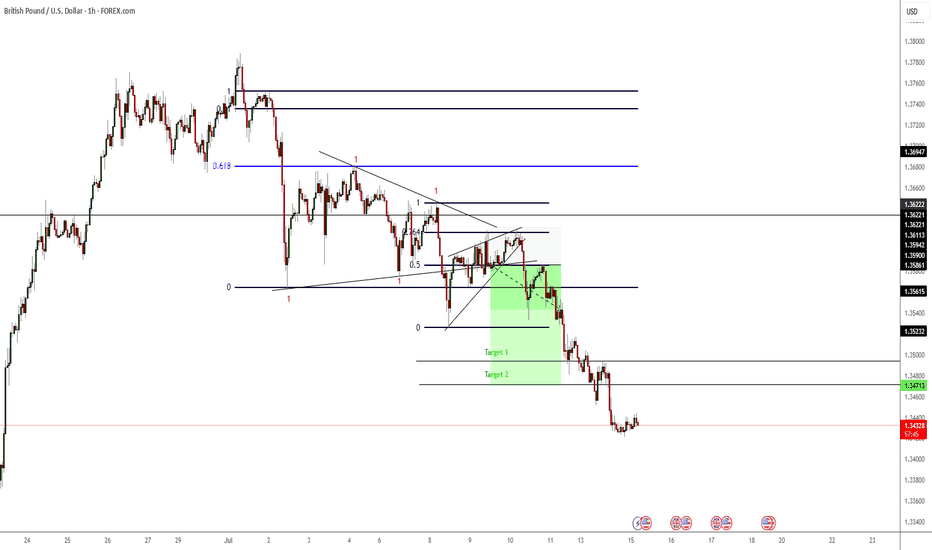

Targets Hit So as you can see previously I stated that I was waiting for a breakout of the rising wedge before I entered this trade. Now it didn't go quite as planned as price made a bigger rising wedge from what I originally mapped out but nonetheless I was able to recognise, it re-adjust and enter the trade. Price hit both targets.

London

LONG ES after London Open*I like the long better for london open.

From 6000, weak liquidity built up above, Finished business below, macro SMAs buy bias...

HOWEVER there is also a good case for shorts as we are heading up into futures open, SMAs and there is LVN space below to squeeze into. So... I will be looking for finished business RISK and test/acc ENTRY as outlined there and targeting the weak liquidity above. Given the SMAs above etc, i doubt price will rush up, so take your time and get that test to confirm.

And as always if its not there DONT chase. Patience.

UK HOUSE PRICES: RELENTLESS UPTRENDIn January 2025, the latest figures reveal that UK house prices have risen by 0.7%, pushing the average price to a staggering £299,238, a new all-time high. For the mainstream media, the narrative of an impending house price crash has been a constant refrain over the past two years, fueled by the belief that prolonged high interest rates would spell disaster for the housing market.

Indeed, these elevated interest rates have significantly hindered the natural upward trajectory of house prices, which typically rise in response to inflation, a growing population, and a persistent shortage of new housing construction.

The current stagnation in UK house prices resembles a pressure cooker, building up energy that is bound to release in a dramatic surge. The government’s ongoing strategy of printing money to appease voters will inevitably flow into asset prices, leading to inflation in these markets, much like the consumer price inflation we’ve already witnessed.

The government finds itself in a bind, compelled to continue this money printing to meet the electorate's demands for free money and to manage an ever-growing debt burden. As the debt increases, so does the need for borrowing to service it. This cycle makes it increasingly challenging for the UK to lower long-term borrowing rates, especially compared to the US, which still holds sway over the global financial landscape.

UK house prices are gradually regaining momentum following the fallout from the Liz Truss debacle, a situation she seems to remain blissfully unaware of, despite the havoc her brief six-week tenure as Prime Minister wreaked on the British economy.

The financial landscape was nearly sent tumbling into chaos, prompting the Bank of England to step in with an unprecedented commitment to purchase UK Government Bonds. The economy is so fragile that the UK is now compelled to invest in US government bonds to shore up its financial system against the spectre of another crisis reminiscent of the Truss era under Labour. We were perilously close to a financial meltdown!

Currently, UK house prices are inching towards a potential increase of around 10% per year, indicating a modest upward trend rather than a frenzied housing boom, while also avoiding the catastrophic price drop that the media seems to obsess over.

Ultimately, average house prices in the UK are set to rise, irrespective of government actions or economic conditions. Therefore, those considering the purchase of a standalone house should act without hesitation, as flats and new builds present more complicated challenges—flats can become a logistical nightmare, and new developments might be situated in flood-prone areas, among other concerns.

GBPUSDGood morning traders, today the market is moving because we have fundamentals both in the pound now at 7:00 and in the afternoon NY we are going to look for a window of opportunity to take advantage of the day. For today's first leg in London, it presents a bullish scenario. Once I get my psychological point and everyone is induced to buy, we will look for sales.

UK100 FTSE100 - ABC Correction Uderway?Hello Guys,

The yearly Candle is slightly Bullish - but we did not see a break on a closing base of the crucial 7900 area -> ATH.

A Retest of this area would constitute a Bullish setup - which I would be happy to be part of after the last rallye.

Q2 Close - Doji -> might see a consolidation phase from here with a sideways to down mentality - considering the recent gains the bulls had.

The monthly Bias is Bearish. A Bearish Engulfing Pattern (Although a small one) has been formed. The Stochastic confirms a Bearish Bias - not totally contradicting the higher Timeframes! So Bulls be prepared for some drop… Just an idea from my side. A Double Top at 8400 would be a strong sign of Bears being back.

-> For the bulls 7900 has to hold - for the bears 8400.

Thats all for now…

Thanks for reading

The RICS UK House Price Balance - Trending Up For Now The RICS UK House Price Balance

(Released this Thursday 14th Mar 2024 for Feb month)

The Royal Institute of Chartered Surveyors (RICS) House Price Balance is a monthly survey that indicates whether more or less surveyors expect housing prices to rise or fall in the U.K. housing market. A positive net balance suggests house price increases, while a negative net balance implies price decreases.

The RICS provides valuable insight into the UK housing markets trend and helps gauge the direction of house price movements whilst also offering insight into consumer spending.

The Chart

The RICS House Price Balance is calculated as the proportion of surveyors reporting a rise in housing prices minus the proportion reporting a fall in prices.

It reflects the expected monthly change in national house prices.

Positive vs. Negative Net Balance:

A positive net balance indicates that more surveyors expect price increases, signaling a robust housing market. A negative net balance implies that more surveyors anticipate housing price decreases, indicating a fragile housing market.

Green Area 🟢 = More Surveyors Reporting an Increase in House Prices

Red Area 🔴 = More Surveyors Reporting an decrease House Prices

Grey Areas ⚫️= Recessions

▫️ The RICS fell sharply from April 2022 down to the 0% level in Oct 2022. This was a leading indication of a downward trend UK House market prices (falling from 78% in Apr 2022 to 0% in Oct 2022).

▫️ The RICS fell into the red zone from Oct 2022 forward indicating that houses prices from this date were in net decline (per surveyors responses).

▫️ Almost 12 months later the RICS reached a low of -66% in Sept 2023. Since this date we have started to trend upwards sharply recovering from -66% to -18.4% today. However we remain in net negative territory indicating house prices are still in declining but not as much as before, a change of trend may forming indicating a move to house price appreciation (not confirmed until we move above the 0% level into + territory).

▫️ The Historic Recession Line on the chart illustrates the -63% level which crossed by the RICS at the onset of the 1990 and 2007 recessions (grey areas on chart). We recently penetrated this level moving to -66% in Sept 2023 which historically does not bode well.

This weeks RICS release will be very revealing and could tell us if we have a continuation of the upward trend for UK House prices or if we we remain firmly in negative territory.

Lets see what Thursday brings, a fascinating little metric to help us keep an eye on the property market in the UK and the to get an idea of UK consumer behavior.

PUKA

GBPJPY - GJ 1hrPull back! SELL Now !

80+ pips on GJ

GBPJPY has made a clean red candle below the support. Now that GJ has retested support and rejected it with a nice red candle we can take sell entries. Watch as GJ is near the weekly resistance . This zone has also been confirmed, so we can see a rejection to test previous support areas

tp 1: 4hr and daily support

tp 2: 3.82 fib

tp 3: D1 support, if GJ breaks below this area look to continue selling

*stop loss can be increased. please use proper risk to reward

GBPCHF SHORTSI have analyzed and seen the weekly and daily timeframe being bearish, these are the main timeframes, so I went to the four hour timeframe to look for opportunity to short, then I spot the resistance zone just below the 50 exponential moving average, now expecting a retracement to the moving average then take shorts.

XAUUSD GOLDPair : XAUUSD ( Gold / U.S Dollar )

Description :

Completed " 12345 " Impulsive Waves at Demand Zone or Fibonacci Level - 61.80%. Bearish Channel as an Corrective Pattern in Short Time Frame and Rejection from Lower Trend Line. It has completed the Break of Structure and making its Retracement

GBPAUD: “Break Out” Setup on “Momentum” Entry (37/100)System has identified a “BO” playbook setup and a potential “momentum” shift market entry during the third hour of the LONDON 12-Candle Window.

RISK: 1R

TARGET: 2R

***DISCLAIMER***

This is a new system based strategy being live tested for the purpose of gathering data. The system generates between 3-6 signals per session upon detecting a qualifying setup and entry signal. Currently being tested only in LONDON and only using certain pairs. The win rate and expectancy are unknown. Please do not take these trades.

GBPAUD: “Breakout” Setup on “Momentum” Entry (38/100)System has identified a “BO” playbook setup and a potential “momentum” shift entry during the second hour of the LONDON 12-Candle Window.

RISK: 1R

TARGET: 2R

***DISCLAIMER***

This is a new system based strategy being live tested for the purpose of gathering data. The system generates between 3-6 signals per session upon detecting a qualifying setup and entry signal. Currently being tested only in LONDON and only using only certain pairs. The win rate and expectancy are unknown. Please do not take these trades.

GBPAUD: “Reversal” Setup “IB Momentum” Buy Stop Entry (37/100)System has identified a “REV” playbook setup and a potential inside bar breakup for a “momentum” shift buy stop entry during the third hour of the LONDON 12-Candle Window.

RISK: 1R

TARGET: 4R

***DISCLAIMER***

This is a new system based strategy being live tested for the purpose of gathering data. The system generates between 3-6 signals per session upon detecting a qualifying setup and entry signal. Currently being tested only in LONDON and only using only certain pairs. The win rate and expectancy are unknown. Please do not take these trades.

XU: “BAT” Setup on “Limit” Buy Stop Entry (36/100)System has identified a “B&R” playbook setup and “depletion” entry during the third hour of the LONDON 12-Candle Window.

RISK: 1R

TARGET: 4R

***DISCLAIMER***

This is a new system based strategy being live tested for the purpose of gathering data. The system generates between 3-6 signals per session upon detecting a qualifying setup and entry signal. Currently being tested only in LONDON and only using only certain pairs. The win rate and expectancy are unknown. Please do not take these trades.

GBPUSD: “618" & "LIBRA" Setup on “Momentum” Entry (34/100)System has identified a “618” fibonacci pullback setup as well as a "LIBRA" or inverse head and shoulders with a potential “momentum” shift market entry during the second hour of the LONDON 12-Candle Window.

RISK: 1R

TARGET: 2R for 618 setup, 4R for LIBRA

***DISCLAIMER***

This is a new system based strategy being live tested for the purpose of gathering data. The system generates between 3-6 signals per session upon detecting a qualifying setup and entry signal. Currently being tested only in LONDON and only using all GBP pairs. The win rate and expectancy are unknown. Please do not take these trades.

GBPNZD: “618” Setup on “Limit” Buy Entry (34/100)System has identified a “618” Fibonacci retracement setup and executed a buy “limit” entry during the second hour of the LONDON 12-Candle Window.

RISK: 1R

TARGET: 4R

***DISCLAIMER***

This is a new system based strategy being live tested for the purpose of gathering data. The system generates between 3-6 signals per session upon detecting a qualifying setup and entry signal. Currently being tested only in LONDON and only using certain pairs. The win rate and expectancy are unknown. Please do not take these trades.