LLOY being a good buy at IH&S highs?Lloyds Bank - 30d expiry- We look to Buy at 43.71 (stop at 41.98)

Broken out of the Head and Shoulders formation to the upside.

Previous resistance at 43.70 now becomes support.

We look for a temporary move lower.

Support is located at 43.70 and should stem dips to this area.

Daily signals are mildly bullish.

Expect trading to remain mixed and volatile.

A break of support at 45.30 should lead to a more aggressive move lower towards 43.70.

Our profit targets will be 47.88 and 48.88

Resistance: 47.35 / 48.00 / 49.85

Support: 45.30 / 43.70 / 43.00

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

LLOY

LLoyds Bank in inverted and shoulders.Lloyds Bank - 30d expiry - We look to Buy a break of 43.71 (stop at 41.98)

Trading has been mixed and volatile.

A bullish reverse Head and Shoulders has formed.

43.62 has been pivotal.

A break of the recent high at 43.62 should result in a further move higher.

The bias is to break to the upside.

Our outlook is bullish.

Our profit targets will be 47.88 and 49.88

Resistance: 43.60 / 45.00 / 46.50

Support: 42.00 / 40.50 / 38.50

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

LLOYDS - new sell signal, lets see!Last buy trade hit our TP3 for 1:3, new sell signal has formed.

For more information on our strategy please view our 'Scripts' page on our Trading view profile.

Our V2 strategy shows the SL and multiple TPs on the chart too - these are customisable based on the ATR of each pair.

We have set these so that TP1 is 1:1 TP2 is 1:2 TP3 is 1:3 RR.

There are infinite ways to manage your trades to suit your mindset and time.

Works on all instruments

Directly onto your own personal trading view - all devices work

Non repainting

Please follow us to keep up to speed with our trading ideas, live streams (coming soon) and weekly recaps using our strategy.

We are continually marking some tweaks and marginal gain improvements to continue to make this easier for our trades and even more profitable. All updates are given to our members and previous purchasers FOC .

Regards

Darren

Blue FX

#LLOY ANALYSIS.. After the big drop, we see a recovery in the price of the stock.. At the point we have reached, there are indications that the positive outlook in the stock will continue..

First of all, when we look at the daily chart, we see that the downtrend has broken upwards and the price is below ma20.. Also, the RSI is now above (42) reference values, which seems very positive.. Besides these, SAR indicates a positive trend and Gator is about to generate a buy signal.. In the framework of all these positive indicators, I think there will be an upward price movement in #LLOY, as I mentioned in the chart.. We will wait and see..

Disclaimer: When it comes to stock trading, please take necessary care. Invest in your own responsibility. What I write is technical analysis. It is not investment advice..

I wish you all the best..

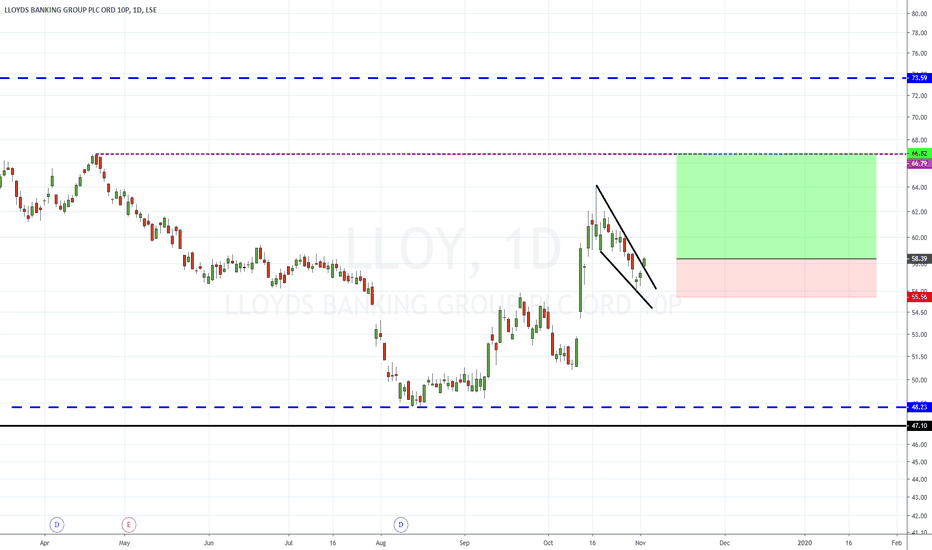

Lloyds - Banking on a move higher.Buy Lloyds Banking Group (LLOY.L)

Lloyds Banking Group plc is a provider of financial services to individual and business customers in the United Kingdom. The Company's main business activities are retail and commercial banking, general insurance, and long-term savings, protection and investment.

Market Cap: £40Billion

Lloyds gapped higher this morning and looks set to close outside of the wedge pattern that has formed on the daily chart. A continuation higher looks possible. The next major resistance to target is 66.8p.

Stop: 55.5p

Target 1: 66.8p

Target 2: 73.50p

Target 3: 80p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me