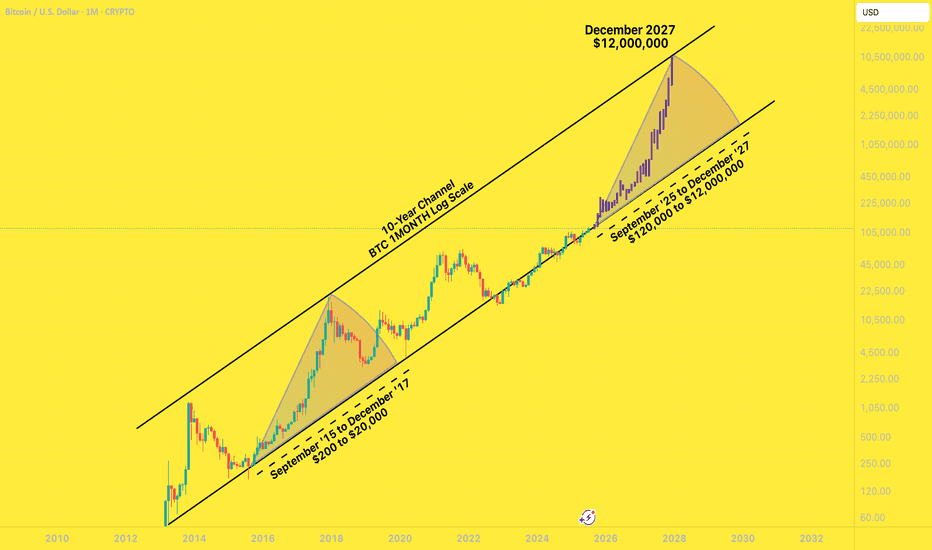

BTC to $12,000,000 December '27I had a years-old bookmarked chart from @MillionaireEconomics that I wanted to update and pick a random, extremely bullish candle pattern from the last time BTC came off the bottom channel to slap on it.

Riddle me this:

Why shouldn't Bitcoin go to $12,000,000 by December 2027?

Saylor continues to lead the way for global companies to scramble to build their own BTC warchests. These early adopters are having investor money dumped into them by the truckload.

Countries are stacking BTC

The BTC ETFs are a smash hit

Trump is all for making his own multi-billy family bitty stack

Mid-curvers will sell far too early, for far too little.

In the next two years, you'll be bombarded with countless, seemingly good reasons to sell your Bitcoins for hundreds of thousands of dollars - and then millions of dollars.

A shocking number of people will be far too early to sell. They will wake up in a cold sweat, night after night, haunted by their "could-have-been" stack, the number that updates in their head ten times a day, going up by six or seven figures a day .

... until they FOMO right back in at $11,999,999.

LOGARITHMIC

SPY Price Projection: Mid-2025 TargetRevealing Market Trends: Logarithmic Regression Analysis Indicates Bullish Path for SPY

In the ever-evolving realm of financial analysis, the search for reliable predictions remains ongoing. Logarithmic scale regression analysis, coupled with potent indicators, has emerged as a promising tool for discerning trends, particularly regarding assets like the SPY.

This analysis delves into the utilization of logarithmic scale regression alongside two robust indicators, offering insights into the potential trajectory of the SPY's price movement. It's essential to note that the interpretations and predictions presented are based on my analysis alone and should not be construed as financial advice. As with any market analysis, uncertainties persist, and actual outcomes may diverge from projections.

Logarithmic scale regression accounts for the exponential nature of price movements, providing a nuanced perspective on long-term trends. When combined with indicators such as moving averages or momentum oscillators, the analysis gains depth, revealing not only the direction but also the strength of the trend.

After meticulous examination of historical data and the application of analytical tools, our analysis suggests a bullish trajectory for the SPY, with a projected price nearing 620 EUR by mid-2025. This projection implies a significant uptrend from the current date, with a potential increase of approximately 20% over the specified timeframe.

However, it's crucial to approach such forecasts with caution, recognizing the inherent risks associated with financial markets. While our analysis indicates a positive outlook, market conditions can change rapidly, leading to deviations from expected trends.

In summary, logarithmic scale regression analysis, supported by robust indicators, offers valuable insights into market trends and potential price movements. While our analysis suggests a bullish sentiment for the SPY, investors should conduct thorough research and seek professional advice before making investment decisions.

Disclaimer: The analysis provided is based on personal interpretation and should not be considered financial advice. Investing in financial markets carries risks, and actual outcomes may differ. Readers are encouraged to conduct their own research and consult with financial professionals before making investment decisions.

BTC can still WIN After DeepSeek DumpTings are looking rough for BTC and ETH in the daily.

Let's talk about ETH first.

The previous time I posted on ETH, we took a look at a bullish pattern forming - the Inverse Head and Shoulders Pattern.

VS the VERY different picture we see today after the weekly closed underneath support:

Apart from chart patterns and bullish indicators - I was also confident that the price of ETH would increase, as we haven't seen a new ETH all time high, compared to the drastic ATH Bitcoin made. This, would be unusual. So the question remains - why did the pattern fail so miserably?

There is no reason specifically as to WHY chart patterns fail - especially if they seem so strong. Some may argue its whale play, others may say it's a news event etc... But either way, the only real way to safeguard a trade from a failing pattern is to wait for confirmation . And the worst ting is - even then, it may still fail. However, this is by far a safer play than just relying on a pattern that's busy forming. Here's a short idea of what a confirmation would look like on some bullish patterns (blue):

Now, to talk about BTC in the Logarithmic view.

I mapped out the date-ranges, as well as how far the price fell logarithmically after each top. You'll see the word "clicks" on the chart. This simply indicates the amount of diagonal trendlines it has fallen. By using this pattern-dedicated approach, a commonality is found which may be useful in speculating a future price. Because if not for past history, how else would we speculate on the future?

It's interesting to note that the past 3 ATH's (all time high's) are each lower than the previous if you compare it not to price but to the "click lines". Even the fourth high (the one coming next) will be on a lower click-line than the previous, and that estimate is already over 300k. This is a really helpful way to speculate a future high because usually on a regular-view chart, the zone above the ATH is uncharted territory. You could use a Fibonacci trend-based extension, but this is limited to the cycle that you're using for input points. Logarithmic chart + indicators factor in the entire history of the price.

So could it be that this is just another dip in the road towards a new ETH ATH - and potentially even another BTC increase?

______________________

BINANCE:ETHUSDT BINANCE:BTCUSDT

Bitcoin Logarithmic Chart Since 2009Bitcoin is currently in a bull cycle similar to previous cycles. Bitcoin has a notorious 4 year cycle that almost everyone knows about due to it's halving. This means the current bull cycle should extend into late 2025. However, things may be a little different from what most people would expect this time.

This is an all-time Bitcoin logarithmic chart going back to 2009 which is when Bitcoin was released. This is a monthly chart so all the information can fit onto a single screen.

The red line shows a trajectory similar to an airborne projectile of some kind. As time goes on, the velocity is slowing. We all know what happens next when velocity slows down too much. Gravity takes over!

The green lines were drawn from the lows to the highs. I realize they may be off by a candle or so depending on data source or where somebody want to put the start/end times, but this doesn't change the overall concept. Every bull cycle has lower growth in terms of %. This is just a fact.

There are 3 important notes I want to make other than slowing velocity:

1) Bitcoin is already extended up to the red line this cycle. Which just so happens to coincide with the strong psychological $100000 level.

2) Notice how the growth percentages are drastically lower each cycle. Bitcoin is currently up more than 500% from it's low point this cycle. The previous cycle only made a 1829% move. So the high for this cycle may have already been made.

3) We are about 25 candle into the current cycle. Each cycle has different durations from low point to high point though. The shortest cycle was only 28 candles. Bitcoin may very well have made it's high point this cycle already. If not, there may be only a few months left of bullish movement.

See my previous analysis using a regular linear chart which I made near the top. Both long-term charts are in agreement.

$BTC #Bitcoin Just Gonna Leave This Here (Hmmmm..Maybe?) 😝This is just adding onto my logarithmic regression-inversion theory and how I personally believe the $BTC price movements may specifically play out. The general theory is that the logarithmic regression of $BTC will invert at a certain point in the next 1-3 years, changing the price suppression $BTC has had for its whole life into exponential support. I personally believe this is very possible, with exponential adoption of #Bitcoin for things like sovereign wealth funds, countries' legal tender and possibly even a world reserve asset. If those things (plus other possible variables) occur then this is how I see that possibly playing out.

Here is a detailed explanation of what I personally believe is happening/going to happen here.

Phase 1:

There would be a breakdown of price like we have now (possibly) completed. This would be in order to accomplish a few things for global institutions. Some of those things are:

1) Get Bitcoin out of the hands of the "common man". It would not be possible to acquire the amount of $BTC needed with so many people holding.

2) Cause liquidity issues for exchanges, making it more difficult for just anyone to purchase. (We have already seen this. ex: Voyager, Celsius, etc.)

3)Allow large accounts to be created at more feasible prices, while also providing a good (high) enough entry price to sustain value for the overall asset in the eyes of the public. (To keep people from losing interest)

There are obviously more reasons, but that's another post.

Phase 2:

A relief rally back up to the median range. This will obviously be a very volatile range, as 50% of investors sell (expecting a sharp move downward) and others (possibly the central financial institutions and/or sovereign wealth funds, who will not initially disclose their acquisitions) accumulating within this range.

Because of this volatility, the likely range it will be in, the immediate supports/resistances, and the typical movement of the $BTC price; My current prediction is that $BTC will move upward, after flipping the top of the recent range into support, and break above the main down-trend of a massive flag that $BTC has been forming for over a year. Then after a retest of that upper trend, price will attempt to break the new-found resistance as traders long from that trend line. Believing that this is the last upward movement, traders will then short the resistance level, and other holders may sell out of fear (or just simply because they will be at a break-even price, since a lot of volume was transacted in that range). This range will then prove to be the median range, previously mentioned. $BTC will then make a lower low, again at the upper trend of the flag. This will seem like a "bear-signal" but will actually be a second confirmation of support off of the upper-resistance trend of the flag, which will "fake-out" traders, causing a short squeeze. Then more traders will continue to short as others switch to a long stance. All of these movements will print an inverse-head-and-shoulders, the break-out of which will give $BTC price the momentum needed to make it back up to the $60K-$70K range.

Phase 3:

After making it back to the "all-time-high" range, there will undoubtedly be heavy volatility, as some call for a triple-top and others "FOMO" into #Bitcoin. This volatility, bouncing between the upper regression curve and the inversion curve, will begin to print a "rising-wedge" pattern. The break-out of this wedge will be the ultimate inversion of regression into exponential growth.

This is all pure speculation, however it is based on both, strong fundamental data as well as technical data. I personally believe in this theory, and it could also play out in other ways, but this scenario seems to make the most sense to me at the moment.

**This is my own opinion based on data observed. This is not financial advice.**

A clue of where xrp can head based on it being a fractal of 2016Ok this will be a slightly extensive dive into how the current breakout move from the multi year triangle that xrp just broke out of has a high probability of being a fractal of the triangle pattern breakout move xrp did in 2016 that yielded explosive parabolic bullish price appreciation. I want to start with this image on xrp on the Monthly chart to show how the first monthly candle that confirmed the breakout of the 2016 triangle went up 287 percent and the first monthly candle confirming the current breakout went very similarly to around 283%. So since we already have it following that same pattern there, I’m gong to extrapolate where price could head from here if we are needed mirroring that same explosive move of 2016 with our current price action. If so, the very first spot XRP had a pullback and then consolidated into a bull flag before heading further up was actually at the 1.038 fib level which is just 13% or so above its previous all time high. If we were to do something similar today we could see xrp’s first real significant pullback consolidation around $3.75-$3.77. This is in line with certain chart patterns breakout targets I have in mallet time frame charts that I don’t have shown here. Other chart patterns in those smaller time frames have a targets around $3.80, $3.84 and some as high as $4.06 and then on the logarithmic chart as high as $4.77-$4.85. I think even as high as $45 would still fall in line with a standard deviation away from the 1.038 fib and would still retain the fractal if we were to reach the top logarithmic target before having that first pull back. We can see on the left of the chart above on the first triangle breakout, after it moved on from the 1.038 level the net level it rose to before the first significant correction s all the way up at the 1.618 (in blue). If Xrp were to maintain the fractal in current price acton then the 1.618 should be its destination to before the first ajar correction, and as you can see the 1.618 for the current Fibonacci retracement is all the way up at around $26!

Bullflag on bitcoin’s monthly log chart putting up big numbers 200k by May?! The measured move target is over 200k and the trajectory of the ensured move line suggests that it could even potentially reach this target in the first half of 2025. A very exciting notion let’s hope it can and will. I do expect one steep corrections on the way to this target. *not financial advice*

An update on the monthly log channel chart from AprilI posted this chart idea originally all the way back in april when I discovered that all the major tapas and bottoms of the market since the 2017 top until now are all in a very clear set of rising channels seen best on the 1 month log chart as shown here. We can see since that time in April, Bitcoin has now broken back upward and is very close to retesting this super strong trendline just above it currently around 47-48k. This trendline is likely to be significant resistance, however there is a chance during a moment of extreme fomo where we could break above this trendline and retest the lighter green ascending trendline with a wick which is currently sitting around 56-58k on the current monthly candle. Ultimately my guess is the trendline just above current price action at the 48k zone is likely to maintain candle body resistance and lead to the next big market correction. It may even maintain wick resistance too but I still believe we can possibly wick above it and retest the trendline just above it with a wick before ultimately closing whichever candle gets above it’s candle body below the 48k trendline. Once this happens, the first zone I’m going to be watching to hold support is at the 1month 50ma shown here in orange. There’s a decent chance we could correct even lower than that but that will be the first zone I watch for a potential reversal back into the uptrend. For now though I think it’s completely possible to go as high as the 56-58k zone with a wick while still maintaining the trendline just above this current area as resistance but I wont be surprised if that trendline at 48k is so powerful we cant even get a wick above it either. Both seem quite probable to me at this point. I am going to attach a link to my original channel idea on this update as well so you can see where this channel discovery originated from. *not financial advice*

4 potential shorter timeframe triangles on rep 1wk log chartMy previous chart idea which I will link to below showed the monthly timeframe logchart of the 2 potential larger triangles xrp has been consolidating in, so I wanted to also follow that up with a weekly chart timeframe of the the 4 potential smaller triangles we have also been consolidating in so I can eep track of their progress as well. All the potential measured move ines here have been randomly placed so of course where ever it does break upward will likely be slightly different and will only require I readjust those measured move lines slightly at that point only changing their price targets slightly. *not financial advice*

Xrpusd Bullishpennant on the 1month timeframeSame pattern as the previous idea i just posted but I’ve switched it from the 3 month chart to the 1 month time frame in order to keep track of the developments in price action more quickly. Im also going to post this pattern one more time but on the weekly timeframe as well. The 3 targets remain the same. *not financial advice*

XRP can breakout of logchart triangle once .59 is sold supportThe top trendline of this logarithmic weekly chart symmetrical triangle has played amazing resistance for quite some time now. However since that trendline is a descending one, the price that xrp’s price action needs to maintain as support gets lower and lower with every weekly candle close. Currently, if xrp can flip 59 cents to solidified support and maintain that support for multiple weekly candles it would validate the breakout. By next week’s candle it could be even lower. For the sake of the steroids 589 number that seems to be associated with XRP, it would be fun if the level needed to flip to support to break above was 58.9 cents imo. With the uptrend in the crypto bull cycle seemingly resuming here, the probability of XRP climbing above .589 in the near future and staying above it has greatly increased. Wouldn’t surprise me if the day it really blasts off and confirms//validates the breakout of this triangle coincides with something newsworthy like Gensler resigning or the SEC Ripple case being settled or even dropped. I anticipate a Bullish December, but perhaps even a quite bullish rest of november here as well for XRP It’s already off to a good start to the month so far and hopefully it can keep that momentum going. Always a chance at some sort of temporary Black Friday black swan discounts though so wise to stay vigilant. In order to get as zoomed in as possible on price action for this post, I cut the measured move target out of the frame, but if you were to drag the chart with your mouse(or finger if using a touchscreen) you will see that the target for the breakout of this log triangle is around $10.57 if it were to break above the triangle on the enxt few candles. *not financial advice*

Bitcoin’s entire history is just a series of bullflag fractalsOn the entire bitcoin history index monthly logarithmic chart we can see how Bitcoin is nothing but bullflags. The second bullflag we broke up from took 2 bull runs to hit its full breakout target. The first one however because of how insanely long its pole is, has still yet to hit its full breakout target. It is now the 4th consecutive bull market since it broke out of the first flag though so perhaps it will reach that target this bull market, if not this market I’m confident the 1st flag will finally reach its full target next bull market. The second bull flag in the fractal series was able to hit its full target within 2 bull markets which is typically about the pace the huge macro patterns on the logarithmic chart tend to take. The other Flags since that second flag also are yet to hit their full targets but if the next flag in the series is also able to hit its full breakout target within a 2 bull market timeframe, the flags after it will also have to hit their targets as well on the way yo hitting that 3rd flags breakout target. We can see each flag seems to be getting progressively smaller as the fractal continues so odds are good the time it takes each flag to reach its full breakout target should also be getting progressively smaller as well so that would make sense. Anyways I just wanted to post a new version of the entire bitcoin history’s bullflag fractal so i could easily reference t and follow its progress for the current bull run *not financial advice*

2 overlapping invh&s patterns on the weekly logchart for XLMThe inverse head and shoulders with the yellow neckline is the same one that is on the linear chart, however on the log chart you get a much higher target of around 44 cents. Reaching that target will also push price above a second bigger inverse head & shoulder neckline (in green) which once that one validates its breakout, it’ll have a full target of around 81 cents. Watch for the weekly 200ma(in blue) to hold support here if so not a bad place for an entry, if not retesting the yellow neckline or even throwin a wick or few back below it is not impossible and would create other good small entry opportunities as well. *not financial advice*

Bitcoin: $300k by 2025Long-term Bitcoin analysis using a logarithmic scale. As shown, Bitcoin remains in the long term trend lines set by the top and bottom of the 2014 bear market, if Bitcoin is to remain in these trend lines, it needs to start making an upwards move in early 2019. I have also drawn a few curves that Bitcoin could follow if it is to fall below the trend line.

My first price target is $100k which I expect to be met between mid 2020 and mid 2021. I then anticipate another 12-16 month bear market before finally resuming the bull market and heading towards $300k between 2025 and 2026; I have chosen $300k as that would put Bitcoin on a slightly smaller market cap than gold assuming that 20 million coins had been mined ($6 trillion).

Finally, I have indicated accumulation zones in green, currently between $5.7k and $7k, I expect to move out of this range within the coming few months. Then similarly in the 2022/2023 bear market I expect Bitcoin to fall 60-70% and accumulate between $30k and $40k range.

XRPETH chart may finally be ready to reclaim some gainsIf price can get above the monthly 50MA here (in orange), and flip it solid support for a candle or few, we should see xrpeth confirming the breakout from this monthly chart falling wedge and then heading up to reach the measured move target posted here. This is a logarithmic chart. *not financial advice*

Bullpennant on 3month logchart for ETH has outlandish targetsIf we went just by the triangle portion of the pennant breakout target, that can take ethereum to 20k. This is potentially a possible target that can be hit during the current bullrun, the second higher target in the 200 thousands is for the entire pennants breakout target. Seems way less likely we can hit that target this bull run but is perhaps not improbable to reach by the bull run after this. Then again, if PlanB’s scenario for bitcoin to somehow reach a million before 2026 actually somehow came to fruition, then the full target of this pennant being reached this bull run would suddenly have some slight probability of happening. You can see here on this chart that to get to Ethereum’s current all time high we basically broke upward from a pennant prior to the current one we are in and the breakout target for that pennant’s triangle portion was just slightly lower than eth’s current all time high. The current pennant’s 20k target for it’s triangle portion only is actually very close to the previous pennant’s full pennant target…so essentially by reaching the current pennants triangle breakout target this bull run we would reach the full target of the the previous pennant breakout from last bull run, making it take 2 bull runs to reach the full target of the previous pennant. This makes me believe in order to reach the full 200k+ target of the current pennant we are in it will likely not occur until the next bull market after the current one. However if PlanB’s million dollar bitcoin before 2026 scenario were to actually play out that would be the one condition where we could see the current pennant reach its target in the current bull run. I know it sounds outlandish and highly unlikely so for now I’ll put that at a very low probability, but a low probability is still better than an impossibility. *not financial advice*

Cup & handle and Bullflag have much higher target on logchartHere on the monthly logarithmic chart we can see both the cup and handle and the bull flag that Bitcoin is starting to break upwards from. Both of these patterns are also very much so valid on the linear chart as well, but as usual, the logarithmic version of these patterns has a much higher ensured move target for their breakouts. While there’s a probability we could hit these higher logarithmic targets during this bull ru, often times the logchart patterns take considerably longer to hit their full targets than the linear charts patterns, so there’s also a chance these targets especially the higher cup and handle target could not get hit until next bull run as well. I will go ahead and follow this chart up with the linear version so people can see the contrast between the breakout targets on both styles of chart. Much higher probability we can hit both of these patterns linear chart targets this bull run. *not financial advice*

Bitcoin: The Short and Long (Term) ViewI want to give a video breakdown of my last Tradingview post which did very well as an Editor's Pick. Commentors posed some very good questions that deserve detailed explanations.

First, I talk about the confluence of three major levels of Resistance that setup last week and remained the overhead Resistance of INDEX:BTCUSD Bitcoin this week (and possibly in the short term).

Finally, lest I be accused of being TOO BEARISH... my LONG TERM view (going out for the next decade and beyond) using logarithmic projections of Bitcoin price action to define the Risk and Reward of a long term (2030 and beyond) investment. When Bitcoin is a good and not-so-good value proposition.

Nik by Dl InvestHello community,

A little daily analysis in log scale, because I use the "Adaptive Trend Finder" and "Price Action Ultimate" indicator.

The channel is bearish.

I drew a Fibonacci retracement in log, to see if there is a golden zone.

If the theory works, we have a target around $90.62.

Nothing says that the title will rebound, change of CEO, so we can hope for change in a while.

Make your opinion, before placing an order.

► Thank you for boosting, commenting, subscribing!