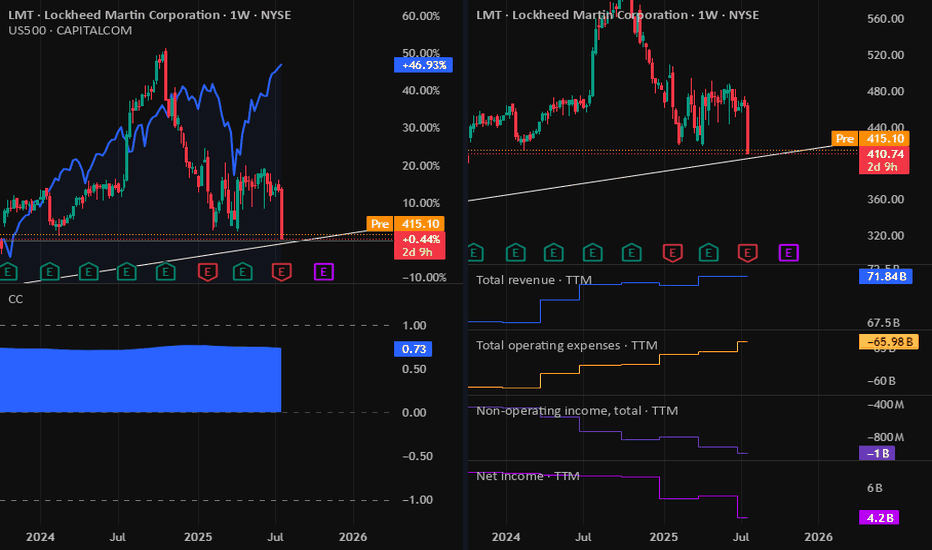

LMT: Lookheed Martin Dropped on Earnings 23-07-2025The dividends now is around 3% which is good for a strong company like Lookheed Martin. But as we are seeing a drop in company profits & Equity, and the stock price is near to a support level, we have to monitor the stock for the next few days or weeks. If all is ok, I will consider buying it.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

LMT

LMT Lockheed Martin Corporation Options Ahead of EarningsIf you haven`t bought LMT before the recent rally:

Now analyzing the options chain and the chart patterns of LMT Lockheed Martin Corporation prior to the earnings report this week,

I would consider purchasing the 490usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $18.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Lockheed Martin... Time to move?With tensions rising in the Middle East and the gaining of military activity here in the United States, it could be assumed that the government spending to grow the defense will mostly be seen by large defense firms. Specifically, we will be looking at NYSE:LMT but that doesn't rule out any other defense contractors from this trade ( NYSE:NOC , NASDAQ:HON , NYSE:RTX , NYSE:BA , NYSE:GD ). Firstly, let's examine the charts before reviewing anything fundamental from the company.

This is the 4h chart looking back into late-mid January

Simply put, this is just two of many possible paths that the NYSE:LMT price action could take. However, these two should be the most expected especially considering its violent downtrend that appears to be "cooling" and not "consolidating". It also appears that NYSE:LMT price action likes to reclaim any Fair Value Gap that it creates quite quickly as of recent trading terms. The good news is that two large FVG's have been created by a rather lackluster earnings report.

Now, as for a fundamental analysis POV, we can firstly examine the defense industry's cyclical movement throughout the years. This means that the industry is facing booms and busts. So lets see what the 1 week chart has to say about that...

With the chart shown above, you're probably thinking that a quick rebound seems unlikely as the other "BUST" sequences seem to last longer than the "BOOM" sequences. To this I would agree, however being first (or being early) is something I can settle for as there is no possible way to buy the exact bottom penny. When prompted with this dilemma of timing, think back to the Margin Call famous quote...

"There are only three ways to make a living in this business: be first ; be smarter; or cheat... it sure is a hell of a lot easier to just be first."

Defence Stocks Rise After Trump's DecisionDefence Stocks Rise After Trump's Decision

As shown in the charts, despite predominantly bearish sentiment in the stock market yesterday — with the difference between the opening and closing price for the S&P 500 index (US SPX 500 mini on FXOpen) being down by 4% — defence company stocks showed growth.

According to the WSJ, Palantir Technologies shares rose by 8% to $84.05 on Tuesday, while General Dynamics and Boeing increased by 5% to $260.12 and $145.365 respectively. Northrop Grumman and Lockheed Martin gained about 4% each.

Why Did Lockheed Martin (LMT) Shares Rise?

This occurred after President Trump announced that the defence budget for the 2026 fiscal year would be around $1 trillion, and Defence Secretary Pete Hegset published his announcement about the budget on X (formerly Twitter).

The increase in the defence budget by approximately $50-100 billion contrasts with previous statements from US leadership in February, when:

→ Trump said that "we have no reason to spend almost a trillion dollars on the military";

→ Hegset suggested annually cutting the defence budget by 8% — or around $50 billion — over the next five years.

Such statements had been putting pressure on the price of LMT stock in 2025.

Technical Analysis of the Lockheed Martin (LMT) Chart Today

As a reminder, on 3 October we suggested that breaking the psychological $600 level would trigger profit-taking, which would, in turn, drive a correction following the impressive rally. In the same analysis, we outlined a long-term channel (shown in grey). Since then, the price has dropped by more than 25%. Today, the LMT share price is near the lower boundary of this channel.

It is worth noting that the recent lows around the $425 level resemble a bullish Triple Bottom pattern.

Given this, it is reasonable to assume that bulls may attempt to recover at least part of the decline that started in October 2024. It’s also possible that concerns over rising geopolitical tensions amid the global trade war could support this move.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Lockheed Martin 1W Possible Scenario 1WTechnical Analysis 1W

The chart shows a second breakout of the weekly trendline, which could increase downside pressure on the price.

Key Levels:

- Support: $393.08 (0.236 Fibonacci), $324.65 (0 Fibonacci)

- Resistance: $439.70 (0.382 Fibonacci), $471.48 (0.5 Fibonacci), $500.00 (0.618 Fibonacci)

Indicators signal weakness, suggesting a potential continuation of the downtrend.

Fundamental Analysis

Lockheed Martin is one of the world's largest defense contractors, specializing in aerospace, defense, and security. The company is known for producing the F-35 fighter jet, missile defense systems, and space exploration technologies.

Key Factors Affecting the Stock:

Financial Performance:

- Strong revenue growth supported by high government defense spending

- Solid backlog of contracts, ensuring future revenue stability

- However, potential budget constraints or shifting defense priorities could impact future earnings

Macroeconomic & Geopolitical Factors:

- Rising global tensions (Ukraine, Middle East, Indo-Pacific) drive higher defense budgets worldwide

- US interest rates and inflation may affect long-term government contracts

- Potential NATO expansion and Indo-Pacific security agreements could bring new contract opportunities

Competition & Industry Risks:

- Competes with Boeing, Northrop Grumman, Raytheon, and General Dynamics

- Cost overruns and supply chain disruptions could pressure profit margins

- The US government's shift to AI-driven warfare and cyber defense might change future contract allocations

Conclusion:

A breakdown below $393.08 could open the way toward $324.65, signaling a deeper correction. To regain an uptrend, the price must reclaim the $439.70 resistance level.

Lockheed Martin... We are moving! Pt.2Just like I drew it up, NYSE:LMT is approaching its Fair Value Gap faster and faster. With the defense spending kept in the public eye, investors seem bullish on Lockheed as reflected from its rise in share price. This rise in price also is reflected from Lockheed's competitors in the industry such as NYSE:NOC , NASDAQ:HON , NYSE:RTX , and other defense contractors such as NYSE:BA , NYSE:HII , and of course $NYSE:GD.

Before we attack the charts, let's review the general sentiment in the arms and defense (or offense) industry. Firstly, we are faced with constant uncertainty in the middle east and eastern Europe. With the conflict between Israel and Palestine, there is no doubt that any flare ups and scares will include U.S. involvement prompting higher revenues for defense industry leaders. As for the eastern European conflict between Russia and Ukraine, what appears to be a ceasefire closing in, there is no doubt that tensions and conflicts will continue through the region which we can expect the defense sector to be involved in. In a simpler sense, as conflict rises, investor interest in the defense sector can be expected to surge.

In the case of peace, we can expect the general indices to rise, but should expect some shedding from the defense industry as their services will be in lower demand . The good news in that scenario is a diversion of a larger scale war (which I'm sure your willing to take a 6% dive on your positions). So, if you are to believe that a peace and/or ceasefire will come of the negotiations, remaining long on this position is just not for you.

As for the current trade itself, I'll first review my main long entry and plans. My first post for this trade was on Feb. 11, 2025. Since then, it has returned an impressive 5.52% (even considering its very low 1y Beta). Even more impressive is the performance of the SP:SPX , TVC:NDQ , TVC:DJI , which have been -4.90%, -6.82%, -3.99% respectively. So in this instance, outperforming the main indices was a literal walk in the park as yours truly spelled the lottery ticket out for you.

And now for the charts....

Here is the NYSE:LMT 1D chart looking back into 2019. We can note the strong trendline, a price action rising towards the 200 EMA, and of course out beloved Fair Value Gap which has yet to see any price action although we are approaching it. As for the good news, the price action approaching two major technical factors which are in the same place at the same time (these being the 200 EMA and our beloved FVG). Ideally, we will hit these two technical targets prior to the next quarterly financial report on April 22.

Hopefully this update helped clear up any uncertainty. This position has been quite participating for anyone who took my trade and I'm glad to see us well into the green especially in times of market turmoil (no matter how minor it is). If you recall, I mentioned that I would be early to this trade (which I was) but I would have no problem with selling into the gain even if it shows no sign of slowing down. The poor man never takes profits.

Can Satellites Redefine Military Power?The strategic chessboard of military technology is undergoing a profound transformation, where Lockheed Martin plays a pivotal role with its advancements in satellite communication systems. The company has recently marked a significant milestone with the successful Early Design Review (EDR) of the MUOS Service Life Extension program, aimed at enhancing secure military communications. This leap forward is not just about maintaining current capabilities but about reimagining how military power can be projected and managed through space.

Lockheed Martin's collaboration with SEAKR Engineering introduces a groundbreaking feature: a reprogrammable payload processor for satellites, which could revolutionize operational flexibility in space. This technology allows for in-orbit adjustments, ensuring satellites can evolve with changing mission requirements without the need for costly replacements. This innovation challenges us to consider the future of warfare, where adaptability and real-time changes could dictate the outcome of conflicts, far beyond the traditional battlefield.

The implications of such technological advancements extend beyond military strategy; they invite a broader conversation about the role of private-sector innovation in national defense. With commercial giants like Starlink reshaping satellite communication, the military must now decide whether to continue investing in proprietary technologies or integrate commercial solutions. This dilemma poses a fascinating question: In an era where technology evolves at breakneck speed, how will traditional military assets adapt to maintain relevance and superiority?

Lockheed Martin | LMT | Long at $472.00Lockheed Martin $NYSE:LMT. The war machine keeps turning... while there may some temporary "peace" with the new Trump administration, it is just never (unfortunately) permanent.

The price has entered my historical simple moving average area. If there is a bounce, I expect it to be between the current price of $466.00 and $450.00. I've started a small position at $472.00 and will grab more shares if it hits $450. Now, if the aerospace and defensive industry goes through a downtrend with the new presidential administration, I expect the price to fill the daily price gap near the low $400s - which is only an even better bargain, in my opinion.

Target #1 = $500.00

Target #2 = $535.00

Target #3 = $610.00

LMT Lockheed Martin Corporation Options Ahead of EarningsIf you haven`t bought LMT before the previous earnings:

Now analyzing the options chain and the chart patterns of LMT Lockheed Martin Corporation prior to the earnings report this week,

I would consider purchasing the 625usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $10.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Lockheed Martin (NYSE: $LMT) Secures $3.2 Billion Contract Lockheed Martin Corporation (NYSE: NYSE:LMT ) is once again making headlines with significant developments that have investors excited. Recently, the company secured a $3.23 billion contract for the procurement of Joint Air-to-Surface Standoff Missiles (JASSM) and Long-Range Anti-Ship Missiles (LRASM). This contract, awarded by the U.S. Air Force Life Cycle Management Center, is a major win for Lockheed Martin and is set to further boost its stronghold in the defense industry. But that's not all driving the excitement around $LMT.

A Giant in the Defense Industry

Lockheed Martin’s business is deeply embedded in global defense and security, and the latest $3.23 billion contract reinforces its leadership. The contract will serve several countries, including Japan, Finland, the Netherlands, and Poland, reflecting the growing demand for Lockheed’s advanced missile systems. This deal also adds to the list of major programs Lockheed has secured in 2024, keeping the company on a steady trajectory of growth.

Both the JASSM and LRASM are among the most advanced missile systems in Lockheed’s arsenal. JASSM, a long-range, precision engagement missile, allows aircrews to strike high-value, well-defended targets from a safe distance, while LRASM is a precision-guided anti-ship missile designed to neutralize threats at sea. These combat-proven systems are not only crucial for U.S. military forces but are also in high demand globally as military conflicts and security threats continue to rise.

The company's ability to continuously secure large contracts, particularly for cutting-edge missile systems, is a testament to its industry-leading technology. With nations around the world increasing their defense spending, especially in missile systems and defense technology, Lockheed Martin is perfectly positioned to benefit from this global trend.

The Growth Story: A Steady Flow of Contracts and Global Expansion

Lockheed Martin’s Missile and Fire Control unit is a key player in the development of missile technologies and defense systems. The unit operates in over 50 countries and houses major programs such as the Patriot Advanced Capability-3 and the Terminal High Altitude Area Defense air and missile defense programs. With rising geopolitical tensions, terrorism, and border conflicts, governments are investing heavily in advanced missile defense systems. As such, Lockheed Martin is expected to benefit from the growing missile market, which Mordor Intelligence projects will have a 5% compound annual growth rate (CAGR) from 2024 to 2029.

The new contract and Lockheed’s existing missile programs suggest that the company is well-positioned to maintain its leadership in this space. Its key peers, such as Northrop Grumman and RTX Corporation, are also poised to capitalize on this growth, but Lockheed’s global reach and product range give it a competitive edge.

Technical Outlook: Bullish Momentum Continues

Lockheed Martin’s stock has been in a steady uptrend since July 2024, and the technical signals suggest that this momentum is far from over. As of now, NYSE:LMT stock is up 2.4%, trading above key moving averages and showing bullish strength. The stock is currently above its 50-day and 200-day moving averages, indicating that buyers have control over the market.

One key indicator of this bullish sentiment is the Relative Strength Index (RSI), which sits at 76. This places NYSE:LMT in overbought territory, but the stock has shown no signs of cooling off yet. Typically, an RSI above 70 signals that a stock may be overbought, but in strong bullish trends, the RSI can remain elevated for extended periods before a correction. Investors should remain cautious but optimistic, especially considering the strength of the recent news and the potential for further upside.

If the current momentum continues, NYSE:LMT is eyeing a move toward the pivot point of $628. Breaking through this level could set the stock up for a further rally, potentially leading to new all-time highs. The stock has surged higher over the past few months, and without any significant signs of a reversal, traders and long-term investors alike are watching for continued gains.

What's Next for Lockheed Martin?

Lockheed Martin’s growth prospects are tied closely to global defense spending trends, and with conflicts and security threats on the rise, the demand for advanced missile systems is expected to remain strong. The recent $3.23 billion contract win is just one of many expected to come Lockheed’s way as governments worldwide seek to modernize and bolster their military capabilities.

Additionally, Lockheed’s third-quarter earnings results, scheduled for October 22, 2024, could serve as another catalyst for the stock. With a solid pipeline of contracts and rising demand for its missile technologies, Lockheed Martin is positioned to deliver strong results in the coming quarters.

Investors will be keeping a close eye on the upcoming earnings call, where CEO James Taiclet and CFO Jay Malave will provide updates on key topics and answer questions. This could provide further insight into the company’s growth strategy and its ability to capitalize on global defense trends.

Conclusion: A Bright Future for Lockheed Martin

Lockheed Martin (NYSE: NYSE:LMT ) is riding a wave of positive momentum, both from a fundamental and technical perspective. The company’s recent $3.23 billion contract win, combined with its ongoing global expansion and strong market position, suggests that NYSE:LMT is well-positioned for continued growth. The stock's technical indicators are signaling bullish strength, and a move toward $628 could lead to even further gains.

With its leadership in missile technology and a growing pipeline of contracts, Lockheed Martin remains a top player in the defense industry. As geopolitical tensions rise and countries invest in advanced military systems, (NYSE: NYSE:LMT ) looks set to benefit from long-term growth in the sector. Investors should watch for continued strength in the stock as the third-quarter earnings report approaches.

History repeats?This has been by far my favorite company to trade this year, it has given me great returns.

Look at the consolidation inside the blue rectangle, and what price did after it broke.

And it looks like it is about to do it again.

This is simple, be patient for an entry above the rectangle breakout at $580 with target at $600

The Silent Assassin - A New Era of Targeted WarfareDelve into the world of precision weaponry with a deep dive into the Lockheed Martin AGM-114 R9X. This non-explosive missile, designed for targeted elimination, challenges traditional warfare concepts. Explore its technical capabilities, potential implications for global security, and ethical considerations.

This analysis explores the Lockheed Martin AGM-114 R9X, a specialized missile designed for precision strikes with minimal collateral damage. Often referred to as the 'Ninja Missile,' the R9X has gained notoriety for its role in high-profile operations. This article delves into the technical specifications, operational history, and implications of this unconventional weapon system.

Key Points:

Detailed technical breakdown of the R9X's design and functioning.

Analysis of the R9X's role in counterterrorism operations, particularly the killing of Ayman al-Zawahiri.

Examination of the ethical and legal implications of using such a weapon.

Comparative analysis of the R9X with other precision strike systems.

Assessment of the R9X's potential for future development and applications.

Let's Focus on the Ethical Implications of the R9X

The ethical dimensions of the R9X are particularly compelling. Given its precision and the potential to minimize civilian casualties, it raises complex questions about the changing nature of warfare.

Hellfire is a low-collateral damage, precision air-to-ground missile with semi-active laser guidance for use against light armor and personnel.

Missiles are used on the MQ-9 Reaper. AFSOC dropped previous plans to integrate the weapons onto its AC-130W gunships in favor of the Small Glide Munition.

Hellfire is procured through the Army, and numerous variants are utilized based on overseas contingency demands. An MQ-1 Predator employed Hellfire in combat for the first time in Afghanistan on Oct. 7, 2001.

The latest AGM-114R replaces several types with a single, multitarget weapon, and USAF is also buying variable Height-of-Burst (HOB) kits to enhance lethality.

The next-generation Joint Air-to-Ground Missile (JAGM) is also procured via the Army, and adds a new multimode guidance section to the AGM-114R. JAGM is used against high-value moving or stationary targets in all weather. FY21 funds 2,497 Hellfire/JAGM via a common production contract.

LMT Lockheed Martin Corporation Options Ahead of EarningsIf you haven`t bought the dip on LMT:

Now analyzing the options chain and the chart patterns of LMT Lockheed Martin Corporation prior to the earnings report this week,

I would consider purchasing the 480usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $9.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

LMT a defense large cap dips for buyers LONGLMT has been flat sideways since a good earnings beat 5 weeks ago. Lockheed Martin as a

defense contractor is in a growth environment with the US supplying arms to Ukraine as well

a Isreal. Domestic stockpiles and those of NATO are somewhat depleted. The contraacts will not

catch up for years. Gone are the days of making face masks and gowns during COVID to keep

revenues flowing in. I see this 2% dip as a change to get a small discount on what should

be a stock with upside for some years to come. This is a long swing trade not expectant of

a 3-4% profit in a week. I expect to hold this at least until the next earnings if not through

the presidential elections where the defense and national security perspectives of the

incoming or returning president may be a factor in the fundamentals of defense contractors.

Lockheed Martin lands US$17bn missile defence contractLockheed Martin Corp. has secured a significant US$17 billion contract to develop advanced interceptors designed to defend the US against intercontinental ballistic missile attacks. This new contract serves as a crucial lifeline for Lockheed Martin, especially following recent setbacks, including reduced orders for the F-35 and the Pentagon's decision to cancel a prospective helicopter project that the company had begun developing.

Although specific details of the contract remain undisclosed, initial reports suggest that the first interceptor is expected to be operational by 2028. This development comes in the wake of an Iranian missile strike on Israel and amidst ongoing commitments by the US to bolster defences in the Asia-Pacific region against North Korean missile threats.

With this backdrop, let's delve into the technical analysis of Lockheed Martin Corp. (NYSE: LMT) stock for potential trading strategies:

On the Daily (D1) timeframe, Lockheed Martin's stock has established a support level at 445.85 USD and resistance at 457.10 USD, with the stock currently exhibiting an upward trend. The stock may retreat to around 430.00 USD if the support level breaks.

For traders considering a position, buying on a rebound from the 445.85 USD support with a short-term target of 474.15 USD appears promising. From a medium-term perspective, holding a long position aiming for a target of 500.00 USD could be advantageous.

—

Ideas and other content presented on this page should not be considered as guidance for trading or an investment advice. RoboMarkets bears no responsibility for trading results based on trading opinions described in these analytical reviews.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law L. 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.88% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

RTX a defense contractor large cap LONGRTX has earnings on April 23rd. It has been on a good trend higher since the last earnings. The

Russian war means US defense contractors will be in a growth mode for the intermediate

future. Depleted stores of weapons systems need to be replenished. Pieces and parts are

needed for damaged systems in need of maintenance. I see RTX and others such as GD and

LMT as good long-term trades or investments. Smaller companies in the areas of robotics and

drones may be worth a look. RTX is at its all-time high but it seems much higher is in its future.

RTX falls on good earnings and defense budget issuesRTX is part of the boom defense sector thriving because of back orders created by

the Russian war against Ukraine. No matter good earnings it fell this week because

of the defense budget debate in Congress. No matter good intents to rein in the

defend spending escalation and spend in other areas such as social and infrastructure,

Russia has made the world more dangerous and national security of the US and its allies

trumps most spending except perhaps insterest on the national debt and paying the

holders of Treasuries. RTX dropped more than 10% from its tight consolidation range,

I see this dip as an excellent buying opportunity into a leader in the defense sector.

LMT -Lockheed Martin Corporation - bullishAccording to market behaviour, LMT has been rising sharply on the one hour, five hours, daily, weekly, and monthly charts. Technical analysis indicates that the next target will $256, and if it crosses that level and closes above successfully, the next target for the market will be $462.

Italian Translated:

Secondo il comportamento del mercato, l’LMT è in forte aumento sui grafici di un’ora, cinque ore, giornalieri, settimanali e mensili. L’analisi tecnica indica che il prossimo obiettivo sarà di 256 dollari e, se supera quel livello e chiude con successo, il prossimo obiettivo per il mercato sarà di 462 dollari.

German Translated:

Dem Marktverhalten zufolge ist LMT auf den Ein-Stunden-, Fünf-Stunden-, Tages-, Wochen- und Monats-Charts stark gestiegen. Die technische Analyse deutet darauf hin, dass das nächste Ziel bei 256 US-Dollar liegt. Wenn es dieses Niveau überschreitet und erfolgreich darüber schließt, wird das nächste Marktziel bei 462 US-Dollar liegen.

LMT continues to hold back the bears.Lockheed Martin Corporation - 30d expiry - We look to Buy at 448.25 (stop at 438.25)

Prices have reacted from 442.30.

Support is located at 447 and should stem dips to this area.

443 continues to hold back the bears.

The primary trend remains bullish.

This stock has seen good sales growth.

Price action was confined to a narrow range highlighting the lack of clear direction.

Our profit targets will be 473.25 and 478.25

Resistance: 458.00 / 467.00 / 475.00

Support: 447.00 / 443.00 / 439.70

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group

LMT a defense sector leader setup LONGOn the daily LMT, over the long term is shown to have descended into the support

of the ascending support trendline in what appears to be an ascending wedge.

Confluent with the support trendline is the mean VWAP and the mean band of

the Bollinger Bands. I see an opening for a long trade targeting the resistance

trendline and also the second standard deviation of the anchored VWAP ( red

thick line) Fundamentally, LMT just beat on both the top and bottom lines.

It is in a obvious growth industry with a bakclog of production in the setting

of the Russian Ukraine war and the need for US and NATO to replenish their

stockpiles. This long trade is best for investors content with slow moving blue

chip Dow Jones type stocks or alternatively agile options traders able to leverage

low magnitude up trends. I see about 10% upside and will buy some call options

to exploit this setup.

Is the DFEN dip buyable?I think that the dip is very buyable. Fundamentally, Russia has made the world more

dangerous. Shipments of weapons to Ukraine have depleted US and European stockpiles.

NATO is in a growth mode as proposed by former president Trump some years ago.

While many would like less defense spending and shift it into social spending or

infrastructure or clean technology government funding. the pragmatics are that

national security is generally higher on the priority list. DFEN just dropped below

the high volume area of the volume profile on the 15 minute chart in a VWAP breakdown.

The relative strength lines did a bottom bounce on the indicator. I will exploit this

as a long buying opportunity looking to a modest 5% upside target at minimal risk.

Buying LMT at current support.Lockheed Martin Corporation - 30d expiry - We look to Buy at 448.25 (stop at 438.25)

447 continues to hold back the bears. Support is located at 447 and should stem dips to this area. We look to buy dips. The primary trend remains bullish. This stock has seen good sales growth. Expect trading to remain mixed and volatile.

Our profit targets will be 473.25 and 478.25

Resistance: 458.00 / 467.00 / 475.00

Support: 447.00 / 443.00 / 439.70

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.