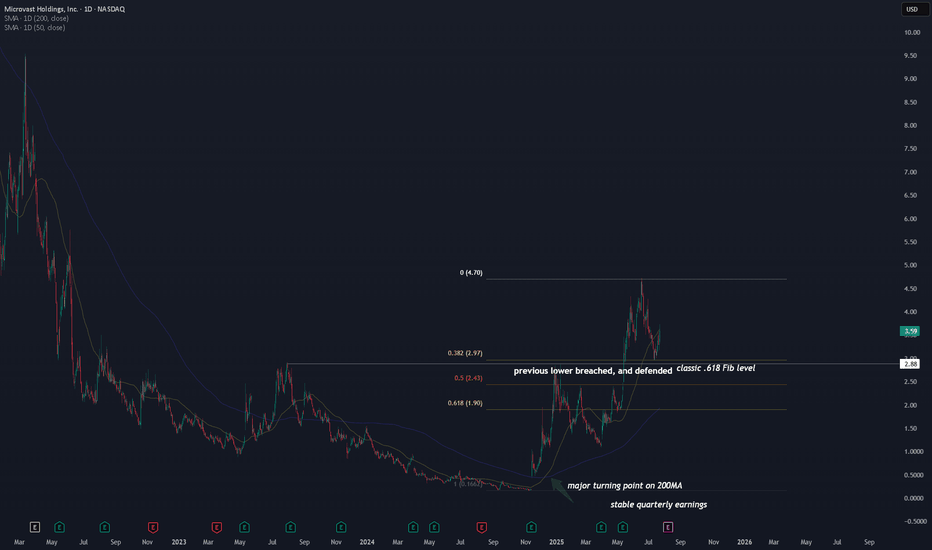

MVST, beginning of the new lithum hype? With ongoing US-China trade war, one of the key issues resides on lithium battery technology . Lithium technology is brought up as a national security concern . This is a tailwind for the industry .

Now let's get to the technicals.

A major turning point on the 200MA . We haven't seen this happening since Dec 2020, when the stock first went public.

$3.00 key level is tested three times . This is not just a .618 Fib level, but the previous cycle high in 2023.

First test happened during Dec 2024, which it failed. Second time we saw the stock blew through this key level on May 2025. Lastly we saw a solid defense on this level on July 2025. If this level were to hold, the upside can be very high .

In addition to the technical side, the company is generating $100M revenue with neutral/break-even earnings this year, up from $60-80M in 2023 and 204. A steady increase in revenue , while not losing much from earning perspective.

This places NASDAQ:MVST at a tipping point . All it needs is some tailwinds from the new geopolitical conflicts , and we will see either an increase in revenue (scale up) or an improvement in profitability. Or both. If that were to happen, MVST will skyrocket.

I am watching and monitoring this stock as right now, I am expecting to add MVST to my portfolio once I see further confirmation.

Potential outside week and bullish potential for CXOEntry conditions:

(i) higher share price for ASX:CXO above the level of the potential outside week noted on 27th June (i.e.: above the level of $0.1025).

Stop loss for the trade would be:

(i) below the low of the outside week on 20th June (i.e.: below $0.083), should the trade activate.

Grounded Lithium - undervalued, strong business modelGrounded Lithium and Denison Mines are exploring and developing direct lithium extraction (DLE) from brines in Western Canada. Exploration is being directly funded via Denison Mines, who has the option to provide funding in exchange for deposit ownership. Their current deposit has an after tax NPV with 8% discount rate of $1B. Grounded Lithium currently owns 70% of the deposit and will, ultimately, own 25% of the deposit ($250M NPV). Assuming Grounded Lithium is bought out by Denison Mines at a rate of 30% of the NPV, Grounded Lithium will be valued at $75M, a 30x increase from their valuation today. This does not include any added value from additional discoveries or other reasons.

This is a long play and I do not expect Denison to make an offer until their buy-in phases have completed in 2026-2027.

$LIT: EV's Lithium-Powered ETF – Charging Up or Running on EmptyAMEX:LIT : EV's Lithium-Powered ETF – Charging Up or Running on Empty?

EV demand is up 35% in 2023, and lithium prices are up 8% in 2025 so far. But AMEX:LIT is at $40.82, down from last year. Is it time to buy, hold, or sell? Let's dive in.

(1/9)

Good morning, everyone! ☀️EV demand is up 35% in 2023, and lithium prices are up 8% in 2025 so far. But AMEX:LIT is at $40.82, down from last year. Is it time to buy, hold, or sell? Let's dive in. 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 40.82 💰

• Sector Trend: EV sales globally strong (35% growth in 2023, IEA) 🌟

It’s volatile, with EV growth as a tailwind! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approximately $ 1.37B (based on $ 40.82 price and 33.5M shares, per Apr 30, 2024, data) 🏆

• Holdings: 40 stocks, top include Albemarle, Tesla (per Global X ETFs) ⏰

• Trend: Lithium demand tied to EV penetration, per IEA data 🎯

Firm, riding the battery wave! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• EV Demand: Continued rise in 2025, per general expectation and IEA trends 🔄

• Lithium Prices: Mixed, with spot prices varying; ETF at $ 40.82 reflects market conditions 🌍

• Market Reaction: Reflects current market dynamics, no specific Mar 3 data 📋

Adapting, EV surge drives interest! 💡

(5/9) – RISKS IN FOCUS ⚡

• Oversupply: Fears may cap lithium gains, per industry reports 🔍

• Competition: New battery tech could shift demand, per industry reports 📉

• Volatility: Lithium prices historically swing, per Reuters 2023 data ❄️

Tough, but risks loom! 🛑

(6/9) – SWOT: STRENGTHS 💪

• EV Growth: Demand for lithium batteries rising, per IEA 2023 data (35% global sales increase) 🥇

• Diversification: 40 holdings across mining, battery tech, per Global X ETF 📊

• Sector Leader: Exposure to Albemarle, Tesla, per Global X ETF 🔧

Got fuel in the tank! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Price volatility, current price down from last known, oversupply fears 📉

• Opportunities: EV sales growth, potential lithium price recovery based on demand, per IEA trends 📈

Can it capitalize on demand? 🤔

(8/9) – 📢 AMEX:LIT ’s at $ 40.82, EV demand climbing, your take? 🗳️

• Bullish: Price to rise with EV surge 🐂

• Neutral: Steady, risks balance ⚖️

• Bearish: Oversupply or other factors cap gains 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

AMEX:LIT ’s EV demand drives potential 📈, but current price at $ 40.82 reflects market caution. Volatility bites, yet dips are our DCA gold 💰. We grab ‘em low, climb like pros! Gem or bust?

US-Ukraine minerals deal: key commodities at stake Ukraine is set to sign an “improved” minerals deal with the US after the US dropped its claim to $500 billion in potential revenue, according to the FT. The news has boosted the euro and market sentiment, but what about the commodities involved?

Ukraine holds about 5% of the world's critical raw materials, essential for EVs, clean energy, and defense. Its untapped reserves, valued at over £12 trillion, include lithium, titanium, and graphite. The US is eager to secure these resources to reduce reliance on China, which dominates 75% of rare earth production.

Ukraine has commercially viable deposits of 117 key minerals. It holds 500,000 tonnes of lithium, vital for rechargeable batteries, and one of Europe's largest titanium reserves, used in aerospace and military industries. Ukraine also holds 20% of global graphite resources, crucial for EV batteries and nuclear reactors.

However, 20% of Ukraine’s land, including regions with £6 trillion in mineral wealth, is currently under Russian occupation. Bordering areas containing £2.8 trillion in resources, faces an advancing Russian military.

Snow lake resources = life changing moneySnow lake has been developing an admirable portfolio of drill sites to their repertoire. With multiple drill sites containing a slew of significant resources, and the snow lake site appraised with an estimated NPV of 1.7 billion. This company seems like a no brainer. Their drill site results should be published soon this month or in Feburary, and they have done three cash offerings to raise cash on hand and capital. The company is well positioned to drill on their sites. I have estimated that they will be making 150 million a year in revenue just off of the lithium in their snow lake site. They have found Uranium and Gallium at their drill sites as well. Gallium is crucial for semiconductor fabrcation and is considered one of the most valuable resources on this day. Most of Gallium and semicoductor production is found in Taiwan and this discovery raises an eye when it comes to valuation on this company. With Ai needing more power for the data centers Uranium/nuclear power has become a major point when it comes to pwoering these data centers. With a market cap of 100million currently this company is considered seriously undervalued with just the estimated profit from lithium drilling at snow lake. I think you will see this company reach a valuation of around 1billion-5billion and you might see these shares rise up from around 1.00 to 20-40 dollars a share in a few years time.

Thanks,

Ben

LITM a lithium penny stock gets momentum LONGLITM is a lithium mining company with operations is Western USA and Canada now getting a

lift as lithium prices are rising. It popped 16% today and hit a screener on volume yesterday.

This is a junior miner compared with LAC and SGML. As such it is more reactive to price. All

indicators confirm the move including the extent of the trend, relative volume spiking and the

RS lines. This is a low float low volume stock.

Accumulation of a low float could precipitate more price action upward quite easily.

As a volatile penny stock LITM is risky. Right now, I see a long trade in a

small position ( < 0.001 of account balance) for the potential gain despite the obvious risk

SL at 10% Targets at 10% 20% (red line pivots to the left-1.2o December to Feb) then 70% (

pivot low March 23) and finally 250% for the runners ( January and July 23 high pivots). Time

will tell. I expect great profit in this swing trade with stratified partial profits and less time

effort in the trend using alerts and notifications. A trailing loss will be employed at 10%

once the trade is over 20% profit.

Volt Lithium ready for healthy uptrendVolt Lithium recently announced the successful deployment of their new DLE field unit in the Delaware Basin in partnership with a significant oil and gas producer. These units can be tailored and scaled for production at individual oil and gas well sites, making Volt's production flexible, geographically decentralized, and cost effective (Volt has one of, it not, the lowest lithium production costs as well as the lowest recoverable PPM that I have seen). Volt is a leader in current DLE production and has the benefit of maintaining a very low all-in sustaining cost- and ability to start small and scale upward. Volt's management team comes from the oil and gas industry and understand the business, giving them an edge on their competitors.

Looking at the charts - the price trend is holding strong and is touching both against the upper boundary of a wedge as well as bumping against a significant price level. I have hidden the much older price action that happened prior to the restructuring of the company into a pure lithium-focused company. I am expecting an eventual price breakout to the upside where the market cap reaches ~$250M USD or greater in the coming months and year. In the short term the price may either experience a modest pullback into this year's trading range or generally hold at this level prior to a breakout upward. Breakout above the wedge and holding steady above ~$0.5 CAD for a few days or weeks will be a clear indicator to me that we will see upward price movement over the coming months.

NILI.V Possible Trend Reversal & Entry - First AnalysisNILI.V (Surge Battery Metals)

Candlesticks:

This past week NILI.V closed Thursday with a dragonfly doji candle, followed by a bullish engulfing on friday. The last time a dragonfly doji appeared was on September 9th, which marked a trend reversal that resulted in a 90% in price over 45 days.

Technical Indicators:

MACD on the daily is about to crossover indicating a possible shift in momentum from bearish to bullish.

Possible Entry:

looking for a confirmation on the trend reversal on Monday with a candle closing above the downward channel that Nili has been trading in over the past couple weeks. If that happens I will take a long position and be looking for profit taking opportunities at .40, .45, and .50 cent price ranges.

I am new to trading and this is my first analysis. Let me know what you think and if I got anything wrong here, any feedback is appreciated!

Why BATT Could Be A Great ETF To Buy & HoldHere I have AMEX:BATT Amplify Lithium & Battery Technology ETF on a Multi-Timeframe Analysis with a Monthly & Weekly Chart!

Technicals:

Starting with the Monthly Chart, taking the Fibonacci Retracement Tool from the All Time Low @ $5.91 to the All Time High @ $20.78, we see that the Selling Pressure is waning with the Price Exhaustion happening in the Fibonacci 78.6% - 88.6% "Kill Zone" Range from ( $9.09 - $7.61 )

-Bears are losing grip on the asset

Zooming down to the Weekly where Price has visited the Kill Zone, we can see a ICT Concept Method called the Bullish Order Block taking place!

After Price found Support, Price created a New Swing Low Breaking Sellside Liquidity, then shortly after, Breaking Structure again while surpassing the Swing High!

-The Week Starting Monday, 29th of July 2024 creates the Bullish Order Block we should suspect Price to revisit before continuing its Uptrend behavior.

-This High of the Weekly candle sits right at the Upper Limits of the Support Zone and at the 50% Fibonacci Retracement Level!

**Price also could potentially make a deeper Retracement to the 61.8% Level to visit the LH it created before Breaking up through the Support Zone!

-Will be looking for Buy Entries in the ( $8.96 - $8.67 ) Range!

Fundamentals:

Lithium Stocks hit alot of hype in 2023 with the expectations of the EV Industry being our Near-Future way of transportation as a move toward a greener way of living!

EV sales wax and wane but as time as gone on, the look for the essential metal and mineral components needed for this industry to boom has began to fill as we are finding more and more vast and rich deposits of Lithium and other Rare Earth Minerals!

-https://www.tradingview.com/news/zacks:e90ae995b094b:0-bullish-views-power-long-term-lithium-etf-prospects/

With that, EV Demand will come

-https://www.tradingview.com/news/benzinga:5ead3a15a094b:0-arkansas-may-be-sitting-on-19m-tons-of-lithium-amid-rising-demand-for-ev-batteries-how-to-invest-in-what-elon-musk-calls-the-new-oil/

** Once Price goes Bullish, I have upcoming Areas of Value that it may contend with on the way up!

LAC & GM Team Up for Thacker Pass! Here I have NYSE:LAC on the Daily Chart!

NYSE:GM plans to contribute $625 Million and seeks to claim 38% of the Joint Venture!

This remarkable announcement this week seen the Price of NYSE:LAC hit 4-Month Highs after Breaking Above the Falling Resistance that was keeping it down.

The rally seems to be tamed by the Resistance Level and Low that was created in February but is now testing the Break of Falling Resistance for potential Support to keep pushing Price Higher!

If Price can Push through this area, we could see Price make a move for the Gap @ ( 4.9 - 6.37 ) then find Strong Resistane @ ( 6.83 - 7.65 )

Indicators:

- Price will need to test the 200 EMA in $4 range

- RSI is Above 50 (Bullish)

- Strong Bullish Volume with Breaking Candle suggests Valid Break

- BBTrend Printing Green Bars

ALB heating back upAfter breaking down from a falling wedge, ALB undercut a long term support line and things looked precarious. Recent weeks have thrown a lifeline to the beleaguered shares with news of China's CATL cutting lithium production and now Rio Tinto's Arcadium takeover bid .

The Rio Tinto bid could have gone another way, since the bid in ALB's stock late last week centered around speculation they could be the acquisition target. It wouldn't have been surprising to see shares slump this morning, but the rally is in tact.

Featured here is the 4 hour chart, where we can see the price has broken through the 200 period moving average. Next up is a golden cross on the short term chart, and we're also looking for the daily chart to register an overbought reading to further validate the rally. Often times overbought signals a near term pullback, and that would be unsurprising. These cupping patterns can have violent breakthroughs or breakdowns as the price tries to penetrate to the upside.

Be patient. It may take a few weeks for momentum to build, but taking a step back to the montly chart we can gauge the potential of the rally that could well be underway. The $120's gets us back to the range before things broke down recently, that area looks very likely, and for the more patient $140 would take us back to the highs of 2017.

ALB - Dip formation might be in play Lithium prices fell more than 85% from their 2022 peak back to 2021 levels. There are still concerns about supply / demand issues. Slowing signals from EV sales might have worsened the outlook. But In 2025, the global demand for lithium is expected to surpass 1.4 million metric tons of lithium carbonate equivalent, a growth of 53 percent in comparison to 2023. And by 2030 3.1 million metric tons. (Statista)

Recently low prices pressured margins and Chinese CATL announced production cut equivalent to 8% of Chinese production. This might be a signal that we are close to low of business cycle.

Albemarle's name also recently came up in news with Rio Tinto's plans of acquiring a major lithium producer.

Can Rio Tinto Save the Day? The Looming Mining Supply CrisisAs the world races towards a greener future, a critical challenge looms on the horizon: a looming supply shortage for essential energy-transition metals, particularly copper. This shortage, if left unchecked, could jeopardize our ambitious plans for a sustainable future.

Rio Tinto, a global mining behemoth, has sounded the alarm, urging the industry to expand mining operations to meet the escalating demand. The company's chairman, Dominic Barton, has dismissed the notion that mergers and acquisitions alone can solve this crisis. He insists that organic growth, involving the discovery and development of new mines, is the only viable path forward.

The urgency of this situation cannot be overstated. The demand for copper, a vital component in electric vehicles and renewable energy infrastructure, is set to skyrocket in the coming decades. Failure to secure adequate supplies of this critical metal could hinder our progress towards a sustainable and electrified world.

Rio Tinto's leadership in the mining industry is undeniable. Their proactive stance on addressing the supply crisis is commendable, and their commitment to organic growth and exploration for critical minerals demonstrates their dedication to the cause. However, even with the efforts of industry giants like Rio Tinto, the road ahead is fraught with challenges.

The Chinese economy, a major player in the global mining landscape, is currently facing its own difficulties. While Barton remains optimistic about China's ability to overcome these challenges, their current economic state could further exacerbate the supply crisis.

As the world grapples with the pressing issue of climate change, the mining industry must rise to the occasion. The time for complacency is over. It is imperative that we invest in exploration, expand mining operations, and secure the critical resources needed to power a sustainable future. The stakes are high, and the world is watching. Can Rio Tinto and the mining industry save the day?

Investing in Albemarle (ALB): A Strategic OpportunityAlbemarle (ALB) stock has been decimated recently, but this presents a prime opportunity for savvy investors.

If you, like me, believe in the future of lithium and electric vehicles, ALB is a stock you cannot afford to overlook.

As a leading lithium producer, Albemarle is integral to the EV revolution. The stock is a key component in many ETFs focused on batteries and lithium, alongside giants like Tesla, BYD, Panasonic, and Samsung.

With the growing demand for EVs, Albemarle's pivotal role in the supply chain ensures it is well-positioned for substantial long-term growth. Invest in ALB now to capitalize on the future of sustainable transportation.

Trading at 65% below estimate of its fair value

Earnings are forecast to grow 55% per year

LTC: big reward📊 Analysis by AhmadArz:

1. Support and Resistance Levels:**

- Support:** Around $82.80.

- Resistance:** Approximately $88.00 and $96.82.

- 📉🛑

2. Trend Channels:**

- Currently, the price is moving within a horizontal range and appears to be awaiting a breakout.

- 📈📊

3. Trading Strategy:**

- Buy Zone:** Enter buy positions if the price breaks and surpasses the $84.15 level.

- Target Price (TP):**

- TP-1:** $96.82

- 💹💰

-Stop loss: 82.80

⛔

4. Overall Trend:**

- The current trend is in consolidation. If the price can break the $88.00 resistance level, it is likely to move towards the higher target price.

- 🚀📈

In summary, consider entering buy trades if the price breaks the $88.00 resistance level and aim for the target price of $96.82.

🔗 "Uncover new opportunities in the world of cryptocurrencies with AhmadArz.

💡 Join us on TradingView and expand your investment knowledge with our five years of experience in financial markets."