PEAQ Network about to make another pea(q) ? Bottom can be IN!

// ==================================

// ====THE===========================

// ========MACHINE=============^^====

// ===============NEEDS===TALK=======

// ====================TO============

// ==================================

Is this the time?

Chart Recap

🔍 Pattern:

Price formed a falling wedge pattern, which typically signals a potential bullish reversal.

A large W-shaped double bottom pattern is highlighted at the wedge's base, adding strength to the bullish thesis. Can this be the awaited bottom?

🟢 Accumulation & Support Zone :

"DISCOUNT ZONE" is marked near $0.0547, aligned with the wedge support.

Repeated touches at this level suggest strong buyer interest — also called "MY NAME IS PEAQ" and "LOADING EVERYWHERE"

🚀 Bullish Scenario & Targets:

If the wedge breakout plays out:

TP1: $0.0923 – early target near the local range high.

TP2: $0.1618 – aligns with the 0.382 Fib level.

Labeled as “LOADING EVERYWHERE”

TP3: $0.4618 – near the 0.618 retracement.

“THERE IS NO GOING BACK NOW”

TP4: $0.7556 – previous swing high.

“GET READY FOR LIFT-OFF”

TP5: $3.5650 – long-term Fib extension target (1.618).

Ultimate moonshot-level target.

Longposition

BTC Double BottomFibonacci sequence is a mathematical concept; it appears in various aspects of everyday life and nature. It's not directly used in a calculated way, but its principles are reflected in the patterns we see around us. Its key for traders to pinpoint these reversal areas to keep a positive risk/reward ratio. Bulls will target 116k if this low can be sustained.

SOLUSD- Has a long-term sport between 155 and 158Technical Analysis by AI

💵 Current Price & Market Context

• SOL trading around $158–$160, down about 2–3% today, still down ~14% from last week’s top near $180+.

🧭 Trend & Momentum

• RSI near 41–47 → not oversold but on the lower side.

• MACD still leaning bearish. Momentum: neutral to slightly bullish across indicators.

🛠️ Support & Resistance

• Immediate support at $160, stronger support at $154.

• Resistance at $172–$176, bigger barrier around $180–$190.

📈 Pattern Behavior

• Still holding an ascending channel, currently sitting near the lower band.

• Failed breakout at $180–$190 means that’s a hard ceiling unless broader market turns bullish.

⸻

✅ Trade Thoughts Based on This

Aspect

Bias Neutral to bearish short-term

Entry Zone Valid? Yes, $156–158 is still solid

Key Level to Watch

$154 — if breaks, downside likely

Upside Potential Target $172–176 short term

Breakout Ceiling $180+ tough without volume/sentiment

⸻

🧭 What You Should Do Now

• You’re in near $156–158 → good spot as long as $154 holds

• If price dips to $154 and bounces: still valid

• If breaks $154: prepare to cut, next support is ~$145

• If price moves above $170: momentum could take it to $176+

• Don’t chase anything. Wait for volume or bounce from support

Continued recovery, positive after NFP news✍️ NOVA hello everyone, Let's comment on gold price next week from 08/04/2025 - 08/8/2025

⭐️GOLDEN INFORMATION:

Gold prices surged over 1.5% on Friday, climbing toward $3,350, as a weaker-than-expected U.S. Nonfarm Payrolls (NFP) report signaled a faster-than-anticipated slowdown in the labor market. Heightened geopolitical tensions between the U.S. and Russia further boosted safe-haven demand for the precious metal.

Following the disappointing July jobs data, markets began pricing in a potential interest rate cut by the Federal Reserve. While the Unemployment Rate held relatively steady, signs of labor market softness supported recent comments from Fed officials Michelle Bowman and Christopher Waller, who advocated for a 25-basis-point rate cut at the July 29–30 meeting.

Additional data added to the cautious sentiment: the ISM’s July report confirmed that U.S. manufacturing activity remains in contraction territory, while consumer confidence took a hit, according to the University of Michigan’s latest survey.

⭐️Personal comments NOVA:

Gold prices continue to be positively affected after last week's NFP news, market expectations of an early rate cut are rising

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3384, $3434

Support: $3331, $3307, $3268

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

U : Long There were both good and bad developments for Unity.

While the joint project opportunity with BMW Group is very positive news,

Departure of the current CEO was negative news.

Technically, it is above the 50 and 200 period moving averages, and the 50 period ema is also above the 200 period ema.

A risk/reward ratio of 3.00 can be evaluated, with the Stop-Loss being close to the 200-period ema and the target price being targeted at the large gap closing value.(Small position size)

Entry : 24.76 - 24.81

Risk/Reward Ratio : 3.00

Stop-Loss : 22.23

Take Profit Level: 32.54

VRT : Long Position Vertiv Holdings is trading above the 50 and 200-period moving averages.

It has overcome the resistances one by one without being exposed to a very high IV.

It has started to draw a cup.

However, it is much better to focus on the big gap rather than the cup formation because with good chances it can encounter a big resistance there.

Targeting the 50-period ema and the 0.5 level of the short-term Fibonacci retracement levels as a stop point gives us the opportunity to try trading at a not bad risk/reward ratio.

With a small position size or small portfolio percent :

Risk/Reward Ratio : 2.54

Stop-Loss : 103.77

Take-Profit : 145.32

BX : First Attempt at Silent StockBlackstone has now decided to invest in Europe.

The stock is technically above the 50 and 200 period moving averages.

After leveling the trend line, an increase in volume was also observed.

In that case, holding a short-medium term or opening a long position with a reasonable risk/reward ratio in a small position size will not hurt us.

I have kept the stop-loss a little tighter now because even if the stop level comes in a sudden drop, it can be tried again. If that happens, I will share it as a new idea.

Risk/Reward Ratio : 3.00

Stop-Loss : 132.53

Take-Profit : 141.73

DOGE Looking Strong as Support HoldsDOGE Looking Strong as Support Holds

🔹 1. Support Zone Validated

The chart shows Dogecoin retested the lower boxed region around $0.221–$0.223, and bounced sharply from that zone. Given the heavy spike in volume during the retest, this suggests aggressive buying and accumulation—a hallmark of bullish conviction.

CryptoRank

The Tradable

🔹 2. Fibonacci 0.618 Support Bounce

On the 4‑hour timeframe, DOGE held firm above the critical Fibonacci 61.8% retracement level, and delivered a strong rebound—indicating technical significance and buyer interest at this level.

Blockchain News

🔹 3. Double-Bottom + Trendline Breakout

Analysts have identified a classic double-bottom formation, with price clearing the neckline (~$0.230–$0.231) and then retesting it successfully. Holding this retest confirms a breakout, suggesting more upside ahead.

Crypto Basic

🔹 4. Whale Activity & Accumulation

On-chain data shows $250 million in Dogecoin accumulation by whales, especially around the support zone—creating a structural demand base and reinforcing the bullish setup.

CoinCentral

🎯 Price Targets & Key Levels

Scenario Levels Rationale

Bullish continuation $0.239–$0.241 union resistance First resistance zone—price must reclaim to continue bullish momentum

$0.260–$0.280 Reclaiming $0.241 could open room toward mid‑channel resistance or prior highs

$0.300+ Potential target if momentum sustains and broader breakout occurs

Bearish invalidation $0.223 support Invalid break below suggests fading momentum—risk of correction to $0.215–$0.218

$0.215–$0.218 Secondary support zone if expansion of sell side continues

⚙️ Trade Setup for a Bullish Bias

Entry Focus: Consider entering long near $0.223 if price retests and holds, with a tight stop just below support.

Stop-Loss Zone: Slightly beneath $0.221 to account for volatility.

Targets: Scale out around $0.241, with larger targets at $0.260–$0.280, and possibly $0.30+ on sustained strength.

Confirmation: Watch for rising volume, break and close above resistance zones, and bullish indicator alignment.

⚡ Market Sentiment & Broader Themes

Momentum Shift: A bearish retrace reversed quickly amid accumulation, suggesting strong buyer commitment.

CryptoRank

The Tradable

AInvest

Double Bottom Status: Analyst commentary supports a reversal setup, with targets toward $0.310–$0.46 if the neckline holds.

Crypto Basic

AInvest

CryptoRank

Macro View: DOGE remains within a bullish channel; some forecasts project

BTC Accumulation, Bullish Breakout Signs💎 BTC PLAN UPDATE

1. Key Chart Features:

Currently, the BTC/USD price is at $118,893.

The chart shows a strong upward trend recently, and we are seeing accumulation with short-term corrections.

2. Fibonacci Levels:

The Fibonacci retracement levels are drawn from the lowest point ($114,460) to the highest point ($119,809).

At the moment, the price is hovering near the 0.5 retracement level ($113,000), which is a key support level.

If the price holds above this level, a rebound is likely.

3. Trendlines and Price Patterns:

The trendlines (dashed blue lines) are indicating a descending triangle pattern, which could lead to a breakout if the price surpasses resistance levels.

A potential Head and Shoulders pattern might be forming, though it is not yet clear and needs confirmation by breaking key resistance.

4. Breakout and Retest Zone:

The breakout zone (red area) is around $119,000.

If the price breaks and holds above this level, we may see a continuation of the uptrend toward the next target around $122,792 (Fibonacci 1.618 level).

After the breakout, the price might retouch (retest) this support area before resuming the upward movement.

5. Technical Indicators:

• Moving Averages (MA):

• The red MA (long-term) is below the current price, indicating a strong uptrend.

• The yellow MA (medium-term) is near the current price, providing support for the uptrend if it holds.

• RSI Indicator:

The RSI has not yet reached overbought levels, suggesting that the market still has potential to rise without being overheated.

6. Conclusion:

If the price breaks above the $119,000 resistance and maintains that level, BTC/USD could continue its strong bullish trend, potentially targeting $122,792 or even $127,941.

Note: If the price fails to hold above $119,000 and drops back below, a pullback to the nearest support level at $114,460 may occur.

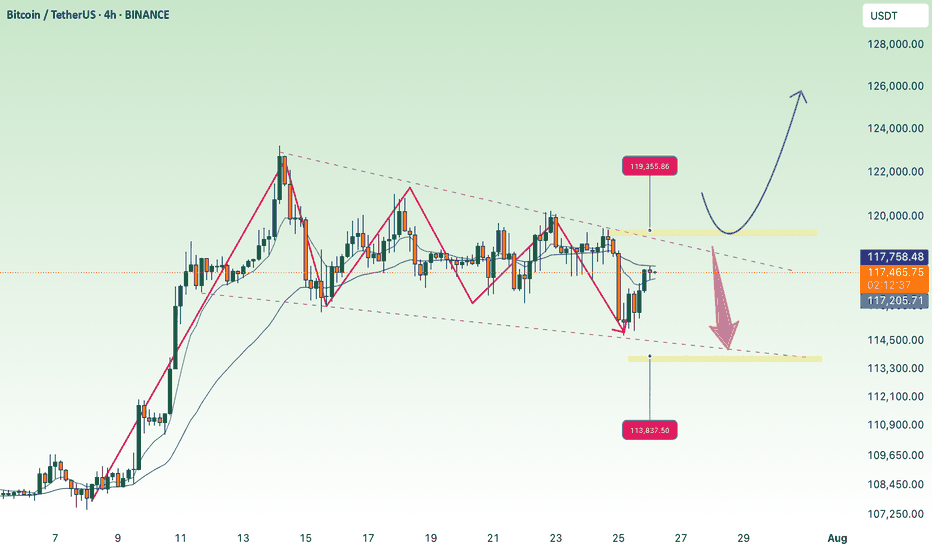

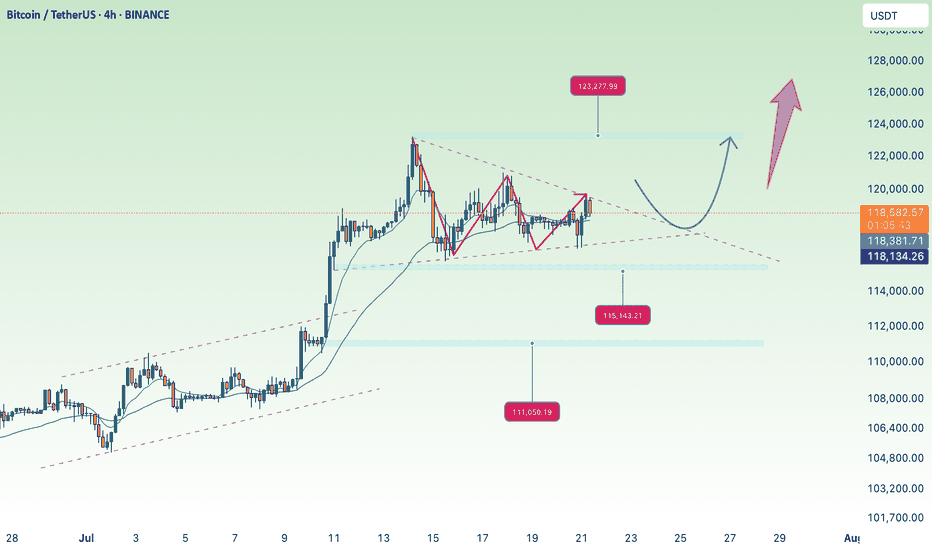

BTC Consolidates Below 119,300 Over the Weekend💎 BTC WEEKEND PLAN UPDATE (26/07)

NOTABLE BTC NEWS

The cryptocurrency market is attempting to stabilize after a wave of sell-offs during Friday’s Asian session, when Bitcoin (BTC) dropped to an intraday low of $114,723. A recovery trend is gradually strengthening, with BTC trading at $115,868 at the time of writing, indicating that buying interest at lower levels may increase in upcoming sessions.

TECHNICAL ANALYSIS PERSPECTIVE

Symmetrical Triangle Pattern

BTC is currently fluctuating within a symmetrical triangle pattern, with converging upper and lower trendlines. This pattern typically signals a strong consolidation phase before a decisive breakout.

Scenario unfolded as planned:

• The price failed to break the resistance zone around $120,000 (previously forecasted as a likely failed breakout zone).

• BTC then dropped sharply to the support zone around $115,000, touching the lower trendline and the potential breakout zone.

• At this level, the price rebounded as expected, indicating strong buying pressure at support.

MA lines supporting the trend:

• The price is currently moving around the 200-day MA (red line), showing that the dynamic support is working effectively.

• The 50-day MA (yellow line) is acting as short-term resistance. If broken, it could support the recovery momentum.

Two potential upcoming scenarios:

🔼 If BTC breaks above the $119,500 – $120,000 zone with strong volume, it may continue to test higher levels around $123,000 – $125,000.

🔽 Conversely, if it faces strong rejection around $119K and turns downward, BTC may retest the support zone at $114,000 – $115,000 once again.

Stay tuned to the channel for the latest and continuous updates on XAUUSD, CURRENCIES, and BTC.

Long $DECK - NYSE:DECK is the only growth story I'm comfortable buying. This was wall street darling for many years. I believe sell off was overdone.

- It has lot of room to run. It is getting traction and NYSE:NKE because of law of large number is not growing much in %age.

- However, NYSE:DECK has lot of road ahead and it can grow for many years to come. Global expansion is also not out of the question.

- I strongly believe NYSE:DECK will make an all time high when this tariff narrative takes a backseat.

- Another bullish thing for NYSE:DECK is that Trump doesn't plan to bring back shoes or clothing manufacturing back in US.

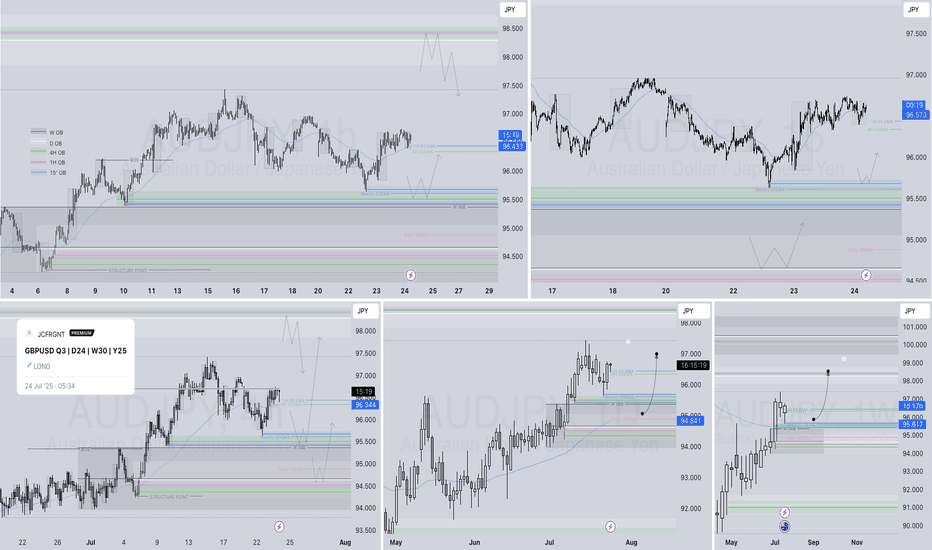

AUDJPY Q3 | D24 | W30 | Y25📊AUDJPY Q3 | D24 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

GMDC, Long 1D, Breakout, VolumesGMDC has shown a good volume in the stock today and has taken support from the previous low. If it breaks its recent high of 428 with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami, then take a long trade on this stock.

Entry: 428 (on Bullish candlestick pattern)

Target1: 445

Target2: 450 till 480.

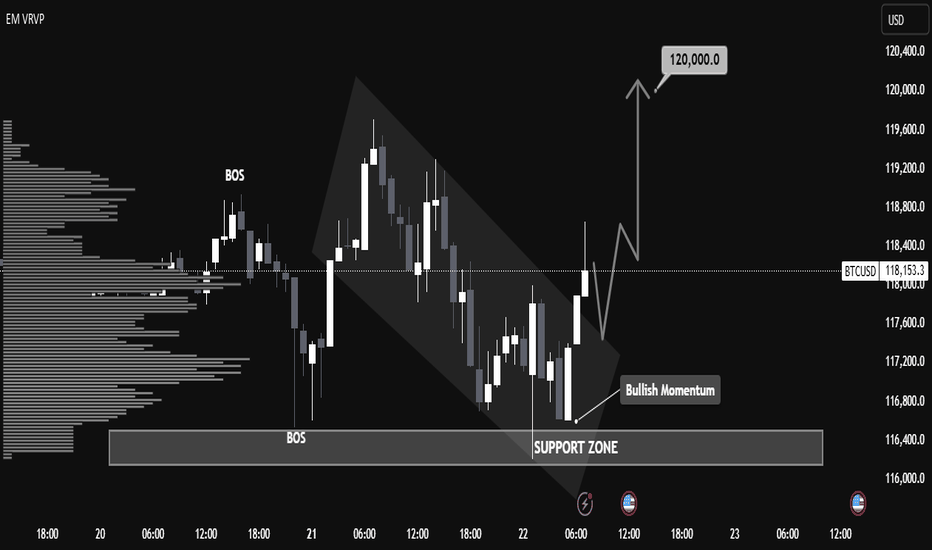

"BTC/USD Breakout Strategy: Identifying Bullish Momentum BTC/USD Technical Analysis – July 22, 2025

📈 Market Structure Overview:

The chart illustrates a recent Break of Structure (BOS) both to the upside and downside, indicating volatility and a shift in market sentiment. The price action formed a descending channel, followed by a breakout with strong bullish candles, suggesting a momentum reversal.

🧱 Support Zone (Demand Area):

Key Level: $116,400 – $116,900

This zone has acted as a strong demand level, with clear evidence of buying pressure pushing BTC higher after testing this area. The volume profile (VRVP) supports this, showing heightened trading activity at this price.

🔄 Bullish Breakout Confirmation:

A bullish breakout from the descending channel occurred just above the support zone, aligning with the label "Bullish Momentum".

The breakout candle has closed above minor resistance, which increases the probability of a trend reversal.

📍 Price Target:

The projection points toward $120,000, aligning with previous resistance and psychological round-number resistance.

This target is highlighted by an expected bullish leg after a possible retest of the breakout zone around $117,500 – $117,800.

🧭 Key Levels to Watch:

Support: $116,400 – $116,900

Retest Zone (Buy Opportunity): $117,500 – $117,800

Immediate Resistance: $118,400

Major Resistance / Target: $120,000

📊 Summary:

BTC/USD has shown a bullish reversal signal from a well-respected support zone after a descending correction phase. The current price structure, volume buildup, and breakout momentum suggest a high probability of continued upside movement toward the $120,000 mark. A successful retest of the breakout zone would provide a strategic entry for long positions with tight risk management.

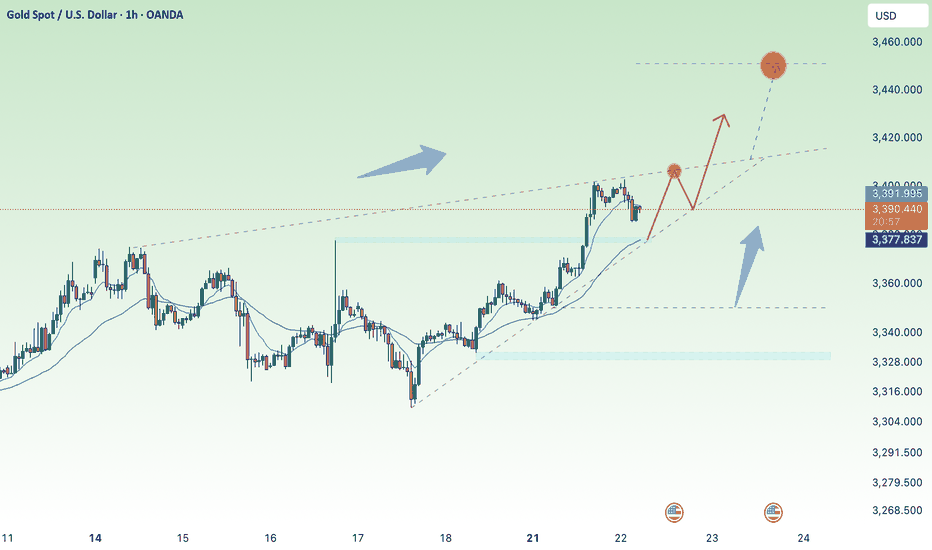

Gold price maintained above 3400⭐️GOLDEN INFORMATION:

Gold prices surged over 1% on Monday as both the US Dollar and Treasury yields declined sharply, driven by ongoing uncertainty surrounding trade negotiations, despite a generally positive risk tone in broader markets. At the time of writing, XAU/USD trades at $3,397, having rebounded from daily lows of $3,338.

While risk sentiment has improved ahead of upcoming US corporate earnings releases, anxiety lingers as the August 1 tariff deadline set by the White House approaches. Investors remain cautious about potential trade disruptions between the US and its key partners—the European Union (EU), Canada, and Mexico.

Meanwhile, reports from Bloomberg indicate that EU officials are preparing to convene this week to finalize a retaliation strategy, should trade talks with President Trump collapse. This backdrop of trade tension continues to support gold’s safe-haven appeal.

⭐️Personal comments NOVA:

Gold price continues to increase before FED's statement, market's expectation of early interest rate cut, setting new ATH in Q4/2025

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3450- 3452 SL 3457

TP1: $3435

TP2: $3422

TP3: $3405

🔥BUY GOLD zone: $3332-$3330 SL $3325

TP1: $3345

TP2: $3358

TP3: $3370

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

ASAN – Cup & Handle Breakout SetupASAN NYSE:ASAN has formed a classic Cup & Handle pattern and has broken above the neckline, turning previous resistance into new support. However, the price is still trading below both the 50 and 200 SMAs, which calls for cautious confirmation.

📌 Entry: Wait for a confirmed retest of the breakout level (new support) with healthy volume.

🔒 Stop Loss (SL): Just below the newly established support zone, in case of a failed retest.

🎯 Take Profit (TP):

First TP: Next visible resistance zone above.

If this level breaks and holds (confirmed by retest),

Next TP: The large gap overhead could potentially be filled.

This setup provides a strong risk-reward structure if confirmation aligns with volume and momentum. Avoid early entry without retest.

⚠️ DYOR (Do Your Own Research) – This is not financial advice.

accumulate, continue to aim for new ATH💎 Update Plan BTC (July 21)

Notable news about BTC

CEO of Charles Schwab, Rick Wurster, said the company plans to deploy Bitcoin and Ethereum transactions for customers.

This company aims to compete with Coinbase, where customers buy BTC.

This development takes place after the progress of cryptocurrencies when President Donald Trump signs the Genius bill into law.

In an interview on Friday, the CEO of Charles Schwab, Rick Wurster, said the company plans to launch Bitcoin (BTC) and Ethereum (ETH) to compete with Coinbase cryptocurrencies. The move took place after President Donald Trump signed the Genius bill, officially confirming the first cryptocurrency law in the United States.

Technical analysis angle

🟠 Main trend:

BTC is sideway accumulated in the amplitude of 117,000 - 122,000 after a sharp increase.

The chart shows the descending triangular model - a potential sign for Breakout.

🔍 important areas:

Resist:

122,000 - 122,700: Strong resistance area, fibonacci mold 1.0.

130,600 - 131,100: The expected area if Breakout is successful (Fibonacci extension 1.618).

Support:

116,000: Support close, coincide with EMA 200.

111,100: The support area is stronger if the current support breaks.

✅ Scenario 1 - Rise:

If the price turns from supporting 116k → Test the resistance area of 122k.

If the 122K break is definitive, the next goal is 130k - 131k.

❌ Scenario 2 - Discount:

If the 116k area is lost, the possibility of falling will fall more deeply at 111k.

This is also the strong EMA area Fibo 0.382 of the previous wave.

Please follow the channel to receive the latest and continuous updates on XauUSD, currency and BTC

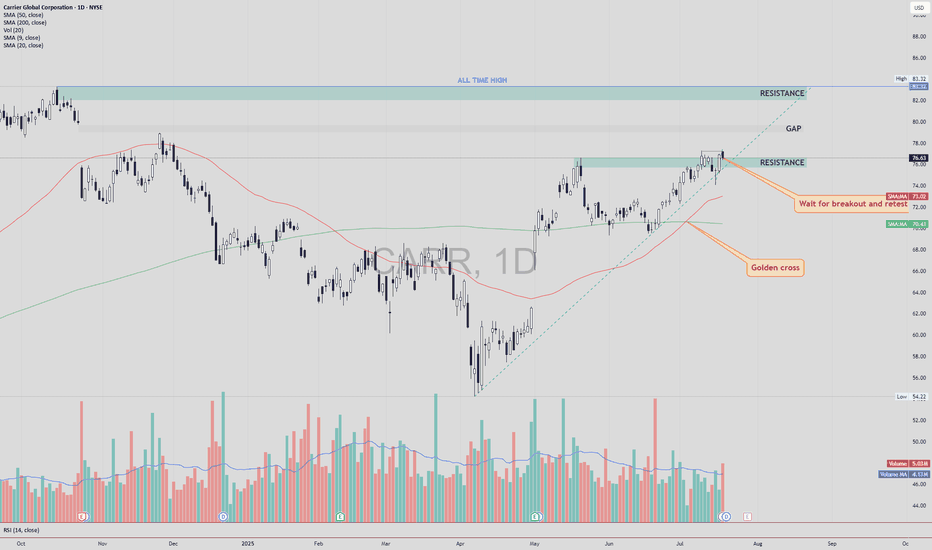

CARR – Bullish Breakout Toward Gap and ATHCarrier Global NYSE:CARR has closed above a key resistance zone near $76.50–$77.00 , indicating a possible breakout setup in progress. This move comes after a Golden Cross , where the 50 SMA crossed above the 200 SMA — a long-term bullish signal.

🔍 Technical Highlights:

✅ Golden Cross: Bullish momentum building.

✅ Breakout level: Price broke above horizontal resistance zone.

🔄 Next step: Wait for a potential retest of the breakout zone.

🔊 High volume on the breakout and retest would increase the strength and reliability of the setup.

🎯 Target Levels:

First Target (TP1): ~$80.00 — near the top of the existing gap.

Second Target (TP2): ~$83.32 — the current All-Time High (ATH).

🛡 Trade Plan:

Entry idea: After a clean retest of the breakout level with supportive volume.

Stop-loss: Below the retest zone or under 50 SMA (~$72-74 area).

Invalidation: If price falls back below resistance on high volume.

Conclusion:

CARR shows a strong breakout setup after a Golden Cross. A confirmed retest with volume could open the door toward the gap fill and new all-time highs.

DYOR – This is not financial advice.

Gold price maintains accumulation below 3400✍️ NOVA hello everyone, Let's comment on gold price next week from 07/21/2025 - 07/25/2025

⭐️GOLDEN INFORMATION:

Gold prices edge higher in Friday’s North American session as a softer US Dollar and pre-weekend profit-taking lend support. Dovish remarks from a Federal Reserve (Fed) Governor, hinting at a possible rate cut as early as July, further bolster the yellow metal. At the time of writing, XAU/USD is trading around $3,353, gaining 0.43%.

Improved market sentiment also underpins bullion, following the University of Michigan’s report showing that US consumers are growing more optimistic about the economy, with inflation expectations easing. Meanwhile, Fed Governor Christopher Waller’s call for rate cuts weighed on US Treasury yields, adding positive momentum to gold.

The US Dollar Index (DXY) weakens to 98.48, down 0.13%, making USD-priced gold more attractive to foreign buyers and helping sustain the current uptrend.

⭐️Personal comments NOVA:

Gold price remains in the accumulation range of 3300 - 3400, the market awaits information on upcoming interest rate policy

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3367, $3392

Support: $3305, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

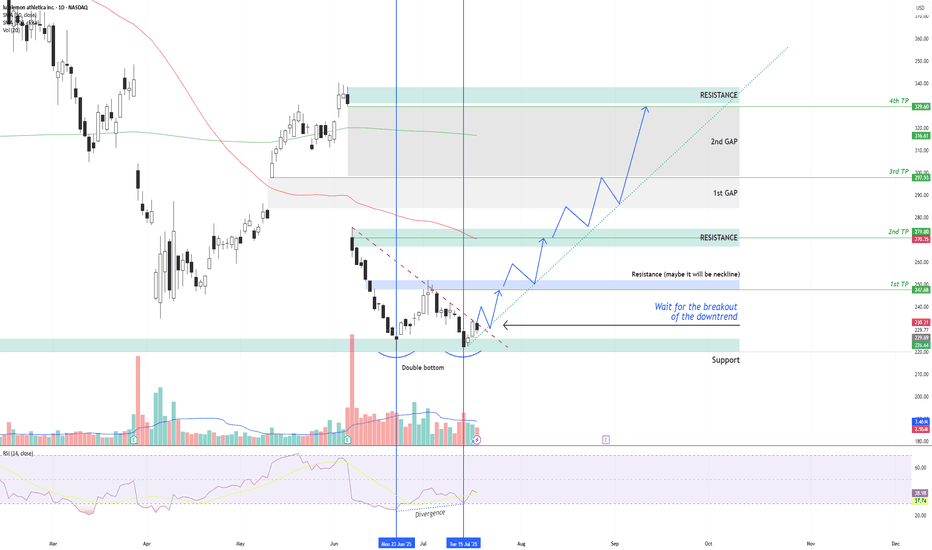

LULU – Double Bottom + RSI Divergence: Multi-Target Setup After LULU NASDAQ:LULU is showing signs of a potential bullish reversal after forming a double bottom structure around the $220 support zone , along with a bullish divergence on the RSI indicator.

Two vertical lines highlight the divergence: while price made a lower low, RSI formed a higher low – indicating a possible momentum shift in favor of buyers.

Currently, price is moving just below a descending trendline, which has been acting as dynamic resistance. The first condition for a long setup is a confirmed breakout above this trendline followed by a successful retest. If that happens, an entry can be considered .

📌 Entry Plan:

Entry: After a breakout and retest of the descending trendline.

1st TP: ~$247 — This level coincides with a local resistance zone, which may act as a neckline of the double bottom.

If price breaks above $247 and retests, it confirms bullish continuation.

📈 Target Structure:

2nd TP: ~$271 — next major resistance zone.

3rd TP: ~$297 — aligns with the first major gap zone.

4th TP: ~$329 — final gap resistance from previous sell-off levels.

This structure allows for scaling into the trade in stages — each breakout and retest offers a new confirmation and extension to the next target zone.

Volume analysis, price action, and RSI momentum all support the probability of a trend reversal — but confirmation is key.

Not financial advice. Always conduct your own research and risk management.

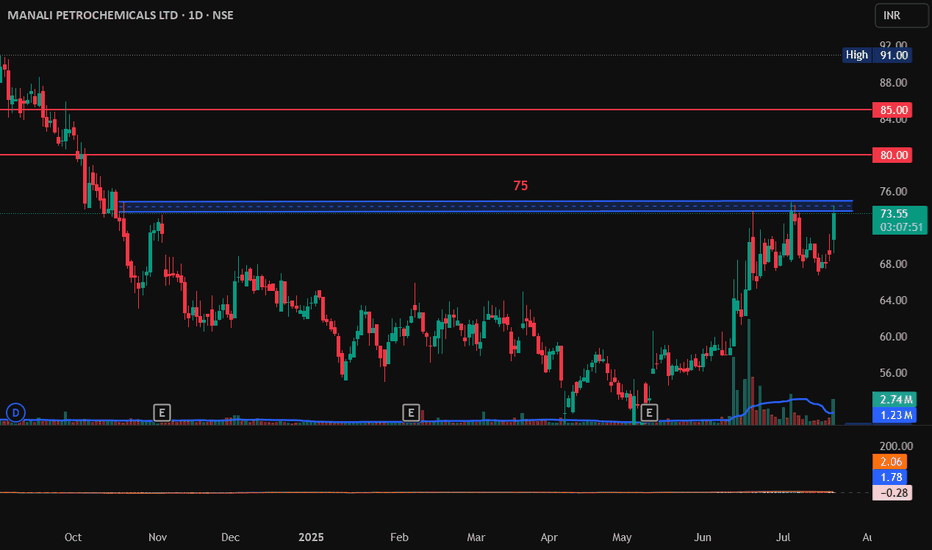

MANALI PETROCHEMICALS LTD, Breakout, LongMANALI PETROCHEMICALS LTD has raised 6% today and its near the resistance zone of 75. If it breaks this 75 and sustain it with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami.

Entry on Bullish pattern: 75

Target1: 80

Target2: 85.

SL: 70.

Bikaji Food Triangular Pattern, Long, 1DBikaji Food is following a triangular pattern. If it breaks the level of 780 with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami, then take a long trade on this stock with first target of 815 and second target of 851.

Entry: 780 (on Bullish candlestick pattern)

Target1: 815

Target2: 851

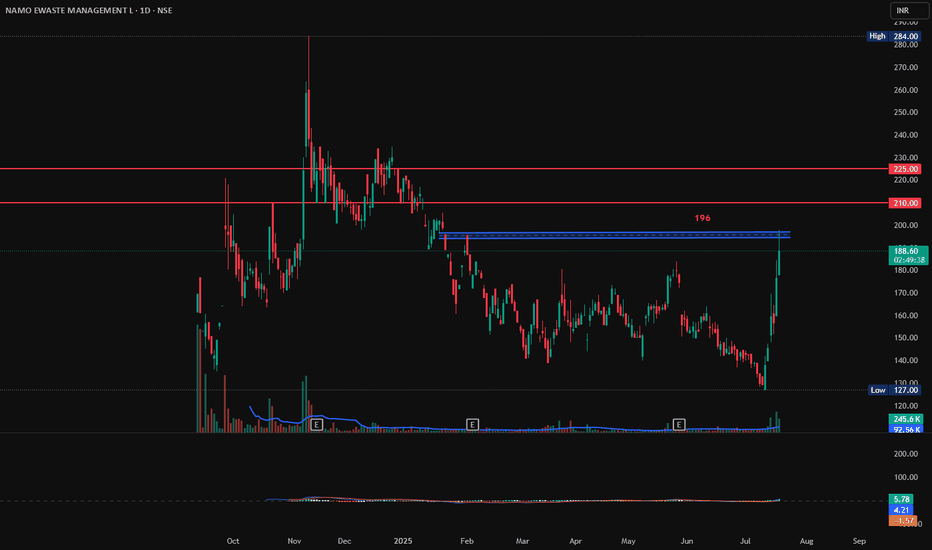

NAMO EWASTE MANAGEMENT, Long, Breakout, 1DNAMO EWASTE MANAGEMENT has gain 6% today with good volumes. If it breaks and sustains 196 with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami, then there are good chances for it to go further up from here. First target will be 210 and second target 225.

Entry: 196 (on Bullish candlestick pattern)

Target1: 210

Target2: 225.

SL: 185