Longgbp

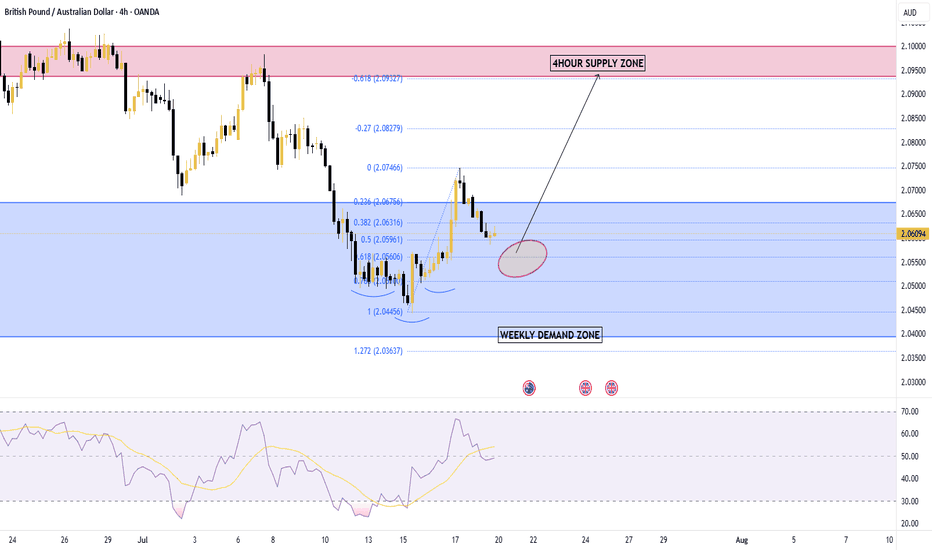

Potential areas for taking a long position in GBPAUDOk, I posted a short analysis of this symbol a few minutes ago, you can go to my profile and see it, and now I want to post a long analysis of this symbol to introduce potential points for buying!

Please place a limit position of 0.5% of your total balance in each of the specified areas and specify the stop loss and target values exactly as shown in the picture.

As always, close half of your position in the first target and risk-free the other half and open it until you reach the second target.

Thank you all

Buy GBPUSDOnly entering this trade if we have a bullish engulfing over asian session candles.

I do 300-500 pips a week. Telegram Signals in bio.

Quick enter and exit trade for 30-100 pips.

Market psychology. The banks and firms do exactly the opposite of what the retail traders do. That's how they make their money. This, if criteria are met, will be the perfect example.

GBPUSD buy pattern. Try to catch long profitMonday, Tuesday and Wednesday - has main news for GBP pairs.

But pair has big long impulse on 7 feb. And next - 3 lower lows on correction.

So right now we can open long position on GBPUSD on 1.2920

SL on - 1.2851 - near 70 pips - big SL so use not big order volume.

TP - 1.3100 and RiskRewardRatio - 2.64.

Long GBP/JPYFundamentals:- After the EU backed the Brexit deal formulated by Teresa May we could see an up swing in some of the GBP currencies. Although some traders believe this is already priced in coupled with recent economic data I can't help feeling that the GBP is slightly undervalued.

Technicals:- As you can see we have used the daily chart to analysis this currency pair. The downward trend was broken back in September with a retest of 149.60 resistance on multiple occasions since then. A fall back to the short trend line shows support indicating that the downturn could come to an end.

The trade:- We are going to use the previous daily upswing to use a break above this candle for the entry point and a stop loss below the previous swing low on the 25th October. Take profit will be the start of the move down way back in Febuary.

Long Entry :- 146.30

stop loss :- 142.70

take profit :- 156.00

Long GBPJPYFundamentals:- The consistently weaker Japanese economy has caused a sell off on the safe haven assets and until trade wars raise there concerns again. As for the GBP a new dawn is approaching as the MPC scale closer and closer to interest rate rises we should see more of the committee members vote in favour of a rate hike tomorrow pushing the GBP higher against most currency pairs.

Technicals:- The recent high breaking the 14700 level induced a pull back to previous support and a fib retracement of 38% also a previous area of resistence. This looks like good a place as any to launch new buyers into the market.

Long GBP/USDFundamentals:- We are taking a short term Fundamental view on the GBP/USD -0.64% at the moment. The USD has gone from strength to strength for many months now; every so often it will produce a pull back and some profit taking. The short term data has been a little worse than expected and with the MPC -0.07% changing its interest rate vote recently we could see a continuation of the GBP strength, at least for the short term.

Technicals:- As you can see from the 1 hour chart we are hovering around an area where there is plenty of support and resistance levels. The recent push up is a sign of buyers coming back into the market, however at an over bought price on the 1 hour chart and current resistance would suggest a slight pull back in its upward path. Overall a retest of the 13330 on short term sentiment is a strong possibility which I intent to profit from.

BUY 13122

STOP 13040

TAKE PROFIT 13340

Long GBPJPYFundamentals:- we had a strong risk on trading day today which caused the JPY to remain range bound. The GBP has some important economic releases due out this week including wage data and CPI both of which the BOE are looking at to tighten monetary policy. ING believe there is upside potential for wage growth and I tend to go along with that scenario as many business increased wages because of the minimum living wage increasing.

Technicals:- The GBP/JPY has been stuck in a downward channel for a while with recent upside from the bottom support line. A rejection from the upper trend line looks to be weak and a retest is on its way. If this breaks then the path should be clear up to the higher resistance line

buy:-14725

stop loss:- 14600

take profit:- 15000

GBP/USD Long from 28th May 2018We have seen GBP / USD fall over recent weeks. Whereas I still believe there are opportunists looking to profit through shorts, I will be going long from the week commencing 28th May.

Here is why;

1. We have gone past the 2018 Daily low (Investors negative around the pounds outlook) and often we see faster recoveries when a major support is broken as traders do not have a mental barrier at these levels.

2. We have tested the 13300ish support once in the light of the inflation news and I expect this to become a major support during this remaining days of this week.

3. Thursday 24th and Friday 25th will be days of (what I expect) news testing this 13300 level again and possible a slight break under it (Opportunity to short before)

4. However I will be setting a trade to go long around this level to profit from next weeks recovery through no new news and breaking through past resistance levels.

GBPUSD Buying opportunityFundamentals: - The UK came to its senses and a leave vote was a victory on Friday. This will of course cause a dip in the economy with the GBP reaching lows not seen since 1985 but just like 2008 it will bounce back except this time I believe it will be stronger than ever. We could see a drop to 12000 against the dollar over the coming week or the market might decide that it has been over sold all ready and start to instigate a buy back. Support levels are going to be hard to find so it is going to be a case of listening to the market sentiment and using candle stick patterns to look for reversal opportunities.

Technical’s: Once in a decade grade volatility could be witnessed on the pair as the pound sold off reaching all time lows not seen in 2 decades. Going forward it’s hard to think more sellers would drive the market lower however after a pullback into the selloff it is very much possible. In the coming days and weeks look for the 14000 as major resistance, however catching the move up to the 14000 can be just as easy once intraday/ daily forms a higher low and has buyer confluence stacked, look for price and candle pattern to identify the turn around.

Learn to trade Forex like a pro for FREE bankonadam.com