LNG

Tell Breaks 2 BucksTELL is a LNG company that has engaged in the largest natural contract ever done. The contract has been pushed off and redated several times due COVID and market conditions. Trump is meeting Modi, this will be apart of their discussion. Driftwood project will be redated and signed this time. As India is trying to secure a great future for their Energy production. India is now the fast economic growth sector as China slows down. TELL is currently highly sought by companies for purchase. The managers are excellent and put company first so great long term success. This will go to 3 dollars very soon. Get in now. My original post of this was broken by powell speech but now its formed double bottom and has found a price agreement.

TELL - LNG Season with broken cup handleTELLURIAN LNG is poised for a come back, if not for recent oil glut with no where to store it leading to negative prices. This shows a broken cup handle as well failing to break resistance up. Watching and waiting as LNG will recover and still lower CO2 emissions and cleaner than OIL (WTI) for most countries. New super carriers awaiting back to new normal.

LNG

NYSE:DLNG

NASDAQ:GLNG

AMEX:CQP

Resistance Broken + Gap FillIn addition to the technicals... Iran has been hit harder than most countries by COVID-19 and its economy is creaking under merciless U.S. sanctions. With nowhere else to turn, the Iranian President, Hassan Rouhani has been forced to cede ground to hardliners. And these hardliners are determined to force Trump into a long and costly war.

Just last week, missiles were fired at a U.S. oil project in Iraq.

Then, earlier this week, a group of unidentified armed men, believed to be Iranian commandos, seized a Hong Kong-flagged tanker and escorted it into Iranian waters.

We’re long $LNG PT $42 short-term is conservative.

Will Natural Gas futures continue to fall? Here is my viewTable of contents:

§ 1 Chart analysis

§ 2 Fundamentals

§ 3 My plan to enter

§ 1 Chart analysis

Looking at the NG!1(LNG futures) price, it's quite easy spotting the giant downward channel that price has been moving within for a while now.

As you likely already know, if you are a conservative trader like I am you would look only to take shorts at this point at the top of the channel, but in this case, things might be a bit different...

§ 2 Fundamentals

Now although looking strictly at the chart you would of course look to take shorts on the top of the channel, however, as I have mentioned in my FLNG analysis, China and India are planning on going from Coal heating to Natural Gas heating .

With that said, as we are currently moving away from summer and I predict colder weather will hit these countries within the next month, we might see a change in direction of price in NG as demand rises. Historically we have seen up to a 100% price increase during the winter, as that is when we have the most demand for heating.

§ 3 My plan to enter

I will be looking to enter short if price rejects upper channel and creates a regular divergence with the RSI, and I will enter if the price closes below the 50 EMA.

I will be looking to enter long if price breaks trough the upper channel, and we are met with a hidden divergence.

Another possibility is price retracing partly downward after rejecting top channel but not reaching the bottom of the channel, in which case if we get a regular divergence close to a previous support I will be looking to go long again, or atleast exit my trade.

Hope you found this helpful and good luck with your trading, although, if you trade based on luck you are already screwed.

Have a good day everyone

China concessions, oil and IMO 2020, BoA listYesterday was not that eventful for financial markets.

As for the general background, the Chinese state media that Sino is ready to make concessions to the United States (mainly, it is about importing food from the United States) and is preparing for “personal” negotiations with the United States instead of current telephone diplomacy.

In the oil market, despite the external calm, everything is quite alarming. Theresa May convened an emergency meeting in response to Iran seizure of a British tanker in the Strait of Hormuz that have led to an increase in tension. However, the effect was limited in forcing price levels, as the markets do not want to develop a conflict.

Today we want are writing about the upcoming revolution in the oil market and the IMO 2020 standard. One of the main oil consumers are ships that burn 3 million barrels per day. So from January 1, 2020, the International Maritime Organization (IMO) tightens standards, reducing the maximum sulfur content in marine fuels (from 2.7-3% to 0.5%). Shipowners will begin to reorient their ships to such clean fuels as LNG, which could significantly reduce the oil demand.

And more about the prospects. Bank of America identified the most “overheated” markets and assets, as well as identified positions that look most threatening in case of problems or force majeure. These are US treasury bonds purchases, the US technology sector shares purchases, and purchases of investment-grade bonds. So if you have such positions you should think about whether it’s time to close them or replace.

As for our trading recommendations for today, they are unchanged. We will continue to look for opportunities for selling the dollar, buying the pound against the dollar as well as against the euro, selling oil and the Russian ruble, and also buying the Japanese yen against the dollar. As for gold, considering how high it climbed, for the time being, we will trade it with no clear preference, buying from oversold and selling from overbought zones.

BUY LNG Asc Tri & PinBar Weekly ChartAMEX:LNG

BUY on Ascending Triangle convergence with a good squeeze, accompanied with 3 consolidated candles making a strong bullish pinbar

On longer term also, LNG has been in a rising wedge kind of formation ready to break.

Buy at 65.7, Tight SL at 60

Tellurian LNG - Good short or longTELL is showing MACD cross on 4h and near on day. LNG gas prices ready for winter spike as prices have been down. Earnings still negative for Tellurian, but LNG is much better than coal and key is west coast distributions hubs for asia for growth vs CQG/LNG (Cheniere). Delivery on larger tankers also helping lower cost. $10 entry with another half as lower limit.

Let me know your energy thoughts. Anyone up on LENR investments to look at?

Post a like @Pokethebear (I'm not supposed to be here). Back to my real work at batman.

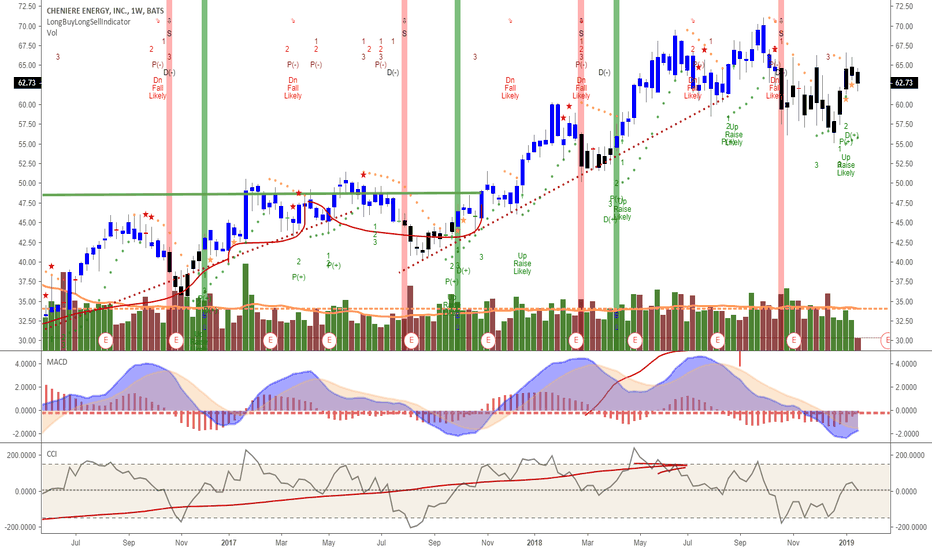

LNG winter fuel use time: MACD and CCI entry signalsOn weekly candlestick chart, MACD is shown crossing over and CCI at 0, but on downward slope at $62.73.

Await 2nd LNG port set-up and exports looking positive as cold weather driving use. LNG will also be a growing industrial energy fuel to replace coal and oil energy plants, as 30% lower CO2.

Nuclear and solar are only better ones and solar equipment costs not net zero CO2. Nuclear has proven solid long term CO2 near zero source (add CO2 output to make plant, deliver fuel).

Conoco Phillips cranking oil and gas - 1M chartCOP riding the cheap energy supply of LNG with technology and gas sales (LNG, CNG).

Looks like good buy based on trend and MACD for next year for those looking for safe haven. Dividend could be 4x higher. 1.5% Dividend

LNG DLNG SHI NEXT TELL CLNE

LNG expands to 600 x its volume to make natural gas, so as compressed liquid cheap to transport provided storage insulation, most good for 6-8 mo.

LNG offers 30% reduction in CO2 over coal and oil energy fuel sources, so developing countries will be using for forseeable decade until solar, wind, EV, hydro, wavepower are utilized.

EU will be sourcing more LNG per recent trade discussions. Safe from US-CH. China just signed agreement with QATAR Gas and another buy if it goes IPO. QATAR wanted

to be more public since 2014, but haven't seen it.

NEXTGEN energy crunchNEXT LNG GLNG SHI TELL

LNG prices not as hit by US-CH trade ware as thought as these are all take it or leave it 10 year contract energy deals.

If you can make it cheaper you make more. Floating refineries and floating transfer stations have cut out thousands of miles of pipeline and handling

costs. I'll let you figure that part out on own.

Fibretracement from 786 showing entry signal and quick 5 to 6.50 coming, or better above this 612 to 500 or above this. Strong volume and

potential here. Sorry for fib retrace values in crappy spot. Need to modify fond to bold, suggestions??

LNG gas expansion entryLNG gas prices becoming attractive and not at mercy of US-CH trade war 10% tax as first thought.

China leads the pack in LNG imports and has 10-yr contracts, wahahhaha.

LNG GLNG SHI TELL NEXT

Here shows a solid entry with strong legs from Fibretracement at 786 on love it the 1w chart and not as good on 1d chart, so more confident to hit higher highs from current $9.

LNG gas will do well provided ships run, weather good, but it's hurricane or monsoon season.

Target 1 over $12 and Target 2 more likely $15 up.

Cheniere Energy, Inc. breaking out of Cup & Handle LNG The LNG market has has some scales of economies to reduce production and processing costs.

Cheniere Energy was Cheniere Energy Partners' revenues went from $270 million in 2015 to $1.1 billion in 2016.

They took another leap in 2017, rising to $4.3 billion, and over $5.8B in expected in 2018 to handle growing pace as demand

for lower cost energy like LNG over oil comes into play. Solid entry with target over $70 expected per prior growth.

Ide

ally dividends would also resume and discontinued for infrastructure costs to build new lower cost processes.

$LNG update $0.415 $0.0415 about to drop out of weak support

Took my medicine(loss) a while back, looks grimm

ARCA: LNG

Ticker: ARCA:LNG

Candlesticks Bullish

Why?

the Bull Flag is Clearly shown, i.m.o this stock is good to hold for a bit ( not to long as RSI is Reaching Overbought Areas and is currently in a channel up)

MACD is heading up.

Earnings is coming up next month so if it's anything like how the banks went take profit or hold at your own risk