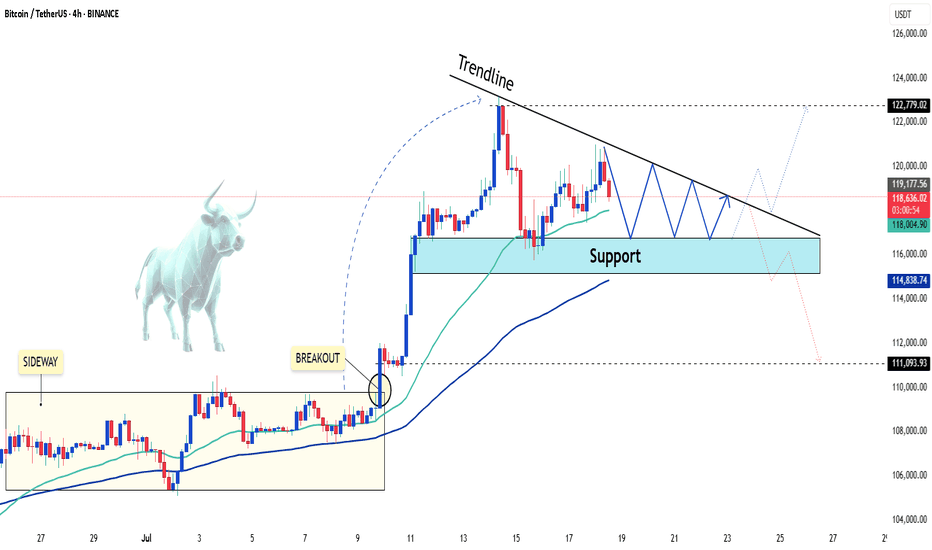

BTCUSD – bullish momentum is backBitcoin is making a strong comeback, breaking above short-term resistance and reestablishing its uptrend after a prolonged consolidation phase. The technical structure now shows clear control from the bulls, with higher highs and higher lows beginning to form.

Positive risk sentiment and growing expectations of capital flowing back into the crypto space—especially after a series of weak U.S. economic data—are fueling the current BTCUSD rally. If momentum holds, the next target could be the upper boundary of the price channel.

Keep an eye on how price reacts at key levels and trendlines — this might be the launchpad for the next bullish leg.

Good luck, and if you enjoyed this analysis, don’t forget to hit like and drop a comment!

Long-short

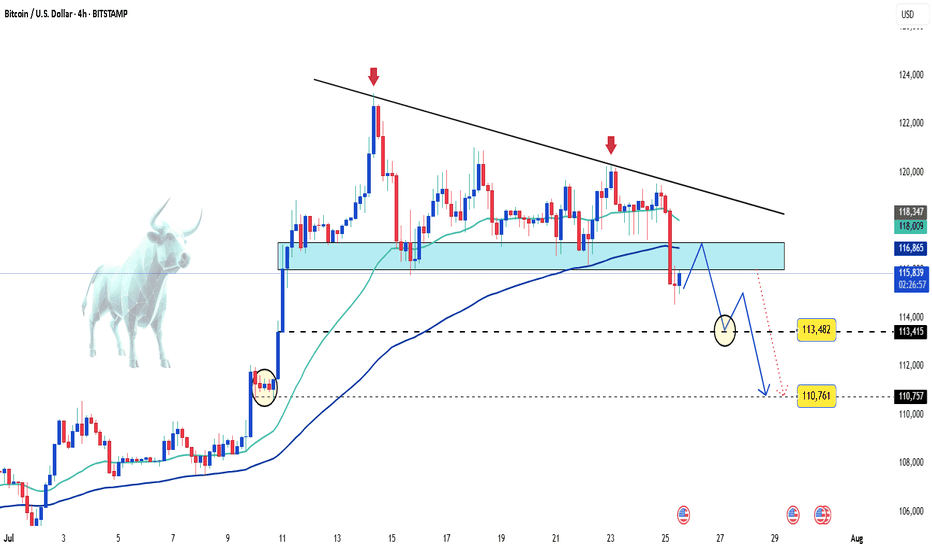

Bitcoin on the edge – Is a sharp drop coming?Bitcoin is keeping investors on edge as price action remains volatile and primed for an explosive move once news or capital flows ignite the market.

🌍 Latest market updates:

– Whales are back in accumulation mode, with on-chain data showing large wallets growing rapidly.

– The U.S. government has just transferred a significant amount of BTC to exchanges — is a dump coming?

– U.S. spot Bitcoin ETFs are witnessing record inflows after CPI came in lower than expected, fueling hopes that the Fed will pause further rate hikes this year.

📉 Technical outlook:

– On the H4 chart, BTC formed a tightening wedge pattern, which has now broken to the downside.

– A steep drop toward the 113,000 to 110,000 USD zone is entirely possible.

This looks like a classic break-retest setup — a golden window for strategic entries. If sell volume surges, it could be the perfect moment for bears to strike.

Stay sharp — and good luck!

The Edge Of The Fork - The Joker In Your PocketWOW!

\ \ First of all, I want to say THANK YOU for all the boosts, follows, and comments. You guys & gals give me the energy to continue this journey with you.\ \

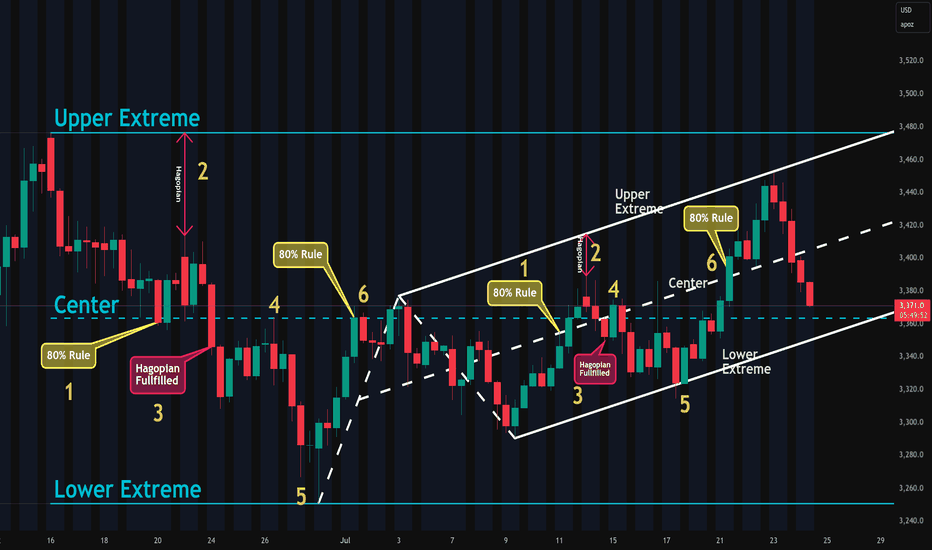

Today, I want to show you that what we’ve learned with horizontal lines can also be applied to "Medianlines," or Forks.

Listen, I don’t want you to blow your brain with all the rules.

Not at the beginning of this journey, and not later on either.

Don’t ask yourself:

* when to use which Fork

* which swing to measure

* when to trade

* where to set your stop

* what if... bla bla bla

That’s not fun — that’s stress.

I don’t like stress — nobody does.

So let’s just chill and have fun here.

That’s my personal reason for doing all this Trading thing. I want to have fun — the money will take care of itself, just like the destination of a trail takes care of itself, as long as I keep putting one foot in front of the other. And that’s simple, right?

So let’s do it exactly the same way.

Just simple steps, connecting some dots, and BAM! — You’re there before you even know it §8-)

\ Let’s jump to the chart:\

Today, you’ll find out why Medianlines/Forks are a cousin of the horizontal Channel — but NOT the same.

Where are they different?

Forks are different because they’re capable of projecting the most probable path of price. And that’s a HUGE difference.

Yes, you can apply the full rule set of Forks to a horizontal Channel.

But the Channel CANNOT project the most probable path of price.

I hear you, I hear you: "No one and nothing can foresee the future. How is it even possible that Forks can?"

\ Here’s why:\

There’s a thing called "Statistical Importance." And it means that if something happens very often in the same way, we have a higher chance of seeing the same behavior again in the future.

And that’s what the inventor, Allan Andrews, discovered — and he created the rules around his findings.

\ A high probability that price will move in the direction of the projected path, as long as it stays within the boundaries of the Medianlines/Fork.\

That’s the whole "magic" behind Medianlines/Forks.

And the same applies to the "Behavior of Price" within and around Medianlines. That’s really all there is to it.

Look at the chart and compare the Channel and the Fork:

1. Price reaches the Centerline about 80% of the time

2. HAGOPIAN → price goes farther in the opposite direction than where it came from

3. HAGOPIAN’s rule fulfilled

4. Price reaches the Centerline again

5. Price reaches the other extreme

6. Price reaches the Centerline about 80% of the time

You’ll see the same behavior inside the Fork!

That’s beautiful, isn’t it? §8-)

And here’s a little Joker in your pocket — if you know the difference between the Channel and the Forks!

Do you know what it is?

Yep! You’d automatically know the direction to trade — giving you another 10% edge right out of the box — LONG TRADES ONLY. Because the Fork projects the most probable path of price to the upside, not down.

That's all folks §8-)

Like this lesson?

With a simple boost and/or a little comment, you load my Battery so I can continue my next step on the trail with you.

Thank you for spending your time with me §8-)

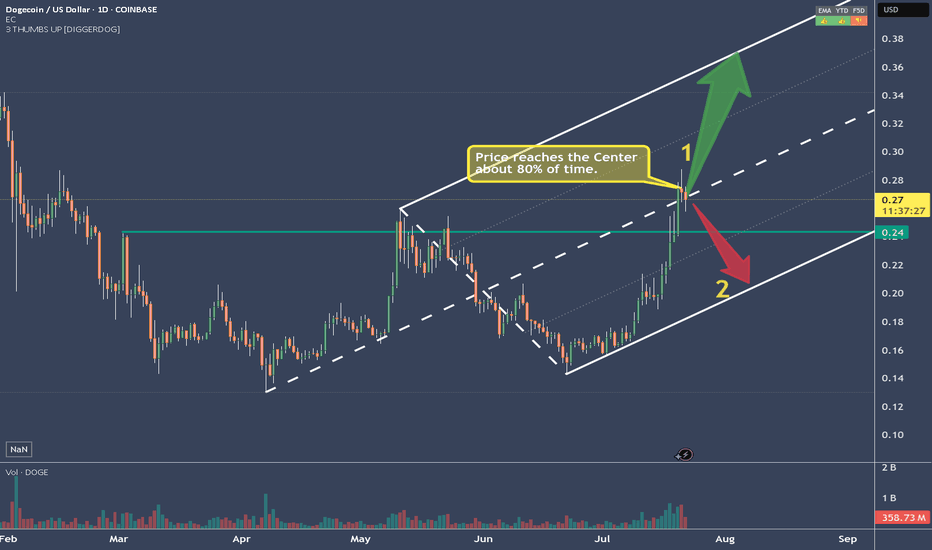

DOGEUSD Has reached it's (first?) targetAfter reaching the Centerline, price eitheradvances to the Upper Extreme (U-MLH), or it reverses and it's target is the L-MLH, the lower Extreme of the Fork.

An Open & Close below the Centerline would indicate further progress to the downside.

A stop above the last high with a target around 2 would be the trade I would take.

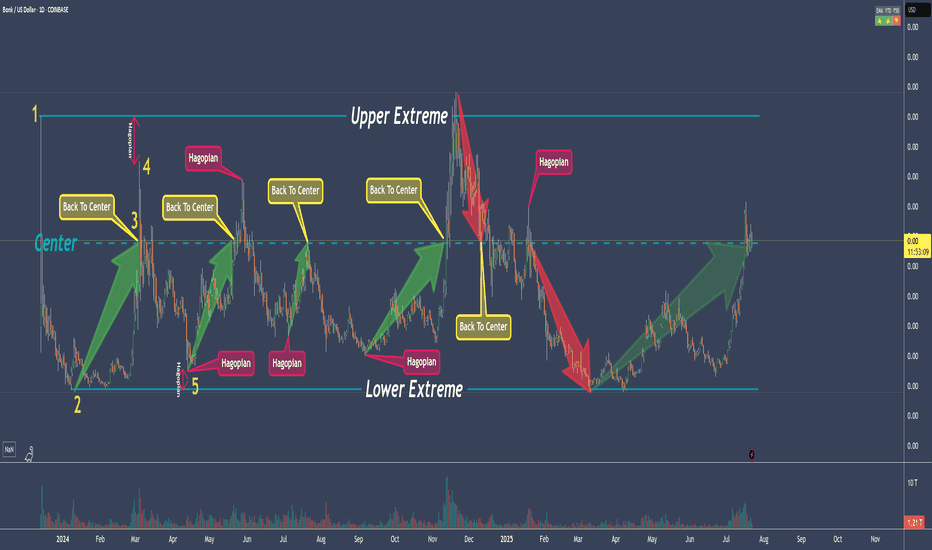

80% Of Time - A Trading Edge You Don't Want To MissDo you want to know why trading with median lines, also known as pitchforks, can be so successful? It’s simple:

Prices swing from one extreme back to the middle.

From the middle, they often swing to the other extreme.

What do we see on the chart?

- The upper extreme

- The center

- The lower extreme

So far, so good.

Now let’s follow the price and learn a few important rules that belong to the rulebook of median lines/pitchforks, and with which you can make great trades.

Point 1

The price starts and is sold off down to…

Point 2

...and from there starts to rise again, up to…

Point 3

...which is the center. And here we have a rule that is very important and one that you need to be aware of in trading to be successful:

THE PRICE RETURNS TO THE CENTER IN ABOUT 80% OF ALL CASES

If we know this, then we can stay in a trade with confidence.

Point 4

The price climbed even higher but missed the upper extreme.

This is the “Hagopian Rule” (named after the man who discovered it).

And the rule goes: If the price does not reach the next line (upper extreme, lower extreme, or center), then the price will continue moving in the opposite direction from where it originally came.

Phew...that’s a mouthful ;-)

But yes, we actually see that the price does exactly this.

From point 4, where the price missed the upper extreme, the price not only goes back to the center but continues and almost reaches the lower extreme!

Now if that isn’t cool, I don’t know what is!

And what do we have at point 5?

A "HAGOPIAN"!

What did we just learn?

The price should go higher than the center line.

Does it do that?

Oh yes!

But wait!

Not only does the Hagopian Rule apply. Remember?

"The price returns to the center line in about 80% of the cases."

HA!

Interesting or interesting?

So, that’s it.

That’s enough for now.

Now follow the price yourself and always consider which rule applies and whether it’s being followed.

How exactly do you trade all this, and what are the setups?

...one step at a time.

Don’t miss the next lesson and follow me here on TradingView.

Wishing you lots of success and fun!

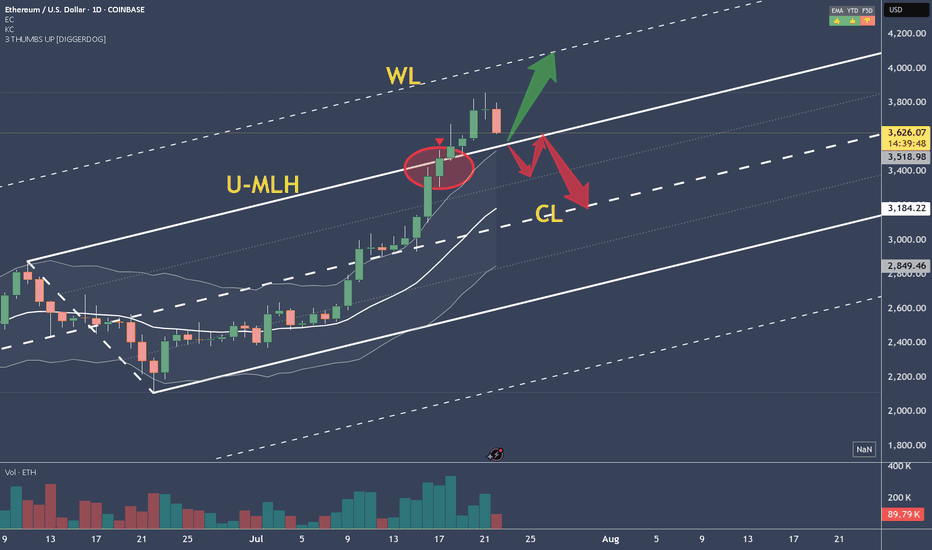

ETHUSD - Decision TimeWhat do make of the current situation?

What if you are long?

Here's what to expect:

a) support at the U-MLH, further advancing up to the WL

b) open & close within the Fork. If so, there's a 95% Chance of price dumping down to the Centerline.

Taking 50% off the table is never bad.

50% money in the pocket if price falls down to the Centerline.

Or if it advances up to the WL, you still have 50% that generates profits.

Either way, you have a winner on your hands.

Don't let it dig into a Looser!

BTCUSDT: A Period of Adjustment and the Next TrendAfter a strong rally to record highs, BTCUSDT is currently entering a period of slight correction. The coin is now trading around 118,500 USD, down more than 0.57% on the day.

From a technical perspective, BTCUSD is moving within a narrowing price wedge, showing a slight downtrend. The support level at 116,500 USD is acting as a springboard for the Bulls. However, as the price approaches the tip of the wedge, a breakout may occur at any time, with two possible scenarios highlighted on the chart.

My personal outlook is that BTCUSDT will continue to decline in the short term before breaking out of the wedge in an upward direction. What do you think about BTCUSDT?

Please share your thoughts in the comments and don’t forget to like this post!

Wishing you all happy and successful trading!

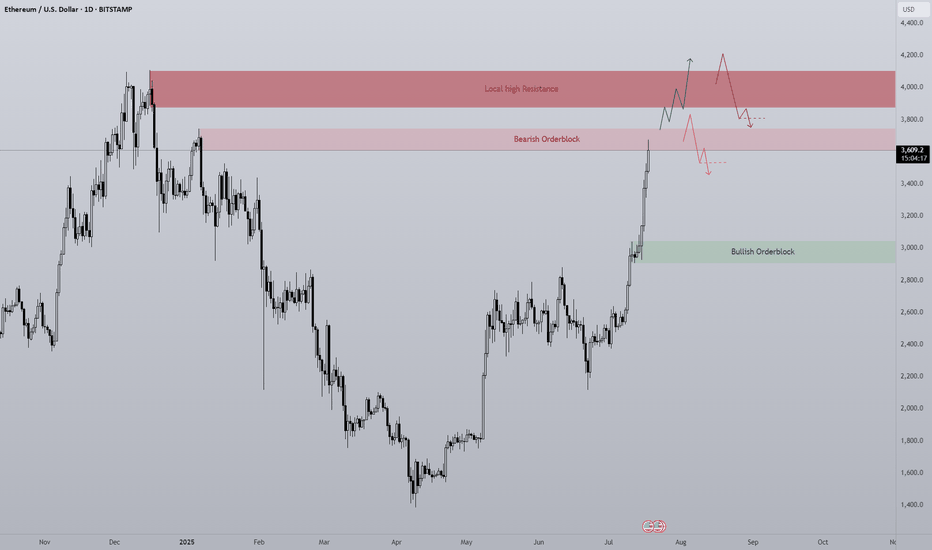

ETH 1D Overview Finally we are seeing altcoins regaining lost ground on Bitcoin and the second largest crypto by market cap is rallying strong.

Since ETH has such strength currently the opportunity to short is quite slim with high risk, however I think it's important to see where ETH may find some resistance or if a pullback was to happen, where would it come from?

The first level is the bearish orderblock level that has just been tapped as of writing. This area previously began the sell-off at the end of 2024 by confirming a new lower high. Naturally this area will present problems for the bulls and so a potential pullback could be initiated from this level. I would like to see a sweep of the stop loss positions just above the area and then a SFP to confirm the pullback is in motion.

Should the bearish orderblock fail the next clear level is the daily local top around $4000. A big even level and the area that started 5 months of downtrend. IMO the most likely level where longs will take profit. I do think if we see any form of consolidation between the bearish orderblock and the local high the bulls will look to carry the rally on, shallow pullbacks maintain momentum

Ten out of the last eleven days have been green candles with the only one day being red just above a key high, I expect if we are to get a pullback that bullish orderblock area ($2900-3000) to be retested as support. Therefor if any of the above areas initiate a pullback this area should provide support and therefor a long entry.

To clarify I am in no way bearish about Ethereum, this is just a plan for different eventualities.

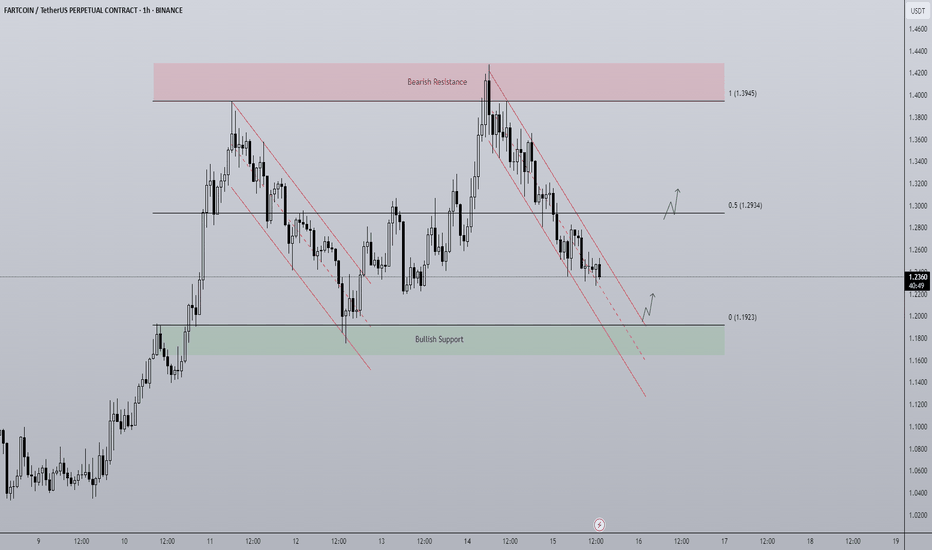

Fartcoin - Rangebound repeat? A BTC makes new highs attention has turned towards altcoins to play catch up.

FARTCOIN has been a top performer of the last month and currently on the 1D timeframe finds itself in a rangebound environment capped between $1.1923 - $1.3945. The end of last week price trended down in a bearish channel from top to bottom and it looks to be doing the same currently. As the supply zone above the range high got swept, price printed a SFP getting back inside the range and began trending down, for me there are two actionable long entries here:

- A range low bounce + breakout of trend channel would be an ideal long entry. An area of clear support coupled with a breakout is a historically strong setup with a clear invalidation if price breaks below the range and gets accepted.

- A more aggressive but potentially less ideal setup would be a breakout of the downtrend before hitting range lows. Higher risk as the level of support is not as defined but in the more risk-on environment crypto is currently in, the chance of major support levels being front run does go up as buyers become more impatient when FOMO grows.

The midpoint is key level to look out for too as a reclaim would mean a run at the highs, rejection opens the door to retest the lows.

14/07/25 Weekly OutlookLast weeks high: $119,494.32

Last weeks low: $107,467.52

Midpoint: $113,480.92

NEW BTC ATH!

This is what we've all been waiting for, BTC breaks through resistance at $110,000-112,000 to set a the highest weekly close ever ($119,086). Thanks to a further $2.27B net inflows via BTC ETFs, the passing of the "big beautiful bill" flipping from a more deficit reduction stance by the US to an environment perfectly suited to risk on assets. Things are looking good for Bitcoin.

This week already in the Asia session BTC has broken above the weekly high to hit $123,100. Despite this incredible rally BTC.D has been falling since Thursday of last week. To me this signals altcoins have started to play catch up and we've seen that with ETH breaking $3000 (+14% relative to BTC).

I would like to see BTC consolidating here above the weekly high while altcoin majors break their choppy rangebound environments and shift to a trending environment just as BTC had last week.

There are also major data releases this week:

Tuesday CPI

Wednesday PPI

Thursday Euro CPI

Thursday US Initial Jobless Claims

I do not expect these data releases to have a major effect on the markets in their current state due to the risk appetite we've seen in both crypto and equities, such shallow pullbacks prove the demand is there to absorb and sell-side pressure for now.

Now is an excellent time to back strong projects with great fundamentals that are breaking out from downtrends/ranges in both their USD & BTC pairs, as BTC.D drops alts can print some great returns. Beta plays of ETH & SOL can offer higher returns than the majors themselves in these market conditions too.

Good luck this week everybody!

TOTAL Q3 As Q2 closes, Q3 begins...

The 2nd quarter of 2025 made up for a lot of the losses of Q1 peaking at $3.5T in the middle of the quarter. Since the peak a steady downtrend channel has formed and continues to be the case going into Q3.

What can we expect to see in the next 3 months in the crypto market? For me there are two different scenarios that are bullish, and one that is bearish IMO:

Bullish scenario 1 - The most likely scenario I think is a breakout above the downtrend channel and a move towards the range top. My reasoning for this comes from what we know about the driving forces in the market. Just last week BTC ETFs had a $2.2B net inflow, MSTR bought another 4,980BTC for $531.9m, various ETFs on the way for other majors such as SOL. Crucially the M2 money supply is at a record ATH. What that means is huge demand and the means to purchase with a what feels like a deadline closing in.

Bullish scenario 2 - We see a trend continuation until the range midpoint which has provided support before. It would coincide with the bottom of the trend channel and therefor I believe would provide a good launchpad for long positions.

Bearish scenario - For me this is the least likely situation but one that must be prepared for, a loss of the range midpoint would be a major setback, one that would mean a potential revisit of the range low in a symmetrical move down mirroring Q2s move up. The reason I believe this is the least likely is there is just too much in favor of risk on assets like crypto currently, I've mentioned the fuel that is the M2 money supply piling up to be deployed. A US interest rate cut all but confirmed for September and the institutional race for acquiring these assets before it is too late.

In conclusion just keeping it simple on the chart, a breakout above the trend channel is a great long opportunity to target the highs.

If BTC continues the grind down a great place for it to turn bullish is the range midpoint as has happened previously.

In the event BTC loses the midpoint a retest of the weekly low would make sense to me.

EURUSD M15 Forecast - Check related IdeaAs explained in previous post we are expecting a pull back down to our order block (H4) then a bullish reversal to retest last weeks highs (1.16) region. If price breaks and closes above the M15 supply zone will have to re-evaluate and potentially take a long position from a retest into a FVG.

TAO 4H - Downtrend bottom? Altcoins have certainly taken a backseat to BTC this cycle with Bitcoin dominance holding around 65%. Despite this, there are still some good setups in altcoins presenting themselves each day, one of which is TAO on the 4H.

To me it looks to be in a clear downtrend respecting the upper and lower limits while reacting off of support levels on the way down. As it stands price has reached a key S/R level that has proven to be support in the past and is in conjunction with the lower end of the trend channel.

With FOMC only hours away and TAO being at such a critical level this would be an interesting place to do business. A good reaction off the level would kickstart a move towards the trends upper limits. A loss of this level and it's very possible what has been support can turn into resistance.

To me the R:R here is good for a long position, the threat to the trade is bearish reaction to FOMC, escalation geo-politically which effects risk-on assets and therefor overalls TA.

Eurgbp Buy price is currently bullish on 4hr timeframe. its trading around the 4hr demand zone and there are also lower timeframe demands zones within the 4hr demand zone add stregnth to it. there are multiple pois above current pirce action which may fuel the buy bias. im wating for price to break a 5min supply zone thats near a 4hr poi in order to enter the trade.

! Audnzd Sell !audnzd is currently in a bearish trend on the Daily tf. its also trading inside of a Daily Supply zone. at the moment price is rejecting off a 30 and 15 poi levels. giving they are also in the Daily supply zone we have confluence added strength the Daily bearish bias. there are 4hr key levels underneath. im waiting to under for a close under the area where theres a 4hr and 15m key level close to each other.

EURUSD Potential Long then ShortEUR/USD looking to trade around a key supply zone between 1.1450–1.1500. We’re watching for signs of bearish rejection to build a short bias from this area. No trade unless price confirms.

Main Setup:

If price retests upper zone (~1.1450–1.1500) and shows clear bearish price action, I’ll be looking to enter short.

Ideal signs: rejection wicks, SFPs, bearish engulfing, lower timeframe structure shift.

Break & Retest Option:

If price breaks below 1.1390, a clean bearish retest could offer a continuation short setup.

Structure break confirmation is key here.

This is a forecast, and trades will be dependent on live PA.

If we don’t get confirmation, we don’t force it. Patience is key.

DXY Outlook:

The Dollar Index looks bearish overall but is currently in a small corrective bounce. A short-term DXY pullback would support a push into EUR/USD’s supply zone — lining up nicely with our plan. If DXY flips back to bullish, that strengthens our short setup.

gbpnzd sellprice is in a 1hr supply at the moment and trend is bearish on 1hr 4hr tf. price is visiting the 1hr zone for the first time on 15m tf. it will form a double top if it closes fueling sell momentum. since its been in a steady uptrend it may look to retrace if it wants to go up. im looking to enter once price trade below the leg of the swing entering the 1hr zone.