OptionsMastery: Breakout Setup on SBUX!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Long-short

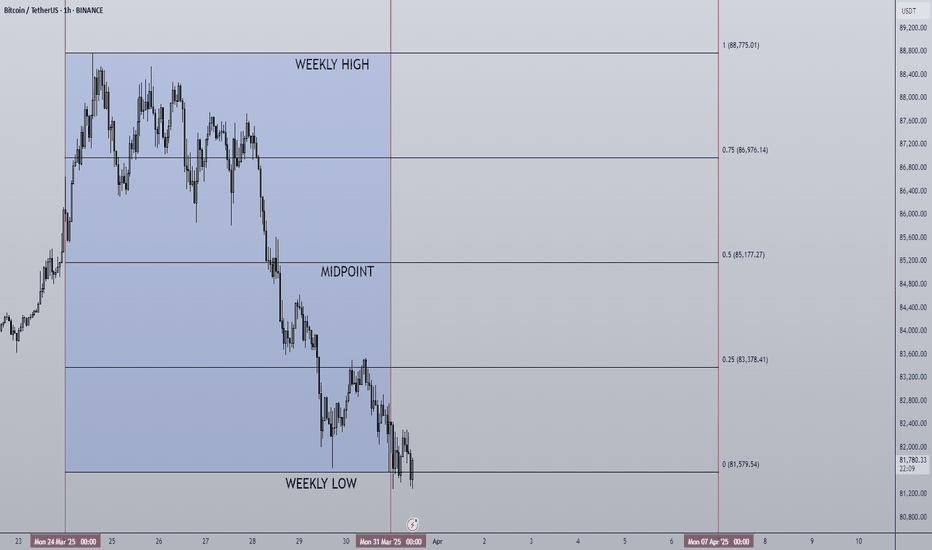

31/03/25 Weekly outlookLast weeks high: $88,775.01

Last weeks low: $81,579.54

Midpoint: $85,177.27

As Q1 2025 draws to a close, last week we saw a mirror image of the March 17th week with a swing fail pattern of the weekly high and a gradual sell=off throughout the week.

The reluctance for buyers to step into the market under the $91,000 resistance is telling me that the bulls are just not confident in current market conditions to bid into resistance. This may be because of the Geo-political factors, ongoing war, tariffs etc. Uncertainty does worry investors and so it's a valid reason.

From a TA standpoint however is a bigger worry in my opinion. Bitcoin failed to flip the 4H 200 EMA after the 8th time of trying since mid February and that is the biggest concern for me. As long as this moving average caps and reversal pattern then the trend is still bearish and should be treated as such.

$73,000 is still the target for a downward move IMO, a further -10% move from current prices. For the bulls a SFP of the weekly low could set up another bounce to weekly highs that have remained in approximately the $88,000 zone for two straight weeks. Major resistance around those levels and of course the dreaded 4H 200 EMA must be flipped too. Currently this is a tall order given how price action has been of late, sentiment is poor and altcoins are completely decimated in most cases. So I can't see the majority wanting to buy in until these criteria are met and we're trading back above $91,000.

This is still a traders environment, not a Hodler/investor.

BTC DAILY - MA compression On the daily timeframe something very interesting is happening. A convergence of price around the blue KEY S/R is very interesting when you factor in what the moving averages are doing around this level also.

1D 200 EMA is completely flat having lost all of its momentum with the months of chop and then the sell-off into current levels. For a bullrun to be credible you want to see price above this level and a steady/steep slope up. Due to the lack of direction of this moving average price is able to climb above and drop below very easily and therefor it is neither support nor resistance until there is a trend.

1D 25 EMA is a different story, now that BTC has put in a local top and trending down, the 25 EMA is resistance but has been flipped in the last few days with price bouncing off the level 4 days in a row. This is good news for the bulls but the longer we linger here there is more chance dropping back under it.

Diagonal resistance as simple as it is has 4 points of contact and will be a big point of resistance and one many traders will be keeping an eye on.

On the lower timeframes we're seeing a bullish channel, a loss of this channel would be a huge red flag and a catalyst for a risk off event IMO, continuing the downtrend.

BITCOIN 4H - 8th time lucky? The 200 EMA is a great indication of the environment a certain asset is currently in. If the 200 ema is not being respected as neither support nor resistance then generally the market environment is rangebound. If an asset is in a trending environment then the 200 ema is often being respected, as in the moving average acts as a key support in an uptrend or as resistance in a downtrend.

What we have seen from BTC is a clear shift from rangebound PA where it seems as though the 4H 200 EMA has no effect on price and is sat relatively neutral with no gradient, to a clear downward gradient capping off any attempt for the bulls to move higher. Eight separate occasions the bulls attempted to flip the moving average and failed each time, until now?

Having ended last week strong with a reclaim of $86,000 an early Monday push has seen BTC close a 4H candle above for the first time in 7 weeks. It is important to note that when the MA is still sloping downward it is still seen as a resistance level, a retest as new support while the slope levels out is always a possibility.

I am now interested in the question of, if Bitcoin reclaims the 4H 200 EMA, does it flip to a bullish trend or another rangebound one? That's where the $91,000 S/R comes in, as a reclaim of that level would put BTC into a LTF rally and therefor bullish trend, rejection off that level would see the MA level-out and becomes less important and therefor rangebound.

Comment with your thoughts on this idea.

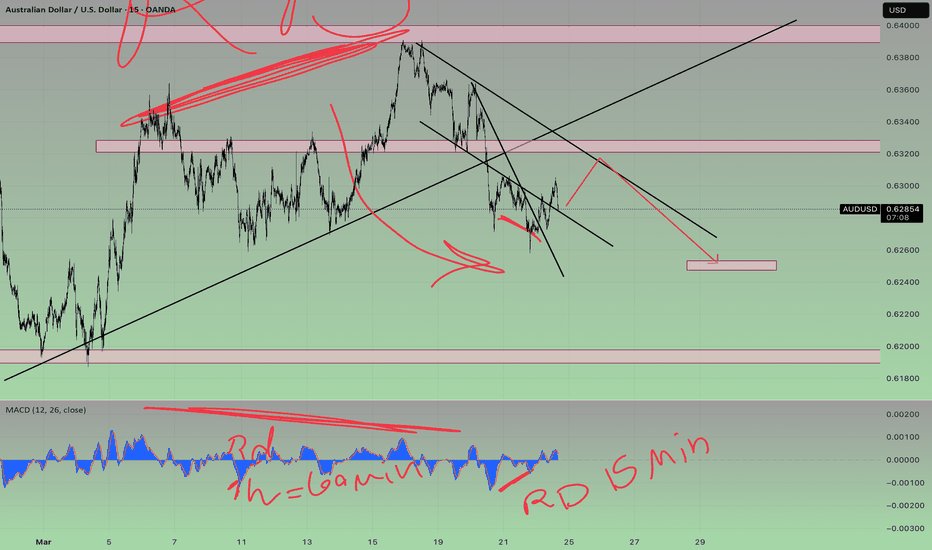

AUDUSD BUYWe have a specific type of divergence on the 1-hour timeframe ⏳, indicating a potential drop 📉 in the higher timeframe. On the other hand, the lower 15-minute timeframe 🕒 gives us a buying perspective 📈. So, the analysis will be as shown in the image.

#audusd #ForexTrading #PriceAction #ForexSignals #TradingAnalysis 💹

24/03/25 Weekly outlookLast weeks high: $87,453.65

Last weeks low: $81,140.91

Midpoint: $84,297.28

Great weekly close for the bulls! A reclaim of the weekly high in the dying hours of the week is a huge win and has spurred on an early run for the weekly high.

The overall goal for this move should be $91,000 in my opinion, and a must not lose area is $86,000 or 0.75 line/ last weeks weekly high.

What happens at $91,000 is yet to be determined and I have an idea many will be tentative around that area. On the high time frames a reclaim of this level unlocks the capability to retest the highs from a TA standpoint as price re-enters the range bound environment. A rejection of that level would make a $73,000 retest a very real possibility.

In terms of altcoins we're seeing some strength returning with some strong gains but relative to their sell-offs it is a a drop in the ocean so far. Currently the market conditions are a traders dream but a long term investor/holders nightmare. No major news is planned to come this week so unless something drastic happens TA should be the driving factor this week.

BTCUSD - Decision Time.As we see, price is at the white L-MLH.

This is a critical level.

On one hand, price showed weakness.

On the other hand, price is stretched to the downside, bearing the possibility to shoot upwards from here.

How can we find out what's happening?

By observation and NOT ACTING!

Just watch, observe, and a good entry Long or Short will uncover. FOMO is your greatest Enemy!

Calm down, wait for the sweet Fruits that will be given to you. §8-)

Secure profits of SHORTBitcoin (BTC) Market Analysis – March 10, 2025

Chart Overview & Key Insights

This is a daily timeframe BTC/USDT chart on Bybit, showcasing a confluence of indicators including the BitcoinMF PRO signals, standard error bands (not Bollinger Bands!), Fibonacci levels, and support/resistance zones. Below, the Fisher Transform indicator is displayed for trend confirmation.

🔍 Current BTC Price Action & Key Observations

Price: $79,404 (-1.60%)

BitcoinMF PRO last short signal hit take profit (TP) → This often results in buy pressure as shorts take profits and exit, creating demand.

A new short signal is forming, but it’s in a riskier position:

Shorting too late into a move can be dangerous, as the market tends to reverse to hunt late shorts.

Price is already near key support zones (~$80,133 and lower at $73,240).

Linear Regression (LR) Channel: Price is currently testing the lower boundary, which often acts as support.

Volume Analysis: Increasing red bars show strong selling pressure, but potential buyer defense near key levels.

📉 Fibonacci & Support/Resistance Levels

🔻 Key Supports:

$80,133 (Short-term support)

$73,240 (Stronger support)

$65,485 (Major support)

🔺 Resistance Levels:

$86,163 (First target if price rebounds)

$92,957 (Major resistance)

🛠 Fisher Transform Indicator (Bottom Panel)

The Fisher Transform is deep in the oversold zone, which historically indicates a high probability of reversal.

If the blue line starts turning upward, it can indicate a bounce incoming.

Right now, Fisher is at extreme levels, meaning that while more downside is possible, a reversal could be forming soon.

📉 CME Gap Around $70K – What It Means

CME gaps occur when Bitcoin futures on the Chicago Mercantile Exchange (CME) close for the weekend and reopen at a different price.

A well-known market phenomenon is that Bitcoin tends to "fill" these gaps over time.

There is a gap in the $70K region, meaning Bitcoin may be magnetized toward that level before a major reversal.

🔍 How This Affects the Current Market?

Current BTC Price: $79,404

CME Gap Zone: $70,000–$72,000

Major Support Zones: $73,240, then $65,485

🛠 Possible Scenarios

1️⃣ BTC moves down toward $70K to fill the CME gap before bouncing.

This is a logical move, especially as Bitcoin is already in a downtrend.

Traders should be cautious of a liquidity grab below $73K.

2️⃣ If BTC doesn’t drop immediately, a short squeeze could come first.

Many late shorts have entered the market (as seen in open interest data).

A squeeze up to $86K– GETTEX:92K could trap them before Bitcoin eventually moves down.

📊 CME Gap Probability in the Current Context

🔹 Likelihood of BTC filling the $70K CME gap: 8/10

🔹 Before that, BTC could see a bounce (short squeeze): 7/10

🧠 What’s the Next Most Probable Move?

📊 Probability Scale (1-10)

Next Move Probability: 7/10 for a bounce before further downside

📉 While BTC is in a downtrend, several factors indicate that shorting now is riskier than before:

Last BitcoinMF PRO short hit TP → Buy pressure from short profit-taking.

Extreme oversold Fisher Transform.

Price sitting near critical support ($80K zone).

🔹 Possible Scenario:

Short squeeze to $86K before any further drop.

If $86K gets rejected → A continued downtrend to FWB:73K or lower.

📢 Conclusion & Trading Strategy

If you are short: Secure profits or set a tight stop-loss in case of a short squeeze.

If you are long: Look for signs of Fisher Transform turning up before entering.

Shorting here is riskier as the market may hunt late shorts before going lower.

⚡ Watch for a relief bounce! While more downside is possible, liquidity grabs often happen before continuation moves. Be strategic with stops and TP zones.

📜 Ancient Wisdom – Patience & Timing in Trading

There’s an old Jewish saying:

"Gam zu l'tovah" – "This too is for the best."

A great trader, much like a wise man, waits for the right moment instead of rushing into moves impulsively. If the market is preparing a short squeeze, traders who chase shorts too late may find themselves trapped. Timing is everything.

🔹 BitcoinMF PRO users caught this downtrend early – consider using it for future trades!

🚀 Get it on TradingView today! 🚀

10/03/25 Weekly outlookLast weeks high: $93,745.25

Last weeks low: $80,029.90

Midpoint: $86,887.58

Last week in crypto saw the first White House Digital Assets Summit. An event that only as recently as the last bull cycle we could only dream of taking place. In the summit that hosted the biggest names in the space a vow was made by the US Gov never to sell their BTC, to establish stablecoin regulatory clarity and to stockpile various US made altcoins. A historic moment but how did that relate to the chart?

Well BTC dropped 14.6% from weekly high set at the beginning of the week to weekly low set at the end of the week. The most important aspect is how this now looks on the higher time frames, the once strong support level of $91K has now been confirmed as new resistance as BTC tried several times to reclaim it and in the end fell away. This now puts BTC in the FVG area from $91-73K. With no real support until the $73,000 level this is knife catching territory and with the SP:SPX rolling over too I would need a lot more evidence that BTC will turn around before going long with any real size.

This week I anticipate further sell-off, now I would be happy to be proven wrong on that however it does look like we are heading towards FWB:73K where I would like to see buyers stepping up and start to dominate the orderbooks. Structurally that would fill a large inefficiency area with an eye to bounce off support and move back towards currently levels ~ GETTEX:82K as that would be the midpoint of the FVG although that is a few steps in the future.

CPI takes place this week and so volatility may be expected but unless the result is wildly different to the forecast numbers the whipsaw PA should level out fairly neutral.

Invalidation on this idea would be a successful reclaim of $91K which is previous mini range low & 4H 200 EMA resistance.

BTC 12000-19000 ?!!! Possibly yes...If BTC falls below $49,000, we could see a major drop to the $12,000 - $19,000 range! This level is a critical support, and losing it could trigger a cascade of liquidations.

📉 Watch for confirmation and manage your risk accordingly!

💭 What are your thoughts? Bullish or bearish? Let’s discuss!

#Bitcoin #BTC #Crypto #Trading #CryptoMarket #Bearish #Bullish

Let me know if you want any tweaks! 🚀

White House Crypto Summit 2025Today on March 7th the White House will host a Crypto summit for the first time. This summit is expected to host

many prominent figures in the space, here are some of the main ones:

Michael Saylor Founder of Strategy.

● David Bailey CEO of Bitcoin Magazine.

● Matt Huang Co-founder of Paradigm.

● Zack Witkoff Co-founder of world liberty financial

● SEC Chairman Paul Atkins

● Changpeng Zhao (CZ) Co-founder of Binance.

● Kyle Samani Managing partner at Multicoin Capital.

● Anatoly Yakovenko Co-founder of Solana.

● Charles Hoskinson Co-founder of Cardano.

● Sergey Nazarov Co-founder of Chainlink.

● Brian Armstrong CEO of Coinbase.

● Vlad Tenev CEO of Robinhood.

● Arjun Sethi CEO of Kraken.

● Kris Marszalek CEO of Crypto(.)com.

● Brad Garlinghouse CEO of Ripple.

Trump is expected to sign executive orders at 3PM EST during the summit but what these orders are is not confirmed as of yet. I would speculate the "Strategic Reserve" including BTC,ETH,SOL,XRP & ADA would be an EO in some capacity as all of the founders/CEOs of those projects are in attendance. Perhaps regulatory framework, a tariff based system to reward US based crypto projects? In truth the specifics are unpredictable.

What we do know is that each of the major announcements have been sell the news events, as the saying goes "Buy the rumor, sell the news" and that has been true so far. Will this be a repeat? This summit so far has not had a rally going into this event, the charts show that BTC and the broader market have pulled back and retested last years chop range high after a liquidity sweep of previous ATH. Altcoins fairing worse than Bitcoin but structurally very similar. I do think the bearish structure of the HTF chart has many worried, sentiment is very low and many see the sell off continue. Either this is a genius way to acquire cheaper coins for the upcoming reserve or many will be caught offside or sidelined.

For now I am not taking sides, there is no clear read on this event for me but I can guarantee huge volatility on the low time frames, whether this leads to a meaningful move on the high time frames is yet to be seen.

$BTC - Wait For $85,000 BuysRE: BTC Under $100k, Where Do I Buy?

Hello Friends,

For those of you looking to capitalize on Bitcoin BITSTAMP:BTCUSD you may want to add to your position, or start accumulating for the first time.

My ideal entry will be at $85,158.42

Check out this link for my BTC Exit Strategy:

XRP DAILY XRP close to retesting the 1D 200 EMA for the first time since the US election. For now I can see a few key levels that create a smaller mini range made up of the DAILY RESISTANCE as the top, KEY S/R as midpoint and BULLISH ORDERBLOCK as the low which will coincide with the 1D 200 EMA soon.

- Current price action is extremely volatile so directionally it's difficult to tell where we are goin in the short term, but I would become interested at the extremes of the mini range.

- A LONG entry would be a more gradual revisit of the Bullish Orderblock and the 1D 200 EMA, that would be a great place to go long because the directional bias would be more clear and uncertainty cleared up.

- A SHORT would be a sweep of the supply zone and drop back into the mini range which would aim to go towards the midpoint and then range low/ 1D 200 EMA.

In general the next few days will be volatile, FOMO will be huge but keeping rational is important.

17/02/25 Weekly outlookLast weeks high: $98,823.86

Last weeks low: $94,093.81

Midpoint: $96,458.84

Not a whole lot to comment on for this weekly outlook, we had a tighter weekly range last week ( EUROTLX:4K instead of $11K) however the midpoints were both $96K and both weeks started at their respective midpoints. For me this suggests a coiling of bitcoins price with anticipation for a larger move in a given direction, this could be either bullish or bearish we are yet to see.

Since last weeks CPI inflation print of a hotter than forecast 3.0%, a dollar that is finally rolling over and tariffs put on hold until April 1st, these factors should all play into the hands of the bulls but the chart needs to reflect this.

For this week I am anticipating more chop, if the pattern of tightening weekly ranges continues with no real idea of direction then the opportunity for credible trades reduces until we get an idea of trend direction. Right now there is no trend direction and so bitcoin should be treated as such.

Altcoins continue to suffer across the board and IMO this will not change until we see a bullish move in BTC. This environment is for short term traders as it stands.

NVDA - Back again, now down again?The pattern seems to repeat.

Again, we had a HAGOPIAN, which sais, that price goes back more than from where it came, and this rule was right.

Up in here, I'm not that confident anymore that price will reach the Centerline. But, it's not about what I think, or how confident I'm are. I just have to follow my Strategy and act according to the Rules, the trading framework of the Medianlines.

That said, we either shoot up on earnings, or we definitely tank down. For now, there is no trade, only a Gamble. I rarely gamble, so I'll sit on the sidelines and let it happen whatever will come out on earnings.

As for a Lotto-Ticket, I would buy some Puts and just have fun to watch how they get burned, or how I get a Christmas Moment in the beginning of the new year §8-)

ETH Updated Building Blocks...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

As per our last analysis, ETH broke below the $2,500 mark to enter long-term bearish territory.

Here is the updated Building Blocks:

📉 Short-Term Bearish:

ETH is currently trading within a short-term bullish block between $2,500 and $3,000.

📉 Long-Term Bearish:

If the $2,500 level is broken to the downside, a long-term bearish movement toward the lower bound of the long-term bearish block, around the $2,100 mark, is expected.

📈 Short-Term Bullish:

If ETH breaks above the short-term bullish block at $3,000, it will enter a short-term bullish block phase.

📈 Long-Term Bullish:

If the $3,500 resistance level is broken to the upside, ETH is expected to enter a long-term bullish block, initiating a new bullish phase toward the $4,000 mark.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

BTC CPI 1H (Jan) CPI (YoY)-

PREVIOUS: 2.9%

FORECAST: 2.9%

ACTUAL: ??

Consumer price index data release rolls around once again, this time the forecast is no change (0.0%) remaining at the same December 2024 level of 2.9%. It is important to note that after this data release there isn't any further news events of note until next month so BTC no planned interference from data releases.

As we go into the data release volatility on the LTF is common and so maybe we'll see a break of this painful trend bitcoin has been stuck in since the sell-off event. With that in mind here are some entry ideas for longs and shorts:

Long:

- The safest option/ highest probability would be a breakout from the bearish downtrend, a retest as new support and begin the move up back towards RANGE HIGH.

- A sweep of the green bullish OB zone with a tag of the lower bearish trend line. A good R:R IMO with the first point of interest being the LOCAL RESISTANCE/ bearish trend high.

Short:

- The bearish scenario would be a loss of the $91K support level that has held for the last 10 weeks in a row and is the daily range low. If price accepts under that level things could get ugly as there is no support until $85K.

10/02/25 Weekly outlookLast weeks high: $102,496.97

Last weeks low: $91,204.00

Midpoint: $96,850.48

Another week of Bitcoin within the range and another one begins. With a very familiar low of ~$91K holding for the 10th week running (since the end of NOV '24), with a weekly high of $102,500 (last weekly outlooks midpoint) capping off the highs, will this weeks midpoint also act as the pivatol level? So far the midpoint has been reclaimed, a retest should add confluence to this.

We have a midweek CPI data release with a forecast 0.0% change remaining at 2.9%. These data events often cause LTF volatility and so that should be taken into account, the same is true for PPI on Friday.

Currently the market sentiment is pretty dire, the fear & greed index is at 43, the lowest since before the US Presidential Election.

Altcoins are struggling across the board, with the exception of some CEX coins all large-midcaps are below the 4H 200 EMA. I think that will change if BTC has a strong rally back above the weekly high and reclaims it, that will give the bulls the chance to finally break the $106K brick wall and flip from a rangebound environment into a trending environment again, altcoins would rally very well if this were to happen.

On the other hand is the midpoint is lost then the weekly low will need to hold for the 11th week running.

Good luck traders!

SUI DAILY First retest of the 1D 200 EMA since September '24, and a fill of the FVG area. A very strong reaction off that level but the overall trend of Lower Highs and Lower Lows signals a bearish trend.

For that reason a golden pocket rejection could be the play if price reacts off that level, SUI would then target a move to fill the wick if breaking it can break under the 1D 200 EMA.

I would look to go long if the Lower High is taken out and 1D 200 EMA is confirmed as support.

MOCAUSDT: Oversold, Yet Ready to Explode? The Market Decides!Is the Bottom In? MOCAUSDT Flashes Buy Signals!

The crypto market never sleeps, and neither do opportunities. MOCAUSDT is currently hovering at $0.18582, down a staggering 62% from its all-time high of $0.48845 recorded just 39 days ago. But is this decline setting the stage for a major comeback?

Technical indicators suggest we are at a make-or-break moment. The RSI14 is at 33.2, approaching oversold territory, while MFI60 sits at 43.8, indicating potential buying momentum. Moreover, the price is struggling near the 200 MA (0.18844), a critical level that could dictate the next major move.

Interestingly, a series of VSA Buy Patterns have emerged over the past 48 hours, hinting at accumulation by smart money. Will this trigger the much-anticipated breakout, or is another dip inevitable?

One thing is certain—the next move will be decisive. Are you ready to take advantage of it?

MOCAUSDT Roadmap: Smart Money Moves and Key Market Reversals

Understanding the market is all about catching the right waves at the right time. Let’s break down how MOCAUSDT moved recently, which patterns played out, and what traders can learn from these price shifts.

January 29: VSA Buy Pattern 3 – The market showed signs of a manipulation buy, signaling the start of an upward move from $0.17241 to $0.1772. This pattern was validated as price continued rising, confirming the bulls were stepping in.

January 30: Buy Volumes Max → Sell Volumes – A massive buying volume spike from $0.17809 pushed the price up to $0.19745, but sellers quickly took control, leading to a sharp reversal. This switch from buy to sell dominance marked a critical liquidity grab before the next wave.

January 31: VSA Sell Pattern 1 & 3 – A textbook manipulation sell setup, where price hit $0.22752 before retracing. This was the first major rejection confirming that the bullish move had peaked. Following this, VSA Buy Pattern Extra 2nd appeared at a lower price point, signaling accumulation near $0.20923.

February 1: VSA Manipulation Buy Pattern 4th – Smart money stepped back in, sending the price higher from $0.19388 to $0.19525, reinforcing the long bias. The key takeaway? Every strong dip in this cycle was met with aggressive buybacks.

February 2: VSA Buy Pattern Extra 2nd – The latest signal showed another attempt at accumulation, with price stabilizing around $0.18867. However, the move lacked the aggressive momentum seen in previous buy setups, meaning traders should watch for confirmations before jumping in.

Conclusion: Reading the Tape

MOCAUSDT has been in a highly reactive accumulation-distribution cycle, where every liquidity grab led to a strong price reaction. The roadmap suggests smart money is accumulating, but not in a rush to push the price up aggressively. For traders, the key levels to watch are whether buyers step in at the recent $0.185 range, or if we see another liquidity grab before the real move.

Are we gearing up for a breakout, or is another shakeout on the horizon? Stay sharp, and trade smart.

Technical & Price Action Analysis: Key Levels to Watch

MOCAUSDT is playing the range game, bouncing between key levels. Here’s what traders need to keep on their radar:

Support Levels:

0.17241 – If buyers don’t defend this level, expect it to flip into resistance, trapping late longs.

0.16567 – A critical retest zone; failure to hold means lower bids will get tested.

0.16455 – The last line of defense before deeper corrections.

Resistance Levels:

0.25966 – The first real battle for bulls; if price rejects, expect a fade back into the range.

0.2951 – Major liquidity zone; breaking above could trigger a trend shift.

0.31409 – If bulls clear this, game on for the next leg up.

Powerful Support Levels:

0.2371 – Big money has been watching this level. If it doesn’t hold, sellers will start dictating the trend.

Powerful Resistance Levels:

0.08949 & 0.06603 – Levels that could cap any weak breakouts. If price stalls here, expect consolidation or a fakeout before the next real move.

Trade Logic: If support levels don’t hold, they flip into resistance, and every failed breakout becomes a new short opportunity. The market isn’t giving out free money—trade smart, wait for confirmations, and don’t get caught chasing weak moves.

Trading Strategies Using Rays: Navigating MOCAUSDT Moves with Precision

The market moves in waves, but instead of relying on static levels, we focus on Fibonacci Rays—dynamic price structures that outline the natural rhythm of movements. These rays, based on mathematical and geometric principles, give us a predictive roadmap where price reacts, either bouncing or breaking through.

Key takeaway? Trade after price interacts with a ray and confirms direction. The movement will continue from one ray to the next, forming the key targets of our trade.

Optimistic Scenario: Bulls Take Control

If buyers step in at key Fibonacci ray intersections, we can expect a continuation to higher levels. The first confirmation will be the price breaking above MA200 (0.18844) and staying above.

Entry: Buy after price interacts with a ray at 0.17241, forming a reversal.

First target: 0.2371 – The next ray and powerful support turned resistance.

Second target: 0.25966 – A strong resistance level where a pullback could occur.

Final bullish target: 0.2951 – If momentum stays strong, this is the next major liquidity grab zone.

Pessimistic Scenario: Sellers in Control

If the price fails to hold MA200 (0.18844) and breaks below Fibonacci rays, expect a move lower to the next liquidity zone.

Entry: Sell after rejection at 0.18844 if price fails to reclaim it.

First target: 0.17241 – The closest ray where buyers might step in.

Second target: 0.16567 – If weakness persists, this is the next stop.

Final bearish target: 0.16455 – The ultimate support before deeper losses.

Trade Ideas: Key Setups to Watch

Ray-to-Ray Bullish Breakout: Buy above 0.18844, target 0.2371, stop-loss below 0.17241.

Ray-to-Ray Bearish Breakdown: Sell below 0.18844, target 0.17241, stop-loss above 0.19525.

Range Rebound Trade: Buy near 0.17241, take profits at 0.18844, stop-loss below 0.16567.

Momentum Scalping: If price bounces at 0.2371, buy and target 0.25966, stop-loss below 0.225.

All these setups are backed by VSA rays, which are already plotted on the chart—so stay patient, wait for interaction, and ride the move from ray to ray.

Your Move, Traders! 🚀

That’s the full breakdown—now it’s your turn! Got questions? Drop them right in the comments below, and let’s discuss the best trading setups together.

If you found this analysis useful, hit Boost and save this idea—you’ll want to check back and see how price respects these rays. Trading isn’t about guessing, it’s about understanding key reaction points, and now you have them.

My private strategy automatically plots all rays and levels, making trade setups clear and structured. If you’re interested in using it, shoot me a private message—it’s exclusive, but we can discuss how you can get access.

Need analysis on a different asset? I can chart any market with precision. Some ideas I share for free, while others can be done privately—depends on what you need. Let me know in the comments which asset you want covered next, and if there’s enough interest, I’ll make it happen!

And of course, if you’re serious about trading—follow me on TradingView. That’s where all the real-time updates and insights go first. See you in the next one! 🔥