Opening (IRA): XBI May 16th -91C/October 17th 60C LCD*... for a 26.56 debit.

Comments: Back in to XBI on weakness, buying the back month 90 delta and selling the front month that pays for all of the extrinsic in the long. (The back month 60C is shown at the 80 so that it fits on the chart).

Metrics:

Buying Power Effect: 26.56

Break Even: 86.56

Max Profit: 4.44

ROC at Max: 16.72%

50% Max: 2.22

ROC at 50% Max: 8.36%

Will generally look to take profit on the setup as a unit at 50% max, roll out the short call at 50% max to reduce my downside break even.

* -- Long call diagonal.

Longcalldiagonal

Opening (IRA): USO May 16th -75C/October 17th 45C LCD*... for a 26.25 debit.

Comments: Buying the back month 90 delta and selling the front month strike that pays for all of the extrinsic in the long. (The long call is shown at a higher strike so that it fits on the chart).

Metrics:

Buying Power Effect: 26.25

Break Even: 71.25

Max Profit: 3.75

ROC at Max: 14.3%

50% Max: 1.88

ROC at 50%: 7.2%

Will generally look to take profit at 50% max and/or roll out short call at 50% max to reduce down side break even.

* -- Long call diagonal.

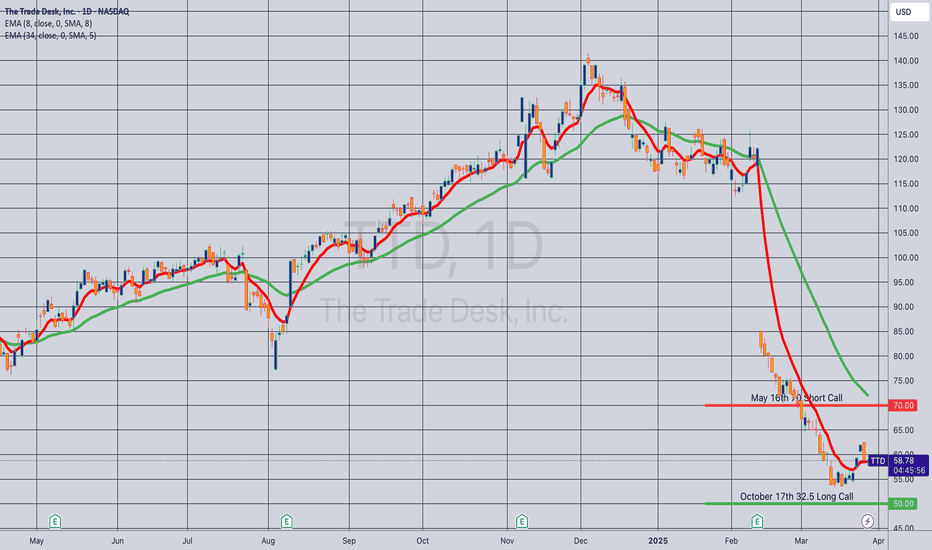

Opening (IRA): TTD May 16th -70C/October 17th 32.5C LCD*... for a 26.10 debit.

Comments: At or near 52-week lows. Buying the back month 90 delta and selling the front month that pays for all of the extrinsic in the long. (The October 17th 32.5C is shown at the 50 strike to fit it on the chart).

Metrics:

Buying Power Effect: 26.10 debit

Break Even: 58.60/share

Max Profit: 11.40

ROC at Max: 43.7%

10% Max: 2.61

ROC at 10% Max: 10.0%

In this particular case, I'll look to take profit at 110% of what I put it on for and/or roll out the short call if it hits 50% max. Earnings are on 5/14, so my preference would be to take it off before then ... .

* -- Long Call Diagonal.

Opening (IRA): XBI May 16th -85C/December 19th 50C LCD*... for a 29.50 debit.

Comments: Adding to my XBI position at or near 52-week lows, buying the back month 90 delta and selling the front month -30 delta that pays for all of the extrinsic in the long. (The 50C is depicted at a higher strike so that it fits on the chart).

Metrics:

Buying Power Effect: 29.50

Max Profit: 5.50

ROC at Max: 18.64%

50% Max: 2.25

ROC at 50% Max: 9.37%

Will generally look to take profit at 50% max and/or roll out short call to reduce downside break even.

* -- Long call diagonal.

Opening (IRA): TGT April 17th -108C/October 17th 75C LCD*... for a 30.05 debit.

Comments: At or near a 52-week low. Buying the back month 90 delta and selling the front month strike that pays for all of the extrinsic in the long. (The 75C is shown at the 100 strike so that it fits on the chart).

Metrics:

Buying Power Effect: 30.05

Break Even: 105.05

Max Profit: 2.95

ROC at Max: 9.82%

50% Max: 1.48

ROC at 50% Max: 4.91%

Will generally look to take profit at 50% max and/or roll the short call at 50% max to lower my downside break even.

* -- Long Call Diagonal.

Opening (IRA): XBI Sept 19th 60C/April 17th -90C LCD*... for a 26.68 debit.

Comments: Taking a bullish assumption directional shot near 52 week lows, buying the 90 delta back month and selling a front month that pays for all the extrinsic in the long, resulting in a break even that is at or below where the underlying is currently trading. The 60 long call is shown at 80 so that it fits on the chart ... .

Metrics:

Buying Power Effect: 26.68

Break Even: 86.88

Max Profit: 3.32

ROC at Max: 12.44%

50% Max: 1.66

ROC at 50% Max: 6.22%

Delta/Theta: 53.79/3.51

Will generally look to take profit on the setup as a unit at 50% max and/or roll out the short call at 50% max to reduce cost basis/downside break even.

* -- Long Call Diagonal

Opening (IRA): XRT April 17th 70/Sept 19th 50 LCD*... for a 17.57 debit.

Comments: And back into XRT, which is at/near 52 week lows with a long call diagaonl/Poor Man's Covered Call, buying the back month 90 and selling the front month that pays for all the extrinsic in the long.

Metrics:

Buying Power Effect: 17.57

Break Even: 67.57

Max Profit: 2.43

ROC at Max: 13.83%

50% Max: 1.22

ROC at 50% Max: 6.92%

Will generally look to take profit on the setup as a unit at 50% max and/or roll out the short call when it is at 50% max.

Opening (IRA): SPXL April 17th 148/October 17th 85 LCD*... for a 56.84 debit.

Comments: Looking to be a little bit more buying power efficient here ... . Buying the back month 90 delta and selling the front month that pays for all the extrinsic of the long.

Metrics:

Buying Power Effect: 56.84

Break Even: 141.84

Max Profit: 6.16

ROC at Max: 10.84%

50% Max: 3.08

ROC at 50% Max: 5.42%

Will generally look to take profit on the setup as a unit at 50% max, roll short call out at 50% max.

* -- Long Call Diagonal.

Opening (IRA): XRT April 17th -71C/Sept 19th 50C LCD*... for a 17.91 debit.

Comments: At or near 52 week lows. Buying the back month 90 delta and selling the front month such that it pays for all the extrinsic in the long, with a resulting break even that is at or below where the underlying is currently trading. The Sept 19th 50C is shown at the 65 strike so that it appears on the chart.

Metrics:

Buying Power Effect: 17.91

Break Even: 67.91

Max Profit: 2.09

ROC at Max: 11.67%

50% Max: 1.05

ROC at 50% Max: 5.83%

Will generally look to take profit at 50% max, roll short call out and/or down and out at 50% max.

* -- Long call diagonal a/k/a a Poor Man's Covered Call.

Opening (IRA): FCX July 18th 25/March 21st 39 Long Call Diagonal... for an 11.02 debit.

Comments: Taking a directional shot post-earnings on weakness, buying the back month 90 delta call and selling the front month 30 delta that pays for all of the extrinsic in the long, resulting in a break even that is slightly below where the underlying is currently trading.

Metrics:

Buying Power Effect: 11.02

Break Even: 36.02/share

Max Profit: 2.98

ROC at Max: 27.04%

With these, I generally look to take profit at 110% of what I put them on for and/or look to roll out the short call to reduce my cost basis/downside break even should that not be hit.

Opening (IRA): UPS June 20th 90C/March 21st -115C... for a 19.60 debit.

Comments: Buying the back month 90 delta call and selling a front month that pays for at least all of the extrinsic in the long such that the break even is at or below where the stock is currently trading.

Metrics:

Buying Power Effect: 19.60

Break Even: 109.60/share

Max Profit: 5.40

ROC at Max: 27.6%

I generally look to take profit on these at 110% of what I put them on for and/or roll out the short call if my take profit isn't hit.

Opening (IRA): EWY July 18th 35C/February 21st -55C PMCC*... for an 18.17 debit.

Comments: Back into EWY, after missing out on the dividend due to my shares being called away. Since there is no longer a dividend to be had, going with a Poor Man's Covered Call/long call diagonal, buying the longer-dated 90 delta strike and selling a shorter-dated call that pays for all of the extrinsic in the long, resulting in a setup that has a break even slightly below where the underlying is currently trading.

Metrics:

Buying Power Effect: 18.17

Break Even: 53.17

Max Profit: 1.83

ROC at Max: 10.07%

50% Max: .92

ROC at 50% Max: 5.04%

Delta/Theta: 46.50/.751

Will look to money/take/run at 50% max.

KRE June 16th 35/April 21st 55 Long Call Diagonal IdeaDo you ... fade this move?

Pictured here is a long call diagonal with the long leg out in June at the +90 delta, and the short leg out in April at the -30 to synthetically emulate the net delta of a covered call position (i.e., long stock/short call) where the short call of the covered call setup would be at the -40 delta strike.

Metrics:

Assumption: Neutral* to Bullish

Buying Power Effect: 15.09 debit

Break Even: 50.09 relative to 50.69 Spot

Max Profit: 4.91 ($491)

ROC%-Age as a Function of Buying Power Effect: 32.5% at max; 16.3% at 50% max; 8.1% at 25% max.

Alternative Setups:

April 21st 54 Covered Call. (Buy a one lot at 50.69, simultaneously sell the April 21st 54)

Metrics:

Assumption: Neutral to Bullish

Buying Power Effect: 48.09 debit (cash secured); 23.33 (on margin)

Break Even: 48.08 relative to 50.69 Spot

Max Profit: 5.91 ($591)

ROC %-Age as a Function of Buying Power Effect: 12.3% at max (cash secured); 25.3% at max (on margin).

April 21st 46 Short Put (25 Delta)

Assumption: Neutral to Bullish

Buying Power Effect: 5.46 ($546) (On Margin); 44.33 (Cash Secured)

Break Even: 44.33 relative to 50.69 Spot

Max Profit: 1.67 ($167)

ROC %-Age as a Function of Buying Power Effect: 30.5% (on margin); 3.8% (cash secured)

As you can see by looking over the metrics, there are various advantages to each setup.

With the long call diagonal, the ROC %-age stands out as its positive attribute, but the break even is basically at or near where the underlying is currently trading.

With the covered call, the buying power effect relative to the long call diagonal is a bummer, but you start out with a break even below where the underlying is currently trading. The max profit potential of the covered call relative to that of the long call diagonal is comparable, but the ROC %-age in the covered call is lower due to the higher buying power effect, particularly in a cash secured environment like an IRA, where the long call diagonal would be far more buying power efficient. There may, however, be some small advantage to being in the stock: KRE pays a dividend, but it's only quarterly, so it would conceivably pay a distribution in March (the next distribution) and June. The last distribution was .4058 (i.e., $40.58 per one lot), so we're not talking hugely motivating money here.

With the short put, your break even is more than $6 below where the underlying is currently trading, but the max profit potential isn't great relative to those of the covered call or long call diagonal. That being said, the ROC %-age at max is comparable to that of the long call diagonal.

* -- I classify covered calls and "synthetic covered calls" like long call diagonals as "neutral to bullish" assumption setups due to the ability to reduce cost basis over time via roll of the short call aspect so that you could conceivably make money if the underlying moves sideways.

Opened (Margin): AAPL Dec 16th 100/Nov 18th 136 LCD*... for a 23.23 debit.

Comments: (Late Post). Did this fairly obvious bullish assumption play in AAPL on Friday weakness, buying the back expiry 90, and selling the front expiry at-the-money. 2.77 ($277) max profit; 11.9% ROC at max; 6.0% at 50% max.

Cost basis of 23.23 with a 133.23 break even on a 26 wide. Max is realized on a finish above 136, with the profit zone being above the break even at 133.23. I don't have many cost basis reduction/rolling opportunities of the short call, so will money/take/run if given the opportunity. Currently, I'm shooting for 50% max/1.39 ($139) profit, so have entered a GTC order to take profit at 24.61.

* -- Long call diagonal.

Closed: EWZ June 17th 25 Long P/March 18th 26/30... for a 4.76 credit.

Comments: The most I could make on this was 5.00 (the width of the diagonal), so closed it out here with 39 days to go, rather than roll out the short call to April or hang out for the remaining extrinsic to bleed out. My cost basis in the entire setup was a 4.22 debit. (See Post Below). Closing it out here for a 4.76 credit results in a small winner of .54 ($54).

Closed (IRA): EWZ June 17th 25 Long Calls... for 7.45/contract.

Comments: With the short leg having expired worthless, went ahead and closed out the long leg of this diagonal here rather than covering it again. My cost basis was 6.37/contract as of the last short leg roll. (See Post Below). Closing out the long leg here results in a 1.08 ($108)/contract winner (which seemed to have taken forever).

Rolled: EWZ February 18th 32 Short Call to March 18th 30 Call... for a .38 credit.

Comments: Rolled the short call aspect of my long call diagonal, the back month of which is in June at the 25 strike. There wasn't much extrinsic left in it, so I first looked at rolling down to the 30 intraexpiry, but that wasn't paying squat, so rolled it down and out to a strike slightly above my cost basis/break even, which is now 4.54 with a 29.54 break even.

I still also have the 24 short put on, but that still has .30 left in it, so will wait until it approaches worthless before rolling.

Rolling (IRA): EWZ December 17th 33 Short Call to January... for a .22/contract credit.

Comments: Rolling the short call leg of my EWZ long call diagonal on approaching worthless (it's gone nearly no bid), the long leg of which is at the 25 strike out in June. (See Post Below).* My cost basis in the setup is now 6.37 with a 31.37 break even with a profit potential of the width of the diagonal (8.00) minus my cost basis (6.37) or 1.63 ($163/contract).

I considered just allowing the short call to expire worthless, waiting for a bounce, and then re-covering the long call leg, but you never know if it will continue lower or sideways, at which point you say to yourself, "Well, if only I would've remained covered, I'd have reduced my cost basis further."

Rolling: EWZ December 17th 32 Short Call to January... for a .25 credit.

Comments: With only 14 days to go in the short call aspect of my long call diagonal/Poor Man's Covered Call, rolling it out on this little bounce here to reduce cost basis in the setup further.

My cost basis in the diagonal is now 5.72 with the resulting diagonal spread being the June 25 long call/January 21st 32 short call.

Rolling (IRA): EWZ Nov 33 Short Call to December 33... for a .20 credit.

Comments: Rolling the short call aspect of my long call diagonal in EWZ here. I originally paid 6.79 (See Post Below), so this reduces my cost basis to 6.59 and my break even to 31.59. Will look to now take profit at the width of the diagonal (8.00) - the credit received for the roll (.20) or 7.80.

Opening (Small Account): EWZ June/Nov 25/32 Long Call Diagonal.. for a 6.26 debit.

Comments: Here, doing a similar trade to the one I did in my IRA (but with far fewer contracts) (See Post Below), buying the long-dated 88 delta call in the June expiry and selling the at-the-money call in November to create what amounts to a synthetic covered call. I paid 6.26 for a 7-wide, so my max profit potential is the width of the diagonal (7.00) minus what I paid (6.26) or .74 ($74), which would be a return on capital of 11.8% assuming the setup converges on max (7.00).

Immediately after fill, I entered an order to take the whole shebang off for 6.95 if that happens, which is a nickel short of max. Naturally, if that doesn't happen as we approach expiry of the front month, I'll roll the short call out for a credit, reducing my cost basis further, as well as improving my break even (which is currently the long strike (25) + 6.26 = 31.26).