Live Cattle Update. Small bounce could become big bounce.We got a small bounce at an important level, and now we are waiting for the trendline to break which would tell us it could become a big bounce.

At the moment we have price hesitation which turned into a pro gap. That's a good bullish sign. But, this downtrend has been very strong, and I'm not willing to be a minute trader for LC. This causes me to wait for the larger time frame candles to show verified momentum. I'm looking for a big green leg candle on the daily before I get involved.

Maybe I will change my mind, but I feel pretty secure with that strategy.

Livecattle

LEJ2021. Live Cattle Daily. In the golden pocket.Any dedicated live cattle traders, I would love to hear your take! If you are there is no need to read what I have below. You would probably find it very stupid.

------

I do not understand the fundamentals surrounding this market as far as when the high prices are. Doing a quick google search I see from the first image brought up that typically live cattle is falling right about now and getting ready to rebound. We have been rising steadily for a while, so I think it's safe to say the market is not behaving to expectation. That makes me a little uncertain, but I am falling back on TA entirely for any decisions here.

I hate to buy anything before I see the momentum in my favor, but if I ever were to buy a zone, this wouldn't be a bad one. I have picked this apart thoroughly, and as non-biased as possible, and I think I did a really good job so I hope you enjoy.

-------

One thing I notice is that whenever I say "this wouldn't be the worst" or "this wouldn't be a bad one" historically it has been a bad one. If this goes against me I will have to make some conscious decisions to change just a little in that department.

---------

Live Cattle is bullLive cattle is bull.

Early May it jumped from 87 to 94, and next day hitting 98.

This breakout caused in the days to follow some oscillating within the 92-100 band, forming a clear up channel.

Market hit 100 yesterday, found support on the mid channel level and closed just below 100. I’m pretty sure we will test it again today.

My believe is this breakout, plus the upward channel, will result in new local high’s.

We have clearly broken out of the downward trend of the last months.

Once we break the 100 level, others will step in and this could lead to a decent bull trend.

LEV2020-LEZ2020: Spread on Live CattleLEV2020-LEZ2020

Commodity Spread Trading is an advanced way to profit statistically from the differences that occur in the commodity futures market based on Contango or Backwardation situations.

These statistics are offered by online software and allow for amazing performance.

So far we have achieved the highest gains in relation to drawdowns with this way of trading,

Here we enter Short on the Live Cattle Spread buying the October Futures and selling the December Futures.

Happy Trading to All!

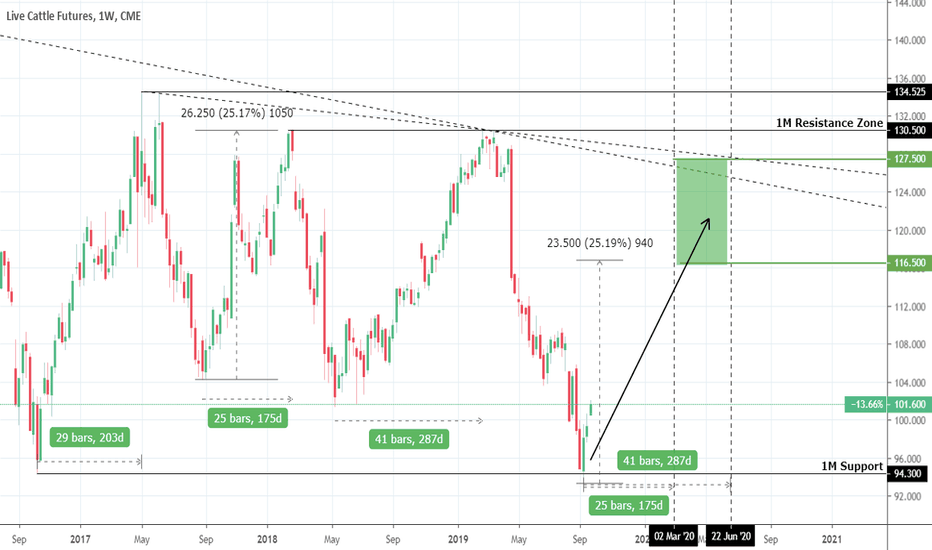

Live Cattle: Strong long term Buy Opportunity.Live Cattle has hit this month the 94.300 1M Support, with the last time we saw these levels being in October 2016. The price appears to be trading within a long term Rectangle within 94.300 and the 130.500 - 134.525 Resistance Zone. The current 3 week rebound on the 1M Support makes LE an automatic long term buy opportunity. We are therefore long at the moment and having calculated all possible scenarios within this Rectangle, we concluded that profit should be taken within 116.500 - 127.500. Take advantage of this opportunity based on your won risk tolerance levels.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Live Cattle (LE) ShortSo, my last analysis on live cattle was April 25th where i talked about the possibility of live cattle breaking support and going further down and it went much further than i thought. In my opinion, I believe live cattle will continue on its trend downwards and will find support at the next support level identified on the chart. Enter and exit at your own risk.

DISCLAIMER

Please note that this chart is an opinion based chart only. Please trade at your own risk

Live Cattle: Cyclical sell opportunity.Live Cattle has been trading within a long term 1M Rectangle (RSI = 45.889, CCI = -24.7510, Highs/Lows = 0.0000) roughly since late 2016. This March the price was rejected exactly on the 1W Resistance (130.500 - 134.525) and in April another Lower High attempt failed. This resulted in a strong downfall which is expected to test again the 1W Support Zone (101.625 - 104.150) before another rebound. We are on a long term sell with TP = 104.250.

See the call of this trade before the strong rejection took place:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Live Cattle: Long term Sell opportunity.The price was recently rejected on the long term Sell Zone of 127.825 - 134.425. For almost 2 years this belt has been used as a sell point by the market. This is a good long term opportunity to go short and target a price above the 101.625 - 104.250 Buy Zone.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Pull back required on the 1W Channel Up.Live Cattle (LE1!) is trading within a long term 1W Channel Up (RSI = 60.152, ADX = 29.000, Highs/Lows = 7.0679, B/BP = 14.6880) that has recently made a Higher High with an obvious Resistance zone at 114.00 - 114.325. Being on overbought STOCHRSI, Williams and CCI, a pull back to a Higher Low (~110.000) is required to sustain a healthy uptrend, which should most likely result in a new Higher High near 116.000 (TP).