wait for GBP/JPY to reach broken resistance then BUY it.Dear traders GBP/JPY has broken strong resistance and it will continue to rise after it touches broken resistance( a support now).

this trade has a geat R/R, I hope you will make lots of pips.

push like button and follow me if you enjoyed my idea.

Longidea

EURCHF Trade Continuation In Channel Pattern.EURCHF is continuously trading in channel pattern since very long time as you can from the chart. This might continue to trade in channel pattern. One can take a trade for long term or short term with channel support and resistance line as stoploss for small pips.

Like/Comment/Follow For More Idea

Note- Trade With Proper Risk Management System Only

Thanks

IAG - excellent follow throughDiscussed that NYSE:IAG may have bottomed two weeks ago. And price action in last two days on very heavy volume supports the fact that it really did.

Now it is approaching resistance zone and neckline of inverse H&S. Might rest for a while, but when resistance is cleared, nothing should stop the rally later on.

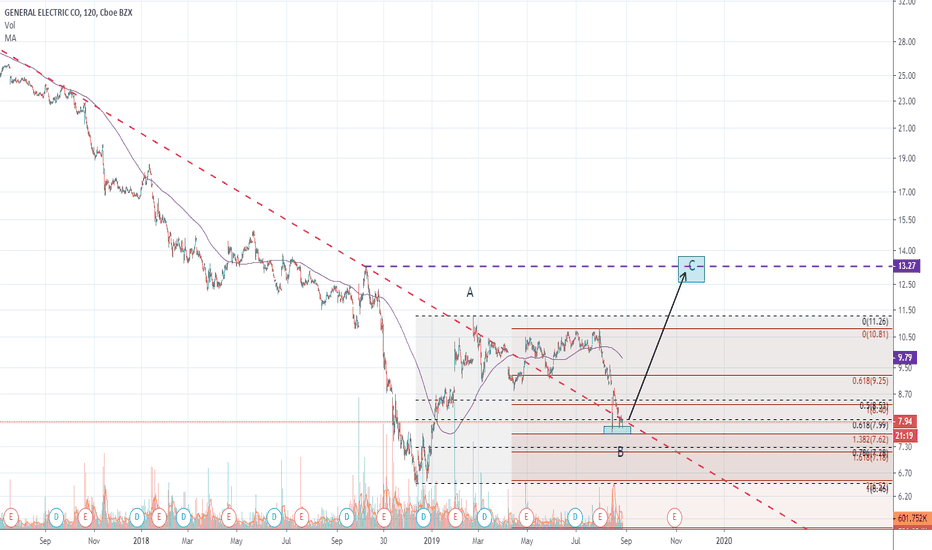

General Electric - contrarian buy?NYSE:GE is not the stock you probably want to own given all the heat experienced by the company recently.

But from contrarian perspective, nice levels right now to attempt speculative buy. Price retraced by 61.8% of previous bounce and is holding the line of previous resistance. Today may be the third daily candle when 7.8 is held, indicating that good support zone might be formed at around current levels.

Trade: stop at 6.39 (previous low), target at ~13$

Royal Gold - another miner to buy at supportNASDAQ:RGLD is one of the leading stocks in gold mining industry. It started major rally earlier than majority of other miners last spring. And was one of the first stocks to caution that pullback is likely in AMEX:GDX in January 2020.

Right now it sits right near major support level, and in bullish scenario this is constructive level from which new leg higher should start.

BBBY - overreaction creates opporunity?NASDAQ:BBBY price is destroyed this morning, based on some ugly sales numbers for the chain.

However, stock was more than punished for all the problems in recent years. So key question is whether future turnaround would be succesful?

If it is, now might be actually good time to buy, and technical picture potentially supports it. If inverted H&S would be formed, price should bottom not far from current levels, I am entering.

IAG - bottom in place?Few weeks ago I mentioned that NYSE:IAG is in good area to make a bottom, and based on recent price action, good odds that bottom is already in (for bullish case to be valid).

Major potential inverted H&S in the making and should not really go below 2.70$, where I am also placing my stop

AK Steel - breakout from the "handle"Week ago discussed that NYSE:AKS looks promising for low risk entry as it touched various support lines. Today, it appears that stock is breaking out of its bullish flag or "handle" in what appears to be cup&handle formation.

Do not expect strong rally immediately, but should continue working higher in the upcoming weeks

Coty - finally, some progressDid not fully work as planned on first recommendation, as price continued to consolidate in what appears as major bullish flag. But today on earnings release, we finally got strong follow through.

Still needs to clear resistances ahead, but overall looks promising as a major turnaround play this year.

Low risk opportunity in AK SteelAfter breaking through inverse H&S and long term resistance in December and making nice rally afterwards, NYSE:AKS continues to correct in what appears to be bullish flag.

However, now stock finally is approaching various support lines including IHS neckline and current market sell-off may be used as a nice opportunity to attempt low risk buy entry for another major leg higher, if it comes.

Coty - turnaround ahead?For a very long period of time NYSE:COTY was a troubled company with deteriorating fundamentals.

However, right now, it is trying to transform itself and improve both financials and position in the market. Top management really believes in turnaround, insiders purchased around $100 million in stock last year!!!

And now it looks like stock might be finally ready to go much higher also from technical perspective. Large inverted H&S in the making, and strong breakout of bullish flag yesterday. Volume also supports higher prices ahead, (you can see that on up days it is much higher compared to down days).

So low risk entry at current prices with stop just below recent lows might yield very good investment returns. I am buying.

$ZM On The Verge Of A BreakoutIf $ZM takes out yesterday's high of $77.78, we think we are in a for a nice rally. $ZM is 28% off its 52-week highs.

Zoom Video Communications, Inc. provides a video-first communications platform that delivers changes how people interact primarily in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. It connects people through frictionless video, voice, chat, and content sharing. The company's cloud-native platform enables face-to-face video experiences and connects users across various devices and locations in a single meeting. It serves education, entertainment/media, enterprise infrastructure, finance, healthcare, manufacturing, non-profit/not for profit and social impact, retail/consumer products, and software/Internet industries, as well as individuals. The company was formerly known as Zoom Communications, Inc. and changed its name to Zoom Video Communications, Inc. in May 2012. Zoom Video Communications, Inc. was founded in 2011 and is headquartered in San Jose, California.

As always, trade with caution and use protective stops.

Good luck to all!

NFLX - Short Term Bullish - Melt Up & 2 Analyst UpgradesNFLX just had a bullish EMA cross and price cross above 10WeekMA.

There is a decent gap to fill from $340-360.

Yesterday there were 2 separate analyst upgrades with $400+ target. www.marketbeat.com

I have been using vertical put credit spreads last two days successfully for $80-$100 each time on single put spread.

Easy income. Put order today, profit tomorrow.

My play here:

Either one or both.

3-Jan 330/335 put credit spread for $2.85+ credit

27-Dec 330/335 put credit spread for $2.70+ credit

Keep this for a day or two max. Buy back at $1.30 or less.

With the current trend, we should be able to play this for a week or two. :)

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long BTCUSD, GBTC

GBTC / BTC - Consolidating in Wedge TipGBTC and BTC are consolidating in the tip of the wedge everyone is watching for months.

I was able to get some fill orders on GBTC for $8.55. I have other wishful orders scattered below $8 (just in case).

RSI is already low and suppressed for some time now.

MACD is showing signs of flipping on Daily, but is not there yet.

Multiple gaps to fill above price.

Price crossing red zigzag (10WeekMA) will confirm uptrend.

Just to give hope to some people who HODL if you miss a selling opportunity.

I was able to reduce my cost basis and pick up 531 extra shares in one account by re-buying and selling on the way down.

If you plan to HODL what I did:

-2000 shares....sell half in 200/300 increments on up ticks.

-I waited for pullback and bought using 500 share orders. (1000 share order would not fill).

-Doing this 3 times helped me gain 25% more shares while offsetting losses as I do not exit BTC during halving events.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long BTCUSD, GBTC

GDX - Bull Flag on Weekly - Waiting for Bullish Trend to ConfirmI will update once the trend on Weekly turns bullish on GDX to confirm entry. Not entered

GDX is bullish in pattern formation currently.

We are at the end of the bull flag pattern. Ready for next leg up.

Price recently crossed 10WeekMA which confirms bullish trend.

RSI trend has also consolidated similar to price pattern.

Longer Weekly RSI trend (yellow) is bullish. Intermediate term trend (white wedge) is bullish breakout pattern.

I am waiting for Weekly trend to confirm bullish trend for entry. Market is too fickle for early entry.

I will update once I see the Weekly trend turn.

If anyone wants me to take a look in between chart updates, contact via PM. No problem.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long BTCUSD, GBTC