The analysis focuses on the short-term to medium-term timeframe.The analysis focuses on the short-term to medium-term timeframe.

Tug-of-War Between Bulls and Bears: At the current price of 157.04, the market is in a tug-of-war between buyers (bulls) and sellers (bears).

Bulls are defending key support levels near 152.48 (Fibonacci 100% retracement of Wave C) and 154.34 (Expanded Flat target). A hold above these levels could signal a potential reversal.

Bears are attacking resistance levels at 160.31 (Fibonacci 100% projection of Wave C) and 162.82 (Expanded Flat target). A break below 152.48 could accelerate downward momentum.

Recent Price History: The market has been in a downtrend recently, with the price dropping from 191.18 (July 10, 2024) to 157.04. Key Fibonacci levels (e.g., 161.8% retracement at 159.84) and Elliott Wave patterns (e.g., Diagonal Ending Downward Candidate) have guided this decline. Momentum indicators (e.g., RSI at 47.51) suggest the downtrend may be losing steam, but the MACD histogram turning positive hints at a potential short-term bounce.

Current Sentiment (Technical & News):

Technical Indicators: Mixed signals. RSI (47.51) is neutral, while MACD shows a bullish crossover (histogram turning positive). The price is below key moving averages (e.g., 200-day SMA at 167.35), indicating a bearish bias.

News Sentiment: Mixed to slightly negative. Ad revenue pressures and regulatory risks weigh on sentiment, but long-term growth catalysts (AI, cloud) provide optimism. Analysts maintain a "Buy" rating despite near-term challenges.

Synthesis: The technical picture aligns with the news—short-term bearishness (price below MAs, ad revenue concerns) but potential for a reversal if support holds (undervaluation, bullish MACD).

Key Levels & Momentum:

The price is currently below the 50-day SMA (161.89) and 200-day SMA (167.35), signaling bearish dominance.

Momentum is fading (RSI neutral, Stochastic not oversold), but the MACD histogram suggests a possible short-term bounce.

2. Elliott Wave Analysis (Contextualized to Current Price)

Relevant Elliott Wave Patterns:

Diagonal Ending Downward Candidate (Valid): Suggests the downtrend may be nearing completion, with Wave 5 potentially ending near 152.48-154.34 (Fibonacci 100% projection).

Expanded Flat Upward Candidate (Potentially Valid): If the price holds above 152.48, this pattern could signal a corrective rally toward 162.82.

Wave Count vs. Indicators/Sentiment:

The Diagonal Ending pattern contradicts the bearish news sentiment but aligns with oversold technicals (RSI, MACD). This divergence suggests a potential reversal if support holds.

The Expanded Flat pattern would confirm a bullish reversal if the price breaks above 160.31.

Near-Term Projections:

Downside: A break below 152.48 could extend losses to 148.36 (161.8% Fibonacci projection).

Upside: A hold above 152.48 and break above 160.31 could target 162.82 (Expanded Flat target) and 167.35 (200-day SMA).

3. Strategy Derivation (Realistic, Actionable NOW, News Considered)

Primary Strategy: WAIT (due to conflicting signals).

Why Wait? The technical setup is mixed (bullish MACD vs. bearish MAs), and news sentiment is neutral-to-negative. The upcoming Q1 earnings could add volatility.

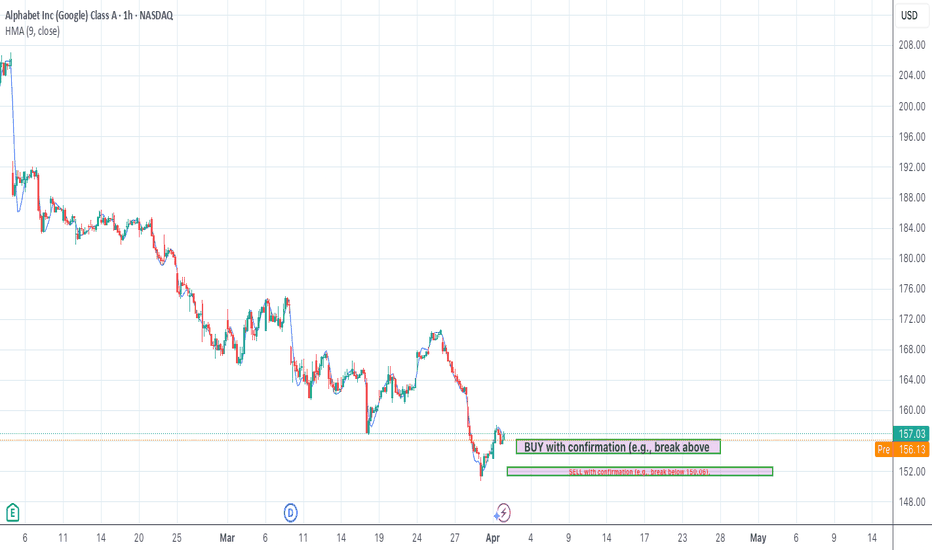

If Price Holds Support (152.48-154.34):

BUY with confirmation (e.g., break above 160.31).

Entry Zone: 154.34-156.13 (Fibonacci 78.6% retracement).

Stop-Loss: 151.44 (below recent low).

Take Profit: TP1 at 160.31 (Fibonacci 100%), TP2 at 162.82 (Expanded Flat target).

Risk/Reward: ~1:2 for TP1.

If Price Breaks Below Support (152.48):

SELL with confirmation (e.g., break below 150.06).

Entry Zone: 152.48-151.44.

Stop-Loss: 154.34 (above support).

Take Profit: TP1 at 148.36 (161.8% Fibonacci), TP2 at 145.90 (Wave 5 projection).

News Context Check:

Earnings uncertainty and ad revenue pressures favor caution. Reduce position size if trading.

4. Trade Setup (Actionable, Realistic, News Aware)

Direction: WAIT (watch key levels).

Key Levels to Watch:

Upside: 160.31 (breakout confirmation).

Downside: 152.48 (breakdown confirmation).

News Reminder: Be mindful of Q1 earnings and ad revenue trends.

5. Summary Section

✅ Investor / Long-Term Holder Summary:

Key Support: 152.48 (accumulation zone if held).

Long-Term Outlook: Undervalued (DCF: $260 vs. $157). Focus on AI/cloud growth.

Action: Wait for pullback to 152.48 or break above 167.35 (200-day SMA).

Long-term-bullish

(Gold) What does the Bullish Future Hold?What does the bullish future hold for gold in the upcoming months? Will Gold just continue to go higher and higher due to inflation or will Gold have 1 last good pullback before we see Gold taking off 🚀 🚀 🚀...

Scenario 1: Gold will continue to push higher and test resistance's and supports while having slight pullbacks throughout its run.

OR

Scenario 2: Is a good size pullback in the near future for Gold, and when it does have the pullback does happen it will create a new buying opportunity for investors to stake up on gold before it explodes in value.

(Either Scenario that happens Gold is still extremely bullish and would recommend all investors/traders to buy physical gold to maintain and grow your wealth against Inflation of the US Dollar...)

BTCUSD and the new wave to 30Kthe king of crypto will start the wave up soon and the target as its in the chart 30K

i think BTCUSD finish the down move before the end if this year and even if there is more down will not be lower this 11 to 13K

the buy started since the JUN ,the blue area is the end as i expect

And that makes me think of two possibilities :

The first

that we have finished the bearish wave in June

The second

we are on the verge of the end and we will achieve 22000 and then return to point B the start the up move

please let me know what you think about it

BESI for the long run.As we can see on the chart, BESI has been moving within this long-term trend the past few years.

It recently has touched the lower trendline again which has been acting as support for a long time.

By looking at what BESI has done in the past few years and with those 2 trendlines in mind, we can expect BESI to be bullish for the next few years to come until it has reached the top trendline again.

LINK - Strong Like A Castle 🏰Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

LINK has been stuck inside a big range for a couple of months now.

At least it hasn't melted like many altcoins during the bear run.

🏹 For the bulls to take over long-term , we need a break above the entire range / above 9.5

Meanwhile, since we are approaching the lower bound of the range, we will be looking for short-term buy setups.

📉 From a medium-term perspective, LINK is overall bullish trading inside the flat rising channel in red.

Moreover, the orange zone 6.5 is a strong support.

🏹 So the highlighted purple circle is a strong area to look for buy setups as it is the intersection of the orange support and lower red trendline. (acting as non-horizontal support)

As per my trading style:

As LINK approaches the lower purple circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

BTC Weekly: Long-Term Bullish Shark Harmonic?Lets take a look at the BTC weekly chart technicals:

RSI is at major lows

Repeated testing of 17k support

Signs reversal on the MACD+Stoch indicators

Increased buy volume on BTC/USDT for KuCoin and Binance

For chart analysis, we can see we are nearing the red line at the bottom, which represents the lowest possible trend floor at around 5.5k along with other support lines at 17k and 10k.

We could see a breakout from the large, declining triangle pattern which I believe is a Bullish Shark Harmonic Pattern . If it proves a valid reversal indicator we could see a good rally from around $12k - $13k. This is my observational opinion.

Alternatively, we could see it test the 10k mark support line below the triangle before a confident reversal signal! I believe this is a more bearish view, but possible.

If we look at market cap indicators, TOTAL, TOTAL1 and TOTAL2, we can see buying volume is higher for BTC relative to altcoints, indicating a possible influx to the largest cap currencies such as ETH, XRP, ATOM, HBAR, etc.

Is This a DCA Oppertunity?

My TL;DR opinion? Neutral-bearish on the short-term, bullish on the long term. Cautiously engaging with solid DCA strategies from these prices.

If we take a look at the wider economy and political climate, there is a tremendous amount of uncertainty surround FIAT after the dollar’s overwhelming rally against the Euro, GBP, and JPY! Gold lost a key support level at $1,700, and major indicies such as NASDAQ are still underperforming.

Whilst crypto is classed as a high-risk asset, some investors are noticing this moment of stability compared to the rest of the global market. It is impossible to make a perfect prediction and we could absolutely see some Lower Lows on crypto before a relief rally.

Silver is a commodity on the radar that could be showing signs of a major upswing, although I have yet to do a confident analysis on it.

With all that said I would personally be comfortable DCAing into crypto from here over time, with the expectation of another respectable dip before a full reversal🙏

Note: Nothing posted constitutes as financial advice, or any form of advice, and is designed to inform and educate!

XRP - Long-Term View 🕝 Analysis #8/50Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

XRP has been overall bearish trading inside the falling brown channel.

XRP is currently rejecting a strong weekly support 0.30 so we will be looking for buy setups.

🏹 Long-Term: Left Chart

For the bulls to over from a long-term perspective, we need a weekly candle close above 0.6 which would be breaking both the last major high and upper brown trendline.

📉 Medium-Term: Right Chart

For the bulls to over from a medium-term perspective, we need a daily candle close above the orange zone 0.420. And as price approaches the 0.320 support we will be looking for short-term buy setups.

Which scenario do you think is more probable and why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Bitcoin Long Term Possible MovementAs you see the #BTC Chart, We have been in a Down trend for almost a year .

In High time frame , in this case Weekly, we are moving down with a weekly compression, you may call it a wedge.

In my opinion, We are gonna complete the down trend in a 3Drive Style, Touching Monthly Demand (12K - 9K ) .

The Demand is so powerful that pushed the Bitcoin Price to 60K last time!

So I believe this order Block can Reverse the downtrend and send the BTC Price to 30 k Supply and then the Market can range for a while between 12K and 30K until we reach Halving and the start of the new Bullrun !

Good Luck my Hodlers!

This is Just my Personal point of view , NOT FINANCIAL ADVICE!

DOW JONES WAVES!!dow jones will touch 33500.

waves have drawn, have a look at it, bull run has started.

i have already drawn for Nasdaq, and nifty 50. i have previously posted all the waves of it.

I HAVE PROVIDED THE LINKS FOR ALL IN THE LINK SECTION,please do refer it.

Nasdaq has started its bull run already, and nifty 50 has basically completed its bull run.

now this is the time for dow jones.

ADDING ON, MOST IMPORTANT THING IS ALL THE MAJOR MARKETS WILL RECOVER BY MID OF SEPT, AND THEN MARKETS WILL MOST LIKELY TO MOVE SIDEWAYS. BUT LETS SEE WHAT HAPPENS AFTER 16TH SEPT. !!!!

Nifty IT to rise!!, bear runs waves gets overNifty IT- target 30500 cross.

i have drawn the waves for the short term, it looks like nifty it has completely corrected, and now it has to start its run. it will go up, with a rally or with some corrections in between(idk), but i guess it has touched its bottom, and will now move upside.

plus, have look on rsi indicator, and macd(strategy). they have started to show some divergence, so if by chance nifty it falls, it will not majorly affect much, and will continue its bull run.

Bitcoin in 1 Minute - Day 28Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

28 out of 500 days done.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

2W BTC bull run profit targets To determine possible stepping stones in the incredible journey of our favorite asset class (yes - bitcoin) we look at the bi-weekly chart, and draw fibonacci trend extension from near 0 to the peak in 2019 and to the all time low after that (122, 19690, 3120). We also draw the 100 moving average line to observe how BTC successfully bounced off it 2 times - in an essence confirming there there never was a bear market in the bitcoin life-time, at least not from the bi-weekly perspective.

We witness the HODLers triumph. (Well done, party people!)

We notice:

1) bitcoin currently is testing resistance at 1.618 extension level. This is a good time to take profits and to wait for a pull-back to re-enter. pull-backs to 30k, 20k are very likely in the next few months. even below 10k levels are possible if there is a significant negative news. No matter what happens - we predict that bitcoin wont' fall below 100 MA on the 2W timeframe. Fundamentals are way too strong: more and more institutional buy-ins, public interest all time high, relentless money printing by the governments).

2) using our tea-leaf indicator we predict new all time high above 40k before august 2021, and 85k levels by the end of 2024.

3) we watch out for ETH 2.0, and bitcoin profits moving into slakeable assets such as PolkaDot.

KCS - Video Top-Down Analysis!Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

Here is a detailed update top-down analysis for KCS.

Which scenario do you think is more likely to happen? and Why?

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

Bitcoin - When in doubt, zoom out.Do you believe in the long-term future of BTC?

Having rallied to 69k for a top in late 2021 from COVID-19 panic lows set in March 2020, BTC has since retraced around 50 percent to the lows of 33.5k set on January 24th, 2022.

In the current environment of endless short-term bulls and bears, it is easy to forget the initial reason why we have invested in the first place, the exponential long-term trajectory of this decentralized, secure, and scarce asset that attracted us to this space.

Although cliched, ‘When in doubt, zoom out’ is an important principle, especially

If you’re a long-term believer of bitcoin.

In this post, I present three scenarios for BTC to play out in the medium term. I will also discuss how I am navigating this uncertain market.

Bullish Scenario - BOOM before DOOM

In this bullish scenario, we would see a breakout of the current range of 45k in the next couple of months, with a potential higher-high set at the mid-50ks for a base for another leg higher and a parabolic breakout above our macrocycle highs of 69k towards 120k+ or so, towards the end of the year or early 2023.

This parabolic run could be similar to November 2017 bull market top. It would likely be followed by a heavy 70%+ correction, falling below the Gaussian channel depicted, and bottoming at around the 200 Week Moving Average, which has marked the bottom for the past three market cycles.

Fundamentally, this would play out based on lengthening-cycle, diminishing returns theory, that bitcoin cycles lengthen with time, thus, taking longer than the 4 years predicted by many analysts using stock to flow model.

You can read more about the Lengthening cycle theory here:

beincrypto.com - Not affiliated.

Note, a 70% correction is a conservative prediction compared with the past blow-off top cycle corrections which have been 95%, 90%, and 85% respectively. This coincides with 120k or so being a conservative figure for a market cycle top.

So, why might there be diminished returns? Well, there are many reasons for this.

Firstly, the BTC market is vastly more institutional. We can see that 80% of trading volume is now Institutions and only 20% is retail as of 14th March 2022. Compare this to the 2017 bull run, where over 90% was retail. Institutional investors in markets tend to reduce volatility.

Secondly, and most importantly, BTC has a magnitude market cap of 800B compared with 2017 and 2013. Larger asset markets tend to be less volatile than smaller asset markets. Compare a small-cap or micro-cap stock to a Large cap dividend-paying stock for example.

Sideways scenario - Consolidation before BOOM.

For the sideways consolidation scenario, we would see the price consolidate within the current macro range lows of 28.8k and 69k until the price breaks out to the upside to new all-time highs. This range-bound price movement could see many relief rallies and breakdowns (some being below the Gaussian channel for the 5 day depicted) adhering to the macrocycle lows and highs.

Because the 200 Week moving average is up-trending, it would eventually catch up to the sideways moving bitcoin price, given enough time. Depending on the moving average position, it could test it later this year, or even early 2023. This test of the 200W MA would mark the bottom of the 4-year cycle.

An important distinction for the breakout is that the all-time high blow-off top, will not occur until AFTER the 2024 halving event and not during the current four-year cycle. Historically halving events have preceded major bull cycle market runs in the following year, as can be seen with 2016 and 2020. It assumes that 69k was the market cycle peak and that four-year market cycle theory holds and cycles do not lengthen.

Why could this consolidation occur? Firstly, it is historically plausible. Note, we did see a major consolidation during the 2018 bear market at around 6K before the major market capitulation at 3k.

Secondly, institutions have largely bought into bitcoin in or around the 30k region. As this is the cost basis of many institutional investors, this may serve to prop up markets primarily through psychological means.

The mass institutional adoption of bitcoin and vastly increased market cap could also shrink volatility more than expected, perhaps to the desired 50-55% to keep it in the range.

Bearish Scenario - DOOM before BOOM.

In this scenario, we would see an eventual capitulation below the macro lows at around $30,000 with a downside target to the 200 moving average on a more aggressive timeframe.

A major catalyst for this could be a black swan style event, e.g. economic collapse of the bond market, world war 3. Alternatively, it may slowly bleed down to the 200-week moving average. The former would likely result in a faster and deeper correction price target in the low 20ks or even wicks below, with a rapid bounce, and the latter likely result in a shallower correction to the mid 20k region. This is due to the nature of the 200-week moving average, trending up with time.

This would be followed by a consolidation phase and trend higher going into the 2024 halving, before a blow-off top to new all-time highs. Similar to the 'sideways scenario', this assumes that the four-year cycle theory holds, meaning that 69k was the top for the current market cycle.

The thesis for the price being bearish over the medium term fits with past bull market collapses such as 2018, where a protracted bear market usually follows in the year after a parabolic run such as 2017.

So you are predicting it will go up, down, or sideways?

YES. Noone on TradingView, has a crystal ball, regardless of how skilled they are. Trading and investing are inherently both, probability-based games, and to be successful, it is important to plan and prepare for multiple scenarios, whilst also holding a primary thesis for what the market will do.

Buy Low - Sell High: The 200 Week Moving average and Gaussian Channel

A common principle for long-term investors of an increasing asset is the concept of 'Buying low and Selling High'. The beauty of this lies in that this is ambiguous to market direction, and encourages investors to buy at opportune times.

There are many ways to do this, using technical, fundamental, and quantitative analysis. One way, that I propose here is using the Gaussian Channel and 200 Week moving average.

Take a look at the chart for 2014, 2018, and 2020 corrections:

The chart illustrates the past price action of bitcoin returning to the 200 week moving average after major parabolic moves and falling below the Gaussian channel range.

This represents a potential accumulation range from the gaussian channel where if one would have maximized their returns if they had bought, and has marked the bottom (for 200-week ma) or 50% from the bottom (for the Gaussian channel lower line) of past bear markets. (illustrated).

How am I navigating the markets? Not financial advice.

Bitcoin will at some point, retrace to the 200 week moving average. It could be later this year or only after another bullish move higher has occurred further down the track.

There will be periods that BTC will remain below the Gaussian channel of the 5 day, which represent undervalued prices.

At the time of writing, the accumulation range is between 20k and 38k. I am accumulating in this range, with buy orders which increase in size as we approach 20k, keeping order size smaller towards the top of the range.

I have a current smaller position in BTC to hedge the opportunity cost of missing out on a shorter-term bull run this year.

If you liked this post, please consider taking a look at some of my free scripts, I love developing software and apps in my spare time, and trading / investing is a passion of mine.

This post is NOT financial advice. Please consult your financial advisor before making any investment decisions, this is for entertainment and education purposes only. Thanks for reading!

BSY BULLISH POTENTIALMarket just finished complete Elliot wave 1-5 with an ABC correction, we are back at the buy zone, which market created with an institutional candle back when in it's beginning.

Aroon: Orange line crossed the blue one in the daily time frame which already shows that we are heading bullish direction.

MACD: Shows gain in the Bullish momentum we need to wait for it to cross upwards with a signal line on a daily timeframe.

Bollinger bands: We already bounced from the bottom Bollinger band which indicates we are heading bullish.

We should retrace all the way back to 50% fib zone, but we have a strong resistance just below it, taking that resistance as our target is a lot safer.

Entry 37

Invalidation 30.59

Target 50.21

Ratio 1:4

APple shows signs of moving upTechnical analysis: Market just broke the uptrend but is still fighting with a support, we are looking for it to break a flag upwards since it is a 4 point of an Elliot wave, and we retraced to 61.8 percent fib zone, so we are looking for it to finish full Elliot wave 1-5 which should end above the third point of Elliot wave, but it is safe Target to take first profits on a same level as a third point of the Elliot wave. And the second Target at the top of an uptrend.

Aroon: Since we are fighting a resistance Aroon is showing gain in a bullish momentum once orange line crosses blue one we are good for an entry

MACD: MACD is slow to catch up on a daily chart it still shows gain in a bearish momentum, but in lower time frames we are already gaining bullish momentum.

Bollinger bands: we just bounced of a bottom Bollinger band which shows we should move bullish direction.

Fundamental analysis: According to CNBC in a past 14 hours we received good news which will help with a bullish momentum.

Gene Munster breaks down Apple’s latest product launch and the bigger tech landscape. The launch of a new products should increase Apple stock price and a bigger landscape should give us more long term opportunities.

Apple’s $429 iPhone SE is one of its cheapest phones ever. Apple's phones becoming one of the cheapest will increase sales. Which should increase Apple stock price.

Invalidation: 145.76

Entry for a better Risk reward ratio: 158

Safe entry: 165

Target 1: 180.52

Target 2: 203.72